Payroll calculation failure in QuickBooks Desktop Enterprise occurs when date mismatches, register inconsistencies, outdated tax tables, incorrect payroll item setups, or damaged company files interfere with payroll accuracy. These issues directly affect wage calculations, tax deductions, liability amounts, and direct-deposit values, leading to incorrect payroll results.

Businesses often encounter these failures during pay schedule changes, edits to past paychecks, data migrations from other systems, or payroll runs performed with incorrect company file dates. Each scenario introduces gaps between pay period data, register information, and payroll configuration settings.

This article explains the key reasons behind payroll calculation failure in QuickBooks Desktop Enterprise and provides clear, step-by-step solutions to restore accurate payroll processing. It also outlines preventive measures to help businesses maintain stable payroll performance and avoid future calculation errors.

Common Causes of Payroll Calculation Errors in QuickBooks Enterprise

Inconsistencies between payroll dates and internal registers often fix QuickBooks payroll calculation failure due to date mismatch. When the system fails to align time-tracking data, pay periods, and account registers, it may skip employee wages, miscalculate taxes, or completely fail to process payroll.

The most common causes of payroll failures due to date or register mismatch in QuickBooks Enterprise are mentioned below:

Incorrect Pay Period Dates

If the pay period does not align with the actual work schedule or overlaps with a previous payroll, QuickBooks may exclude time data or double-count wages. This can lead to miscalculations or result in no payroll being generated for the affected period.

Mismatch Bank Transaction

If the payroll bank account in the company file does not correspond with the account selected for payroll processing, it can lead to:

- An error like “Unable to post paycheck to account.”

- Payroll liability payments are not recorded correctly.

- Payroll calculation failures or refusal to create checks.

Damaged or Corrupted Data Files

When the data file is damaged or partially corrupted, users may encounter issues such as:

- Errors like “Payroll calculation failed due to data issues” or “Verify Data failed”.

- Missing or inaccurate employee wage data.

- Crashes or freezing during payroll processing.

- Incomplete or failed payroll calculations.

Incorrect or Misconfigured Payroll Items

Misconfigured payroll items such as Hourly Wages, Salaries, Overtime, Deductions, and Company Contributions can lead to QuickBooks excluding items from calculations.

If one or more payroll items are:

- Linked to the wrong tax tracking type

- Conflicting with other payroll items

- Assigned to incorrect accounts or expense categories

Then, these issues can cause payroll calculations to fail, resulting in:

- Incorrect paycheck amounts

- Over- or under-withholding of taxes

- Missing entries for benefits or deductions

Outdated Payroll Tax Table

QuickBooks uses the latest payroll tax tables to accurately calculate federal and state taxes, including Social Security and Medicare.

An outdated tax table can lead to:

- Incorrect tax calculations on paychecks,

- Errors like “Payroll calculation failed due to outdated tax table.”

- Inability to run payroll

- Warnings stating, “You must update your tax table before processing payroll.”

These issues often arise when:

- Your QuickBooks subscription is inactive or expired

- You miss payroll updates

- Your QuickBooks version is not up to date.

Outdated QuickBooks Desktop Enterprise Version

Using an outdated version of QuickBooks can result in compatibility issues between the payroll engine, register entries, and tax tables. This may lead to errors or freezing during payroll processing.

To ensure full compatibility with the latest payroll tax tables, security standards, and calculation algorithms, it’s essential to keep QuickBooks Desktop Enterprise up to date.

Payroll Subscription Problems

If your payroll subscription is expired, inactive, or temporarily suspended, QuickBooks will turn off calculation features, leading to errors even when the pay period data is correct.

Users may experience:

- Errors like:

- “You must activate payroll before processing.”

- “Payroll service subscription has been canceled or expired.”

- “Payroll item calculation failed.”

- Missing payroll features and disabled tax form generation.

- Inability to run payroll, update tax tables, or calculate employee taxes.

Incorrect Bank Account Type

If payroll is set to process through an account that does not support ACH transfers, the register may reject payroll transactions, causing failures.

