Highlights (Key Facts & Solutions)

- The following facts and solutions are essential for managing QuickBooks Desktop updates:

- Version Check: Use F2 (Ctrl+1) on Windows or Command+1 on Mac to check the current version and release number.

- Updates vs. Upgrades: Updates are free, mandatory fixes for security, bugs, and tax compliance; Upgrades are paid, optional annual releases with new features.

- Failed Update Troubleshooting: If an update fails, the following steps are critical:

- Admin Access: Always run QuickBooks as an administrator before installing the update to ensure necessary file permissions.

- End Processes: Manually end conflict processes in Windows Task Manager, specifically QBW32.exe and qbupdate.exe.

- Tool Hub: Use the QuickBooks Tool Hub to fix underlying Windows component errors (.NET Framework, MSXML) that block installation.

- Multi-User Environment: All workstations must be updated to the exact same release number simultaneously (server first, then clients) to prevent version mismatch errors and maintain file access.

- Compliance is Mandatory: Updates are necessary to ensure correct payroll tax table calculations and current tax form generation.

- Preparation: Always close background applications, especially antivirus software, which can block the update files during installation.

How To Check Your QuickBooks Desktop Version?

To check the version of the QuickBooks desktop you are using, follow these steps:

| FAQs: How can I check the version of the QuickBooks Desktop I am using? |

For Windows

Step 1: Lunch QuickBooks Desktop.

Step 2: Press F2 (or Ctrl + 1) to launch the Product Information window.

From the product information window, the user can check the current version and release.

The following are the latest releases available for the QuickBooks Desktop versions:

- QuickBooks 2024 R3_61

- QuickBooks 2023 R9_56

- QuickBooks 2022 R11_51

- QuickBooks 2021 R16_4

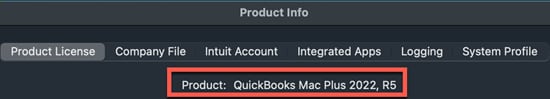

For MacOS (Apple Devices) – Know Your QuickBooks Version

Step 1: Launch QuickBooks Desktop.

Step 2: Press Command + 1 to launch the Product Information window.

From the product information window, the user can check the current version and release.

The following are the latest releases available for the QuickBooks Desktop versions:

- QuickBooks Mac Plus 2024 R1

- QuickBooks Mac Plus 2023 R5

- QuickBooks Mac Plus 2022 R10

- QuickBooks Mac 2021 R13

This process will help you determine whether your QuickBooks Desktop is running the latest version or if an update is needed.

How To Update QuickBooks (For Windows)?

The users can update QuickBooks Desktop manually or set it to update automatically whenever a new update is available.

How To Manually Update QuickBooks?

To manually update QuickBooks, follow the steps below:

Step 1: Launch QuickBooks Desktop.

Open the QuickBooks Desktop application on your computer. Ensure that no company files are open before proceeding with the update.

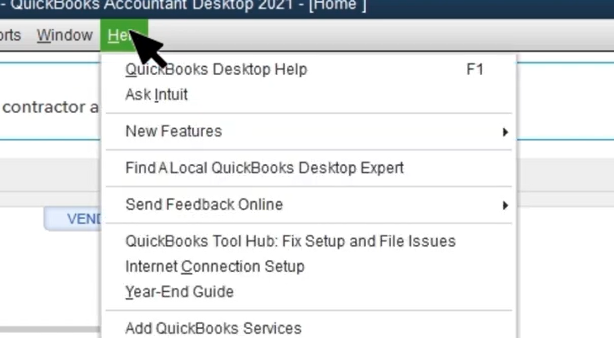

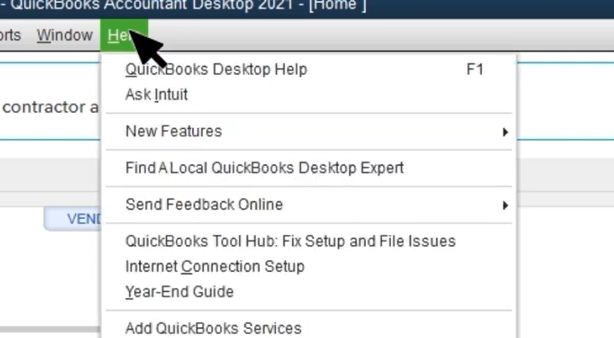

Step 2: Select Help from the menu bar.

In the menu bar at the top of the application, click on Help. This will open a drop-down menu with various options related to assistance and updates.

