Highlights (Key Facts & Solutions)

- Segregate K-1 Income: Always create a dedicated “Other Income” account for K-1 distributions to correctly separate them from primary business sales and simplify complex tax treatment.

- Reconciliation is Mandatory: Regularly reconcile the K-1 income account against the official Schedule K-1 form to confirm that all cash deposits match the reported profit share, minimizing IRS audit risk.

- QBO Limitation: QuickBooks Online (QBO) allows for recording the cash transaction but does not support direct tax processing or generation of the Schedule K-1 form itself; a CPA or integrated software is required.

- Use Class Tracking for Multiple Entities: Utilize the Class Tracking feature to assign a unique class to income and expenses from each separate partnership or S-Corp, allowing for precise Profit and Loss by Class reporting.

- Avoid Unverified Entry: Never record K-1 income based on estimates; ensure the amount is confirmed and verified against the final, official Schedule K-1 form to prevent discrepancies and incorrect estimated tax calculations.

- Record Tax Payments Separately: Record K-1 related tax assessments or estimated payments immediately using a Tax Expense or Journal Entry, not a standard expense account, to maintain a clear audit trail.

- Consult a CPA: An accountant’s review is essential for verifying complex tax classifications, such as distinguishing between passive and active K-1 income, which critically impacts personal tax liability.

Overview

To record K-1 Income in QuickBooks (both Desktop and Online), create a separate account ( dedicated to K-1 income), then mention the income as a deposit, categorize the K-1 income, record the related expenses and reconcile the account.

K-1 income refers to the share of income, losses, deductions, and credits that a partner, shareholder, or beneficiary receives from a pass-through entity. K-1 income is issued to particular tax implications, which vary based on the type of partnership and its tax filing.

The income reported on a K-1 is generally subject to individual income tax rates rather than corporate tax rates, making it essential for partners and shareholders to accurately report this information on their tax filings.

Recording K-1 income in QuickBooks(both Desktop and Online), is essential for accurate financial records and IRS compliance. It saves time, reduces errors, and leads to a smoother tax reporting process while minimizing the risk of penalties or audits.

Recording K-1 income in QuickBooks Desktop is used to track all income distributions received from Partnerships, S-corporations, or Trusts.

There are three primary types of K-1 forms:

- Form 1065: This form is used for partnerships and reports each partner’s share of the partnership’s income, losses, deductions, and credits.

- Form 1120-S: This form is issued by S corporations to report each shareholder’s share of income, losses, deductions, and credits.

- Form 1041: This form is used by estates and trusts to report income passed through to beneficiaries.

How to Record K-1 Income in QuickBooks Desktop?

It involves setting up accounts, categorizing income and expenses, and reconciling financial records for accurate tax and financial reporting.

Step by Step to record K-1 Income in QuickBooks Desktop

Step 1. Set Up a New Dedicated Account for K-1 Income

- Navigate to the Chart of Accounts:

- Go to Lists > Chart of Accounts in QuickBooks.

- Create a New Account:

- Click the Account button at the bottom and select New.

- Choose the appropriate account type (usually Income or Other Income).

- Name the account (e.g., “K-1 Income”) and add a description if needed.

- Save the new account.

Note: Ensure proper categorization for compliance with financial and tax reporting standards.

Step 2. Record K-1 Income as a Deposit

Enter the K-1 income as a deposit under the newly created account.

Here is how:

- Go to the Bank Account:

- From the Banking menu, select Make Deposits.

- Select the K-1 Income Account:

- In the deposit window, choose the new K-1 income account from the “Account” dropdown.

- Enter the Income Details:

- Enter the amount of income received as listed on the K-1 form.

- Add any necessary memos or references for clarity.

- Save the Deposit:

- Once all details are entered, click Save & Close.

- Follow partnership agreements and tax laws to ensure accurate record-keeping.

Step 3. Categorize K-1 Income

- Review Your K-1 Form:

- Identify the types of income reported (e.g., dividends, interest, capital gains).

