Highlights (Key Facts & Solutions)

- Verification is First Step: Start the troubleshooting process by verifying the payroll subscription status directly within QuickBooks Desktop’s Employees → My Payroll Services menu to re-authenticate the entitlement service.

- PSID Null Root Cause: The error message “PSID null” points to a corrupted payroll entitlement file (

Paysub.ini), which can be resolved by locating and renaming the file to force QuickBooks to generate a clean version. - Use QuickBooks Tool Hub: The official QuickBooks Tool Hub should be utilized to run the Quick Fix My Program utility, which automatically addresses common program and file errors contributing to Error 30159.

- System File Check: The Windows System File Checker utility must be run using the command

sfc /scannowto scan for and repair any corrupted or missing core operating system files that are interfering with QuickBooks’s processes. - Check EIN and Tax Table: Error 30159 can be triggered by a mismatch in the Employer Identification Number (EIN) linked to the payroll subscription, requiring verification in the Account Maintenance window, and requires a mandatory manual payroll tax table update after the error is resolved.

- Update Software and OS: Maintaining the latest release of QuickBooks Desktop and ensuring all Windows updates are installed is crucial, as incompatibility between outdated software and the operating system is a common source of entitlement validation failures.

Overview

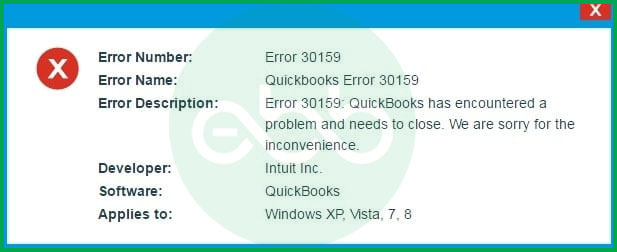

QuickBooks Error 30159 is a payroll update error that occurs when the QuickBooks Desktop software fails to verify or process active payroll subscriptions. This error primarily affects Windows-based systems and can interrupt ongoing payroll operations, cause system slowdowns, or trigger repeated crashes. The issue typically arises from incorrect system configurations, inactive payroll agreements, damaged company files, or outdated software versions.

This article explores QuickBooks Error 30159, a payroll-related malfunction that disrupts automated tax calculations and employee payment processing. It outlines the technical factors that cause the error and provides practical methods to restore stable payroll operations, and provides preventive recommendations to help users avoid similar update-related issues in the future.

What is QuickBooks Error 30159?

QuickBooks Error 30159 is a system-generated payroll update issue that prevents the software from validating the payroll subscription or accessing the required entitlement data. It is most commonly triggered when the payroll service ID (PSID) or entitlement file becomes inactive, corrupted, or incorrectly configured in the operating system.

This error may also occur when QuickBooks fails to recognize the registered username or when the payroll subscription setup is incomplete or improperly configured in Windows. When this error occurs, QuickBooks displays on-screen messages such as:

ERROR 30159 – Unable to load account for PSID null: Entitlement is Enabled, but Entitlement Unit is deactivated.

Or

“Can’t Verify Payroll Subscription Error 30159”.

When this code appears, it signifies a mismatch between the active payroll entitlement service and the user authentication payroll credentials. This interruption stops QuickBooks from processing payroll data updates until both the subscription and entitlement configurations are restored or reactivated correctly.

How Does QuickBooks Payroll Error 30159 Affect System Performance?

When QuickBooks Payroll Error 30159 appears, it disrupts both software performance and overall system stability. Users may encounter frequent interruptions, reduced processing speed, and recurring error notifications during payroll operations. The key symptoms include:

- Frequent crashes or freezing while running QuickBooks Desktop.

- Slow response time or system lag when executing payroll-related tasks.

- Error pop-ups repeatedly appearing on the screen during updates.

- Sudden shutdown of other active programs due to system overload.

- Continuous crashes when performing the same payroll operations.

