To fix QuickBooks payroll update error PS032, try running QuickBooks as an administrator, suppressing the company file, checking and updating your payroll subscription and tax tables, and repairing the QuickBooks installation.

If the issue persists, renaming the “Payroll” folder in the components directory or using the QuickBooks Tool Hub may resolve the problem.

QuickBooks Desktop Payroll Update Error PS032 occurs when the payroll update process fails due to issues such as corrupted payroll tax tables, outdated or invalid billing information, damaged company files, or an unregistered QuickBooks installation.

QuickBooks Desktop Payroll Update Error PS032 prevents the software from downloading or installing payroll updates, which can interrupt payroll processing.

The article provides a comprehensive set of verified troubleshooting methods to address this problem, including correcting billing data, downloading the latest tax tables, disabling User Account Control (UAC), repairing damaged installation components, and renaming configuration files to restore proper functionality.

By following these structured solutions, users can ensure seamless payroll updates and maintain the accuracy of employee compensation data.

| Methods which will help you in resolving the QuickBooks Desktop Payroll Update Error PS032 | |

| Method 1 | Updating Billing information |

| Method 2 | Downloading latest payroll tax tables |

| Method 3 | Turning off / Disable User Account Control (UAC) for Windows7, 8 and Vista |

| Method 4 | Only one version QuickBooks Installation being installed |

| Method 5 | Change the CPS folder name |

| Method 6 | Adding a new user account |

| Method 7 | Using QuickBooks Install Diagnostic tool |

| Method 8 | Rename ‘QBWUSER.ini’ and ‘EntitlementDataStore.ecml’ Files |

| Method 9 | Updating Accountant’s copy along with the QuickBooks files |

| Method 10 | Update QuickBooks to the latest release |

What is the Payroll Update Error PS032 in QuickBooks Desktop?

Error PS032 in QuickBooks occurs when the payroll tax table file is either damaged or corrupted, or when there’s an issue with the components in the payroll folder. This error prevents users from downloading or updating payroll, which can delay processing employee payments.

Table: Overview of QuickBooks Desktop Payroll Update Error PS032

| Category | Description |

|---|---|

| Error Code | QuickBooks Desktop Payroll Update Error PS032 |

| Error Message | “Error PS032: QuickBooks cannot read the payroll setup files. Note the message number and choose Help for troubleshooting tips.” |

| Primary Causes | Corrupted payroll tax table files, invalid billing information, unregistered QuickBooks installation, damaged company or CPS folders, incorrect UAC settings, or outdated payroll subscription. |

| Major Symptoms | Failure to download or install payroll updates, freezing during payroll processing, recurring error pop-ups, and delayed payroll calculations. |

| Key Troubleshooting Steps | 1. Update billing information 2. Download latest payroll tax tables 3. Run QuickBooks as Administrator 4. Repair installation using Tool Hub 5. Rename Payroll/CPS folder 6. Disable UAC (if required) 7. Update QuickBooks Desktop to latest release |

| Expected Outcome | Successful payroll update installation, restored payroll functionality, and elimination of error PS032 alerts. |

What Does QuickBooks Payroll Update Error PS032 Indicate?

The Intuit QuickBooks Desktop Error PS032 ( payroll errors) appears while downloading and installing the payroll updates. You will get the following error message on your PC’s screen.

| “Error PS032: QuickBooks can not read the payroll setup files, note the message number and choose Help for troubleshooting tips to fix the issue.” |

Due to payroll error PS032, you can’t download the payroll updates and tax table. An error message frequently appears on your screen. Your system may also start freezing up.

What May Cause QuickBooks Payroll Update Error PS032?

QuickBooks Error PS032 occurs when payroll updates fail due to corrupted tax table files, damaged company or CPS folders, misconfigured or unregistered QuickBooks installations, outdated or incorrect payroll subscription details, unstable internet connections or firewall/antivirus blocks, incorrect UAC settings, and occasional system glitches—all of which interrupt update validation and halt payroll processing; repairing or replacing corrupted files, verifying registration and subscription status, ensuring network access, and adjusting security and UAC settings typically resolve the error efficiently. To help you fix the issue, here are the key causes you should check out first:

Below, you can find out all the factors leading to QB Payroll Error Code PS032:

- The payroll tax table / file is corrupted.