- Assign Income to the Correct Category:

- Go to the Chart of Accounts and ensure each income type from the K-1 form is matched to the correct QuickBooks category (e.g., interest income, dividend income).

- Ensure Correct Allocation:

- If the K-1 reports different types of income (e.g., capital gains or other sources), assign them to the corresponding categories in the deposit or transaction entry.

- Use the “Income” or “Other Income” Category:

- If income is non-standard, use a sub-account under “Other Income” for better tracking.

Note: QuickBooks provides tools through which you can categorize and track capital gains and losses accurately.

- Track Business Expenses:

- Go to Vendors > Enter Bills or Write Checks for any expenses related to K-1 income.

- Categorize Expenses:

- For each expense, assign it to the correct account (e.g., travel, office supplies, professional fees).

- Link the expense to the K-1 income account if possible to track deductions accurately.

- Ensure Documentation:

- Attach receipts or documentation for each expense for record-keeping.

Step 5. Reconcile the K-1 Income Account

Regularly reconcile the account to ensure financial accuracy and compliance.

Here is how to do it:

- Go to Reconciliation:

- From the Banking menu, select Reconcile.

- Select the Account:

- Choose the K-1 income account you set up earlier.

- Match Transactions:

- Compare the transactions in QuickBooks with those on your bank statement, making sure everything aligns.

- Check for Discrepancies:

- If any discrepancies are found, review your records and fix any errors, such as unrecorded income or missed expenses.

- Complete the Reconciliation:

- Once everything matches, complete the reconciliation.

Note: Verify the figure twice against the information on Schedule K-1 to address discrepancies and maintain consistency.

Important Note: At this moment, QuickBooks Online does not support processing Schedule K1. However, you have the option to download the form directly from the IRS official website. After that, run the financial report in your account and utilize the information to manually process the form.

How to Record K-1 Income in QuickBooks Online?

To record K-1 income in QuickBooks Online, create a “K-1 Income” account in the Chart of Accounts. Then, record the income via a bank deposit, and verify it using a Profit and Loss report.

Step by Step to record K-1 Income in QuickBooks Online

Start by signing in to QuickBooks Online and select the company where you need to record K-1 income.

After that follow the below steps:

Step 1. Create an Income Account

- Navigate to the Chart of Accounts:

- Go to Accounting > Chart of Accounts.

- Create a New Account:

- Click on New.

- Choose Income as the account type and click Save and Close.

- Name the account (e.g., “K-1 Income”) and provide any necessary details.

Step 2. Record the K-1 Income

- Go to the Bank Account:

- Click on + New and select Bank Deposit.

- Select the K-1 Income Account:

- Choose the bank account where the K-1 income is deposited.

- Enter the Income Details:

- In the Add funds to this deposit section, select the K-1 Income account you set up.

- Enter the amount and any other necessary information.

- Click Save and Close.

Step 3: Categorize the K-1 Income

- Review Your K-1 Form:

- Review the K-1 form to identify the specific types of income reported, such as interest and dividends.

- Assign Income to the Correct Category:

- For each type of income, create a corresponding category within QuickBooks Online

- Then, categorize the K-1 income transactions.

Step 4: Track Expenses ( if needed)

- Track Business Expenses:

- Record any expenses related to K-1 income in QuickBooks Online.

- Ensure Documentation:

- Be sure to categorize these expenses correctly and link them to the relevant K-1 income items.

Step 5. Verify the Entry

- Run profit and Loss report

- To confirm the accuracy of your records, run a Profit and Loss report

- Match Transactions:

- Ensure that the K-1 income account balance is correctly listed under the designated account.

