Recording mortgage payments in QuickBooks is essential for tracking financial obligations and maintaining correct mortgage account records. This integration will help people and businesses understand their cash flow and general financial health and streamline their financial procedures.

Why is it Important to Record Mortgage Payments in QuickBooks?

It is crucial to record mortgage payments in QuickBooks to maintain accurate mortgage account records, track financial responsibilities, and ensure effective financial management.

If individuals and businesses integrate mortgage payments into QuickBooks, they can streamline their financial processes and also gain a clear understanding of their cash flow and overall financial health. This will allow them to make an informed decision regarding forecasting, budgeting, and investment opportunities, all heading towards better financial accountability.

Correct record-keeping in QuickBooks will lead to a solid foundation for loan application, tax reporting, and financial audits, eventually creating a strong financial reputation and correctness.

Configuring Escrow in QuickBooks Desktop for Mortgage

To configure escrow in QuickBooks Desktop, create three accounts: a Long Term Liability account for the loan, an Other Current Asset account for escrow, and an Expense account for interest. You can track escrow activity in QuickBooks Desktop by creating three accounts.

Follow the steps below:

Step 1: Access the Chart of Accounts:

First, select the Chart of Accounts from the QuickBooks Lists section.

Step 2: Add New Account:

Now, right-click anywhere and click New.

Step 3: Then, Create a loan Account:

- Step 1: Select Account Type:

- Click on Other Account Types from the drop-down menu, select Long Term Liability, and click the Continue button.

- Step 2: Name the Account:

- Now, from the Name menu, enter the name of the loan.

- Step 3: Enter Opening Balance:

- Then, click the Enter Opening Balance option, and in the Opening Balance section, enter the full (beginning) amount of the loan.

- Step 4: Set Loan Origination Date:

- In the as of field, enter the loan origination date.

- Step 5: Save Account:

- Click on the Save & New button.

Step 4: Create an escrow account:

- Step 1: Select Account Type:

- First, from the Type drop-down menu, select Other Current Asset.

- Step 2: Name Escrow Account:

- Now, enter the account’s name ( for example, Escrow), the Opening Balance amount ( if there might be any prior payments), and the as-of date.

- Step 3: Save Account:

- Click the Save & New option.

