To record S-Corp Distribution in QuickBooks Desktop and Online, users debit the retained earnings and then create a shareholder equity account to show the payment to shareholders as “their portion of S-Corp’s profits“.

S-Corp distributions are recorded as distributions to equity and adjusted against the retained earnings or shareholder equity accounts in QuickBooks rather than as expenses.

In QuickBooks, the payouts are designated as:

- Shareholders payout

- Owner’s draw

S-Corp distributions are normally paid out based on the capital ratio or ownership percentage, which means that they are usually paid out in accordance with each shareholder’s investment in the business rather than their amount of work.

Before recording any distributions, both versions need a properly structured Chart of Accounts.

For QuickBooks Desktop:

- Step: Navigate to the Chart of Accounts > New to add an account.

- Step: Save the account under Equity.

- Step: Name it something specific, such as Shareholder Distribution Account.

- Step: Choose the appropriate account type to ensure proper financial reporting.

For QuickBooks Online:

- Step: Go to Settings > Chart of Accounts.

- Step: Click on New to add a new account.

- Step: Choose Equity as the account type.

- Step: Under the Detail Type > Partner Distributions.

- Step: Enter Shareholder Distributions as the account name.

- Step: Review the details and click Save to finalize the setup.

How to Record S-Corp Distribution in QuickBooks Desktop?

Users can record S-Corp distributions in QuickBooks Desktop using checks or journal entries.

Follow the below-mentioned steps to set up and record these transactions accurately:

Record the S-Corp Distribution Using Journal Entries in QuickBooks Desktop

Step 1. Access the Chart of Accounts

- Open QuickBooks and navigate to the Chart of Accounts.

Step 2. Create a New Account

- Select “New” to add an account.

- Save the account under ‘Equity.

- Name it something specific, such as “Shareholder Distribution Account.”

- Choose the appropriate account type to ensure proper financial reporting.

These accounts should be classified properly to ensure that distributions are correctly reported on the company’s financial statements and tax reports.

By accurately setting up these accounts, recording distributions for S Corps in QuickBooks becomes more transparent and streamlined.

Step 3: Make Journal Entries

- Go to the Company menu and select Make General Journal Entries.

- In the journal entry screen, complete the following fields:

- Debit the newly created Shareholder Distribution Account with the distribution amount.

- Credit the cash or bank account from which the funds are being distributed.

- Add a memo to describe the purpose of the transaction for future reference.

- Review the journal entry to ensure accuracy, then click Save & Close.

Step 4: Monitor Total S-Corp Distributions

- Regularly check that total distributions do not exceed the company’s accumulated earnings and profits:

- Go to the Reports menu and run the Balance Sheet report to review retained earnings.

- Compare retained earnings to distribution amounts.

- Distributions exceeding profits may lead to negative tax consequences for shareholders. Always consult a tax professional if in doubt.

Step 5: Categorize S-Corp Transactions Consistently

- If recording distributions as an expense or liability on the balance sheet:

- Open the Expense menu and review the list of transactions.

- Update the payee or category to align with “Shareholder Distribution” for consistency.

- Ensure all entries reflect accurate terminology, such as “Shareholder Distribution,” rather than generic terms like “Owner Distribution.”

Record the S-Corp Distribution Using Checks in QuickBooks Desktop

Step 1: Open QuickBooks Desktop

- Open by launching QuickBooks Desktop.

- Navigate to the Banking menu and select “Write Checks.”

Step 2: Enter the Check Details

- Choose the appropriate bank account from which you will issue the distribution.

- Enter the name of the shareholder who is receiving the distribution.

- Select the correct account from your Chart of Accounts.

- Input the amount of the distribution and add a memo to describe the transaction.

- Click Save to record the check.

How Do You Record S-Corp Distribution in QuickBooks Online?

To record S-Corp distributions in QuickBooks Online, you transfer retained earnings to the shareholder’s equity account and then distribute it to shareholders. This process involves writing checks and recording them against the equity account on the “Expenses” tab of the check. Since distributions reduce equity rather than being considered expenses, they won’t affect the Net Income on the Profit and Loss statement.