- Because of invalid payroll folders, you may face QB Error Code PS032.

- Due to corrupted or damaged QuickBooks company files.

- An unregistered QB user may face payroll error PS032.

- When the billing information is out-of-date or incorrect, Error PS032 might take place.

Tips to Remember Before Troubleshooting QuickBooks Desktop Payroll Update Error PS032

- Check whether your QuickBooks Desktop Payroll Subscription is valid or not.

- Verify all the billing information, making sure all the content is correct and accurate.

- Ensure that only one QuickBooks Desktop application is installed on your system.

- Make sure to take a backup of your company file.

- Check if any QuickBooks Desktop settings are not synced properly.

How to Troubleshoot QuickBooks Payroll Update Error PS032?

There are different scenarios due to which users get the QuickBooks Desktop Payroll Update Error PS032. The following solutions are to be performed to resolve if the QuickBooks payroll update is not working and you face error PS032. These solutions are also perfect for those who don’t have much technical knowledge.

Let’s start attempting the solutions underneath:

Solution 1: Update Billing Data

It is quite possible that the user is entering incorrect billing data, which leads to the Payroll Update Error PS032, so follow the below mentioned steps below and make sure to note down the license number carefully.

Step 1: You may first have to choose the F2 key.

Step 2: Write down the license number.

Step 3: Finally, click OK from the Product Information window.

Solution 2: Download and Update Payroll Tax Tables to The Latest Release

To keep your paycheck calculations compliant, you need to update the payroll tax tables in QuickBooks.

Here’s how:

Step 1: Download the latest payroll tax table files and re-sort the lists to users.

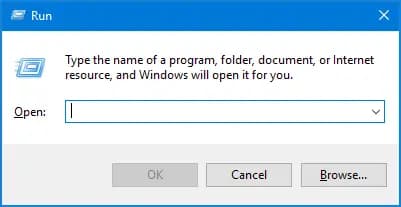

Step 2: Then, close and reopen QuickBooks. Press Windows + R to open the Run window.

Step 3: In the search box, type “update the payroll tax table” and follow the onscreen instructions to complete the update.

To check your current tax table version, you can select Payroll Update Info for more details.

Solution 3: Update the Accountant’s Copy Along with the QuickBooks Files

To update your Accountant’s Copy along with the QuickBooks files, follow these simple steps:

Part 1: Import the Accountant’s Changes

Step 1: Open QuickBooks Desktop and go to the File menu.

Step 2: Select Send Company File, then click on Accountant’s Copy.

Step 3: Choose Client Activities.

Step 4: If your accountant sent you an Accountant’s Changes file (.qby extension)

Step 5: Select Import Accountant Changes from File. Browse your computer and locate the file.

Step 6: If your accountant used the Accountant’s Copy File Transfer Service

Step 7: Select Import Accountant’s Changes from Web and follow the instructions to complete the import.

Part 2: Review the Changes

QuickBooks will automatically apply your accountant’s changes.

When you’re ready:

Step 1: Click Incorporate Accountant’s Changes to apply them.

Step 2: If you don’t want to import the changes, select Close instead.

Step 3: Confirm by selecting OK to apply and close the windows.

Note: QuickBooks will create a backup of your company file during this process. To review the changes later, you can find a PDF report in the same folder as your company file. This report will list all the updates made during the import.

