What Are Carryforward Deductions?

According to IRS provisions, Carryforward deductions are the portion of net operating losses that can be offset from the future tax liability of the businesses.

Carryforward deductions are the tax benefits that stay unused in the current year before getting carried into future taxation periods. Such situations occur whenever tax deductions surpass the tax liabilities of the taxpayer.

All taxpayers can benefit from unused deduction portions through the IRS provision of a write-off program which reduces their future tax liabilities.

Taxpayers can use such deductions because their total losses or credits surpass their annual tax requirement and income for the year. Taxpayers who have more deductions than benefits can forward the tax benefits to credit future tax payments. The ability to use carryforward deductions becomes substantial for organizations together with individuals who experience irregular cash flow patterns and substantial one-time expenses.

Types of Carryforward Deductions

The IRS has established multiple kinds of deductions and credits that follow particular rules regarding carryforward eligibility. Two major carryforward deductions exist as well as several others.

a). Net Operating Loss (NOL) Carryforward

When net operating losses occur it means sales deductions surpass yearly taxable income resulting in a situation where income becomes negative. The tax benefit from NOLs becomes available to businesses and individuals when they want to reduce future taxable income. Any loss your business incurs can be carried forward to reduce future profits indefinitely starting from 2018 for losses from all years. Specifically, the taxpayer can offset future taxable income through this provision over periods extending up to 20 years for pre-2018 losses.

b). Capital Loss Carryforward

Any excess amount of capital losses beyond capital gains during a tax year enables taxpayers to apply this excess amount to any ordinary income during consecutive tax periods. Single individuals have up to $3,000 of capital loss deductible while married taxpayers who file separately can use up to $1,500 for deducting capital losses against their ordinary income during the tax year. Any unutilized loss from the capital assets can be carried forward to future tax years until its entire value is offset.

Tax Credit Carryforwards as Long-Term Benefits

The general business credit and other tax credits can become portable in excess of annual tax responsibility when they first arise. Taxpayers can apply these leftover credits towards future tax bills although they must follow particular rules before they can do so.

State Tax Carryforwards as Long-Term Benefits

A subset of states operates under provisions similar to those of the federal government regarding the ability to carry forward state-based tax benefits and losses or credits. Each state regulates its own tax carryforward rules in distinct ways though most jurisdictions maintain principles analogous to the federal tax carryforward system.

Why Are Carryforward Deductions Important?

The importance of carryforward deductions exists because of the following three reasons:

- Maximizing Tax Benefits:

Taxpayers maintain their opportunity to use any deductions or credits they could not exhaust in the recent year. Taxpayers benefit from bringing forward their unused deductible amount so they reduce their tax liability during times when they possess a better ability to utilize these deductions.

- Flexibility in Tax Planning:

Flexible income patterns between individuals and businesses benefit from using carryforward provisions. A remarkable business loss from a previous year often will not directly bring benefits to the company. The business maintains the loss as a forward-moving benefit which it uses to reduce taxes whenever it generates profits.

- Strategic Tax Management:

Long-term tax planning benefits from the implementation of carryforward deductions as valuable tools. Careful administration of deductions carried forward enables taxpayers to reduce future tax obligations while achieving leveled tax expenses and potentially attaining lower overall tax rates in the long run.

How Do Carryforwards Work?

Different types of deductions use carryforward methods in diverse ways whereas all deductions apply this principle by transferring unused tax benefits to reduce future taxable income or liability.

The $10,000 NOL generates a benefit that allows taxpayers to use $6,000 against their current year’s taxable income since they only have $6,000 of taxable income. The $4,000 remaining tax benefit has the potential to reduce future tax obligations in successive years.

Taxpayers can benefit from the IRS authorization to forward extra deductions beyond the initial year but they must follow set time constraints for each deduction type. The IRS allows taxpayers to carry forward the unused deduction segments indefinitely but this duration ends upon complete deduction use or the running out of the prescribed time period.

