The IRS standard mileage rate is an annual rate applied to calculate deductible vehicle expenses without accounting for actual costs. It’s derived from an annual survey of fixed and variable expenses, such as fuel, maintenance, depreciation, and insurance.

The standard mileage rate is revised yearly by the Internal Revenue Service (IRS) and applies to deducting miles driven for business, medical, moving, or charitable activities. Self-employed professionals and businesses mostly utilize this method for mileage reimbursement.

If your mileage deduction is substantial, consider hiring a tax professional to help you comply with all IRS regulations and receive the maximum benefits.

2025 IRS Standard Mileage Rates Deductions (Current Year)

For the tax year 2025 (filed in 2026), the IRS mileage rates are:

| Standard Mileage Rate Categories | Rates |

|---|---|

| Business (an increase of 3 cents from 2024) | $ 0.70 |

| Medical or Moving (no change) | $ 0.21 |

| Charitable (no change) | $ 0.14 |

These rates are for gas, diesel, hybrid, and electric vehicles. Depending on the reason for travel, you need to record qualified miles separately.

Who Can Use the Standard Mileage Rate?

The standard mileage rate method is used by:

- Self-employed individuals for business mileage.

- Employees, only if reimbursed by employers, unreimbursed employee mileage is no longer deductible.

- Taxpayers claiming medical and moving (if qualified) or charitable deductions.

- Vehicles used for hire (e.g., taxis).

- Fleet vehicles or those with claimed depreciation using certain methods.

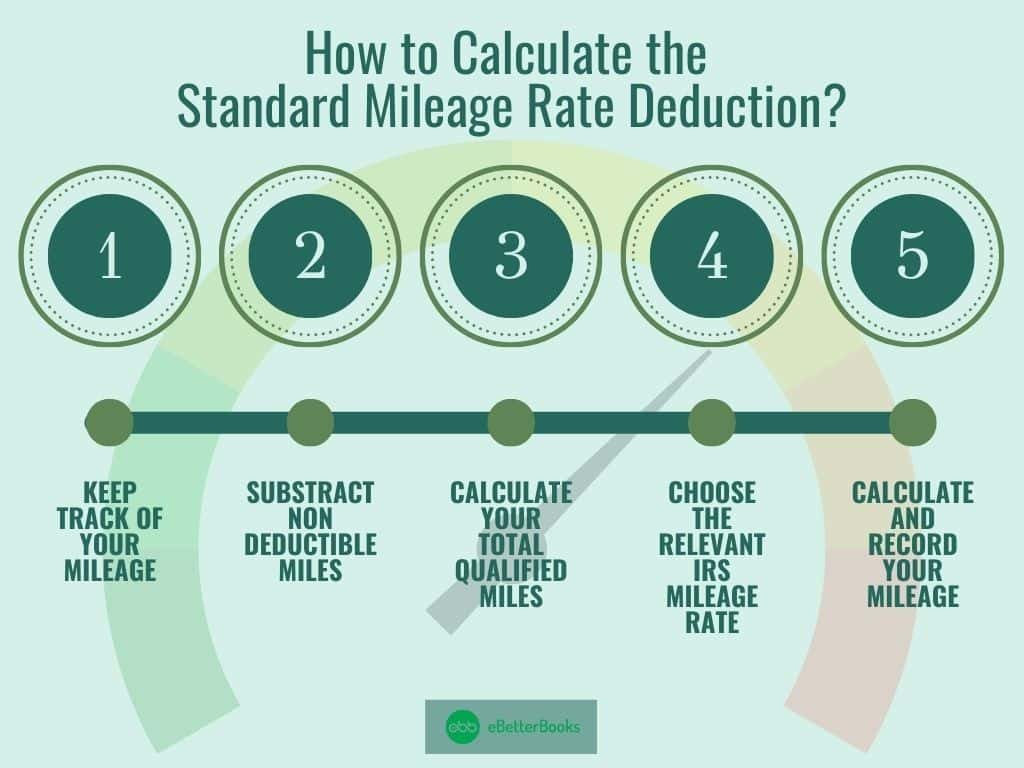

How to Calculate the Standard Mileage Rate Deduction?

