Highlights (Key Facts & Solutions)

- Best Practice Categorization: Cash back should be recorded as a contra-expense (a reduction in spending), not as taxable income, to ensure accurate financial reports and expense optimization.

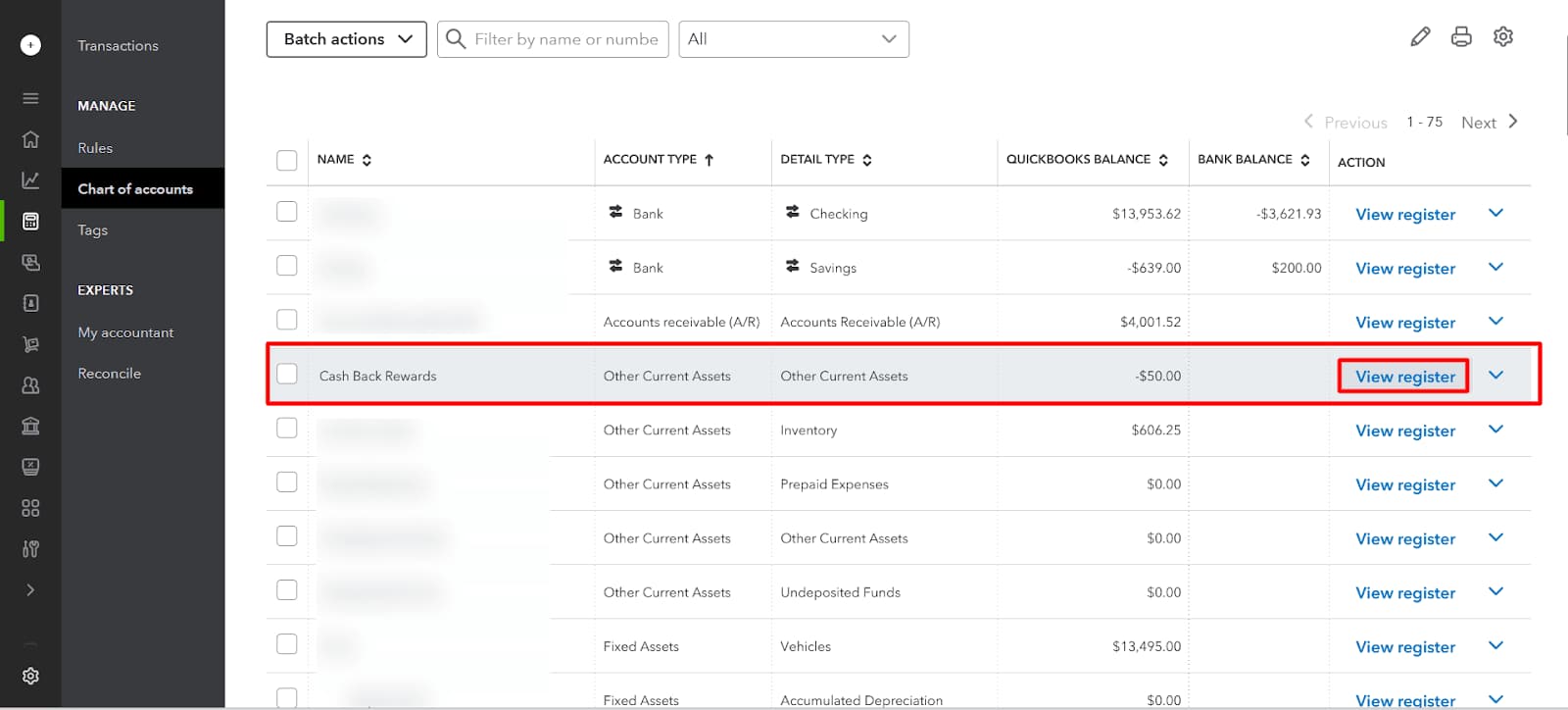

- Account Setup: A specific “Cash-back Rewards” account must be created, generally using the Other Current Asset type, to properly separate rewards from primary revenue streams.

- Tracking Multiple Cards: Use sub-accounts under the main Cash-back Rewards account to segment and track savings from individual credit cards, simplifying analysis and reconciliation.

- Software Specific Steps: Detailed, step-by-step instructions are provided for creating and recording rewards transactions in both QuickBooks Desktop and QuickBooks Online.

- Advanced Reporting: Utilize Class and Location tracking in QuickBooks Online to assign rewards to specific departments or branches, offering deeper insights into where cost savings originate.

- Avoid Common Mistakes: Do not record cash back as regular income, and always link the reward transaction to the corresponding expense account to preserve the audit trail and context.

- Compliance: Consult a CPA for categorization of large or unusual rewards and to ensure compliance with tax regulations regarding taxable versus non-taxable business incentives.

Overview

Recording cash-back rewards in QuickBooks correctly is essential for maintaining accurate financial records and supporting better financial management.

Cash-back rewards are one of the main and most attractive options, along with credit cards, which can be used to compensate for costs or add to savings.

Cash-back rewards function as a “contra-expense” on the profit and loss statement, showing a reduction in expenses rather than income.

Whether you use QuickBooks Desktop or QuickBooks Online, you should document these kinds of rewards well to provide the correct picture of your financial situation.

How Do You Record Credit Card Cashback Rewards in QuickBooks Desktop?

Step 1: Create a Cash-back Rewards Account

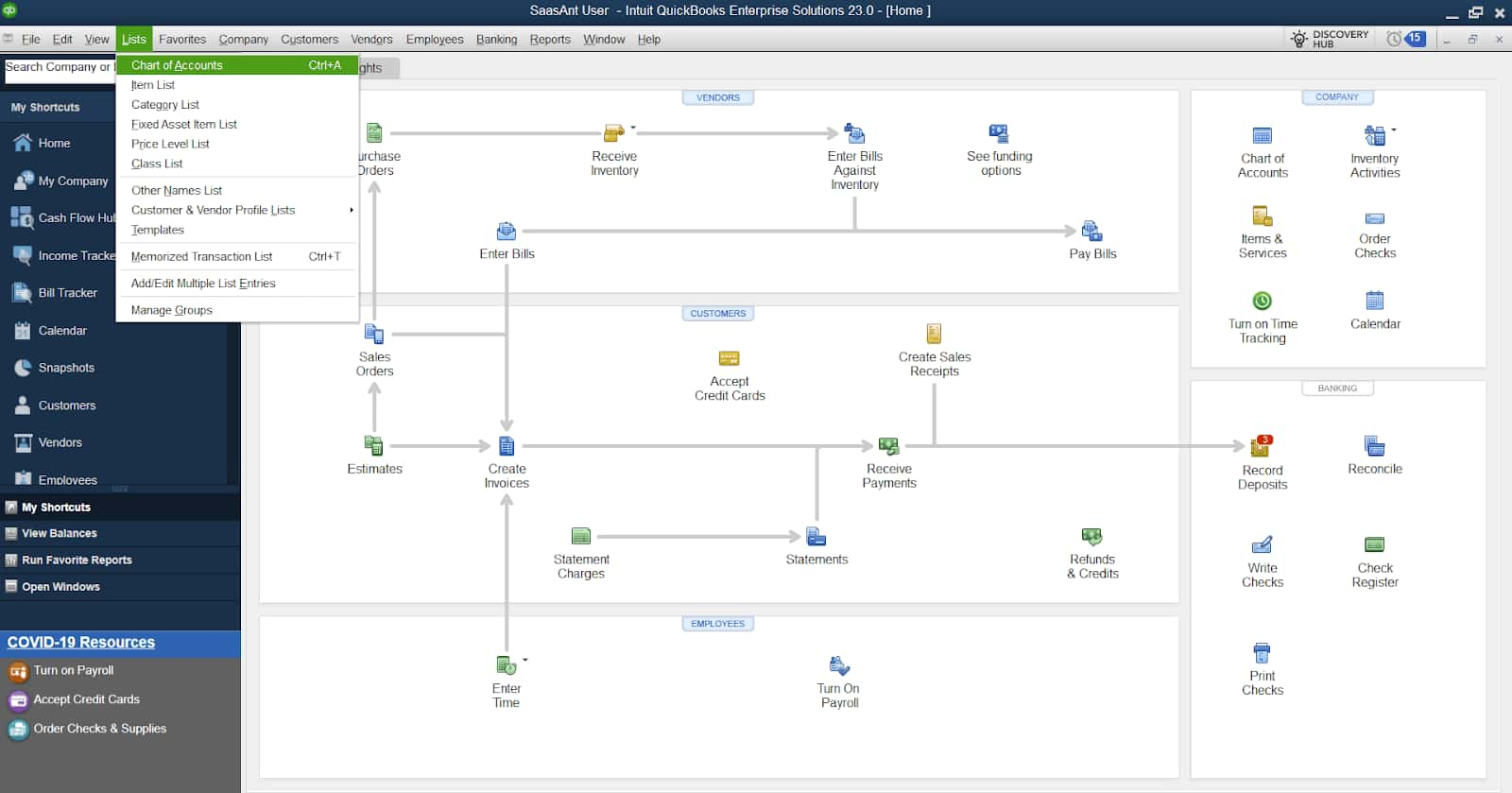

Step 1: Access the Chart of Accounts

- From the top menu bar, click on Lists.

