Downloading the latest payroll tax table update in QuickBooks Desktop is very crucial as it offers the latest payroll updates to all its subscribers who have an active payroll subscription. These updates come up with the most recent and accurate rates or calculations for payroll tax forms, supported state and federal tax tables, e-file and pay options, etc.

What is a Payroll Tax Table?

The payroll tax table is basically a chart that is categorized into different columns, helping to calculate the appropriate taxes to be withheld from the employee’s paycheck.

The withholding taxes are affected by multiple factors such as the income amount, marital status of the employee, and also the payment schedule through which the employee is paid, whether bi-weekly or monthly. Hence, updating the tax table is necessary every time when you pay your employees.

| Important: The most recent Payroll Update is 22416, released on September 19, 2024. The latest tax tables are only available in QuickBooks Desktop 2024 or QuickBooks Desktop Enterprise Solutions 24.0. |

What’s Included in Payroll Update 22416 (September 19, 2024)?

Tax Table Updates:

- Federal: No updates.

- Arkansas: Revised and new withholding tables effective January 1, 2024.

- Delaware: New Paid Family & Medical Leave program begins on January 1, 2025.

- District of Columbia (DC): Paid Family Leave rate increased from 0.26% to 0.75% starting July 1, 2024.

- Kansas: New withholding tables effective July 1, 2024.

Here is the table for the past payroll updates:

| Payroll Update Number | Date Released |

| 22413 | 7/18/2024 |

| 22412 | 6/20/2024 |

| 22410 | 5/23/2024 |

| 22408 | 3/21/2024 |

| 22404 | 1/25/2024 |

Points to Remember Before Updating the QuickBooks Payroll Tax Table!

When proceeding with the QuickBooks Payroll Tax Table Update process, you are required to keep the following things in mind. Let’s discuss:

- You must have an active payroll subscription if you are planning to update the tax table.

- To get the payroll tax table updates automatically as soon as the updates are released, make sure to turn on the automatic updates feature in QuickBooks Desktop.

- It is recommended that you download the tax table within at least 45 days, or you can update the same every time you make a payment to your employees.

- Also, check that you have updated the QuickBooks Desktop version, and if required, update it as soon as possible.

- It’s also important to have a stable internet connection while updating your tax table.

How to get the latest payroll Tax Table update in QuickBooks Desktop?

To download the most recent payroll tax table update in the QuickBooks desktop application, follow the steps listed below:

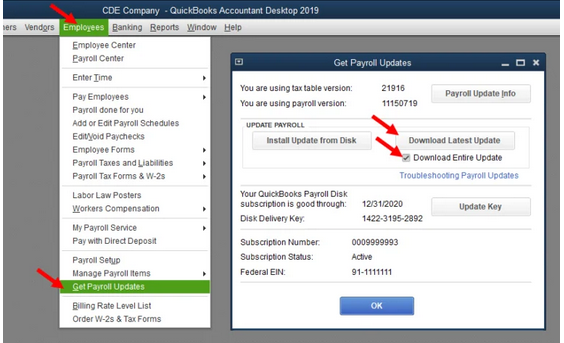

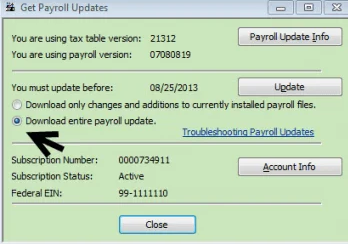

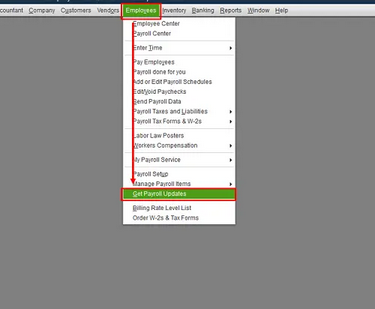

Step 1: Firstly, go to the Employees menu and then choose the Get Payroll Updates option.

Step 2: Now, select Download Entire Update.

Step 3: Click on the Update icon.

Step 4: Once the download finishes successfully, an informational window will appear on your screen with the notification your payroll tax tables have been installed on your device.

Step 5: At last, press OK to confirm.

Note: If you’re using QuickBooks Online Payroll, your tax tables are updated automatically. No further action is required on your part.

What is the current payroll tax table version?

The current QuickBooks Desktop payroll tax table is version 11934004, is released on June 18, 2024 and is effective from July 1, 2024 to December 31, 2024.

Confused about your current Payroll Tax Table version?

Adhere to the following steps to check which version you’re using:

- For this, navigate to the Employees menu under QuickBooks.

- Choose the My Payroll Service option.

- Then, click on Tax Table Information.

- In your tax table version, the first three numbers denote the tax table version you currently have, which is named 11833003. However, if you updated your product earlier this year, you may already have released 118.