This issue occurs when:

- The account type (checking or savings) does not match the payroll setup

- The incorrect bank account is chosen for direct deposit

- QuickBooks mistakenly uses a personal or unsupported account type for business payroll.

Data Sync or Communication Errors

If QuickBooks is unable to sync with the payroll service during a calculation, it could be due to:

- Firewall/Antivirus blocking connections

- Internet connectivity issues

- Multi-user mode conflicts

- Outdated software or incompatible versions

The data flow may be interrupted, leading to a mismatch between local data and payroll settings.

Step-by-Step Fixes for Payroll Calculation Issues

Payroll calculation issues in QuickBooks Desktop Enterprise result from misaligned date attributes, inconsistent register attributes, inaccurate payroll item attributes, incorrect account attributes, inactive subscription attributes, and outdated system components & tax table attributes. These discrepancies change wage, tax, and liability values. This section helps to align temporal data, confirm register integrity, correct payroll item attributes, validate account configurations, update system components, and stabilize payroll output.

Case 1: Incorrect Pay Period

To ensure that the pay period aligns correctly with actual work dates or the check date, follow the below-mentioned steps:

- Step: Go to Employees > Edit/Void Paychecks.

- Step: Enter the paycheck date in the Show paychecks from and through fields.

- Step: Select the paycheck with the incorrect pay period and double-click it.

- Step: Click on Paycheck Detail.

- Step: Update the pay period dates in the Review Paycheck window and click OK.

- Step: Select Save & Close, then confirm with Yes.

- Step: Repeat for any other incorrect paychecks.

Case 2: Mismatch in Bank Transaction

When the bank account selected during the payroll run doesn’t match the payroll settings, then follow the below-mentioned steps to correct it:

- Step: Navigate to Edit > Preferences > Payroll & Employees.

- Step: Click on Company Preferences tab.

- Step: Under Bank Account, confirm the account matches the one linked in your payroll setup.

- Step: If needed, update the bank account details in Company > My Company > Payroll Bank Account Info.

Case 3: Damaged Data Files

To fix corrupted company or payroll files, start by verifying the company data and follow each step carefully to ensure proper resolution:

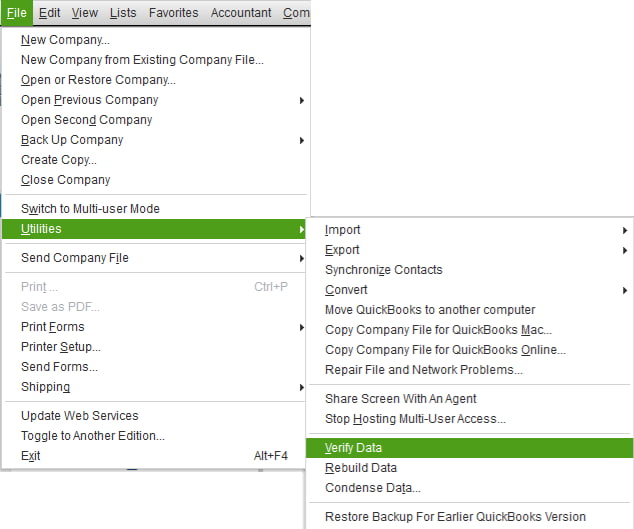

Step 1: Verify Your Company Data

- Go to Window > Close All.

- Navigate to File> Utilities > Verify Data.

- Based on the results, follow these steps:

- QuickBooks detected no problems with your data”. No action is needed.

- Error message appears – Search for the specific error on the QuickBooks Desktop Support site for a solution.

- “Your data has lost integrity” – Data damage is found. Proceed to rebuild the File.

Note: If you are using Assisted Payroll, contact QuickBooks support before proceeding with the Rebuild.

Step 2: Rebuild Your Company File Data

- Go to File > Utilities > Rebuild Data.

- Select OK to back up before rebuilding, choose a unique name and location for the backup, enter a new name in the File name field, and then select Save.

- Click OK when you get the message that Rebuild has completed on the screen.

