Land, personal property, stocks and bonds, art and coins, property with a useful life of less than one year, and further as mandated by IRS are considered as property that cannot be depreciated.

It’s important for every business to depreciate its assets to lower its taxable income. However, not all property can be depreciated. Some properties can be depreciated, such as long-term assets like buildings, vehicles, and equipment, or assets that wear out or lose value over time.

As a business owner, it’s crucial to know which property cannot be depreciated to avoid errors on the tax return. Inaccurate or false financial statements can result in fines, interest, or an audit by the IRS.

So, understanding the asset type and how to record depreciation in the account is important for effective tax and financial planning.

Depreciation is a practice of distributing the asset’s cost over the course of its useful life. All depreciable assets are considered as fixed assets, but not all fixed assets are depreciable. An asset must decrease in value over time to be depreciated.

Those assets and properties are not depreciated, are neither owned by the business nor engaged in income generation, and don’t have a life of more than a year.

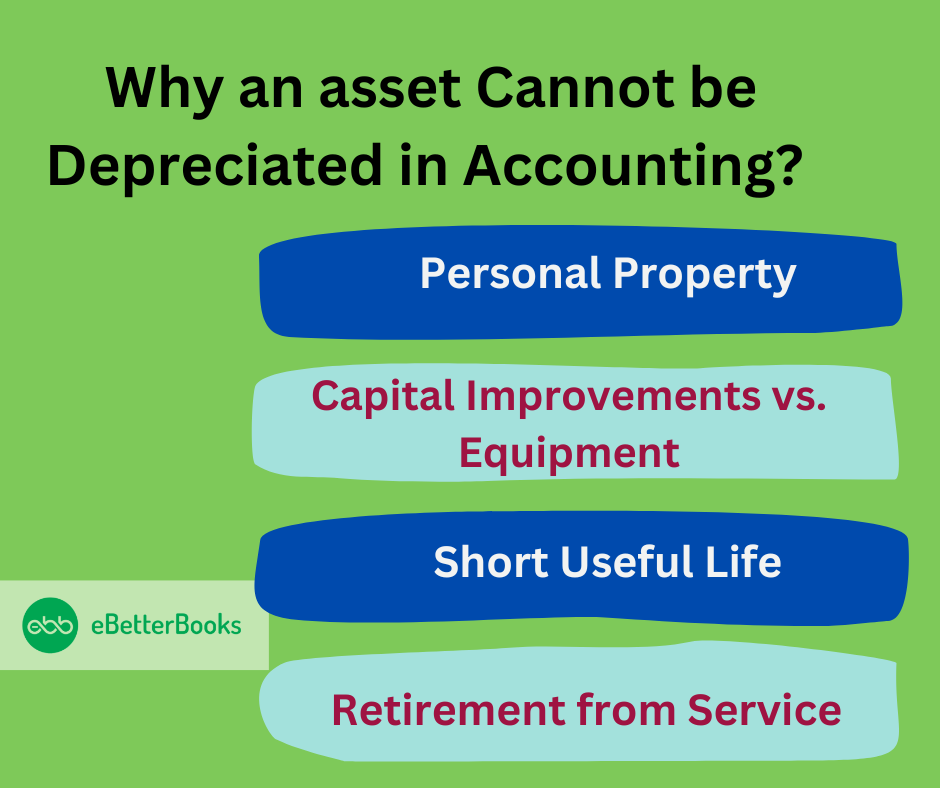

Why an asset Cannot be Depreciated in Accounting?

The IRS Publication 704 Depreciation outlines specific conditions under which an asset cannot be depreciated.

These include:

- Personal Property: Depreciation cannot be claimed on the owner’s personal property, such as a personal residence or private car.

- Retirement from Service: Once an asset is no longer part of the business, depreciation cannot be claimed, even if the cost has not been fully recovered. An asset is considered retired from service if it is taken for personal use, exchanged or sold, or destroyed or abandoned.

- Short Useful Life: Assets with a useful life of less than a year cannot be treated as depreciable assets.

- Capital Improvements vs. Equipment: While the cost of capital improvements for business buildings is depreciated, the cost of equipment purchased for improvements is not eligible for depreciation.”

Types of Property which cannot be depreciated

Land, personal property, intangible assets, inventory, excepted property, Investments in Affiliated Companies, Stock and Bonds, Antiques, and Natural Resources cannot be depreciated as per IRS.

1. Land

The land purchased by the business will not be considered depreciable property because it does not deteriorate, lose its value, or get used up. Land has an endless usable life, and its worth increases rather than decreases.