Reasons Behind QuickBooks Payroll Error Code 30159

QuickBooks Payroll Error 30159 is mainly triggered by issues within the payroll setup or system configuration. It appears when the software cannot verify subscription details, access entitlement files, or communicate properly with the operating system. The most common causes include:

- Inactive or expired payroll subscription.

- Multiple active payroll agreements with an inactive Direct Deposit setup.

- Damaged or corrupted company file (Paysub.ini).

- Incorrect Employer Identification Number (EIN) in the company file.

- Invalid or mismatched payroll service key (PSID).

- Incompatibility between the windows OS and QuickBooks versions.

- Malware infection or system file corruption affecting QuickBooks processes.

- Authentication failure of the registered QuickBooks username.

- Outdated QuickBooks Desktop or missing payroll tax table updates.

![How to Fix QuickBooks Error 30159 [Payroll Update Error]? 1 Resolve-it-now-button-e1691065246506-1024x107-1](https://ebetterbooks.com/wp-content/uploads/2023/09/Resolve-it-now-button-e1691065246506-1024x107-1.png)

How to Resolve Payroll Update Error 30159 in QuickBooks?

QuickBooks Payroll Error 30159 can often be fixed by verifying your active payroll subscription and updating both QuickBooks Desktop and Windows to the latest versions. These steps address common validation and compatibility issues, helping restore smooth payroll processing.

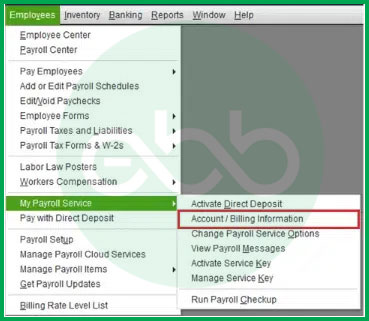

Solution 1: Check Payroll Subscription Status

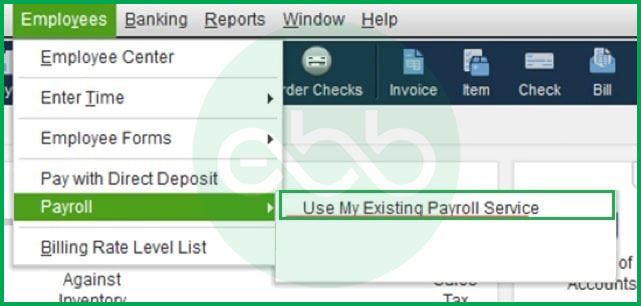

- Firstly, go to QB Desktop–> Employees tab–> My Payroll Services–> Account and Billing Info.

- Enter the login credentials, and sign in to the system.

- After that, a window to confirm your account information pops up. Select your verification method and proceed. Once you complete the sign-up process, update the payroll tax table again to check if the QuickBooks Payroll Error 30159 persists or not.

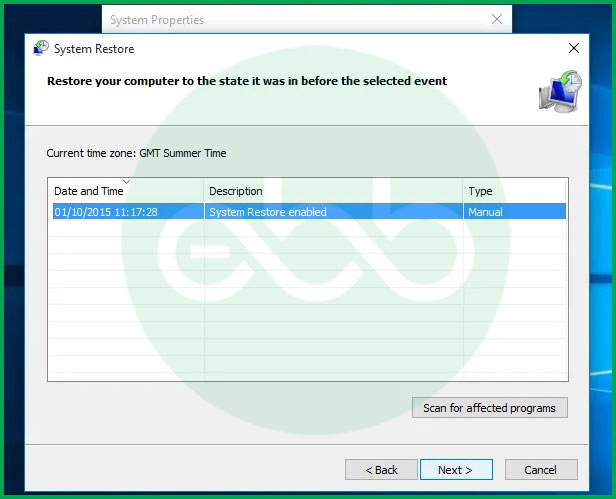

Solution 2: System Restore in Windows

- Firstly, log into your computer as a system administrator.

- Go to start–> All Programs–> Restore.