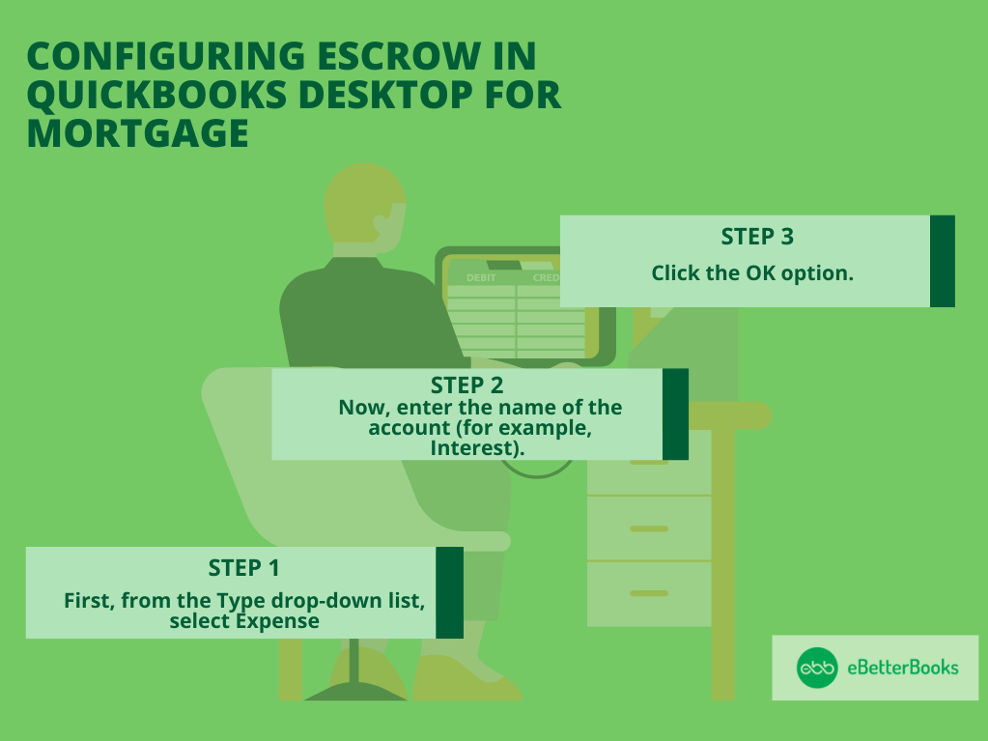

Step 5: Create an expense account:

Step 1: Select Expense Type:

- First, from the Type drop-down list, select Expense.

Step 2: Name Expense Account:

- Now, enter the name of the account (for example, Interest).

Step 3: Save Changes:

- Click the OK option.

Recording Mortgage Payments in QuickBooks

To record mortgage payments in QuickBooks: Use Write Checks from the Banking menu, enter vendor and amount, and fill in account details. For escrow, adjust the Chart of Accounts and Register entries, then click Record.

Follow the steps below to learn how:

Record Mortgage Payments as Write Checks

- First, from the Banking menu, select Write Checks.

- Now, select the relevant vendor and enter the payment amount.

- Then, from the Expenses tab, enter the accounts you’ve created and the relevant amounts. You will generally get this information from your lending institution.

Note: QuickBooks doesn’t do loan amortization.

- Click the Save & Close option.

- Make the shift from the escrow account:

- First, from the Lists section, select Chart of Accounts.

- Now, double-click on the escrow account to open its Register.

- Then, enter the amount in the Decrease section, and then choose the Expense account.

- Note: You can make accounts that depend on the expenses that make up your escrow payment.

- Lastly, after making the correct entries, click the Record option.

Record Mortgage Payments as Expenses

You can make a journal entry to clear the Account Payable (A/P) balance. To record mortgage payments as expenses, create a journal entry by selecting Plus (+) > Journal Entry, adjust dates, enter amounts, and save. Then, apply the entry by navigating to Expense > Vendors, locating the bill, making the payment, and linking it with the journal entry.

Follow the steps mentioned below:

- First, click on the Plus sign (+).

- Now, select the Journal Entry.

- Then, from the Journal Entry window, change the date if it’s required.

- In the Account field, select the right debit account from the drop-down menu.

- After this, enter the amount in the Debit field.

- Tap on the name field and choose the right debit account from the drop-down menu.

- In the next row, select the off-setting or the clearing account from the Account section.

- The amount from the Credit section should be the same as the amount in the Debit section.

- Click on the Save & Close option.

Once you’ve made the journal entry, then apply it to the existing balance by making an expense transaction.

- First, navigate to the Expense menu.

- Now, choose the Vendors tab.

- Then, look for the vendor’s name.

- After this, search for the Bill to pay.

- Click on the Make Payment option.

- Mark both the Bill and the Journal Entry to link them.

- Lastly, click on the Save and Close button.

Recording Mortgage in the Property Purchased

First, you’re required to set up an asset account to track the commercial property that you’ve purchased.

- First, navigate to the Accounting menu.

- Now, choose Charts of Accounts, then click New.

- Then, from the Account Type drop-down section, select Fixed Assets.

- In the Detail Type drop-down section, choose the option that closely describes the asset.

- After this, name the account, then choose the Track depreciation of this asset checkbox.

- Enter the recent value of your asset in the Original cost section and the as-of-date. If recording the loan, leave this field blank.

- Lastly, click on the Save and Close option.

After this, set up a liability account to record the mortgage and loan payments. If you’re confused about which categories to use, you should consult an accounting professional to ensure that everything is recorded correctly.

Configuring QuickBooks for Setting Up a Mortgage Company

To configure QuickBooks for a mortgage company: Click the Gear Icon, select Account and Settings, choose Company type, select Mortgage and nonmortgage loan brokers, and click Save. For integration, contact Intuit Developer.