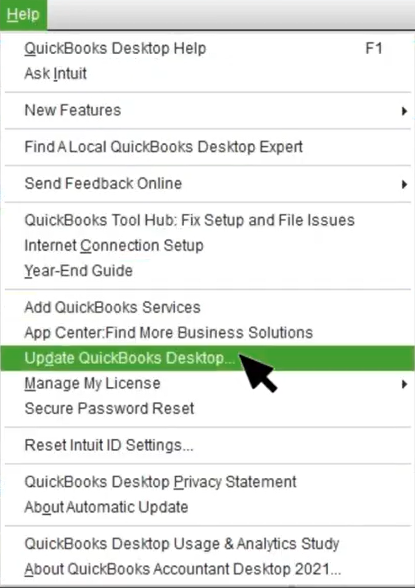

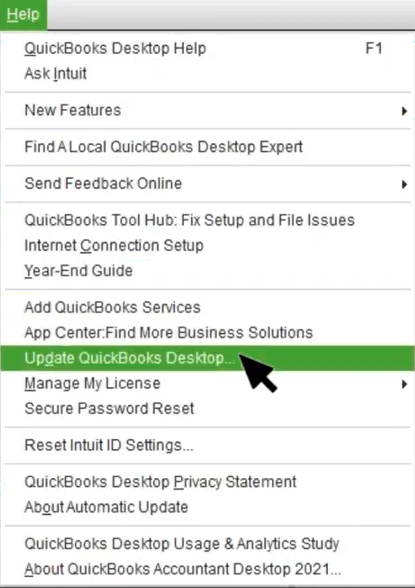

Step 3: Click on Update QuickBooks Desktop from the drop-down list that appears after clicking on Help.

Click on Update QuickBooks Desktop from the drop-down list that appears after clicking on Help.

