In tax accounting, accurately recognizing and classifying expenses is crucial to maintaining regulatory compliance and optimizing deductions when relevant. Every small business owner, self–employed person, or gig worker should know the difference between business expenses and personal expenses.

The income statement should be made after knowing which expenses belong to the business. Recording business expenses leads to lower taxable income and reduces the amount of tax you owe.

What is Business Expense?

Business expenses refer to those expenses that are incurred as a part of the business’s operations.

Business expenses are the costs incurred during the business’s day-to-day operation, such as space rent, personnel wages, and equipment expenditures.

Section 162 of the Internal Revenue Code allows businesses to record any ordinary and necessary expenses.

Ordinary means the expense must be common in your industry, whereas Necessary means the expense must benefit your business.

Business expenses, such as certain legal fees, equipment rentals, employee education and training expenses, and advertising and marketing, are tax-deductible.

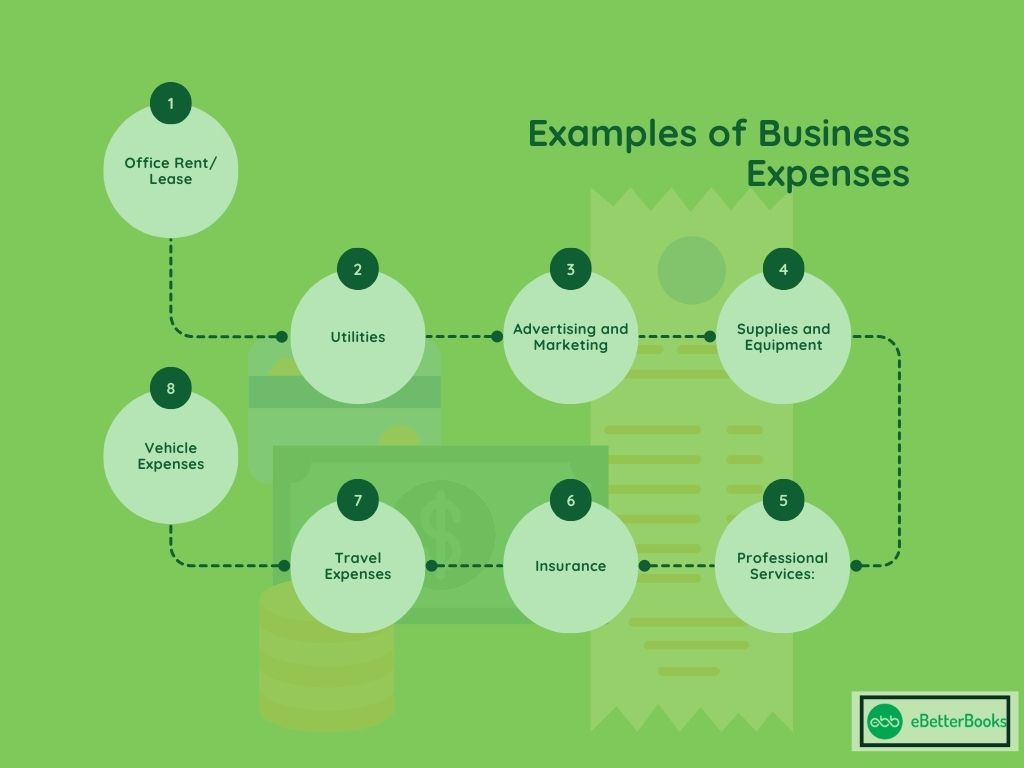

Examples of Business Expenses

Here are common examples of business expenses:

- Office Rent/Lease: The cost incurred in renting or leasing an office space that one’s business needs.

- Utilities: Any utility used in running the business, such as power, water, internet, and phone bills.

- Advertising and Marketing: Expenses made towards advertising your business through online platforms, social media platforms, or events.

- Supplies and Equipment: This includes office supplies, spare machinery, computers, and tools necessary for the business’s operation, among other things.

- Professional Services: These are expenses paid to persons other than employees, such as consultants, accountants, lawyers, and all other service providers.

- Insurance: Compensation for insurance paid with respect to the business, such as liability insurance, health insurance for the employees, or property insurance, among others.

- Travel Expenses: Expenses such as travel and accommodation, meals, and transport costs incurred in business trips.

- Vehicle Expenses: Expenses incurred in the course of carrying out business for business purposes, such as vehicles, maintenance, fuel, and leasing charges.

What is Personal Expense?

Personal expenses refer to those expenses that are not related to the business and are entirely for personal use.

Personal expenses are the costs associated with meeting one’s requirements, such as groceries, mortgage payments, or personal auto upkeep.

Personal expenses are not tax-deductible, such as car payments, home office expenses, or meals and entertainment.

