Cost of Goods Sold (COGS) represents the direct costs incurred by a company in producing or purchasing the goods or services that it sells during a specific period. As a critical expense reported on the income statement, COGS includes only costs directly traceable to the production process, such as the expense of raw materials, direct labor, and manufacturing overhead.

It serves as a fundamental metric for calculating a company’s gross profit (revenue minus COGS), which is essential for determining a viable pricing strategy and assessing operational efficiency. Accurately tracking COGS is not only vital for internal financial management and inventory valuation but is also mandatory for external financial reporting and adherence to tax compliance regulations.

Highlights (Key Facts & Solutions)

- COGS Fundamentals: COGS includes direct production costs (materials, direct labor, production overhead) and is essential for calculating Gross Profit and setting prices. The core calculation is COGS = Beginning Inventory + Purchases – Ending Inventory.

- QuickBooks Setup: Accurate tracking requires creating and linking two primary accounts in QuickBooks: an Inventory Asset account (Balance Sheet) and a COGS expense account (Income Statement).

- Journal Entry: The COGS expense is recognized by Debit COGS and Credit Inventory when a sale occurs, following the matching principle.

- Tax and Compliance: COGS is a deductible business expense reported on various IRS forms (e.g., Schedule C, Form 1125-A). Inventory valuation methods, such as FIFO and LIFO, must be consistently applied, and manufacturing/reselling businesses must comply with UNICAP Rules (IRC Section 263A) by capitalizing certain indirect costs.

- Service Businesses: Hybrid businesses must calculate Cost of Services (COS) separately from COGS, using direct labor and direct service-related overhead.

- Accuracy Best Practices: Reconciliation between the Profit and Loss COGS total and the Balance Sheet Inventory Asset value is necessary to maintain accurate financial reporting. Avoid common errors like using manual journal entries for inventory changes or misclassifying freight-out as COGS.

What is the Cost of Goods sold?

The cost of goods sold (COGS) represents the direct expenses incurred in producing an item or delivering a service that a company sells. To determine the cost of goods sold, you need to consider costs like materials, labor, and overhead directly associated with the production process. Knowing the cost of goods sold can help you better manage your inventory, taxes, and business. COGS can also inform a proper price point for an item or service.

Why is the Cost of Goods (COGS) important?

The cost of goods sold is an essential financial metric for any business that usually sells goods, whether manufactured or purchased.

This key figure serves multiple critical purposes in business management, which are as follows:

Calculates True Cost of Merchandise Sold

COGS helps businesses identify the actual expenses involved in producing or purchasing the goods they sell. This calculation includes direct costs such as materials and labor, and it’s needed to know what each unit sold actually costs the company.

Assesses Profitability

Businesses can calculate their gross profit by subtracting COGS from sales revenue. This term is fundamental for assessing the profitability of products or services, helping businesses understand which items are contributing most to the bottom line and which may be costing more than they bring in.

Monitors Business Performance

COGS is a key metric in tracking financial analysis and business performance. By monitoring changes in COGS relative to sales over time, management can determine trends, control costs, and make informed decisions about production, pricing, and inventory management.

Supports Pricing Strategy

Understanding COGS enables businesses to set prices that cover all production costs while ensuring a profit margin. This is essential for remaining competitive in the market while also sustaining the business financially.

Focuses on Inventory Management

Effective inventory management depends on a clear understanding of COGS. Many businesses use this information to decide how much stock to keep on hand, which products to reorder, and which may need to be discontinued based on cost-effectiveness and sales performance.

Provides Tax Reporting Services

COGS is a deductible business expense that can significantly impact the taxable income reported by a company. Accurate calculation and reporting of COGS help businesses maximize their tax benefits, including tax compliance, e-filing, tax regulations, etc.

COGS vs. Cost Accounting

Unlike COGS, cost accounting is a broader approach with both direct and indirect costs associated with producing a product. This method provides a more comprehensive view of the total expenses involved in running a business.

Cost accounting allows for better allocation of overhead costs, a deeper understanding of profit margins, and more informed strategic planning for the businesses. It helps you to understand the profitability of individual products or services in the context of the company’s overall financial health.

What is included in the Cost of Goods sold?

Cost of Goods Sold (COGS) includes materials, direct labor, and production-related overhead. It excludes indirect expenses like distribution, marketing, and costs for unsold inventory.

