Highlights (Key Facts & Solutions)

- Accounting Setup: Recording requires linking the payroll item to two distinct accounts: a Liability Account (to track the owed amount on the Balance Sheet) and an Expense Account (to track the cost on the Profit and Loss Statement).

- Tax Classification (Desktop): The most critical step is setting the correct Tax Tracking Type during payroll item setup to ensure the contribution is properly classified as non-taxable and correctly mapped to Form W-2 Box 12.

- Compliance Review: Year-end compliance requires verifying:

- All contributions are within the annual IRS elective deferral limits.

- The Payroll Liability Balances report matches payments made to the plan provider.

- Contribution totals are mapped correctly to the appropriate W-2 box codes.

- Audit Documentation: The Payroll Item Detail Report is the essential document for an audit, as it isolates all transaction activity for the 401k contribution item.

- Post-Submission Correction (Online): To correct an error after submission, you must edit the original paycheck directly in the employee’s payroll history to ensure the liability account is automatically and accurately adjusted.

- Integration Benefit: Direct integration with third-party providers (e.g., ADP, Guideline) improves efficiency by automating data syncing and simplifying the required monthly reconciliation.

Overview

Recording 401k employer contributions in QuickBooks is beneficial for businesses as they get tax advantages and support in maintaining clear records for accounting and payroll reporting.

The 401k Employer contribution is an additional contribution made by employers to an employee’s retirement account. It is based on the employee’s contributions. These contributions are also known as matching contributions.

Different types of 401k employer contribution

- Traditional 401(k) plans

- Safe harbor 401(k) plans

- SIMPLE 401(k)plans

Who pays the 401(k) Employer Contributions?

Employers pay the 401 (k) employer contribution, which is placed directly into the employee’s 401(k) account. The amount varies according to the conditions of the individual 401(k) plan and the firm’s policies.

Advantages of 401k Employer Contributions Plans

401k employer contributions boost employee retirement savings without extra costs, enhance compensation value, and reward participation. For employers, they attract and retain talent, improve workforce satisfaction, and offer potential tax benefits.

- For Employee:

- It raises retirement savings without adding to the employee’s expenses.

- It increases the pay package’s overall worth.

- It offers a reward for taking part in the retirement plan.

- For Employers:

- It provides attractive benefits that aid in luring and keeping talent.

- It promotes employees’ retirement security, which may result in a happier and more effective workforce.

- It may give the business tax advantages.