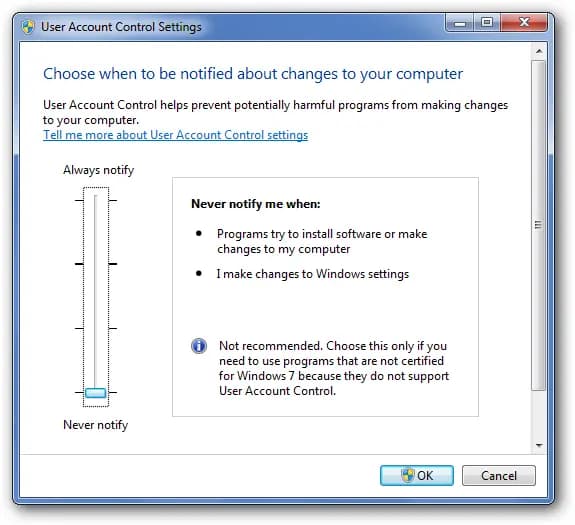

Solution 4: You Need to Switch Off User Account Control ( UAC )for Windows 8, 7, and Vista

On Windows 7 or 8

Step 1: Open the Control Panel

- Access the Start Menu, then go to the Control Panel. Navigate to User Accounts and Family Safety, and select User Accounts.

Step 2: Change UAC Settings

- Click on Change User Account Control settings.

Step 3: Adjust the Slider

- Move the slider down to the bottom position, labeled Never Notify.

Step 4: Confirm the Change

- Click OK to apply the changes.

Step 5: Restart Your Computer

- Reboot your computer to ensure the changes take effect.

On Windows Vista

- Step 1: Click the Start button and go to All Programs.

Step 2: Open Accessories, then click Run.

Step 3: In the Run dialog box, type msconfig and click OK.

Step 4: Go to the Tools tab.

Step 5: Scroll down and select Disable UAC.

Step 6: Click Launch.

Step 7: A message saying “Operation Completed Successfully” will appear.

Step 8: Click OK and restart your computer to apply the changes.

Solution 5: Update QuickBooks to The Latest Release

To check if you have the latest release of QuickBooks Desktop, follow the below mentioned steps below:

Step 1: Open QuickBooks Desktop on your computer.

Step 2: Press F2 (or Ctrl+1) to bring up the Product Information window.

Step 3: In the Product Information window, check your current version and release number.

Step 4: Compare it with the latest release available for your version to see if you’re up to date.

If you find you’re not on the latest version, you may need to update QuickBooks Desktop.

Note down the QuickBooks License number. Follow the steps mentioned below to do the same.

Step 1: Firstly, choose the Home section and press F2.

Step 2: Check out the license number.

Step 3: Finally, write down the license number and press OK.

Make sure that there is only a single installation of QuickBooks in your system. Uninstall the unutilized software and reset the QuickBooks payroll update.

Solution 6: Only One Version of QuickBooks Installation Being Installed

Firstly, you need to create a backup of the company file and close all the running applications. And launch the Run Window. Now, apply the steps if you have a single QuickBooks installation according to your Windows.

For Windows 8

Step 1: Initially, choose the Window Section and launch the Start Screen.

Step 2: Right-tap on the background to All Apps.

Step 3: Finally, select Run.

For Windows 7 and XP

Step 1: First of all, launch the Start option and click Run.

Step 2: If you don’t have Admin Credentials, launch Windows Start and click All Programs.

Step 3: And then, choose the Accessories and Run option.

For Windows Vista

Step 1: Firstly, choose the Control Panel and go to Programs and Features.

Step 2: Double-tap on it for installing and uninstalling programs. ( If you have only one QuickBooks, you are not required to move on to the next steps.)

Step 3: Now, a QuickBooks Desktop Installation Wizard pops up, where you need to select Next.

Step 4: After that, choose Remove > Next > Continue.

Step 5: Meanwhile, click Yes to complete the update procedure. QB PS032 Error may have the option to go online.

Step 6: Now, the download starts automatically if you choose the Ok tab.

Step 7: Shut down QuickBooks and run the payroll update from the server.

Step 8: Finally, you can install all QuickBooks versions.

Perform these steps if you have an installation of multiple QB versions.

The first step is to install a clean version of QuickBooks Desktop in Selective Startup. After that, follow the steps written below.

Step 1: Firstly, delete all unutilized QuickBooks versions and reset the QuickBooks update.

Step 2: Download and install the latest payroll tax tables.