The cost of goods sold (COGS) may include the following:

- Materials used to create a product or perform a service.

- Labor is needed to make a product or perform a service.

- Overhead costs are directly related to production (for example, the cost of electricity to run an assembly line).

The cost of goods sold excludes:

- Indirect expenses (for example, distribution or marketing).

- Overhead costs associated with general business operations.

- The cost of creating unsold Inventory or services.

The Formula for the Cost of Goods sold

Considering what’s included and what’s excluded, you can determine the cost of goods sold calculation with the following equation:

(Cost of Inventory at the beginning of the reporting period) + (Other Inventory purchased for sale during the reporting period) – (Cost of Inventory remaining at the end of the reporting period) = Cost of goods sold

Why is Tracking Cost Important?

Cost tracking is an essential metric when you calculate the correct profit margin of an item. Your profit margin is the percentage of profit you earn from each sale. Understanding your profit margins can help you determine whether your products are priced correctly or not and if your business is making money.

Tracking the accurate costs of your inventory lets you calculate your true inventory value, the cost of goods sold, the total dollar value of inventory you have in stock, and your business profitability. In most cases, your Inventory is your largest business asset. When tax time rolls around, you can include the cost of purchasing Inventory on your tax return, which can reduce your business taxable income.

Record the Cost of Goods Sold in the Accounting Journal

You can record the cost of goods sold as a debit in your accounting journal and then credit your inventory account with the same amount.

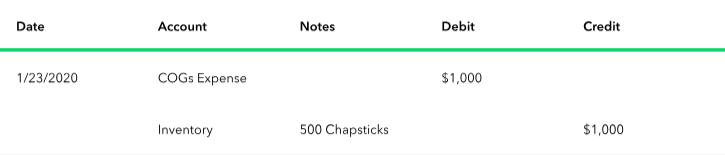

For example, a local spa makes handmade chapstick. One batch yields about 500 chapsticks. It costs $2 to make one chapstick. To determine the cost of goods sold, multiply $2 by 500. The spa’s total cost of goods sold for a batch is $1,000.

Their cost of goods sold journal entry might look like this:

Note: The above example shows how the cost of goods sold might appear in a physical accounting journal. The entry may look different in a digital accounting journal.

No matter how COGS is recorded, it is required to keep regular records of your COGS calculations. Like most business expenses, records can help you prove your calculations are accurate in case of an audit. Plus, your accountant will appreciate detailed records during tax time.

In accounting, debit and credit accounts should always balance out. The example above shows that Inventory decreases because, as the product sells, it will take away from your inventory account.

Examples of the Cost of Goods Sold

When calculating COGS, the first step is to determine the beginning cost of Inventory and the ending cost of Inventory for your reporting period.

Here’s an example:

Twitty’s Books began its 2018 fiscal year with $330,000 in sellable Inventory. By the end of 2018, Twitty’s Books had $440,000 in sellable Inventory. Throughout 2018, the business purchased $950,000 in Inventory.

Let’s assume the bookshop is using the average costing method when determining their Inventory’s starting and ending cost.

Below we’ve mentioned how you will calculate the cost of goods sold:

($330,000) + ($950,000) – ($440,000) = $840,000 Cost of Goods Sold

Twitty’s Books will then note this amount on its 2018 income statement.

Calculate the Cost of Services in a Service-Based Business

Some service companies may record the cost of goods sold as related to their services. But other service companies—sometimes known as pure service companies—will not record COGS at all. The difference is that some service companies do not have any goods to sell, nor do they have inventory.

Below are the examples of service companies that do have Inventory:

- Construction

- Plumbing and Electrical

- Repair and installation

- Mining and manufacturing

- Transportation and lodging

For example, a plumber offers plumbing services but may also have Inventory on hand to sell, such as spare parts or pipes. To calculate COGS, the plumber has to combine both the cost of labor and the cost of each part involved in the service.

Some examples of pure service companies that do not have Inventory such as:

- Accounting firms

- Law offices

- Doctors

- Dancers

- Real estate appraisers or firms

- Business consultants

Pure service companies may calculate the “cost of services” or the “cost of revenue.” COGS is not on their income statement.

