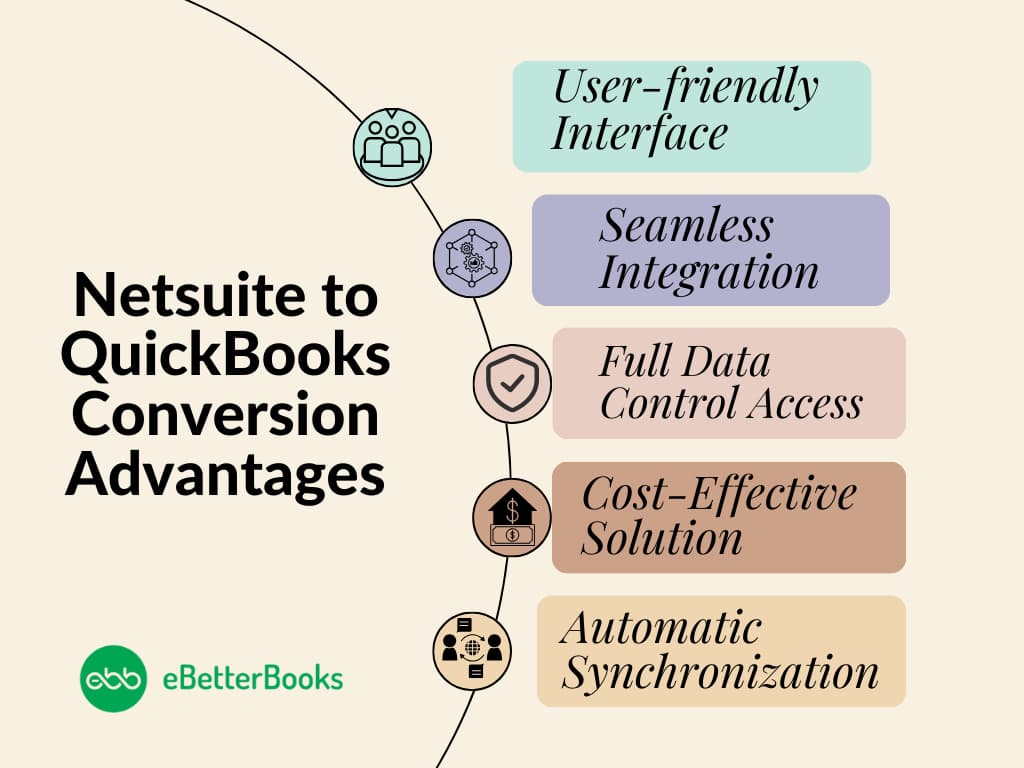

Switching from NetSuite to QuickBooks can be beneficial for you due to its lower cost, with QuickBooks starting around $12 per month compared to NetSuite’s $1,000. QuickBooks also offers a user-friendly interface which makes it more convenient for small businesses to manage their accounting without a steep learning curve.

QuickBooks’ focused functionality caters well to smaller organizations that don’t need the extensive features of an ERP system. QuickBooks has a wide range of third-party integrations which enhances its capabilities while remaining straightforward to use.

Both NetSuite and QuickBooks can help you save time by automating various bookkeeping operations. They do, however, have different features and pricing. So, if you are using NetSuite or have made up your mind to switch to QuickBooks, you have to understand the whole migration process and understand how you can make this switch smooth. Migrate from NetSuite to QuickBooks and streamline your finances efficiently with better customization and flexibility.

Overview of NetSuite and QuickBooks

NetSuite Overview:

NetSuite is cloud-based accounting software designed for businesses and enterprises. It is an all-in-one platform for small, mid, or large-sized businesses to streamline their workflow, improve efficiency, and manage various accounting operations. It offers real-time visibility and customizable dashboards with multi-currency and multi-language support. Still, like other software, it also has some limitations, such as limited third-party integrations and configurations, less industry-specific features, and a complex user interface.

QuickBooks Overview:

QuickBooks is a more localized and preferred accounting software that is best for small to mid-sized businesses. It offers automatic synchronization features, highly customizable invoices, forms, reports, and add-on integrations with third-party apps. This software has different versions, including Pro, Premier, Enterprise, and Accountant.

