Retirement planning is an important part of financial security, not only for business owners but also for their employees. The best method to save for the future while dealing with tax obligations is through retirement contributions. Retirement contributions enable people to save money in tax-deferred accounts, which helps ensure financial security during retirement while gaining substantial tax benefits.

For entrepreneurs, providing a retirement plan not only allows them to save for themselves but also increases employee satisfaction, lowers turnover, and offers significant tax deductions. This article discusses the idea of retirement contributions, the advantages of providing a retirement plan, and how these contributions are an important tax deduction resource.

What is a Retirement Contribution?

Employees, together with their employers, save funds into qualified retirement plans that are considered retirement contributions. People save retirement funds that multiply through time with investment income while securing their financial stability during retirement years. The central goal of retirement fund contributions exists to ensure senior citizens maintain their existing standard of living in retirement.

Business owners need to select from various retirement plans according to the size of their business structure and individual retirement goals, as well as employee requirements. Business owners have access to four retirement plan types, which include 401(k) plans, Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, and defined benefit plans. The decision to retire depends on its contribution limits, tax benefits, and administrative needs.

Two primary forms of retirement contributions exist:

- Employer Contribution: Organizations can provide retirement plan contributions to their workers through their compensation packages. Employer plans differ regarding employee contribution requirements because some force matching actions against employee deposits while others let employers make optional payments.

- Employee Contribution: The retirement savings plan accepts employee financial contributions that reduce taxable income because they are made before taxes apply.

There are two main tax-treatment categories for retirement contribution funds:

- Traditional Contributions: Traditional Contributors make payments using untaxed funds, thereby diminishing their tax base during the year of contribution. The tax deferment of retirement funds starts when the money needs to be withdrawn during retirement.

- Roth Contribution: It is possible to contribute money through Roth accounts, which use after-tax income to get tax-free retirement withdrawals whenever specified conditions apply.

Why Offer a Retirement Plan?

Providing retirement plans presents two-fold benefits to business entrepreneurs since it helps them save for their future while simultaneously strengthening their business tactics. An appropriately designed retirement plan delivers aligned advantages, including tax benefits and worker retention, which lead to business expansion.

Tax Advantages

A retirement plan allows employers to obtain substantial tax benefits, which represent a major business incentive for establishing such a program. The contributions employers make toward employee retirement funds become tax-deductible for companies. Contributions into qualified retirement accounts can accumulate tax-deferred until withdrawals, which will result in compound growth of earnings.

Employee Retention and Recruitment

High-performing employees remain loyal, and new talented candidates seek employment because of business retirement plans and competitive benefit packages. Workers seek financial protection, so businesses offering retirement plans tend to maintain dedicated staff. Businesses that provide retirement plans demonstrate employee welfare concern, resulting in pleased workers who stay with the company.

Personal Retirement Security for Business Owners

Business owners routinely reinvest profits into their business operations rather than establish investments for their financial security beyond the business. A disciplined retirement plan provides business owners with savings mechanisms that help them reach their retirement goals while obtaining tax advantages. Small business owners can maximize their retirement funds using SEP IRAs and Solo 401(k)s because these plans extend their savings potential.

Competitive Edge in the Market

Internal retirement benefits make small businesses more attractive on the job market when compared to organizations without these benefits. Most candidates view organizations with beneficial retirement options when they consider potential employment opportunities. Such employee retirement benefit schemes enable organizations to be favored choices for potential candidates in the workforce.

Lower Payroll Taxes

Several retirement arrangements such as SIMPLE IRAs and 401(k)s enable staff members to deduct their contributions from their taxable income before taxes. The reduction in payrolled taxes affects both employee and employer. Employers get tax credits from the government, which they can use to pay for expenses when establishing new retirement plans.

Role of Retirement Contribution in Tax Deduction

Business owners need to make retirement contributions because they function as a strategy to decrease their tax expenses. Business owners benefit from retirement plan contributions because the funds let them decrease their taxable income and create safeguarded financial security for both themselves and their worker pool.

- Reducing Taxable Income: Retirement plan payments qualify for tax deductions, which allows businesses to reduce their taxable income through these deductions before performing tax calculations. Significant tax reduction occurs because retirement plan contributions minimize the overall taxable income amount. A traditional SEP IRA investment of $50,000 from a business owner reduces their taxable income, thus lowering taxation on their payments.

- Tax-Deferred Growth: Contributions invested for retirement grow tax-deferred, meaning all investment profits stay untaxed until funds are withdrawn. An accumulation of funds grows more efficiently through time because reinvested gains remain untaxed during the period. Business owners benefit through increased retirement savings because of tax-advantaged accumulation mechanisms.

- Employer Contribution Deductions: Employer payments made to retirement schemes reduce business costs, which the company can use for tax deductions. The tax benefit applies to all major plans, including 401(k)s, SEP IRAs, and defined benefit plans. The tax deductions enable business owners to pay less in taxes, thereby enabling them to both decrease their income subject to taxation and enhance employee benefits.