The formula for calculating Cost of Services in a service-based business is as follows:

Direct Labor Costs +Direct Materials Used +Direct Overhead Cost = Cost of Services

- Direct Labor Costs: Calculate the total wages paid to employees directly involved in providing services, including salaries, wages, and related benefits.

- Direct Materials Used: Add up the costs of any materials that are consumed directly in the delivery of services.

- Direct Overhead Costs: Include any overhead costs directly attributable to service delivery, such as utilities for the service area or depreciation of tools and equipment used for the business.

Adding these numbers determines the total cost of services for your service business. This will help you understand the direct costs of providing your services and assess the profitability of your business operations.

Record Inventory Assets and Cost of Goods Sold in QuickBooks Online

To track what you receive from your vendor, you can create a bill from the purchase order if you’ll pay your vendor later. However, if you pay your vendor on the spot, you can create a check or an expense from the purchase order.

When categorizing your purchases in your transaction history, you can categorize them as Inventory. Record as transfer is when you move money or transaction from one account to another. You can create either an invoice or sales receipt so your COGS ( Cost of Goods Sold) will be affected whenever an item gets sold. Before sending a sales transaction, you’ll have to create an account to track your inventory value.

Below are the steps to be followed for the same:

Part 1: Create an Account to track inventory value

To track inventory value, navigate to the Chart of Accounts, select Current Assets, choose Other Current Assets, and save.

Step 1: Go for the Chart of Accounts

Hit the Gear icon at the top and then choose a Chart of Accounts.

Step 2: Select Current Assets

Press New and click on Current Assets under the Account Type drop-down.

Step 3: Add Other Current Assets

From the Detail Type drop-down, select Other Current Assets.

Step 4: Finishing up

Click the Save and Close tabs.

Part 2: Create an account to track the Cost of Goods Sold

To track the Cost of Goods Sold, navigate to the Chart of Accounts, select COGS, choose the closest matching type, and save.

Step 1: Go for the Chart of Accounts

Head to the Gear icon at the top and then choose a Chart of Accounts.

Step 2: Select the Cost of Goods Sold

Click + New and then select the Cost of Goods Sold from the Account Type drop-down.

Step 3: Mark the closest type of Cost of Goods Sold

From the Detail Type drop-down, pick the closest type of Cost of Goods Sold that matches your situation. If you’re not sure, use Other Costs of Service – COS.

Step 4: Finishing up

Press the Save and Close buttons.

When you purchase Inventory using Checks, Expenses, or Bills, use the asset account you created to track its value under the Account field. This “transfers” the money into the asset account, increasing the value of your Inventory. However, if you’re using QuickBooks Online Plus, you can use the built-in inventory feature instead of tracking Inventory manually.

Enable Inventory Tracking Feature

Depending on your subscription, if you’re on QuickBooks Online Plus or Advanced, you can add everything you buy and sell in your Inventory into QuickBooks. Then, you can allow QuickBooks to update the quantity on hand as you work, so you don’t have to do them. Once it’s set up, you can easily track Inventory in QuickBooks and products to sales forms. To begin with, turn on the inventory tracking feature.

Here’s how:

Step 1: Go for Account & Settings

Hover over the Gear icon and then choose Account and Settings.

Step 2: Select Sales and Edit

Click the Sales tab and then hit Edit under the Products and Services section.

Step 3: Enable Show Product/Service column

On Sales Forms, turn on the Show Product/Service column. You can also enable price rules if you want to set up flexible pricing for the things you sell.

Step 4: Turn on Track quantity and price/rate and Track inventory quantity on hand

Turn on both Track quantity and price/rate and Track inventory quantity on hand.

Step 5: Finishing up

Press Save and then Done.

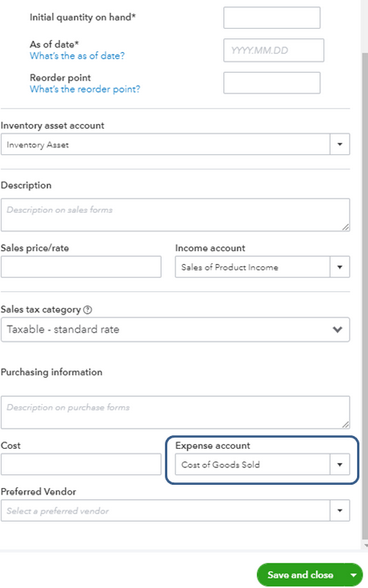

Set Up COGS Account to an Inventory Item

If you’re trying to set up a COGS account for an inventory item, then you can add it under the Expense account.