- After that, open a new window to select Restore my computer. Follow the process by clicking NEXT.

- Here, the user has to enter the confirmation window, and restart the system.

- Upon its restart, download and install QuickBooks File Repair Tool (For the best experience, we recommend you use Tool Hub on Windows 10, 64-bit.).

- After the installation is complete, go to scan–> Fix Error.

At last, the screen shows success. Restart the system again and look for QuickBooks update error code 30159. If the error doesn’t pop up, it means that the error is resolved.

Solution 3: Install The Windows Updates

- Firstly, go to start–> type Update (in the search box)–> Press Enter.

- If there are any updates available, the system will show them on the search results.

Lastly, install all of these updates, and reboot the system upon completion of the process.

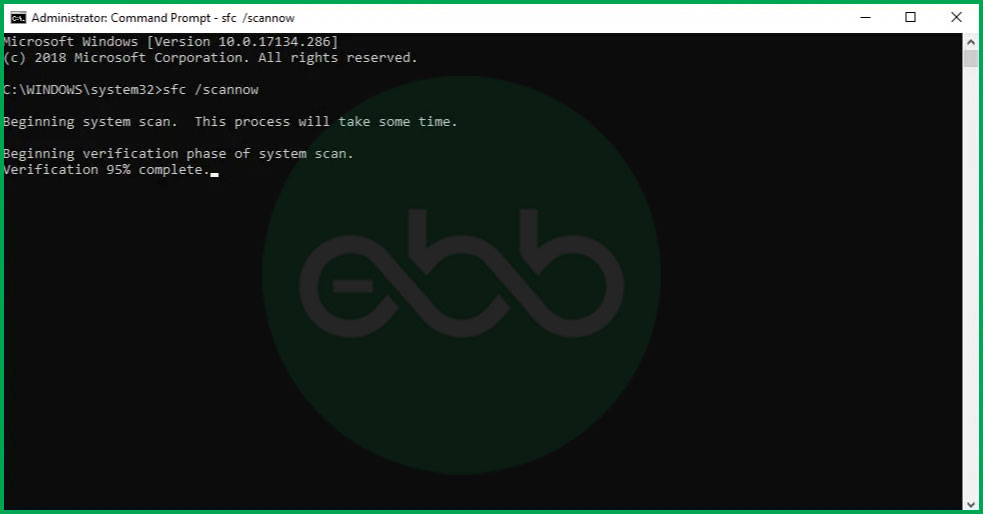

Solution 4: Using The Windows File Checker

- Log in to the system as a system administrator.

- Press the windows+R keys. It will open the run box.

- After that, type cmd, and press enter.

- When the black window appears, type scannow/sfc and press Enter.

- After a few seconds, the process will be completed. After that, follow the rest of the prompts and restore the problems in the system files.

Hopefully, it will fix the QuickBooks Payroll Error 30159.

Solution 5: Employee Identification Number

- Firstly, log into the system as a system administrator.

- After that, go to choose payroll–> Use my Existing Payroll Service.

- This action will open the Account Maintenance window on the desktop.

- Go to add a file, and check the radio button labeled as ADD EIN NUMBER.

- If the radio button is disabled, this implies that the user has a subscription to EIN for the company.

- After that, click NEXT and complete the process.

At last, open QuickBooks and look for QuickBooks Error code 30159. Hopefully, the issue must have been resolved.

Solution 6: Repairing The Paysub.ini File

- Firstly, open the file explorer, and choose the View tab.

- Open Hidden Files and Folders.

- Locate the Paysub.ini file.

- Rename this file by adding .old at the end of it.

It will disable QuickBooks from using the file. Hence, when the user runs the accounting software, it will automatically generate a new file for use. Ultimately, it will resolve QuickBooks Error code 30159.

Solution 7: Ensure to have the latest tax table update in QuickBooks Desktop Payroll

Keeping your QuickBooks Desktop Payroll tax table updated is essential to ensure accurate paycheck calculations and compliance.

