Negative Deposit Recording in QuickBooks is necessary when managing customer refunds or credit card chargebacks, but the software structurally prohibits entering a negative value directly into the Make Deposits screen. To accurately record money leaving the account, users must utilize specialized accounting tools: a Journal Entry, a Refund Receipt (QBO), or a Credit Memo (QBD). The core solution involves using the Undeposited Funds account as a clearing mechanism, requiring a Journal Entry to offset the negative banking transaction with a corresponding positive entry in Undeposited Funds. This procedure culminates in a zero-sum bank deposit that clears the linked transactions simultaneously, ensuring accurate bank reconciliation and preventing errors caused by complex scenarios like negative credit card batches.

- Direct Entry Prohibition: QuickBooks prevents entering a negative amount in the Make Deposits feature because deposits are structurally recorded as asset increases (credits); withdrawals must be recorded as expenses or checks.

- Master Solution (Zero-Sum Deposit): The final step for clearing negative entries from Undeposited Funds is creating a bank deposit where the positive transaction (or the corrective Journal Entry) and the negative transaction total zero.

- Key Accounting Tools by Platform:

- QuickBooks Online (QBO): Use a Refund Receipt for quick refunds.

- QuickBooks Desktop (QBD): Use a Credit Memo to create a credit on the customer’s account.

- Clearing Account: A Clearing Account (set up as a Bank Account type) is useful for complex scenarios, isolating negative deposits or refunds via Journal Entries to simplify reconciliation.

- Negative Credit Card Batches: When a refund exceeds sales, the withdrawal must be recorded as a Check or Expense transaction, not a deposit, to reflect the negative cash flow accurately.

- Upgrade Path: Your QuickBooks Desktop 2020 company file (QBW) can be upgraded directly to the latest supported QuickBooks Desktop product.

- Final Reconciliation Step: Always create a Journal Entry to move the negative refund amount out of Undeposited Funds before creating the final zero-sum deposit, which is essential for accurate bank reconciliation.

What is an Undeposited Funds Account?

Undeposited Funds Account in QuickBooks is a nominal account for the amounts of money collected but not yet banked. This facilitates the monitoring of outstanding deposits, ensuring that several payments are recorded in a single bank deposit entry as seen in the actual bank statement.

What is a Negative Deposit?

A negative deposit is a situation in which money has been withdrawn from an account or when a deposit amount must be changed because of a refund, reversal, or correction.

As you may note when using the ” Make Deposits ” option, depositing a negative amount to QuickBooks Online or Desktop is not possible. But there are ways to tackle situations where you have to record a negative deposit, for instance, refunds or adjustments.

If you receive a correction for service, you need to record it as a separate transaction. Once done, you can apply it to the Bill. It’s a very simple way to ensure your records are accurate and up-to-date in QuickBooks.

Here’s how you can manage it:

QuickBooks Online (QBO)

There are 3 methods to record a negative deposit issue in QuickBooks Online:

Method 1: Journal Entry

By making a reverse journal entry, this issue can be resolved:

- To do this go to Gear Icon → Journal Entry.

- If you want, off-set the account by debiting the bank account with the negative amount.

- Charge the right income or clearing account.

- Save the journal entry.

Method 2: Refund Receipt

This situation can also be resolved by filling a refund receipt:

- Tab + New → Choose Refund Receipt.

- Decide who the customer should be when requesting for a refund.

- Punch-in the refund amount, but in this case as a credit amount, meaning a negative value.

- Choose the bank account for refund.

- Save the refund receipt.

Method 3: Clearing Account

A negative deposit issue can also be resolved by setting up a clearing account by following the below steps:

- Set up a clearing account with the following details: Go into the program and select Settings → Chart of Accounts → Add New.

- Select Bank Account, and for the Account name, use Clearing Account.

- Record the negative deposit or refund, which is usually used in the clearing account, using a journal entry or payment.

- Clear the clearing account as needed with another journal entry or transfer when necessary.