For this, do the following:

Step 1: Select Products and Services

Navigate to Sales and then click on Products and Services.

Step 2: Enter Product/Service information

Press New and select your preferred Product/Service information.

Step 3: Fill out the necessary details

Type the necessary information and make sure to choose COGS under the Expense account.

Step 4: Finishing up

Hit the Save and Close tabs.

How to Calculate the Cost of Goods Sold from an Income Statement?

To calculate the Cost of Goods Sold (COGS) from an income statement, adhere to the steps listed below:

- Identify COGS Directly: If the income statement explicitly lists “Cost of Goods Sold,” use that number directly.

- If COGS is not listed, calculate it by using the formula:

COGS= Beginning Inventory + Purchases − Ending Inventory

- Beginning Inventory: Found on the previous period’s balance sheet.

- Purchases: Sum of all purchases during the period (from the income statement or additional records).

- Ending Inventory: Available on the current period’s balance sheet.

This method gives you the COGS for the period, reflecting the direct costs of goods that were sold.

Cost of Goods Sold and Taxes

Every business that sells products, and some that sell services, must record the cost of goods sold for tax purposes. The calculation of COGS is the same for all these businesses, even if the methods for determining cost (FIFO, LIFO, or average costing method) are totally different from one another. Businesses may have to file records of COGS separately, depending on their business license.

- Record COGS on Line 8 of Form 1125-A for

- C corporations

- S corporations

- LLCs

- Partnerships

- Record COGS under Part 1: Income and calculate it in Part 3 on Schedule C for

- Sole proprietorships

- Single-member LLCs

COGS may be recorded on other tax forms for gross profit calculations, too. For partnerships and multiple-member LLCs, record COGS under Income for Form 1065 (partnership tax return). Corporations may record COGS under Income on Form 1120. S corporations may record COGS under Income on Form 1120-S.

Is there a Tax Deduction for the Cost of Goods Sold?

Yes, there is a tax deduction for the cost of goods sold. This deduction is available for businesses that produce or purchase goods for sale. The COGS is deducted from your business revenue to calculate the gross profit, which is then used to determine taxable income.

This deduction is typically reported on IRS Form 1040, Schedule C for sole proprietors and single-member LLCs, where it is specifically accounted for in the section detailing income and expenses.

For other business structures, the deduction still applies but might be reported in different forms corresponding to their tax filing requirements. The IRS guidelines on COGS allow businesses to add the cost of products or raw materials, direct labor costs involved in production, and factory overhead in their calculations.

Inventory Costing Methods

The IRS (Internal Revenue Service) requires businesses that produce, purchase or sell merchandise for income to calculate the cost of their Inventory. Depending on the business’s size, type of business license, and inventory valuation, the IRS may implement a specific inventory costing method. However, once a business chooses a costing method, it should remain consistent with that method year over year. Consistency helps businesses stay compliant with generally accepted accounting principles (GAAP).

The IRS explains costing methods in Publication 538. If an item has an easily identifiable cost, the business may use the average costing method. However, the cost of some items may not be easily identified or may be too closely intermingled, such as when making bulk batches of items. In such cases, the IRS recommends either FIFO or LIFO costing methods.

Average Cost Method

To determine the average cost of an item, use the following formula:

Avg cost per unit = Total cost of goods purchased or produced in period Number of items purchased or produced in period.

In simple words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year.

How are FIFO and LIFO Methods Different?

FIFO and LIFO inventory valuations differ because each method makes a different assumption about the units sold. To understand the FIFO and LIFO flow of Inventory, you need to visualize inventory items sitting on the shelf, each with a cost assigned to it.

The price of items often fluctuates over time due to market value or availability. Inflation causes prices to increase over time, and this discussion assumes that inventory items purchased first are less expensive than more recent purchases. Since the economy has some level of inflation in most years, prices increase from one year to the next.

First in, First Out (FIFO)

The first in, first out (FIFO) costing method assumes two things:

- The items purchased or produced first were also the first items sold.

- The inventory items at the end of your reporting period are matched with the costs of related items recently purchased or produced.