Here’s how to get the latest tax table version:

- Check Your Current Tax Table Version:

- Go to the Employees menu.

- Select Get Payroll Updates.

- You’ll see the tax table version listed next to “You are using tax table version.”

- Verify If It’s the Latest Version:

- Review the latest payroll news and updates to confirm if your tax table version is latest.

- For more details, click on Payroll Update Info.

- Download the Latest Tax Table update:

- In the Payroll Updates window, select Download Entire Update.

- Click Update.

- Once the download is complete, you’ll receive an informational window confirming the update.

Solution 8: Update QuickBooks Desktop to the latest release

Keeping your QuickBooks Desktop updated is essential to access the latest features, improvements, and to avoid issues like QuickBooks Error 30159. Here’s how you can ensure your software is up-to-date:

Check for the Latest Release

- Open QuickBooks Desktop.

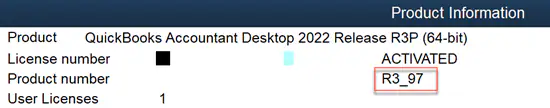

- Press F2 (or Ctrl+1) to open the Product Information window.

- Review your current version and release to see if it matches the latest available versions:

- QuickBooks 2024: R9_53

- QuickBooks 2023: R14_41

- QuickBooks 2022: R17_34

Manually Install Updates

If you need to update your QuickBooks Desktop manually, follow these steps:

- Select “Update Available” when prompted.

- Click on “Install Now” to begin the installation process.

- Wait for the update to install. This may take some time, so be patient.

- Once the installation is complete, open QuickBooks to ensure everything is functioning correctly.

Best Practices to Prevent QuickBooks Error 30159

Regular maintenance and accurate payroll configuration help prevent QuickBooks Error 30159. Keeping the software, system, and subscription details updated ensures smooth and error-free payroll processing.

- Keep the payroll subscription active and regularly verify account details.

- Update QuickBooks Desktop and Windows to the latest versions.

- Ensure the Employer Identification Number (EIN) and payroll service key are accurate.

- Regularly scan the system for malware or file corruption.

- Back up company files before installing updates or making major changes.

Conclusion!

QuickBooks Error 30159 reflects a system validation failure that can hinder automated payroll management and tax compliance. This error often occurs due to inactive service keys, damaged entitlement files, or outdated system components. You’re recommended to check the payroll subscription status, repair corrupted files, and update both QuickBooks Desktop and Windows to the latest versions to fix this error. By following the outlined troubleshooting steps and maintaining regular software updates, you can restore normal payroll operations and prevent similar disruptions in future payroll processing.

You can contact our support team at +1-802-778-9005 or email us at support@ebetterbooks.com if you are still experiencing issues with QuickBooks and need professional assistance for accounting, bookkeeping, or software-related issues.

FAQs:

1. What does the specific error message “PSID null” indicate in QuickBooks Error 30159?

The term “PSID null” (Payroll Service ID null) in the Error 30159 message is a critical indicator that QuickBooks cannot find or validate the required Payroll Service ID necessary for your subscription to function.

- Meaning: “Null” means the software is receiving an empty or unrecognizable value where a valid Payroll Service ID should be.

- Root Cause: This usually stems from a corrupted or missing payroll entitlement file (

Paysub.ini) within your system’s hidden configuration folders. - Resolution: The primary fix involves either verifying your payroll subscription status through the My Payroll Services menu or renaming the corrupted

Paysub.inifile to force QuickBooks to generate a new, correct entitlement file upon the next launch.

2. Can I fix Error 30159 by just verifying my subscription status online, or do I need to perform file repairs?

Verification is the essential first step, but it may not be sufficient if the error is caused by a corrupted local file. You should always start with the least destructive solution.

- First Attempt (Verification): Checking your subscription status via the Employees ➜ My Payroll Services ➜ Account/Billing Info menu forces QuickBooks to re-authenticate with the Intuit servers. If the error was due to a temporary authentication glitch, this is often enough.