QuickBooks Desktop (QBD)

There are also 3 methods to record a negative deposit issue in QuickBooks Desktop:

Method 1: Journal Entry

Follow the steps to resolve the issue with a journal entry:

- Then click on Companies then hit on Make General Journal Entries.

- Decrease the bank account for the negative deposit amount.

- Credit the appropriate income or clearing account.

- Save the journal entry.

Method 2: Credit Memo

In QuickBooks Desktop, creating a credit memo will also resolve this issue:

- Click on Customers in the navigation panel and then select Create Credit Memos/Refunds.

- Choose the customer to whom you are willing to return the money.

- If you’re collecting refunds, enter the details and the negative amount.

- The correct account to use under the income account category is.

- Preserve the credit memo and use it for the deposit.

Method 3: Clearing Account

Follow the below steps to resolve the issue using a clearing account:

- Under lists select Chart of Accounts, then click on New to create a clearing account.

- Go to Settings, follow by selecting Bank Account, and then label it as “Clearing Account”.

- This should be done by preparing the journal entry, which reflects the refund or adjustment in the clearing account.

- Use the clearing account to balance another transaction later. Therefore, do not clear the account.

These are logical instructions for documenting negative deposits in QBO and QBD, offered in a simple structure.

Record Negative Credit Card Batch Transactions in QuickBooks Desktop

Since the refund is larger than the amount in your undeposited account, you may need to create a Journal Entry in QuickBooks Desktop for Windows or Mac to offset the Undeposited Funds.

To record negative credit card batch transactions in QuickBooks Desktop, go to Company, select Make General Journal Entries, adjust the date, and enter the necessary details to offset Undeposited Funds.

Let’s see how:

Step 1: Navigate to Company

- Hover over the Company at the top menu bar.

Step 2: Select Make General Journal Entries

- Choose to Make General Journal Entries.

Step 3: Fill out the Date column

- Edit the DATE.

Step 4: Finishing up

- Type all the necessary details.

Record Negative Deposits using Batch Enter Transactions in QuickBooks Desktop

QuickBooks Desktop (QBDT) won’t allow a negative total amount when recording transactions manually. However, you can use the Batch Enter Transactions option to enter negative amounts for credit card charges or credits.

To record negative deposits using Batch Enter Transactions in QuickBooks Desktop, go to Accountant, select Batch Enter Transactions, choose Checks, enter date, number, payee, and credit card details, and input the amount as positive. This will decrease both bank and credit card balances.

Below are the steps you must follow:

Step 1: Go for Batch Enter Transactions

- Head to the Accountant menu and then choose the Batch Enter Transactions option.

Step 2: Select Checks as the Transaction Type

- Select Checks as the Transaction Type and then click on a Bank Account.

Step 3: Enter the Date, Number, and Payee

- Type the Date, Number, and Payee.

Step 4: Add the credit card

- Choose the credit card as the affected account.

Step 5: Finishing up

- Enter the amount as positive.

Note: This process will decrease both bank and credit card balances.

Record the Credit Card Charges in QuickBooks Desktop

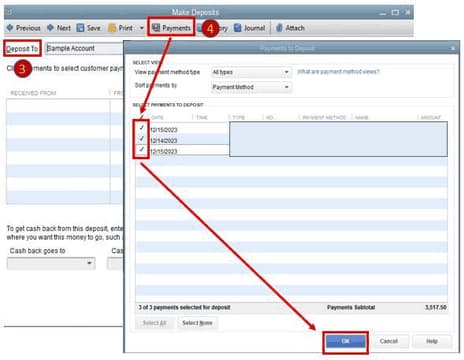

Record credit card charges in QuickBooks Desktop, go to Banking, select Make Deposits, choose your Deposit To account and date, click Payments, review transactions, add the charge, and save.

Following the step-by-step information below:

Step 1: Navigate to Banking

- Hover over the Banking at the top menu bar.