Last in, First Out (LIFO)

The LIFO method will have the opposite effect as FIFO during times of inflation. Items made last cost more than the first items made because inflation causes prices to increase over time. The LIFO method assumes higher-cost items (items made last) sell first. Thus, the business’s cost of goods sold calculation will be higher because the products cost more to make. LIFO also assumes a lower profit margin on sold items and a lower net income for Inventory.

The last in, first out (LIFO) costing method assumes two things:

- The items purchased or produced last are the first items sold.

- Closing inventory items is considered to be part of opening inventory for the same year. Items are assumed to have been sold in order of acquisition, which includes items in your Inventory at the start of your year and those acquired during the year.

The IRS notes the LIFO method has complex rules and requires the completion of Form 970. You only need to file this form with your yearly taxes the first year you use LIFO costing. Two LIFO rules highlighted in IRS Publication 538 are “dollar-value methodology” and “simplified dollar-value methodology.”

- The dollar-value method groups goods and products together into one or more pools or classes of items.

- The simplified dollar-value method uses a similar pooling system but uses government price indexes to determine the annual change in price.

Finally, the difference between FIFO and LIFO costs is due to timing. When all inventory items are sold, the total cost of goods sold is the same, regardless of the valuation method you choose in a particular accounting period.

Limitations of COGS

COGS is a financial metric used by companies to determine the direct costs associated with the production of the goods they sell. However, it has certain limitations as compared to more comprehensive cost accounting methods.

Let’s have a look:

Focus on Direct Costs Only

COGS includes only the direct costs of producing goods, such as raw materials and direct labor. This focus excludes indirect costs like overhead, administrative expenses, and marketing costs.

Non-Profitable Measures

Since COGS does not account for all operating expenses, the gross profit (revenue minus COGS) might give an inflated view of overall profitability. Without considering expenses like marketing, R&D, and administration, businesses might not have an accurate measure of how profitable their operations truly are.

Fluctuations Across Periods

COGS can vary significantly from one period to another due to changes in raw material costs, manufacturing efficiency, and production volume. Such fluctuations make it difficult to predict future financial planning, leading to challenges in budgeting and forecasting.

Exclusion of Other Expenses

Operational costs such as marketing, sales force expenses, and after-sales support are not included in COGS. These costs can be substantial and are vital for managing sales and the product’s market position. By not including these costs, COGS overlooks essential aspects of the total cost of delivering a product to market.

Less Effective for Service Industries

In service-oriented businesses, where direct costs of services (like labor) may not be as clearly definable as in manufacturing, COGS becomes a less valuable metric. In such cases, comprehensive cost accounting methods that can allocate overhead and administrative costs are usually more accurate and more informative.

Advanced Insights: Unlocking COGS Accuracy in QuickBooks

Recording COGS in QuickBooks isn’t just about entering numbers—it’s about maintaining financial precision, reducing tax errors, and optimizing decision-making. In this section, we break down 5 critical angles that often go unnoticed but directly affect your COGS accuracy. From financial analysis to reconciliation techniques, these advanced insights will help you avoid costly mistakes and build a reporting system that’s both scalable and audit-ready.

How Does COGS Impact Financial Reporting and Analysis in QuickBooks?

COGS directly impacts 3 core reports in QuickBooks — the Profit and Loss statement, Balance Sheet, and Inventory Valuation Summary. A change in COGS alters your gross profit margins, affects tax liability, and shifts net income, which are all key for business analysis. Inaccurate COGS skews at least 4 financial ratios: gross margin, net profit margin, inventory turnover, and return on sales. QuickBooks uses your COGS entries to calculate monthly profitability trends, track cost efficiency, and guide pricing decisions. If your COGS is off by even 5%, it can distort your financial reporting by 10–20%, making timely and accurate entries essential.

Key Differences in COGS Tracking for Product-Based vs Service-Based Businesses in QuickBooks

Product-based businesses in QuickBooks track COGS through Inventory Parts, using purchase cost, sales quantity, and inventory adjustments—all auto-linked to financial reports. In contrast, service-based businesses calculate COGS using service items, billable labor hours, and direct material costs, which must be manually assigned to jobs. Product businesses deal with restocking, asset depreciation, and FIFO or LIFO adjustments, while service firms manage labor efficiency, job costing, and time tracking integration. At least 3 workflows differ: item setup, expense allocation, and COGS account mapping. Misalignment in either model causes reporting errors in 2 key areas—gross profit and expense breakdown.