- In the drop-down menu, select Chart of Accounts.

- The Chart of Accounts window will open, listing all your accounts.

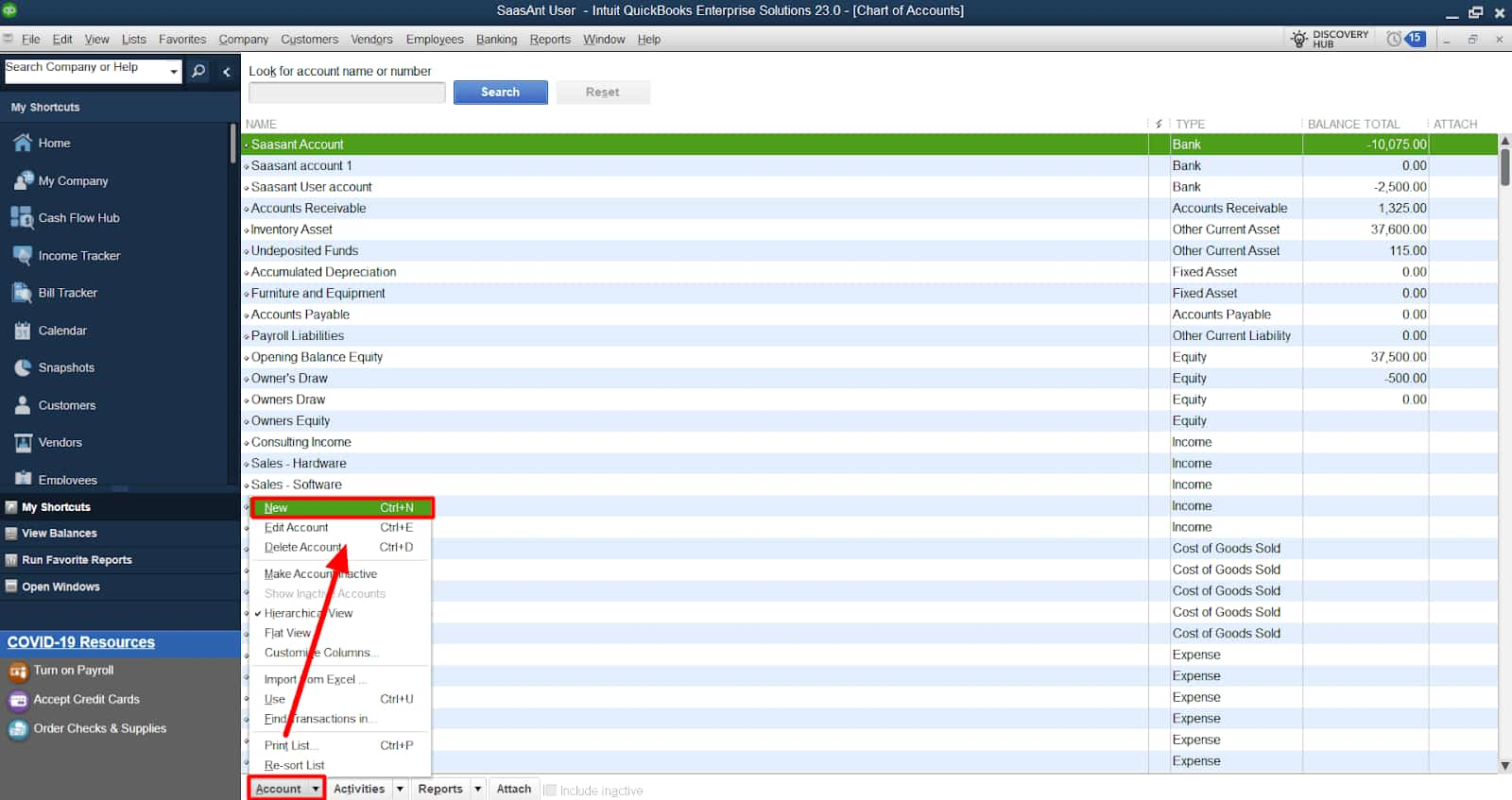

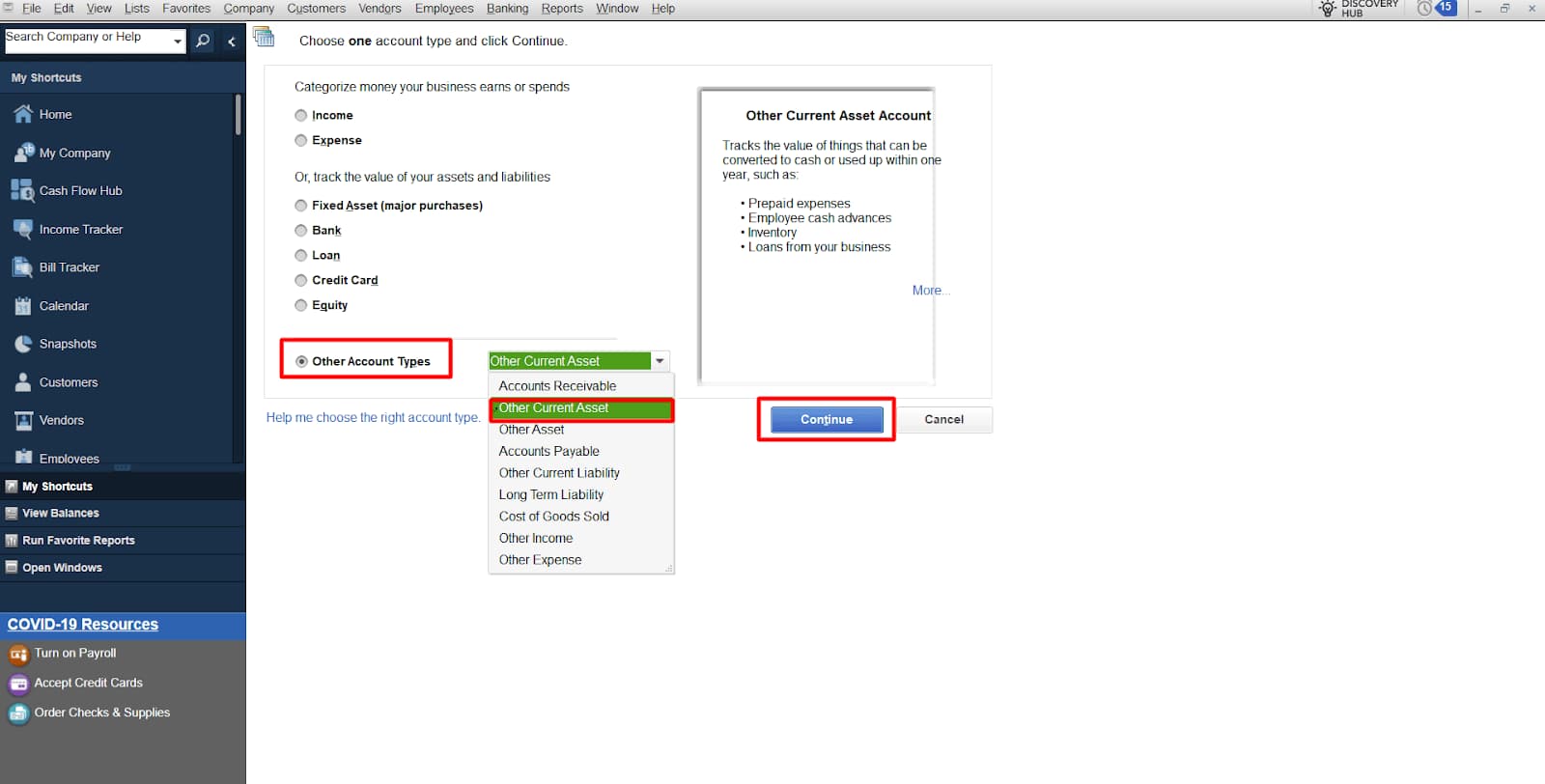

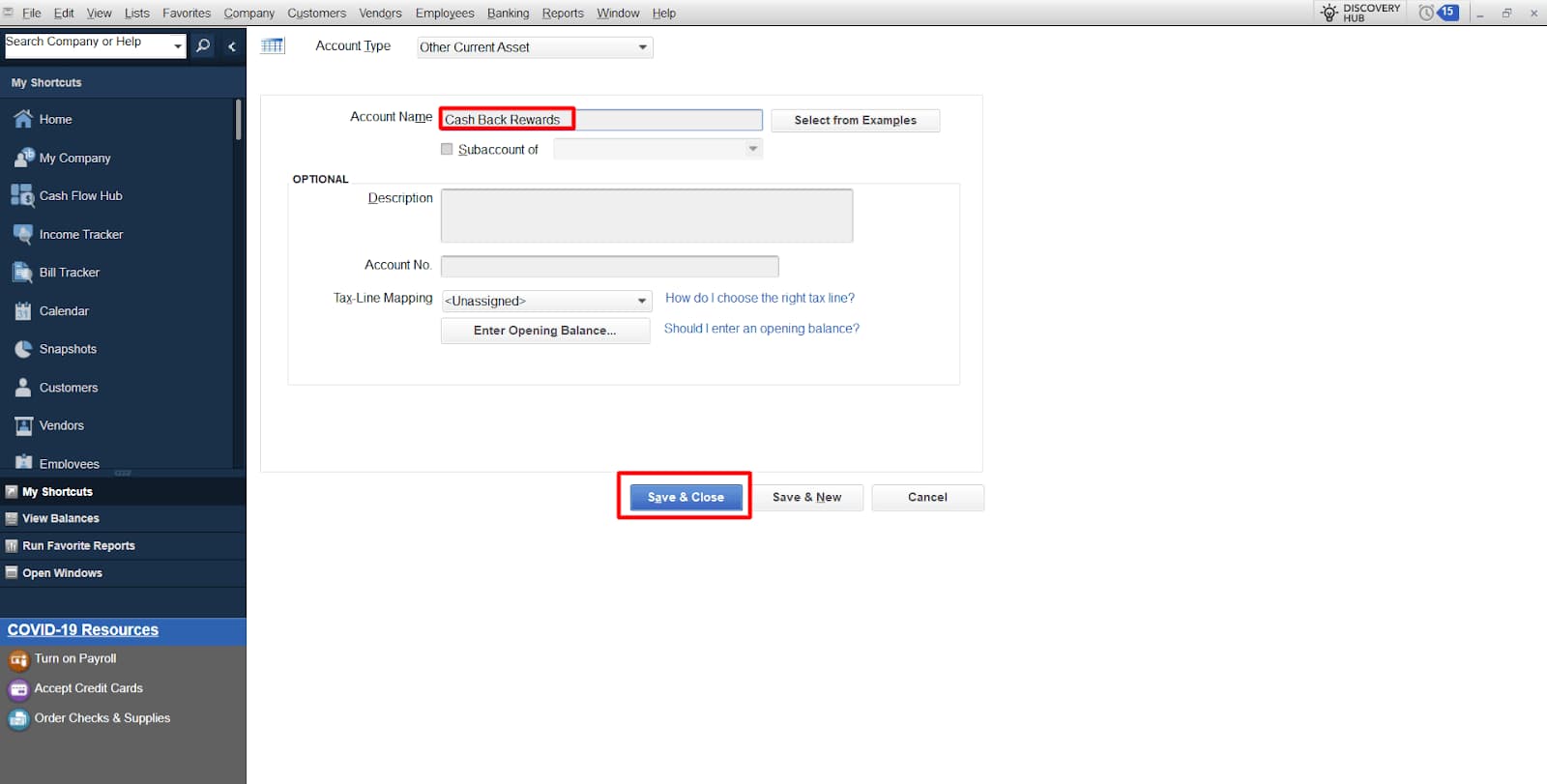

Step 2: Set Up the New Account

- Click the + New button at the bottom left of the Chart of Accounts window.

- In the Account Type field, select Income from the drop-down menu.

- In the Other Current Assets, enter a name for the account, such as “Cash-back Rewards.”

- In the Description field (optional), provide additional details if needed.

- Set any other necessary account details (e.g., Account Number, Tax Line Details, etc.) if required.

- Click Save and Close to create the account.

Step 2: Record the Cashback Reward

Step 1: Open the Credit Card Charges Entry Screen

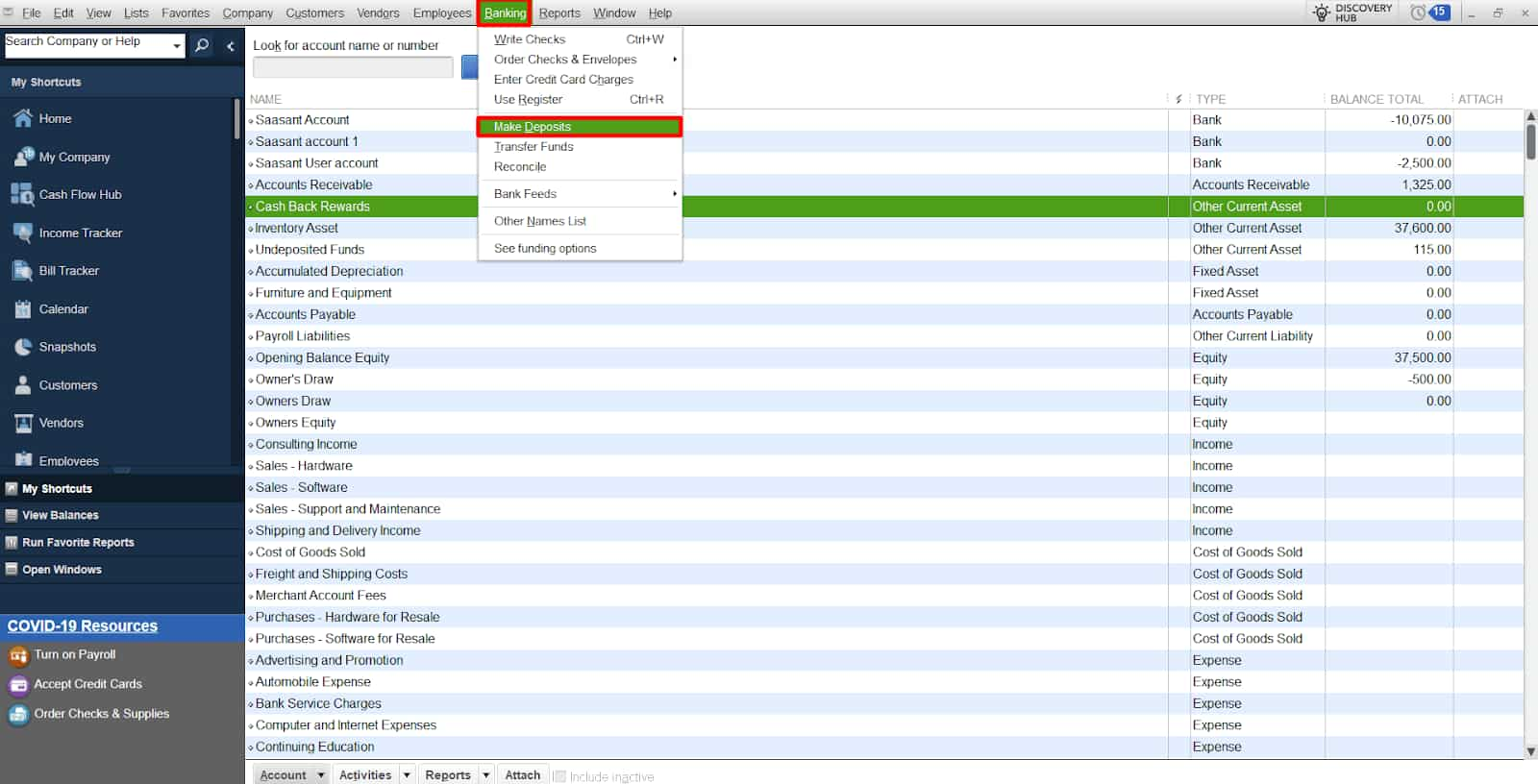

- From the top menu bar, click Banking.

- In the drop-down menu, select Enter Credit Card Charges.

- The Credit Card Charges window will open.

Step 2: Enter the Cashback Transaction

- In the Payee field, select the name of the credit card issuer or the specific vendor from which the cashback originated.

- In the Account field, select the Cash-back Rewards account you created earlier.

- In the Payment/Credit section, choose Refund/Credit.

- In the Amount field, enter the amount of cashback you received.

- Optionally, add any other details, like a memo or description for reference.

Step 3: Save the Transaction

- After entering all the required details, click Save and Close to complete the transaction.

Step 3: Assign the Appropriate Expense Account

After you’ve recorded the deposit, you must apply the cash-back incentives to the proper spending account.

- Navigate to the Banking menu and choose Use Register.

- Locate the deposit you made in the register and double-click it to initiate the transaction.

- In the transaction window, choose the Account field from the Account column.

- Choose the appropriate expenditure account for the initial expense linked with the cash-back incentives. For example, if the payback is for travel expenditures, choose the Travel Expense account.

- If required, create a note to offer more information about the transaction.

- To save your changes, click on Save & Close.