When it comes to migrating from NetSuite to QuickBooks, the enterprise version is the first choice of many users as it offers advanced user permissions, enhanced reporting capabilities, and robust inventory management features. It allows you to track serial numbers, barcodes, multiple locations, etc., all in one place.

Why Migration from NetSuite to QuickBooks is Required

QuickBooks is a renowned accounting software platform that offers a variety of solutions to businesses of all sizes.

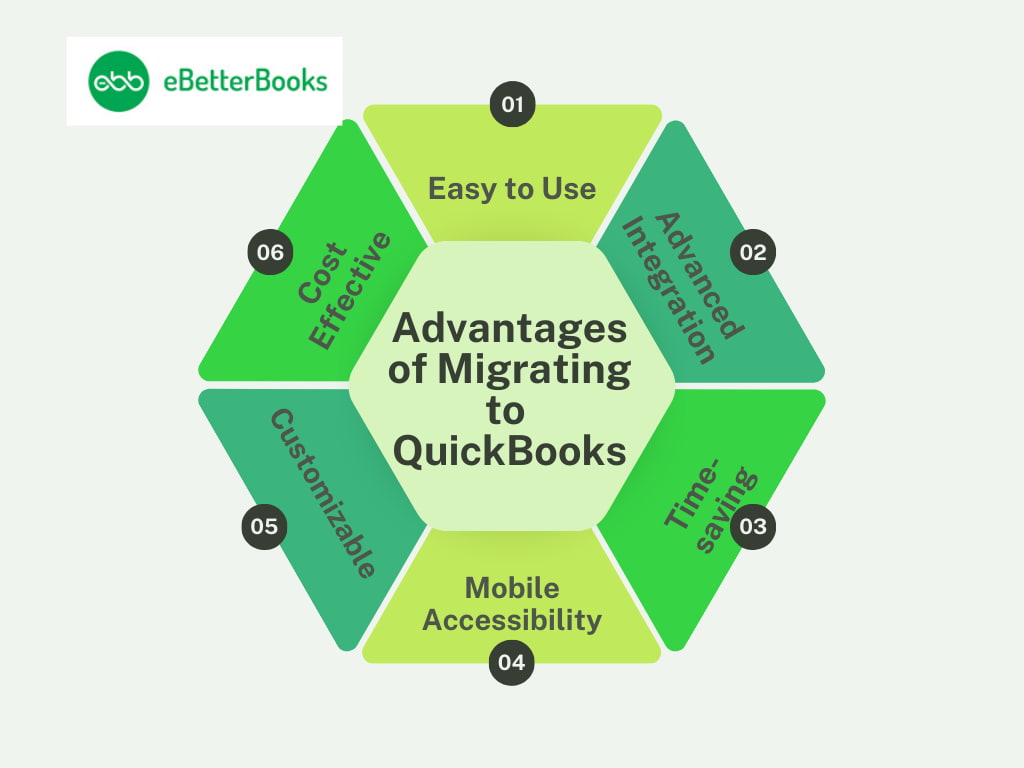

Advantages of Migrating to QuickBooks

Some of the advantages of using QuickBooks are:

- Easy to Use: QuickBooks features a user-friendly layout and is simple to navigate, making it suitable for people with no accounting experience.

- Advanced Integration: QuickBooks interacts with a range of different software platforms, including PayPal and Shopify, to help businesses improve operations and decrease human data entry.

- Time-saving: QuickBooks includes a number of automated tools, such as online banking and automatic transaction categorization, that help businesses reduce the time spent on human data entry.

- Mobile Accessibility: QuickBooks comes with a mobile app feature that allows users to access financial information while on the road, making it easier for businesses to stay connected and manage their money from anywhere.

- Customizable: QuickBooks comes with a customizable option, which is very convenient for businesses as they can meet their own bookkeeping needs. It also helps them to produce custom reports, invoices, and financial statements.

- Cost Effective: QuickBooks offers various price plans, including a low-cost self-employed plan, making it a viable option for enterprises of all sizes.

