A partnership does not pay income tax at the entry-level. A partnership firm is only a pass -through organization since partners’ tax returns reflect their respective shares of income, credits, losses, and deductions from the partnership.

Businesses pay payroll taxes on behalf of their employees and federal and state taxes on their profits. Other taxes, such as excise taxes, which are levied on particular goods and services, could also apply to some firms.

The partners are not considered employees and so are required to fill individual forms.

U.S. Taxation Partnership Firms– LLC

There are two common forms of business structures in the United States, i.e.,

- Partnership Firms

- Limited Liability Companies

Partnership Firms

A partnership firm is a relationship between two or more people who trade or do business.

The partnership’s profits and losses pass through to the partners, who then report their share of the partnership’s income or loss on their tax returns. This tax mechanism, known as pass-through taxation, is a key characteristic of partnership firms.

Partnerships must file an annual tax return with the Internal Revenue Service using Form 1065, which reports the partnership’s income, deductions, and general business credits.

Partnerships are also subject to self-employment tax, which is a tax on the partner’s share of the partnership’s income that is used to fund Social Security and Medicare.

Limited Liability Companies

Limited Liability Companies are hybrid business entities that combine the liability protection of a corporation with the tax benefits of a partnership.

An LLC is a pass-through entity for tax purposes, just like a partnership. This implies that the owners receive a pass-through of the LLC’s gains and losses, and they record their portion of the LLC’s income or loss on their tax returns.

LLCs have the option of being taxed like corporations, partnerships, or sole proprietorships. For tax purposes, an LLC with two or more owners is automatically categorized as a partnership. Until the owner chooses to be taxed as a corporation, an LLC with just one owner is always categorized as a sole proprietorship.

Taxing Profits in a Partnership

Form 1065

The Form 1065 is divided into 21 items on page number 1, which begin with

- Gross receipts or sales

- Cost of goods,

- Gross profit,

- Net farm profit or loss,

- Ordinary income or loss from other partnership firms

Deductions for things like salaries, guaranteed payments to partners, repairs and maintenance, rent, bad debts, depreciation, retirement plans, etc.

Form 1065 follows a logical sequence. Item 21, total deductions, marks the end of the first part. The second part begins with ordinary business income (loss) in item 22, followed by tax and payment details in items 23–32. Schedule B, which consists of 31 items, is on pages 2, 3, and 4, providing further details in a structured manner.

The Partners’ Distribution Share Items, a key component of Form 1065, are found on Page 5. These items, categorized under headings such as Income/Loss, Deductions, Credits, Foreign Transactions, Alternative Minimum Tax (AMT) Items, and other information, collectively referred to as Schedule K, provide a comprehensive overview of the partnership’s financial distribution and its tax implications.

Pass-Through Taxation

The partnership firm does not pay income tax, which benefits the partnership firm more. Taxes are paid individually, and each partner lists their portion of these items on their respective tax return. C-corporations are not subject to double taxation under this arrangement.