Step 4: Review and Analyze

To examine the classification of cashback rewards:

- Go to the Reports option at the top of the screen.

- Select Custom Reports, then Transaction Detail.

- Customize the report options to include the Cash Back Rewards and corresponding spending accounts.

- Run the report to examine and evaluate the cash-back incentives sorted by spending account.

- Other reports, such as Profit & Loss and Expense by Vendor, will help you better understand your savings and costs.

How Do You Record Credit Card Cashback Rewards in QuickBooks Online?

Step 1: Create an Income Account

To help improve your record keeping, you should open a separate account on QuickBooks online for your cash-back earnings.

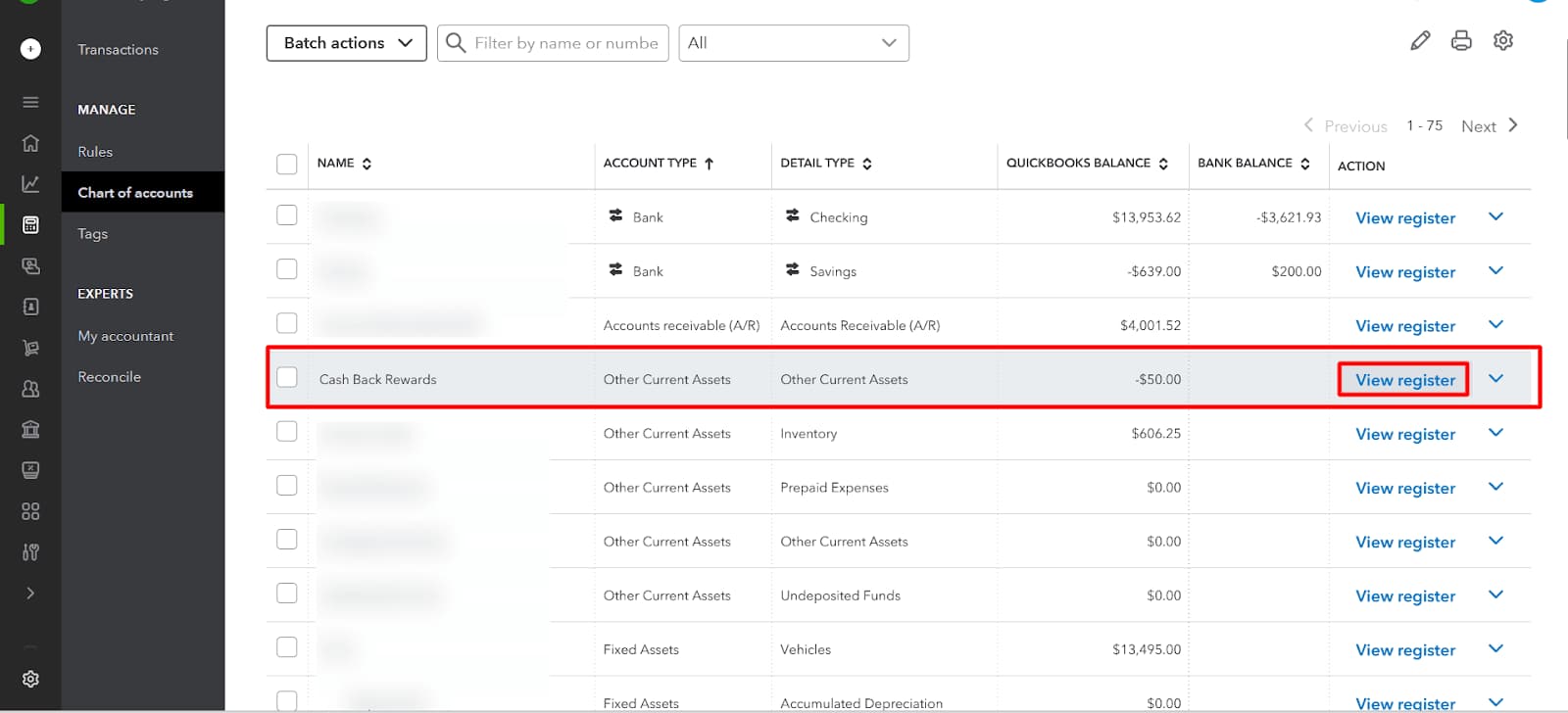

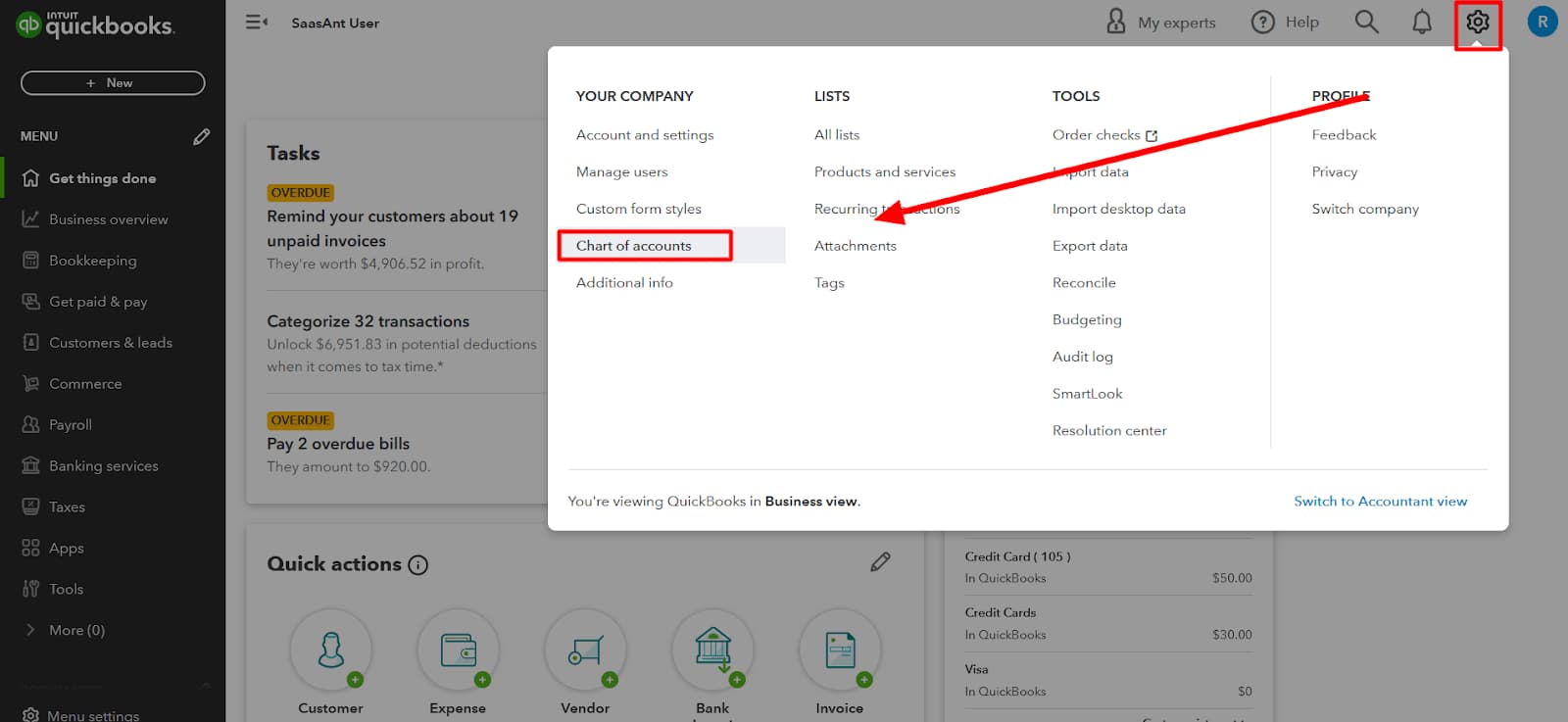

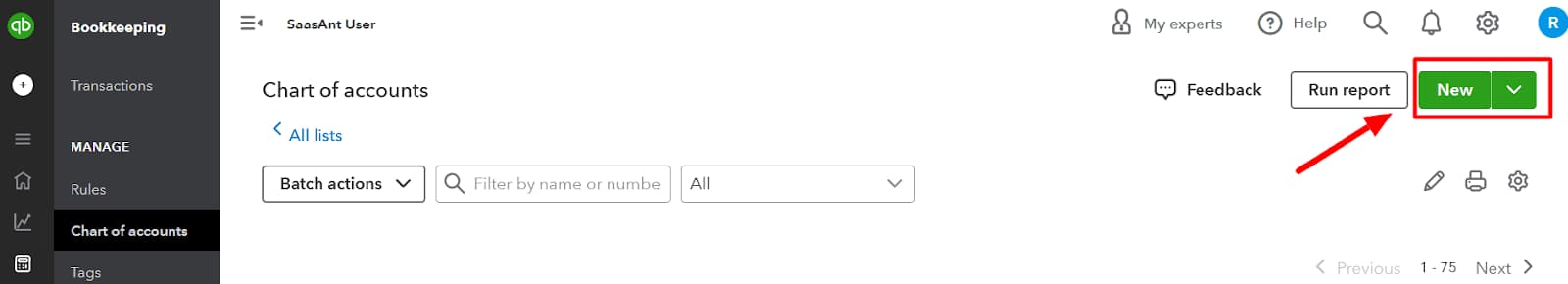

- Navigate to the Chart of Accounts.

