What is the Declining Balance Depreciation Method?

The Declining Balance Depreciation Method is an accelerated depreciation system that records larger depreciation expenses during the asset’s earlier years. Due to increased initial usage and maintenance costs, assets lose value more quickly in the early years.

It is also known as the “Reducing-Balance Method“.

Under this method, an asset undergoes depreciation at a constant rate, which is applied to its declining book value each year. This results in accelerated depreciation and higher values in the early years of the asset’s life.

The declining balance method’s highly versatile nature makes it useful when matching depreciation cost to an asset’s usage/productivity rate. Given the opportunity to offset a greater proportion of taxable income in the initial years, this could result in tax benefits.

Companies use this method for recording assets like computers, printers, cell phones, and other high-technology products that quickly become obsolete.

How Do You Calculate the Declining Balance Depreciation Method?

Formula of Declining Balance Depreciation Method

Declining Balance Depreciation = Current Book Value * Depreciation rate

where:

- Current Book Value: It refers to the net value at the beginning of an accounting period.

Current Book Value = Net Book Value – Residual Value

- Residual value: It refers to the estimated salvage value at the end of the useful life of the asset.

- Depreciation Rate: It is determined based on the expected pattern of an asset’s usage over its useful life.

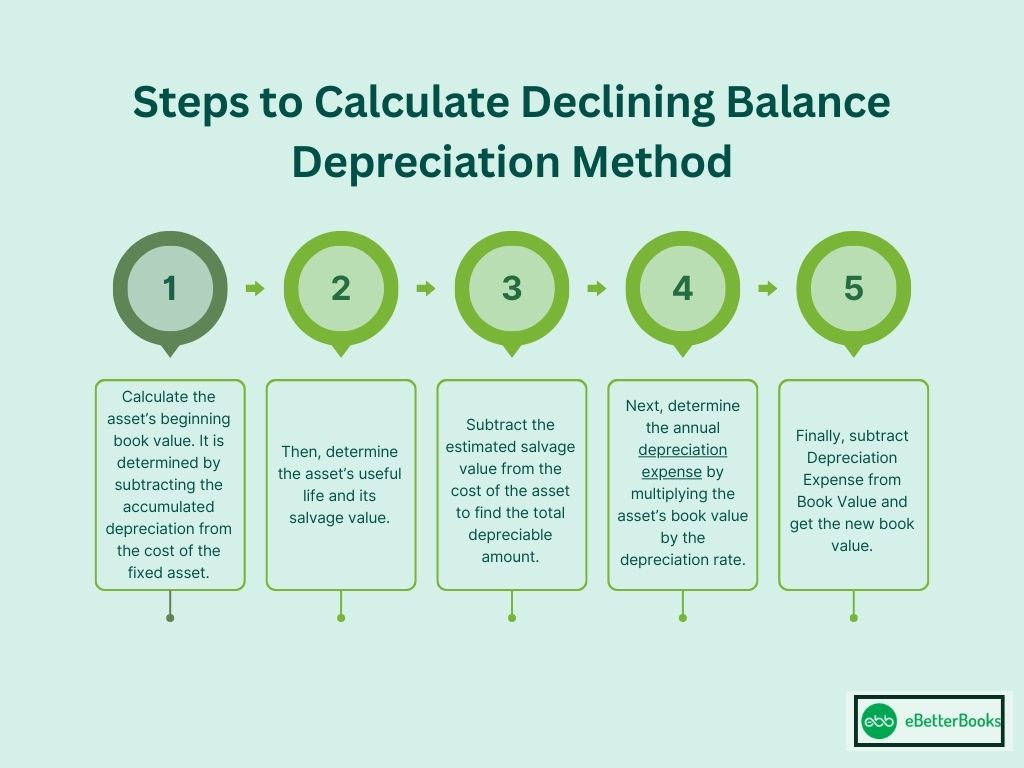

Steps to Calculate the Declining Balance Depreciation Method

Below are the steps to follow for calculating declining balance depreciation:

- Step: Calculate the asset’s beginning book value. It is determined by subtracting the accumulated depreciation from the cost of the fixed asset.

- Step: Then, determine the asset’s useful life and its salvage value.

- Step: Subtract the estimated salvage value from the cost of the asset to find the total depreciable amount.

- Step: Next, determine the annual depreciation expense by multiplying the asset’s book value by the depreciation rate.

- Step: Finally, subtract Depreciation Expense from Book Value and get the new book value.

Example of Declining Balance Depreciation Method

On April 1, 2011, Johnson Jenner Private Limited purchased equipment at the cost of $140,000.

The equipment is estimated to have a useful life of 5 years. At the end of the 5th year, its salvage value will be $20,000.

Johnson Jenner Private Limited recognizes depreciation to the nearest whole month. Using the 150 percent declining balance depreciation method, find the depreciation expenses for 2011, 2012, and 2013.

