C corp is taxed separately from its shareholders as per the IRS rules. It is not a pass through taxation. C Corp are liable for federal income tax, employment taxes, state taxes or other taxes.

What is a C Corp?

A C corporation is a legal entity in which the owners or shareholders are taxed separately from the entity under IRS rules.

It is considered as a separate legal entity from its owners or shareholders. This means that it can enter into contracts with, be sued, own assets and incur liabilities in its own name.

There is no limit to the total number of shareholders. C corporations offer unlimited growth potential through the stock sales. This attracts many wealthy investors.

Examples of C Corporation

- Walmart

- AT&T

- Coca-Cola

- Boeing

- Apple

- Johnson & Johnson

- Microsoft

- JPMorgan Chase

Why Do C Corporations Exist?

C corporation existence protects the owners from liabilities. As there is a lot of risk involved in dealing with goods and services in the marketplace, the tax code gives business owners the option to incorporate their business enterprise.

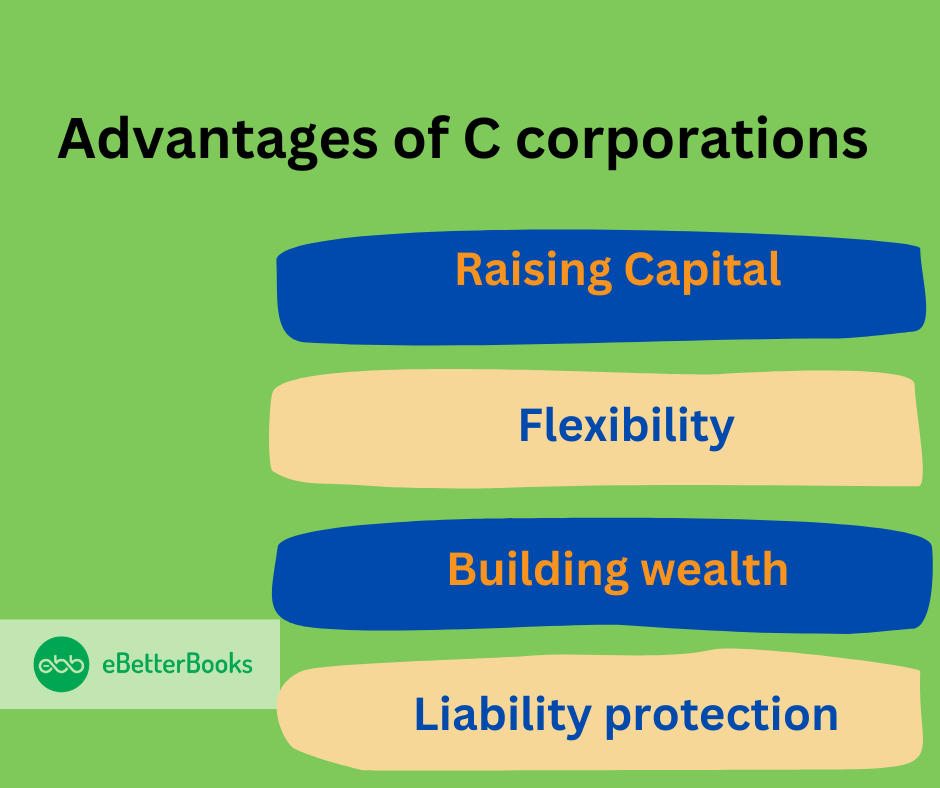

Advantages of C corporations

- Raising Capital: As C corporations attract many investors, this leads to a rise in business capital. This inflow of capital can lead to a substantial increase in business funds. The appeal to investors is enhanced by the limited liability protection, which provides a sense of security and encourages further investment.

- Flexibility: Foreign ownership is not limited because C corporations have unlimited owners and create multiple classes of stock.

- Building wealth: C corporations allow businesses to build wealth without drawing it down as personal income.

- Liability protection: It protects the personal assets of shareholders and owners from the business liabilities.

How Are C Corporations Taxed?