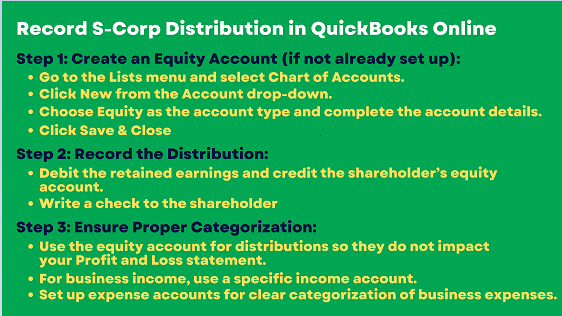

Step-by-Step Process to Record S-Corp Distribution in QuickBooks Online

Step 1. Create an Equity Account (If Not Already Set Up)

- Go to the Lists menu and select Chart of Accounts.

- Click New from the Account drop-down.

- Choose Equity as the account type and complete the account details.

- Click Save & Close.

Step 2. Record the Distribution

- Debit the retained earnings and credit the shareholder’s equity account.

- Write a check to the shareholder:

- Go to the “Expenses” tab on the check.

- Assign the shareholder’s equity account for proper recording.

Step 3. Ensure Proper Categorization

- Use the equity account for distributions so they do not impact your Profit and Loss statement.

- For business income, use a specific income account.

- Set up expense accounts for clear categorization of business expenses.

S-Corp Account Setup in QuickBooks: Income, Equity, and Expenses

| Income Account | Equity Accounts | Expenses |

|---|---|---|

| Create a specific income account for the S-Corp’s revenue. Use this account to record your invoiced amounts. | Maintain the Shareholder Capital and Shareholder Distribution equity accounts as you have set them up. | Set up expense accounts to categorize your business expenses effectively. |

Managing S-Corp Transactions in QuickBooks: Income, Salary, and Distribution

| Invoice Entry | Salary Payment | Distribution |

|---|---|---|

| When you receive payments from clients, use the income account designated for the S-Corp’s revenue. | Process salary payments through your ADP service. This transaction will reduce the shareholder Capital equity account and record the salary expense. | Record the transaction directly from the Shareholder Distribution equity account for the shareholder distribution. |

Establishing an income account allows you to generate reports on revenue specific to the S-Corp. The equity accounts monitor the flow of funds between the S-Corp and shareholders.

When running a Profit and Loss (P&L) report, the income from the designated income account, minus salaries and other business expenses, will provide a clear picture of the S-Corp taxable net income.

Problems Faced by Users When Recording S-Corp Distributions

Users often encounter challenges while recording S-Corp distributions, including:

- Shareholder Basis Tracking: Accurately maintaining stock basis records is critical for correct tax computation but often goes overlooked, potentially leading to errors.

- Proportional Distribution: Managing and verifying distributions based on ownership stakes can become complex, particularly with multiple co-owners, requiring careful attention.

- Differentiating Distributions: Confusion between distributions, salaries, and loans can lead to misclassification, impacting tax compliance and potentially triggering audits.

- Software Limitations: QuickBooks, for example, requires manual input or configuration, which increases the likelihood of errors in data entry or calculation.

- Tax Implications: Misreporting distributions can result in IRS audits, penalties, and additional financial burdens, highlighting the importance of precise record-keeping.

Debiting the Shareholder Distributions account and crediting the Cash account is the standard journal entry for documenting a shareholder distribution.

Example of Journal Entry in Shareholders Distributions

Let’s say an S-Corp chooses to give a shareholder $10,000.

The entry in the journal would be:

| Account | Debit | Credit |

|---|---|---|

| Shareholder Distributions Cash | $10,000 | $10,000 |

This entry shows a decrease in the company’s cash and, via the Shareholder Distributions account, a corresponding decline in the equity held by shareholders.

Checks or bank transactions used to pay shareholders are usually utilized to record distributions in QuickBooks instead of requiring a separate journal entry. The transaction’s terms allocate the distribution amount to the shareholder’s equity account.

In order to prevent any tax repercussions, distributions should also be made in line with the ownership proportion of each shareholder. They should not surpass the total earnings and profits of the business.

IRS Requirements of S-Corporation

To qualify for a S Corporation, the IRS requires compliance with specific criteria:

- Eligibility:

- The corporation should be domestic and not possess 101 shareholders.