- Tax Credits for Small Businesses: The government offers tax credits to businesses as an incentive for them to establish retirement plans and maintain their programs. The setup of new retirement plans by businesses with 100 employees or less entitles them to yearly tax credits reaching up to $5,000 during their initial three years.

- Roth Contributions for Tax-Free Withdrawals: The major difference between traditional retirement contributions and Roth contributions is that the former offers tax benefits when deposits happen, whereas the latter provides tax benefits for withdrawals at a later time. Later high-income brackets should be anticipated by business owners who choose Roth contributions because withdrawals in retirement will be tax-free. The retirement savings strategy enables taxpayers to keep more money while managing their tax liability for later years.

- Reducing Self-Employment Taxes: Deposits in retirement plans help those who operate their businesses decrease their self-employment tax obligations. Business owners who operate as self-employed individuals can minimize their self-employment taxable amounts through contributions made to Solo 401(k) and SEP IRA plans.

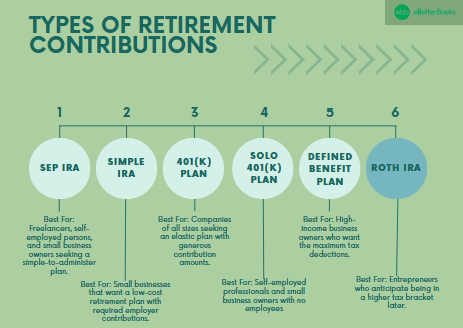

Types of Retirement Contributions

An owner of a business has the option to fund various retirement plans that carry distinct distribution structures and related tax benefits.

Simplified Employee Pension (SEP) IRA

Small businesses, together with self-employed individuals, can use SEP IRA as their retirement plan. Employers using this plan receive permission to make deductible retirement payments toward their staff members and their accounts.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| The setup of new retirement plans by businesses with 100 employees or less entitles them to yearly tax credits reaching up to $5,000 during their initial three years. | Contributions are deductible, and the investments grow on a tax-deferred basis. | Freelancers, self-employed persons, and small business owners seeking a simple-to-administer plan. |

Savings Incentive Match Plan for Employees (SIMPLE) IRA

SIMPLE IRA is meant for small businesses with up to 100 employees. Both employer and employee contributions are allowed, which makes it a viable choice for businesses looking to offer retirement benefits.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| The employee contributes via salary deferrals, and the employer is required to match employee contributions or make non-elective contributions. | Employer contributions are tax-deductible, and employee contributions are pre-tax, lowering taxable income. | Small businesses that want a low-cost retirement plan with required employer contributions. |

401(k) Plan

A 401(k) is a common retirement plan in which employees can contribute a portion of their pay on a pre-tax or after-tax (Roth) basis. Employers can also elect to match employee contributions.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| Participants contribute from payroll deductions, and employers can provide matching contributions. | Contributions made under a Traditional 401(k) decrease taxable income, and Roth 401(k) contributions grow tax-deferred. | Companies of all sizes seeking an elastic plan with generous contribution amounts. |

Solo 401(k) Plan

A Solo 401(k) is used for self-employed workers or small business owners without any employees (with the exception of a spouse). It supports more contribution opportunities than other plans.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| Business owners may contribute as employees (salary deferral) and employers (profit-sharing). | Contributions are deductible, and investment returns accumulate tax-deferred. Roth Solo 401(k) features enable tax-free retirement withdrawals. | Self-employed professionals and small business owners with no employees. |

Defined Benefit Plan

A Defined Benefit Plan is a retirement plan that offers a fixed amount at retirement. Employers make contributions according to a formula that takes into account salary and length of service.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| Contributions are actuarially determined to pay for future retirement benefits. | Contributions by employers are tax-deductible, and investment earnings are tax-deferred. | High-income business owners who want the maximum tax deductions. |

Roth IRA

A Roth IRA is a type of individual retirement account in which contributions are invested with after-tax dollars but withdrawn tax-free during retirement. Roth IRAs are different from traditional IRAs because they don’t offer a tax deduction today.

| Contribution Structure | Tax Benefits | Best For |

|---|---|---|

| Individuals, not employers, fund the plan. | No tax deduction is allowed for contributions, but in retirement, the withdrawals are tax-free. | Entrepreneurs who anticipate being in a higher tax bracket later. |

Comparison Table: Pros & Cons

| Plan Type | Contribution Limits (2024) | Tax Benefits | Best For | Pros | Cons |

|---|---|---|---|---|---|

| SEP IRA | Up to 25% of compensation or $69,000. | Employer contributions are tax-deductible; investments grow tax-deferred. | Self-employed individuals, freelancers, and small business owners want a simple plan. | Easy to set up and administerHigh contribution limitTax-deductible employer contributions | No employee contributionsThe employer must contribute equally to all employees |

| SIMPLE IRA | Employee: $16,000; Catch-up (50+): $3,500. | Employer contributions are tax-deductible; employee contributions reduce taxable income. | Small businesses seeking a low-cost plan with mandatory employer contributions. | Employer contributions are required, helping employees saveLower cost and less administration than a 401(k) | Lower contribution limits than a 401(k)Mandatory employer contributions |