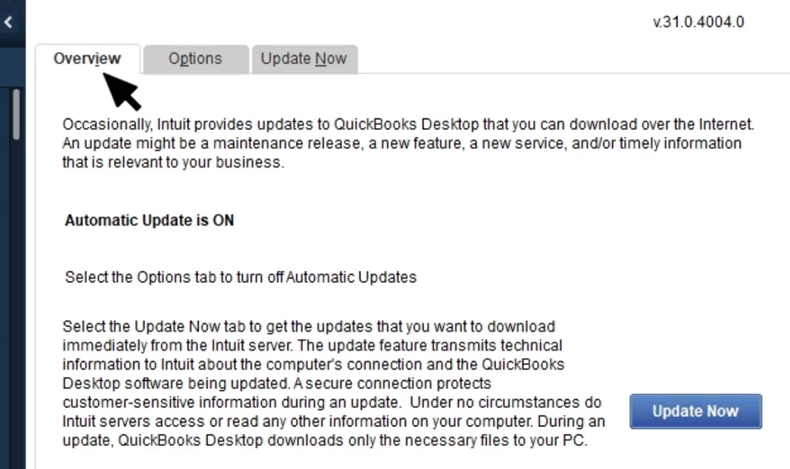

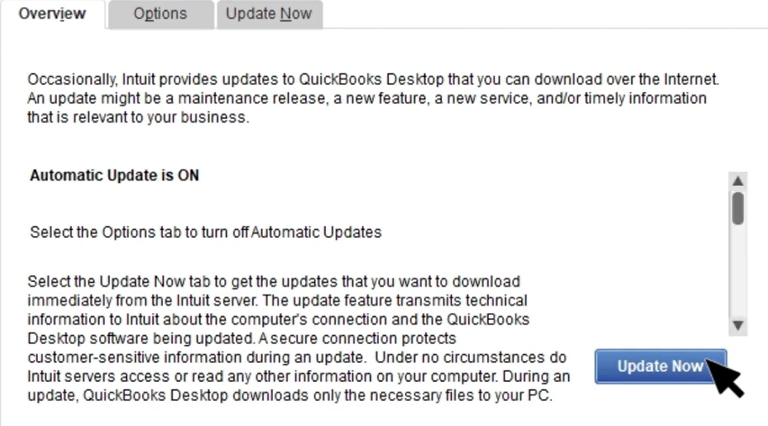

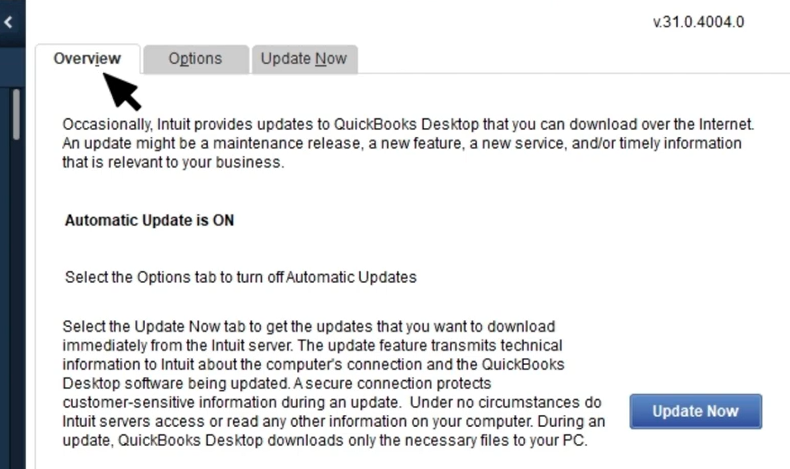

This action will redirect you to the Overview tab of the Update QuickBooks window, where you can manage update settings. (shown below)

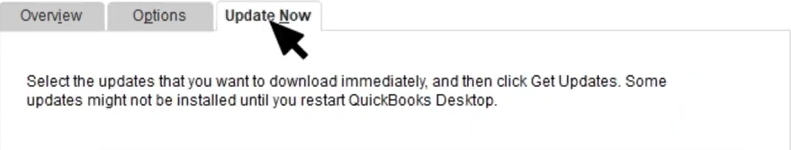

Step 4: Select Update Now.

In the update window, click on Update Now to prepare to download the latest updates.

OR

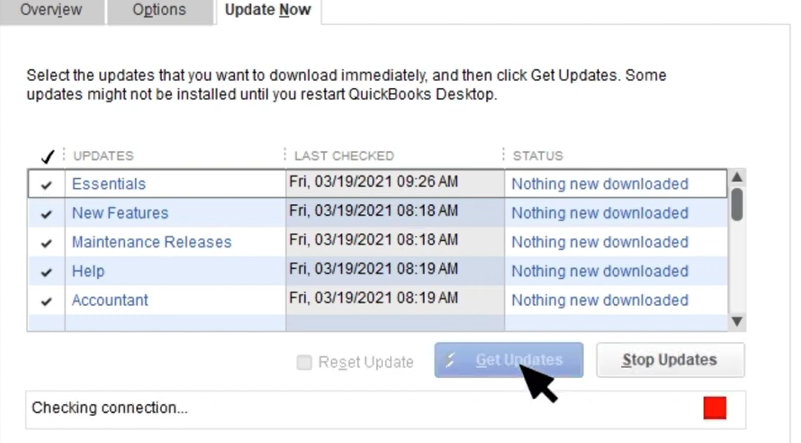

Step 5: When you are ready to update, select Get Updates.

When you are ready to proceed with the update, click on Get Updates. This initiates the download process for any available updates for your version of QuickBooks.

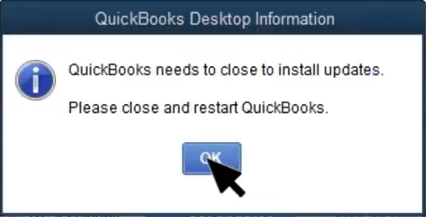

QuickBooks will now start downloading updates. Once the download is complete, the user will see the below prompt directing the user to restart QuickBooks in order to install the update.

QuickBooks will now start downloading updates.

Step 6: Click on OK to restart and install the update to complete the update process.

Once the download is complete, a prompt will appear directing you to restart QuickBooks to install the updates. Click OK to restart and allow the installation process to complete.

How To Set QuickBooks To Update Automatically?

To configure QuickBooks to update automatically whenever an update is available, follow the below steps:

Step 1: Launch QuickBooks Desktop.

Open the QuickBooks Desktop application on your computer to begin the update process.

Step 2: Select Help.

In the top menu bar, click on the Help option. This will open a drop-down menu with various help-related options.

Step 3: Click on Update QuickBooks Desktop

From the dropdown list that appears after selecting Help, click on Update QuickBooks Desktop.