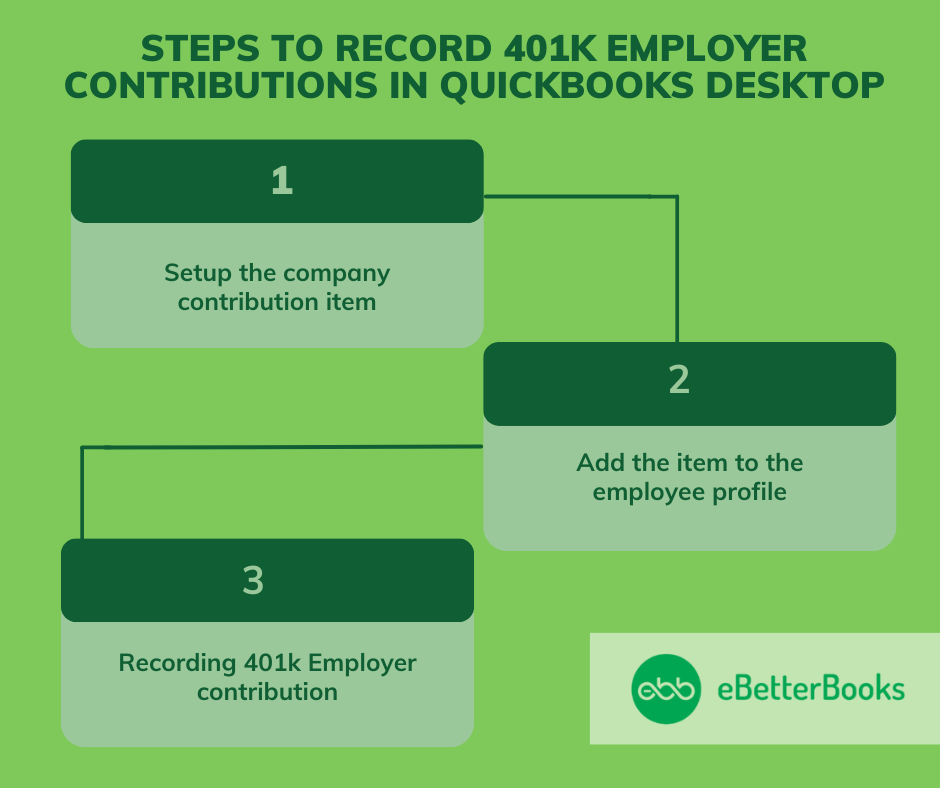

How do you record 401k Employer Contributions in QuickBooks Desktop?

Record 401k employer contributions in QuickBooks Desktop, first set up the company contribution item, add it to the employee’s profile, then enter the contribution amount per period, and save the transaction.

Part 1: Setup the Company Contribution Item

To set up a company contribution item in QuickBooks, navigate to the Payroll Item List, select New, choose Custom Setup, and create the company contribution. Assign liability and expense accounts, and track the contribution item. Finish setup by configuring tax tracking and calculation settings.

Following the step-by-step information below:

Step 1: Navigate to the Payroll Item List

- Click on the List menu on the screen and then click on the Payroll Item list.

- Choose the Payroll Item drop-down.

- Now, hit on New.

Step 2: Mention the Item Name

- Choose the Custom Setup option on the screen.

- Then, hit next.

- Now, click on the Company contribution option on the screen and then Next.

- Enter the name of the item and then hit on next.

Step 3: Choose the Liability Item

- Choose the name of the agency to which the liability is paid (or add it)

- Then, enter the account number

- Now, choose the liability and the expense account where you want to track the item, then select Next.

Step 4: Track the Contribution Item

- In the Tax Tracking Type window, choose the specific contribution item.

- Then, click on Next twice.

- Under Calculate based on quantity, choose Neither, then Next.

- Leave the Default rate and limit fields blank. [ You can add the rate and limit when adding the item to the employee profile.

- Click on Finish.

Part 2: Add the Item to the Employee Profile

Add a contribution item to an employee profile in QuickBooks, go to the Employee Center, select the employee, and under Payroll Info, click on Additions, Deductions, and Company Contributions. Then, add the 401k Employer Contribution item.

Following the step-by-step information below:

Step 1: Locate the Payroll Info

- Click on the employee’s option on the screen.

- Now, choose the employee center.

- Double-click to select the employee’s name.

Step 2: Add the Additions, Deductions, and Company Contributions

- Click on Additions, Deductions, and Company Contributions option on the screen.

- Now, add the contribution item [i.e., 401k Employer cONTRIBUTION]

Part 3: Recording 401k Employer Contribution

How to record a 401k employer contribution, enter the contribution amount and limit per period, then click Save and close to finalize the transaction.

Following the step-by-step information below:

Step 1: Mention the 401k Employer Contribution Amount

- Put the contribution amount per period and the limit.

Step 2: Save the Transaction

- Once you are satisfied, Click on Save and close.