Follow the steps mentioned below to set up a company:

- First, navigate to the Gear Icon.

- Now, choose the Account and Settings under the company section.

- Then, navigate to Company and choose Company type.

- Choose the menu beside the Industry.

- After this, type Mortgage and nonmortgage loan brokers.

- Lastly, click the Save option.

Additionally, if you already have a program for your mortgage company that you wish to integrate, you need to contact the Intuit Developer.

how to record mortgage payments in QuickBooks online?

To record mortgage payments in QuickBooks Online, follow these below steps:

Step 1. Set Up a Liability Account

- Go to Settings (⚙️) > Chart of Accounts

- Click New, select Long Term Liabilities (or Other Current Liabilities if short-term)

- Name it (e.g., “Mortgage Payable”)

Step 2. Record the Mortgage Loan

- Go to + New > Journal Entry

- Debit Bank Account (amount received)

- Credit Mortgage Payable (loan amount)

- Credit Escrow or Other Fees (if applicable)

Step 3. Enter Monthly Mortgage Payments

- Go to + New > Check or Expense

- Select the Bank Account

- Enter the Lender as Payee

- Allocate amounts:

- Principal → Mortgage Payable (Liability)

- Interest → Interest Expense (Expense)

- Escrow (if any) → Escrow Account (Asset)

- Click Save and Close

For automation, set up a Recurring Expense under Gear > Recurring Transactions.

Configuring Escrow in QuickBooks Online for Mortgage

If you signify about setting up a loan, you have the option to set up loans in your books by creating liability accounts to track what’s owed.

Follow the steps mentioned below:

- First, from the left navigation bar, navigate to Accounting, then Chart of Accounts.

- Now, click on the New button.

- Then, in the Account Type drop-down menu, select the Long-Term Liabilities. If it’s decided to be paid off by the end of the fiscal year, select Other Current Liabilities instead.

- In your Detail Type drop-down section, select Notes Payable.

- Provide the account name.

- In the Balance section, enter the amount which is currently in your account.

- Decide the as of date. Enter today’s date if you wish to begin tracking immediately.

- Select the Save and Close option.

Tips for Recording Mortgage Payments in QuickBooks

To increase the precision and efficiency of mortgage payment recording in QuickBooks, try implementing advanced tips such as:

- Leveraging mortgage payment tracking software

- Statement reconciliation

- Optimizing mortgage payment bookkeeping processes

This approach easily identifies and resolves discrepancies between recorded transactions and the actual bank statements, ensuring that all mortgage payments are appropriately accounted for. Using specialized mortgage payment tracking software will streamline the process, provide real-time updates on payment status, and facilitate timely reconciliation.

Enhancing mortgage payment bookkeeping is essential for upholding regulatory compliance, keeping records in order, and building a strong financial management system.

Accurate financial record-keeping requires learning how to record mortgage payments in QuickBooks, whether you work as an accountant or own a small business.

Managing Interest Charges and Additional Fees

Step 1: Create a New Transaction

- Initiate a new transaction account by navigating to the Banking tab and select Make Deposits to create a new transaction to record additional fees and interest charges associated with your mortgage payments in QuickBooks. This allows you to document all components of your mortgage record accurately.

Step 2: Select the Mortgage Payment Account

- Choose the specified mortgage payment account you set up earlier. This will ensure that all related transactions are categorized correctly which will facilitate tracking and reporting within QuickBooks.

Step 3: Enter Interest Charges and Additional Fees

- Provide the specific details about any additional fees or interest charges:

- Go to the Banking tab, select Make Deposits, and ensure you categorize these charges correctly under the Interest Expense account.

- Utilize QuickBooks’ reconciliation features to confirm that all payments are matched accurately which will enhance your bookkeeping efficiency.

Managing Multiple Mortgage Payments in QuickBooks Desktop and Online?

If you’re handling multiple mortgage payments in QuickBooks, here’s how you can manage them efficiently:

- Set Up Multiple Mortgage Accounts:

- In QuickBooks Desktop or Online, create separate accounts for each mortgage. This ensures that each mortgage payment is tracked correctly.

