QuickBooks Error PS077 occurs when the payroll update process is interrupted due to corruption in the tax table files or inconsistencies in registration and billing data. This payroll-specific error typically prevents users from downloading or installing updates, which can disrupt regular payroll operations. The issue is linked to damaged company files, incorrect user information, or multiple QuickBooks installations conflicting during the update process.

This article explains QuickBooks Error PS077, which occurs when corrupted tax table files or incorrect registration details interrupt payroll updates. It covers the main causes, common symptoms, and effective repair methods, including validating the payroll subscription, repairing QuickBooks Desktop, and restoring payroll file integrity to ensure smooth payroll operations.

What is QuickBooks Error PS077 & How does it Looks When Occurs?

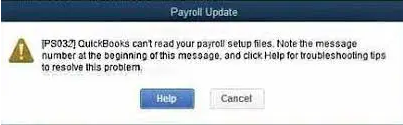

QuickBooks Error PS077 occurs when the software encounters an issue while downloading or installing payroll updates. This payroll-related error, identified by the “PS” prefix, often results from corrupted tax table files or incorrect setup information. Although it may not always block tax table updates completely, it can disrupt other payroll functions. The typical error message displayed is:

“Payroll Update

[PS032] QuickBooks can not read your payroll setup files. Note the message number at the beginning of this message, and click Help for troubleshooting tips to resolve this problem.”

QuickBooks Error PS077 signals that the software is unable to access critical payroll configuration files or registration details required to process payroll updates accurately.

What are the root causes of QuickBooks Error PS077?

QuickBooks Error PS077 is mainly caused by corrupted tax table files, incorrect billing or registration details, and incomplete payroll updates. It can also occur due to damaged company files or multiple QuickBooks installations on the same system.

- Corrupted or damaged payroll tax table files.

- Incorrect or outdated billing or registration information.

- Inaccessible or incomplete QuickBooks registration data.

- Damaged or corrupted company files.

- Multiple or conflicting QuickBooks installations on the same system.

Signs & Symptoms: How can we identify the effect of QuickBooks Error PS077?

QuickBooks Error PS077 displays several noticeable symptoms that indicate issues within the payroll update process. It commonly interrupts payroll downloads, causes update failures, and may result in system lag or freezing during payroll operations.

- Payroll updates fail to download or install.

- The tax table does not update successfully.

- The update process stops or crashes midway.

- A payroll-related error message appears on the screen.

- QuickBooks or the system becomes slow or unresponsive.

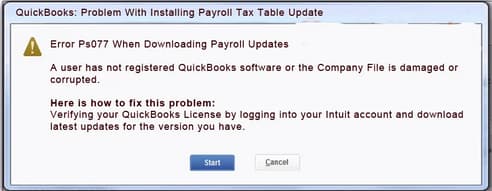

The following error message might show up on your computer when the QB payroll error code PS077 is triggered:

“QuickBooks: Problem With Installing Payroll Tax Table

Error PS077 When Downloading Payroll Updates

A user has not registered QuickBooks software or the Company file is damaged or corrupted.”

Customized Solution to Fix QuickBooks Error PS077

Before applying advanced troubleshooting methods, it is important to start with a basic system refresh. Logging out of QuickBooks and restarting your computer helps clear temporary files, close background processes, and reset the application environment. This simple step often resolves minor glitches that may interfere with payroll updates or cause QuickBooks Error PS077 to reappear.

- Save any pending work in QuickBooks before signing out to avoid data loss.

- Sign out from your QuickBooks account.

- Close all active QuickBooks windows and ensure no background instances remain open.

- Open Windows Task Manager and verify that all QuickBooks processes have been terminated.

- Clear temporary system files using the Disk Cleanup tool to remove cached data that might interfere with QuickBooks processes.

- Restart your computer to refresh the system and clear temporary data.

- After the reboot, reopen QuickBooks to start with a clean session and check if the error persists.

How to Resolve QuickBooks Error PS077?

QuickBooks Error PS077 can often be fixed by repairing the QuickBooks Desktop application. This process restores damaged program files and resolves issues that interrupt payroll updates. Ensure your payroll subscription and billing details are correct before starting the repair.

Solutions Part 1: Repair QuickBooks Desktop

Here are some important points to consider before you proceed with the repair of QuickBooks Desktop:

- Validate your QuickBooks payroll subscription before proceeding with the solution steps.

