Contents

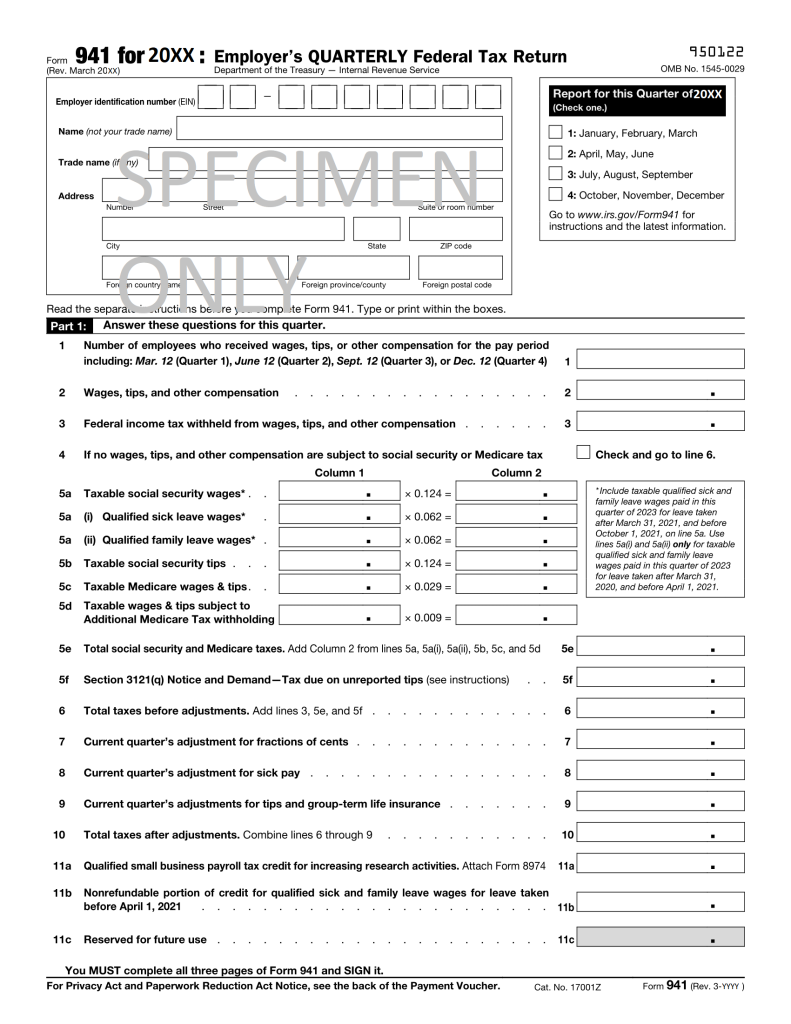

The IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return, is used by employers in the US to report tax withheld from employee salaries like federal income tax, Medicare tax, and social security tax.

As per federal law, employers in the United States must withhold a certain amount of tax from an employee’s pay every time they pay a wage.

The IRS Form 941 is essentially a consolidated version of two tax collections brought into effect in 1950:

Any business in the United States that withholds income tax, Medicare tax, and Social Security tax must file Form 941.

If any of the elements below apply to your business payroll, you must file Form 941.

Although most businesses need to file Form 941, there are exceptions like:

However, businesses that do not fall under these exceptions need to file IRS Form 941 every quarter, whether or not they have paid wages for the quarter.

The IRS updates Form 941 once every year to reflect changes in tax legislation, policy, and reporting requirements. For example, the last update in 2021 was centered around the Early Termination of the Employee Retention Credit.

To fill out Form 941, you’ll need the following information:

Form 941, the Employer’s Quarterly Federal Tax Return, consists of 5 main parts. Each part requests information about the business or explains the tax deposit process for employment taxes.

It is crucial that businesses report their tax liability within the deadline for each quarter and also ensure that they report the actual tax liability. The IRS can penalize businesses if the above is not followed and charge 5% of the total tax due for the months the return is not filed up to 5 months.

The deadlines for filing the IRS Form 941 are:

The deadline moves to the next business day if these dates fall on a federal holiday or weekend.

Moving on to the five parts of Form 941 and how to file it.

On this page, the employer needs to update information about the total number of employees, total wages paid, and any additional tips and calculate the total federal income tax withheld from employee paychecks.

If you have overpaid in the previous quarter, you can check the box on Line 15 to specify your preference to apply the excess amount to the next return or get a refund. You should check only one box. If you check both boxes, the IRS generally applies it to your next return.

In this section, you disclose the particular quarter’s tax liability and deposit schedule. Your tax liability will either be semi-weekly or monthly.

For monthly depositors (taxes are $50,000 or less unless the next-day deposit rule applies), check the monthly depositor box on Line 16 and detail your monthly tax liability based on wages paid dates. Your total tax liability for the quarter should match the total tax on Line 12.

For semi-weekly depositors (more than $50,000 in taxes), you need to check the third box on Line 16. You should fill out and submit Schedule B (Form 941), not on Line 16, along with your Form 941.

Part 3 of Form 941 is all about sharing information about your business. For example, if you’re closing or stopping wage payments, check the box on Line 17 to indicate this is your final return and the last wage payment date.

If you’re a seasonal employer, you should mark the box on Line 18 to inform the IRS that you don’t file quarterly. If you check the box, the IRS will not reach out to you for unfiled returns if you file at least one return yearly. You should check this box every time you file Form 941.

In Part 4, you need to authorize an employee or tax preparer to discuss the return with the IRS by saying “Yes” and providing their details like name, phone number, and PIN. You should not enter the name of any firm but an authorized individual.

The authorized employee can then provide missing information, call about the return’s processing, and respond to certain IRS notices but not to represent you fully before the IRS. The authorization expires one year after the filing due date.

Part 5 of Form 941 must be signed by an individual authorized to represent the business, such as the sole proprietor, the president or vice-president of a corporation, or a duly authorized partner or member based on the entity type.

If you hire a paid tax preparer (not an employee of your organization) to file Form 941, the preparer should sign the form and enter other details like Preparer Tax Identification Number (PTIN), address, firm’s name, etc.

Check this link to download current version of Form 941.

The taxes you report in Part 1 of Form 941 are:

You have two options to fill out and submit Form 941, i.e., via mail to the IRS address in your state or online via the E-file system.

When filing Form 941, consider the following points:

Form 941 is a key tool for employers to ensure they meet their tax obligations and maintain tax records in compliance with IRS regulations. It makes the reporting process more efficient for the IRS and employers to manage employment taxes.

It’s crucial to submit it accurately and on time to avoid charges and penalties from the IRS. Special rules apply to different types of employers, so it’s important you know which guidelines apply to your business.

The deadline to file Form 941 quarterly is by the last day of the month following the end of a quarter.

Yes, even if you have no payroll for a quarter, you still need to file a zero return.

The mailing address varies by state. Check your state address here. You can mail your return through an IRS-approved Private Delivery Service (PDS). However, note that tax payments must be made electronically despite mailing the return, ideally via the EFTPS.gov service.

Businesses that don’t need to file Form 941 are seasonal businesses, employers of household employees, and those who file annually using Form 944 (with IRS permission).

The IRS will impose penalties if you don’t file Form 941 or delay it. There is generally a 5% charge on the total taxes due for each month the return is late, up to a maximum of 5 months.