QuickBooks Desktop Pro/Premier payroll backup data retrieval and conversion describe the processes that reconstruct payroll datasets, ensure version-accurate restoration, and maintain continuity during system transitions. Payroll backup files store payroll attributes, including employee records, paycheck histories, tax filings, and payroll item configurations. The retrieval and conversion procedures preserve dataset integrity and prepare payroll information for version upgrades, platform transitions, and restoration events.

To retrieve and convert payroll backup data from QuickBooks Desktop Pro or Premier, users initiate the restoration workflow through the File menu by selecting Open or Restore Company and Restore a backup copy. The conversion workflow transfers the reconstructed company file into QuickBooks Online through the Export Company File to QuickBooks Online feature.

Retrieving and converting payroll backup data is essential for preserving accurate payroll information during system upgrades and data-recovery events. These processes maintain data integrity, protect against loss, facilitate system upgrades, and allow quick recovery after system failures. Regular backups strengthen operational stability and safeguard financial records.

- QuickBooks supports two types of backup files:

- .QBB (QuickBooks Backup File) contains complete financial and payroll data.

- .QBM (QuickBooks Portable File) is a compact version primarily used to transfer data between systems.

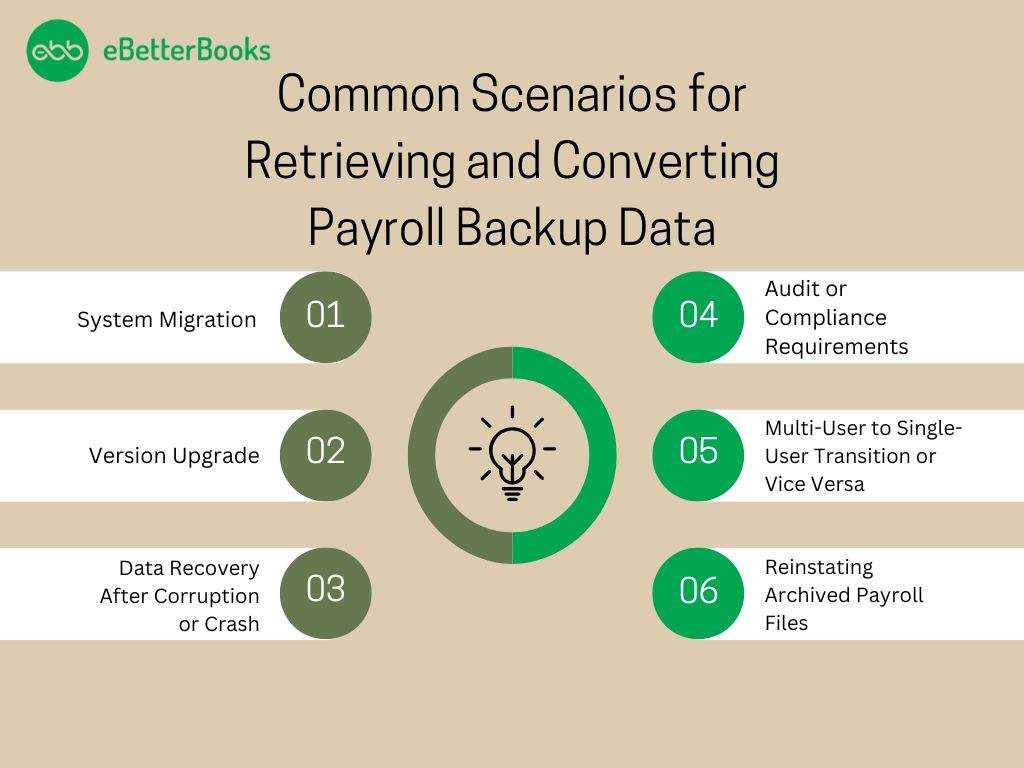

- Businesses retrieve and convert payroll backup data in the following scenarios:

- System migration to a new server

- Version upgrade, such as QuickBooks Pro 2020 to 2024

- Data recovery after corruption or crashes

- Internal audits or compliance checks

- Switching between user modes

- Restoring archived payroll records

Common Scenarios for Retrieving and Converting Payroll Backup Data

Common scenarios for retrieving and converting QuickBooks Desktop Pro/Premier payroll backup data define the conditions that require payroll record reconstruction and dataset continuity. System migrations, version upgrades, file corruption, audit examinations, mode changes, and archived data access all depend on payroll backup data to maintain accurate payroll histories and stable payroll operations.