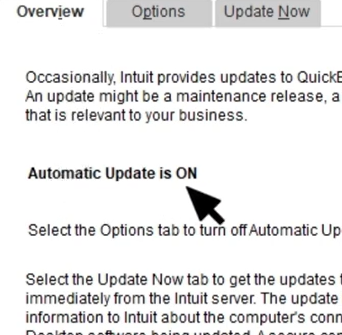

The user will then be redirected to the Overview tab, where you can manage update settings. (shown below)

In the Overview tab, the user can see if the automatic updates are turned on or off.

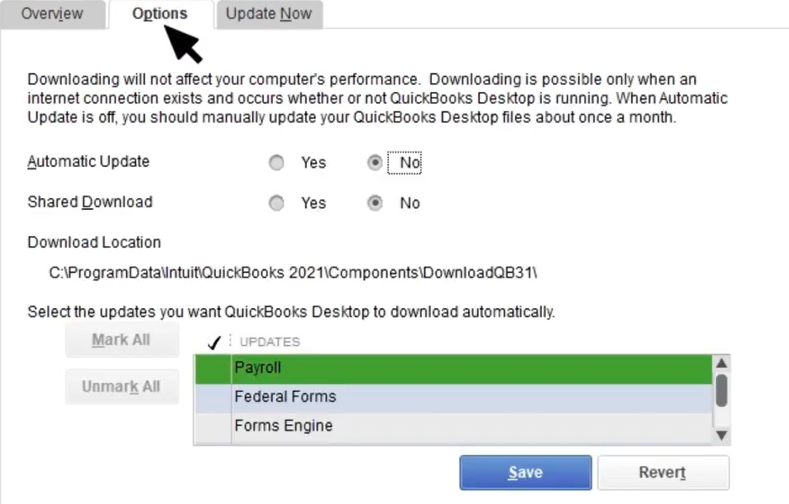

Step 4: To turn on Automatic Updates, select Options.

Look for an Options button in the Overview tab if the automatic updates are off. Click on it to access settings related to automatic updates.

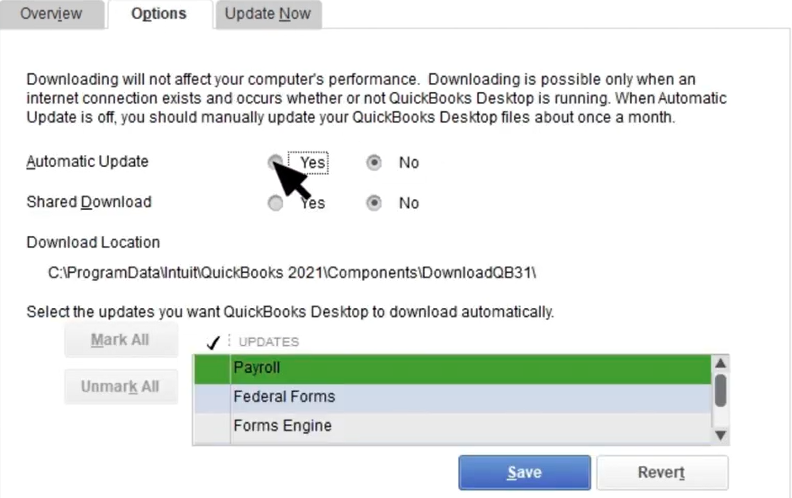

Step 5: Select “Yes” to turn on Automatic Updates.

When prompted, choose Yes to enable Automatic Updates. This setting ensures that QuickBooks will automatically download and install updates as they become available.

Step 6: Click on Save to save changes.

Finally, click on Save to confirm your changes. This will activate the automatic updates feature, which allows QuickBooks to keep itself up-to-date without further manual intervention.

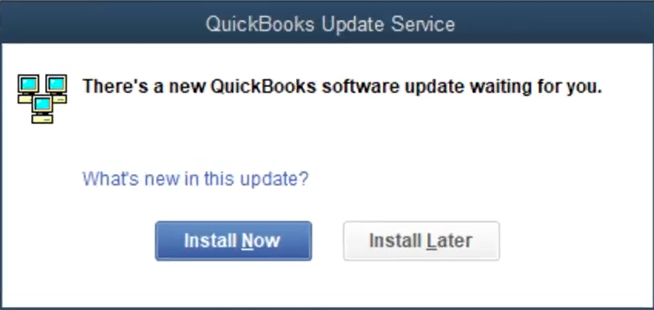

Note: The following prompt will appear from now on every time QuickBooks has a new update

How To Update QuickBooks (For macOS or Apple Devices)?

The users can update QuickBooks Desktop manually or set it to update automatically whenever a new update is available.

