Depreciation and Amortization are two accounting techniques used to spread the amount over the use life of assets, but both techniques are meant to apply to different types of assets.

Amortization is primarily implemented on intangible assets, such as patents, goodwill, copyrights, and trademarks which, despite being non-physical in existence, lose value over a period of time. This is similar to depreciation, which is implemented on tangible assets like cars, machinery, buildings, and equipment. In both circumstances, the objective is to spread the asset’s cost over its useful life, by accounting standards.

While depreciation pertains to physical assets with a measurable lifespan and potential salvage value, amortization is reserved for intangible assets, which generally do not have residual value. Both amortization and depreciation are non-cash expenditures and are accounted as a deduction in the asset amount on a corporation’s balance sheet.

These techniques are ruled by different accounting standards, such as GAAP and IFRS, and are organized to adhere to the matching principle, assuring that expenses are identified in the same period as the related revenues.

Further, both depreciation and amortization expenses are tax-deductible, delivering potential tax benefits to corporations.

What is Amortization?

Amortization refers to a systematic allocation of intangible assets ( such as copyrights, trade names, customer lists, patents ) cost over a certain period of time.

Amortization is essential for predicting the future value of businesses and investments. Amortized expenses have a significant impact on a company’s balance sheet, income statement, and tax liability. Whether it’s loan payments or tax purposes, amortization helps to clearly indicate the interest vs the principal amount.

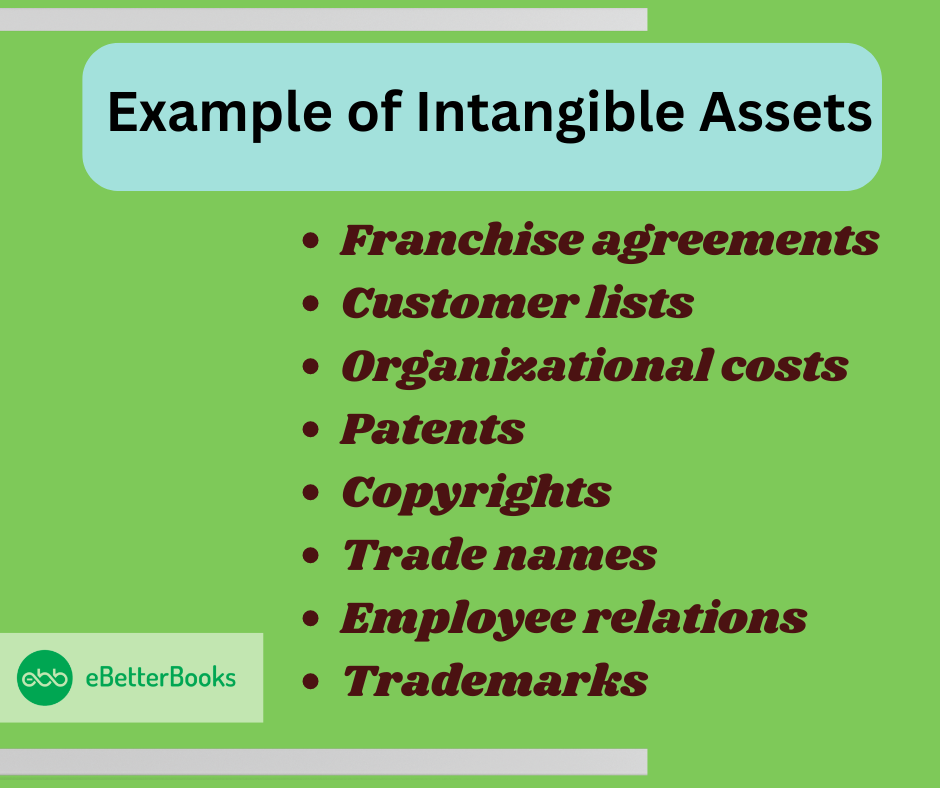

Example of intangible assets are:

- Franchise agreements

- Customer lists

- Organizational costs

- Patents

- Copyrights

- Trade names

- Employee relations

- Trademarks

Amortization of a Loan

Amortization of a loan refers to a continuous process of paying off the total loan amount over a period of time. At the time of taking out the loan, a schedule of loan payments is set and the individual or the company is responsible for repaying the balance on time with each fixed payment.

Loan payments consist of fixed amounts for each month or in installments. However, the allocation between principal and interest on the loan will change over time. Initially, the interest portion is higher and decreases as the months pass. Loan amortization is crucial in both consumer and business contexts as it determines how to allocate the payments appropriately between principal and interest.

Amortization of Assets

While handling the amortization of assets, the value of intangible assets over a period of time is calculated. However, it is quite difficult to calculate the asset’s value with no fixed value and true cost.

Amortization enables you to recognize your gradual losses and then match the expense with the annual revenue amount.

When to Use Amortization?

