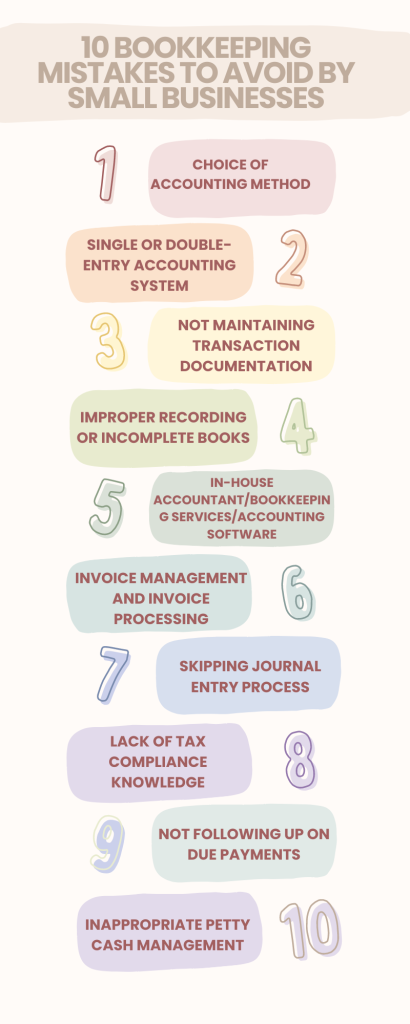

Bookkeeping is an essential part of running a small business. However, it can be challenging to keep track of all the financial transactions and ensure that everything is recorded accurately. In this article, we will discuss 11 common bookkeeping mistakes made by small businesses and how to avoid them. By avoiding these mistakes, small businesses can ensure that their financial records are accurate and up-to-date.

1- Wrong Choice of Accounting Method

Suppose you are launching a startup or own a small business and intend to maintain your books but need to gain bookkeeping knowledge. Now understand that opting for a manual bookkeeping system to record your business’s financial transactions gives you two options. You can either use cash accounting or accrual accounting.

In cash accounting, transactions are recorded at the point where the cash is received or paid out. Meanwhile, in accrual accounting, transactions are recorded at the point where a transaction takes place, regardless of when the cash is received or paid out.

Let’s understand the two most common methods with an example, which are cash accounting and accrual accounting. In cash accounting, – In cash accounting, if a business sells a product for $100, it will record the sale when it receives the payment. You need to keep in mind that revenue is accounted for on the records only when the cash is received or paid.

While in accrual accounting, if a business sells a product for $100, it will record the sale when the product is delivered, even if the payment is not received until later. Here, the revenue is recorded when a product or service is delivered to a customer with the expectation that money will be paid in the future.

Now, understand the difference between the two methods. Let’s say a business provides a service to a customer in December 2023, but the payment is not received until January 2024. Under cash accounting, the business would record the revenue in January 2024 when the payment is received. However, under accrual accounting, the business would record the revenue in December 2023 when the service was provided.

Generally, the cash accounting method is preferred by freelancers, small businesses, and personal finances. And the accrual accounting method is used by businesses where there are a lot of credit transactions, or the goods and services are sold on credit.

Therefore, it is important to choose the right accounting method for your business by considering the size of your business, the nature of your transactions, and your long-term goals when making this decision.

2 – Single or Double-Entry Accounting System

You cannot imagine a business without a correct bookkeeping system. Every business should perform an accurate bookkeeping system to manage their financial transaction data. Now, talking about the systems, there are two different accounting or bookkeeping systems- Single-entry and Double-entry accounting systems. Performing the right method depends on the size of your business and the nature of your transactions.

Single-entry bookkeeping is a simple method that records each financial transaction only once, which refers to only one entry made per business transaction, while double-entry bookkeeping records each transaction twice, which refers to recording financial transactions based on principles of debit and credit.

Let’s make it more simpler for you with an example, suppose a company purchases a new computer for $1,000. In a single-entry system, the transaction would be recorded as a debit to the computer expense account and a credit to the cash account. In a double-entry system, the transaction would be recorded as a debit to the computer expense account and a credit to the cash account, as well as a debit to the asset account and a credit to the liability account.

Generally, single-entry bookkeeping uses a cash-based accounting method and is suitable for small businesses with uncomplicated financial transactions.

On the other hand, double-entry bookkeeping uses accrual accounting and is suitable for businesses that need audits or external financial reporting.

Therefore, not knowing single or double-entry bookkeeping can lead to incorrect bookkeeping processes. It is important to have an understanding of accounting systems and implement them accordingly.

3 – Not Maintaining Transaction Documentation

When it comes to the bookkeeping process, invoices and receipts are the building blocks of basic inputs. They provide a record of transactions between the buyer and seller, and it’s essential to keep them organized and up-to-date.

One of the most significant risks of poor transaction documentation is that it can lead to audit issues. If you don’t have the necessary paperwork to back up your claims, the auditor may decide that you need to pay more taxes than you originally had to pay. There may also be costly penalties for the failure to file taxes appropriately. By securely storing and organizing important financial documents and receipts, businesses can easily access the necessary paperwork to support their claims.