To figure your tax deduction under the standard mileage rate, do the following:

Step-by-step process:

- Keep Track of Your Mileage: Log all miles traveled for qualified uses (Business, medical, charity, and moving).

- Substract Non-Deductible Miles: Commuting and personal use miles are not deductible.

- Calculate Your Total Qualified Miles: Keep logs separate for each category.

- Do the Calculations as per The Relevant IRS Rate:

- Business: $ 0.70

- Medical or Moving: $ 0.21

- Charity: $ 0.14

- Record Your Mileage: Use a logbook, spreadsheet, or mileage tracking app.

Example:

You traveled 30,000 miles for business in 2025.

30,000 x 0.70 = $ 21,000 business deduction

You can do the same calculation for other categories using the appropriate rate for each.

Recordkeeping and Documentation Requirements

The IRS demands precise and detailed records to qualify for a mileage deduction. Partial or estimated logs may result in denied deductions or an audit.

What you Must Track/Record:

- Date of every trip,

- Departure point and distance traveled,

- Destination of the trip and reason (e.g., client meeting, delivery, etc.),

- Total mileage for every trip,

- Odometer Readings (optional but preferred).

Tools you can utilize:

- Hardcopy mileage logbooks

- Excel or Google Sheets templates

- Mileage tracking applications such as MileIQ, Everlance, or QuickBooks Self-Employed

Log your miles daily or weekly to avoid forgetting details. It would be helpful to keep backup documentation such as appointment confirmations, receipts, or calendar events.

How to Claim Standard Mileage Rate Deduction on Your Tax Return?

Reporting it properly on your tax return, include different IRS forms for different individuals:

For Self-Employed Individuals:

- Report mileage deductions on Schedule C (Form 1040) under “Car and truck expenses.”

- You’ll need to indicate the number of business miles driven, the total miles for the year, and whether the standard mileage rate was used.

For Employees:

- Mileage reimbursements from your employer are not taxed if they match or are below the IRS standard rate.

- Under the Tax Cuts and Jobs Act (2018–2025), unreimbursed employee mileage is no longer deductible for most employees.

For Medical or Moving Expenses:

- Claim on Schedule A (Form 1040) if you itemize.

- Moving expenses are deductible only for members of the military in active duty under current law.

For Charitable Purposes:

- Report charitable contributions on Schedule A (Form 1040).

- Must be for services rendered to a qualified organization (not merely personal volunteering).

Tip: Always use a tax professional or reputable tax software to make your deductions properly.

Standard Mileage Rate vs. Actual Expense Method

The IRS has provided two options for deducting vehicle expenses: the Standard Mileage Rate Method and the Actual Expense Method. Both have specific requirements, advantages, and limitations.

| Standard Mileage Rate Method | Actual Expense Method |

|---|---|

| Goes easy on the deduction with a standard per-mile rate. It pays for all car expenses, such as fuel, oil, repairs, upkeep, insurance, registration costs, and depreciation. | It requires a detailed record of every actual cost related to operating the vehicle, such as gasoline, repairs, insurance, tires, lease or rental payments, and depreciation. |

| It requires the calculation of miles operated for each entitled use but not actual costs. | You have to determine what percentage of overall vehicle usage was for qualified purposes in order to use that share of total costs. |

| Must be utilized in the initial year in which the vehicle is put to use if you wish to opt for actual cost later. | More accurate, but it needs heavy paperwork. |

Which Method Should You Use?

- If you want convenience and your car expenses are modest, use the standard mileage rate.

- If your vehicle’s costs are high and you’re willing to document them, use the actual expense method.

Once you select the actual expense method, you cannot revert to the standard mileage rate for the same vehicle.