- Ensure that the billing information entered in the payroll account is accurate and appropriate.

- Update your QuickBooks application to the latest release.

- Confirm that only one QuickBooks application is installed on your system.

- Try repairing the QuickBooks desktop application to avoid any complications.

- It is also recommended to back up your QuickBooks company file.

To repair your QuickBooks Desktop application, complete the following steps:

- Step: First, log out from your QuickBooks account.

- Step: Close all your system windows, ensuring that no QuickBooks windows are left open.

- Step: Open Windows Task Manager and verify all previously opened QB windows.

- Step: Reopen QuickBooks and attempt to download the payroll updates once again.

- Step: If the issue is still unresolved, Navigate to File.

- Step: Select the Utilities option.

- Step: Finally, choose the option to Repair QuickBooks.

Solution Part 2: Run QuickBooks Install Diagnostic Tool From Tool Hub

Download and launch the QuickBooks Install Diagnostic Tool via the Tool Hub Program to deal with the QuickBooks Error PS077. Follow the below steps to accomplish this:

- Download and install the QuickBooks Tool Hub on your computer from the official Intuit website.

- Launch the application.

- Select the ‘Installation Issues’ tab.

- Next, opt for the ‘QuickBooks Install Diagnostic Tool.’

The diagnostic process may take some time, depending on the company file’s size. Allow the diagnostic process to finish without interruption. Once completed, restart your computer and verify if the issue has been resolved.

Miscellaneous Solutions for Solving Error PS077

There are a few miscellaneous solutions to resolve this error which you can try:

Turn Off UAC

To disable the UAC setting, complete the following steps:

- Click on the Windows Start main menu key button

- Search and select the Control Panel tab.

- Click on the View option by the drop-down arrow keys and then choose its large icons.

- Click on User Accounts.

- Click on Change User Account Settings in the appeared window.

- Move the slider to the position that says “Never Notify,” and then click OK to complete the process.

Change the CPS Folder Name

To change the CPS folder name, complete the following steps:

- Launch File Explorer using the Windows + E keys.

- Select the option that says “This PC or My PC.”

- Navigate to the local disk: C.

- Open the program files folder.

- Navigate and Open the QuickBooks desktop folder that matches your software version.

- Access the Payroll folder.

- Right-click on the CPS folder and select the rename folder option.

- Rename it to CPSOLD and press the enter key.

- Create a new CPS folder and open QuickBooks desktop.

Now, try downloading the latest payroll tax table update again.

Rename QBWUSER.ini and EntitlementDataStore.ecml files

To rename the QBWUSER.ini and EntitlementDataStore.ecml files, complete the following steps:

- Find the file named QBWUSER.ini on your computer.

- Once you’ve located the file, right-click on it.

- Select the ‘Rename’ option from the drop-down menu.

- Add the term ‘.old’ to the current name of the file.

- In the same manner, change the name of the EntitlementDataStore.ecml file.

- Launch the QuickBooks application and navigate to your company file.

- Create a backup of this file and store it in a local directory on your computer.

- Navigate to the directory where you saved the backup and open the file.

- Finally, Verify if the file opens without any issues.

Assess The Payroll Service Subscription

Evaluate your payroll service subscription and confirm your QuickBooks license:

- Sign in to your Intuit account.

- Confirm your QuickBooks License.

- Ensure that the latest updates for your QuickBooks version have been installed on your system.

- Visit the Payroll service account information and review other details such as the billing information dates.

- Navigate to the file.

- Select utilities.

- Now, inspect and/or generate your QuickBooks data.

- If your computer has Windows 7 or 8 installed, you should temporarily deactivate the UAC (User account control).

Attempt to download the QB Payroll updates again to determine if the issue persists or not.

Verify The Billing Information

Errors can often occur due to incorrect billing information, so it’s recommended to ensure that the billing information is correct and up-to-date. Also, record the QuickBooks license number by:

- Launch QuickBooks

- Press the F2 key.

- Make a note of the License number.

- Close the product information window by clicking the OK tab.

Add A New User Account

If the previous solution didn’t resolve the issue, consider creating a new user account.

Here are the steps:

- Start by pressing the Windows tab and navigating to the settings menu.