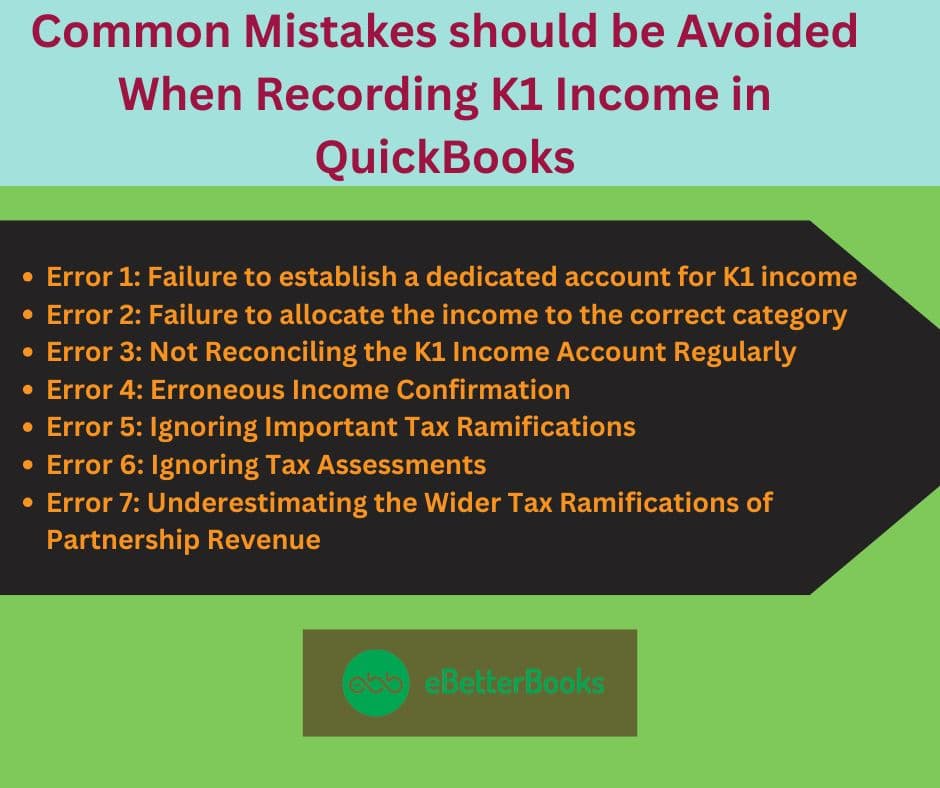

Common Mistakes should be Avoided When Recording K1 Income in QuickBooks

When recording K1 income in QuickBooks, avoid common errors such as incorrect income confirmation, failing to establish a dedicated account for K-1 income, overlooking critical tax implications, neglecting tax assessments, allocating wrong income to wrong category, and underestimating the broader tax consequences of partnership income.

Failing to accurately verify K1 income can lead to discrepancies in financial records, potentially triggering audits or tax penalties. Overlooking tax implications can result in underpayment or overpayment of taxes, causing financial strain and possible legal issues. Refrain from paying tax assessments to avoid unexpected tax bills or missed opportunities for deductions. Being mindful of these factors ensures accurate recording and reporting of K1 income in QuickBooks.

Error 1: Failure to Establish a Dedicated Account for K1 Income

Mistake: Not having a separate account for K-1 income can create challenges in tracking income and meeting tax obligations, which may lead to revenue discrepancies, reduced financial transparency, incorrect tax liabilities, and missed tax adjustments, resulting in penalties and complicating finances.

Solution: If you failed to establish a dedicated account for K1 income, then, go to the Lists menu and select Chart of Accounts. Click the Account button and choose New. Select the account type (Income or Other Income), name it (e.g., “K-1 Income”), add a description if needed, and save. This will help you track this income source clearly.

Error 2: Failure to Allocate the Income to the Correct Category

Mistake: Assigning K1 income to the wrong category can lead to errors during tax preparation, difficulties reconciling income, limitations with tax software, and potential inaccuracies in tax reporting tools within QuickBooks. This misclassification may result in underreporting or overreporting earnings, complicating financial accuracy and increasing audit risks.

Solution: If you have allocated the wrong income to the correct category, Go to the “Chart of Accounts” in QuickBooks. Create or edit income accounts to match the income types from your K-1. For non-standard income, use a sub-account under “Other Income” for better tracking. Make sure each income type has a corresponding account.