Step 2: Select Make Deposits

- Click on Make Deposits.

Step 3: Add your Deposit To account

- Select your Deposit To account, then enter the correct Date.

Step 4: Click Payments

- Hit the Payments icon.

Step 5: Check the transactions used to pay the refund

- Once done, a new window will pop up with the transactions under the Undeposited Funds. You need to review the transactions that were used to pay the refund for that day. Then, press OK.

Step 6: Create another line for the charge

- Create another line for the charge that was made to your bank account with the Credit Card Processor.

Step 7: Finishing up

- Enter all the necessary details. Then, hit the Save & Close tabs.

Resolve Negative Entries from Undeposited Funds in QuickBooks Online

At times, negative value transactions show up in Undeposited Funds and appear on the Bank Deposit screen (for instance, if you issue a customer refund from Undeposited Funds). You can’t deposit a negative value entry by itself. The net deposit must be a value greater than or equal to zero. To resolve issues with negative transactions in Undeposited Funds, make a zero-value deposit and record the negative-value deposit with it.

How do you record negative entries from Undeposited Funds in QuickBooks Online? Create a journal entry with the Undeposited Funds and bank accounts, enter amounts in debit and credit columns, and then save. Next, use Bank Deposit to offset the negative value, ensuring the total is zero.

Part 1: Create a Journal Entry

Create a Journal Entry, click + New, select Journal Entry, enter the date, choose Undeposited Funds in the Debit column, select the bank account for the Credit column, then save and close.

Step 1: Select Journal Entry

- Click + New and then choose Journal Entry under Other.

Step 2: Type the transaction date

- Write down the transaction date in the Journal date field.

Step 3: Add the Undeposited Funds Account

- On the first line, select the Undeposited Funds account from the Account column.

Step 4: Enter the single-line deposit amount

- Under the Debit column, type the single-line deposit amount.

Step 5: Opt for the bank account

- Click on the bank account in the Account column on the second line.

Step 6: Re-enter the single-line deposit amount

- In the Credit column, re-enter the single-line deposit amount (if it does not already display).

Step 7: Finishing up

- Press the Save and Close buttons.

Part 2: Offset the Negative Value

To offset the negative value, click + New, select Bank Deposit, add the payment and the Journal Entry ensuring the total is zero, then save and close.

Step 1: Select Bank Deposit

- Click + New and then choose Bank Deposit under Other.

Step 2: Add the payment and the Journal Entry

- Select the payment and the Journal Entry you created. Make sure the total amount must be zero.

Step 3: Finishing up

- Hit the Save and Close tabs.

Another Way to Record a Negative Deposit in QuickBooks Online

Record a negative deposit in QuickBooks Online, create a Journal Entry, set Undeposited Funds for Debits and a bank account for Credits, ensuring the amounts match the negative balance. Save and close.

Select Undeposited Funds and Bank Account

You can choose your undeposited funds and bank account as the source account of your journal entry to zero out the negative balance.

Here’s how:

Step 1: Select Journal Entry

- Navigate to the + New tab and then choose Journal Entry under OTHER.

Step 2: Enter the date of your Journal Entry

- Input the date of your journal entry.

Step 3: Add Undeposited Funds

- On the first line, select Undeposited Funds from the ACCOUNT column.

Step 4: Type the amount equal to the negative balance

- Under the DEBITS column, enter the amount equal to the negative balance.

Step 5: Opt for any Bank Account

- Choose any of your bank accounts on the second line from the ACCOUNT column.

Step 6: Write down the same account

- Type the same amount under the CREDITS column.

Step 7: Finishing up

- Press the Save and Close buttons.

Deposit the Journal Entry to Offset the Negative Credit Card Balance

How to Deposit the journal entry to offset the negative credit card balance, click + New, select Bank Deposit, choose the journal entry created, and then hit Save and Close.

Step 1: Go for Bank Deposit

- Click + New button and then select Bank deposit under OTHER.