Rules and Limitations for Carryforward Deductions

The tax benefits derived from carryforward deductions exist within rules which apply definite constraints. Understanding these regulations enables taxpayers to sustain the highest value from their carryforward benefits.

- Expiration of Carryforwards:

The existence of carryforward deductions is limited by time limits. Capital loss carryforwards exist for a maximum of five years but NOLs operate without expiration (following losses that occur after 2017). Uncounted deductions comprising charitable contributions and others must be used within the span of five consecutive years.

- Annual Limits:

Some allowable deductions or credits enforce yearly limitations regarding their maximum utilization. The IRS bars taxpayers from using more than $3,000 of capital losses to balance regular income in a single tax period even though the remaining losses transfer to future periods.

- Interaction with Other Deductions:

Tax benefits work together with carryforward deductions though particular investment plans might restrict such deductions’ method of use. Taxpayers need to collaborate with tax professionals because this helps them maximize the value of carryforward deductions.

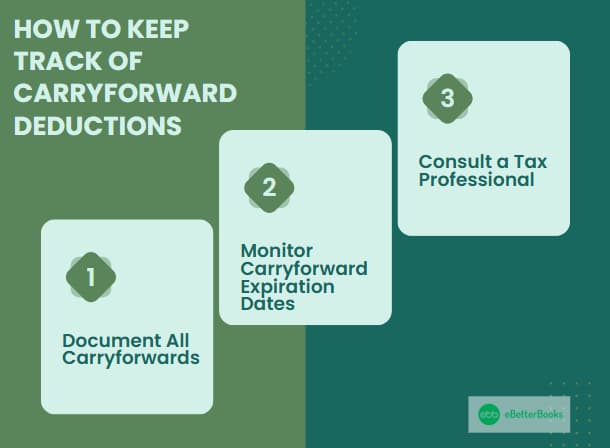

How to Keep Track of Carryforward Deductions

Taxpayers need to monitor their carryforward deductions because this helps them maximize all their tax advantages.

Here are some best practices:

- Document All Carryforwards:

All carryforward deductions must be documented by taxpayers who should note both the unused amounts and dates of origin together with the carryforward period. Detailed record maintenance prevents mistakes from occurring in future income tax declarations.

- Monitor Carryforward Expiration Dates:

People should maintain knowledge about the dates when their tax carryforwards will run out. Taxpayers need to collaborate with their tax preparer to establish automatic expiration date alerts for their carryforward utilization before the deadline.

- Consult a Tax Professional:

Complex tax regulations make it essential for people to seek professional expertise when they plan to exploit carryforward deduction strategies. A tax professional helps people and businesses through taxation rules to achieve their best long-term tax results.

Common Mistakes and Pitfalls to Avoid

Several typical errors occur when taxpayers attempt to utilize their carryforward deductions due to the potential tax-saving possibilities they provide.

- Failing to Track Carryforwards:

No proper record-keeping methods will result in loss of visibility regarding carryforward deductions which leads to missed future application opportunities.

- Not Applying Carryforwards Timely:

Carryforward deductions have expiration dates. Taxpayers lose the complete benefit of the deduction since they cannot apply it past the expiration date.

- Ignoring State Tax Carryforwards:

Taxpayers typically only manage federal carryforward usage while disregarding their available state tax carryforward benefits. The tracking of federal and state carryforward opportunities is necessary because states enforce separate regulations for tax benefits.

Conclusion

Future tax liabilities decrease significantly as well as long-term tax benefits increase through the effective utilization of carryforward deductions. Through its tax carryforward provisions, the IRS provides people and businesses the advantage of strategic tax planning based on their income changes and extraordinary expenses throughout different tax years.

Taxpayers who grasp carryforward deduction principles together with their eligible types and governing rules and restrictions will make better tax decisions which will ultimately decrease their tax obligations over time. Premeditated tax planning along with appropriate record maintenance allows taxpayers to maximize their carryforward deductions which leads to enduring tax achievements.