Overview

Depreciation is a crucial component of QuickBooks because it enables companies to record the gradual decline in asset value appropriately, which affects tax reporting and financial statements. Keeping accurate and current financial records can be achieved by understanding how to record depreciation in QuickBooks. All you have to do is enter data such as the asset’s cost, residual or salvage value, depreciation method, and life. Entering these numbers will result in an easy-to-understand calculation.

It is recorded on the income statement as a non-cash expense that reduces the company’s net income. This allows the company to match depreciation expenses to related revenues in the same reporting period—and write off an asset’s value over a period of time for both tax and accounting purposes.

What is Depreciation in QuickBooks?

Depreciation represents the reduction in value of a fixed asset over time due to wear and tear or obsolescence. It is recorded as an expense to allocate the cost of the asset across its useful life, helping to accurately reflect the asset’s value and expense in financial reports.

What are Assets?

An asset is a resource with economic value that an individual, a company, or a country owns or controls with the expectation that it will provide a future benefit to its owner. The assets owned by the company are referred to as “Company assets”.

Here’s the difference between two types of assets:

- Current assets: These are the assets you’re likely to convert to cash within one year. They include the cash you have on hand, the money in your checking and savings accounts, and the money your customers owe your business.

- Fixed assets: Fixed assets are resources with an expected life of more than a year such as plants, equipment, and buildings. It allocates the cost of the asset over time. These assets are usually important for your day-to-day business operations.

Why is Depreciation Important in QuickBooks?

Depreciation holds significant importance in QuickBooks as it allows businesses to accurately reflect the decrease in asset value over time, affecting financial statements and tax reporting. Businesses can maintain accurate records of asset values, which is essential for presenting a realistic financial position. It ensures compliance with tax regulations and contributes to the overall financial growth and profitability.

- Depreciation maintains accurate financial ratios, such as return on assets (ROA) and profit margins, depending on accurate financial data.

- Depreciation is required for accurate financial reporting in line with accounting standards, such as Generally Accepted Accounting Principles (GAAP).

- Depreciation allows businesses to spread out the cost of an asset over time, which reduces taxable income each year.

- Depreciation can be crucial when applying for loans or seeking investment, as it demonstrates financial transparency.

- Depreciation ensures that your financial statements accurately reflect the current worth of your assets.

When to Enter Depreciation in QuickBooks?

You need to add Depreciation in QuickBooks at the end of each accounting period, typically monthly, quarterly, or annually, depending on how your business tracks financial performance. It should be entered in QuickBooks at specific times to ensure accurate financial reporting and compliance with tax regulations.

Here’s when and how often you should enter Depreciation:

- If you are following accrual accounting, enter Depreciation at the end of each month.

- If you prefer quarterly updates or if your business prepares quarterly financial reports, enter Depreciation at the end of each quarter.

- If you choose to record Depreciation annually, make sure to enter it at the end of your fiscal year for accurate financial and tax reporting.

- Once you purchase a new asset and it is placed into service, you need to start recording Depreciation until the asset reaches the end of its useful life.

- Enter all depreciation entries before you prepare and file taxes as Depreciation is a tax-deductible expense.

- When an asset reaches the end of its useful life, you need to make the final depreciation entry to bring the asset’s book value to zero (or its salvage value if applicable).

Things to Remember Before Entering Depreciation in QuickBooks!

When recording Depreciation in QuickBooks, it’s important to keep a few key points in mind to ensure accurate financial reporting and compliance with accounting standards.

Here’s a checklist to guide you:

- Make sure you know which depreciation method (e.g., straight-line, declining balance) your business uses for its assets.

- QuickBooks doesn’t automatically calculate Depreciation. You need to manually enter a journal entry for the depreciation expense.

- Before entering Depreciation, ensure that fixed assets (e.g., vehicles, equipment, buildings) are set up in QuickBooks with accurate purchase dates and costs.

- Double-check depreciation entries during year-end closing to ensure they match the depreciation schedule.