Error 3: Not Reconciling the K1 Income Account Regularly

Mistake: Neglecting regular reconciliation of the K1 income account in QuickBooks can cause inaccuracies in financial records and complicate tax accounting. This oversight affects accurate assessment of the partnership’s finances, disrupts income and deduction allocations, and can result in delays and errors in tax filings, impacting compliance and overall financial health.

Solution: To keep your K-1 income updated, reconcile it quarterly or monthly by going to the Banking menu and selecting “Reconcile.” Choose the K-1 income account, compare transactions, and correct any discrepancies like unrecorded income or missed expenses. Once everything matches, complete the reconciliation.

Error 4: Erroneous Income Confirmation

Mistake: Sometimes, businesses enter K-1 income without verifying it against the official Schedule K-1 received, which leads to understatement, overstating of income, reconciliation issues with the IRS, misalignment with tax returns, etc

Solution: S-corp and partnership produce a Schedule K-1, so make sure to double-check the K-1 form from S-corp or partnership and then enter the correct amount into the account. Only enter those records that have been confirmed and verified.

Error 5: Ignoring Important Tax Ramifications

Mistake: If you fail to understand the tax implications of K-1 income, such as passive vs. active treatment of income and employment tax, then it can lead to errors in reporting and unexpected liabilities.

Solution: When recording K-1 income in QuickBooks, use designated accounts like “K-1 Other Income” and add notes for clarity. Consult a CPA to determine if the income is subject to self-employment tax, how to apply losses, and its impact on estimated taxes. T

Error 6: Ignoring Tax Assessments

Mistake: Sometimes, businesses forget to enter or track tax payments or assessments related to K-1 income, creating gaps in expense tracking and misrepresenting net profit.

Solution: Record all tax assessments or payments related to K-1 income under “Tax Expense” or a custom category in QuickBooks, like “K-1 Related Tax Adjustment.” Use Journal Entries for prior-year adjustments, including clear memos with dates and references, to maintain an accurate audit trail and net income reporting.

Error 7: Underestimating the Wider Tax Ramifications of Partnership Revenue

Mistake: Many users overlook the ripple effects of K-1 income, which can include phase-outs for tax credits, increased exposure to the Alternative Minimum Tax (AMT), or impacts on multiple entities. Recording this income in isolation without understanding its broader implications for the overall tax situation can lead to flawed planning and reporting.

Solution: In QuickBooks, categorize K-1 Inc.” me using class tracking or”memo fields (e.g., passive, rental, guaranteed payments) to help your tax professional assess its implications. Pair K-1 entries with reports like Profit & Loss by Class to see how this income impacts your overall finances and tax position.

Advantages of Recording K-1 Income in QuickBooks

Recording K-1 income in QuickBooks offers several advantages for individuals and businesses:

- Accurate Tracking: It checks that K-1 income is properly incorporated into overall financial statements and that there are no discrepancies.

- Simplified Tax Reporting: QuickBooks can prepare reports that incorporate K-1 income into taxes, which will help minimize the possibility of making blunders.

- Enhanced Financial Management: They tried to outline net and gross income, which helps to control cash flow and forecast operating expenses.

- Simplified Reconciliation: QuickBooks assists in matching the records with the K-1 form, making audits and reviews easy.

- Organized Records: Saving it in QuickBooks is helpful because it keeps the records clean and organized, especially if one needs to recall the amount of K-1 income later or show documentation.

- Reporting & Analysis: Business owners and financial specialists may use QuickBooks’ reporting features to understand how K-1 income influences their status and make decisions.

What Additional QuickBooks Features Can Assist in Managing K-1 Income?

Beyond recording K1 income, QuickBooks offers features like comprehensive general ledger management, tax code integration, and simplified income statement generation for partnership income. Users can create detailed, customizable ledger entries for accurate financial tracking and reporting. The integration of specific tax codes streamlines the allocation of income, expenses, and deductions, making tax reporting less complex. QuickBooks also generates tailored income statements, providing a clear overview of financial performance. These features collectively aid in informed decision-making for managing partnership income.