- Record Payments for Each Mortgage:

- For each mortgage, record payments by selecting the appropriate mortgage account in QuickBooks. Use “Write Checks” or “Pay Bills” for payments, depending on the version you’re using.

- Include Escrow and Taxes:

- If your mortgage includes escrow for property taxes or insurance, make sure to record these separately in QuickBooks. You can create a liability account for each escrow portion.

- Track Interest and Principal Separately:

- When recording mortgage payments, allocate a portion of the payment to interest and another to the principal. QuickBooks can help you split this using categories.

- Review Reports Regularly:

- Regularly review your mortgage payment reports to ensure everything is being tracked correctly. QuickBooks provides detailed reports that can help you monitor your mortgage balances.

This simplified version keeps the focus on key actions that users can take to manage multiple mortgages effectively.

How to Create Mortgage Payment Schedules and Balance Sheets in QuickBooks?

Creating mortgage payment schedules and balance sheets helps you track payments and manage your financial obligations efficiently. Here’s how you can do it:

- Set Up a Mortgage Account

In QuickBooks, create a liability account for your mortgage. This will track the principal balance and payments over time. - Record Loan Details

Enter the loan amount, interest rate, and payment frequency into QuickBooks. This will automatically generate a schedule of future payments. - Generate Payment Schedules

Use the payment schedule to map out the amount due each month. QuickBooks will calculate interest and principal amounts based on the loan terms you entered. - Track Payments and Update Balance Sheets

As you make mortgage payments, record them in QuickBooks under the appropriate liability account. This keeps your balance sheet updated and accurate. - Review Financial Reports

Regularly review your balance sheet to ensure all mortgage payments are reflected correctly and that your principal balance is decreasing over time.

This summary removes unnecessary details and focuses on clear, actionable steps, making it easier for users to follow and implement.

How to Use the Write Checks Feature to Record Mortgage Payments in QuickBooks?

To record mortgage payments in QuickBooks, the “Write Checks” feature is a simple and effective method. Here’s how you can do it:

- Open QuickBooks: Launch your QuickBooks Desktop or Online account.

- Navigate to Write Checks:

- In QuickBooks Desktop, go to the Banking menu and select Write Checks.

- In QuickBooks Online, go to the + New button and select Check under the “Other” section.

- Fill Out Payment Details:

- Payee: Enter the name of the mortgage lender.

- Bank Account: Select the bank account you’re paying from.

- Payment Amount: Enter the total mortgage payment (including principal and interest).

- Categorize the Payment:

- For the expense account, select your mortgage liability account to track the loan balance.

- If applicable, split the payment between principal and interest to ensure accurate tracking.

- Add Any Additional Fees: If there are additional charges like escrow or insurance, you can add them under separate expense accounts.

- Save the Check: Once everything looks correct, click Save and Close or Save and New to record the payment.

By following these steps, you’ll accurately record your mortgage payments in QuickBooks, ensuring proper tracking of both principal and interest.

Differences in Recording Mortgage Payments Between QuickBooks Desktop and Online

QuickBooks Online and QuickBooks Desktop both offer ways to record mortgage payments, but they differ in features and how they are used.

- QuickBooks Online is cloud-based, allowing real-time collaboration and access to accounting data from anywhere. It’s ideal for businesses that need flexibility and remote access.

- QuickBooks Desktop is desktop-based, offering more control over data and stability. It’s suited for businesses that prefer locally installed software.

Migration Tip: When moving from QuickBooks Desktop to Online, bank and credit card information does not transfer automatically. To connect bank accounts in QuickBooks Online:

- Go to Bookkeeping

- Select Transactions

- Choose Bank Transactions

QuickBooks Online is perfect for remote access, while QuickBooks Desktop is best for businesses seeking data control.

FAQ

Common Errors When Recording Mortgage Payments in QuickBooks

When recording mortgage payments in QuickBooks, common mistakes include:

- Not Recording the Loan: Failing to record the loan can lead to payments being categorized as expenses.

