What is Bookkeeping?

Bookkeeping is a way of systematically keeping and sorting records of a firm’s financial transactions. It entails the ability to record sales, purchases, receipts, payments, and any other financial activity geared toward the success of the enterprise in a very systematic manner.

Accounting starts with bookkeeping, which involves keeping records of various business transactions that occur in the business daily. These records can then be used to prepare legal, systematic, and periodic accounts, which are then used to create balance sheets and income statements. Businesses use these statements to determine their position on cash flow. Tools such as the ledger, journals, and accounting software make this process easy.

For small and medium business owners, bookkeeping is usually seen as one of the toughest parts of a job that needs to be done without any glitches. The tiresome and monotonous task of maintaining the books can take up valuable hours of your time, which can be put into the things for which you started the business in the first place.

As monotonous as it sounds, bookkeeping can be the source of your success and the biggest driving factor when it comes down to growth and management. It’s the accurate measurement of a business’s financial performance that can effectively expand your business. Let’s understand it further.

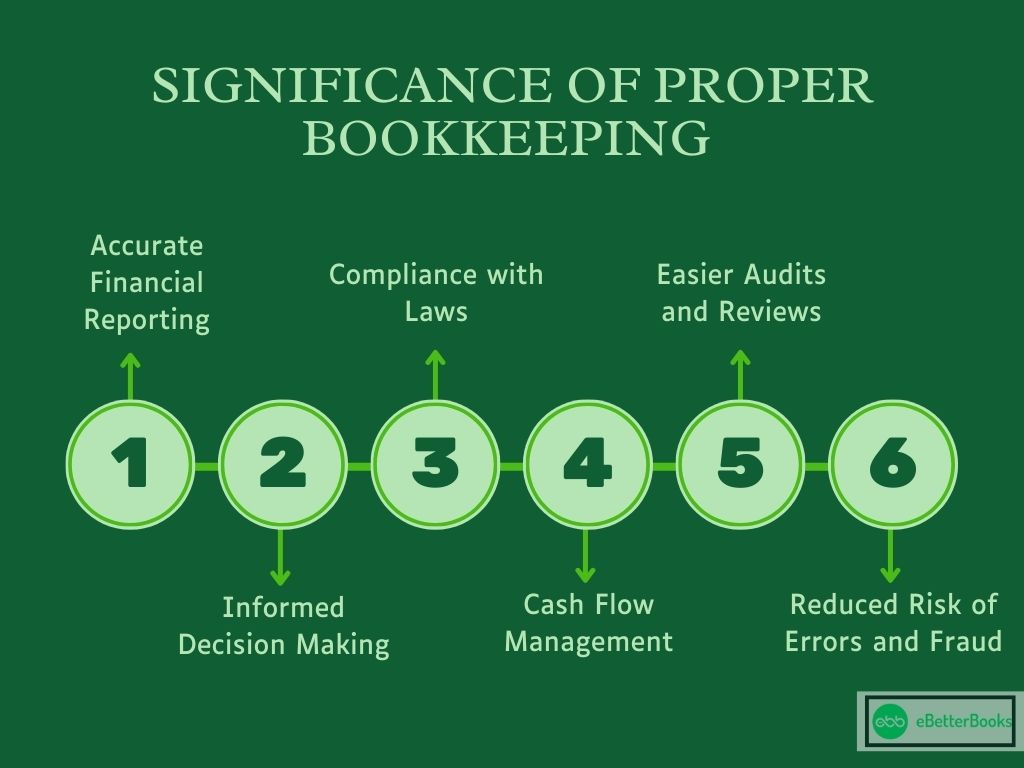

Significance of Proper Bookkeeping

Bookkeeping plays a crucial role for any company, as many of them cannot survive without it.

Its significance includes:

- Accurate Financial Reporting: Bookkeeping helps document all the financial operations in the organization so that other crucial financial statements, such as income statements, balance sheets, and cash flow statements, can be produced easily. It enhances the comprehensiveness of information regarding the company’s financial performance.

- Informed Decision Making: By Maintaining business records, business owners can make appropriate decisions on expenditures, costs, and resource allocation. The annual budget assists in determining trends, the likely financial outlook, and a strategy for growth in the future.

- Compliance with Laws: Bookkeeping assists an organization in adhering to its tax laws and other reporting laws and regulations. It allows for the provision of evidence of each financial transaction in a given process, avoiding potentially emerging legal consequences or auctions.

- Cash Flow Management: By analyzing their total income and expenditures, businesses can determine whether they have adequate cash to meet their obligations.