Step 2: Select the Journal Entry

- Under the Select the payments included in this deposit section, choose the journal entry you’ve created.

Step 3: Finishing up

- Hit the Save and Close icons.

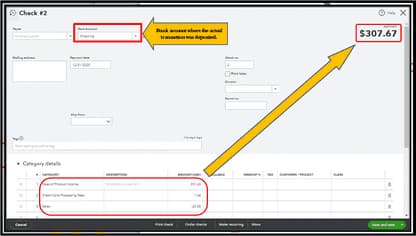

How to Write a Check or Create an Expense Transaction?

You can write a check or create an expense transaction to record the money you take away or withdraw from your bank account.

To record money withdrawn from your bank account, click + New and select Check or Expense. Choose the bank account, enter details for the withdrawal amount, fees, and client payment, then save and close.

Below are the steps you’ve to follow:

Step 1: Select Check/Expense

- Hit the + New icon and then choose either Check or Expense.

Step 2: Navigate to the account where the transactions are posted

- Select the account where the transactions are posted from the Bank Account drop-down.

Step 3: Enter the following information

In the Category detail section, type the following:

- 3331.63 (total amount of withdrawal), you can use an AR account (or any Income account used in the original transaction) since this transaction is for client CC refund.

- 1.04 for the credit card processing fees.

- – 25.00 (This is the total amount of your client’s payment ( $23.96 +Credit Card fee) for the service you rendered.)

Step 4: Finishing up

- Press the Save and Close buttons.

Negative Credit Card Deposit in QuickBooks Accountant Online/ QuickBooks Payments

If you run into a scenario in which you actually have a negative deposit (a banking debit/withdrawal from your account) by your merchant services processor, you need to move the expected deposit from the Undeposited Funds account to your Bank Account via a journal entry.

This may happen in the event you have a large credit card refund that exceeds your new credit card sales on a particular day. Thus, you are required to match your downloaded payments with your QuickBooks transactions to resolve negative credit card deposits.

About the refund, record it as Check or Expense by do the following:

Step 1: Select Expense/Check

- Navigate to + New and then choose Expense or Check.

Step 2: Add the Customer

- Select the customer you want to refund from the Payee drop-down menu.

Step 3: Navigate to the Bank account

- Under the Payment account drop-down, click on the bank account where you deposited the overpayment to.

Step 4: Opt for Account Receivables

- Choose Accounts Receivable on the first line of the Category column.

Step 5: Enter how much amount you want to refund

- Write the amount how much you want to refund in the Amount field.

Step 6: Finishing up

- Fill out the other fields as you see fit, then press the Save and Close tabs.

After this, link the refund to your customer’s credit or overpayment.

Adhere to these steps:

Step 1: Go for Receive Payment

- Hover over + New and then select Receive payment.

Step 2: Add the same customer you used for the Check/ Expense

- Choose the same customer you used for the check or expense when recording the refund.

Step 3: Mark the Expense or Check checkbox you created

- In the Outstanding Transaction section, tick mark the checkbox for the Expense or Check you created when recording the refund.

Step 4: Match the payment to the open balance

- Make sure the payment is equal to the open balance.

Step 5: Finishing up

- Hit the Save and Close icons.

Handling Negative Deposits in QuickBooks: Quick Tips and Solutions

Negative deposits—caused by refunds or corrections—can disrupt your QuickBooks accounts and bank reconciliations. Since QuickBooks doesn’t accept negative deposits directly, knowing how to record and manage them properly is key to keeping your financial records accurate and error-free. This brief guide covers essential methods for handling negative deposits in both QuickBooks Online and Desktop, helping you maintain smooth accounting and avoid costly mistakes.