- Incorrectly Categorizing Transactions: Ensure mortgage payments are linked to the correct accounts like Mortgage Interest, Mortgage Liability, and Mortgage Escrow.

- Not Matching Payments to Bank Statements: Always verify that the payment amounts recorded in QuickBooks match your bank deposit slip.

How to Fix These Errors:

- Review your payment transactions in the Deposit window.

- Uncheck any payments that aren’t part of the actual deposit from the bank.

- Add missing payments by selecting the checkbox next to them.

How to Track Multiple Mortgage Payments in QuickBooks

To track mortgage payments in QuickBooks, you can set up different accounts for the loan, escrow, and expenses. Here’s how to create and manage them:

- Create a Loan Account:

- Go to Lists > Chart of Accounts

- Click New and choose Long Term Liability

- Fill in the account details (Number and Account Name)

- Click Save & Close

- Create an Escrow Account:

- Go to Lists > Chart of Accounts

- Click New and choose Other Current Asset

- Enter the Account Name and click Save & New

- Create an Expense Account:

- Go to Lists > Chart of Accounts

- Click New and choose Expense

- Fill in the Account Name and click OK

By setting up these accounts, you can accurately track principal, interest, and escrow payments through splits in transactions.

How to Automate Mortgage Payments in QuickBooks

Automating mortgage payments in QuickBooks can save time and help keep your records up to date. Here’s how to do it:

- Set up your mortgage account: First, add your mortgage company as a vendor in QuickBooks and set up the mortgage account under your chart of accounts.

- Enter the mortgage details: Under the “Expenses” section, enter the mortgage payment details, including the payment amount, due date, and interest.

- Create a recurring payment: Set up a recurring transaction for the mortgage payment. This ensures payments are automatically entered into QuickBooks on the due date.

- Assign the payment categories: For accurate tracking, assign the payment to the correct expense account, such as “Mortgage Interest” or “Principal Payment.”

- Monitor and review: Regularly check the automated payments to ensure they are accurate and reflect any changes in your mortgage payment amount.

This automation process makes it easier to track mortgage payments, streamline your accounting, and ensure you’re always on top of your financial obligations.

Managing Escrow Payments Along with Mortgage Payments in QuickBooks

When handling mortgage payments in QuickBooks, it’s essential to manage escrow payments alongside them for a complete record of your finances. Here’s how you can do it:

- Set up your mortgage account: Create a liability account for your mortgage in QuickBooks, and include an escrow account to track payments for taxes and insurance.

- Record the mortgage payment: Enter your mortgage payment as a “Write Check” or an “Expense” depending on how you pay. Be sure to split the payment into the principal amount, interest, and escrow amounts.

- Track escrow payments: For taxes and insurance paid via escrow, enter these as payments to the appropriate accounts. This ensures you’re keeping accurate records for both the mortgage and any escrow transactions.

- Review and reconcile: Regularly check your accounts to ensure the amounts paid for escrow are correctly recorded and match your mortgage statements. This helps avoid any discrepancies and keeps your financial records accurate.

Managing escrow payments with mortgage payments in QuickBooks ensures your bookkeeping stays organized, covering both the principal and the extra payments for taxes and insurance.

How Mortgage Payments Affect Tax Calculations in QuickBooks?

When you record mortgage payments in QuickBooks, it’s essential to consider both the principal and interest components, as they impact your tax calculations differently.

- Principal Payments: These are not tax-deductible since they reduce the outstanding loan balance.

- Interest Payments: The interest portion of your mortgage payment is typically tax-deductible, reducing your taxable income.

QuickBooks allows you to categorize these payments correctly so that your tax reporting is accurate. Ensure you set up a liability account for your mortgage and separate the interest expense, making it easier to track the deductible portion when preparing taxes.

By keeping mortgage payments properly recorded, QuickBooks helps streamline your tax filing process and ensures you’re not missing out on potential deductions

Disclaimer: The information outlined above for “How to Record a Mortgage Payments in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.