Common Mistakes Businesses Make When Recording COGS in QuickBooks

Many businesses make at least 5 frequent mistakes while recording COGS in QuickBooks: using the wrong expense account, skipping inventory setup, misclassifying non-COGS items, not matching invoices to sales, and forgetting adjustments for damaged goods. These errors affect 3 critical outputs—COGS total, gross profit, and inventory balance. Misreporting COGS by even $1,000 can impact tax filings by over $200–$300 depending on your tax rate. Businesses often overlook COGS in service items, leading to underreported costs. Incorrect account mapping results in imbalanced journal entries and flawed financial reports. Prevent these by reviewing COGS entries monthly, reconciling Inventory, and training your team.

How to Reconcile COGS with Inventory Reports in QuickBooks?

To reconcile COGS with inventory reports in QuickBooks, match 3 core figures: COGS total from the Profit & Loss report, Inventory Asset value from the Balance Sheet, and Inventory Valuation Summary. Discrepancies often come from manual adjustments, missing item mappings, or negative inventory entries. Run reports for the same date range, and verify at least 2 filters—item type and transaction source. If COGS doesn’t match inventory movement, check for unlinked purchase orders, zero-cost items, or duplicate entries. Perform monthly reconciliation to avoid reporting gaps, tax miscalculations, and ensure your stock flow matches your expense tracking precisely.

Best Practices for Maintaining Accurate COGS Entries Throughout the Year

To maintain accurate COGS in QuickBooks, follow these 5 best practices: (1) Use proper item types—Inventory for products, Service for labor, (2) Always map items to a COGS account, (3) Update inventory counts monthly, (4) Reconcile reports quarterly, and (5) Audit all purchase entries for accuracy. Automate recurring purchases using memorized transactions and validate pricing every 30–60 days. Regular reviews catch cost spikes, missing links, and unassigned expenses, which typically affect over 20% of inaccurate COGS reports. Train your staff on correct workflows, and ensure COGS vs Inventory Asset accounts are monitored side-by-side to avoid misstatements.

Strategic Add-Ons: Deepening COGS Control in QuickBooks

Beyond basic COGS tracking, businesses need to manage deeper operational variables that affect accuracy, compliance, and long-term profitability. This section uncovers 5 high-impact areas that support better COGS handling in QuickBooks—from audit trails and system integrations to seasonal inventory shifts and budgeting alignment. These insights aren’t just supplementary—they’re strategic tools to help you avoid financial blind spots and build a robust, error-resistant accounting workflow.

Role of Audit Trails in Verifying COGS Entries in QuickBooks

Audit trails in QuickBooks help verify COGS by tracking 3 key elements—user activity, transaction history, and modification timestamps. Every time a COGS-related entry is added, edited, or deleted, the audit trail records the exact user, time, and change made. This is crucial during audits, especially when adjustments exceed 5% of reported COGS. Reviewing audit trails monthly helps detect unauthorized edits, duplicate entries, and mapping errors. For businesses with multiple users, enabling role-based access control limits COGS manipulation. The audit log ensures data transparency, supports financial integrity, and protects against internal errors or fraud tied to inventory and expense entries.

Integrating Third-Party Tools with QuickBooks for Better COGS Tracking

Integrating third-party tools with QuickBooks enhances COGS accuracy by automating inventory syncing, real-time purchase tracking, and cost allocation. Tools like SOS Inventory, TradeGecko (QuickBooks Commerce), and Fishbowl sync data across sales, purchases, and stock in real time. This reduces manual entry errors by up to 70%, improves stock valuation accuracy by 30%, and ensures faster COGS updates. These tools support multi-location inventory, batch costing, and barcode scanning, which QuickBooks alone doesn’t handle efficiently. Integration ensures COGS entries reflect actual activity, not estimates, and provides clean, audit-ready data that aligns with both tax compliance and operational insights.