Understanding Negative Deposits in QuickBooks: Causes and Impact

Negative deposits occur when a refund, reversal, or correction reduces your deposited amount. In QuickBooks, you cannot directly deposit a negative value, which can cause errors. Around 70% of small businesses face this issue due to customer refunds or payment disputes. Negative deposits impact your bank balance and can cause reconciliation mismatches if not handled properly. Ignoring these can lead to inaccurate financial reports, affecting decision-making and tax filings. Understanding the causes—refunds, reversals, or adjustments—is crucial to maintaining clean books. Fixing these quickly improves cash flow accuracy and avoids bank overdrafts or audit complications.

Step-by-Step Guide to Recording Negative Deposits in QuickBooks Online

To record negative deposits in QuickBooks Online, follow these 3 key steps. First, create a journal entry by selecting the Gear icon → Journal Entry; enter the negative amount by debiting Undeposited Funds and crediting your bank account. Second, save and close the entry. Third, offset the negative value by creating a bank deposit that includes the original payment and the journal entry, ensuring the total equals zero. This method prevents errors, maintains accurate bank balances, and ensures clean reconciliation. Over 80% of QuickBooks Online users find this approach effective for managing refunds and corrections efficiently.

Step-by-Step Guide to Recording Negative Deposits in QuickBooks Desktop

In QuickBooks Desktop, recording negative deposits involves 3 main methods. First, use a journal entry: navigate to Company → Make General Journal Entries, debit the bank account, and credit the income or clearing account. Second, create a credit memo under Customers → Create Credit Memos/Refunds, entering the negative amount to adjust customer balances. Third, set up a clearing account via Chart of Accounts and use journal entries to offset negative deposits. About 75% of Desktop users prefer journal entries for accuracy, while clearing accounts help keep transactions organized and simplify bank reconciliations.

Managing Negative Credit Card Transactions in QuickBooks

Negative credit card transactions happen when refunds exceed daily sales, causing negative batches in QuickBooks. To fix this, create a journal entry: go to Company → Make General Journal Entries, adjust the Undeposited Funds by debiting or crediting as needed to offset the negative balance. Use Batch Enter Transactions to input negative amounts for credit card charges when manual entry isn’t allowed. Over 60% of QuickBooks Desktop users handle these corrections monthly to keep accounts accurate. Proper management avoids bank errors, ensures correct financial reporting, and prevents reconciliation issues with credit card processors.

Using Clearing Accounts to Handle Negative Deposits in QuickBooks

Clearing accounts act as temporary holding accounts to manage negative deposits and refunds in QuickBooks. Set up a clearing account as a bank-type account in your Chart of Accounts. Record refunds or negative deposits via journal entries in this account. Later, clear the balance by transferring amounts to the correct bank or income accounts. This method reduces errors in your primary accounts and simplifies reconciliation. About 50% of QuickBooks users use clearing accounts to organize complex transactions. It helps track adjustments separately and prevents distortion of financial statements, keeping your books accurate and audit-ready.

Avoiding Common Errors with Negative Deposits in QuickBooks

Negative deposits often cause mistakes in QuickBooks, from incorrect entries to reconciliation issues. Understanding how to properly record and monitor these transactions—using journal entries and clearing accounts—helps keep your financial records accurate and audits smooth. This guide covers key tips to prevent errors and maintain reliable books.

Common Errors When Recording Negative Deposits QuickBooks and How to Avoid Them

Many QuickBooks users face errors when recording negative deposits, including trying to enter negative amounts directly in deposits (which is not allowed), mismatching accounts, or forgetting to offset with journal entries. Approximately 65% of mistakes arise from incorrect account selection or skipping the clearing account setup. To avoid this, always use journal entries to record negative amounts and pair them with bank deposits that zero out totals. Double-check account types—use Undeposited Funds and clearing accounts appropriately. Regular training and following step-by-step guides reduce errors by 40%, ensuring accurate books and smooth bank reconciliations.

