Live Support

+1-802-778-9005

Contents

Cryptocurrency is money that is exchanged electronically or over the Internet and is highly secured by cryptography to prevent fraud and duplication. While central authorities issue traditional money, cryptocurrencies are used in decentralized networks based on the blockchain.

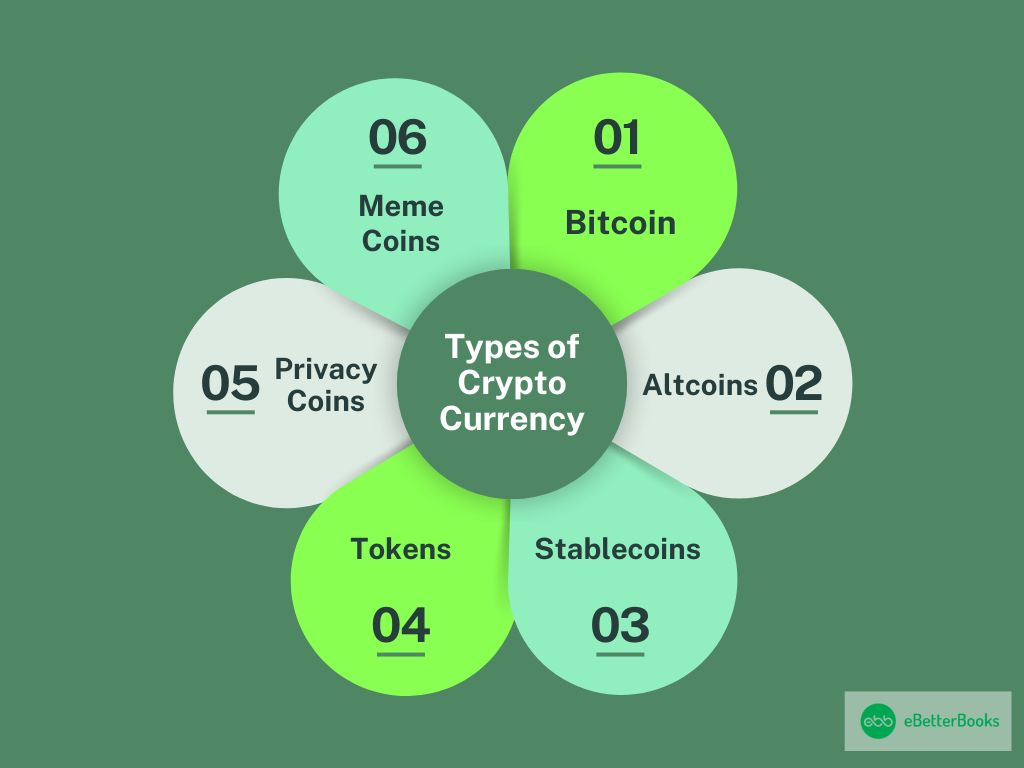

A blockchain is the record of all activities within a network, in which all computations take place in a public database distributed among various computers. Cryptocurrencies include Bitcoins, Altcoins, Tokens, and Stablecoins. Cryptocurrencies involve using these different currencies to complete transactions directly with another party without the involvement of a third party, such as a bank, making transactions faster and potentially cheaper.

Holders of cryptocurrencies use digital wallets, which are equipped with specific public and private keys to facilitate safe purchases. Cryptocurrencies decentralize the client’s assets, making it very difficult for any unscrupulous person to manipulate or defraud the client. However, such a market is very sensitive, and prices change very sharply from time to time.

Bitcoin was created in 2009 by an enigmatic person or group, Satoshi Nakamoto, and is the fundamental form of digital currency; thus, people can transact with each other through the use of the currency without necessarily involving third parties such as banks.

Originally known as a digital currency or even Internet money, Bitcoin is widely used as a digital asset and a means of payment. It has a limited circulation, with a set maximum number of 21 million pieces.