Impact of Seasonal Inventory Changes on COGS Accuracy

Seasonal inventory changes affect COGS accuracy by creating 3 major fluctuations: purchase volume spikes, cost variation, and inventory rollover errors. If inventory increases by 50% in peak season but COGS tracking isn’t adjusted, profit margins can be misreported by 20–30%. QuickBooks users must align COGS entries with seasonal stock updates, discounted bulk purchases, and return rates. Failing to adjust for off-season shrinkage or overstocking skews both inventory valuation and cost reporting. Use historical trends, update stock counts monthly, and enable alerts for rapid movement items to maintain accurate COGS during seasonal highs and lows.

Internal controls help prevent COGS errors by enforcing 3 safeguards: user access restrictions, multi-level approvals, and monthly transaction reviews. In QuickBooks, limit COGS account access to authorized roles only, which reduces manipulation risks by over 60%. Use audit logs to monitor changes, and require dual approvals for high-value inventory purchases. Set up alerts for negative inventory entries and incorrect item mappings—these are top causes of COGS misstatements. With monthly review checkpoints, you can catch anomalies early, maintain data accuracy, and ensure that every expense linked to COGS is properly classified and backed by documentation.

How COGS Influences Cash Flow and Budgeting Decisions in Small Businesses

COGS directly influences 3 major cash flow areas: vendor payments, inventory holding costs, and pricing decisions. If COGS rises by even 10%, cash reserves can drop sharply due to higher procurement and production expenses. In QuickBooks, tracking COGS monthly helps forecast real-time cash outflow, adjust budget allocations, and identify low-margin products. Small businesses often fail to connect fluctuating COGS with seasonal demand or bulk purchase timing, leading to budget overruns. Analyzing COGS trends lets you plan smarter restocking, negotiate better pricing, and allocate funds more effectively—ultimately improving cash flow stability and long-term sustainability.

Bottom Line!

Calculating and recording COGS in QuickBooks throughout the year can help you determine your net income, expenses, and Inventory. When tax season rolls around, having accurate records of COGS lets you and your accountant file your taxes properly. The term COGS better evaluates how efficient a company is in managing its labor and supplies in the production process, keeping in-check its financial status, performance, and profitability.

FAQ

What is the fundamental difference between COGS and Operating Expenses (OpEx), and why is correct classification critical for tax purposes?

The core difference lies in the purpose of the cost:

- Cost of Goods Sold (COGS) represents direct costs necessary to produce or purchase the goods that are sold. These costs directly follow the flow of inventory.

- Includes: Direct materials, direct labor, and manufacturing overhead.

- Impact: Deducted from revenue to calculate Gross Profit.

- Operating Expenses (OpEx) are indirect costs necessary to run the business but are not directly traceable to the production of a specific product sold.

- Includes: Rent for the administrative office, marketing, accounting fees, and sales commissions.

- Impact: Deducted from Gross Profit to calculate Operating Income (or Net Income).

Tax Compliance: Correct classification is critical because the Internal Revenue Service (IRS) requires only costs related to producing or acquiring the goods sold to be included in COGS. Incorrect reporting—such as misclassifying OpEx as COGS distorts both the Gross Profit and the final taxable income, potentially leading to audit scrutiny, penalties, and interest charges.

When setting up an inventory item in QuickBooks, why must I link it to both an Inventory Asset account and a COGS expense account?

Linking an inventory item to both accounts is essential because QuickBooks uses the double-entry accounting system to track the life cycle of the item:

- Purchase Impact (Balance Sheet): When you buy the item, QuickBooks debits (increases) the Inventory Asset account (a balance sheet account under Other Current Assets). This tracks the value of the stock you hold, which is considered an asset until sold.

- Sale Impact (Income Statement): When you sell the item, QuickBooks performs two automatic transactions to uphold the matching principle:

- It credits (decreases) the Inventory Asset account by the item’s cost.

- It debits (increases) the COGS Expense account (an income statement account) by the same cost.

This ensures that the expense of the goods is recorded in the same period as the revenue generated from their sale. Failure to link to the COGS account means the expense is never recorded, leading to an overstated gross profit and an inaccurate tax liability.

What are the key differences between the FIFO and LIFO inventory costing methods, and which one is generally preferred for tax purposes during inflation?

The difference lies in the assumption of the inventory flow for calculation:

- First In, First Out (FIFO): Assumes the oldest costs (First In) are matched with sales revenue.

- Effect during Inflation: Results in a lower COGS and a higher net income (because older, cheaper costs are expensed first). The remaining inventory value on the balance sheet is closer to current market prices.