- Easier Audits and Reviews: With systematic bookkeeping, auditors’ requirements are more easily met since records are clear and correct. As a result, investors and regulatory bodies have more transparency and confidence in the companies.

- Reduced Risk of Errors and Fraud: Sound record-keeping reduces excess, irregularities, and possible embezzlements by recording all the financial dealings accurately most of the time.

Bookkeeping Mistakes and How to Avoid It?

Here’s a list of 12 common bookkeeping mistakes small business owners make and the ways to avoid them.

1. Conducting Business with Personal Funds

This is common among business owners when they combine their personal and business accounts. Misinterpretation of figures is one effect that may lead to wrong financial records.

Example: A business owner uses a business credit card for personal expenses such as purchasing groceries, and therefore, it becomes difficult to distinguish the business-related costs from the personal costs.

Solution: It is sound business practice to open a new bank account for your business. Also, open business credit card accounts and religiously use such cards for business purposes only. This will assist in ensuring that all the financial records are well filed for easy access and also avoid embarrassing mistakes, like adding instead of subtracting.

2. Not Keeping Receipts

The problem with not keeping receipts is that one is unable to validate an expense, and when he tries to do this during tax time or during an audit, chaos will always ensue. Receipts can also be used to support business-related purchases.

Example: A company buys office supplies but loses the receipt. During the audit, it cannot explain where the deductions were made and, therefore, may be penalized.

Solution: Download an application for receipt management or save all receipts in digital format through the cloud. This will help you keep records of all transactions that may be important in bookkeeping and tax repayment.

3. Ignoring Small Transaction

This means that we overlook small transactions, bearing in mind that their values accumulate over time. Failure to monitor them can result in poor financial records and a misunderstanding of all the books’ records.

Example: Many times, a cafe owner regularly purchases something relatively small, such as napkins or cleaning material, but generally does not keep a record of the expenditure.

Solution: They should keep every record of any transaction, whether big or small. Establish petty cash or use accounting software to note all bills because the records must be complete.

4. Ignoring Accounts Payable

Accounts payable management means failing to acknowledge the amounts that the business owes to suppliers and vendors. This may lead to delayed payment, strained business relationships, and other forms of penalties.

Example: A retailer who does not make a payment on time to a supplier incurs late payment penalties, which affect the retailer-supplier relationship.

Solution: Ensure proper accounts payable management and incorporate the due date, possible automatic alerts, and frequent checks of outstanding balances. This helps adhere to the payment schedule, and no extra charges are made.

5. Not Reconciling Accounts

Account reconciliation is the process of reviewing your accounts and a bank statement to check their compliance. Failure to reconcile accounts results in a wrong manipulating pointer of the financial statements and unreported inequality.

Example: A business is unable to do a bank reconciliation, which involves comparing the records in its accounting software with records in its bank statement. Therefore, an error in a payment process goes unnoticed and leads to the production of wrong accounts.

Solution: Balance your accounts monthly to compare the records between the bank statement and your books of accounts. Use accounting software with a feature that automates the reconciliation of the accounts, thus enabling the identification and sorting of all the discrepancies.

6. Recording Transactions Late

The occurrence of that delay results in incomplete and/or inaccurate accounting records of the transactions, which in turn can lead to a client’s taxation problem as well as other related problems.

Example: Freelancers fail to record client payments immediately into their accounts. As a result, they are always in a dilemma about how best to match their income and expenditures when filing their returns.

Solution: Develop a habit of entering all business transactions daily or at least weekly. Use a tally to record all the transactions and any other transactions written immediately because the books should not be behind the transactions made at any time.

7. Misclassifying Costs

Misclassifying business expenses is wrong because it leads to issues such as preparing incorrect accounts and paying the wrong amount of tax. Developing negative symptoms may also cause regulatory issues or an incorrect profit/loss record.

Example: A small business owner expenses equipment as office expenses when it is, in fact, a property, hence misstating the financial statements and tax returns.

Solution: Label all expenses using clear and predictable categories. When choosing your accounting software, check for in-built categorization or speak to a bookkeeper to review your expense categories.

8. Overlooking Petty Cash

Micro purchases are made using petty cash, and failing to consider its management is likely to result in uncontrolled expenses and distorted records. These expenses may, at any given time, go unnoticed and, if not recorded, greatly affect the principal account.

Example: Petty cash is spent to buy items such as cleaning materials, and small expenses need to be recorded properly, resulting in an off-balance cash flow statement for the restaurant.

Solution: It is important to open the petty cash log and ensure employees record every activity they undertake. Perform petty cash control by reviewing and balancing petty cash regularly, constantly checking all minor expenditures.