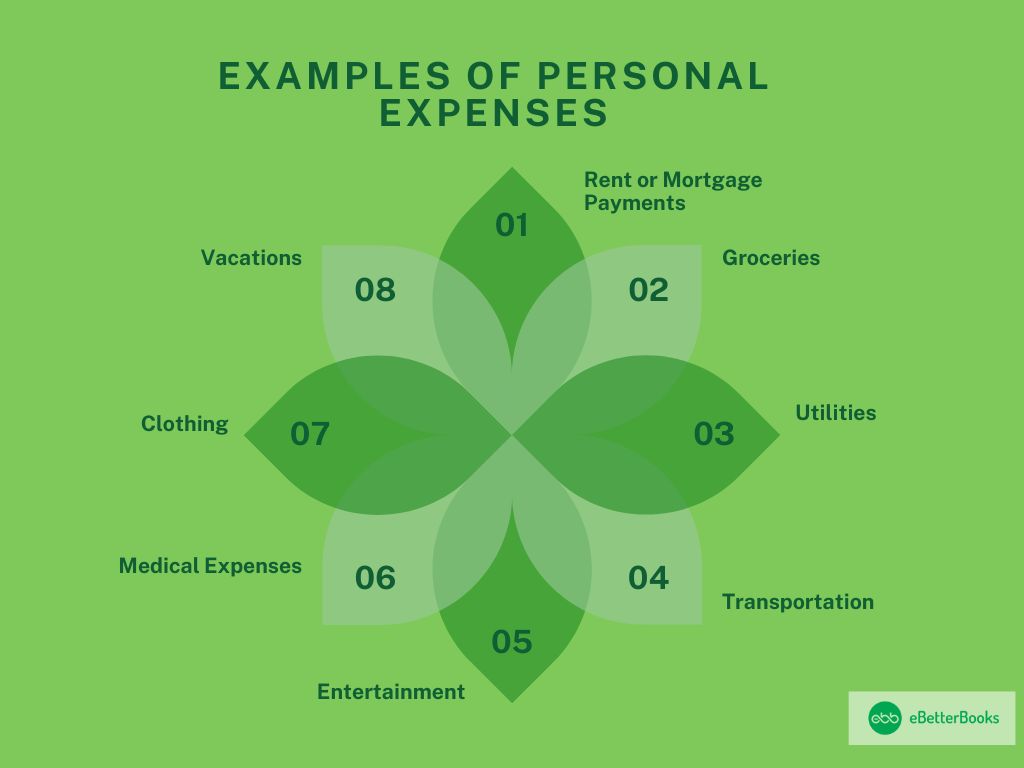

Examples of Personal Expenses

Here are some common examples of personal expenses:

- Rent or Mortgage Payments: These payments are for your house or an apartment you are leasing.

- Groceries: Groceries and liquefied items can be categorized as consumables and used in houses by individuals.

- Utilities: For household use, expenses such as electricity, water, internet, and phone bills are included.

- Transportation: Gas, car, bus, or taxi for short private and business travels.

- Entertainment: Expenses such as theater, restaurants, concerts, and all streaming services.

- Medical Expenses: Doctor’s visits, prescriptions, and other health-related costs that are paid directly by the patient as a cost bearer.

- Clothing: Everyday essentials, such as apparel, handbags, and cosmetics, are commonly acquired from stores or the local market.

- Vacations: Expenses incurred while on a personal trip, such as transport, accommodation, and other miscellaneous expenditures.

Business Expense vs Personal Expense

Below is the difference in tabular form:

| Basis | Business Expenses | Personal Expenses |

| Purpose | Directly related to business operations and revenue generation | Related to maintaining personal lifestyle and well-being |

| Tax Deductibility | Generally tax-deductible | Not tax-deductible |

| Record Keeping | It requires detailed documentation like receipts, invoices, etc., for taxes. | There is no requirement for a tax deduction, but it is useful for budgeting. |

| Regulatory Requirement | Required for accurate business financial reporting | There is no regulatory requirement; it is purely personal tracking. |

IRS Guidelines

IRS gives clear-cut guidelines to enable the difference between business and personal expenses.

Below are the key IRS principles:

- Ordinary or Necessary Expenses: According to the IRS, for an expense to qualify as a business expense, it must be.

- Ordinary: Business or trade customary or considered normal and OK.

- Necessary: Useful and relevant for your type of business, but it doesn’t have to be crucial.

- Deductions and Classifications: Ordinary and necessary are the two key requirements that a business must meet in order to deduct most of its expenses.

Common deductible business expenses include:

- Payment toward monthly or annual fee for the business to use a property belonging to another party.

- Payroll for the employees includes wages for the labor, salary for the employees, etc.

- Stationery and other materials used in running a business or an organization,

- Tangible expenses include advertising and marketing expenses.

