Tax setup errors in QuickBooks Desktop Enterprise Payroll occur when payroll tax attributes, liability mappings, and employee identifiers fail to align with the data structure used in QuickBooks Online. The migration process introduces structural differences in tax parameters, account assignments, and withholding logic, which must be validated to restore accurate payroll calculations.

QuickBooks Desktop Enterprise Payroll relies on a defined set of federal, state, and local tax attributes, a consistent liability framework, and a stable data file structure to accurately calculate employee deductions and employer liabilities.

This article reviews the causes of tax setup errors after migration and the steps to verify tax settings, confirm payroll item mappings, validate employee identifiers, rebuild corrupted company files, update tax tables, and cross-check migrated data. It outlines procedures to ensure tax accuracy, correct structural discrepancies, and maintain compliance, providing a complete overview for stable post-migration payroll operations.

Why Tax Setup Errors Occur in QuickBooks Desktop Enterprise Payroll?

Tax errors in QuickBooks Desktop Enterprise Payroll arise when migrated payroll data does not align with the system’s tax calculation structure, regulatory requirements, or payroll item configuration. Discrepancies may occur during data transfer or tax-attribute mapping, resulting in conflicts between imported values, Desktop-specific tax rules, jurisdiction formats, and account structures.

- Platform differences between QuickBooks Online and Desktop modify tax attributes, liability mappings, and calculation rules.

- Incomplete or inconsistent federal, state, or local tax parameters transfer during migration.

- Mismatched tax jurisdiction formats prevent accurate mapping of state codes, local identifiers, and multi-state filing data.

- Incorrect payroll item–to–account assignments disrupt withholding accuracy and liability reporting.

- Discrepancies in employee tax profiles arise from incompatible field formats or missing exemption data.

- Inconsistent payroll item architecture changes wage bases, deduction behavior, and tax-type classification.

- Corrupted company file components interfere with tax tables, deduction logic, and payroll item relationships.

- Outdated tax tables apply obsolete regulatory thresholds, wage bases, and jurisdictional rates.

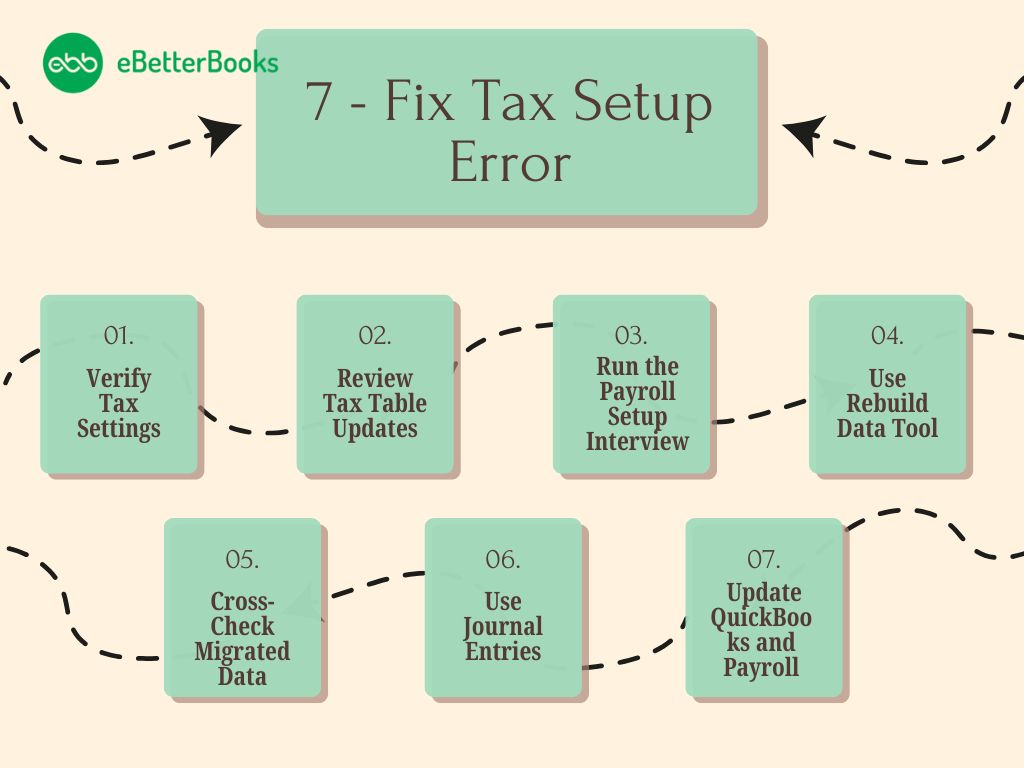

How to Fix Tax Setup Errors After Migrating from QuickBooks Online to Desktop?