How To Manually Update QuickBooks?

To manually update QuickBooks, follow the steps below:

- Step 1: Open QuickBooks.

- Step 2: Go to the QuickBooks menu.

- Step 3: Select the Check for QuickBooks Updates option.

- Step 4: Select Install and Relaunch.

QuickBooks will now install the update and relaunch itself automatically once the update is done.

How To Set QuickBooks to Update Automatically?

To set QuickBooks to update automatically whenever an update is available, follow the below steps:

- Step 1: Open QuickBooks.

- Step 2: Go to the QuickBooks menu.

- Step 3: Select the Check for QuickBooks Updates option.

- Step 4: To set QuickBooks to update automatically in the future, select the “Automatically download and install updates in the future” option.

- Step 5: Select Install and Relaunch.

From now on, the QuickBooks updates will be automatically downloaded and installed.

How To Fix Unable To Install The QuickBooks Update Error?

In case the update won’t advance to the next release number, or the user may encounter an error during the update installation.

Follow the following steps to bypass this issue and install QB update:

For Windows:

Solution 1: Re-download the update.

- Step 1: Launch the Help drop-down menu.

- Step 2: Select Update QuickBooks Desktop.

- Step 3: Click on Update Now, then Get Updates.

- Step 4: Close and reopen QuickBooks to install the update again. Repeat these steps a few times to see if the release number advances and if the issue is resolved.

Solution 2: End certain background processes.

- Step 1: Close QuickBooks.

- Step 2: Launch Task Manager.

- Step 3: Under the Details tab, search for and end the following background processes:

- QBW32.exe or QBW.exe

- QBCFMonitorService.exe

- qbupdate.exe

- QBDBMgr.exe or QBDBMgrN.exe

- QBMapi32.exe

- Step 4: Launch QuickBooks administrator access.

- Step 5: Run the update again.

For macOS:

Solution 1: Re-download the update.

- Step 1: Open the QuickBooks menu and select Check for QuickBooks Updates.

- Step 2: Click on Install and Relaunch.

- Step 3: If the update fails or the release number doesn’t advance, try ending all the running processes and initiate the update process again. Repeat these steps a few times to see if the release number advances and if the issue is resolved.

Solution 2: Download updates from the official site.

- Step 1: Visit the “Downloads & Updates” page and choose the standard setup.

- Step 2: Choose the right entries for the following:

- From the Select Country dropdown, choose country.

- From the Select Product dropdown, choose the product.

- From the Select Version dropdown, choose the product version (year).

- Step 3: Choose the Search option.

- Step 4: Click on Get the latest updates.

Once the download finishes, open the file to install the update. Then, restart the operating system to finish the update process.

The above steps should help you overcome update issues in QuickBooks on both Windows and macOS. If you encounter an error during the update installation or the update doesn’t advance to the next release number, these solutions can help fix those issues.

What Are The Reasons To Update QuickBooks?

| FAQ: Why is it important to update QuickBooks? |

- Bug Fixes: Updates often include bug fixes that address software glitches, enhancing the overall stability of the software. By updating the software, users can quickly resolve issues such as data level permission errors or incorrect report filters.

- Security Patches: Security is a top priority for every QuickBooks user. To protect accounting data and prevent potential data breaches, new updates include security patches that fix any bugs in previous versions.

- New Features: Updates frequently introduce new features and tools that enhance the software’s functionality and user experience. For example, updates can offer features like,

- enhanced reporting capabilities,

- improved inventory management,

- better automation features,

- and more efficient integrations with third-party tools.

- Compliance: QB updates incorporate modifications to comply with new tax laws and regulations, ensuring that the software stays familiar with the new legal requirements and laws.

- Performance Improvements: Updates often include performance enhancements that optimize the software for faster processing and improved efficiency. They also address any version mismatches or compatibility issues with specific operating systems or third-party apps.

- Compatibility: Updates ensure that QuickBooks remains compatible with other software and operating systems, preventing potential conflicts or issues.

Merits of Updating QuickBooks

QuickBooks offers a multitude of benefits to business owners, aiding in efficient financial management and informed decision-making for business growth and success.

QuickBooks update can offer several benefits with each update, including:

- Time Efficient: QuickBooks automates numerous financial management tasks, including bookkeeping and invoicing. This automation saves valuable time for business owners, freeing them up to concentrate on expanding their business and other important tasks.