Tracking Expenses and Income by Class

Using QuickBooks to track expenses and income by class enhances financial planning, informed tax advice, accurate tax liability assessment, and proper segmentation of tax-exempt income within a partnership. This feature provides businesses with a clearer understanding of their financial status, aiding in cost-saving and revenue generation.

Categorizing income and expenses by class simplifies the analysis of different revenue streams’ impacts on overall financial health. Accurate tax liability accounting and segregation of tax-exempt income ensure compliance with tax regulations.

Generating Reports for K1 Income

QuickBooks generates comprehensive reports tailored for K1 income, enabling seamless income tracking, meticulous tax record management, and streamlined income tax filing for partnerships. These reports provide a clear overview of the partnership’s financial health, ensuring accurate K1 income recording.

By integrating relevant tax records, users gain insights into tax implications, aiding in informed tax planning and compliance. This consolidation simplifies tax return preparation, reducing complexities associated with income tax filing.

Setting Up Automatic Transactions for K1 Income

Automating K1 income transactions in QuickBooks streamlines financial management, ensures tax compliance, meets filing deadlines, and provides accurate documentation for recordkeeping. This reduces human error, simplifies organizing and categorizing income and expenses, and creates a solid foundation for tax compliance.

It also allows businesses to manage cash flow and allocate resources strategically and proactively. Automation frees up time for financial professionals to focus on higher-value tasks, enhancing overall financial management efficiency.

How Do I Enter other Income (Loss) to Flow to the Schedule K or Schedule K-1 in QuickBooks?

To enter other income (loss) that flows to Schedule K or Schedule K-1 in QuickBooks, follow these steps:

For Partnership Schedule K-1

- Access the Input Return:

- Navigate to Input Return in your QuickBooks tax software.

- Select Passthrough K-1’s:

- Click on Income and then select Passthrough K-1’s.

- Choose Partnership Info:

- Select the Partnership Info (1065 K-1) option.

- Locate Other Income Section:

- Go to the Less Common Scenarios tab and scroll down to find the Separately Stated Income section.

- Enter Other Income (Loss):

- For reporting, if the income is passive, it should flow to Schedule E, page 2, line 28, column h. If it is nonpassive, it should go to line 28, column k.

For Other Deductions and Income

- Select Schedule K Items:

- In the Input Return tab, choose Schedule K and then click on Other Schedule K Items.

- Input Other Income (Loss):

- Find the section for income (loss) and enter the relevant codes and amounts from your K-1.

Mastering K-1 Income Recording in QuickBooks

Understanding how to record K-1 income in QuickBooks goes beyond basic data entry. The following advanced subtopics explore essential yet often overlooked aspects that impact accuracy, compliance, and tax efficiency. From distinguishing K-1 income from traditional business revenue to managing amended forms and tax implications, each section is crafted to deliver actionable insights. These five focused areas help users prevent costly mistakes, improve record-keeping, and ensure alignment with IRS standards—turning QuickBooks into a powerful tool for managing partnership income with confidence.

How Does K-1 Income Differ from Traditional Business Income in QuickBooks?

K-1 income differs in 3 core ways: source, tax treatment, and tracking method. Unlike traditional business income, K-1 income originates from pass-through entities like partnerships or S-corps—there’s no payroll, just allocated profit shares. Second, it’s taxed at the individual level, not corporate, affecting personal returns directly. Third, K-1 entries require specific categorization (dividends, interest, capital gains), unlike general sales income. In QuickBooks, this means setting up separate income accounts, reconciling with official forms, and ensuring alignment with IRS codes—something not required for regular revenue. Ignoring these differences can lead to 4 major issues: misreporting, penalties, audits, and tax mismatches.