Overall, QuickBooks is a dependable and extensively used accounting software platform that may help businesses save time and money by streamlining financial operations.

Due to the non-intuitive user interface, less reporting capabilities, costly maintenance, and limited integrations and configurations, many users switch from NetSuite to QuickBooks for better productivity and smoother business management.

QuickBooks is the most renowned accounting software. It is popular for streamlining various business tasks such as invoices, expense tracking, payroll processing, reporting, and inventory management.

Despite its exclusive features and functionalities, QuickBooks has limitations, including limited scalability for large businesses, limited user access, and less comprehensive functionality.

Pros and Cons of QuickBooks and NetSuite

NetSuite and QuickBooks both have some pros and cons based on their own accounting terms and conditions, which include:

Pros and Cons of QuickBooks

Here are the pros and cons of using QuickBooks:

| Aspect | Pros | Cons |

| Interface | Intuitive, user-friendly interface, suitable for non-accountants. | Lacks advanced features like multi-entity accounting. |

| Accessibility | Offers offline mode, allowing work without internet access. | It depends on local networks, limiting team collaboration and real-time access. |

| Business Fit | Ideal for small businesses with features like invoicing, payroll, tax preparation, expense tracking, and reporting. | Limited scalability means this is not ideal for rapidly growing businesses or enterprises. |

| Affordability | Affordable and easy to implement for startups and small businesses. | Manual updates and upgrades can lead to disruptions, double entries, and inconsistencies in data |

| Third-Party Apps | Seamlessly integrates with popular third-party applications such as PayPal, Shopify, and Square. | Support can be slower compared to more premium ERP solutions. |

| Data Control | Full data control for users, ensuring flexibility. | Lacks comprehensive functionality and automation compared to advanced ERP systems like NetSuite. |

| Support | Provides responsive support for small business owners. | Limited multi-user collaboration and performance issues due to dependence on local networks. |

Pros and Cons of NetSuite

Here are the pros and cons of using NetSuite:

| Cloud-Based | Cloud-based system offering real-time visibility, customizable dashboards, and 24/7 access from anywhere. | Higher implementation and maintenance costs, including IT support and regular follow-ups. |

| Scalability | Highly scalable, suitable for growing or large businesses with complex accounting needs. | Steep learning curve, requiring professional training, especially for non-technical users. |

| ERP Capabilities | Comprehensive ERP functionality for financial management, budgeting, reporting, and multi-entity consolidation. | Customization and implementation can be time-consuming, taking longer to configure for specific business needs. |

| Global Business Fit | It supports multi-currency, multi-language, and integrated CRM and e-commerce modules, which are ideal for global operations. | Limited industry-specific features and less tailored reporting capabilities compared to specialized solutions. |

| Automation | Advanced automation features for workflows, approvals, and financial processes. | More expensive overall compared to other accounting solutions, especially with customizations. |

| Multi-User Access | Facilitates collaboration across departments and locations with real-time, multi-user functionality. | Customization may require ongoing technical support and additional resources. |

| Customization | Flexible and highly customizable to meet the specific needs of complex businesses. | Initial setup can be complicated, and longer onboarding times are common. |

QuickBooks Data Conversion – A Detailed Overview

QuickBooks data conversion is a process by which you can seamlessly transfer your financial data from one accounting software to QuickBooks or between the different versions within QuickBooks. QuickBooks is a robust accounting software used by many business owners for bookkeeping, invoicing, financial reporting, and payroll management. It comes in different versions, like Pro, Premier, and Enterprise, and can be easily installed on both Windows and iOS.

Below, we’ve mentioned all three QuickBooks versions, including Pro, Premier, and Enterprise. You can choose any one that best aligns with your accounting needs.

- QuickBooks Pro: QuickBooks Pro is the most basic version, which includes everything related to your growing business’s needs, such as invoicing, managing accounts payable, and sales tax reports.

- QuickBooks Premier: QuickBooks Premier is an excellent choice for business owners who require additional features and industry-specific functionality. It allows users to track bills, create customized charts and reports, manage inventory, use built-in templates, and much more.