- System Migration

- Migrating QuickBooks to a new computer or server requires retrieving and converting payroll backup data to preserve payroll history and configurations.

- Version Upgrade

- Converting payroll backup files is necessary during upgrades from an older QuickBooks Desktop version, such as Pro 2020 to Premier 2024, to maintain compatibility and data integrity.

- Data Recovery After Corruption or Crash

- When the primary company file becomes corrupted or inaccessible, retrieving the most recent backup restores payroll operations without data loss.

- Audit or Compliance Requirements

- Retrieving historical payroll data is necessary during internal audits or government compliance checks to provide accurate and verifiable records.

- Multi-User to Single-User Transition or Vice Versa

- Converting payroll data is necessary when shifting between single-user and multi-user setups, especially when the network environment changes.

- Reinstating Archived Payroll Files

- Accessing and converting old payroll backups is essential when it is required to refer to or reuse previously archived data for financial reporting or employee records.

Importance of Retrieving and Converting QuickBooks Desktop Pro/Premier Payroll Backup Data

Retrieving and converting QuickBooks Desktop Pro/Premier payroll backup data relate to the recovery of accurate payroll records, the preservation of dataset integrity, and the continuity of payroll operations during system changes. Restored and converted payroll data maintain complete employee histories, verified tax filings, and functional compatibility across versions and platforms.

- Data Protection: Backups safeguard against data loss from hardware failures, software issues, or cyberattacks, allowing for quick recovery and minimizing disruptions.

- System Upgrades and Migrations: Backing up data before upgrading QuickBooks Desktop or moving to a new computer or server prevents downtime and data loss.

- Business Continuity: A recent backup allows a business to quickly restore accounting data after a disaster, minimizing losses and ensuring continuity.

- Compliance and Audits: Accurate and current financial records are essential for compliance and audits, as they provide auditors with clear and accessible information.

- Recovery and Rebuilding: Restoring from a backup is essential when data is corrupted or a file is unreadable to prevent data loss and maintain smooth business operations.

- Data Extracts and Exports: QuickBooks allows users to export specific data, including payroll data, which is useful for reporting, analysis, and integration with other systems.

- Portable Company Files: Portable company files allow easy data sharing and transfer between computers for better collaboration.

Prerequisites Before Retrieving and Converting QuickBooks Desktop Pro/Premier Payroll Backup Data

Before starting the troubleshooting steps, meet the following prerequisites to establish a stable restoration environment, prevent conversion errors, and preserve existing payroll records.

- Verifying File Location and Validity

- Confirm the backup file’s location, version, and date to make sure it contains the most recent and relevant payroll data.

- Avoiding Overwrites

- Plan to restore backups in a separate directory or under a unique file name to protect existing company files.

- System and Version Compatibility

- Verify that the target system version supports the backup file format to prevent conversion errors.

- Active Payroll Subscription

- An active payroll service is required to access and validate payroll data post-restoration.

Step-by-Step Guide to Retrieve and Convert QuickBooks Desktop Pro/Premier Payroll Backup Data

Retrieving and converting the QuickBooks payroll backup data provides accurate restoration of payroll records, secure data access, and smooth transition to new environments or platforms. It supports scenarios such as data recovery, version upgrades, platform migration, and audit preparation, which minimize the disruption to payroll operations and maintain data integrity.

Step 1: Locate the Payroll Backup File

Identifies the correct .QBB backup file containing the payroll data, ensuring the restoration process starts with the right dataset.

- Open QuickBooks Desktop > No Company Open screen > click Find a company file.

- Let QuickBooks scan the computer and connected drives for .qbb backup files.

In case the users don’t find the file:

- Open Windows File Explorer > This PC or My Computer.

- In the search box, type *.qbb and press Enter to find all QuickBooks backup files.

- Check the default backup folder:

C:\Users\Public\Public Documents\Intuit\QuickBooks\Company Files. - Review the file dates and sizes to determine the correct backup.