- All the shareholders should be American citizens or residents of America.

- The company cannot have more than 100 shareholders.

- The shareholders can only be individuals, estates, and certain trusts; the company can have only one type of stock.

- Election: Send Form 2553, “Election by a Small Business Corporation,” executed by all shareholders on or before the 15th day of the third month of the tax year.

- Tax Filing: Every year, corporations file Form 1120-S, which includes income, deductions, and credits. They also prepare Schedule K-1 for shareholders’ tax returns.

- Reasonable Compensation: Employer-shareholders must recognize that they must offer their employees a reasonable wage that is subject to payroll tax only.

- Compliance: To avoid automatically revoking the S Corporation status, it is important to keep record books up to date, meet the state’s tax requirements, and follow the Internal Revenue Service rules.

| Form | Purpose |

|---|---|

| Form 2553 | Election by a Small Business Corporation – Used to elect S-Corp status. All shareholders must file this on or before the 15th day of the third month of the tax year. |

| Form 1120-S | U.S. Income Tax Return for an S Corporation – Filed annually by the corporation to report income, deductions, and credits. |

| Schedule K-1 | Shareholder’s Share of Income, Deductions, Credits, etc. – Prepared with Form 1120-S and given to each shareholder for their personal tax return. |

| Form W-2 | Wage and Tax Statement – Used to report wages paid to employees, including shareholder-employees, subject to payroll tax. |

| Form 941 | Employer’s Quarterly Federal Tax Return – Used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees’ paychecks. |

How to File the S-Corp Taxes?

To file S Corporation taxes, you first need to complete Form 1120-S, which reports the corporation’s income, deductions, and credits. This form is due by the 15th day of the third month (Calendar month) after the close of the tax year, for example, March 15 for calendar-year corporate taxpayers. You can file Form 1120-S online or on paper using the IRS website.

After that, the Schedule K-1 (Form 1120-S) should be provided to each shareholder with the same due dates. It presents the shareholders with their income, deductions, and credits to be declared on the personal tax returns of the corporation. Every single shareholder is required to complete a personal income tax return with respect to his share of the income.

If, in any case, there is an employee, file Form 941 quarterly for payment of payroll taxes and Form 940 annually for federal unemployment tax. Further, check for state tax regulations; some states are known to require S-Corps to meet specific filing standards.

S-Corp Bookkeeping In QuickBooks

S-corp must engage in regular business transactions throughout the year to comply with state and year-end tax reporting obligations. External parties like lenders or investors may also request access to the company’s books for credit assessments. Managing the general ledger is essential, typically requiring monthly updates to manage accounting responsibilities, with frequency adjusted based on business activity levels.

The primary duty of an S-corp involves booking to monitor revenue generation through various means, including:

1. Income

Income accounting is considered the most crucial fundamental task for an S-corp. This includes revenue from service sales, rent, interest, capital gains, and asset sales. Categorizing income by type can enhance marketing strategies effectively.

2. Sale of Company Assets

This section is required to record separately from income and expenditure. When utilizing accounting software, any information about assets and liabilities is reported on the balance sheet. The worth of the asset is confirmed at the time of acquisition, and the worth of the asset is equivalent to the acquisition fees required to secure the property. Record the beginning price of the obligation. Assets are modified according to depreciation, and debt payments are adjusted to liabilities.

3. Cost

This includes any expenses that the company pays because of operational and legal requirements. Goods and services paid to loans, interest rates, suppliers, wages, and taxes are a few examples of items. The company utilizes accounting software, and revenue and expense transactions will be displayed in the income statement.

4. Responsible for their Seats in the Company

Shareholders of an S-Corp are accountable for their ownership stakes in the company. The shareholder basis typically starts with the amount they invest to acquire shares. This basis increases with announced profits and decreases with recorded losses at year-end. The S-Corp aims to inform its shareholders about these accounting obligations.

Conclusion

Recording S-Corp distributions in QuickBooks is a careful process that must adhere to IRS guidelines. If the distribution is properly classified, the shareholders’ register is well-maintained, and the company has a clear understanding of the legal tax requirements, the firm will be in a strong position to comply with the law.

Frequently Asked Questions

What are the key advantages of S-Corp accounting in QuickBooks?