All digital currencies except for Bitcoin are known as altcoins, the concept of which is to build upon Bitcoin either in terms of technology and/or added use cases. For example, there is Ethereum, which provides the operation of smart contracts and various applications, and Litecoin, which aims to increase the speed of transactions. There are numerous differences between altcoins and original bitcoins, ranging from faster transaction clearing to the creation of new services in the sphere of finance. Thus, the crypto-square has become more diverse.

Stablecoins may be defined as cryptocurrencies whose prices are anchored on one or a basket of assets such as foreign currencies or precious metals. These are, for instance, Tether (USDT) and USD Coin (USDC) because they offer less risky investments to buy, sell, and use in the cryptocurrency market. They are used especially in exchanges for fast conversion of fickle assets into a more stable digital currency.

Tokens are related to final goods, services, or securities or are considered utilities based on the given blockchain platforms and more frequently originate from smart contracts primarily on Ethereum. While coins serve as their independent currency, tokens have other uses, such as providing an entry into DeFi platform games or buying an NFT. Some examples are Chainlink (LINK), which sources real-world data for smart contracts, and Uniswap (UNI), which is used in governance on its decentralized exchange platform.

Privacy coins are basically blockchain-based coins designed to work specifically on the issue of increasing transaction anonymity and user identity. Unlike the Bitcoin ledger, which makes every transaction that has taken place transparent, there are privacy coins like Monero (XMR) and Zcash (ZEC), which, through the use of cryptography to conceal the information in a transaction, including the transaction origin and the destination. These coins go well with those who are extremely shy with their identities in the online marketplace.

Meme Coins are coins that are created as a mere joke or as a result of a meme, but with lots of support from the communities and social media. Some of these are the Dogecoin (DOGE), which was created as a satire of Bitcoin, and the Shiba Inu (SHIB), which was named after a dog breed of dogs; these have received massive coverage in the market and have been boosted by celebrities and groups online instead of having unique functions.

Bitcoin is the oldest and most famous cryptocurrency; many people call it the flagship of virtual currencies. Founded in 2009, Bitcoin explains the concept of decentralized finance, as transactions can occur between people anywhere in the world without the intervention of financial institutions.

This disrupts traditional ordering using its blockchain technology to make all orders available on a public, non-editable ledger by a network’s computers (nodes). This decentralized system reduces the requirement for a third party through which value can be transferred directly.

Similar to other commodities or financial assets, Bitcoin’s supply is limited to 21 million coins. Thus, the crypto-asset became popular as a long-term store of value, or “digital gold.” Their use is limited to make them scarce, and they can serve as a store of value against inflation.

Bitcoin is currently the most expensive digital currency, with significantly more value than anything else in terms of market capitalization and demand from users, merchants, governments, and hackers. It is often used to measure the state of the cryptocurrency market, and its use in payment is increasingly being adopted, making it the most widely used virtual currency in the world.