- It is recommended to record Depreciation for each asset individually, especially if they belong to different asset classes, including Equities (e.g., stocks), fixed income (e.g., bonds), cash and cash equivalents, real estate, commodities, and currencies.

How to record Depreciation in QuickBooks Online?

To record depreciation in QuickBooks Online, first create a depreciation account under “Other Expenses.” Then, record the depreciation via a journal entry, crediting the asset account and debiting the depreciation account.

Note: Determining asset depreciation is difficult. Your accountant knows the best ways. We recommend working with them to regularly review how you track Depreciation.

Step 1: Create a depreciation account

If you already have an account, then don’t create one; otherwise, follow the steps below:

- Click on Settings and select the Chart of Accounts.

- Click on New.

- Add the name of the description account in the Account name field.

- Choose Other Expenses in the drop-down from the Account type field.

- From the Detail type field, choose Depreciation from the dropdown.

- Select Save.

Step 2: Set Up a Depreciation Account

In case you are not sure about the depreciation account, kindly follow the below-mentioned steps to check the same:

- Click on Settings.

- Choose the Chart of Accounts.

- Enter the “depreciation” in the “Filter by name” field.

- If you can locate the account with “Depreciation” in the Name column, “Depreciation” in the Detail Type column and “Other Expense” in the Type column, then your chart of accounts exists.

- Now, follow the ( Step 3: Record the Depreciation).

Step 3: Record the Depreciation

- Choose + new.

- Select Journal entry.

- In the first line, choose the asset account that you use to track the loan from the Account dropdown.

- Put the depreciated amount in the Credits column.

- Now, choose the depreciation account you created from the Account dropdown.

- Put the same depreciated amount in the Debits column.

- Select Save.

How do you enable automatic depreciation calculations?

When automated Depreciation is enabled, QuickBooks creates a monthly or yearly journal entry that credits accumulated depreciation and debits depreciation expenses. The depreciation expense affects your income statement, lowering net income.

The balance of the Depreciation recorded over the asset’s life is represented by the offsetting accumulated depreciation account, which may be found on your balance sheet.

You can enable the automatic depreciation calculations if you follow the below-mentioned steps:

- Go to the Gear icon, click on the Accounting option, and then click on Fixed Asset Manager.

- Select the name of the asset.

- Choose the depreciation method.

- Put the useful life and salvage value.

- Check the “Automatically calculator depreciation”.