Step 3: Now, utilize the verify data or rebuild the data process.

Step 4: Finally, do a clean installation in selective startup.

Solution 7: Change the CPS Folder Name

Step 1: Open the file explorer by pressing the Windows + E keys.

Step 2: Next, you need to select the option stating This PC.

Step 3: You need to go to the local disk C.

Step 4: Furthermore, in the event of being unable to find the program files, you have to open the program files folder.

Step 5: Now, open the QuickBooks desktop folder that resembles your version of the software.

Step 6: Open the components and go to the payroll folder.

Step 7: Right-click on the CPS folder and choose the Rename Folder option.

Step 8: Heading forward, you are supposed to rename it, enter CPSOLD, and then hit the Enter tab.

Step 9: Make a new CPS folder and open QuickBooks Desktop.

Step 10: Download the latest payroll tax table update, and you will be good to go.

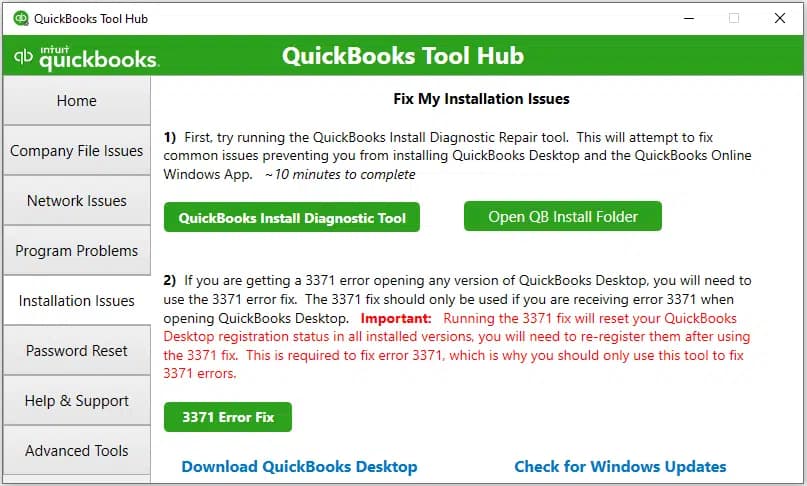

Solution 8: Using QuickBooks Install Diagnostic Tool Using the Tool Hub Program

Step 1: Download & Set up QuickBooks Tool Hub on your PC.

Step 2: Launch the tool.

Step 3: Select the tab labeled ‘Installation Issues.

Step 4: Afterward, select ‘QuickBooks Install Diagnostic Tool.’ (The diagnosis will take time, depending on the size of the company file. Wait patiently for the diagnosis to conclude.)

Step 5: Reboot your system and check if the error has been fixed.

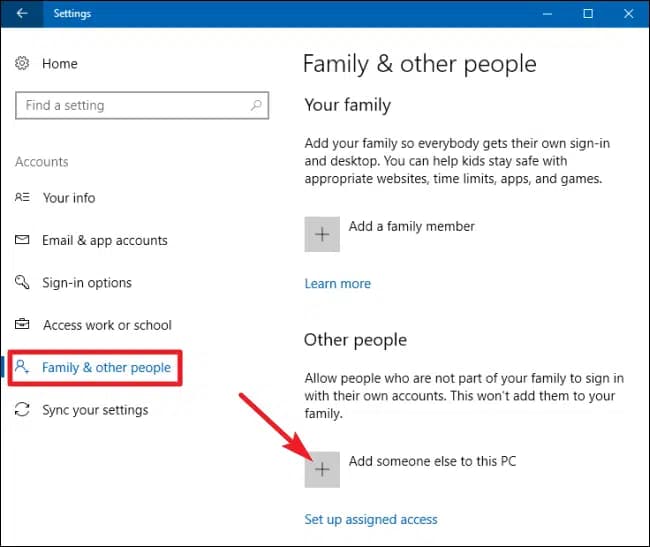

Solution 9: Adding a New User Account

Step 1: Press the ‘Windows’ key and go to ‘Settings.’