- Click on New to create a new account.

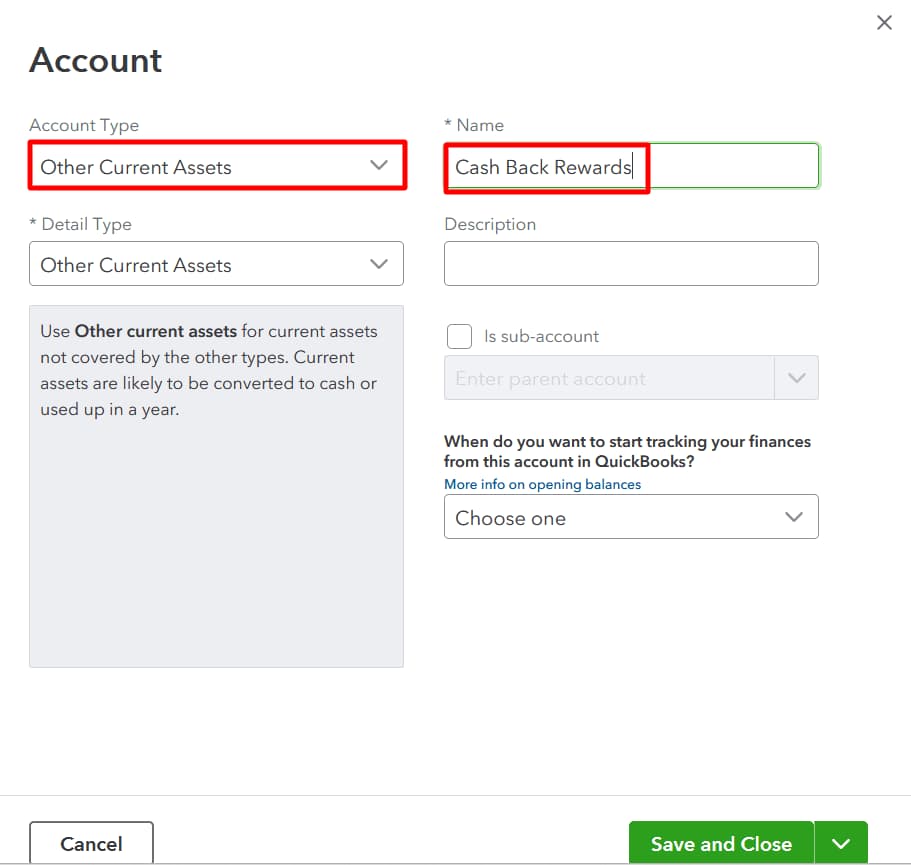

- Select Other Current Asset as the account type.

- Name the account Cash Back Rewards.

- Click Save and Close.

Step 2: Record Cash Back Transactions

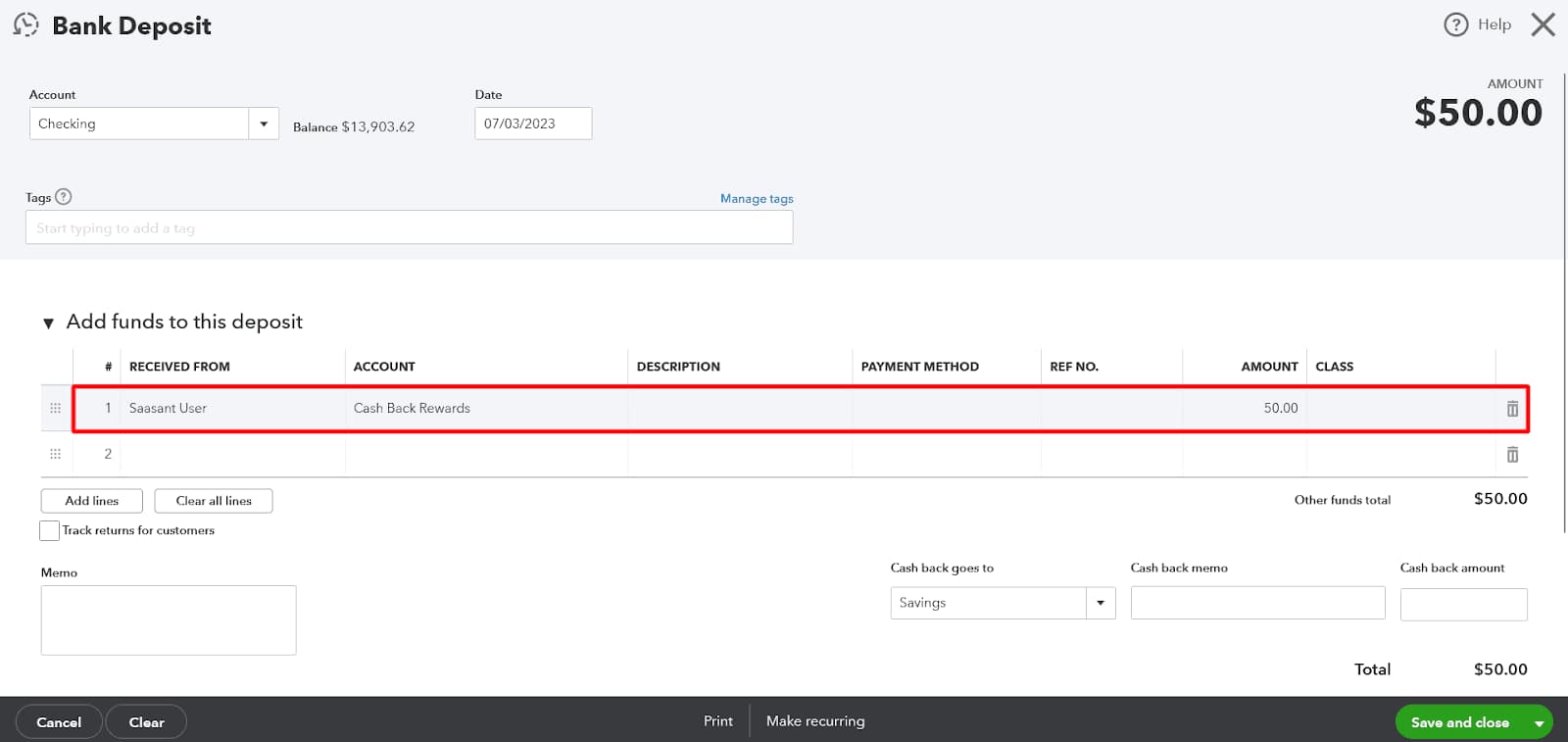

If you get any form of cash back on your credit card, be sure to enter it as a deposit to QuickBooks Online.