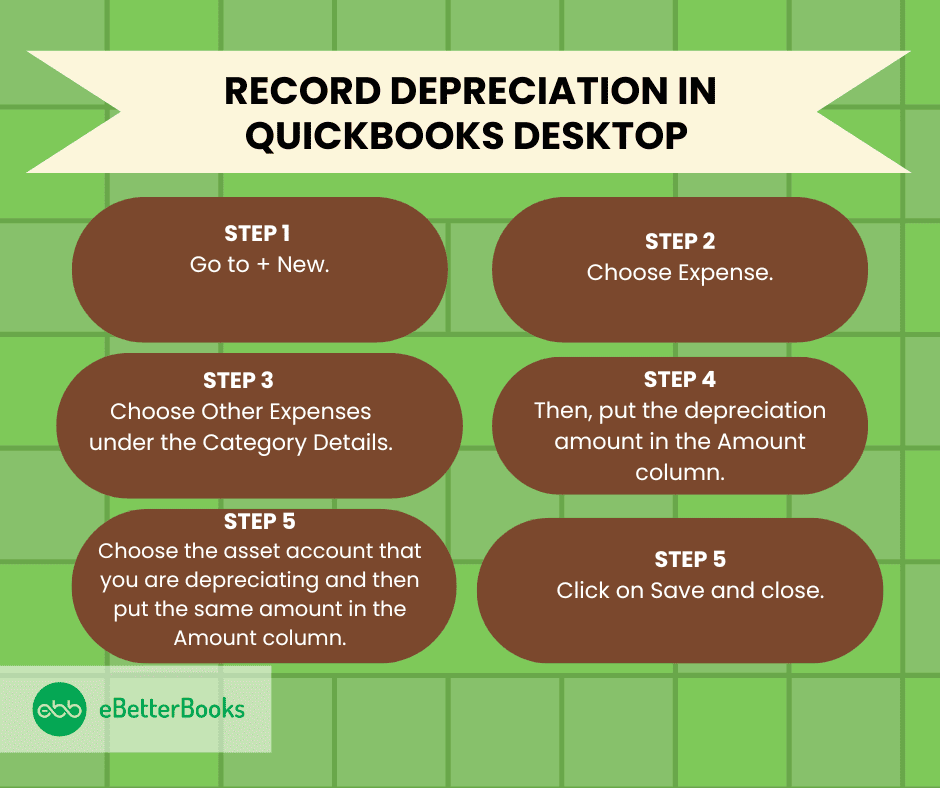

How to record depreciation in QuickBooks Desktop?

Important: Calculating the amount of Depreciation to deduct can be a complex process, and the IRS rules on the subject change often. Ask an accountant for help in figuring actual depreciation amounts.

In order to record depreciation, you must have a depreciation expense account (if you don’t have one, first create that, read under the heading above “Step 1: Create a depreciation account “), then follow the below-mentioned steps on how to record depreciation as an expense in QuickBooks Desktop:

Step 1: Go to + New

- Click on the + New button at the top of the screen.

Step 2: Choose Expense

- Under the Vendors section, select Expense.

Step 3: Select Other Expenses

- In the Category Details section, choose Other Expenses.

Step 4: Enter Depreciation Amount

- In the Amount column, enter the depreciation amount.

How to Set Up Fixed Assets to Track Depreciation in QuickBooks Desktop?

To set up fixed assets for tracking depreciation in QuickBooks Desktop, access the “Chart of Accounts” via the “Lists” menu. Select the sub-account for accumulated depreciation, enter the depreciation amount, and save the transaction.

Depreciation and Accumulated Depreciation

Depreciation is the decline in the value of a physical asset while accumulated Depreciation is the cumulative Depreciation of an asset up to a single point in its life.

1. For Windows Users

Follow the below-mentioned steps to record the depreciation expense in QuickBooks Desktop (Windows):

Step 1: Click on the “Lists” Menu

- In the QuickBooks menu, Click on the “Lists” menu.

Step 2: Select “Chart of Accounts”

- Now, click on the “Chart of Accounts” option.

Step 3: Open Sub-Accounts for Accumulated Depreciation

- Double-click on the sub-accounts that help track the accumulated Depreciation of the asset that is to be depreciated.

Step 4: Enter Depreciation Amount

- Put the depreciation amount when creating a transaction. Click on the “Account”.

Step 5: Fill in the Depreciation Expense Account

- Fill in the expense account that is used to track Depreciation.

Step 6: Save the Transaction

- Once all the details are filled in, click Save to complete the transaction and record the Depreciation.

2. For Mac Users

In order to record the depreciation expense in QuickBooks Desktop (Mac), kindly follow the steps below:

Step 1: Click on the “Lists” Menu

- Click on the “Lists” menu.

Step 2: Navigate to ‘Chart of Accounts

- Then, click on the “Chart of Accounts” option.

Step 3: Track the accumulated depreciation

- Select the sub-account that is used to track the accumulated Depreciation.

Step 4: Enter Depreciation Amount

- Click on the “Use Register” from the drop-down menu of “Action”.

- Put the depreciation amount in the register as a decrease.

- Click on the Account field.

- Fill out the expense account to set up the account that will be used to track the Depreciation.

Note: QuickBooks subtracts the depreciation amount from the current value of the asset in the main fixed asset account. Under the account that tracks Depreciation, QuickBooks enters the depreciation amount as an increase to your company’s depreciation expense.

How Do You Track Depreciation in QuickBooks?

Tracking the depreciation is as important as recording the depreciation in QuickBooks.

