Cash flow refers to the net change in cash, and cash equivalents moved in and out of a company.

Cash flow includes both cash inflows and outflows and their difference is stated as “net cash flow”, for a given accounting period.

Cash and cash equivalents are the most important metrics for startups as they measure how much money is coming in and how much is going out.

Cash equivalents are short-term investments that are highly liquid with a maturity period of 90 days or less, and lower risk can be converted into cash easily. Some of the examples of cash equivalents are treasury bills, banker’s acceptance, commercial paper, etc.

Cash flow is the crux of any business. Without proper cash flow management, businesses will not be able to pay bills, give salaries to their staff, or provide service to new customers.

Every startup runs out of cash in its early days and this all happens because of poor cash flow management. Startups need to have an experienced and robust startup for its financial management.

Why is cash flow such an important aspect of any startup venture?

Cash Flow is an important aspect of any startup because it control’s business financial health. If a startup company has adequate cash, the firm may cover basic expenses such as wages, taxation, and other costs.

Cash flow affects the short term liquidity of a business.

The key components of cash flow include:

- Expenses: These are expenditures for mandatory payments on behalf of an organization’s employees, rent, utilities, and other general expenses. Specifically, applying the concept of proper management lets me ensure all necessary expenses are paid.

- Profits: The second control tool is cash receipts, which are the monies flowing into the business through customers to ensure adequate revenues exist to meet the costs.

- Net Cash Flow: Net cash flow is a calculated measure obtained from cash received from and paid to other parties. If there is still some cash left at the end of the month after all expense payments are made, then this remaining lump sum can be used for some investment purposes or travel, charity, etc.

Understanding Cash Flow Statement

Cash Flow statement tracks the movement of cash and cash equivalents into and out of a startup.

Three areas of the company that generate cash:

- Operating Activities

The amount of money a startup makes or needs during its business operations is known as cash from operations. This comprises items that affect a startup’s cash flow in one way or another, such as accounts receivable and payable, accrued revenue and costs, deferred revenue, and tax liabilities.

- Investing Activities

Cash derived from investing activities includes any proceeds from the purchase or sale of long-term assets and other financial instruments. This includes making payments for mergers and acquisitions, as well as selling or purchasing real estate or equipment needed to produce a product.

- Financing Activities

Cash from financing operations might come from debt or venture capital financing. It’s the sum of the money you spend for whatever funding you

How do startups calculate Cash Flow?

There are three different ways to calculate startup cash flow:

- By adding up all costs incurred in a given year.

- By Subtracting expenses from revenue (gross profit) for each month of the year.

- By adding up all revenues received in a given year.

Calculating your startup’s cash flow is very important because it shows the cash you have at any given time, finds areas where you might be spending too much or not enough, and determines whether your company can survive or not.

Two methods of calculating Cash Flow:

- Direct Method

The direct method uses actual cash inflows and outflows to calculate cash changes over time. Receipts and payments are calculated to find the real amount of cash a startup has on hand at any given time.

- Indirect Method

The indirect method is based on accrual accounting, which records expenses as they happen, regardless of when money changes hands. To reconcile actual cash flows from your operating operations, you begin with net income (from the company’s income statement) and then add or deduct non-cash items. Items like depreciation, which reduces earnings but doesn’t deplete cash, increase cash flow.

How should a startup or a new business maintain cash flow?

Startups must determine how to keep some cash coming in because cash is usually the business’s life.

When a startup can control its working capital, it will perform well because it will struggle to pay the employees and other dues. Below are some of the tips for managing cash flow in your startup company:

- Learn what cash flow is and discover how to calculate it by studying both the money that is received and the money that is paid out, and always know the sources of cash inflows and outflows.

- Always focus on spending since the lower the expenses, the higher the possibility of a high profit.

- Always ensure your working capital is adequate for at least three months of expenditure.

- Taxes should be included in the calculations because they are often one of the largest expenditures, especially for young startups needing more earnings for fixed costs.