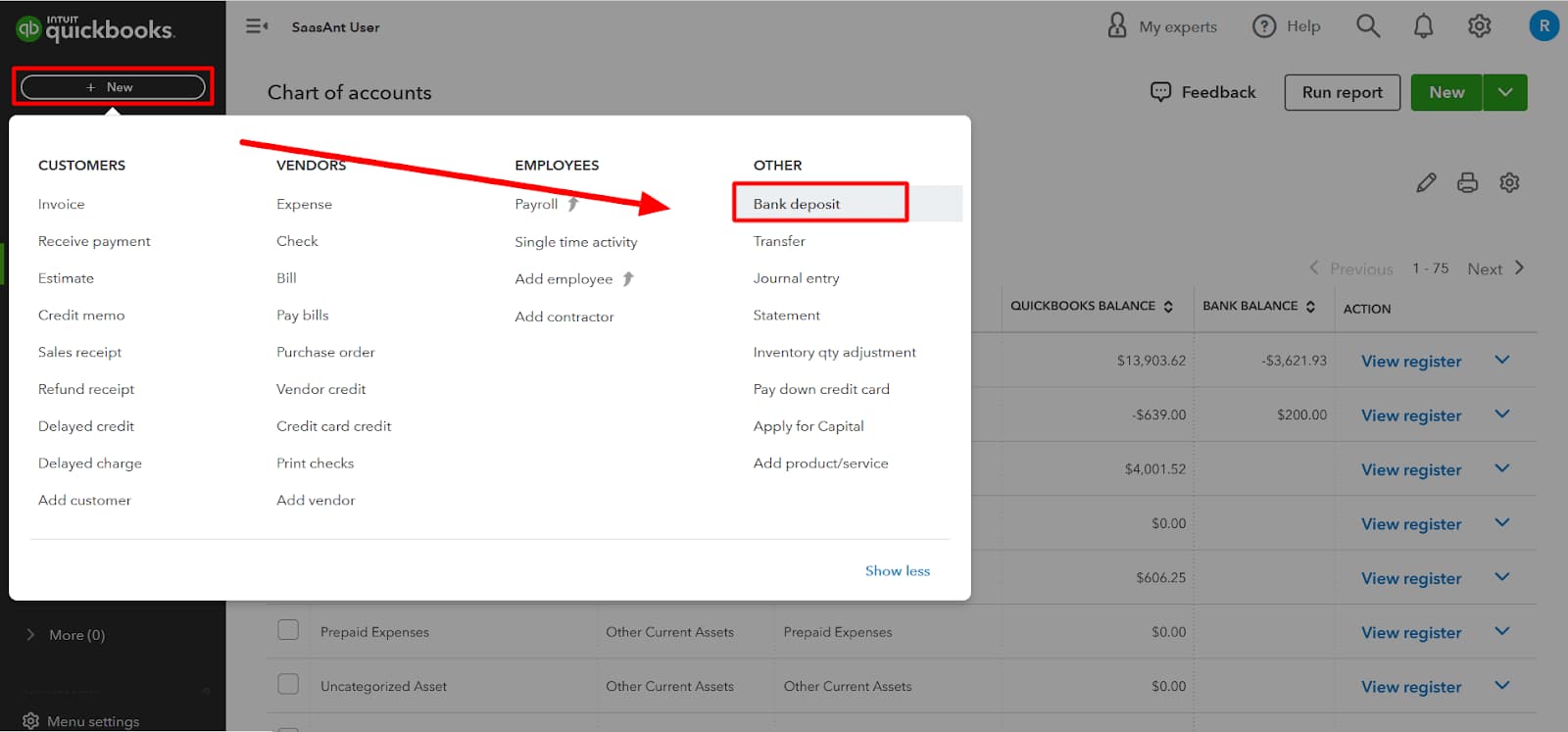

- Click on the + New button at the top left corner and select Bank Deposit.

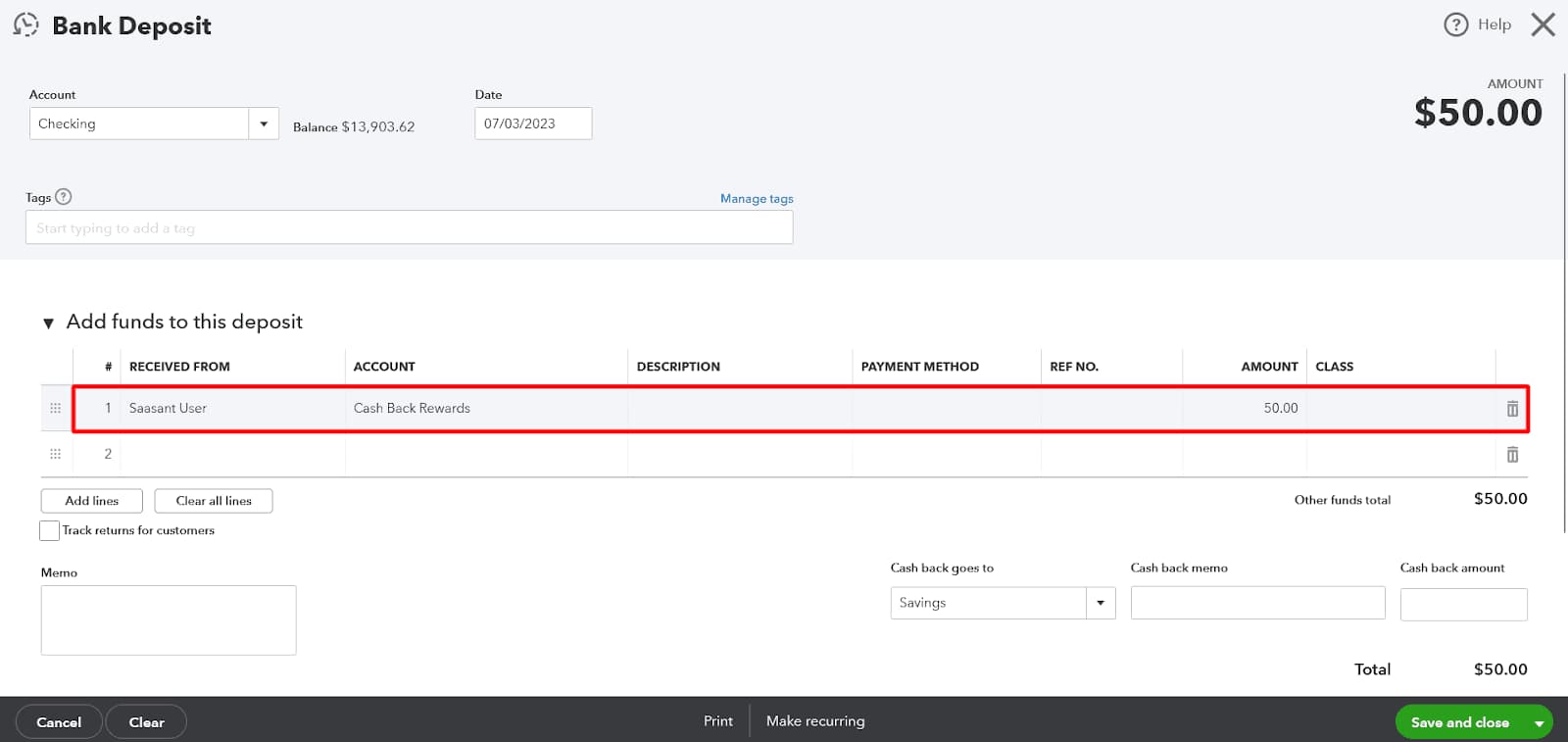

- Choose the bank account where you received the cash-back rewards.

- In the Add funds to this deposit section, select the Cash Back Rewards account you created.

- Enter the amount of the cash-back rewards in the Amount field.

- Click Save and Close to record the deposit.

Step 3: Assign an Appropriate Category

After you’ve recorded the deposit, you must accurately classify the cash-back benefits.

- Navigate to Chart of Accounts.

- Locate the deposit you made and click on it to initiate the transaction.

- In the transaction window, click on the Category column and choose the category that corresponds to the original cashback expenditure. For example, if you received cash back on office supplies, choose Office Supplies Expense.

- Select Save and Close.