Accurate tax setup after migrating from QuickBooks Online to QuickBooks Desktop ensures correct withholding, liability alignment, and compliance. QuickBooks Desktop Enterprise Payroll resolves tax setup errors by validating migrated tax attributes, confirming employee identifiers, reviewing payroll item mappings, and updating tax tables.

Use the following methods to identify and fix tax setup errors:

1. Verify Tax Settings

Tax settings ensure that payroll calculations comply with federal, state, and local regulations. Misconfigured tax rates or employer identification numbers (EINs) can lead to incorrect deductions, affecting tax liability and employee compensation.

Below are the steps to validate tax settings:

- Log in to QuickBooks Desktop and go to Employees > Payroll Setup > Tax Setup.

- Check all tax details, including federal, state, and local tax details for each employee. Verify that the setup matches the requirements of your organization.

- Cross-check for discrepancies in tax rates, employer identification numbers (EINs), or filing statuses. Discrepancies could lead to errors in tax calculation or wrong amounts.

2. Review Tax Table Updates

Payroll tax tables contain critical updates on the latest tax rates, deductions, and withholding calculations.

The following steps ensure that tax tables are up to date, maintaining compliance with regulatory changes:

- Regular payroll tax table updates are necessary for correct tax calculations.

- Go to Employees > Get Payroll Updates and make sure you have the latest version.

- Choose to download the latest payroll updates, then restart QuickBooks once updated. This maintains compatibility with the newest tax forms and rates.

3. Run the Payroll Setup Interview

The Payroll Setup Interview is an automated tool that helps configure payroll tax details correctly after migration. Errors in tax IDs, filing statuses, or employee tax settings may create discrepancies in payroll processing.

Following these steps, one can ensure all missing details are identified correctly:

- Open the Payroll Setup Interview in QuickBooks Desktop Enterprise. It guides you through the entire setup process step-by-step.

- Enter any missing information, such as tax IDs, employee tax information, and filing options. This identifies and resolves any gaps that have occurred during the migration process.

4. Use Rebuild Data Tool

Corrupt data files interfere with tax calculations and payroll reporting, leading to errors in paycheck deductions and tax liabilities. The Rebuild Data Tool fixes internal file issues and restores missing components.

Follow the steps to run this tool to eliminate corruption and ensure accurate payroll data processing:

- Faulty data files can cause tax setup errors and miscalculations.

- Go to File > Utilities > Rebuild Data to fix corrupted company files. Proceed through the instructions to back up your data before rebuilding.

- After rebuilding, go to File > Utilities > Verify Data to check that there are no residual issues.

5. Cross-Check Migrated Data

Ensuring consistency between QuickBooks Online and Desktop prevents payroll errors and incorrect tax deductions. Any mismatch in employee tax details can lead to calculation inaccuracies, requiring manual updates to maintain accuracy and compliance.

The following is a checklist to verify the accuracy:

- Verify tax-related information from QuickBooks Desktop Enterprise and Online. In particular, verify employee information like Social Security numbers (SSNs), tax exemptions, and withholding allowances.

- Update the data in QuickBooks Desktop manually to ensure consistent with the online information accurately.

6. Use Journal Entries

Journal entries help reconcile financial records and align payroll tax liabilities.

Following these steps ensures payroll tax accuracy and seamless financial tracking:

- Create journal entries to consolidate data and align accounts.

- Ensure that the journal entries are accurate and reflect the correct amounts.

7. Update QuickBooks and Payroll

Outdated versions of software lead to payroll processing errors, mismatches in tax calculations, and incompatibility with regulatory updates. Keeping QuickBooks and payroll services up-to-date prevents disruptions and avoids compliance issues.

Regular updates using the following steps help ensure payroll accuracy:

- Ensure that both QuickBooks Desktop and the payroll service are updated to the latest versions.

- Go to Help > Update QuickBooks Desktop and Employees > Get Payroll Updates to check for updates.

Potential Challenges When Setting Up Tax Errors in QuickBooks

The following are the potential challenges encountered when configuring tax settings in QuickBooks, including data discrepancies, incorrect tax mappings, and system errors that affect payroll calculations and compliance:

1. Payroll Setup Interview Does Not Save Changes

Issues arise due to incorrect user permissions, corrupted company files, or incomplete setup procedures. If changes are not saving, the configuration may be missing essential data, causing the payroll setup to remain incomplete.

2. Error Codes When Rebuilding Data

Severe file corruption, outdated software, or insufficient system resources trigger errors during the rebuild process. These issues prevent QuickBooks from restoring accurate payroll tax settings, leading to miscalculations.