9. Ignoring Sales Tax

Failure to factor in sales tax in one’s computation of sales revenue and expenses will lead to an under-deposit of taxes and fines accrued interest. Merchants are required by law to collect and pay sales taxes for those goods and services that attract the tax to the relevant authorities.

Example: A retail store that sells products needs to remember to compute sales tax and record it on its checks. At the end of the quarter, there is quite a lot to pay in terms of unremitted sales tax, resulting in an aggregation of penalties.

Solution: Set up a program that calculates sales tax on each sale and an organized method of collecting and storing records of those taxes. Continually monitor the tax liabilities and remit the correct sales tax to evade fines.

10. Not Backing Up Financial Data

Failing to backup financial data results in loss of information in the event a company’s hardware is affected by a mishap, one is hacked, or someone deletes data accidentally. The absence of financial information can be catastrophic and lead to a lot of professional issues, such as those arising from suits or tax returns.

Example: An organization has financial documents on a computer, and a virus corrupts all the data, and everything needs to be backed up. This results in time consumption for financial reports and taxes.

Solution: Make backup copies of all the financial information and save them in another location, such as cloud storage or a USB drive, at least once a week. To avoid data loss, make sure there are duplicate copies at several locations.

11. Misclassifying Employees

Mistakingly administering some of its employees as independent contractors or perhaps the other way around exposes it to numerous legal entities, such as legal penalties from the tax authorities. Classification defines tax liability, benefits, and adherence to labor laws.

Example: An employer does not classify a full-time employee as an independent contractor to avoid paying benefits and taxes. However, when the tax authority conducts an audit, the company receives a penalty for misclassification.

Solution: Learn how the tax laws define the criteria needed to determine whether an individual is an employee or contractor. It is recommended to consult a tax consultant or a lawyer for the correct classification of workers and compliance with employment laws.

12. Not Following Up on Invoices

Failure to pursue unpaid invoices has consequences like slow cash flows and delayed payment; hence, the business struggles to meet key overheads. That is why delayed payments and missed payments exacerbate relationships with clients.

Example: An organization gets an invoice from a graphic design firm, and the company pays the invoice with a promise of prompt procurement, but after 60 days from the invoice unpaid by the client, the graphic design firm fails to recall, and it affects the timely payment for cash bills.

Solution: Use technology to adopt an invoicing system that will notify the client that the invoice is due soon. Clients should be contacted frequently and respond timely to payment, which will reduce the incidence of delayed payments.

Now that you have reviewed all the possible bookkeeping mistakes and how to avoid them, look at your business and identify whether any of them apply to it. Turn the monotonous tasks of bookkeeping into a successful business weapon and let your company thrive.