- Run File > Utilities > Verify Data to confirm all issues are resolved.

- If more errors appear:

- Open the qbwin.log file to locate the specific issues.

- Search for errors on the QuickBooks Desktop support site for manual fixes.

- If more errors appear:

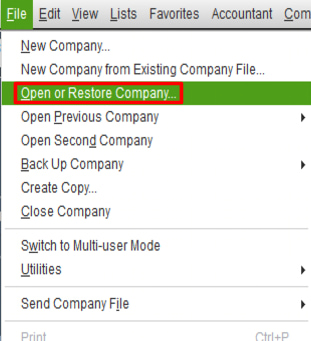

Step 3: Restore a Backup

If errors persist and can’t be fixed:

- Go to File> Open or Restore Company > Restore a backup copy.

- Select the most recent backup created before the damage occurred.

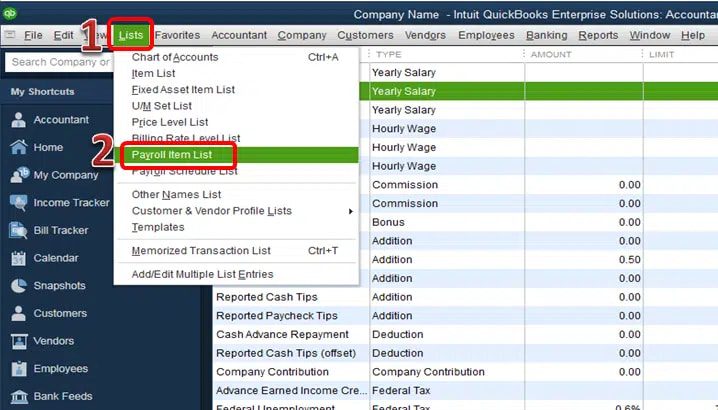

Case 4: Misconfigured Payroll Items

Review each payroll item carefully to ensure accurate setup and functionality. Follow the steps below to verify and correct any misconfigurations:

- Step: Go to Lists > Payroll Item List.

- Step: Double-click the incorrect payroll item and add “Do Not Use” to its name to prevent future use.

- Step: Click Next > Finish.

- Step: Choose the Payroll Item ▼ dropdown.Step 5: Select New to set up a new payroll item, ensuring the correct Tax Tracking Type and taxability are selected.

Case 5: Sync Errors

Failed data synchronization with the QuickBooks Payroll service can block payroll updates, tax table downloads, or direct deposit processing, follow the steps below to troubleshoot and resolve the issue.

- Step: Close QuickBooks.

- Step: Download and install the QuickBooks Tool Hub from the official Intuit website.

- Step: Open the Tool Hub > navigate to Program Problems > select Quick Fix my Program.

- Step: Reopen QuickBooks and attempt to sync your payroll again by going to Employees> Send Payroll Data.

Case 6: Incorrect Bank Account or Account Type

Payroll cannot be processed from an invalid or incompatible bank account, such as a savings account. To ensure that a valid checking account is linked.

Follow the steps below to verify and update your bank account information:

For QuickBooks Desktop Enterprise Basic, Standard, and Enhanced:

- Step: Go to Employees > My Payroll Service > Accounts/Billing Information.

- Step: Sign in with your Intuit Account.

- Step: Under Payroll Info, select Edit next to Direct Deposit Bank Account.

- Step: Enter your payroll PIN > Continue.

- Step: Update your bank account info and select Update.Step: Close after receiving the confirmation message.

For QuickBooks Desktop Enterprise Assisted:

- Step: Go to Employees > My Payroll Service > Billing/Bank Information.

- Step: Select Edit next to Bank Account.

- Step: Enter your payroll PIN and select Continue.

- Step: Update your bank account info and select Update.Step: Close after receiving the confirmation message.

Case 7: Outdated QuickBooks Software

An outdated QuickBooks version may not support the latest payroll features or tax calculations. Follow the steps below to check for updates and install the latest version:

- Step: Navigate to Help > select Update QuickBooks Desktop.

- Step: Click on Update Now > Get Updates.