Another risk of poor transaction documentation is that it can lead to missing historical data. Historical data is important for businesses, and it must be accurate to ensure that the business can make informed decisions. If there are any errors in the historical data, the business may not be able to make the right decisions, which can result in lost opportunities.

Therefore, a proper transaction documentation is essential for accurate bookkeeping. It is crucial to ensure that all invoices and receipts are accurate and complete and that written communication to the buyer is clear and concise. Failure to maintain proper transaction documentation can lead to audit and tax issues, missing historical data, and other issues that can be costly and time-consuming to resolve.

4 – Improper Recording or Incomplete Books

You cannot run a business without proper recording of your profit and loss. It is important to maintain accurate and up-to-date records to ensure that the financial statements are correct and reliable.

One common method is reconciling the books, which involves comparing the company’s records with bank statements and other financial documents to ensure that they match. This process helps to identify any discrepancies and correct them before they become bigger problems. When the books are not reconciled, it can lead to issues such as inaccurate financial statements, incorrect tax filings, and even legal problems.

Let’s say that a company has a bank account with a balance of $10,000. The bank statement shows a balance of $9,500. The company’s records show a balance of $10,500. To reconcile the bank statement, the company would need to identify the differences between the bank statement and their records.

In this case, the difference is $1,000. The company would need to investigate this difference to determine the cause. It could be due to an error in recording a transaction, a bank error, or some other reason. Once the cause is identified, the company can correct the error and update its records.

The bank reconciliation statement would then be updated to reflect the corrected balances. This process helps to ensure that the company’s financial records are accurate and up-to-date.

Also, without proper analysis, it is impossible to make final accounts. This can lead to errors in financial statements and tax filings. It is important to ensure that all transactions are recorded accurately and completely. This includes recording all income and expenses, as well as keeping track of assets and liabilities.

Improper recording or incomplete books can have serious consequences for businesses. It is important to maintain accurate and up-to-date records to ensure that the financial statements are correct and reliable. Reconciling the books and analyzing the data are essential steps in ensuring that the books are complete and accurate.

5 – In-House Accountant or Bookkeeping Services or Accounting Software

Choosing between in-house accountants, bookkeeping services, or accounting software can be a tough task for businesses. Each option has its pros and cons, and the decision ultimately depends on the specific needs of the business.

Hiring an in-house accountant can be beneficial for businesses that require a more personalized approach to their finances. An in-house accountant can provide a deeper understanding of the company’s financial situation and offer customized advice. However, this option can be expensive, especially for small businesses.

Bookkeeping services, on the other hand, can be a more cost-effective option for businesses. These services provide access to a team of professionals who can handle all aspects of bookkeeping, including payroll, accounts payable, and accounts receivable. This option is ideal for businesses that require a high level of expertise but do not have the resources to hire an in-house accountant.

Accounting software is another option that businesses can consider. This software can automate many of the bookkeeping tasks, such as invoicing, expense tracking, and Financial Reporting. This option is ideal for businesses that require a more streamlined approach to their finances and do not require a high level of expertise.

Ultimately, choosing between an in-house accountant, bookkeeping services, or accounting software depends on the business’s specific needs. It is important to consider factors such as cost, expertise, and the level of personalization required before making a decision.

6 – Invoice Management and Invoice Processing

Let’s consider that your company is doing well, you have dedicated employees, and you serve customers professionally. Still, if your invoice management or processing is not performing well, your company will not be in business for long.

An invoice is a document used to itemize and record a transaction between a vendor and a buyer.

Components of Invoice

A legally invoice should include all the necessary information for the customer to make payments and contact the seller with any questions. An invoice has the following five components:

- Invoice number: It is a unique identifier assigned to the invoice.

- Date: The date on which the invoice was issued.

- Business contact information: The name, address, and contact information of the vendor and the buyer.

- Descriptions of goods and services: A detailed description of the goods or services provided, including the quantity, unit price, and total amount due.

- Payment terms: The payment due date, payment method, and any other relevant payment information.

- Discount, Taxes, or Additional Charges (If any): After listing the products or services provided, include any applicable discounts, taxes, or additional charges such as shipping costs.

Invoices help during legal courses. If there is a lack of invoice management or processing, a business can not establish a formal agreement with its seller. Invoice management also helps track payments and manage accounts receivable. They provide details about the amount owed, payment due dates, and payment terms, making them important for payment tracking.

They are the building blocks of basic inputs for bookkeeping, and they provide a record of transactions between the buyer and seller. One of the most significant risks of poor invoice management is that it can lead to future disputes between the buyer and seller. They work as a written communication between a buyer and seller, and if the evidence is filled with errors, it can cause disputes between the parties.

One of the major problems can be with invoices that are processed manually because they are prone to errors, and the process is slow and inefficient. This can lead to delays in payments, which can damage vendor relationships and impact the bottom line.