- Last In, First Out (LIFO): Assumes the newest costs (Last In) are matched with sales revenue.

- Effect during Inflation: Results in a higher COGS and a lower net income (because newer, more expensive costs are expensed first).

Tax Preference: During periods of sustained inflation, businesses often prefer LIFO for tax purposes because the higher COGS leads to a lower taxable income. However, the IRS requires a business to file Form 970 to adopt LIFO, and LIFO is not permitted under International Financial Reporting Standards (IFRS).

How does a service-based business, such as a construction company, calculate its “Cost of Services” (COS) when it also sells tangible goods (like plumbing parts)?

A hybrid business must separate its costs into two distinct categories for accurate financial reporting:

- For Tangible Goods Sold (Inventory): The standard COGS formula is applied to track the parts:

- COGS = Beginning Inventory + Purchases – Ending Inventory.

- For Services Rendered: The Cost of Services (COS), often called Cost of Revenue, is calculated.

The formula for the Cost of Services for the service component is:

- COS = Direct Labor Costs + Direct Materials Used (Consumables)} + Direct Overhead Cost (e.g., job-specific tools and utilities).

This separation is necessary because the tangible goods’ costs flow through inventory asset accounts, while the service costs (primarily labor) are often expensed directly, ensuring that the gross profit margin for both the product and the service is accurately reflected.

What are the top three common mistakes businesses make when recording COGS in QuickBooks that lead to reconciliation errors?

Reconciliation errors between the Profit and Loss Report (COGS) and the Balance Sheet (Inventory Asset) usually stem from manual interference or incorrect setup:

- Improper Item Type/Mapping: Setting up an inventory item as a “Service” or “Non-Inventory Part” instead of an “Inventory Part.” This prevents QuickBooks from automatically creating the corresponding COGS journal entry upon sale.

- Manual Journal Entries: Directly debiting (increasing) or crediting (decreasing) the Inventory Asset or COGS accounts via journal entry without using an item-based transaction (like a sale or adjustment). This breaks the link between the item quantity tracked in the Inventory Valuation Summary and the dollar value in the general ledger.

- Incorrectly Including Freight/Shipping: Including freight-out (the cost of shipping goods to the customer) in COGS. Freight-out is a selling or distribution expense (OpEx), while only freight-in (cost of shipping goods from the supplier) should be capitalized as part of the inventory cost.

Why is accurate COGS tracking essential for the financial ratio, Inventory Turnover, and what does a low turnover ratio suggest?

Accurate COGS is the essential numerator in the Inventory Turnover Ratio, which measures how efficiently a company manages its stock:

- Ratio Formula:

- Inventory Turnover = Cost of Goods Sold \ Average Inventory

A misstated COGS figure (too high or too low) directly results in an inaccurate ratio, skewing operational analysis.

- Low Turnover Suggests: A low turnover ratio indicates that the company is taking too long to sell its stock. This points to key financial risks:

- Poor sales performance or weak market demand.

- Excessive inventory levels (overstocking).

- Increased carrying costs (storage, insurance, obsolescence risk).

Management uses this ratio to make vital decisions on ordering, storage, and pricing.

Besides the COGS formula, what other cost elements might the IRS require a manufacturing business to capitalize into the cost of its inventory under Section 263A (Uniform Capitalization Rules)?

The IRS’s Uniform Capitalization (UNICAP) Rules under Internal Revenue Code Section 263A require manufacturers, certain wholesalers, and retailers to capitalize a proper share of certain indirect costs into the cost of their inventory, rather than immediately deducting them as operating expenses.

These costs are capitalized and become part of the Inventory Asset value until the goods are sold, at which point they flow into COGS. Examples of costs frequently required to be capitalized include:

- Storage and Warehousing Costs: Rent, depreciation, utilities, and property taxes for the facility where materials or finished goods are stored.

- Quality Control and Inspection Costs: Expenses for personnel and materials used in the quality assurance process.

- Indirect Labor: Wages, benefits, and payroll taxes for production supervisors, materials handlers, and purchasing department personnel.

- General and Administrative Costs: A portion of these expenses, if they directly benefit or are incurred by reason of the production or resale activities.

Disclaimer: The information outlined above for “How to Record COGS in QuickBooks Desktop / Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.