Importance of K-1 Form Accuracy Before Data Entry in QuickBooks

Verifying your K-1 form before entry prevents 3 major problems: incorrect tax filing, misclassified income, and audit risks. Each K-1 line—dividends, capital gains, interest—maps to a specific QuickBooks account, so even a $10 error can misstate profit margins. 70% of K-1-related issues stem from manual entry without verification. Cross-checking ensures amounts, codes, and ownership percentages align with IRS Form 1065, 1120S, or 1041. This step takes less than 15 minutes but avoids weeks of reconciliation later. Accuracy at this stage improves year-end financials, reduces CPA correction fees, and strengthens audit defense. Always double-check before hitting “Save.”

Impact of K-1 Income on Estimated Quarterly Taxes

K-1 income directly affects your estimated quarterly tax obligations in 3 key ways: unpredictability, pass-through taxation, and variable income timing. Since K-1 income isn’t withheld like wages, 100% of the tax burden shifts to the individual. Even $5,000 in unexpected K-1 earnings can trigger underpayment penalties if not reported in quarterly estimates. IRS safe harbor rules require 90% accuracy or matching 100% of last year’s liability—missing this with K-1 fluctuations leads to fines. Use QuickBooks reports to forecast K-1 income, update Form 1040-ES estimates, and avoid surprises. Recalculate every quarter if distributions vary.

Role of an Accountant in Reviewing K-1 Entries in QuickBooks

An accountant adds 3 layers of protection when reviewing K-1 entries: tax code accuracy, category validation, and audit preparedness. 80% of small businesses misclassify at least one K-1 income type—interest, capital gains, or passive income. A CPA ensures each line aligns with IRS standards, QuickBooks categories, and state-specific rules. They also verify matching amounts between K-1 forms and QuickBooks deposits, preventing discrepancies that lead to IRS flags. Quarterly reviews reduce tax-season corrections by 65% and improve estimated tax planning. In complex cases—multi-entity income or amended K-1s—professional oversight becomes non-negotiable. Always consult before filing or reconciling.

How to Handle K-1 Amendments or Corrections in QuickBooks

Handling amended K-1s in QuickBooks requires 3 steps: locate original entries, adjust figures, and reclassify where needed. If an updated K-1 changes capital gains by even $1,000, failing to revise your QuickBooks records can trigger mismatches with IRS filings. First, identify affected accounts via audit trail or deposit history. Second, use “Edit Transaction” to correct amounts or memo references. Third, document changes with notes and attach the new K-1 as a file. 1 in 5 partnerships issues an amended K-1—missing them leads to inaccurate tax returns and potential penalties. Always reconcile post-adjustment and inform your CPA immediately.

Strengthening Your K-1 Income Workflow in QuickBooks

While recording K-1 income accurately is essential, maximizing efficiency and avoiding long-term errors requires deeper operational strategies. This supplementary section explores five advanced practices that support and enhance the K-1 income management process in QuickBooks. From year-end reviews and report generation to team training and software integration, each topic focuses on minimizing mistakes, improving compliance, and streamlining collaboration. These actionable insights help business owners, accountants, and finance teams maintain accurate records, reduce audit risk, and improve tax readiness—turning routine bookkeeping into a strategic advantage.

Best Practices for Year-End Review of K-1 Income in QuickBooks

A year-end review of K-1 income in QuickBooks should focus on 3 priorities: account accuracy, tax alignment, and documentation. Start by reconciling all K-1 income entries against official forms—mismatches over $500 often lead to tax filing delays. Next, verify each income type is correctly categorized (e.g., passive, portfolio, or ordinary income). Use QuickBooks reports to compare distributions with prior-year figures; a 10–15% variation may signal an error or amendment. Finally, attach all K-1 forms to relevant entries and include CPA notes for audit clarity. This review improves filing accuracy by up to 90% and reduces compliance risks.

Recommended Reports to Run After Recording K-1 Income

After recording K-1 income, generate 3 essential QuickBooks reports: Profit and Loss by Class, Income by Account, and Transaction Detail by Account. These reports help detect misclassifications, missing entries, and income discrepancies. For example, the P&L by Class can reveal passive vs. active income splits—critical for tax planning. Income by Account shows if K-1 earnings were routed to the right categories, reducing audit flags by 60%. Transaction Detail helps verify exact dates, memos, and K-1 form references. Running these monthly or quarterly ensures real-time accuracy and simplifies year-end filing. Always export and archive these reports for CPA review.