Note: Before downloading the tax table update, be sure you are using either QuickBooks Desktop 2023 or QuickBooks Desktop Enterprise Solutions 23.0.

Steps to Install the Latest QuickBooks Payroll Tax Table update using a CD (Disk Delivery Service)

To install QB payroll tax table update using a CD or disk delivery service, perform the instructions outlined below:

Step 1: To begin with, insert the Payroll Update CD.

Step 2: Select the Get Payroll Updates option.

Step 3: For QuickBooks Desktop Pro and Premier, click on the Employees menu and then hit the Get Payroll Updates icon.

Step 4: After this, if you are prompted to locate the ‘update.dat‘ or ‘data file‘ under the ‘Install Payroll Update window, ‘ it is recommended that you take the necessary actions and respond to the prompts.

Step 5: Once you are finished, click Browse.

Step 6: From the Look in the drop-down arrow, tap to select the CD drive in the Install from the window.

Step 7: Now, select the ‘date or update3.dat‘ from the ‘Payroll Update Disk and then choose Open to continue.

Step 8: Finally, navigate to the Payroll Update Window and then press the OK button.

Note: If you get a pop-up message displayed on your screen that says “File Not Found,” go through your CD drive by adhering to the steps given below:

Step 1: Close the QuickBooks Desktop and press the Start Button.

Step 2: Now, choose My Computer.

Step 3: Hit right-click on the CD drive and then select the “If you cannot see the files, test the CD on a second desktop” option.

Step 4: In case the files appear on the second desktop, then there might be some issues with the hardware on the first desktop.

Step 5: However, if you are unable to see the file on both desktops, then you are required to order a new payroll update disk.

What is the current payroll tax table version?

The current QuickBooks Desktop payroll tax table is version 11934004, is released on June 18, 2024 and is effective from July 1, 2024 to December 31, 2024.

Steps to find your current Payroll Tax Table version

Step 1:For this, navigate to the Employees menu under QuickBooks.

Step 2:Choose the My Payroll Service option.

Step 3:Then, click on Tax Table Information.

Step 4:In your tax table version, the first three numbers denote the tax table version you currently have, which is named 11833003. However, if you updated your product earlier this year, you may already have released 118.

Note: Before downloading the tax table update, be sure you are using either QuickBooks Desktop 2023 or QuickBooks Desktop Enterprise Solutions 23.0.

However, if you are unable to see the file on both desktops, then you are required to order a new payroll update disk.

What’s Included in Payroll Update 22416 (September 19, 2024)?

| Tax Table Updates | |

| Federal | No updates |

| Arkansas | Revised and new withholding tables effective January 1, 2024. |

| Delaware | New Paid Family & Medical Leave program begins on January 1, 2025. |

| District of Columbia | Paid Family Leave rate increased from 0.26% to 0.75% starting July 1, 2024. |

| Kansas | New withholding tables effective July 1, 2024. |

| Forms updates : There are no forms updates in this Payroll Update. | |

| E-file and e-pay update : There are no forms updates in this Payroll Update. | |

Here is the table for the past payroll updates:

| Payroll Update Number | Date Released |

| 22413 | 7/18/2024 |

| 22412 | 6/20/2024 |

| 22410 | 5/23/2024 |

| 22408 | 3/21/2024 |

| 22404 | 1/25/2024 |

How to Verify QuickBooks Payroll Tax Tables?

Step 1: You need to confirm in the “Install Confirmation” window that the installation is in the correct location and that the “Tax Tab ‘ Versions” in both the current and new fields are accurate.

Step 2: After the update is complete, or when a message appears stating “A new tax table has been installed on your desktop ,click “OK ” to read about the changes.

Step 3: Finally, if the tax table version has not changed, a pop-up message will appear on the screen saying, “You have successfully installed the payroll update.”

Conclusion

To ensure accurate payroll processing in QuickBooks Desktop, keep your payroll tax tables up to date. Confirm your active payroll subscription, update QuickBooks to the latest version, and download the tax table update.

Enable automatic downloads to save time and reduce errors. If you encounter any issues, QuickBooks support is available to assist you.

FAQs:

Where is the tax table in QuickBooks Desktop?

To find the tax table in QuickBooks Desktop:

- Go to the Employees menu.

- Select My Payroll Service.

- Then, click on Tax Table Information.

Can I manually edit the payroll tax tables in QuickBooks?

QuickBooks payroll tax tables are automatically updated via the “Get Payroll Updates” feature. If you need to make manual changes, consult a tax professional or contact our support team, as incorrect adjustments can lead to inaccurate payroll and compliance issues.

Disclaimer: The information outlined above for “Download the Latest Payroll Tax Table Update in QuickBooks Desktop” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.