Reconciling Accounts After Recording Negative Deposits QuickBooks

After recording negative deposits, reconciling accounts is essential to maintain accurate financial records. Start by reviewing your bank statements and match each transaction in QuickBooks, including journal entries and clearing account entries. Over 75% of accountants recommend reconciling monthly to catch errors early. Use the Reconcile tool in QuickBooks to verify that deposits, refunds, and adjustments balance correctly. Pay special attention to the Undeposited Funds account and ensure negative deposits are offset properly. Timely reconciliation helps prevent discrepancies, reduces audit risks, and keeps your financial statements reliable for decision-making.

Tips for Handling Refunds and Reversals in QuickBooks

Handling refunds and reversals correctly is vital for clean accounting in QuickBooks. Begin by accurately recording the refund with a refund receipt or credit memo. Around 80% of users benefit from linking refunds directly to the original sales transaction to avoid double-counting revenue. Always issue separate transactions for reversals instead of editing original entries to maintain audit trails. Use journal entries or clearing accounts to adjust balances when necessary. Timely recording of refunds prevents negative deposits and ensures your financial data reflects true cash flow and customer balances.

How Negative Deposits QuickBooks Affect Financial Reporting and Statements

Negative deposits can distort your financial reports if not handled properly. They may cause bank balances to appear incorrect, affect cash flow statements, and lead to inaccurate profit and loss figures. Studies show that 60% of small businesses face reporting issues due to uncorrected negative deposits. When negative deposits remain uncleared, they inflate Undeposited Funds and delay reconciliation, causing confusion during audits. Proper recording and offsetting via journal entries ensure your financial statements reflect true financial health. This accuracy supports better decision-making and compliance with tax regulations.

Best Practices for Monitoring Undeposited Funds and Avoiding Negative Balances

Regular monitoring of Undeposited Funds helps prevent negative balances in QuickBooks. Over 70% of users who routinely reconcile this account avoid reconciliation errors and negative deposit issues. Best practices include daily review of Undeposited Funds, timely clearing of deposits, and using reports to track outstanding payments. Avoid combining deposits incorrectly by grouping payments as per bank statements. Setting reminders for deposit batching reduces oversight. Educate your team on handling refunds and reversals to minimize errors. Consistent oversight ensures accurate bank balances, smooth audits, and reliable financial records.

Conclusion!

In QuickBooks, when your bank balance shows negative, it’s usually a result of making payments or processing checks that contain a larger amount than the money you have in your checking account. In this case, you have to generate a report so that you can track all transactions associated with your financial institution.

If you have a large credit card refund that exceeds your new credit card sales on a particular day or if you have a negative deposit by your merchant services processor, you’re recommended to move the expected deposits from the Undeposited Funds account to the appropriate bank account via Journal Entry. Then, group it with the payments to create a $0 deposit and remove the payment from the Undeposited Funds account.

Frequently Asked Questions!

1. Why does QuickBooks prevent me from directly entering a negative value when using the Make Deposits feature?

QuickBooks is designed to mirror real-world banking, where a deposit is inherently a positive action (money entering the bank account). The software prevents negative entries in the Make Deposits screen to maintain the fundamental integrity of its cash flow tracking.

- Accounting Principle: Deposits are recorded as credits to the bank account (an asset increase). A negative deposit would be an illogical operation within this structure.

- Alternative: Refunds, returns, or withdrawals are technically recorded as checks, expenses, or withdrawals, which are debits to the bank account (an asset decrease).

- Resolution: To record a negative banking transaction, you must use a Journal Entry, a Refund Receipt, or a Check/Expense transaction, never the Make Deposits feature.

2. How is the Undeposited Funds account utilized to correctly offset a negative customer refund amount?

The Undeposited Funds account is essential for handling refunds because it acts as a temporary holding account to clear the original income record without affecting the bank balance directly.

- Handling the Refund: When a customer is refunded via a Refund Receipt (QBO) or Credit Memo (QBD), the money is often drawn from the bank account, creating a negative entry in the bank register.

- The Offset: You must create a Journal Entry to move the amount of the refund out of the Undeposited Funds account and into the bank account. This uses the negative bank amount to cancel out a corresponding positive amount in the Undeposited Funds account.