Here are the steps on how to track the depreciation and accumulated depreciation in QuickBooks:

Step 1: Make a fixed account for all the assets

Here you will create a fixed account ( or a group of assets) you want to depreciate. The account will represent a single asset or a group of assets.

- Choose the account type as “Fixed Account”.

- Label each account with the asset name which you are going to track.

- Keep the opening balance at 0.00.

Step 2: Add sub-accounts for each asset

Now add two sub-accounts to each asset account you have created. One will track the cost of the asset, and the other will track the accumulated Depreciation.

- Each main account must have two sub-accounts.

- You can name the first account “Cost” and the second account “Accumulated Depreciation.” This will help you to distinguish the account in your Chart of Accounts.

- Put the original cost of the asset in the Opening Balance field for the Cost sub-account. Put the date on which you have purchased the asset in the “AS OF” field.

- Put 0.00 as the opening balance for the Accumulated Depreciation sub-account in case the asset has been acquired after your QuickBooks start date. If you have acquired the asset before the start date, then put the accumulated Depreciation of the asset in the “AS OF” the start date. You have to put the amount as a negative number in the field.

Step 3: Create an expense account

Now, create an expense account to track the depreciation expense. You can name the account “Depreciation Expense.”

Step 4: Go to Chart of Accounts

- Click on Go.

- Choose the Chart of Accounts.

- Now, choose the sub-account that tracks the accumulated Depreciation for the asset you are depreciating.

- Choose Use Register from the Action pop-up menu.

Step 5: Put the transaction in the bottom of the register

- Put the depreciation amount as a decrease in the register.

- Put the expense account you have set up to track the Depreciation in the Account field.

Note: The depreciation amount gets subtracted from the current value of the asset under the main fixed asset account. Under the account that tracks the Depreciation, QuickBooks puts the depreciation amount as an increase to the company’s depreciation expense.

Record Depreciation without Using a Journal Entry

You can depreciate an asset without using a Journal Entry. After creating a depreciation expense account, follow the steps below:

At the end of the year, when you or your accountant have calculated the depreciation amount, enter the transaction below:

Step 1: Click + New

- Click on the + New button at the top of the screen.

Step 2: Select Expense

- Under the Vendors section, choose Expense.

Step 3: Choose Other Expenses

- From the Category Details section, choose Other Expense, then type the depreciation amount under the Amount column.

Step 4: Select Asset Account

- Click on the asset account you are depreciating in the second line and enter the same amount in a negative figure.

Step 5: Save and Close

- Press the Save and Close buttons.