- Step: Close QuickBooks and reopen it to complete the installation.

Case 8: Payroll Subscription Issue

If your QuickBooks Payroll subscription is suspended, inactive, or expired, you won’t be able to access essential payroll features such as direct deposit, tax calculations, or paycheck creation.

To resolve this issue, follow the steps below:

- Step: Go to Employees > select My Payroll Service.

- Step: Choose Account/Billing Info > sign in with your Intuit Account.

- Step: Select Resubscribe under Status.Step 4: Follow the on-screen steps to reactivate your payroll service.

Case 9: Outdated Tax Tables

Using outdated tax tables can lead to incorrect or failed payroll calculations. Follow the steps below to update your tax tables and ensure accurate payroll processing:

- Step: Go to Employees > select Get Payroll Updates.

- Step: To know your tax table version:

- Check the number next to “You are using tax table version:”

- To determine if it’s the correct version, refer to the latest payroll news and updates.

- For more details on your tax table version, select Payroll Update Info.

To get the latest tax table:

- Choose Download Entire Update > select Update.

- An informational window will appear when the download is complete.

Best Practices to Prevent Payroll Calculation Errors in QuickBooks Desktop Enterprise

To avoid payroll processing issues in QuickBooks Desktop Enterprise, follow these best practices consistently:

- Backup Regularly – Create backups before each payroll cycle to protect against data loss or corruption.

- Audit Payroll Setup Monthly – Regularly review employee profiles, payroll items, and item mappings for accuracy.

- Ensure Stable Internet Connection – Use a reliable internet connection to avoid syncing issues or interruptions during payroll processing.

- Keep Software Updated – Ensure the latest payroll tax tables and QuickBooks Desktop updates are installed.

- Use Timesheets Consistently – Enter time daily or weekly using timesheets to avoid discrepancies in work hours.

- Verify Bank Account Setup – Double-check the business bank account used for payroll processing.

- Monitor Payroll Subscription – Keep your payroll subscription active and verify billing information to avoid interruptions in service.

Conclusion

Payroll calculation errors in QuickBooks Desktop Enterprise arise from mismatched dates, outdated tax tables, corrupted files, or misconfigured payroll items. These issues may disrupt paychecks, tax filings, and direct deposits.

To fix these errors, update your software and tax tables, verify payroll setup, correct account conflicts, and restore clean backups if necessary. To prevent future errors, regularly audit payroll settings, keep your subscription active, ensure a stable internet connection, and maintain consistent timesheet practices.

Frequently Asked Questions

What Should I Do if QuickBooks can’t Calculate Payroll After an Update?

Navigate to Employees > Get Payroll Updates and check whether the latest updates are installed. If the issue continues, restart QuickBooks and confirm your payroll subscription status.

What if QuickBooks Freezes During Payroll Processing?

Freezing issues may occur due to data corruption, outdated software, or memory problems. To resolve this, run the QuickBooks Tool Hub and select Quick Fix my Program, then restart the application.

Why is My Employee’s Paycheck Showing $0?

This usually happens when time entries don’t align with the pay period, leading to excluded hours. It may also be due to misconfigured or missing tax tracking for the payroll item.

How does an inactive payroll subscription impact payroll calculation?

An inactive payroll subscription blocks access to updated tax tables, compliance rules, and payroll validation services. The blockage prevents accurate wage computation, tax deduction processing, and direct-deposit functionality.

What causes date-mismatch issues in QuickBooks Desktop Enterprise payroll?

Date-mismatch issues occur when paycheck dates, pay period ranges, and company file dates do not align. The mismatch alters payroll calculations, tax withholding values, and liability register values.

Why does a register mismatch lead to payroll calculation failure?

Register mismatch occurs when the payroll bank register, paycheck records, or liability accounts contain inconsistent attributes. The mismatch disrupts wage posting, tax allocation, and liability tracking.

Disclaimer: The information outlined above for “How to Fix QuickBooks Payroll Calculations Failure in Desktop Enterprise Due to Date or Register Mismatch?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.