In the case of intangible assets, amortization is used to align the cost or expense of an asset with its related revenue, following the matching principle of GAAP. This means that the cost or value of an intangible asset is spread out over its projected useful life using a straight-line basis, as intangible assets do not have a salvage value or resale value. By expensing the same amount every reporting period, the total sum equals the total cost or value of the asset.

Amortization is a vital financial tool for companies, used for both loan repayments and expensing intangible assets. In the case of loan amortization, schedules are created to help forecast the repayment of the principal amount and the associated interest expense, which is then deducted for tax purposes.

What is Depreciation?

Depreciation refers to the process of calculating the value of an asset such as building, machinery, equipment for its useful life.

Depreciation is computed by deducting the asset’s initial cost from its salvage or resale value. The difference is equally depreciated throughout the asset’s anticipated life in years.

Examples of fixed assets include:

- Office furniture

- Land

- Buildings

- Equipment

- Vehicles

- Computers

- Tools

- Machinery

When to Use Depreciation?

Machinery, plant, equipment, and land property represent significant investments for companies. By using depreciation, businesses can effectively manage these costs, aligning them with the revenue generated over the asset’s lifespan. This approach prevents a large, immediate expense in a single reporting period.

According to the IRS, a taxable entity can claim depreciation for a property after meeting the following requirements:

- The taxpayer must own the property.

- Only assets tied to a business may be claimed for depreciation.

- The asset’s life needs to be ascertainable.

- The asset should have a longer useful life than a year.

According to the matching principle in generally accepted accounting principles (GAAP), a business is required to align the expense or cost of an asset with the benefit of its use over time. This means that even if the company pays for the asset in full at the beginning, it must spread out the expense over a longer period for tax and financial reporting purposes, ensuring a more accurate representation of the company’s financial position.

Businesses also use another method of depreciation known as the accelerated depreciation method. In this method, the company depreciates the asset more quickly than the traditional straight-line method.

Under accelerated depreciation, financial statements show larger deductions in the asset’s book value in the earlier years compared to the later years. This method provides a greater tax credit for the company in the early years of depreciation.

Example:-

ABC Enterprise purchased a software patent for $100,000 with a legal life of 10 years and a new set of office furniture for $50,000 with a useful life of 5 years.

Calculating Amortization

Amortization = Cost of patent / Legal life

= 100,000 / 10

= 10,000 per year

Journal Entry to record Amortization:

| Account | Debit | Credit |

| Amortization expense ………Dr | $10,000 | |

| Accumulated amortization | $10,000 |

Calculating Depreciation

Depreciation = Cost of furniture / Useful life

= 50,000 / 5

= 10,000 per year

Journal Entry to record Depreciation:

| Account | Debit | Credit |

| Depreciation expense ………Dr | $10,000 | – |

| Accumulated depreciation | – | $10,000 |

Amortization vs Depreciation

| – | Amortization | Depreciation |

|---|---|---|

| Applicability | Only applies to intangible assets. | Only applies to tangible assets. |

| Formula | Annual Amortization= (Cost of Intangible Asset) / Useful Life | Annual Depreciation = (Cost of Tangible Asset-Salvage Value) / Useful Life |

| Implementation | It only uses a straight-line method for calculating amortization expenses. | It uses a straight-line method, Declining balance, Double-declining balance, Units of production, Sum-of-years-digits for calculating depreciation expenses. |

| Salvage Value | It doesn’t incorporate salvage value while determining amortization base. | It may incorporate salvage value while determining depreciation base. |

| Contra Assets | It may not always use the contra assets. | It always uses the contra assets. |

How Can I Decide if an Asset Should be Depreciated or Amortized?

Clear instructions on how to account for various asset kinds are provided by GAAP. These accounting rules state that intangible assets should be amortized and tangible, physical assets should be depreciated. For assets that are exempt from depreciation, although there are exceptions for non-depreciable assets.

Is it Preferable to Depreciate or Amortize an Asset?

Neither depreciating nor amortizing an asset has any benefits. Accounting standards that specify whether an asset should be depreciated or amortized serve as the basis for the choice. Neither approach provides a financial advantage over the other; both serve to spread out an asset’s cost across its useful life.

Conclusion

Running a business is a challenging task, and companies require both tangible and intangible assets to operate and achieve profitability. However, effectively managing costs and navigating tax complexities can be time-consuming and challenging. This is where amortization and depreciation come into play. Whether it’s a tangible or intangible asset, there are likely opportunities for deductions, and assisting clients in understanding the intricacies of both amortization and depreciation further solidifies your role as their trusted advisor.

FAQs

What are depreciation and amortization with examples?

Depreciation is the allocation of the cost of tangible assets over time (e.g., machinery), while amortization spreads the cost of intangible assets (e.g., patents) over their useful life.

What is an example of amortization?

An example of amortization is a company amortizing the cost of a patent over 10 years.

What is amortization in simple words?

Amortization is the process of gradually writing off the cost of an intangible asset over time.

What is the difference between depreciation, amortization, and depletion?

Depreciation applies to tangible assets, amortization applies to intangible assets, and depletion is used for natural resources.