- More Accurate: QuickBooks aids in reducing errors in financial data entry and calculations. This ensures the accuracy of financial reports and tax filings, providing reliable data for business operations and removing the margin of error.

- Elevated Efficiency: QuickBooks streamlines financial management tasks, reducing paperwork and enhancing overall efficiency. This leads to a smoother operation and less time spent on administrative tasks.

- Tax Preparation: QuickBooks simplifies tax preparation by automatically categorizing transactions and generating reports needed for tax filings. With each update, tax and compliance policies are updated if needed. This makes the task of tax preparation more manageable, accurate, and compliant with laws and regulations that change in real-time.

- Scalability: QuickBooks is designed to grow with a business. It offers a range of features and tools that can accommodate the needs of small-scale businesses and large corporations.

QuickBooks “Updates” Vs. “Upgrades”

Intuit, the creator of QuickBooks, regularly introduces new versions of the software. These are categorized as “Updates,” which are free, and “Upgrades,” which require a purchase.

| FAQ: What is the difference between QuickBooks “Updates” and “Upgrades”? |

Intuit offers a variety of QuickBooks products. It’s important to note that they provide both desktop versions (Pro, Premier, Enterprise, etc.) and online versions (Online Essentials, Plus, etc.). The online versions are updated automatically in the background, so the “upgrade” vs. “update” discussion is only relevant to the desktop versions.

Updates are designed to enhance the functionality of the software the user has already purchased, ensuring its long-term usability. They’re always free and include fixes and performance improvements. On the other hand, upgrades are like new versions of the software, offering new features, tools, and significant enhancements. These are optional and available for purchase.

In summary, each QuickBooks update offers numerous benefits to business owners. It helps manage finances efficiently, ensures accuracy, provides real-time data, and scales with the business, all of which contribute to the growth and success of the business.

Mastering QuickBooks Desktop Updates: Advanced Subtopics for Total Control

Updating QuickBooks isn’t just a task—it’s a process that affects performance, security, and accuracy. This section dives deeper into critical subtopics that users often overlook. From troubleshooting failed updates to understanding edition-specific behaviors, you’ll gain the clarity needed to manage every update with precision and confidence.

Step-by-Step Troubleshooting When QuickBooks Fails to Update

If your QuickBooks Desktop fails to update, follow these 3 critical actions: (1) Re-download the update manually using the Update Now tab—this resets broken connections. (2) End background processes like QBW32.exe and qbupdate.exe using Task Manager to clear memory conflicts. (3) Run QuickBooks as administrator—this ensures permissions are granted for the update. These steps fix over 80% of update errors. Repeat the process twice if the release version doesn’t change. Always restart your system after updating to finalize changes. Skipping these can cause version mismatches, blocked features, or data sync errors in real-time environments.

Understanding Update Channels: Manual vs. Automatic in Depth

QuickBooks offers two update methods—each with 3 distinct impacts. (1) Manual updates give full control, letting users test stability before applying changes. (2) Automatic updates ensure you never miss critical patches, especially for security and compliance. (3) Hybrid approach (manual check + auto-install) helps users maintain oversight while staying current. Manual is best for IT-managed environments; automatic suits solo users needing zero downtime. Choosing the right method affects system performance, error prevention, and legal compliance. Always verify which update mode is active to avoid missing vital version upgrades or introducing bugs from outdated files.

How to Verify a Successful QuickBooks Update

To confirm your QuickBooks update worked, follow these 3 fast checks: (1) Press F2 or Ctrl + 1 to open the Product Information window—check the version and release number. (2) Compare this number with the official release notes on Intuit’s site to ensure it matches the latest. (3) Test core functions like reporting, invoicing, and backup to verify stability. A mismatch in version means the update failed or partially installed. Ignoring verification can lead to broken features, compliance risks, and corrupted company files. Always log update dates for record-keeping and audit purposes.

How Different QuickBooks Editions Handle Updates (Pro, Premier, Enterprise)

Each QuickBooks Desktop edition processes updates differently, impacting 3 key areas: (1) Update frequency—Enterprise gets more frequent patches for advanced features, while Pro and Premier receive general fixes. (2) Feature delivery—Enterprise updates may include exclusive tools like advanced reporting or inventory modules. (3) System requirements—Enterprise updates often demand higher RAM and CPU specs compared to Pro or Premier. Users must check compatibility before applying updates to avoid performance lags or crashes. Understanding your edition helps ensure smoother upgrades, proper resource allocation, and consistent functionality across devices and users.