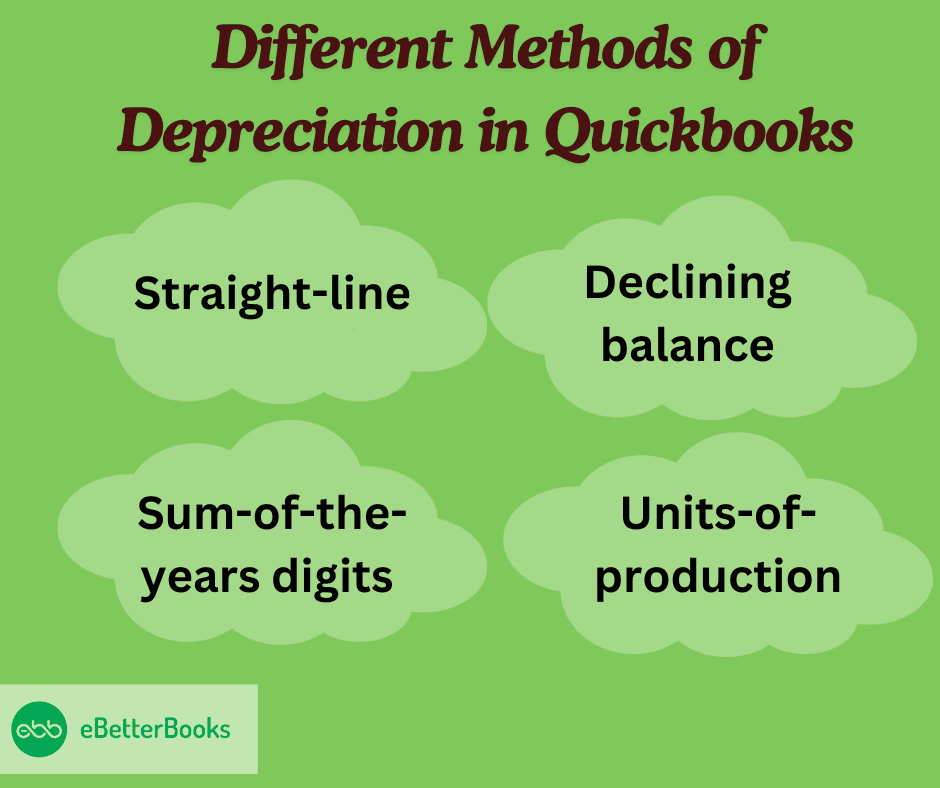

What Are the Different Methods of Depreciation in QuickBooks?

There are different methods of calculation and financial repercussions when recording Depreciation in QuickBooks.

QuickBooks has multiple depreciation strategies, such as:

1. Straight-Line

In QuickBooks, straight-line depreciation offers a consistent and uncomplicated method of asset devaluation by allocating an identical percentage of an asset’s cost as depreciation expense each accounting period. Straight-line Depreciation is computed by taking into account the asset’s initial cost, residual value, and usable life. The annual depreciation formula is calculated as follows: (Cost of asset – Residual value) / Useful life. This allocation strategy is appropriate for assets with steady and predictable consumption since it equally distributes the asset’s cost throughout its useful life.

2. Declining Balance

In QuickBooks, declining balance depreciation reflects an accelerated asset devaluation strategy by initially applying a larger depreciation rate to an asset’s book value and then progressively decreasing the depreciation allocation in later quarters. This approach is best suited for assets with higher initial production and utility because it speeds up the write-down of the asset’s value. The depreciation rate is applied to the asset’s book value at the start of each period using Quickbooks’ calculating technique, which leads to a decreasing depreciation expense over time.

3. Sum-of-the-Years Digits

The Sum-of-the-years digits approach results in larger depreciation charges in the early years and reduced charges in the later years, in line with the notion of matching expenses to revenues over an asset’s useful life. Users can apply this strategy with ease using Quickbooks, which gives an accurate picture of an asset’s declining worth over time. Businesses can improve the accuracy and transparency of their financial reports by better aligning their financial statements with the actual wear and tear of their assets by including the sum-of-the-years’ digits depreciation.

4. Units-of-Production

Units-of-production depreciation in QuickBooks offers a dynamic and activity-based approach to asset devaluation by distributing depreciation charges according to an asset’s utilization or production output. By matching the asset’s operating costs to its revenue, this approach enables organizations to reflect an asset’s declining assets over time more accurately. When calculating depreciation using this method, QuickBooks multiplies the asset’s cost by the anticipated number of units produced or hours of use.

How Do You Choose the Right Depreciation Method in QuickBooks?

In order to choose the best depreciation technique for accurate asset valuation in Quickbooks, it is necessary to consider a number of aspects, including asset categories, useful life estimates, and financial reporting goals.

This choice affects cash flow, tax consequences, and financial statements; hence, it’s important to take into account different depreciation techniques like:

- Straight-line

- Double-declining balance

- Units of production

- Sum-of-the-years’-digits

The profitability and tax obligations of the business are impacted by how depreciation charges are allocated, which varies according to the technique used. To guarantee accurate reporting and transparent financial statements for stakeholders and regulatory agencies, it is crucial to match the selected approach with the nature of the assets, industry standards, and regulatory compliance.

Tips for Accurate Depreciation Recording in QuickBooks

Accurate depreciation recording involves maintaining detailed asset records, staying updated on regulatory changes, and accessing reporting features for comprehensive depreciation analysis and compliance.