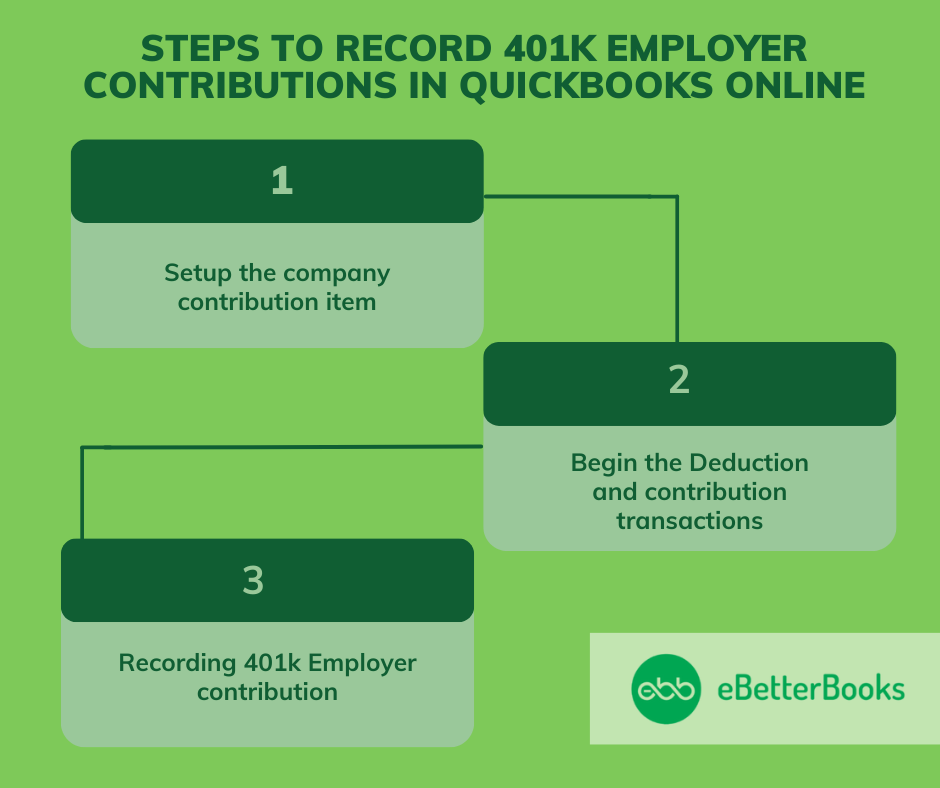

How do you record 401k Employer Contributions in QuickBooks Online?

Record 401k employer contributions in QuickBooks Online, set up the contribution item via Payroll settings, add the contribution details to the employee’s profile, and then review and save the payroll transaction.

Part 1: Setup the Company Contribution Item

Set up a company contribution item, click the Gear icon, select Payroll, then choose Employees. From the list, select the employee you want to set up the contribution for.

Following the step-by-step information below:

Step 1: Navigate to Payroll

- Click on the Gear icon from the left menu.

- Now, choose the Payroll option from the drop-down.

Step 2: Select the Employee

- Click on the Employees option on the screen.

- Choose the employee from the list.

Part 2: Begin the Deduction and Contribution Transactions

The begin deduction and contribution transactions, click on Deductions & Contributions, add a new item, select the type, enter the contribution amount or percentage, and set an annual max if needed. Save and close the transaction.

Following the step-by-step information below:

Step 1: Create a New Deduction

- Click on Deductions & contribution and then click on Start or Edit.

- Click on + Add deductions/contribution.

Step 2: Decide the Deduction/Contribution Type

- Now, select the following:

- Deduction/contribution type: Choose the contribution type.

- Type: Choose the specific contribution item.

- Description: Put the name of the contribution or plan provider.

Step 3: Mention the Contribution Amount

- Select how the contribution is calculated under the Company contribution section.

- Now, put the amount or percent per paycheck.

- Mention the amount in the “Annual Max” field in case you want to set an annual maximum amount for company contributions.

Step 4: Save the Transaction

- Once you are satisfied, Click on Save and close.

Part 3: Recording 401 k Employer Contribution

To record a 401k employer contribution, navigate to Payroll, select the employee, enter pay details, add the 401k contribution, review the payroll summary, and save the transaction.

Following the step-by-step information below:

Step 1: Navigate to the Payroll Setting and Mention Employee Details

- Click on the payroll on the screen.

- Select the employee.

- Enter the employee’s hours and other pay details.

Step 2: Add 401k Employer Contribution

- Click on + Add deductions/contribution.

- Choose 401k employee contribution in the deductions/contributions type dropdown.

Step 3 Review & Save

- Review the payroll summary.

- Submit the payroll once, you’re satisfied.

Insights into Recording 401k Contributions in QuickBooks

Understanding the basics isn’t enough when it comes to managing 401k employer contributions in QuickBooks. To ensure full compliance, accurate reporting, and smooth payroll operations, you must go beyond the standard steps. The following subtopics highlight 5 key operational areas—ranging from error prevention to financial reconciliation—that users often overlook. Each section is packed with direct, high-value guidance designed to eliminate guesswork, reduce risk, and increase efficiency. Whether you’re using QuickBooks Desktop or Online, these insights will help you avoid critical mistakes, stay audit-ready, and maintain control over your retirement contribution workflows.