Role of Admin Access in QuickBooks Desktop Updates

Admin access affects 3 core parts of QuickBooks updates: (1) Permission control—only administrators can install updates, preventing unauthorized changes. (2) File locking—admin mode ensures no company file conflicts occur during installation. (3) Update stability—running QuickBooks as admin reduces errors from blocked processes or registry access. Without admin rights, updates may stall, misapply, or silently fail. Always right-click and choose “Run as Administrator” before starting the update. Skipping this step can result in partial installs, missing features, and repeated error messages. Admin access is non-negotiable for reliable updates and secure data handling.

Essential Add-Ons: Supplementary Insights for Seamless QuickBooks Updates

Even the best update guide isn’t complete without addressing what surrounds it. This section covers high-impact but often ignored areas like system prep, multi-user coordination, and tool-based fixes. These insights help prevent silent failures, reduce update downtime, and ensure your QuickBooks stays stable across every user and device.

Common Misconceptions About QuickBooks Updates

Many users hold 3 major misconceptions about QuickBooks updates: (1) “Updates are optional”—in reality, skipping them can break features, cause tax errors, or create compatibility issues. (2) “Updates and upgrades are the same”—updates are free improvements; upgrades are paid new versions. (3) “Auto-update means everything is handled”—not true; some updates still need user confirmation or admin access. Believing these myths can delay fixes, reduce performance, and even corrupt financial data. Always review update notes, check your edition’s needs, and never assume QuickBooks is fully updated without verifying the release version.

Tips to Prepare Your System Before Installing QuickBooks Updates

Before updating QuickBooks, follow these 3 prep steps to avoid errors: (1) Backup your company file—always create a local and cloud backup to prevent data loss. (2) Close background apps—end all non-essential programs, especially antivirus and syncing tools, to reduce update conflicts. (3) Check admin access and internet stability—ensure you’re logged in as admin with a strong, uninterrupted connection. These actions reduce the risk of partial installs, file corruption, and version mismatches. Skipping prep can turn a 5-minute update into hours of recovery. Always prepare before you click “Update.”

How Updates Affect Multi-User Mode in QuickBooks Desktop

QuickBooks updates can disrupt 3 key functions in multi-user mode: (1) Version mismatch—if one user updates and others don’t, it blocks access and causes syncing issues. (2) File hosting errors—updates may reset hosting settings, requiring manual reconfiguration on the server. (3) User permissions—new patches can alter access rules, leading to denied actions or missing features. To avoid downtime, always update all workstations together and verify that multi-user mode is re-enabled post-update. Ignoring this causes file lock errors, lost changes, and slowed productivity in collaborative environments.

Best Practices for Scheduling Updates in a Business Environment

To avoid disruptions, apply these 3 best practices when scheduling QuickBooks updates: (1) Choose off-hours—schedule updates after business hours or during low-activity periods to prevent work interruptions. (2) Notify team members in advance—alert users to save work and close QuickBooks before updates begin. (3) Test updates on one system first—use a single workstation to verify stability before applying changes company-wide. These steps minimize downtime, prevent version conflicts, and safeguard financial data. Poor scheduling can cause halted workflows, update failures, or misaligned software versions across users.

QuickBooks Tool Hub solves 3 common update issues fast: (1) Runs Quick Fix My Program—this repairs basic installation errors that block updates. (2) Uses Install Diagnostic Tool—it scans and fixes .NET Framework, MSXML, and C++ issues critical for update success. (3) Resolves network and file permission errors that cause failed installs in multi-user setups. Download it from Intuit’s official site and install it on the affected machine. This tool reduces update troubleshooting time by over 70%. Skipping it can lead to repeated errors, wasted hours, and incomplete version installs.

Frequently Asked Questions

1. What is the difference between a QuickBooks “Update” and an “Upgrade,” and why is this distinction important?

The distinction between an update and an upgrade is crucial because one is free and mandatory, while the other is paid and optional.

- Updates (Free): These are minor, incremental releases (e.g., R1 toR2 designed to enhance the existing version you own. They primarily include:

- Security patches to protect your data.

- Bug fixes for software glitches and errors.

- Compliance modifications for new tax laws.

- Upgrades (Paid): These represent a jump to a new annual product version (e.g., QuickBooks 2024 to QuickBooks 2025). Upgrades typically introduce:

- Significant new features and tools.

- Major enhancements to functionality.

- Changes to system requirements.