- Most expenses are linked to travel and accommodation associated with business, food, and fare.

Economic Justification: The IRS continues to remind the public that the law does not allow for the use of owned property for personal purposes to be claimed on tax returns.

Some specific distinctions include:

- Personal and Business Vehicle Use: If a car is used for business as well as personal use, only the business use of the car (like fuel, maintenance, etc.) is allowed. The DCF and SPU have different uses, and therefore, accurate record-keeping is essential to isolate these uses.

- Home Office Deductions: However, if part of your home is used for business purposes only and frequently, then it may be allowed, but if part of the house is used for business and personal use, then it is not.

- Travel: General travel expenses are not allowed, but incidental business expenses are. Trips taken as family holidays or partly for business and partly for holidays are only allowable if the main purpose of the trip is business.

- Meals: Business meals are as low as 50% tax deductible, while personal meals or even entertainment are not allowed.

Commingling Funds: According to the IRS, business and personal funds must not be mixed. The blurring of an owner’s business and personal expenditures complicates record keeping for business expenditures and winds up attracting audits. It is advisable to maintain business and personal accounts as well as cards so that the two work independently of each other.

Mixed-Use Expenses: Some expenses may involve some level of mixed-use, either partly or wholly, between personal and business expenses, such as car or home expenditures. The IRS needs a clear documentation procedure and a rational technique for apportioning the business part of the expenses. For example, Cell Phone: A phone used for personal and business calls, only the business part must be computed, and only that part can be claimed.

The IRS always insists that only expenses that can be linked to the business and its operations should be claimed under business expenses. It would lead to penalties or audits if the expenses incurred are considered personal expenses, and then they are eligible for consideration under the personal expenditure account. For further information about this topic, kindly read the IRS Publication 535 (Business Expenses) or see a tax accountant.

Allocation based on Business Types

- Sole-Proprietorship: Independent contractors deduct costs based on the percentage of business usage. For instance, a home office or a car could be used partly for work purposes, and they should divide the general cost for the deduction. It is only allowable to deduct the business portions of a mixed cost.

- S Corporation: S corporations permit the sharing of expenses by way of reimbursement. Business expenses such as home office or vehicle use can be reimbursable to the employee shareholders under an accountable plan. These reimbursements do not attract tax, and the corporation can fully deduct business-related expenses.

- C Corporation: C corporations can fully deduct business expenses from their income. Costs incurred by employees, for example, traveling or using the company vehicle, are usually recoverable. The corporation itself can deduct expenses related to its business, such as supplies, electricity, rent, or even the employee’s welfare, without having to allocate them for personal use.

Separating business expenses and personal expenses

It is very important to keep separate accounts for your business and personal expenses. Recording taxes becomes easy if the expenses are already recorded separately.

Every business owner should use a business bank account and credit card for all business expenses. This helps maintain clarity while recording the transactions.

If you are confused about which expense should be recorded in:

1. Healthcare

Employers who provide group health insurance to their staff members may deduct the cost of qualified medical services from their taxes. Small businesses need to insure more people in order to be eligible for group coverage.

The Health Insurance Deduction, which allows self-employed individuals to write off the expense of qualified health plans for themselves and their families, is supported by the IRS.

2. Vehicle Expenses

Travel expenses are handled differently than vehicle travel. When you use your car for work, you can write off a percentage of the cost. This covers tires, oil and gas changes, depreciation or lease payments, maintenance, tune-ups, insurance, and registration costs.

The mileage incurred for work and personal purposes must be separately computed, and journeys from your residence to your place of business cannot be claimed as business-related mileage. There are two methods for allocating company expenses based on mileage.

You have two options:

- Break down the cost of each car according to the business miles driven

- Make things easier by calculating your annual vehicle business expense deductions using the normal mileage rate.

3. Home business costs

When someone uses a portion of their house as an office, they incur home business expenses. When you utilize the business portion of your house completely and frequently for your trade, you can deduct your home office. You can also use a separate building that isn’t a part of your house as your home office.

A portion of your mortgage interest, utilities, insurance, maintenance, and depreciation may be deductible as business expenses.

4. Hobbies

The IRS has established its hobby loss rules in IRC Section 183, which are designed to stop taxpayers from claiming business losses for activities that are primarily recreational and nonprofit.

If the IRS considers your hobby as a primary recreational activity, then the income it generates is taxable. However, if the IRS considers your hobby a business, the net loss would be deductible against other income, similar to any other net business loss.

Examples of Separating Expenses

Below are a few examples that will help you understand why it is important to separate business and personal expenses:

Cards & Accounts

- Business: To facilitate orderly management of all company transactions, it is recommended that a business bank account and a business credit card be opened.

- Example: Charging office rent or buying office stationery or other consumables through a business credit card.

- Personal: Keep the personal account for those purchases unrelated to business.