Resolutions for Tax Setup Errors in QuickBooks Desktop Enterprise Payroll

QuickBooks Desktop Enterprise Payroll resolves tax setup errors by correcting migrated tax attributes, verifying payroll item mappings, and aligning employee identifiers with the system’s calculation framework. These steps restore structural accuracy, apply current tax tables, and reestablish precise withholding and liability reporting.

Fix for Payroll Setup Interview Not Saving Changes

Ensuring that admin permissions are correctly configured prevents QuickBooks from restricting payroll modifications. Verifying and rebuilding the company file removes corruption that may block setup changes.

The following steps help resolve these issues effectively:

- Log in using admin credentials with full permissions to modify payroll settings.

- Run File > Utilities > Verify Data to identify any corruption in the company file.

- If errors persist, use File > Utilities > Rebuild Data to repair the file.

- Carefully complete each step in the Payroll Setup Interview, as omissions prevent changes from being saved.

- Close and reopen QuickBooks after setup to apply modifications.

- Update QuickBooks to the latest version by selecting Help > Update QuickBooks.

Fix for Error Codes During Data Rebuild

Backing up company files protects critical payroll data from loss during the rebuild process. Creating a local backup ensures that any corrupted entries can be restored without disrupting ongoing financial records.

The following steps help maintain data integrity and resolve rebuild errors:

- Back up the company file before initiating the rebuild process to prevent data loss.

- Navigate to File > Back Up Company > Create Local Backup to store a copy of your data.

- Ensure system resources meet QuickBooks requirements for smooth data processing.

- Verify that the latest QuickBooks version is installed, as outdated software may conflict with the rebuild function.

Tax Setup Validation Checklist (Post-Migration)

Post-migration checklist ensures that tax attributes, employee identifiers, payroll items, and updated tax tables in QuickBooks Desktop Enterprise Payroll align with the system framework to maintain accurate withholding and compliant reporting.

| Task | Description |

| Verify company EIN | Ensure the EIN matches what was used in QuickBooks Online |

| Confirm employee SSNs | Double-check SSNs and personal info accuracy |

| Validate the federal and state tax setup | Match all tax types, rates, and jurisdictions |

| Update the payroll tax table | Ensure the latest tax rates are downloaded |

| Complete payroll setup interview | Walk through the entire interview in QBDT |

| Rebuild and verify company data | Repair and confirm that no corruption exists |

| Reassign liability and expense accounts | Map payroll items to correct accounts |

| Compare reports (QBO vs QBDT) | Validate year-to-date figures and liabilities |

| Run test payroll or preview | Confirm accurate calculations before live payroll |

Conclusion!

Accurate tax setup in QuickBooks Desktop Enterprise Payroll depends on a validated alignment between migrated tax attributes, employee identifiers, payroll items, and account assignments. The verification of these elements removes the structural discrepancies introduced during the transfer from QuickBooks Online and restores correct withholding, liability mapping, and jurisdictional configuration.

Rebuilding and verifying utilities remove damaged company file components to maintain corruption-free calculation frameworks, while updating payroll tax tables ensures the latest federal, state, and local thresholds to maintain compliance and prevent outdated tax rates usage. These steps establish a stable post-migration payroll environment that supports precise calculations, consistent reporting, and long-term reliability across all payroll operations.

FAQs

What causes tax setup errors after migrating to QuickBooks Desktop Enterprise Payroll?

Tax setup errors occur when payroll tax attributes, liability mappings, or employee tax identifiers differ between the Online and Desktop systems.

What Happens When You Switch from QuickBooks Desktop to Online?

When you switch to QuickBooks Online, your company file data is converted, but certain features like custom reports or payroll setup require manual adjustments.

How do I Fix QuickBooks Desktop Installation Errors?

Use the QuickBooks Tool Hub to run the Installation Issues tool and follow prompts to resolve common installation problems.

How to Fix the QuickBooks Payroll Error?

Update QuickBooks and payroll tax tables, verify data integrity, and rerun payroll setup to fix most payroll-related errors.

Can you Use QuickBooks Online Payroll with QuickBooks Desktop?

No, QuickBooks Online Payroll is not compatible with QuickBooks Desktop; each version requires its own payroll service.

Which payroll data must be manually reviewed after migration?

Employee identifiers, withholding attributes, state unemployment rates, payroll item mappings, and year-to-date tax balances require manual review.

Why is a tax table update required after migration?

A tax table update is required to replace outdated wage bases, jurisdictional rates, and regulatory thresholds with current values for compliant payroll calculations.

Disclaimer: The information outlined above for “Tax Setup Errors in QuickBooks Desktop Enterprise Payroll After Switching from Online to Desktop” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.