For example, suppose a company receives an invoice from a vendor for $1,000. The invoice is recorded in the company’s books as $10,000 due to an error in data entry. This error can lead to incorrect financial statements and tax filings, which can result in penalties and fines. The company may also end up paying more than what is due, which can lead to a loss of revenue.

As a small business owner, you can opt for accounting software that offers an invoice service. They can help save time and effort by creating and managing invoices without any errors. You must learn to create and send invoices using accounting software.

7- Skipping Journal Entry Process

Journal entry is the most integral part of accounting and is used to record the financial transactions of a business. They are essential for maintaining accurate financial records and ensuring that the financial statements are correct. When journal entries are skipped, it can lead to blunders in the bookkeeping process.

Here comes a scenario, suppose a company purchases a new computer for $1,000. If the journal entry process is skipped, the transaction will not be recorded in the books of accounts. This can lead to discrepancies between the bank balance and the book balance. It can also result in incorrect financial statements and mismanagement of funds.

Another example is when a company fails to record depreciation expenses, which can lead to an overstatement of profits and an understatement of assets.

To avoid incorrect bookkeeping process due to skipping journal entries, businesses should ensure that all transactions are recorded in the books of accounts. They should also ensure that the journal entries are accurate and up-to-date.

This can be achieved by hiring a professional accountant or bookkeeping service. These professionals can guide the journal entry process and ensure that the financial records are accurate.

8 – Lack of Tax Compliance Knowledge

Lack of tax compliance knowledge can lead to bookkeeping errors and can have serious consequences for businesses. It is important to understand the tax laws and regulations to ensure that the financial statements are correct and reliable.

When businesses lack tax compliance knowledge, it can lead to issues such as inaccurate financial statements, incorrect tax filings, and even legal problems. Tax compliance risk is listed as one of the top 10 risks that need to be actively managed. This is according to the majority of company risk management reports created by reputable insurers in recent years.

Areas of Tax Compliance

There are four main areas of tax compliance risk that require active management:

Tax registrations: Before a company is allowed to function in a given market, it must register for tax purposes. Failure to determine the appropriate tax registrations needed could make it impossible to conduct business in certain locations.

Digital taxation requirement: The trend is toward expanding the definition of services included in the scope of digital tax. As a result, more companies must register in nations where they previously had no such requirement and must provide more information about their transactions. Businesses have a great responsibility to understand local laws and to stay current with service definitions.

Transaction details: Specific registrations and business licenses are required for certain sorts of transactions. For instance, import and export licenses are required in some countries.

Tax disputes: Disputes with tax authorities can be costly and time-consuming. It is important to have a clear understanding of the tax laws and regulations to avoid disputes.

It is important to ensure that all transactions are recorded accurately and completely. This includes recording all income and expenses, as well as keeping track of assets and liabilities.

Incomplete books can also lead to wrong bookkeeping. Without proper analysis, it is impossible to make final accounts. This can lead to errors in financial statements and tax filings.

Lack of tax compliance knowledge can have serious consequences for businesses. It is important to understand the tax laws and regulations to ensure that the financial statements are correct and reliable.

9- Not Following Up on Due Payments

Late payments or due payments can be a real headache for small businesses. They can cause cash flow problems, and these problems can lead to major blunders in bookkeeping. Not following up on late or due payments can make it easy to forget about them and lose track of what’s owed to you. This can lead to errors in your financial records, which can affect your business on a serious note.

Every small business owner must track payments, whether they are receiving them on time or are a bit delayed because this simple process helps them keep track of finances and ensures that their accounts are clear.

It also shows your clients that you’re serious about getting paid on time, which can help you build a reputation as a reliable business partner. In order to avoid mistakes in bookkeeping, it’s important to have a system in place for tracking payments and following up on late or due payments.

Tracking late payments can be an easier process as you can set up reminders in your calendars or send due payment reminders to your clients with the help of invoicing or bookkeeping software.

The choice is yours; choose what suits you best, and that works for you and your business. Following up on late payments is about keeping your financial records accurate and up-to-date. By doing so, you’ll be able to make better decisions for your business and avoid costly mistakes down the line.

10 – Inappropriate Petty Cash Management

Think of a situation where an employee is given access to the petty cash fund without proper training or supervision, and they may use the funds for personal expenses or fail to document their transactions.

Exactly! Not managing your petty cash can be one of the major mistakes that leads to an incorrect bookkeeping process. Petty cash is a small amount of money that is kept on hand for small purchases and expenses. And mismanagement of petty cash can lead to inaccurate financial records and misguided business practices.

To avoid such major blunders, you need to assign a custodian who can manage your business money with responsibility and accountability. Also, make sure that the custodian is well-trained to handle it correctly.

In addition, you can set up a system that can help you in tracking your petty cash and disbursements. Consider the following points in setting up a system:

- Get a petty cash box for your custodian and ask them to put the money in it.

- Make every amount entry you take from your petty cash box and where you are using this money.

- Get in the habit of collecting receipts for all the disbursements.

- Match the receipts, and the remaining cash should equal the original dollar amount designated to the fund.