Common Mistakes to Avoid When Recording 401k Contributions in QuickBooks

Many users make 3 critical mistakes: selecting the wrong payroll item type, linking incorrect liability accounts, and forgetting to assign contribution limits. These errors lead to misreported taxes, compliance risks, and inaccurate financial records. 4 out of 5 errors happen due to manual setup without cross-verification. Always double-check contribution types, ensure matching liability accounts, and apply annual IRS limits to avoid audits. Misclassifying employer matches as employee deduction confuses reporting and misstates expenses. QuickBooks requires exact configuration—1 wrong setting can affect 3 core areas: payroll accuracy, liability tracking, and retirement reporting.

How to Edit or Delete 401k Contribution Entries in QuickBooks

To edit or delete 401k entries in QuickBooks, follow 3 focused steps: locate the payroll transaction, open the employee paycheck, and modify the contribution section. Many users skip checking historical pay runs, leading to inconsistencies in year-end reports. Always verify the pay period, contribution type, and tax impact before saving changes. Deleting without adjusting liability accounts causes 2 common issues: mismatched payroll reports and unreconciled ledgers. For accuracy, re-run payroll summaries after edits. Whether in Desktop or Online, make sure 3 key areas are synced: employee profile, paycheck records, and payroll item configuration.

Understanding 401k Contribution Limits and Compliance in Payroll Setup

Setting up 401k contributions without understanding limits can trigger 3 major issues: IRS penalties, over-contributions, and audit red flags. In 2025, the elective deferral limit is $23,000, with an additional $7,500 catch-up for those 50+. QuickBooks users must manually enforce these limits in both Desktop and Online versions. Failing to apply annual caps in employee profiles can lead to incorrect W-2 reporting and payroll tax miscalculations. Ensure 3 things during setup: accurate employee age classification, plan type selection, and yearly limit updates. Compliance starts with configuration—1 small oversight here may result in 3 cascading payroll errors.

How to Generate 401k Reports in QuickBooks for Audits and Reviews

QuickBooks offers 3 essential reports for 401k audits: Payroll Summary, Employee Earnings Summary, and Payroll Item Detail. Generating these reports helps track contribution accuracy, verify compliance, and support annual filings. Users often skip filtering by date range, payroll item, and employee name—leading to data gaps during audits. Always customize your report with these 3 filters for clarity. Use the Payroll Item Detail to isolate 401k entries by type and match them with ledger totals. Accurate reports reduce audit risks, save 4–6 hours of manual checks, and ensure your payroll records are ready for third-party plan reviews.

Steps to Reconcile 401k Liability Accounts in QuickBooks

Reconciling 401k liability accounts involves 3 critical actions: matching payroll liabilities with payment records, verifying ledger entries, and checking for unmatched transactions. Every pay run should reflect accurate employer contributions, recorded against the correct liability account. If the balance remains after payment, 2 common causes are duplicate entries or incorrect account links. Use the Payroll Liability Balances report to spot inconsistencies, then cross-check with bank transactions. Ensure alignment between 3 key areas: payroll liabilities, chart of accounts, and actual disbursements. Monthly reconciliation avoids year-end surprises, ensures clean books, and supports accurate Form 5500 filing for plan administrators.

Advanced Strategies to Strengthen 401k Contribution Management in QuickBooks

Once the basics are handled, it’s time to unlock the full potential of your 401k setup in QuickBooks. This section dives into 5 high-value strategies that go beyond data entry—focusing on automation, system integrations, financial accuracy, and year-end efficiency. Each topic is designed to reduce errors, save time, and improve your long-term payroll workflows. These insights give you control over 3 crucial dimensions: compliance, reporting accuracy, and financial clarity. Whether you’re a small business or scaling enterprise, applying these best practices will help you maximize the value of your 401k management process inside QuickBooks.

Benefits of Automating 401k Contributions in Payroll Systems

Automating 401k contributions delivers 3 major benefits: eliminates manual errors, ensures timely deposits, and maintains compliance with IRS deadlines. With automation in QuickBooks, contributions are calculated, tracked, and recorded during every payroll run—without extra effort. Manual entry leads to 2 frequent issues: missed contributions and misapplied limits. Automation also improves efficiency by syncing deductions and employer matches instantly with liability accounts. This reduces reconciliation time by up to 60%. For businesses processing weekly payrolls, automation guarantees consistent accuracy across 3 key areas: employee paychecks, financial records, and year-end retirement reports.