| 401(k) Plan | Employee: $23,000; Catch-up (50+): $7,500. Employer match varies. | Traditional 401(k) reduces taxable income; Roth 401(k): Tax-free withdrawals in retirement. | Businesses of all sizes wanting a flexible plan with high contribution limits. | High contribution limitsEmployer match incentivizes savingThe Roth option allows tax-free withdrawals | More administrative complexity and costsSubject to annual compliance testing |

| Solo 401(k) Plan | Up to $69,000 total contributions ($76,500 with catch-up). | Contributions are tax-deductible; investment growth is tax-deferred. The Roth option allows tax-free withdrawals. | Self-employed individuals or business owners with no employees (except a spouse). | Allows high contributionsFlexibility of pre-tax or Roth contributionsNo non-discrimination testing | Only available for businesses with no employees (except a spouse)More administrative work than a SEP IRA |

| Defined Benefit Plan | Varies based on actuarial calculations, often exceeding $100,000. | Employer contributions are tax-deductible; investment earnings grow tax-deferred. | High-income business owners seeking maximum tax deductions. | Extremely high contribution limitsPredictable retirement benefitSignificant tax advantages | Expensive to maintainRequires actuarial calculationsLess flexibility in contribution amounts |

| Roth IRA | $7,000; Catch-up (50+): $1,000. Income limits apply for eligibility. | No tax deduction on contributions, but tax-free withdrawals in retirement. | Entrepreneurs expecting to be in a higher tax bracket later. | Tax-free withdrawals in retirementNo required minimum distributions (RMDs) | Lower contribution limitsIncome limits restrict eligibility |

Tax Status

Tax regulations regarding retirement fund contributions depend specifically on what plan type a person selects. Business owners must understand these different retirement contribution tax rules in order to achieve maximum tax savings.

Pre-Tax Contributions (Traditional Accounts)

- Before taxes, the contributions are removed from income, which minimizes the amount taxed.

- Investment returns compound tax-deferred.

- All retirement benefits receive customary tax treatment as standard income at the time of payout.

- Applicable to Traditional 401(k), SEP IRA, SIMPLE IRA, and Defined Benefit Plans.

After-Tax Contributions (Roth Accounts)

- After-tax income is used to make contributions, while the initial tax benefit does not apply during this transaction.

- Investment gains accumulate tax-free.

- A person can make tax-free withdrawals during retirement under specific provisions.

- Applicable to Roth 401(k) and Roth IRA.

Employer Contributions

- The tax law permits employers to deduct business expenses that include their contributions.

- Employer contributions to plans, including Roth accounts, become taxable for employees at withdrawal only.

- All other plans except Roth have no taxes on this benefit until funds are withdrawn.

- Applicable to 401(k), SIMPLE IRA, and Defined Benefit Plans.

Limits of Retirement Contribution Plans

The Internal Revenue Service controls all retirement plan contribution thresholds that undergo periodic modifications to account for inflationary trends. The penalties and additional tax burden are applicable when contribution amounts exceed these specified guidelines.

Contribution Limits 2024

- 401(k) & Solo 401(k): Employees are eligible to contribute $23,500 and an extra $7,500 catch-up contribution if they are 50 years or above.

- SEP IRA: Employers can contribute a maximum of 25% of an employee’s income or $70,000, whichever is less.

- SIMPLE IRA: The employee contributions are capped at $16,500, with a $3,500 catch-up contribution for participants 50 or older.

- Defined Benefit Plan: Contribution amounts are determined on an actuarial basis, sometimes more than $280,000 per year for high earners.

- Roth IRA: Contributions are limited to $7,000, with an additional $1,000 catch-up contribution for those 50 and older. Income limits.

Tax Deduction Limits

Employers who contribute to retirement plans can use those funds as complete business expenses. The deduction limits that self-employed people can take depend on their net earnings amount. The Roth IRA contribution opportunities for individuals with high incomes end due to phase-out restrictions.

Withdrawal Rules & Penalties

Big penalties await those who make early withdrawals between birth and age 59 1/2, owing both a tax charge and a 10% penalty for the earnings portion.

People need to withdraw Required Minimum Distributions from Traditional IRAs and 401(k)s and Defined Benefit Plans starting at age 73. Roth IRAs lack the minimum distribution rules required to provide users with total control over their long-term investment strategy.

Conclusion

For entrepreneurs, retirement contributions play a vital role since these assets provide both income tax relief and extended growth of their financial wealth. The selection of suitable retirement plans by an entrepreneur enables income tax reduction and useful employee benefits plus future security.

Business owners gain better retirement security through an advanced understanding of different retirement plan types and the related tax regulations and contribution maximums. Business owners must select between 401(k), SEP IRA, SIMPLE IRA, and Defined Benefit Plan before tailoring their strategy to match their objectives as well as organizational structure and workforce requirements. Strategic investments into retirement funds help entrepreneurs both secure future finances and claim maximum tax benefits at the present time.