- Example: Such things as paying for a gym membership or for groceries.

Travel Expenses

- Business: Travel for business purposes and make airline bookings, hotel reservations, and meal bookings, all using the business account.

- Example: For example, you may want to meet with a client in another city.

- Personal: Book any vacations or family trips and take them with your own money and from your pocket.

- Example: Planning for one or two days off with your family.

Phone and Internet Bills

- Business: If you use it for work, divide the expense or get a different work number line.

- Example: You make 70% of calls to your clients; therefore, it is only reasonable to claim 70% for business use.

- Personal: Pay for the part that was utilized on calls besides business or entertainment, such as watching movies.

Workspace Expenses

- Business: If you work from home or from a residence, determine the percentage of rent and utility bills attributable to the workspace.

- Example: One-fifth of the home is used as an office working station; allow only 20 percent of rent as working expenses.

- Personal: The rest of the rent and utilities are considered to be incidental expenses.

How to Identify the Type of Expense?

To Identify whether an expense is business or personal, consider the following key factors:

- Purpose: A cost is the business cost if it is in direct proportion to the generation of business revenues or performance of business activities. If it benefits your physical self or your way of life, then it’s a personal expense.

- Context of Use: Find out how the particular item or service is being utilized. For instance, a computer used for work purposes only is considered an organizational expense. In contrast, a personal computer or laptop used mostly for purposes other than work is a personal expense.

- Benefit to the Business: For this discussion, business expenses are any expenditure that is useful in the business—office supplies, employee wages, etc. If it directly impacts you individually (such as groceries and entertainment), it is a personal expense.

- Tax Destructibility: There is a wide difference between business and personal expenses. For instance, while business expenses are allowable for deduction, personal ones are not. Any expense that allows you to reduce your taxable income falls under business expenses.

- Record Keeping: This means that all business expenses should have some form of documentation, such as a receipt or invoice, for accounting and tax purposes.

By assessing these factors, you can mark up your expenses, which in turn helps you group your expenses into the right categories.

Additional Tips for Better Management

Here are some additional tips for better management of business and personal expenses:

- Separate Accounts: Always segregate business and personal finance to keep a record of transactions easily and competently.

- Use Accounting Software: Accounting software like QuickBooks or FreshBooks can be used to improve financial control by enabling better, easier categorization and reporting of expenses.

- Regularly Review Expenses: Conduct periodic checkups of expenditures, both business and individual, to outline some of the ways in which content expenses could be trimmed down.

- Maintain Accurate Records: Properly record all receipts, invoices, bills, or other documents pertaining to business expenses to record all the actual spent amounts, which would be useful while preparing tax returns.

- Set Budgets: Settle the right budget plans for personal and business expenditures to work appropriately and avoid overspending.

- Utilize Expense Tracking Apps: You can employ monetization apps or simple tools that help capture and classify expenses made on a mobile device.

- Monitor Cash Flow: The prospect of getting into trouble should be monitored keenly to avoid problems related to financial propriety and failure and risks related to future costs and liabilities,

- Tax Deductions: Be aware of the business expenses that are allowable deductions so that they may claim every possible deduction in order to increase the client’s tax payers spare or non-taxable income.

- Plan for Irregular Expenses: Learn to always expect irregular expenses, such as tax, insurance, or car maintenance, by setting aside some cash to meet them.

- Consult a Financial Advisor: Since we are discussing expenses, one could seek the professional help of a financial advisor or an accountant on how to plan the best ways to manage one’s expenditures and plan on issues related to taxation, among other things.

Conclusion

It is relevant to separate the business and personal expenses to ensure proper appropriation of monies and tax compliance. Business expenses, on the other hand, are costs incurred to generate sales, while on the other end, personal expenses are costs incurred for personal benefits. Consequently, proper classification of expenses optimizes deductions, whereas wrong reporting is unfavourable.

Some of the approaches include keeping expense accounts separate, conducting frequent evaluations, and use of other tools in accounting. Knowing these differences helps in responsible borrowing and thus in the success and economic stability of the people and establishments of the society.

FAQs!

Can I use my business for personal expenses?

No, because it causes tax and legal problems and puts a business in a situation where it may be audited. Always keep them separate.

How do you separate business and personal expenses?

Follow the steps below:

- Maintain a business and a personal account,

- Keep both business and personal credit cards separate,

- Keep the accounting separate as well.

This is true for tracked shared expenses such as home office or rent. Divide them equally according to the respective proportion.

Why is it important to separate personal and business?

It helps to file correct taxes, not end up in legal trouble, manage finances easily, and safeguard properties.

How do I know if my bank account is personal or business?

A business account is one that is opened under the name of a business and is used for only business transactions. A personal account is an account that is opened by one person for their near-exclusive use.