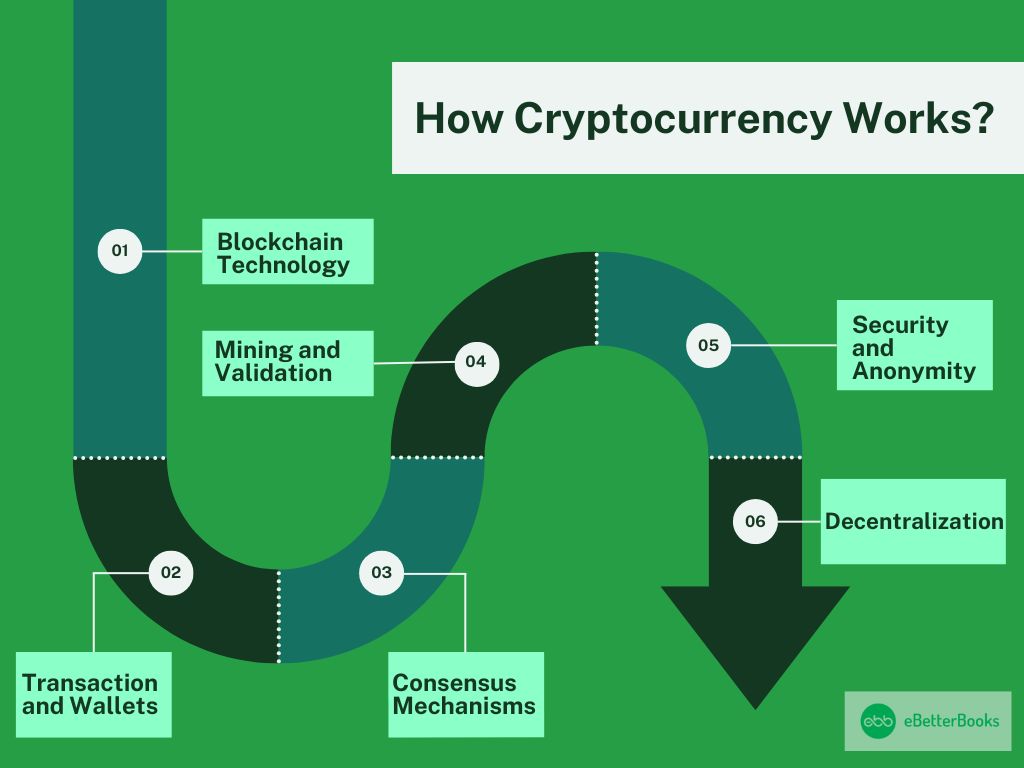

Cryptocurrencies rely on several key technologies to function securely and efficiently:

These technologies collectively provide the twin features that make cryptocurrencies safe and decentralized, making them usable as digital currency and for many other purposes.

Cryptocurrency involves the use of already defined blockchain, cryptography, and other decentralized systems that enable safe transactions between individuals without involving the use of middle agents such as banking systems.

Here’s a breakdown of how cryptocurrency works:

A crypto wallet is a digital technology that enables one to effectively access and transact virtual currencies while preventing unauthorized access to the money he or she is transacting with. It does not contain the actual money but keeps the compulsory public and private keys, which help to access and control the money in the blockchain.

The public key works more or less as an address through which other individuals can transfer digital currency to the wallet. In contrast, the private key works similarly to a password by confirming transactions. The security of the private key is of the utmost importance, for it is the key and holder of the wallet and has full control over the funds within the wallet.

Crypto wallets come in two main types:

Wallets can serve multiple digital currencies and can be further supplemented with other functionalities, including trading. On balance, crypto wallets are mandatory for individuals engaged in operations with digital currency, as well as for those who want to store their crypto funds securely.

Crypto ATM is a machine that enables customers to purchase cryptocurrencies supported by BTC, including bitcoin, and it also supports the selling of the BTC backed by the cashier’s cash or debit card. While normal ATMs are linked to accounts, the crypto one is connected to a cryptocurrency exchange, making the buying or selling process easier. They may deposit cash in order to buy cryptocurrency and have it delivered to their wallet or may use the same machine to exchange cryptocurrency for cash.

Popular Locations for Crypto ATMs:

These places make crypto ATMs available for people who would rather pay cash for their crypto business.

Crypto exchanges are online marketplaces that allow buyers and sellers to exchange, buy, and sell various cryptocurrencies. They also serve as agents that help connect the buyer to the seller. Also, buyers are allowed to exchange one type of cryptocurrency for another (peer-to-peer or P2P trading) or to exchange cryptocurrencies for traditional currencies like Dollars or Euros, respectively, known as seeding. There tend to be charges levied depending on the exchange and the transaction that takes place, and there could be extra services such as wallets, staking, and margin.

There are two main types of exchanges:

Famous Crypto Exchanges:

In conclusion, there is an implication that cryptocurrency is the new order in the financial system that enhances the use of a blockchain ledger for efficiency in contract enforcement and reduces transaction costs. Still, these have not hindered the progress of related markets; they continue to expand, thereby pointing to a possible shift in the global economy. For those seeking to unlock the potential of blockchain and successfully apply it in the context of a developing digital economy, it is essential to understand how it operates and what potential dangers may be latent in the technology.