This process begins with adding the purchase date, cost, salvage value, and useful life of each asset in QuickBooks. It is essential for businesses to regularly run and review depreciation reports in QuickBooks so that they can track depreciation expenses and ensure compliance with accounting standards.

Advanced Scenarios for Recording Depreciation in QuickBooks

Recording depreciation isn’t always straightforward—especially when your business involves multiple departments, asset disposals, or complex adjustments. In this section, we’ll explore 5 advanced yet practical subtopics that go beyond the basics. You’ll learn how to handle real-world depreciation situations, avoid costly mistakes, and maintain compliance with accounting standards. Whether you’re using QuickBooks Online or Desktop, these insights are designed to help you streamline your asset management and improve your financial accuracy with confidence.

Common Mistakes to Avoid While Recording Depreciation in QuickBooks

Many users make 3 critical errors while recording depreciation in QuickBooks. First, they skip creating a proper depreciation expense account, which leads to incorrect categorization and reporting. Second, 70% forget to match the depreciation method (like straight-line or declining) with the asset type, affecting tax accuracy. Third, users often fail to post depreciation entries monthly or annually, causing gaps in financial tracking. Avoid using the wrong asset account, posting duplicate entries, or ignoring salvage value. These 5 mistakes reduce financial clarity, affect compliance, and distort profit margins. Always double-check entries, review schedules quarterly, and consult an accountant when unsure.

How to Adjust or Reverse Depreciation Entries in QuickBooks

Reversing depreciation in QuickBooks involves 3 key steps: identify the incorrect entry, create a reversing journal entry, and adjust the asset balance. Many users miss this when correcting errors from prior periods. To adjust, first locate the original journal using the “Chart of Accounts.” Second, use the same accounts but reverse the debit and credit. Third, verify that the accumulated depreciation and expense amounts now match the corrected totals. This process helps maintain audit trails, ensures accurate book value, and avoids double depreciation. Always recheck monthly reports, document reversal reasons, and sync with tax records to prevent long-term inconsistencies.

How to Record Depreciation for Disposed or Sold Assets in QuickBooks

When an asset is sold or disposed of, record depreciation carefully to avoid 3 major errors: incorrect asset removal, wrong gain/loss reporting, and skipped final depreciation. First, calculate depreciation up to the disposal date using your existing schedule. Second, create a journal entry to credit the asset account, debit accumulated depreciation, and record gain/loss. Third, remove the asset from the fixed asset register. This process ensures clean balance sheets, proper profit/loss statements, and tax compliance. Always update asset status, confirm depreciation totals, and retain documentation for at least 5 years to support audits or financial reviews.

Role of Accountants in Reviewing Depreciation Entries in QuickBooks

Accountants play 3 vital roles in reviewing depreciation entries in QuickBooks: verification, optimization, and compliance. First, they check that depreciation methods align with asset types and industry standards. Second, they help optimize tax deductions by reviewing salvage values, asset lifespans, and schedules. Third, they ensure compliance with GAAP or IRS rules, reducing audit risks. Every quarter, they reconcile accounts, correct misclassified entries, and validate accumulated depreciation totals. Their input improves accuracy by 60%, strengthens financial reporting, and avoids costly tax penalties. Always involve a qualified accountant before year-end to catch errors, revise schedules, and ensure regulatory alignment.

Tracking Depreciation Across Multiple Locations or Departments

Tracking depreciation across locations or departments requires 3 key actions: segment assets, assign cost centers, and use custom reports. First, label each asset by location or department in the fixed asset register. Second, create separate depreciation expense accounts or classes for each segment. Third, generate custom reports monthly to review depreciation by the business unit. This helps identify overused assets, plan replacements, and allocate budgets more accurately. Companies with 2 or more branches improve cost control by 45% using this method. Always standardize naming, update usage logs quarterly, and reconcile depreciation totals across all units for complete financial transparency.

