Tax filing professionals like CPAs, enrolled agents, tax attorneys, etc., should be well-versed in state and federal tax laws and regulations and must be updated with tax notifications from the IRS.

Tax filing professionals assist in filing tax returns, preparing documentation, refund filing, replying to IRS communications, resolving tax disputes, or advising on decisions that have tax implications.

Every business must file a tax return accurately. Understanding the provisions of the IRS tax code is key to avoiding fines and penalties. It can lead to significant savings for small businesses.

Different forms need to be filled in order to file a tax return, such as Forms W-2, Form 1099-NEC, Form SSA-1099, Form 1095-A, etc.

The tax filing process can be complex, with various forms to fill and numerous potential pitfalls. Even a small error, such as entering the wrong income amount for taxes, wrong dates, or negative values in the amount columns, can have significant consequences.

This is where a tax service provider can be a game-changer, navigating these complexities with ease. A tax accountant helps businesses to navigate the process easily.

Who are tax professionals?

Tax professionals are specially trained to prepare both business and individual tax returns. They offer tax accounting services to individuals, small businesses,

and identify ways to save clients money at tax time.

- Certified tax professional (CPA ) – They are the ones who are licensed by the state to practice public accounting. They are licensed professionals who have passed the examination administered by a state’s Board of Accountancy.

- Enrolled Agent – They are the ones who have earned the privilege of representing taxpayers before the Internal Revenue Service when it comes to audits, collections, and appeals.

- Licensed tax preparer – They have a PTIN ( Preparer tax identification number ) issued by the IRS. In exchange for a fee, they are allowed to prepare and sign a federal tax return.

- Tax Attorney – They are licensed by their state board and proficient in federal and state taxes. They work with taxpayers to interpret the tax code, resolve tax disputes, etc.

Why do you need a taxation professional?

- A taxation professional can easily audit your previous tax returns or refunds and check if any deductions were missed earlier.

- A tax professional helps save your time, as they are certified and know how to file the tax return, prepare documentation, and file refunds in less time. According to the Internal Revenue Service, the average tax return with deductions takes almost twenty hours to complete. Still, if you have a tax professional working on the same, the time to complete the filing is already reduced.

- Tax professionals are able to address concerns and provide answers. You may have inquiries concerning your income taxes or partnership firm taxes. You might have to wait on hold for hours if you call the IRS. Tax professionals can quickly answer the majority of issues.

- The tax code is incredibly intricate. Expert tax preparers stay on top of all those changes annually, saving you the trouble.

- A tax professional can help ensure your forms are done correctly and help minimize errors that could result in missed deductions, IRS letters, or audits.

- By hiring a tax professional, you open the door to potential savings. The amount you save by having your tax return prepared by a professional can easily be surpassed if your preparer discovers even one general business credit or deduction that you may have overlooked, sparking intrigue and motivation to explore this avenue.

- A professional tax preparer also knows how to handle the IRS if you are audited or if they start asking you questions that are difficult to answer.

Who should hire a tax professional?

If you are someone who thinks that filing a tax return is simple and you can do it accurately, then you don’t need any tax accounting professional to help you with your tax return.

Following are the cases where hiring a tax professional helps:

- Inadequate understanding of tax laws

- Replying to IRS communications

- Meeting a tax deadline

- Having multiple sources of income

- Filing payroll taxes

- To maintain accurate and updated tax records

- Preparing tax filing

- Sorting and filing forms

- Replying to an IRS audit requirement

- Conducting tax audits

Benefits of having a tax professional

- Resolve errors

- Increase refund amount

- Saves time and money

- Accuracy

- Tax saving strategy

- Representing the taxpayer to the IRS

- Replying to the notices and communication by the IRS

Kind of tax preparer – Credentials and Qualifications

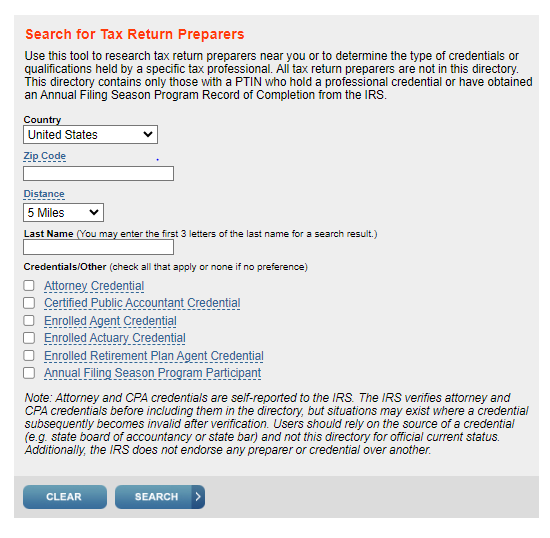

To know the credentials and qualifications, the Internal Revenue Service has a public directory containing certain tax professionals.

The public directory includes:

- Name of the tax preparer

- City

- State

- Zip code

- Valid PTIN

- Annual Filing Season Program Record of Completion Recipients

To properly prepare your tax return for payment, each of the individuals ( enrolled agents, certified public accountants, attorneys) needs to have a preparer tax identification number (PTIN) issued by the IRS. Make sure your preparer has one and adds it to the IRS return you filed.

Note: Select any tax return preparer carefully, as even those with PTINs who are not in the directory may offer excellent services for preparing tax returns. Always ask about their training and credentials.

How can I check or verify a tax preparer credential?

A client’s tax return can be prepared by anyone who has a Preparer Tax Identification Number (PTIN).

Every tax preparer has a different level of knowledge, training, and experience of tax return preparers. The searchable directory, which includes a list of local preparers who currently possess IRS-recognized professional credentials or an Annual Filing Season Program Record of Completion, is meant to assist you in making your decision.

As of June 17, 2024, the directory is up to date and is updated on a regular basis. The IRS may require up to four weeks to add or amend a tax return preparer’s information in the directory following receipt of an update.

Tips to select a tax preparer for small businesses

A tax professional should always be a member of a professional organization because most of them have rules for professional behavior, codes of ethics, and certification programs. Professional associations can be in a better position to put you in touch with a tax preparer whose qualifications and experience match your requirements.

Request a PTIN

The Internal Revenue Service requires a preparer tax identification number for anybody who prepares to submit federal tax returns for remuneration. Preparers with PTINs and professional credentials accepted by the IRS are included.

As required by the IRS, make sure your income tax preparer includes their PTIN number on your form.

Do background verification

Always verifying the preparer’s or company’s standing with the Better Business Bureau (BBB) is one approach to accomplish this. Depending on your preparer’s exact title, you can potentially delve further into their past:

- Enrolled agents: Send an email to epp@irs.gov to confirm the title.

- Certified Public Accountants: Check with the board of accountancy in your state or use the CPA Verify tool.

- Tax attorney: Speak with the bar organization in your state.

- Examine tax preparation costs. – Tax preparers either charge a flat fee for each form and schedule required for your return or a minimum fee plus additional expenses dependent on the complexity of your return.

- Verify that they will sign the document – Paid preparers are required by law to sign their clients’ returns and supply their PTINs.

Get Tax Filing Services – eBetterBooks

Get professional tax preparation services from eBetterBooks. They provide a wide range of business-specific tax services, such as tax administration, filing, and preparation. Their group of committed tax experts manages tax obligations, creates strategic income plans, and offers thorough analysis of earnings and income.

eBetterBooks uses cutting-edge financial technologies and work processes to streamline tax procedures, guaranteeing IRS compliance, and ongoing support. To handle taxes effectively and without worry.

Conclusion

Selecting the right tax service provider is an important choice. They can have a big impact on your financial health and compliance with tax laws. This procedure necessitates evaluating a number of crucial elements, such as the provider’s experience, standing, service offerings, and costs.

By carefully weighing these factors and conducting in-depth research, you may choose a provider who will meet your specific needs while also offering value and dependability. As a result, you can focus on other important areas of your personal or corporate finances, knowing that your tax matters or partnership firm tax matters are being handled expertly, giving you peace of mind.