Solution:

Asset’s Useful Life = 5 years ( given)

Straight-line depreciation rate = 1/5

= 20% per year

So,

Depreciation rate (150 percent declining balance depreciation method) = 20% * 150%

= 20% * 1.5

= 30% per year

The depreciation amounts are calculated as follows:

- For the Year 2011:

Depreciation = $140,000 * 30% * 9/12

= $31,500

- For the Year 2012:

Depreciation = ($140,000 – $31,500) * 30% * 12/12

= $32,550

- For the Year 2013:

Depreciation = ($140,000 – $31,500 – $32,550) * 30% * 12/12

= $22,785

- For the Year 2014:

Depreciation = ($140,000 – $31,500 – $32,550 – $22,785) * 30% * 12/12

= $15,950

- For the Year 2015:

Depreciation = ($140,000 – $31,500 – $32,550 – $22,785 – $15,950 )*30% *12/12

= $11,165

- For the Year 2016:

Depreciation = ($140,000 – $31,500 – $32,550 – $22,785 – $15,950 -$11,165 )*30% *12/12

= $7,815

Note: In order to maintain the book value the same as the salvage value, the depreciation for the Year 2016 must be taken as $6,051 but not $7,815.

$26,051 – $20,000 = $6,051 (here, depreciation stops)

| Year | Book Value ( at the beginning) | Depreciation Rate | Depreciation Amount | Book Value ( at the end) |

| 2011 | $140,000 | 30% | $31,500 | $108,500 |

| 2012 | $108,500 | 30% | $32,550 | $75,950 |

| 2013 | $75,950 | 30% | $22,785 | $53,165 |

| 2014 | $53,165 | 30% | $15,950 | $37,216 |

| 2015 | $37,216 | 30% | $11,165 | $26,051 |

| 2016 | $26,051 | 30% | $6,051 | $20,000 |

How Do you Calculate the Rate of Depreciation?

To calculate the rate of depreciation for the Declining Balance Depreciation Method, the following formula is used:

Formula:

Declining Balance Depreciation Rate:

Rate of depreciation = (100% / Useful life of asset)

Double Declining Balance Depreciation Rate:

Rate of depreciation = 2 x (100% / Useful life of asset)

Important terms to consider:

Salvage Value: The value of the asset at the end of the useful life as estimated.

Cost of Asset: The price at which an individual or company acquires an asset; it may also measure the original value of a fixed asset.

Useful Life: The period in terms of years it is expected the asset will be in use.

Variations of Declining Balance Depreciation Method

Fixed Declining Balance Depreciation

The Fixed Declining Balance Depreciation Method uses the same depreciation rate for the asset throughout its useful life. This method leads to higher charge-off depreciation in the initial year and, subsequently, a smaller amount as the asset gets older. The depreciation is fixed at the beginning and is used to evenly distribute the cost of the asset over its useful life. Still, since the amount used to charge depreciation is based on the book value, the amount of depreciation charged will be reduced in future years. The formula used to calculate fixed declining balance depreciation in this method is:

Depreciation Expense = Depreciation Rate x Book Value at the Beginning of the Year

This means that all that is required to arrive at the Depreciation Expense is the multiplication of the depreciation rate and book value at the beginning of the year under consideration. This method is appropriate for assets that decline in value significantly in the first few years of use.

Variable Declining Balance Depreciation

The Variable Declining Balance Method or the Double Declining Balance Depreciation Method is also an example of the accelerated depreciation method that grants derivation in the rate of depreciation up to twice the straight line. This method provided a quicker depreciation charge in the initial years of the assets and charges less after some years of the use of the asset. This is expressed as a proportion of the asset’s original book value; this leads to high depreciation expenses in the initial years while low expenses in the subsequent years. The formula to calculate the variable declining balance method is:

Depreciation Expense = 2 × (Straight-Line Depreciation Rate) × Balance of the asset account at the start of the year

This approach is particularly useful for business fixed assets, particularly technology or machinery, that experience significant depreciation in the first few years of their useful life.