Comparison Between QuickBooks Desktop and Online for 401k Management

QuickBooks Desktop offers 3 strong features for 401k: customizable payroll items, detailed liability tracking, and advanced reporting. In contrast, QuickBooks Online provides easier access, simplified setup, and seamless updates—but with limited item-level control. Desktop suits firms needing granular control over accounts, while Online is ideal for speed and accessibility. The key differences affect 3 areas: payroll customization, integration flexibility, and reporting depth. Users switching platforms often overlook 401k item behavior, causing data gaps. Understanding these 3 functional gaps prevents setup errors, saves migration time, and ensures retirement contributions remain accurate across systems.

How 401k Employer Contributions Impact Financial Statements

401k employer contributions directly affect 3 key financial statements: the Profit & Loss (P&L), Balance Sheet, and Cash Flow Statement. Contributions appear as payroll expenses in the P&L, increase liabilities on the Balance Sheet, and reduce available cash in operating activities. Misclassifying these entries distorts net income and misrepresents company obligations. Accurate tracking in QuickBooks ensures financial transparency, supports investor confidence, and simplifies tax reporting. Always align contribution records with charts of accounts and payroll summaries. This triple alignment strengthens reporting accuracy, minimizes audit risks, and keeps your financial statements clean and compliant.

Integrating Third-Party Retirement Plan Providers with QuickBooks

Integrating third-party 401k providers with QuickBooks boosts efficiency through 3 main benefits: automatic data syncing, reduced manual entry, and real-time tracking. Providers like Guideline, ADP, or Human Interest offer direct integration options, ensuring contribution data flows into QuickBooks without delays. Manual uploads often result in 2 common issues—data mismatches and reporting gaps. With integration, you maintain alignment across payroll, retirement accounts, and liability ledgers. It also simplifies reconciliation by syncing 3 critical data points: employee deductions, employer matches, and deposit confirmations. This integration not only saves time but also enhances accuracy during audits and year-end processes.

Best Practices for Year-End 401k Contribution Reviews in QuickBooks

Year-end reviews of 401k contributions require 3 best practices: verify contribution limits, reconcile liability accounts, and confirm W-2 accuracy. Start by running Payroll Summary and Payroll Item Detail reports to cross-check annual totals. Compare them against IRS limits—$23,000 standard and $7,500 catch-up (2025). Unreconciled accounts often signal missed payments or duplicate entries. Ensure that employee and employer totals match both ledger balances and provider statements. Review 3 areas carefully: payroll item setup, year-to-date totals, and tax form mapping. These checks prevent compliance issues, reduce amendment risks, and ensure your retirement data is audit-ready and error-free.

Conclusion!

Recording 401 (k) employer contributions in QuickBooks is crucial to ensuring regulatory compliance and keeping correct financial records. Proper account setup and active contribution tracking allow businesses to control their payroll expenses and financial information effectively. Accurately registering these contributions guarantees that employees’ retirement benefits are handled, which improves employee trust and facilitates smooth payroll processing.

Frequently Asked Questions

1. How do I ensure my 401k employer contribution is correctly classified for tax reporting in QuickBooks Desktop?

To ensure the 401k employer contribution is classified correctly for tax reporting in QuickBooks Desktop, you must select the appropriate Tax Tracking Type during the initial payroll item setup.

Key setup requirements:

- Navigate to the Payroll Item List and edit the company contribution item.

- In the Tax Tracking Type window, select the option that correctly identifies the contribution as a company match or non-taxable employer contribution (often labeled as 401(k) Match or similar non-taxable category).

- Ensure that the item is not set to track as a traditional deduction, as this can lead to misreported wages or tax liabilities.

- The system will automatically link the contribution to the correct box on the employee’s Form W-2 based on this setting.

2. What are the three critical compliance areas I must verify during my year-end 401k contribution review in QuickBooks?

A thorough year-end review of 401k contributions is essential for preparing accurate Form W-2 and Form 5500 filings.