- Then, select ‘Add someone else to this PC’ in the ‘Other Users’ tab.

- Next, choose the option ‘I don’t have this person’s sign-in information.’

- Then select ‘Add a user without a Microsoft account.’

- Assign a name to the new account.

- Click on the finish tab.

- Choose the account you have set up.

- Select the account type and click the admin tab.

- Click on OK.

Open QuickBooks and try downloading the payroll tax table update again. The above should potentially resolve the issue.

Download The QuickBooks Updates as An Administrator

To update QuickBooks to the latest release as an admin, follow the steps below:

- Launch QuickBooks Desktop from an admin user account.

- Select Help from the menu bar.

- Click on Update QuickBooks Desktop from the drop-down list that appears after clicking on Help.

- Select Update Now.

- Then select the Get Updates option.

QuickBooks will now start downloading updates. Once the download is complete, the user will see the below prompt directing the user to restart QuickBooks in order to install the update.

- Click on OK to restart and install the update to complete the update process.

Conclusion!

QuickBooks Error PS077 usually arises from corrupted payroll tax table files, incorrect registration information, or incomplete payroll updates. Users can resolve this issue by validating billing details, repairing the QuickBooks Desktop application, and installing the latest payroll updates to ensure smooth payroll operations.

To prevent recurrence, it is recommended to regularly update QuickBooks and payroll data, verify registration information, and perform routine system maintenance. Contact eBetterBooks Error Support contact number +1-802-778-9005 for immediate support if the error persists even after applying the suggested solutions.

FAQs!

Does QuickBooks Error PS077 affect company data?

No, this error typically does not damage company data. It mainly affects payroll updates, but it is still advisable to back up your company file before performing any troubleshooting steps.

What are the different QuickBooks payroll installation errors?

Some common QuickBooks payroll installation errors include:

➜PS077 and PS032: Problems that arise when amending payroll taxes.

➜PS036: Failed to validate subscription.

➜15240: Lack of permission settings on the internet connection or wrong Internet settings.

➜12002: Certain situations include a network timeout or loss of connectivity.

Can multiple QuickBooks versions on the same system cause Error PS077?

Yes, having multiple or conflicting QuickBooks versions installed on the same computer can interfere with payroll updates and lead to Error PS077. It is best to keep only one active version installed.

Can using an outdated version of QuickBooks Desktop cause the tax table to become corrupt and trigger Error PS077?

Yes. QuickBooks tax table updates are released for specific, supported versions of the software. If your QuickBooks Desktop application is significantly outdated and you try to apply the newest tax table update, compatibility conflicts or improper installation routines can occur. This often leads to data corruption within the payroll files, which in turn triggers errors like PS077 during the update attempt.

What is the significance of the CPS Folder in relation to payroll updates, and what data is stored there?

The CPS (Client Payroll Service) folder is where QuickBooks temporarily stores the downloaded payroll update files and the core tax table data that is about to be installed. Errors like PS077 often mean the files within this folder are corrupted or incomplete due to an interrupted download. Renaming the CPS folder forces QuickBooks to create a new, clean folder and download a fresh set of tax table files, bypassing the corruption.

Does damaged or outdated billing information in my Intuit account affect payroll update downloads?

Yes. If payment or billing information is outdated or incorrect, Intuit may temporarily restrict payroll services. Users can update payment details through the Intuit Account Billing Portal, which ensures uninterrupted payroll update access.

If I rename the EntitlementDataStore.ecml file to fix PS077, do I lose my company data or any important payroll information?

No, renaming the EntitlementDataStore.ecml file (a common troubleshooting step) does not cause loss of company data, payroll transactions, or employee records. This file only stores encrypted licensing and registration information. Renaming it forces QuickBooks to assume the file is missing and prompt you to re-register the product when you next open the company file, effectively resetting the licensing status without touching your transactional data.

After successfully fixing Error PS077, what is the best way to verify that the tax table update was fully applied and is current?

To verify a successful tax table update:

➜In QuickBooks, press the F2 key (or Ctrl + 1).

➜In the Product Information window that appears, look for the Tax Table Version line.

➜Confirm that the version number displayed is the current, expected version for the latest payroll release date (e.g., 22401). If the number is correct, the update was successful and the payroll is compliant.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error PS077 Due to Corrupted Tax Table File?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.