- QuickBooks Enterprise: This software is best suited for businesses that need to be presented in multiple locations. It provides its services to various industries, from contractors, hospitality, non-profits, and retail to manufacturing and wholesale.

QuickBooks desktop allows you to work seamlessly without network dependency. This software is installed locally on your system with one-time purchases. It is ideal for small to large businesses and offers highly customizable features, industry-specific versions, and limited integration add-ons.

QuickBooks Online, on the other hand, is cloud-based accounting software that requires a monthly subscription. It is ideal for small to medium sized organizations and offers several integration options. The software also allows several users to work together and receive online automatic updates, with limited customization options.

Do You Need Experts When Converting from NetSuite to QuickBooks?

Data conversion involves extracting, transforming, and loading data into QuickBooks in a format compatible with the software. It guarantees the seamless and error-free transfer of all vital business data, including invoices, payments, inventory information, and customer records, to a new program.

Transitioning from one accounting software to another is a major decision that impacts your business in numerous ways. The way you manage your finances, record, report, and refer to the changes. There is always a risk of data loss or data that cannot be converted, which may later lead to inconsistencies in the accounting records.

Apart from accounting risks, your accounting workflow may be hampered by technical risks related to proper data mapping, file formats, compatibility with payment and recording ecosystems, etc. For this reason, skill and accuracy are needed to ensure that the transformed data is free from errors or inconsistencies. Experts from a professional data conversion service are available to oversee, manage, and carry out the entire data conversion procedure with ease.

They have ample experience dealing with various issues, tools, or different methods to fix the errors encountered while migrating. They also provide post-conversion support, set up new software, and perform regular follow-ups. They aim to maintain accounting continuity for faster or more accurate results while switching between two software programs and customize your converted data according to specific business needs without disrupting your day-to-day activities.

There are many reasons why you need a dedicated expert during NetSuite to QuickBooks data conversion.

Let’s have a look:

- Save your countless hours

- Advanced-Data Security & Protection

- Avoid duplicate entries

- Data Migration Accuracy

- Better Customization

- Seamless Integration

- Optimize workflow & efficiency

- Implement a turnkey solution

- Cost-effective Services

- Minimize legal and financial risks

- Set up new software for enhanced capabilities

- Get help with many more files, such as a Chart of accounts, Aged receivables and payables, Supplier details, and Bank transactions.

EBB Checklist – NetSuite to QuickBooks Data Conversion

Below, we’re presenting a comprehensive checklist for users who don’t know how to proceed and what to check or ensure before transferring from NetSuite to QuickBooks:

- QuickBooks Integrations: Add integration options such as Payroll and Time Tracking for improved efficiency, elimination of redundancy, and a streamlined data management process.

- Browser Requirements: Ensure a stable internet connection and use Google Chrome for optimal compatibility during the conversion process.

- NetSuite Installation: NetSuite can be installed on the same system as QuickBooks to facilitate seamless data transfer between the two systems.

- Operating System Compatibility: To support the smooth conversion, verify that your system runs on Windows 8, Windows 10, or Windows 11.

- Processor Requirements: Maintain a minimum of a 500 MHz Intel Pentium II processor to ensure efficient handling of conversion tasks.

- Memory (RAM) Requirement: Provide at least 512 MB of RAM to prevent system slowdowns.

- Microsoft .NET Framework: For better compatibility with conversion tools, make sure that Microsoft .NET Framework Version 2.0 or higher is installed on your system.

- NetSuite Version: Use NetSuite Version 2013 or higher to run the conversion process smoothly without encountering compatibility issues.

- Hard Drive Space: Allocate a minimum of 2.5 GB of free space on your hard drive to accommodate conversion files and ensure seamless operation.

- QuickBooks Compatibility: Verify compatibility with QuickBooks Desktop Pro, Premier, Enterprise, or Online editions and make your conversion smoother and faster.

- Cross-Region Conversions: Conversion tools cannot be used for cross-region conversions, ensuring compliance with data protection regulations.

- Storage Considerations: Check that the computer’s hard drive has enough space to store both the QuickBooks Database and NetSuite-associated files for efficient data management.