S-Corp accounting in QuickBooks desktop provides benefits such as tax savings, liability protection, and streamlined bookkeeping, ensuring compliance with tax regulations and accurate financial reporting.

How do you set up S-Corp medical insurance in QuickBooks Desktop?

Setting up S-Corp medical insurance in QuickBooks Desktop involves determining the type of insurance plan you offer to your 2% shareholders and employees. Depending on the plan, you’ll need to set up specific payroll items to track and report these benefits correctly on W-2 forms.

Here’s a simple guide:

Step 1: Identify the Insurance Plan Type

- Same Plan for All Employees:

- Use S-Corp Pd Med Premium if the 2% shareholder provides the same medical insurance plan to all employees.

- This is taxable for federal and state withholding but exempt from Social Security, Medicare, and FUTA.

- Different or No Plan for Employees:

- Use Fringe Benefits if 2% shareholders have a different plan or don’t offer any plan to other employees.

- This is fully taxable for federal, state, Social Security, Medicare, and FUTA.

Step 2: Set Up Payroll Items in QuickBooks Desktop

- Go to Lists > Payroll Item List.

- Click on Payroll Item > New.

- Choose Custom Setup, then select Other Earnings.

- Enter the appropriate name for the payroll item:

- For same-plan benefits: Use “S-Corp Pd Med Premium.”

- For different or no-plan benefits: Use “Fringe Benefits.”

- Assign the correct tax tracking type:

- Select “S-Corp Medical” for S-Corp Pd Med Premium.

- Select “Fringe Benefits” for Fringe Benefits.

- Set up the item’s tax ability:

- Configure as exempt or taxable based on the selected item type (refer to Step 1).

Step 3: Apply to Payroll

- Add the appropriate payroll item to the 2% shareholder’s paycheck.

- Ensure the amount is accurately recorded for W-2 reporting under Box 14.

Step 4: Verify and Report

- Double-check that your payroll setup aligns with IRS guidelines.

- At year-end, review W-2 forms to ensure Box 14 reflects the correct benefit amounts.

How do you Record Distributions to owners?

To record distributions to owners in QuickBooks, create an equity account labelled “Owner’s Distribution” or “Shareholder Distribution,” then record the transaction as an expense linked to this account, ensuring accurate tracking of funds distributed to owners.

How do you report distributions on S corporation?

Dividend payments to S corporation shareholders are recorded on Form 1099-DIV and Schedule K, Line 17c. Loan repayments to shareholders are documented on Schedule K, Line 16e, and on shareholders’ Schedule K-1, Line 16, code “E.”

Why do S-Corp Owners need to be on Payroll?

S-Corp owners are considered employees of their business. Unlike distributions, which are not subject to Social Security and Medicare taxes, the IRS mandates that owners take a reasonable salary to ensure these taxes are properly withheld. This separates personal and business finances while ensuring compliance with federal tax regulations.

How should I set up and manage S-Corp accounts in QuickBooks Online (QBO)?

When managing S-corp distributions in QuickBooks Online (QBO), it’s important to set up your accounts properly to reflect the financial transactions accurately.

Here’s a recommended approach:

- Income Account:

- Create an income account specifically for the S-Corp’s revenue.

- Use this account to record client payments and invoiced amounts.

- Equity Accounts:

- Maintain Shareholder Capital (tracks owner contributions).

- Maintain Shareholder Distribution (tracks profit distributions).

- Expense Accounts:

- Set up separate expense accounts for various business costs.

- Transaction Entries:

- Invoice Payments: Record client payments in the designated income account.

- Salary Payments: Process salaries through payroll (e.g., ADP) as an expense, not through the equity account.

- Shareholder Distributions: Record distributions directly from the Shareholder Distribution equity account (not as an expense).

- Financial Reporting:

- Run a Profit & Loss (P&L) report to see revenue, expenses, and net taxable income.

- Use the equity accounts to track the movement of funds between the S-Corp and shareholders.

A shareholder distribution account is typically classified as an equity account, specifically under retained earnings or owner’s equity in the balance sheet. It represents profits distributed to shareholders, usually in the form of dividends. These distributions reduce retained earnings but are not considered an expense.

Disclaimer: The information outlined above for “How to Record S-Corp Distribution in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.