Supporting Essentials for Smarter Depreciation Management in QuickBooks

Effective depreciation tracking goes beyond simple journal entries—it requires strategic setup, regular audits, and smart use of integrated tools. This section covers 5 supplementary aspects that directly support and enhance how you manage depreciation in QuickBooks. From preparing asset classes to integrating fixed asset software, each topic delivers actionable insight to improve accuracy, streamline workflows, and keep your finances audit-ready. These areas are often overlooked but play a vital role in maintaining a clear, compliant, and scalable asset management system.

How to Set Up Asset Classes Before Recording Depreciation

Before recording depreciation, setting up asset classes in QuickBooks is essential for 3 reasons: organized tracking, accurate reporting, and better forecasting. First, create distinct classes like Vehicles, Equipment, or Furniture under the “Class” feature. Second, link each asset purchase to its appropriate class, ensuring clear categorization. Third, generate class-based reports to analyze depreciation impact by asset type. This setup improves decision-making, enhances tax planning, and simplifies audits. Businesses using asset classes reduce reporting errors by 40%. Always name classes clearly, update them during asset additions, and review quarterly to keep your asset structure aligned with business growth.

Impact of Depreciation on Cash Flow and Financial Ratios

Depreciation directly impacts 3 critical financial areas: cash flow, net income, and key ratios. First, as a non-cash expense, it reduces taxable income without affecting actual cash, improving short-term cash flow. Second, it lowers net profit on the income statement, affecting margins and earnings ratios. Third, it alters financial ratios like Return on Assets (ROA) and Fixed Asset Turnover by changing the book value of assets. Ignoring depreciation skews these metrics by up to 25%. Always factor depreciation when analyzing performance, planning budgets, or presenting reports to stakeholders—it reveals the real cost and value of using long-term assets.

How to Audit Depreciation Records During Year-End Closing

Auditing depreciation during year-end closing involves 3 must-do steps: verify asset schedules, match entries, and reconcile totals. First, review each fixed asset’s cost, useful life, and salvage value against your records. Second, match journal entries to your depreciation schedule to ensure accuracy. Third, reconcile accumulated depreciation in the balance sheet with expense accounts in the P&L. Skipping this audit can cause 20–30% reporting discrepancies. Use year-end checklists, cross-check with accountant reports, and document any adjustments made. Accurate audits ensure tax compliance, clean financials, and prevent regulatory issues during external audits or funding evaluations.

Using QuickBooks Reports to Analyze Asset Performance Over Time

Analyzing asset performance in QuickBooks involves 3 key reports: Fixed Asset List, Depreciation Summary, and Profit & Loss by Class. First, use the Fixed Asset List to track purchase dates, costs, and assigned accounts. Second, run the Depreciation Summary to monitor yearly write-offs and spot underperforming assets. Third, compare asset-related expenses in the P&L by class or department for ROI insights. Businesses using these reports quarterly improve asset utilization by 35%. Always schedule report reviews, filter by date range or location, and export data for deeper analysis. This ensures smarter decisions on asset repairs, replacements, and capital planning.

Integrating Fixed Asset Management Software with QuickBooks

Integrating fixed asset management software with QuickBooks improves 3 core areas: automation, accuracy, and scalability. First, it automates depreciation schedules, eliminating manual entries and reducing human error by 60%. Second, it syncs asset data in real time, keeping QuickBooks updated with changes in value, status, or location. Third, it enables bulk imports, barcode tagging, and audit trails for hundreds of assets across multiple sites. Tools like Asset Panda, NetSuite, or Sage Fixed Assets integrate easily with QuickBooks. Always verify compatibility, map accounts properly, and test sync functions monthly to ensure seamless, error-free asset tracking and financial reporting.

Conclusion!

To ensure that every fixed asset is properly set up in QuickBooks, make sure to include the cost, projected useful life, date of acquisition, and depreciation method. This guarantees precise tracking and computations. Although depreciation can appear difficult, tracking your fixed assets and doing automatic depreciation calculations is made simple with QuickBooks. Setting up the proper depreciation method can help QuickBooks users maintain organized books and save money on their taxes. It is a necessary procedure for any company that uses a lot of assets.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “How to Record Depreciation in QuickBooks Online/Desktop – Learn the Process” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.