Federal employment taxes

In this, corporations with employees must withhold, deposit and pay employment taxes. Most of the corporations are required to fill the Form 941 on quarterly basis whereas corporations with employees need to fill the Form 940 annually by 31st January.

The taxes include the payroll tax, which further include the unemployment tax (FUTA), the employer and employee share of Social Security and Medicare tax (FICA), and income tax withholding.

Corporate-level income taxes

In this, the corporation must complete and fill Form 1120 to calculate the income subject to the flat corporate rate. The tax rate is 21%.

The due date for the Form 1120 depends upon the choice of calendar year. Generally, the due date for form 1120 and for the individual tax return is 15th April. But if the corporation chooses the fiscal year, then they must file Form 1120 by the 15th day of the fourth month following the last day of their tax year.

Tax Considerations

The US tax accounting system is based on the principle of voluntary reporting and self-assessment.

A corporate taxpayer is required to file Form 1120 an annual tax return by the 15th day of the fourth month following the close of the tax year. This timely filing is crucial to avoid penalties.

A taxpayer can obtain an additional six-month extension of time to file its tax return, but it’s important to remember that failure to file a return in a timely manner may result in penalties.

US corporate taxpayers are taxed annually, and they may choose a tax year other than the calendar year. This means that if your business operates on a fiscal year basis, you can align your tax year with your fiscal year. However, you need to get the approval of the IRS for this change.

New corporations may use a short tax year for their first tax period . A short tax year is a period of less than 12 months. This could be the case if your business was incorporated in the middle of the calendar year. Similarly, corporations may use a short tax year when changing the tax years.

C Corporation Tax Rates

The current tax on C corporations is 21%. C corporations are subject to double taxation. It means that the company will pay taxes on its profits, and if some or all of those profits are distributed as dividends to the shareholders. The shareholders will pay taxes on those dividend payments.

The current 21% corporate tax rate, coupled with the ability to deduct a range of company expenses, significantly maintains the financial advantages of C corporations, instilling a sense of security and confidence in business owners.

Forms filled by C corporations :

| IRS Form 1120 | It is used to report the tax deduction, gross income, and taxable profit. |

| Form 1099-DIV | It is used to report the amount of profit that is distributed to the shareholders. |

C Corporation Default Tax Treatment

C corporations are subject to double taxation. Double taxation occurs in two stages:

- The corporation pays income tax on its net profit.

- Shareholders are taxed when profits are paid to them as dividends.

C Corporation has the most allowable deductions of any business structure, such as:

- Wages

- Healthcare

- Retirement plans

- Employee training

- Vacation and sick pay

- Employee education

C Corporations can deduct a wide range of operational expenses, including leasing costs, license fees, subscriptions, professional fees, business permits, work vehicles, and insurance premiums. These deductions can significantly reduce the corporation’s taxable income, leading to potential tax savings.

C Corporations often enjoy the advantage of paying taxes at a lower federal income tax rate compared to individual income tax rates of Sole Proprietorships and Partnerships. This financial benefit makes the C Corporation structure a preferred choice for business owners who plan to reinvest their earnings, thereby saving significantly on federal income taxes.

Double Taxation in C Corporation

One of the biggest disadvantages of C corporations is double taxation.

There are two levels of taxation: corporate income tax and shareholder dividend taxes.

First, the company pays the taxes on its annual profit and then the company pays its dividends to shareholders. The shareholders then pay the tax.

Hire Tax Filing Services for a C Corporation

Get professional tax preparation services from eBetterBooks. They provide a comprehensive range of business-specific tax services, including tax administration, filing, and preparation. Their dedicated tax experts not only manage tax obligations but also create strategic income plans, offering a thorough analysis of earnings and income.

eBetterBooks leverages cutting-edge financial technologies and work processes to streamline tax procedures, ensuring IRS compliance and providing ongoing support. Rest assured, your taxes are handled effectively and without worry.

Conclusion

C companies get a lot of benefits in terms of development potential, liability protection, and capital raising.

C corporations can efficiently manage their tax responsibilities while optimizing their financial and operational capabilities by complying with IRS regulations for timely filing and comprehending the subtleties of corporate income taxes, federal employment taxes, and tax planning methods and strategies.