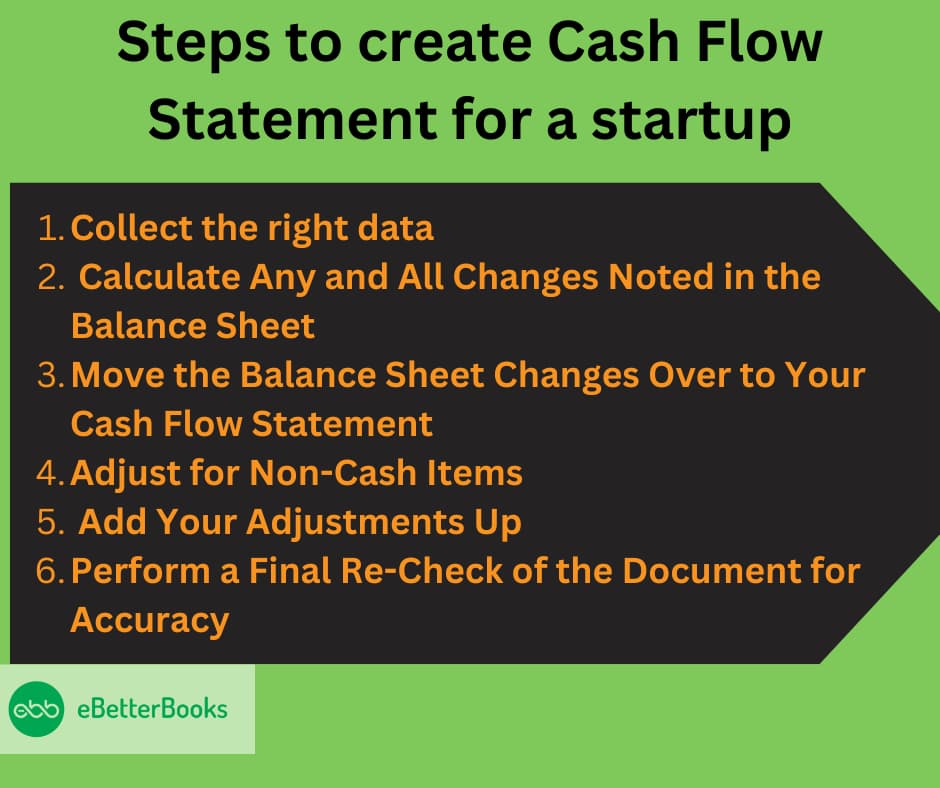

How to create a Cash Flow Statement for a startup?

Step 1: Collect the right data

The first step includes collecting all the required data and relevant documents in order to create the cash flow statement. Right date pertains to information related to cash from investing, financing, and daily operations of the business.

These include the following:

- Payments made to creditors and suppliers

- Cash paid for inventory

- Payment received from vendors and debtors

- Petty cash book

- Any marketable security bought or sold

- Record of money deposited or withdrawn from bank

- Cash paid in advance

- Cash received in advance

- Cash paid for investment

- Bank or cash transactions

- Cash and bank balance carried forward from previous accounting period

Step 2: Calculate Any and All Changes Noted in the Balance Sheet

Make sure to set up your starting and closing balance sheets with three distinct columns. The balance of this particular section at opening, the balance upon closing, and the balance sheet title will appear first, second, and third, respectively.

Each gain or loss will be totaled at the end, with a list under each column. This facilitates the process of observing the movement and evolution of cash from the beginning to the end of a spending period. Your total assets and total liabilities for the specified period will be the consequence of the additions and modifications made to each column.

Step 3: Move the Balance Sheet Changes Over to Your Cash Flow Statement

Now, use the previous period’s cash flow statement to use as a base for your current cash flow statement and also to copy over the titles of each caption.

You will likely still have identical expense items in the present quarter. If not, adding additional expenses or earnings to a few lines is simple. You will insert a row for each individual item as the difference for each change in cost.

Step 4: Adjust for Non-Cash Items

Determine the locations of non-cash transactions using your statement of total comprehensive income and the other documents mentioned in the first stage.

Regular non-cash transactions in a startup include the following:

- Expenses for depreciation

- Expenses involving recognition and income involving derecognition of older provisions

- Interest expenses and income

- Tax expenses

- Notable changes in reserves

- Foreign exchange differences

- Barter interactions

Make adjustments to the cash flow statement’s balance for each non-monetary transaction you identify. Every modification needs to be in its column.

Step 5: Add Your Adjustments Up

Once your adjustments have been submitted and your totals have been confirmed to be zero, it’s time to complete your cash flow statement. This is where the actual cash flow statement, represented by a fifth column, will be created.