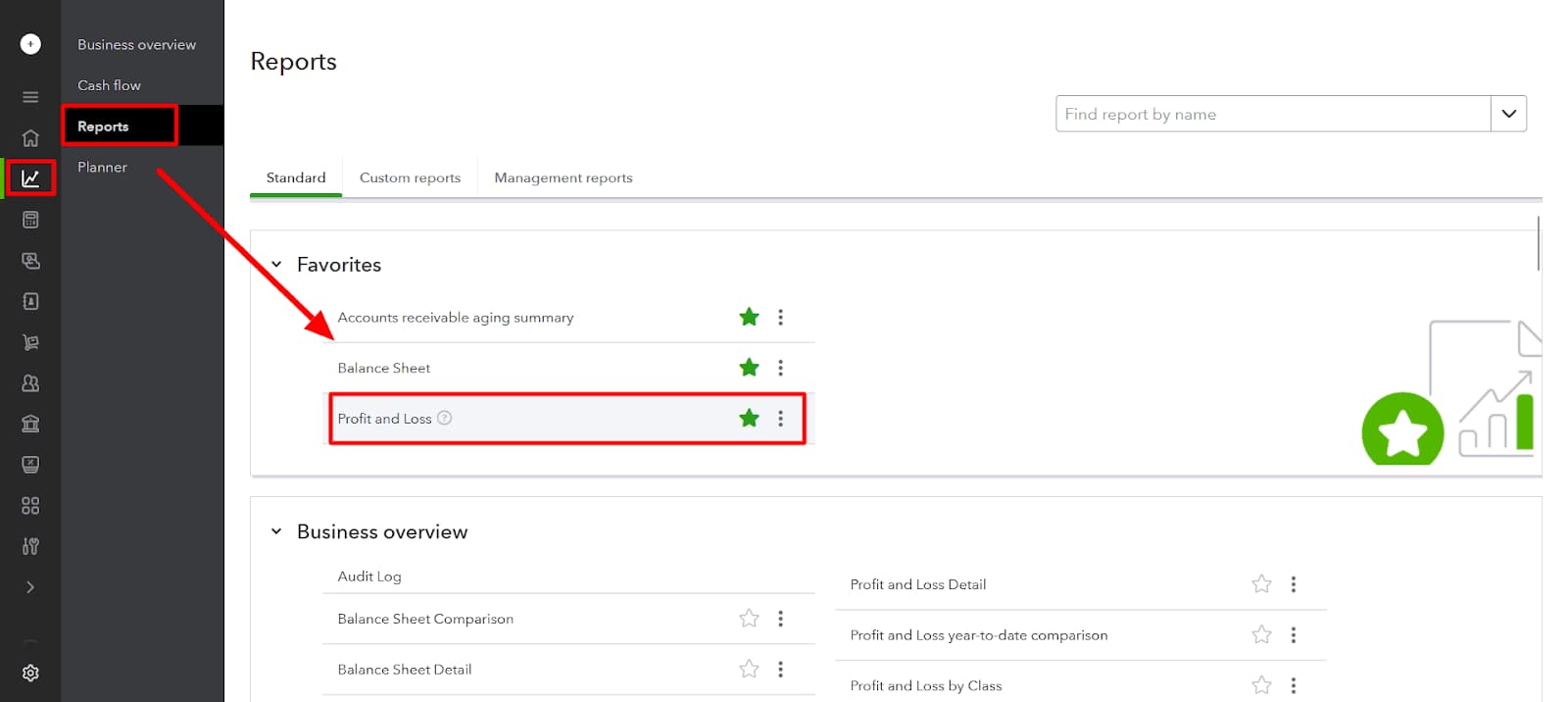

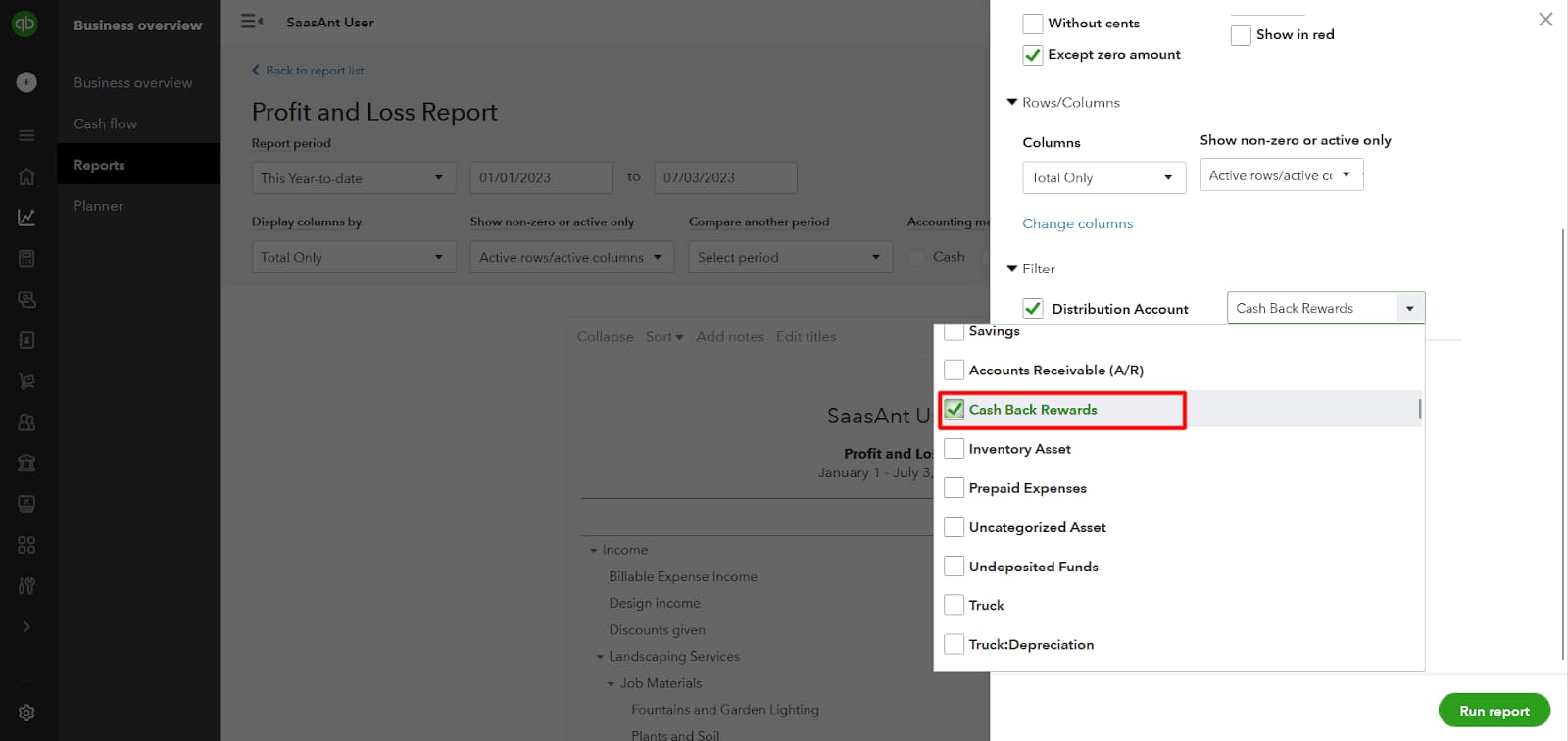

Step 4: Review Reports

Making sure that cash-back rewards are correctly categorized requires routinely going over reports in QuickBooks Online.

- Select All Reports from the Reports option, or pick certain reports such as Profit & Loss or Expense by Vendor.

- Add the Cash Back Rewards account and the corresponding spending categories to the report settings.

- Examine the reports to track the amount of money you are saving in each area, thanks to cash-back rewards.

Why is it Important to Record “Cash Back Rewards”?

Recording Cash Back Rewards is important for several key reasons:

- Accurate Financial Tracking: Recording cash back rewards allows tracking of all often or savings obtained from the rewards program as a way of enhancing the accountancy of the business.

- Expense Categorization: These are mostly derived from certain purchases or kinds of purchases or products and services (for example, office supplies, travel, etc.). Writing these benefits facilitates the proper classification of the rewards because your reports will include real cost savings.

- Improves Financial Insights: It is helpful to monitor the cash-back rewards as they are informational in terms of how much savings are functioning and how much they are functioning well enough to be rewarded from specific expenditures.

- Tax Purposes: When filing tax returns, proper recording and categorization of cash back rewards will help in following the law and, in addition, enable the faculty to maximize its tax benefit or minimize its taxable income by indicating where the cash back rewards had been utilized.

- Budgeting and Cost Efficiency: It also enables you to have an insight into how much you are to earn and thus have a clue on how to balance your earnings and expenditures well.

Mastering Cashback Rewards in QuickBooks: Accurate Recording and Smart Tracking

Recording credit card cashback rewards correctly in QuickBooks is crucial for maintaining precise financial records and optimizing business savings. Whether you use QuickBooks Desktop or Online, understanding how to categorize these rewards—as income or contra-expense—impacts your profit reports, tax calculations, and budgeting. Avoid common errors, track rewards from multiple cards separately, and leverage advanced tools like class and location tracking for deeper insights. This guide breaks down essential strategies to help you record, reconcile, and analyze cashback rewards efficiently, empowering you to make smarter financial decisions and maximize business benefits.

Difference Between Recording Cashback as Income vs Contra-Expense in QuickBooks

Recording cashback as income increases your total revenue, shows up on your Profit & Loss report, and may affect tax calculations. On the other hand, treating it as a contra-expense directly reduces your reported expenses, gives a clearer view of net spending, and usually avoids taxable income classification. For example, $200 cashback recorded as income may inflate profit, while the same amount as contra-expense offsets original costs. Most businesses prefer contra-expense for accurate cost tracking, cleaner reports, and audit readiness. Choose the method based on tax advice, reporting preference, and accountant recommendations for compliance and clarity.

Common Mistakes to Avoid While Recording Cashback Rewards in QuickBooks

Entering cashback as regular income instead of non-taxable contra-expense is a frequent mistake that can lead to overstated profits, incorrect tax filings, and confusing reports. Many users skip setting up a dedicated account, which causes poor categorization, unclear transactions, and reconciliation issues. Another error is recording cashback without linking it to the original expense, resulting in loss of context, tracking accuracy, and reporting value. Avoid mixing cashback from personal cards, as it creates compliance risks, data pollution, and audit concerns. Always review entries for consistency, correct account types, and transaction history alignment.

How to Track Cashback Rewards from Multiple Cards Separately in QuickBooks

To track cashback from multiple cards, create individual sub-accounts under a parent “Cashback Rewards” account for clear segmentation, source tracking, and organized records. Assign each card’s rewards to its respective sub-account to avoid data overlap, ensure transaction clarity, and simplify monthly reconciliation. Use card-specific payee names, descriptions, and memos to maintain transaction history, category alignment, and audit trail. Running reports with filters by sub-account provides insights into which card delivers more rewards, helps in expense allocation, and supports smart financial decisions. Structure and naming should remain consistent, intuitive, and report-friendly.