2. Why do I need to run QuickBooks as an administrator to install an update (as mentioned in the troubleshooting section)?

Admin access is necessary because the update process involves making fundamental changes to the operating system’s files, registry, and services that are essential for QuickBooks to function.

- Core Reasons for Admin Access:

- Permission Control: Only an administrator has the necessary rights to modify the program files located in the Windows or macOS application folders.

- Registry Access: Updates often need to read or write settings in the system registry, which standard user accounts are typically restricted from doing.

- Service Installation: Installing new database manager services QBDBMgrN.exe or monitor services QBCFMonitorService.exe requires elevated permissions.

- Consequence of Skipping: Without administrator rights, the update may fail silently, partially install, or lead to recurring error messages due to insufficient permissions.

3. What are the specific background processes I should end in Task Manager (Solution 2) if my QuickBooks update fails?

When an update fails, it is often because critical QuickBooks processes are running in the background, locking files the update needs to overwrite. You should use the Windows Task Manager (under the Details tab) to end the following specific processes:

- Primary Conflict Processes:

- QBW32.exe or QBW.exe (The main QuickBooks application)

- qbupdate.exe (The update installation agent)

- QBCFMonitorService.exe (The corporate file monitor service)

- Secondary Conflict Processes (Multi-User Environments):

- QBDBMgr.exe or QBDBMgrN.exe (The QuickBooks Database Manager service)

- QBMapi32.exe (QuickBooks MAPI process, related to email)

4. How does an update affect multi-user access, and what is the best practice for scheduling updates across the team?

Updates significantly impact multi-user access because all workstations must be running the exact same release number to connect to the company file on the server.

- Multi-User Risks:

- Version Mismatch: If one user updates and another does not, the non-updated user will be blocked from accessing the company file until they update.

- Hosting Errors: Updates may sometimes reset the file hosting settings on the server or workstation, requiring the user to re-enable multi-user hosting manually.

- Best Practice for Scheduling:

- Off-Hours Scheduling: Schedule the update installation for all workstations and the server during off-hours (evenings or weekends) to minimize workflow disruption.

- Sequential Update: Update the server machine (where the company file is hosted) first, then update all client workstations.

- Post-Update Verification: Check the F2 Product Information screen on all computers to confirm the release number is identical.

5. Why is it important to end non-QuickBooks background applications, such as antivirus software, before installing an update?

Ending non-essential background applications, especially security software, is a crucial preparation step to prevent update failures due to file conflicts or interruptions.

- Reasons for Conflict:

- Antivirus Interference: Antivirus programs may flag the update’s installation files setup.exe or patch files) as suspicious and block them from modifying program folders, leading to a partial or failed installation.

- Resource Contention: Heavy-duty applications (like large sync clients or backup tools) consume significant system resources (CPU and memory), which can cause the QuickBooks installer to timeout or crash.

- Best Practice: Temporarily disable real-time protection on your antivirus/antimalware software and close all unnecessary applications before starting the qbupdate.exe process.

6. If my update fails, is it better to re-download the patch manually or use the QuickBooks Tool Hub?

The most efficient approach is to first re-download the update manually from within QuickBooks (using Help > Update QuickBooks Desktop > Get Updates). If that fails, then use the QuickBooks Tool Hub for a deeper fix.

- Manual Re-Download (First Step): This is the easiest fix, as it often clears a corrupted or interrupted download cache, allowing the installer to run correctly.

- QuickBooks Tool Hub (Second Step): The Tool Hub is designed to fix the underlying Windows components that often prevent installation, such as:

- Repairing basic program errors using Quick Fix My Program.

- Addressing critical dependencies like .NET Framework and MSXML using the Install Diagnostic Tool.

7. Besides fixing bugs, what critical non-feature benefit do QuickBooks updates provide that is mandatory for businesses?

The most critical mandatory benefit, often overlooked in favor of new features, is Regulatory and Tax Compliance.

- Mandatory Benefit: QuickBooks updates incorporate modifications to comply with the latest federal, state, and local tax laws and forms.

- Consequences of Skipping:

- Tax Penalties: Skipping an update means your payroll tax tables (if using QuickBooks Payroll) or sales tax calculations may be incorrect, leading to potential fines or penalties from tax authorities.

- Form Errors: Your software will be unable to generate the latest versions of required tax forms (e.g., W-2s, 1099s) if you do not install compliance updates.

Disclaimer: The information outlined above for “How to Update QuickBooks Desktop (Manual & Automatic Methods)” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.