Make line or horizontal totals in each item area. Add up the numbers in columns two through four to accomplish this. After your non-monetary things are included, the cash in the section’s balance sheet is the final result.

As a result, you will receive an accurate and suitable cash movement for those particular things.

Step 6: Perform a Final Re-Check of the Document for Accuracy

Verify that all of the figures are accurate. If you want to ensure the accuracy of your cash flow statement, it could be wise to collaborate with a financial advisor or another person.

incur and the money you receive from venture capital.

Free Template – Cash Flow Statement for Startup

| ( Company Name ) Cash Flow Statement | |||||

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Operating Cash Flow | |||||

| Net Earnings | xxx | xxx | xxx | xxx | xxx |

| Plus: Depreciation & Amortization | xxx | xxx | xxx | xxx | xxx |

| Less: Changes in Working Capital | xxx | xxx | xxx | xxx | xxx |

| Cash from Operations | xxx | xxx | xxx | xxx | xxx |

| Investing Cash Flow | |||||

| Investments in Property & Equipment | xxx | xxx | xxx | xxx | xxx |

| Cash from Investing | xxx | xxx | xxx | xxx | xxx |

| Financing Cash Flow | |||||

| Issuance (repayment) of debt | – | – | xxx | – | – |

| Issuance (repayment ) of equity | xxx | – | – | – | – |

| Cash from Financing | xxx | – | xxx | – | – |

| Net increase ( decrease ) in Cash | xxx | xxx | xxx | xxx | xxx |

| Opening Cash Balance | – | xxx | xxx | xxx | xxx |

| Closing Cash Balance | xxx | xxx | xxx | xxx | xxx |

Formulas on the Cash Flow Statement

The formula for calculating Operations = Net Income + Non-Cash Expenses – Changes in Working Capital = Net Cash Flow from Operating Activities

The formula for calculating Investing = Cash Inflows from Investing Activities – Cash Outflows from Investing Activities = Net Cash Flow from Investing Activities

The formula for calculating Financing = Cash Inflows from Financing Activities – Cash Outflows from Financing Activities = Net Cash Flow from Financing Activities

The formula for calculating Net cash flow = Net Cash Flow from Operating Activities + Net Cash Flow from Investing Activities + Net Cash Flow from Financing Activities = Net Increase/Decrease in Cash

What are your current income trends?

Your business in its early stage is most likely compromising on the cash flow statement by keeping track of your money with accrual accounting rather than cash basis accounting.

Accrual accounting is the process when you record income expenses after delivering a service rather than when the money is being actually transferred to your account.

Cash basis accounting makes sense of your cash flow only when the exchange of money happens and is then recorded in the books.

- Accrual Statements

Accrual accounting is good for your business as it offers insights into your profit and loss statements and provides an overview of the income of the business as a whole.

It defines the health of the startup. It tells you the movement of your money. Where it is coming from, how it is going to be spent, and what you will be left with in order to increase the revenue of your business. It will show you the cash flow analysis of the sales, how often you witness an increase/decrease for what amounts, giving an upper hand than merely looking into cash deposits.

Now, what the accrual process doesn’t tell you is the cash flow formula for a particular period of time. For instance, if you made $10000 last week, it will show you that the money has been made by you at the said time. But not the time when you are actually going to receive it because you didn’t. It will not show you the real value of your cash flow at the current time because the money has not been transferred into your account. Assuming that you made a sale of $10000 without the amount reflecting into your account can lead to major disastrous decisions for the finances of your company.

- Cash Basis Statements

Small businesses and startups should focus on this method of maintaining their cash reserves and cash flow management. It is a recommended process for such businesses who have just started or in the process of their growth. The cash flow statement will show you the real-time being spent, earned, and the amount left in your bank. It will show you the money you had in the beginning until a certain period of time such yearly, quarterly or monthly balances. The amount that you are left at the end of this period is what you actually have as a balance in the bank.

3 activities for a positive startup cash flow statements:

- Cash flow from investing activities determines the number of investments that you are making in the company related to growth. These are your noncurrent assets such as long term investments, property, plant, equipment, and the principal amount of loans made to other entities.

- Cash flow from financing activities is the amount of money that is invested in your company by others such as investors and bank loans that gets recorded. It includes the noncurrent liabilities and owner’s equity such as the principal amount of long term debt, stock sales and repurchases, and dividend payments.