You can depreciate the land preparation costs, which include planting, cleaning, landscaping, and grading. These can be depreciated since they are regarded as separate from the land itself and have a defined useful life.

2. Personal Property

If the property is not used for business purposes, then it will be considered as personal property and will not be depreciated. As per the IRS, only those property can get depreciated which are used for business purposes.

In case, a vehicle, for both business and personal purpose, then only the portion used for business purposes will be depreciated.

For vehicles used for both personal and business purposes, you can choose between two depreciation methods:

- Actual Expense Method

- Standard Mileage Rate

3. Intangible Assets

Some intangible assets, like goodwill, trademarks, and copyrights, may not be depreciated. Instead, they are subject to amortization, which systematically allocates their costs over their estimated useful lives.

4. Inventory

Inventory is not depreciated because it is not held for use in the business. Inventory refers to any property held by the business for sale to customers.

In some cases, businesses are not sure whether to consider whether the property is held for sale or use in the business. In that scenario, always consider the facts related to the business operation.

Similarly, if the business uses containers for the product in order to sell them, they are considered as a part of the inventory, whereas if the containers are used to ship your products and meet the below-mentioned requirement, it is going to be depreciated.

Requirements:

- Life is longer than 1 year.

- Property used in the business.

- Title to the containers does not transfer to the buyer.

5. Excepted Property

There are some properties which you cannot depreciate such as:

- If you place the property in service and then dispose of it in the same year.

- When you use equipment to build capital improvements, you must add the otherwise allowable depreciation on the equipment during the construction period to the basis of your improvements.

- For Section 197 intangibles, it is best to amortize these costs.

- There are specific rules that apply to certain term interests. After July 27, 1989, you are not allowed to depreciate a term interest in property if, during the period in which the remainder interest is held, directly or indirectly, by a person related to you.

6. Investments in Affiliated Companies

Investments in the stock of other companies are not typically depreciated; instead, they may be subject to impairment charges if their value declines.

7. Stock and Bonds

Items kept for sale in the regular course of business, such merchandise in a retail store, are considered inventory. Inventory is not regarded as a depreciable asset because it is meant to be sold rather than used for ongoing business purposes.

Stocks, bonds, and other securities are examples of investments that cannot lose value. These assets are financial instruments without a defined lifespan. Moreover, they are not employed in the company operations that generate revenue, which is a prerequisite for depreciation.

8. Antiques

Antiques do not lose value due to usage or wear and tear, whereas they might gain value with time. They are not subject to depreciation since they are frequently retained as investments or for personal enjoyment rather than for use in the business.

9. Natural Resources

Depreciation is not applied to assets such as timber and mineral reserves. Rather, depletion is usually used to account for their expenses.

Requirements for Depreciable Assets

An item must meet the criteria set by the Internal Revenue Service (IRS) to qualify as a depreciable asset and GAAPs.

Here are the key qualifications:

- Ownership: The asset must be owned by the taxpayer. This means that the individual or business claiming depreciation must have legal title to the asset.

- Business Use: The asset must be used in a business or for income-producing activities. Personal-use assets do not qualify for depreciation.

- Useful Life: The asset must have a determinable useful life that extends beyond one year. This means it should be expected to provide economic benefits over multiple accounting periods.

- Reduction in Value: The asset should gradually lose value over time due to factors such as wear and tear, obsolescence, or usage, which is the essence of depreciation

Examples of what property can be depreciated

- A salon owner leases a building for 10 years. The tenant cannot depreciate the building itself because the salon doesn’t own it. However, any leasehold improvements (e.g., installing custom sinks) can be depreciated.

- A small business owner purchases a plot of land for $100,000 to build an office. The cost of the land cannot be depreciated because land does not wear out, become obsolete, or get used up over time. However, improvements made to the land (like landscaping or fencing) might be depreciable.

- A real estate agent purchases a car for personal use. Since the car is not used for business purposes, it cannot be depreciated. If the vehicle is later used for business purposes, then a portion might become depreciable based on the business usage percentage.

- A coffee shop buys an espresso machine but sells it within the same year. The machine is considered as property disposed of in the same year, so it cannot be depreciated. The cost is generally recorded as an expense for that year.

Conclusion

Every business should understand that accurate tax filings, correctly computed depreciation, and asset classification are very important in maintaining financial records.

The IRS has provided the Modified Accelerated Cost Recovery System (MACRS) method for depreciating property placed in service on or after 1986. Taxpayers need to complete and include Form 4562 with their tax return to claim depreciation under Section 179 for listed property and property placed in service in a taxable year.