Best Practices for Reconciling Cashback Rewards with Bank Statements

Always match cashback entries with bank deposits to avoid ledger mismatches, statement discrepancies, and false balances. Use the transaction date, exact amount, and payee name from your credit card provider to ensure data consistency, audit accuracy, and record transparency. Reconcile monthly by comparing your QuickBooks register, bank feed, and credit card statements to catch missing entries, duplicate deposits, or wrong categorizations. Tag each cashback with a memo, assign it to the correct account, and include it in your bank reconciliation workflow. Consistent checks lead to error-free books, cleaner reports, and stronger financial control.

Using Class and Location Tracking for Cashback Entries in QuickBooks Online

Enable Class and Location tracking in QuickBooks Online to separate cashback by department, project, or business unit, improving reporting depth, expense mapping, and performance analysis. Assign each cashback entry a class to identify where the reward originated, ensuring operational clarity, cost-center alignment, and strategic insight. Use locations to track cashback geographically or by branch, helping with regional comparisons, cashflow trends, and location-level decisions. This setup is ideal for companies with multi-entity operations, allowing them to maintain organized books, create custom reports, and gain actionable data visibility from cashback activities.

Enhancing Financial Accuracy: Advanced Tips for Managing Cashback Rewards in QuickBooks

Cashback rewards offer more than just savings—they can significantly impact your business’s financial health when managed correctly in QuickBooks. Beyond basic recording, understanding how cashback affects financial reports, budgeting, and expense optimization is crucial. Integrating automation and leveraging expert advice ensures consistent categorization and tax compliance. This guide explores advanced strategies to help you streamline cashback tracking, improve reporting accuracy, and make smarter financial decisions. Empower your bookkeeping with these practical tips to maximize cashback benefits and maintain robust, audit-ready accounts.

How Cashback Rewards Impact Financial Reports Like Profit & Loss or Balance Sheet

Cashback rewards affect your financial reports by reducing expenses or increasing income, depending on how you record them. When logged as contra-expenses, cashback lowers your total costs, improving net profit visibility on the Profit & Loss statement. If recorded as income, it raises revenue figures, which can distort profitability and tax obligations. On the Balance Sheet, cashback accounts appear under current assets or income accounts, influencing your company’s financial position. Accurate categorization ensures clear reports, better financial analysis, and compliance. Understanding these impacts helps you make informed decisions and maintain trustworthy financial statements.

Integrating Cashback Tracking with Budgeting Tools Inside QuickBooks

Integrating cashback tracking with QuickBooks budgeting tools helps businesses monitor savings against planned expenses effectively. By linking cashback accounts to specific budget categories, you can compare actual savings versus budgeted amounts, improving cost control. This integration aids in forecasting future cashback benefits based on spending patterns, enhancing cash flow management. Using QuickBooks reports alongside budgets allows you to identify areas where cashback contributes most, enabling smarter allocation of resources. Regularly updating budgets with cashback data ensures your financial planning is realistic, transparent, and aligned with business goals for improved profitability.

Setting Automation Rules for Frequent Cashback Deposits in QuickBooks Online

Automation rules in QuickBooks Online save time by automatically categorizing frequent cashback deposits. By creating rules based on transaction descriptions or amounts, cashback entries are assigned to the correct account without manual input. This reduces errors, speeds up bookkeeping, and ensures consistent categorization for accurate reporting. Automation helps maintain up-to-date records, simplifies bank reconciliation, and frees up resources for strategic tasks. For businesses with multiple credit cards, automation rules can differentiate cashback sources, enhancing tracking and financial clarity. Implementing these rules improves efficiency and keeps your cashback rewards properly managed.

The Role of Cashback Rewards in Business Expense Optimization

Cashback rewards play a key role in optimizing business expenses by effectively reducing net costs. When tracked accurately, these rewards highlight spending categories that yield the highest returns, enabling smarter purchasing decisions. By analyzing cashback data, businesses can negotiate better vendor terms or shift budgets toward high-reward areas. This process improves cash flow management and increases overall profitability. Consistent monitoring of cashback helps identify unnecessary expenses and maximizes the value extracted from everyday purchases. Leveraging cashback insights turns routine spending into a strategic tool for cost efficiency and financial growth.

When to Consult a CPA for Cashback Rewards Categorization

Consulting a CPA is essential when unsure about the tax implications of recording cashback rewards in QuickBooks. CPAs provide expert guidance on whether cashback should be treated as taxable income or a contra-expense, ensuring compliance with current tax laws. They help interpret complex regulations that vary by jurisdiction and business type, reducing the risk of audits or penalties. A CPA can also advise on best practices for record-keeping and reporting, optimizing your financial statements and tax returns. Early consultation saves time, prevents costly errors, and aligns your bookkeeping with legal and financial standards.

Conclusion!

Businesses must record cash back rewards in their QuickBooks accounting software to maintain complete records of all incoming auxiliary income and gains. Cash-back rewards are recorded as revenue in the company’s books of accounts and are shown in the Statement of Profit and Loss as income received.

Frequently Asked Questions!

1. What is the fundamental difference between recording cashback as Income versus Contra-Expense in QuickBooks?

The distinction lies in how the transaction impacts your Profit and Loss (P&L) statement and tax liability.

- Income Method: Treats the reward as revenue. This artificially inflates your sales figures and increases your total net profit, which may lead to a higher taxable income.

- Contra-Expense Method: Treats the reward as a reduction of the original expense. This provides a clearer view of your true net spending and total business costs, which is generally preferred by accountants because cash back on business purchases is typically non-taxable.

Most CPAs recommend the Contra-Expense method for better financial reporting and audit readiness.

2. If I choose the Contra-Expense method, what specific Account Type should I use for the Cash-back Rewards account in QuickBooks?

For the Contra-Expense method, you should avoid using a standard Income account type. The generally accepted practice is to set up the Cash-back Rewards account under Other Current Asset or sometimes Other Income (depending on your Chart of Accounts structure).

Setting the account type correctly is crucial for:

- Keeping the transaction separate from primary revenue streams.

- Ensuring the reward offsets the correct expense category on the P&L report.

3. What is the most common mistake when recording cash back, and how can I avoid it during bank reconciliation?

The most common mistake is entering the cash back as regular income without linking it to the original expense category. This results in:

- An inaccurate P&L statement that overstates your revenue.

- Confusion during bank reconciliation because the deposit lacks context.

To avoid this, always set up a dedicated Cash Back Rewards account and, during reconciliation, ensure the reward is categorized to that specific account, not a generic sales account. Use a detailed memo referencing the original credit card payment or the source of the reward.

4. How can I efficiently track cash back rewards when I use multiple credit cards for my business?

To maintain clear segmentation and simplify audit trails, you should create a structured Chart of Accounts using sub-accounts.

The recommended structure is:

- Parent Account: Cash-back Rewards (Type: Other Current Asset)

- Sub-Accounts:

- Cash Back Rewards: Card A (e.g., Amex Business)

- Cash Back Rewards: Card B (e.g., Chase Ink)

- Cash Back Rewards: Card C (e.g., Vendor Specific Card)

Assign each reward transaction to the specific sub-account. This allows you to run reports and analyze which card provides the highest net savings.

5. When should I use the advanced Class and Location Tracking features for cashback entries in QuickBooks Online?

Class and Location tracking are essential for businesses with multiple departments, projects, or branches.

You should use these features when you need to answer questions such as:

- Which specific business location generated the most cash back savings?

- How did the cash back rewards impact the net spending of the Marketing Department versus the Operations Department?

Assigning a specific Class or Location to the reward transaction provides deeper financial insights and supports accurate budgeting and profitability analysis across different business segments.

6. How does the accurate recording of cash back specifically impact reports like the Profit & Loss and Balance Sheet?

Accurate categorization is vital because it directly affects reported financial health.

On the financial reports:

- Profit & Loss (P&L): When recorded as a Contra-Expense, the cash back reduces the line item for the original expense (e.g., reducing the Travel Expense total), resulting in a more accurate and higher net profit figure.

- Balance Sheet: If the reward is deposited directly into a bank account, it increases the Current Assets (Bank Account balance). The Cash Back Rewards account itself usually appears as a negligible balance or is cleared out monthly, appearing under Current Assets or Other Income depending on the setup.

7. When is it necessary to consult a Certified Public Accountant (CPA) regarding cash back rewards categorization?

While the Contra-Expense method is standard, you must consult a CPA in the following specific scenarios:

- Large, Unusual Rewards: If you receive a very large sign-up bonus or reward that the IRS might consider substantial enough to be taxable.

- Bartering/Services: If the reward was received in exchange for services, rather than as a refund on a purchase price.

- Tax Jurisdiction: If your business operates in multiple states or countries with differing tax laws regarding business incentives.

A CPA ensures your recording method is compliant with the latest federal and local tax regulations, protecting your business from audit risks.

Disclaimer: The information outlined above for “How to Record Credit Card Cash Back Rewards in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.