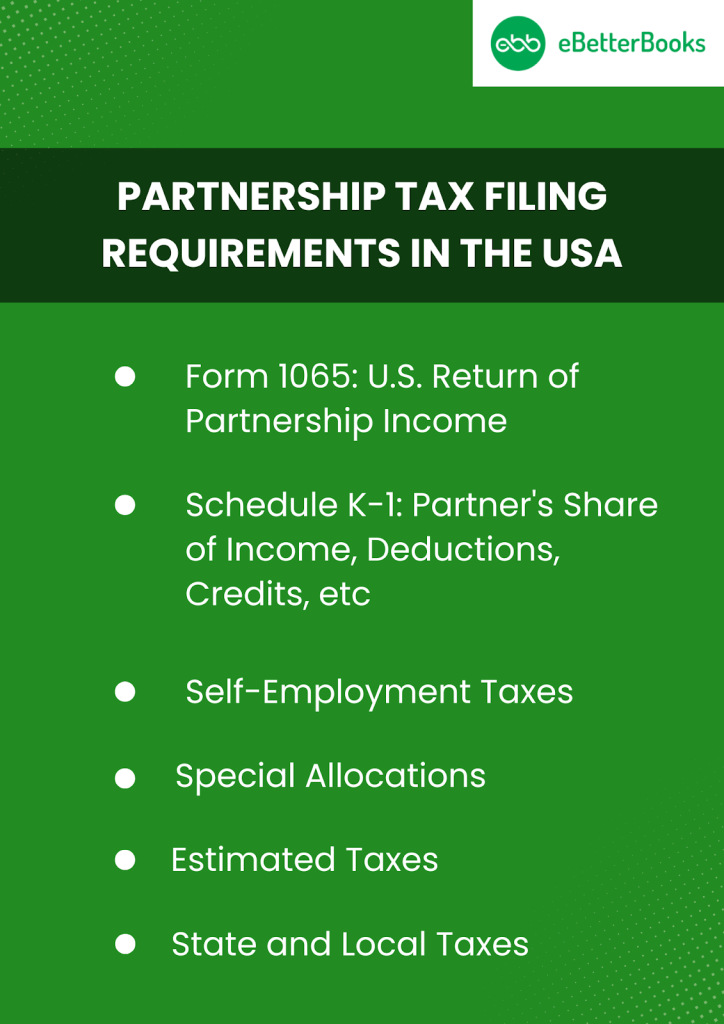

Partnership Tax Filing Requirements in the USA

Form 1065: U.S. Return of Partnership Income

A partnership must submit Form 1065 every year. This form reports the partnership’s total income, deductions, and other financial data. However, Form 1065 is only informational, as the partnership doesn’t pay taxes on its own.

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.

A Schedule K-1 outlining each partner’s portion of the partnership’s income, credits, and deductions is provided to them. Partners fill out their tax forms using this information.

Self-Employment Taxes

Due to their status as independent contractors, partnership partners are liable for self-employment taxes on the money they receive from the partnership. Self-employment taxes cover Medicare and Social Security contributions. Partners compute this tax using Schedule S.E., Self-Employment Tax.

Special Allocations

Special allocations are allowed in partnership agreements, enabling partners to distribute income, credits, and deductions differently depending on their ownership stake. These allotments must adhere to IRS guidelines and have a significant economic impact.

Estimated Taxes

If partners anticipate owing $1,000 or more in taxes upon filing their return, they may be required to make quarterly anticipated tax payments. This is because partnerships do not withhold taxes on income distributions to partners.

State and Local Taxes

Partners also have state and municipal tax obligations to consider in addition to federal taxes. Partnership income is subject to income taxes in several states, and partnerships may also be subject to special tax rules in some local governments.

Partnership Types and Their Tax Implications

General Partnerships

All partners in general partnerships are equally accountable for the company’s operations and debts. Each partner’s income is subject to personal income tax.

Limited Partnerships (L.P.s)

There are general and limited partners in limited partnerships. Limited partners have less power over management but more limited liability; general partners oversee the company and bear personal debt repayment responsibility. The same pass-through taxation rules apply, although revenue distribution may vary.

Limited Liability Partnerships (LLPs)

Limited liability companies, or LLPs, protect all partners from personal accountability for some of the partnership’s obligations and liabilities.

Deductible Expenses

A partnership may deduct a range of company expenses, such as rent, utilities, salaries, wages, and other running costs. These deductions decrease the total taxable income that is passed through to partners.

Here are some of the form by the IRS:

Tax related forms for partnerships | |

Annual return of income | Form 1065, U.S. Return of Partnership Income |

Employment taxes | Form 941, Employer’s Quarterly Federal Tax ReturnForm 943, Employer’s Annual Federal Tax Return for Agricultural Employees Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax ReturnDepositing and reporting employment taxes |

Nonemployee Compensation | Form 1099-NEC |

E-file information returns with IRIS | E-file Form 1099 with the Information Returns Intake System (IRIS) |

| Excise taxes | Form 965-A, Individual Report of Net 965 Tax LiabilityForm 8990, Limitation on Business Interest Expense Under Section 163(j) |

Forms for individual in partnerships | |

Income tax | Form 965-A, Individual Report of Net 965 Tax LiabilitySchedule E (Form 1040), Supplemental Income and LossForm 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors |

Self-employment tax | Schedule SE (Form 1040), Self-Employment Tax Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors |

Estimated tax | Form 1040-ES, Estimated Tax for Individuals |

International tax | Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property InterestsForm 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships |

Penalties for Late Payment under US Taxation

The last date to file the individual income tax and pay any tax owed is 15th April. The IRS checks the tax returns, and when they are completed, you will receive a bill if you have any penalty, tax, or interest.

The penalty for late payment is the percentage of the amount owed, and the interest charges are applied to the outstanding amount until it is paid in full.

Consult a Tax Expert for Partnership Tax Advice

Tax experts like certified public accountants, enrolled agents, tax attorneys, and licensed tax preparers help in strategic income planning, tax liability management, and profit and income analysis.

When it comes to partnership tax guidance, it’s essential to consult with experts. eBetterBooks is your partner for partnerships. Their use of cutting-edge financial instruments and contemporary web tools ensures timely filings, effective tax management, and, most importantly, IRS compliance.

Conclusion

The tax accounting treatment in the United States enhances the simplicity and flexibility for small businesses and professional practices. The business gets benefits from pass-through taxation, where profits and losses flow through to the individual partners rather than being taxed at the entity level.