Step 2: Restore the Backup File

Restoring the backup files will help to reconstruct the company file from the backup, which creates a fully accessible version of historical payroll and financial data.

- Open QuickBooks Desktop

- Go to the File menu > select Open or Restore Company

- Select ‘Restore a backup copy’ (.qbb) and click Next.

- Select Local Backup and click Next.

- Go to the folder with .qbb file, select it, and click Open.

- Select the folder to restore the company file.

Tip: To avoid overwriting, save the restored file with a unique name or in a separate folder.

- Click Save

Step 3: Access and Review Payroll Data

Confirms the completeness and accuracy of restored payroll components, including employee profiles, paychecks, and filings.

- After restoring, open the restored company file > go to Employees > Payroll Center

- Review data like:

- Employee details

- Paychecks

- Tax filings

- Payroll summaries

Note: Ensure the Payroll Subscription is active to see complete data.

Step 4: Convert/Export Payroll Reports

Generates essential payroll reports and prepares them for export to Excel, enabling analysis, documentation, or data transfer

- Go to Reports > Employees & Payroll.

- Run reports such as:

- Payroll Summary

- Payroll Detail

- Employee Earnings Summary

- Export these to Excel:

- Click Excel > Create New Worksheet (in the report window).

Step 5: Convert to Another Platform

Facilitates migration to QuickBooks Online or external payroll systems by exporting and adapting the data to the required formats.

To QuickBooks Online:

- Step: Open QuickBooks Desktop Pro/Premier as an Admin.

- Step: Go to Company > Export Company File to QuickBooks Online.

- Step: Set up or sign into a QuickBooks Online account.

- Step: Choose Yes when it is prompted.

- Step: Once migration is complete, log in to QuickBooks Online, then:

- Go to Payroll > Overview.

- Enter historical payroll data manually under Employees > Enter prior pay.

- Reconnect direct deposit and tax agencies.

- Step: Run reports to verify accuracy.

Tip: Before switching, run Payroll Summary and Payroll Detail reports in QuickBooks Desktop to verify entries after migration.

To another provider:

- Step: Open QuickBooks Desktop > Go to Reports > Employees & Payroll.

- Step: Export key reports:

- Payroll Summary

- Payroll Item Detail

- Employee Contact List

- Tax Liability Report

- Step: Click Excel > Create New Worksheet for each report.

- Step: Clean and organize the exported spreadsheets.

- Step: Request CSV templates from the new payroll provider.

- Step: Submit the templates via their portal or to the account.

Conclusion!

QuickBooks Desktop Pro/Premier payroll backup data supports the maintenance of accurate payroll records, stable dataset integrity, and continuous payroll operations during system transitions. Restored and converted payroll datasets retain employee records, paycheck information, tax filings, and platform-compatible payroll configurations.

These outcomes support audit verification, reinforce migration procedures, and maintain operational continuity when primary files or system environments change. The article presents a structured approach that connects backup identification, restoration, data verification, and cross-platform conversion to ensure long-term reliability in payroll management.

FAQs

What types of backup files does QuickBooks Desktop support?

QuickBooks Desktop supports .QBB (backup file) and .QBM (portable company file) formats.

Can I restore a .QBB file on a different version of QuickBooks?

Yes, but users must use a version equal to or newer than the one used to create the backup.

How can I find my QuickBooks payroll backup file?

Search the system for files ending in .qbb, typically located in:

C:\Users\Public\Public Documents\Intuit\QuickBooks\Company Files.

How do I export payroll reports for use with other payroll providers?

Run payroll reports in QuickBooks > Export to Excel > Clean and format > Upload via provider templates.

What does QuickBooks Desktop Pro/Premier payroll backup data contain?

QuickBooks Desktop Pro/Premier payroll backup data contain employee records, paycheck histories, tax filings, payroll items, and company-level payroll configurations that reconstruct payroll information after restoration.

How does payroll backup data support audits after retrieval and conversion?

Payroll backup data support audits by providing complete employee histories, validated paycheck records, and accurate tax filings that meet regulatory verification requirements.

Disclaimer: The information outlined above for “How to Retrieve and Convert QuickBooks Desktop Pro/Premier Payroll Backup Data” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.