- Second Attempt (File Repair): If the verification fails, the problem is local. The next step requires using the QuickBooks Tool Hub to run the Quick Fix My Program utility, which is designed to repair minor program errors and system components related to payroll entitlements.

- Last Resort: If both fail, file-level intervention, such as renaming the

Paysub.inifile, is necessary.

3. What is the role of the Paysub.ini file, and where can I find it to rename it?

The Paysub.ini file is a crucial configuration file that stores the local information about your payroll subscription, including the Service ID (PSID) and entitlement data. When this file is corrupted, it causes Error 30159.

Steps to locate and rename the file:

- Enable Hidden Items: In File Explorer, navigate to the View tab and enable the option to show Hidden Items (or Hidden Files and Folders).

- Locate the Path: The file is located in a hidden folder, typically under the path similar to

C:\ProgramData\Intuit\QuickBooks\20XX\Components\Payroll. - Rename: Once found, rename the file by adding

.oldto the end (e.g.,Paysub.ini.old). - Auto-Generation: When you restart QuickBooks, the software detects the missing file and automatically generates a new, clean version, resolving the corruption issue.

4. Why are the Windows System File Checker and Windows updates listed as solutions for a QuickBooks error?

Error 30159 is often a symptom of underlying operating system issues that prevent QuickBooks from communicating with its entitlement files or servers. Therefore, Windows maintenance is a critical part of the fix.

- System File Checker (

sfc /scannow): This command scans all protected Windows system files for corruption and replaces any damaged or missing files. If a core Windows component needed by QuickBooks is damaged, this utility fixes it. - Windows Updates: Outdated Windows versions can cause incompatibility problems. Ensuring the operating system is fully updated resolves known security issues and patches that can interfere with QuickBooks software services.

- Compatibility: Intuit designs QuickBooks to run on fully patched, supported versions of Windows. Mismatches frequently lead to validation errors like 30159.

5. What role does the Employer Identification Number (EIN) play in triggering or resolving Error 30159?

The Employer Identification Number (EIN) is directly tied to your payroll service subscription and is a common point of failure for Error 30159.

- Subscription Linkage: Intuit links your payroll service subscription and activation key directly to your specific company’s EIN.

- Mismatched Data: The error can occur if:

- The EIN in your QuickBooks company file is incorrect.

- You have multiple company files and are trying to run payroll with the wrong EIN linked to the active subscription.

- Resolution Step: By going to the Account Maintenance window and verifying the EIN, you force a reconciliation between the data stored on the Intuit servers and the data in your local company file, often restoring the lost entitlement link.

6. If Error 30159 appears after an automatic update, how should I proceed to ensure the tax table is not the issue?

After resolving the primary error through subscription verification or file repair, you must manually run a payroll tax table update to ensure the correct tax data is applied.

Steps to ensure the tax table is current:

- Access Update Menu: Go to the Employees menu➜ Get Payroll Updates.

- Verify Version: Check the tax table version listed against the latest version available on the official Intuit payroll news page.

- Download Entire Update: Select the Download Entire Update option.

- Confirm: Click Update to install the full, current tax table, ensuring the system has the latest regulations needed to run payroll without validation errors.

7. Does the QuickBooks Tool Hub contain a specific tool for resolving Error 30159?

Yes, the QuickBooks Tool Hub is the official starting point for many payroll errors and contains utilities specifically designed to repair the underlying causes of Error 30159.

- Quick Fix My Program: Found under the Program Problems tab, this utility often resolves general program glitches and permissions errors that interfere with entitlement checks.

- Payroll Update Tool: The Payroll Issues tab within the Tool Hub directs you to specific fixes for validation and update errors.

- Tool Hub Benefit: Intuit designed the Tool Hub to perform automated diagnostics and non-destructive repairs that are safer and more efficient than manual file manipulation or system restores.