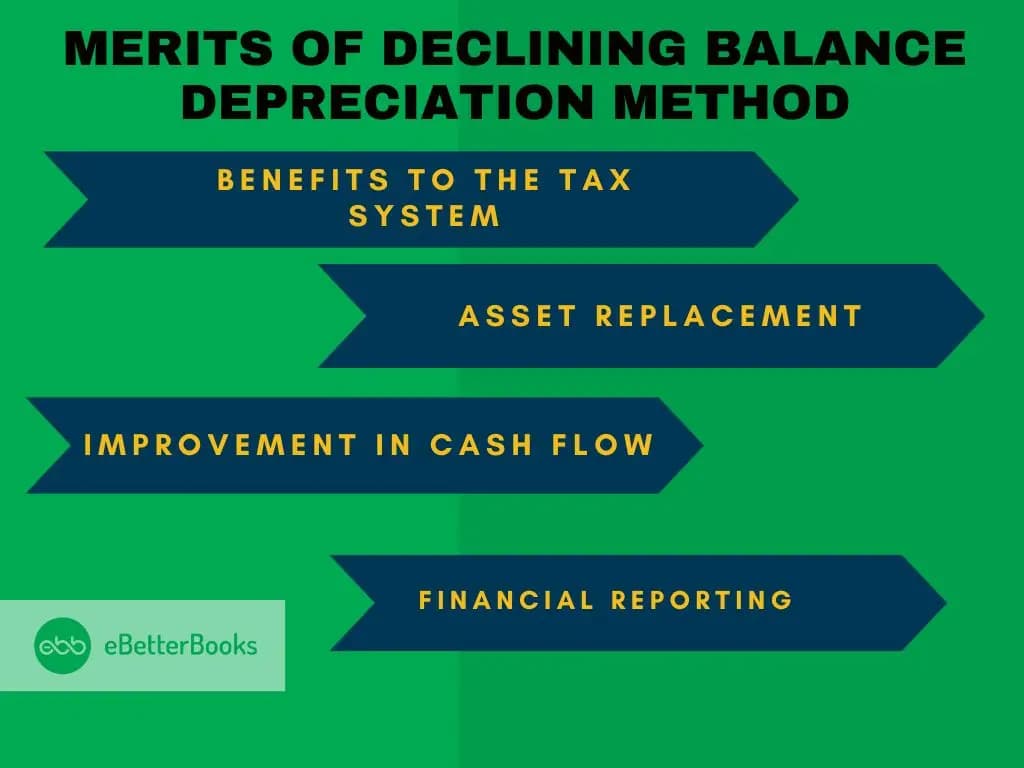

Merits of Declining Balance Depreciation Method

There are merits of the declining balance method:

- Benefits to the Tax System: Early depreciation costs lower taxable income, which may save taxes.

- Improvement in Cash Flow: Early tax savings can improve cash flow, supporting debt reduction or business reinvestment.

- Asset Replacement: Faster depreciation can facilitate timely asset replacement planning and yield more insightful data.

- Financial Reporting: It provides a more accurate picture of how an asset’s value and utility deteriorate over time.

Demerits of Declining Balance Depreciation Method

There are a few demerits also, which are listed below:

- Complex Calculations: Compared to straight-line depreciation, this approach necessitates more complicated calculations.

- Reduced Depreciation in Subsequent Years: Depreciation expense decreases dramatically with the asset’s useful life, which may cause it to fall out of step with rising maintenance and operating costs.

- Not Suitable for All Assets: This strategy is less suitable for assets that do not decline significantly in the first years of their life.

- Possibility of Financial Statement Fraud: Lower reported earnings in the early years due to high depreciation charges may not accurately reflect the company’s financial health.

- Inconsistency with Non-Tangible Assets: This approach is less appropriate for assets like software or intellectual property that retain value quickly and have a long useful life.

Declining Balance Vs. Straight Line Method of Depreciation

The two widespread techniques of cost allocation are the Declining Balance Depreciation Method and the Straight-Line method, although the two are dissimilar regarding the depreciation rate and utilization.

The formula for the Depreciation charged in the Declining Balance Method is more in the early years and less in the later years. This is done by using a specific rate that is charged on the book value of the asset at the start of every year. In this case, book value, which is the net asset, is shared over the useful life; hence, when the book value reduces over time, depreciation also reduces. They are most appropriate for use where the assets have the higher proportion of their cost charged to expense during their earliest years of use, for instance, machinery or technology assets.

On the other hand, the Straight-Line Depreciation Method allocates the asset’s cost equally between the number of years in the useful life period. This tends to imply that the same proportion of the cost is charged as depreciation each year, which in turn is easier and more easily understandable. The straight-line method provides a perfect match of the assets that produce values that are similar throughout their useful life expectancy, such as buildings or office equipment. Despite more extensive initial deductions in the declining balance method, this method gives a coordinated expense over time, which may be more acceptable for accurate cost estimates and future prognoses.

Conclusion

Businesses must choose the appropriate depreciation method based on the asset, its planned use, and how technological advancements may affect its usefulness. The Declining Balance Depreciation Method works best with assets and equipment, like technological goods, that are likely to become outdated and worthless in a matter of years.

FAQs

What is the Diminishing Balance Method of Depreciation?

The diminishing balance method is a variety of accelerated depreciation where the fixed percentage is charged on the asset’s book value every year so as to give higher charges in the early years while lower charges in later years.

How Do you Calculate Declining Balance Depreciation?

Use the formula:

Depreciation Expense = Book Value of asset at the beginning of the year * Depreciation Rate

Example: That means if an asset was bought for $10,000 and there was a depreciation rate of 20%, the first year depreciation was:

$10,000 × 20% = $2,000.

Which Depreciation Method is Best?

It depends on the asset’s usage pattern:

Diminishing balance method: Most suitable for elements of the balance sheet that depreciate or become obsolete soon (e.g. land and buildings, vehicles, machinery).

Straight-line method: Appropriate for those kinds of assets that are used equally throughout their lifetime within the organization.