- Cash flow from operating activities is the total amount of money that your startup/company has made during the course of its business operations. The amount of revenue generated and deriving the operational costs to keep the show running. It determines the net income of a business.

For a lot of startups, operating expenses are not a positive cash flow. You may end up spending more on the business assets and not have the same return on your investments. This leads to a burn rate and demotivates the success and profitability of your venture.

Understand your inflow and outflow of cash caters to good cash flow management. No matter how small your company is today, there are more moving financial parts than you can manage dynamically.

By maintaining a balance sheet and the above financial statements intact, your business will get a track of the current cash flow and the projected changes in the future.

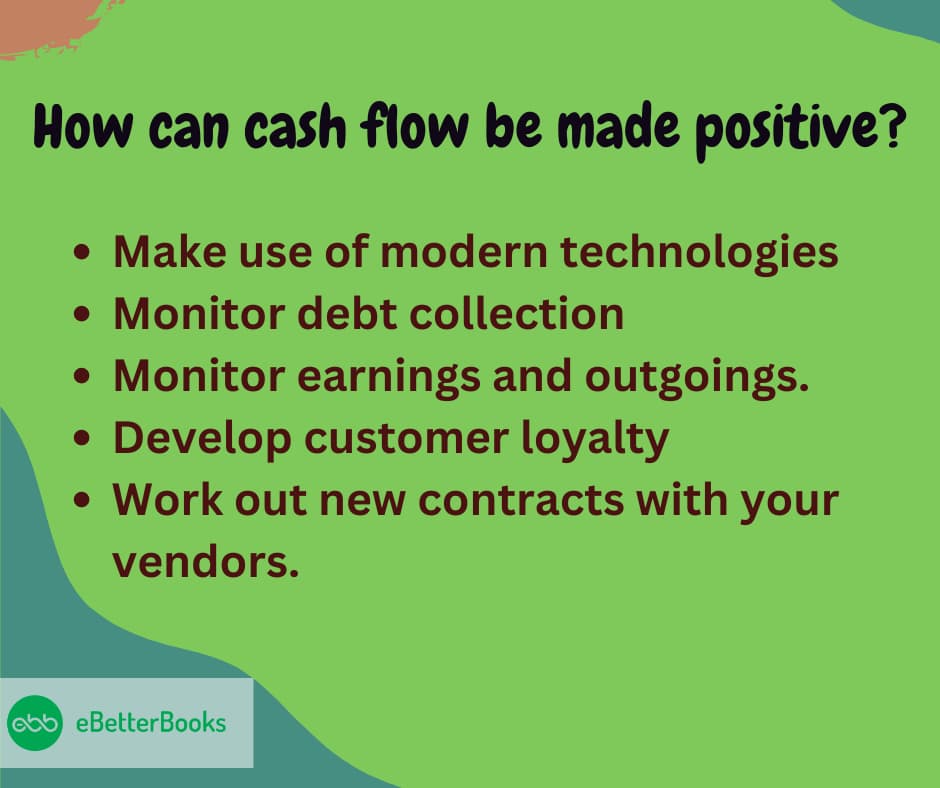

How can cash flow be made positive?

- Make use of modern technologies

This reduces expenses and streamlines procedures. There are different tools that can help simplify business cash flow management and automatically project receipts and payments.

- Monitor debt collection

Achieving an appropriate financial balance will be facilitated by adhering to the established timeframes for debt collection.

- Monitor earnings and outgoings.

Accounting inconsistencies in the company are prevented by adjusting business expenses. To know when costs need to be modified, cash flow forecasting is crucial.

- Develop customer loyalty

Businesses can create recurring revenue streams by creating loyalty initiatives.

- Work out new contracts with your vendors.

Reviewing supplier agreements gives the company the chance to negotiate better terms that will improve its cash flow.

Conclusion

Cash flow is an important indicator that reflects the net cash inflows and outflows over a specific period. It helps startup managers and potential investors understand a company’s ability to generate liquidity. This analysis not only provides insight into the current state of the business but also helps plan for future sustainability. By conducting a thorough cash flow analysis and forecast, a company can assess the potential for new investments, prepare for future cash shortages, and explore additional financing options.

How do you like the above Startup Cash Flow Tips? Please let us know by mailing to support@ebetterbooks.com