The three critical areas to verify are:

- Contribution Limits: Compare the employee and employer year-to-date totals in QuickBooks against the current year’s IRS elective deferral limits (e.g., $23,000 for 2025) and catch-up limits.

- Liability Reconciliation: Verify that the total amount recorded in the Payroll Liability Balances report exactly matches the total amount paid and deposited to the third-party 401k plan provider.

- W-2 Accuracy: Confirm that the Year to Date (YTD) contribution totals are correctly mapped to the appropriate W-2 box codes (typically Box 12 codes D, E, F, or G depending on the plan type).

3. How do I correct a 401k contribution entry after the paycheck has already been submitted in QuickBooks Online?

To correct a contribution error after payroll submission in QuickBooks Online, you must edit the original paycheck, which requires immediate attention to prevent liability mismatches.

Steps to correct the entry:

- Navigate to the Payroll menu and select the Employee whose paycheck needs modification.

- Go to the payroll history and open the specific paycheck containing the error.

- Under the Deductions & Contributions section, modify the employer contribution amount or percentage.

- Save and resubmit the payroll. The system will automatically calculate the required adjustment to the employee’s net pay and update the liability ledger.

Warning: Always cross-check the adjusted liability account balance after modifying a historical paycheck, as this can create discrepancies if not handled carefully.

4. When setting up the 401k employer contribution in QuickBooks Desktop, which two general ledger accounts must I assign?

When setting up the company contribution item in QuickBooks Desktop, you are required to assign two distinct general ledger accounts to track the transaction accurately.

The two required accounts are:

- Liability Account (Credit): An account that tracks the amount owed to the plan provider. This is typically named 401k Liability and should be set up as a Other Current Liability type.

- Expense Account (Debit): An account that records the cost of the employer match to the business. This is typically named 401k Employer Contribution Expense or Payroll Expense and is categorized as an Expense account.

This double entry ensures the contribution hits the Profit & Loss Statement (as an expense) and the Balance Sheet (as a liability) correctly before payment.

5. Which three essential reports should I generate in QuickBooks to support a formal 401k plan audit or review?

For any formal audit or third-party plan review, generating specific reports from QuickBooks provides the necessary documentation to verify contribution accuracy and compliance.

The three essential reports are:

- Payroll Summary Report: Provides a high-level view of all payroll costs for a specific period, useful for reconciling total wages against contribution percentages.

- Employee Earnings Summary Report: Used to verify individual employee gross wages and contribution calculations.

- Payroll Item Detail Report: This is the most crucial report, as it isolates the exact debit and credit activity for the 401k Employer Contribution and 401k Employee Deduction items across all pay periods.

Always filter these reports by the exact plan year or audit period to ensure accurate data extraction.

6. What is the benefit of integrating a third-party 401k provider (like Guideline or ADP) directly with QuickBooks?

Integrating a third-party 401k provider with QuickBooks offers significant benefits by automating data flow and reducing manual workload and error risk.

The key benefits of integration are:

- Automatic Data Syncing: Contribution and deduction amounts are automatically synced, eliminating the need for manual export and import, which reduces data entry errors.

- Real-time Tracking: Ensures that contributions are calculated, tracked, and reflected in the liability accounts immediately after each payroll run.

- Simplified Reconciliation: Provides a seamless link between the payroll records, the liability ledger, and the actual deposit confirmation from the plan provider, greatly simplifying the monthly reconciliation process.

7. How does the 401k employer contribution primarily impact the Profit and Loss Statement versus the Balance Sheet?

The 401k employer contribution affects both financial statements differently, reflecting its dual nature as an expense of doing business and a short-term obligation.

The impact is as follows:

- Profit and Loss Statement (P&L): The contribution is recorded as an Expense (specifically, 401k Employer Contribution Expense or a similar payroll expense line). This decreases the company’s net income.

- Balance Sheet: The unpaid contribution is immediately recorded as a Liability (401k Liability) until the funds are remitted to the plan provider. This temporarily increases the current liabilities.

Accurate tracking is essential because misclassifying the employer match as an employee deduction distorts both the company’s true expense on the P&L and its tax liability.

Disclaimer: The information outlined above for “How to Record 401k Employer Contributions in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.