Step 2: In the ‘Other Users’ option, select ‘Add Someone Else to this PC.’

Step 3: Now, choose the option ‘I don’t have this Person’s Sign-in Information.’

Step 4: Next, pick ‘Add a User Without a Microsoft Account.’ [A name must be given to the new account.]

Step 5: Now click on ‘Finish.’

Step 6: Choose the account that you’ve set up.

Step 7: After that, select ‘Account Type’ and then choose ‘Administrator.’

Step 8: Click ‘OK.’

Step 9: Open QuickBooks and access your company file(s).

Solution 10: Rename ‘QBWUSER.ini’ and ‘EntitlementDataStore.ecml’ Files

Step 1: Find the ‘QBWUSER.ini’ file on your PC and open it.

Step 2: Right-click the file once you’ve found it.

Step 3: Select ‘Rename.’

Step 4: Add’ .old’ to the end of the existing name.

Step 5: Similarly, rename the ‘EntitlementDataStore.ecml’

Step 6: Now, open QuickBooks software and access your company file.

Step 7: Make a duplicate copy of this file and save it to your computer’s local folder.

Step 8: After that, go to that folder and open your file.

Step 9: Check if the file opens without any errors.

Concluding the Post!

Hopefully, you have successfully fixed the QuickBooks Payroll Update Error PS032 by applying any of the solutions. In some cases, users may experience the error even after applying all of the provided solutions. If you are also going through the same situation and are unable to find a way, contact ebetterbooks Error Support Number 1-802-778-9005. We will help you out in fixing all the QuickBooks-related issues.

Frequently Asked Questions:

After fixing Error PS032, how can I manually check and ensure I have the absolute latest payroll tax table version installed?

To manually verify your current tax table version, navigate to the Employees menu in QuickBooks Desktop, select Get Payroll Updates, and then look for the Current Tax Table Version listed at the top of the window. You can then compare this version number to the latest one posted on the official Intuit QuickBooks support website to ensure your system is fully current.

Can revalidating my payroll subscription fix Error PS032?

Yes, sometimes revalidating your payroll subscription helps. Go to Employees > My Payroll Service > Account/Billing Information, then log in and validate your payroll service.

Why is my User Account Control (UAC) setting relevant when troubleshooting QuickBooks errors like PS032?

User Account Control (UAC) is a security feature in Windows that limits an application’s ability to make changes to system files. When UAC is set too high, it can prevent QuickBooks from properly accessing or writing to critical files required for a successful payroll update (such as the CPS folder), sometimes triggering errors like PS032. Temporarily disabling or adjusting UAC can often resolve permission-related update issues.

Will resolving QuickBooks Error PS032 affect my previously processed paychecks or employee data?

No, resolving Error PS032 only fixes the issue preventing you from downloading and installing the future payroll tax updates. It does not alter or corrupt the data for paychecks you have already processed and saved in your company file. The successful installation of the latest tax tables ensures that your future payroll calculations will be accurate and compliant with the latest tax laws.

What should I do if the error persists even after trying all 10 troubleshooting solutions?

If you have tried all verified troubleshooting steps (like running the Tool Hub, renaming the CPS folder, and checking billing) and the error persists, the issue may require deeper technical intervention. The next recommended step is to contact QuickBooks Desktop Support or consult with a certified QuickBooks ProAdvisor to troubleshoot potential system-specific conflicts, corrupted Windows user profiles, or complex data damage.

How can I verify whether my QuickBooks Desktop Payroll subscription is currently active?

You can confirm your payroll subscription status in QuickBooks Desktop by opening Employees > My Payroll Service > Account/Billing Information, which redirects you to Intuit’s secure account portal. From there, you can verify billing details, subscription renewal dates, and active services. This is helpful when a payroll update cannot proceed due to account-related restrictions.

Is it necessary to be logged in as the Windows admin to install payroll updates?

Intuit recommends installing payroll updates using a Windows Administrator account, especially when file permissions or UAC settings may block QuickBooks from updating payroll components or writing to program folders. This applies even if the issue is not directly PS032-related.