Integrating QuickBooks with Tax Software for K-1 Handling

Integrating QuickBooks with tax software improves K-1 income accuracy, saves time, and reduces manual errors by over 75%. Tools like Intuit ProConnect, Drake Tax, or TurboTax Business allow seamless data import of categorized K-1 entries from QuickBooks. This reduces duplicate entry, ensures income alignment across systems, and supports real-time tax calculations. For example, importing $25,000 of K-1 capital gains directly avoids reconciliation mismatches on Schedule E. QuickBooks’ mapping tools help match income codes with tax software fields, minimizing rework. Integration also enables cross-year tracking of carryovers, losses, and adjustments. Always test imports before filing to avoid syncing issues.

Using Class and Location Tracking for Multi-Entity K-1 Income

Class and location tracking in QuickBooks helps separate K-1 income across multiple entities, improving clarity, compliance, and financial analysis. Assign each partnership or S-corp a unique class or location—this allows you to track $10,000 from Entity A and $7,500 from Entity B without confusion. It simplifies Schedule K-1 reconciliation and helps identify which income is passive, active, or rental-based. Monthly P&L by Class reports show exact earnings and expenses per source. This method reduces misallocation errors by 65% and supports better forecasting. Always name classes clearly (e.g., “ABC LLC – Passive”) to maintain audit-ready records.

Tips to Train Your Team on Handling K-1 Income in QuickBooks

Training your team on K-1 income requires 3 focus areas: form interpretation, QuickBooks categorization, and error prevention. Begin with short sessions on reading Forms 1065, 1120S, and 1041—understanding these improves data accuracy by 70%. Then, teach them to create dedicated income accounts, assign correct classes, and record deposits with memo references. Use real K-1 examples during training to build practical skills. Finally, set up review checklists to catch errors before posting. A well-trained staff reduces entry mistakes by 50%, speeds up reconciliation, and ensures clean finances. Reinforce learning quarterly to adapt to updated tax rules or QuickBooks features.

Conclusion

Managing K1 income is essential for both businesses and individuals. Accurately recording K-1 income in QuickBooks Desktop and Online is vital for maintaining financial records and meeting tax obligations. QuickBooks provides an efficient and accurate method of recording K1 income, streamlining financial management. By following the specific steps for each version, users can effectively input K-1 distributions, improving the tracking of partnership income and losses.

Frequently Asked Questions

1. Why must I use the “Other Income” account type instead of a standard “Income” account when recording K-1 distributions?

The choice of account type is critical for maintaining accurate financial records and adhering to tax best practices, as K-1 income is fundamentally different from regular business revenue.

- Source Distinction: K-1 income is your share of profit or loss from a pass-through entity (like a partnership or S-Corp), not direct revenue from your own primary business activities or sales.

- Tax Treatment: Using an Other Income account clearly segregates this money on your Profit & Loss report, preventing it from incorrectly inflating your gross operating profit. This distinction is vital for your Certified Public Accountant (CPA) when they determine tax liability, as K-1 income may have different self-employment or passive income tax treatments.

- Clarity: Setting up a dedicated sub-account named “K-1 Income” under Other Income provides the cleanest audit trail.

2. How does failing to reconcile the K-1 income account impact my tax and financial health?

Failing to regularly reconcile the K-1 income account in QuickBooks is a critical mistake that can lead to major financial and compliance issues that may be difficult to fix during tax season.

- Inaccurate Income Assessment: Neglecting reconciliation prevents you from confirming that the actual cash deposits in your bank match the amounts officially reported on the Schedule K-1 form.

- Discrepancies and Audit Risk: Errors, such as missed expenses or unrecorded distributions, will create an unexplained variance in your financial records. This misalignment between your QuickBooks balance sheet and the official K-1 figures is a major red flag that can complicate audits or tax reviews.