NetSuite to QuickBooks Data Conversion Process

Moving your NetSuite data to QuickBooks might be challenging for users with little accounting knowledge.

Below are some basic steps to simplify your migration from one software to another.

Phase 1: Know your Business Needs

Our QuickBooks data conversion specialists evaluate your NetSuite data that needs to be converted, its data structure, technical specifications, and your needs. This may include financial data such as general ledger accounts, inventory data, accounts payable and receivable, and much more. We solve your doubts, identify data to be transferred, communicate with our clients to check the compatibility of your system, and set up the scope and timeline. You’ll be in command at every stage.

Phase 2: Prepare Data for Migration

Based on your business needs, you can choose any from QuickBooks Pro, Premiere, Enterprise, or Online. We will help you transfer information like Accounts Receivable and Accounts Payable reports, P&L, monthly balance sheets, and any other data that needs to be converted to QuickBooks software without any discrepancies, errors, or duplicate entries. Your data will be cleaned and backed up as a security measure before the conversion begins.

Phase 3: Informed Decision Making

When migrating from NetSuite to QuickBooks, in case you’ve any doubt, our dedicated QuickBooks data conversion experts will help you choose the appropriate version as per your specific business needs, team size, and future plans. Desktop or Online, single-user or multi-user, PC or networked, Payroll or POS, etc. Our service providers will assist you in making an informed decision.

Phase 4: Mapping Data to QuickBooks Fields

Mapping the data from NetSuite to the corresponding fields in QuickBooks. The data that is identified to be transferred (Balance Sheets, Income Statements, Payroll Database, Invoices, Accounts Receivables, Accounts Payables, expense reports, reconciliations, and any other data needed to be converted) will be sorted, and experts will ensure that data categories align accurately to avoid discrepancies and redundancy.

Phase 5: Conversion, Verification and Testing

Our in-house full-time programmers initiate and monitor the data conversion process and fix any issues or errors so that the system functions properly. We check the new system to ensure the integrity and accuracy of your financial transactions and reports. If any other data is required to be transferred or you want to add more, the process will be repeated for your satisfaction and scope.

Phase 6: Team Trainings & Follow-Ups

Our highly skilled staff will shorten your team’s learning curve and ensure they know the functionalities, navigations, or features of your new system. For this, we conduct special training sessions for them so they can help you manage workflows, set up basic configurations, charts of accounts, and integrations, and try to make your move convenient and successful. We aim to make things work for you efficiently.

Phase 7: Post-Conversion Support & Optimization

Experts will review all your unresolved queries and optimize your workflow, system, software, etc., for improved efficiency. They’ll ensure that users are comfortable or happy with the new QuickBooks setup and don’t encounter any problems during or after the migration process. We do our best to meet your expectations within the promised time period.

Try Another Way to Convert from NetSuite to QuickBooks

You are recommended to use Excel, CSV, IIF, and web connect files to import your data to QuickBooks, but always keep in mind that these methods don’t import the entire company file data. For instance, the web connect method can only be used to import bank transactions, and the Excel option can only be chosen to import your list of items, names, accounts, etc. Also, you can browse third-party apps for a complete, accurate, and fast transition.

| Note: You need to be very careful when asking for help for any third-party application. Make sure you check the background or legitimacy and its service providers to ensure the safety and security of your data. |

Know What you can Convert or What you cannot!

Here’s a comprehensive list of some NetSuite records that can be converted to QuickBooks:

| NetSuite to QuickBooks Conversion | |

| What Can Be Converted | |

| NetSuite Entities to QuickBooks | ContactCustomerEmployeeGroupJobPartnerVendor |

| NetSuite Activities to QuickBooks | EventPhone CallTaskProject Task |

| NetSuite Accounting to QuickBooks | AccountAccounting PeriodsBudgetClassCurrencyDepartmentLocationRevenue Recognition ScheduleRevenue Recognition TemplateSubsidiaryUnits of Measure |