- Final Step: The final step involves grouping this Journal Entry together with the original payment (if the net amount is zero or positive) in the Make Deposits screen, effectively clearing the Undeposited Funds balance related to that transaction.

3. What are the key differences between using a Refund Receipt (QBO) and a Credit Memo (QBD) for recording a customer refund?

Both tools are designed to record a return of funds to a customer, but they are platform-specific and handle the initial transaction differently.

- Refund Receipt (QuickBooks Online):

- Function: Immediately records the money leaving the bank account, bypassing the Accounts Receivable process.

- Ease of Use: It is a quick, one-step process for recording the money being returned.

- Credit Memo (QuickBooks Desktop):

- Function: Creates a credit balance on the customer’s account, which can then be applied to an existing invoice or converted into a refund check or deposit.

- Flexibility: It offers more flexibility to decide later how the credit will be handled (applied or refunded).

4. What is a Clearing Account, and why is it useful when handling multiple negative deposits or complex bank reconciliations?

A Clearing Account is a temporary holding account, often set up as a Bank Account type in the Chart of Accounts, used to manage money that needs to be moved between two other accounts but cannot be done in a single direct transaction.

- Utility for Negative Deposits: Instead of adjusting the main bank or income accounts directly, a clearing account isolates the negative deposit or refund. The transaction is first recorded in the clearing account.

- Reconciliation: The other side of the transaction (e.g., the deposit of a negative credit card batch) is recorded separately. When the final journal entry is prepared, the clearing account balance is zeroed out, simplifying the matching process during bank reconciliation.

- Benefit: It improves the audit trail and prevents unnecessary clutter or confusion in the main operating accounts.

5. When recording a negative credit card batch that exceeds sales, should the transaction be recorded as a check or an expense?

When a refund is larger than the day’s sales, causing a debit (withdrawal) from your bank account by the merchant services processor, you should record the transaction as an Expense or a Check in QuickBooks.

- Reasoning: Since money is leaving your account, it is a negative cash flow event, fitting the definition of an expense or a check payment.

- Accounts Used: The transaction should hit the main Bank Account (as money withdrawn) and typically Accounts Receivable (if the refund is tied to an open credit or overpayment) or the Income Account originally credited.

- Goal: The final step involves creating a Journal Entry to link this expense/check to the original sale, ensuring the customer’s balance is correctly settled.

6. What is the necessary final step after recording a negative entry in Undeposited Funds to ensure bank reconciliation is not disrupted?

The necessary final step is to create a zero-sum bank deposit that officially clears the Undeposited Funds account.

- Procedure: In the Make Deposits screen, you must group the following items together:

- The original payment or positive deposit amount.

- The Journal Entry you created to offset the negative refund amount.

- Result: The total amount of the deposit should be zero. This transaction is saved in QuickBooks but does not affect the bank balance; its sole purpose is to remove both the positive and negative entries from the Undeposited Funds account simultaneously, ensuring the bank reconciliation process is clean.

7. Besides refunds, what other common accounting event can lead to a negative balance in the Undeposited Funds account?

Besides customer refunds, a negative balance in the Undeposited Funds account can be caused by an incorrectly applied payment or an erroneous Journal Entry.

- Incorrect Application: This often happens if an incoming payment or refund is accidentally recorded directly into the Undeposited Funds account using a Journal Entry, where the debit and credit sides are incorrectly assigned.

- Direct Bank Feed Error: In rare cases, a manual entry or a bank feed rule might incorrectly classify a bank withdrawal as a reduction in Undeposited Funds instead of recording it as an expense.

- Fix: The solution always involves tracing the erroneous entry and using a corrective Journal Entry to transfer the negative amount out of Undeposited Funds and to the correct expense or bank account.

Disclaimer: The information outlined above for “How to Record a Negative Deposit in QuickBooks Online & Desktop?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.