- Flawed Planning: Without reconciliation, you cannot accurately assess the partnership’s financial impact on your own income, which leads to errors in forecasting cash flow or making estimated quarterly tax payments.

3. What is the difference between recording K-1 income in QuickBooks Desktop versus QuickBooks Online?

The fundamental difference lies in the level of tax integration and automated form generation supported by each platform.

- QuickBooks Desktop: Historically offers a closer integration with certain tax software (like ProSeries or Lacerte) and provides more detailed features for multi-entity tracking, especially through its full Chart of Accounts control and advanced reporting.

- QuickBooks Online (QBO): QBO currently does not support direct processing or generation of the tax-ready Schedule K-1 form. The steps in QBO are strictly for accurately recording the cash transaction in your Chart of Accounts as a bank deposit, not for managing the tax form itself. You must use the information to manually process the form or provide it to a CPA.

4. How can I use Class Tracking in QuickBooks to simplify the management of K-1 income from multiple entities?

Class Tracking is a powerful internal feature in both QuickBooks Desktop and Online that allows you to tag transactions based on different segments or projects, which is ideal for isolating income from various K-1 sources.

Using Class Tracking enhances management in these ways:

- Segregation: You can assign a unique Class (e.g., “ABC LLC K-1,” “Rental Partnership K-1”) to every income deposit and expense related to that specific K-1 entity.

- Reporting: You can run a Profit and Loss by Class report, which separates the revenue and expenses for each K-1 source. This instantly shows you the net profit/loss for Entity A versus Entity B.

- Compliance: This segmentation is vital for your CPA to accurately distinguish between passive versus active or rental income, which are taxed at different rates.

5. What are the key consequences of erroneously confirming K-1 income without verifying the official form?

Entering K-1 income before meticulously verifying it against the final, official Schedule K-1 form is a major cause of financial and tax discrepancies.

The consequences include:

- Misstatement of Income: If you enter an estimated amount that is higher or lower than the final official figure, your QuickBooks reports will misstate your profit and your net worth.

- IRS Reconciliation Issues: The IRS and your tax software will reconcile your tax return against the official K-1 form received from the issuing entity. If your QuickBooks entry does not match this form precisely, it can trigger mismatches and potential audit flags.

- Incorrect Estimated Taxes: If your K-1 income is a significant portion of your total income, an unverified entry can lead you to calculate the wrong amount for your quarterly estimated taxes, potentially leading to underpayment penalties.

Tax assessments, estimated payments, or state-level entity taxes related to K-1 income must be recorded immediately to maintain an accurate net profit and audit trail.

- Timing: Record the payment on the exact date it is withdrawn from your bank account or paid via check.

- Account: Do not record these payments under a standard Expense account, as this can confuse tax classification. Instead, use one of the following methods:

- Tax Expense: Use an existing Tax Expense account, clearly labeling the payment in the memo field (e.g., “CA State K-1 Tax Payment”).

- Journal Entry: For more complex adjustments (like prior-year assessments), use a Journal Entry to debit a specific Tax Liability account and credit the bank account, ensuring a clear audit trail.

7. What is the role of an accountant in reviewing K-1 entries, and how does this improve audit preparedness?

An accountant is indispensable in the K-1 process, acting as a crucial second layer of verification that ensures your QuickBooks entries are compliant with complex tax codes.

An accountant improves audit preparedness by:

- Tax Code Accuracy: They confirm that each line item of your K-1 (e.g., interest, capital gains, guaranteed payments) is correctly mapped to the right QuickBooks account and will flow to the correct line on your individual tax return (Form 1040) and associated schedules.

- Validation of Category: They verify that you have correctly identified the income as passive versus active (especially important for Schedule E), preventing misclassification that could lead to unexpected tax liabilities or penalties.

- Quarterly Review: Quarterly reviews reduce the risk of needing major, time-consuming corrections during tax season by up to 65% and ensure your estimated taxes are accurate, drastically reducing the risk of IRS underpayment penalties.

Disclaimer: The information outlined above for “How to Record k-1 Income in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.