IRS Rules & Restrictions for Standard Mileage Rates

The IRS has certain rules and restrictions to make sure that mileage deductions are proper and not misleading:

- Only Qualified Miles: You can deduct only miles traveled exclusively for business, medical, charitable, or moving reasons.

- No Commuting Deduction Allowed: Miles traveled between your home and regular workplace aren’t deductible, even if you’re a contractor.

- Changing Methods: To deduct the standard mileage rate, you have to elect it during the first year that the vehicle is used for business. You can change to the actual expense method in later years, but not the reverse.

- Depreciation Limits: When you deduct the standard mileage rate, the IRS presumes that a depreciation portion is covered in the rate. You can’t claim additional depreciation as a separate deduction.

- Vehicle Ownership: The car should be yours or leased, and you should not take mileage for reimbursement-vehicles of an employer (except where reimbursement was less than the IRS rate).

- Leased Cars: If you have leased your car and also decided to take the standard mileage rate, you should continue using it throughout the lease duration (renewals included).

Reimbursement vs. Deduction

It is important to know the distinction between being reimbursed and taking a deduction:

| Mileage Reimbursement | Mileage Deduction |

|---|---|

| When your employer reimburses you for mileage (at or below the IRS rate), the reimbursement is not taxable, and you may not also deduct it on your return. | Applies only when you pay the mileage cost yourself and are not reimbursed. |

| If you’re reimbursed in excess of the IRS rate, the amount in excess is regarded as taxable income. | Typical for self-employed persons, freelancers, and gig workers. |

| Employers may use the IRS standard mileage rate as a baseline to reimburse employees reasonably for business use of personal cars. | This reduces your taxable income but not your tax bill directly. |

Key Takeaway: You can either be reimbursed or take a deduction—not both for the same mileage.

Final Tips for Maximizing Your Mileage Deduction

To get the most from your mileage deductions:

- Use an app to track mileage automatically, such as Everlance, MileIQ, or QuickBooks.

- Keep personal and business use separately recorded; never guess.

- Record mileage regularly and substantiate it with appointment records or client notes.

- Check IRS updates each year since mileage rates may change from year to year.

- Don’t overlook other deductible categories like medical, charity, and moving expenses, which can accumulate.

If your mileage deduction is substantial, consider hiring a tax professional to help you comply with all IRS regulations and receive the maximum benefits.

Conclusion

Using the IRS standard mileage rate to claim mileage deductions is an easy and effective method of reducing your taxable income, particularly if you drive regularly for business, medical, moving, or charitable reasons.

To take full advantage, keep accurate records, know what miles qualify, and use the option that best suits your financial position. Whether you’re a gig economy worker or a self-employed professional, being compliant with IRS guidelines can make a big dent in your taxes.

Frequently Asked Questions

Is mileage paid to and from work?

No, miles commuting home to your primary workplace and returning are not deductible, even when you’re self-employed. Just travel between business locations or to and from customer sites is.

Can I switch between the standard mileage rate and actual expenses?

Yes, but with restrictions. You must choose the standard mileage rate in the first year the car is used for business. In later years, you can switch to actual expenses but not the other way around if you’ve claimed depreciation under the actual method.

I’m leasing; should I use the standard mileage or actual deduction method?

If you use the normal mileage rate, you have to use it consistently throughout the lease term (including renewal). It is easier, but the actual cost method could return a greater deduction if your lease payments and operation expenses are high.

How many miles can you write off without getting audited?

There is no exact limit, but very high mileage (e.g., 50,000+ business miles) can lead to an IRS audit. Provided you keep accurate and detailed records, you can justify your claim irrespective of mileage.

What is the current standard IRS mileage rate?

For 2025, the IRS mileage rates are:

- Business: 70 cents per mile

- Medical/Moving: 21 cents per mile

- Charity: 14 cents per mile

Can I write off both mileage and gas?

No. If you’re using the standard mileage rate, gas and other operation costs are factored in. If you’re using the actual expense method, you can deduct gas, maintenance, insurance, and depreciation, but not mileage.