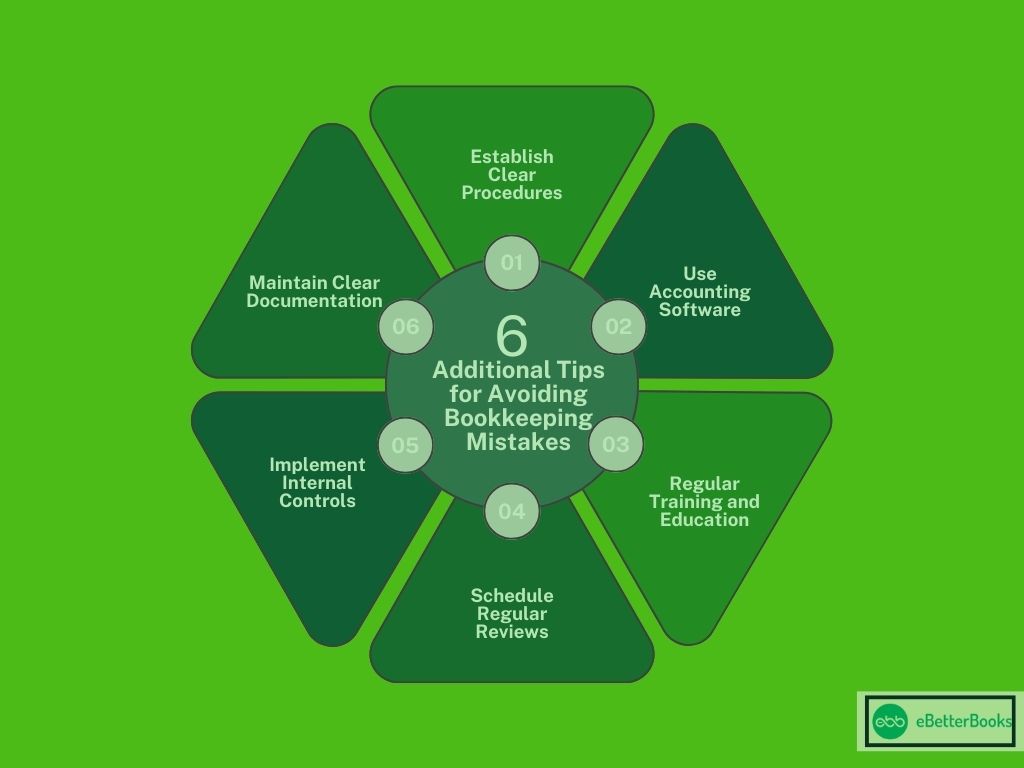

Additional Tips for Avoiding Bookkeeping Mistakes

Here are some additional tips for avoiding bookkeeping mistakes:

- Establish Clear Procedures: Establish and write down the polices in relation to entering transactions; receive and deposit receipts; and perform account reconciliations. It keeps things consistent and this is always a good thing because if a staff member is unsure of the correct process to follow then they have a document to refer to.

- Use Accounting Software: Purchase good accounting software that will help do most of the bookkeeping on its own to include its functions like sending invoices, tracking of expenses and preparing of financial reports. This minimizes possibilities of human interfears and makes the work of bookkeeping easier.

- Regular Training and Education: Organise monthly training sessions to help the employees involved with bookkeeping. Up-gradation of the staff will help reduce mistakes arising from ignorance in legal requirements or recommended procedures, taxes, or the software in use.

- Schedule Regular Reviews: By doing a financial evaluation and book auditing on a periodically basis. This can help to discover all gaps in time quickly, as well as work effectively under the authoritative framework of accounting standards.

- Implement Internal Controls: Implement stewardship by preventing overlapping responsibilities of employees. For instance, one person handles receipting, another handles payment, and the third handles account compilation. This, in turn, reduces cases of fraud and mistakes.

- Maintain Clear Documentation: Record all transactions that are in any way related to the project in such documents as invoices, receipts, contracts, etc. This offers a clear trail of audit and also makes it possible to adjust whenever there is an error.

The mentioned strategies will help business entities minimize chances of bookkeeping errors and keep proper records.

Integrating Technology for Efficient Bookkeeping

Incorporating the use of technology in various bookkeeping activities can be of great benefit.

Here are some key ways to leverage technology for effective bookkeeping:

- Cloud-Based Accounting Software: Employ cloud solutions such as QuickBooks Online or Xero – they enable to work with account information in real time. This allows several users to collaborate on the management of financial records from any possible location.

- Automated Data Entry: Integrate Smart Scanners that incorporates optical character recognition (OCR), to scan receipts& invoices and encode them into accounting systems. This helps to minimize mistakes during entries as well as time consuming during data entry.

- Mobile Apps for Expense Tracking: Synchronous the use of mobile applications in submission and capturing of expenses by employees. This can help optimize the workflow of employees and accelerates the process of entering the data..

- Integrated Payment Solutions: Have an integrated payment processing with accountants where they are merged in such a way that enables invoices to be issued automatically from the paymaster and alerts given on payment processing. This makes it possible for companies to record the flow of transactions in real time and in the process avoid instances whereby payments are missed.

- Automated Bank Reconciliation: Use of software that compare and distinguish between banking statements and company accounts records and come up with missing balances.

- Financial Dashboards and Reporting Tools: Financial tools that allow the use of a financial dashboard that displays established and important measures. This makes decision making easier and also the ability to monitor one’s financial status conveniently.

- AI and Machine Learning: Integrate AI-based tools that extract patterns of financial data characteristics and help to manage cash flow fluctuations and make valuable strategic decisions.

- Document Management Systems: Maintain the necessary financial documents in relation to their stating financial management system in a digital format. It can facilitate the access to the information and is also useful in compliance with requirements during the audit.

- Cybersecurity Measures: Put up proper measures in protection of financial information to ensure it is not accessed by unauthorized personnel. Employ encrypted software to reduce the aspects of intrusion and do cloud storage to reduce cases of leakage.

- Collaboration Tools: Automate the linking of communication and collaboration software tools such as, slack or team’s military with accounting software in order to improve interaction of team members, clients and accountants.

As shown by these technologies, the proper implementation of these tools will lead to increased efficiency, accuracy and untold control over the books of account.

Conclusion

The application of technology in bookkeeping results in improved efficiency, accuracy, and effective finance management. Cloud-based accounting software, automated data entry, and other applications via mobile phones make work easier and free from frequent mistakes. Further, the use of automated tools for bank reconciliation and artificial intelligence to obtain more information about financials is helpful.