| NetSuite Transactions to QuickBooks | Bin Putaway WorksheetBin TransferBuild/Unbuild AssemblyCash RefundCash SaleCheckCredit MemoCustomer DepositCustomer Deposit ApplicationCustomer PaymentCustomer RefundEstimateIntercompany Journal EntryInventory AdjustmentInvoiceItem Demand PlanItem FulfillmentJournal EntryOpportunityPurchase OrderPurchase Order ReceiptReturn AuthorizationSales OrderTransfer OrderVendor BillVendor CreditsVendor PaymentVendor ReturnsWork Order |

| NetSuite Support to QuickBooks | CaseIssueSolutionTopic |

| NetSuite Items to QuickBooks | Assembly/BOM Item, including serial and lot numberedDescriptionDiscountGift Certificate ItemInventory Item, including serial and lot numbered inventory NumberKit/Package ItemMarkupNon-Inventory Item for Purchase/Sale/Re-sale other Charge for Purchase/Sale/Re-salePaymentService for Purchase/Sale/ResaleSubtotalDownload |

| NetSuite Communications to QuickBooks | MessageNote |

| NetSuite Miscellaneous to QuickBooks | Expense ReportTime TrackingOther Lists |

| NetSuite Web Site to QuickBooks | Categories |

| NetSuite Tax Records to QuickBooks | Sales Tax ItemTax GroupsTax Type |

| NetSuite Customization to QuickBooks | Custom ListsCustom Record TypeCustom Record |

| NetSuite Marketing to QuickBooks | NetSuite CampaignNetSuite Campaign ResponseNetSuite Promotion Code |

| NetSuite File Cabinet to QuickBooks | FileFolder |

| What Can Not be Converted? |

| 1. Bank Reconciliation 2. Paychecks are converted as Journal Entries (Importing Paychecks is not supported by QuickBooks) 3. Employee YTD information 4. Individual employee wage or deduction information 5. Custom templates 6. Jobs are not attached to transactions 7. Budgets 8. Fixed Asset Items 9. Work Tickets |

Common Errors During QuickBooks Data Conversion Process

Can we face any challenges during the QuickBooks data conversion process?

When transferring from NetSuite to QuickBooks, you may notice the error prompt stating, “It looks like something went wrong.”

Which could be due to the following data migration errors which include:

- The company file size is too big to export or exceeds its character limits.

- Your file may not be saved locally on your system.

- QuickBooks program, in which you intend to transfer your transaction data, has not been updated to the most recent release.

- The issue can also occur when you host a file over a network or on a server.

- You did not make a backup of your converted data, and the system requirements are incompatible with your new program.

- The data is transferred from NetSuite to QuickBooks, resulting in various errors and redundancies.

- You do not have full administrative privileges to access your converted data.

- When attempting to transfer data from one software to another, your QuickBooks desktop inventory causes a problem.

- You did not export critical business data from your software to Excel spreadsheets.

Wrapping Up

NetSuite to QuickBooks data conversion entails selecting the appropriate version of QuickBooks for your business needs and preparing your data by removing errors and multiple entries before migrating to a new software. Also, make sure your data is properly categorized and reliably migrated to your new system. For more integrity and efficiency, contact professionals to ensure a smooth transition and access to your financial data in the most appropriate setting for your organization.

Frequently Asked Questions

Can I import NetSuite data into QuickBooks Online?

Yes, you can import NetSuite data into QuickBooks Online utilizing third-party solutions or manual CSV file transfers. You can also get help from a qualified ProAdvisor to ensure a seamless and accurate transfer.

How Long Does it Take to Convert NetSuite to QuickBooks Online?

The conversion process varies according to the size and complexity of your financial data. Small firms typically require 1-2 weeks; however, larger enterprises may take a month or more.

Does QuickBooks Online Have all of the Features of NetSuite?

No, QuickBooks Online does not include all of NetSuite’s capabilities because it is intended for small—to medium-sized organizations. However, it does include necessary accounting functions such as invoicing, spending monitoring, and financial reporting.

Does it Cost Extra to Transfer Data from NetSuite to QuickBooks Online?

Yes, transferring data from NetSuite to QuickBooks Online may incur additional fees if you use third-party tools or professional services. However, many service providers provide low-cost packages or fixed charges for transforming financial data.