First-in, First-Out (FIFO), and Last-In, First-Out (LIFO) are two common inventory valuation methods for businesses. The FIFO method assumes that the oldest inventory is sold first, while the LIFO method implies that the most current inventory is sold first.

Although FIFO is often approved under Generally Approved Accounting Principles (GAAP), LIFO is also allowed in the United States because of its possible tax benefits during inflationary times.

Nevertheless, IFRS (International Financial Reporting Standards) prohibits LIFO. Particularly during periods of price increases, the effects of both strategies on a business’s finances are distinct.

What is FIFO?

A system of accounting and inventory management that assumes the oldest products will leave inventory first is known as FIFO (First In, First Out). This implies that when a company makes product sales, the oldest stock is part of the cost of goods sold (COGS Knicks).

FIFO is often used within sectors that are worried about inventory turnover, especially when it comes to perishable or expiration-date items. This approach helps to make room for newer and potentially more expensive items, allowing market costs to be more accurately reflected.

How Does FIFO Work?

FIFO is an inventory control method that insists that the oldest inventory be used first before any newer stock. As items are sold, the price of the oldest batch of inventory is used to record their cost.

As this approaches, new products that have been purchased stay in stock, and their valuation is determined by the current purchase prices. This suggests that the price related to items sold will be decreased by employing older, more affordable goods while the remaining inventory keeps pace with current market costs.

FIFO clearly demonstrates that stock is efficiently turned into sales and that financial statements reflect the actual worth of what remains.

What is LIFO?

Last In, First Out (LIFO) refers to the method of valuing inventory that sells or uses the inventory obtained most recently before earlier inventory. It assumes that the newest inventory item purchased will be the first to be disposed of, while the older items stay either unsold or untouched.

This trend is often encountered in business settings that are prone to higher inventory expenses, which can, in times of inflation, cause a decline in their taxable income.

How Does LIFO Work?

LIFO reveals that the total expense of the goods sold is connected to the most recent items obtained. The older inventory still in stock is valued at the cost it was obtained for in previous times.

Due to this, COGS involves recently purchased stock costs, which frequently show signs of inflation-related price inflation. When an increased volume of items is sold, newer inventory is used to calculate the cost of goods sold, while the older inventory is maintained on the balance sheet at cheaper rates.

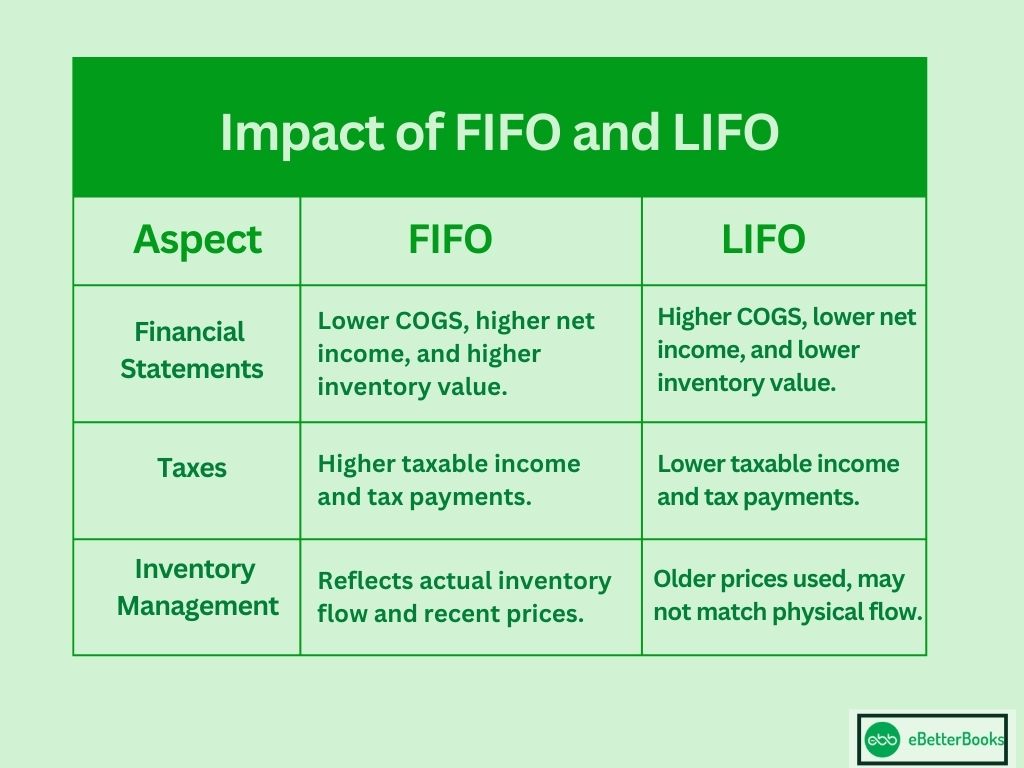

Impact of FIFO and LIFO

Impact of FIFO

- Financial Statements:

Using FIFO during inflation tends to increase net income because of the tactical integration of low-cost inputs and ongoing revenue.

Additionally, it increases balance sheet values for assets since any leftover inventory is calculated against more recent, typically higher costs.

- Taxes:

Employing FIFO could improve profits, leading to increased tax liabilities for firms due to the enlarged revenues they reflect.

- Inventory Management:

The employment of a FIFO (First-In, First-Out) structure facilitates the optimization of inventories for organizations, enabling them to sell products of older stock first while reducing the chances of these products becoming obsolete.

Impact of LIFO

- Financial Statements:

The implementation of LIFO most regularly results in a decrease in net income due to inflation because the higher costs of more recent items are included in COGS, which then decreases the reported benefits.

This process lowers the asset values seen on the balance sheet, as prior inventory is noted at lower historical costs.

- Taxes:

Using the Last-In-First-Out (LIFO) strategy for profits can result in lower tax liabilities, which could be useful for companies that are dealing with inflation.

- Inventory Management:

When Last In, First Out (LIFO) is used for inventory, it enhances the risk of products becoming outdated after a long period.

Similarities and Differences

Similarities

- Purpose: FIFO (First In, First Out) and LIFO (Last In, First Out) are inventory costing techniques that serve as essential factors in accounting to assess COGS (Cost of Goods Sold) and the inventory balance reported on the financial statements.

- Impact on Financial Statements: While both methods impact key financial ratios such as gross profit on sales and net income on sales, they also alter the balance sheet figure for inventory.

- Accounting Practices: The United States allows companies to use the FIFO and LIFO methods in accordance with GAAP accounting.

- Tax Implications: Companies’ valuations could influence their tax responsibility since the reported COGS and inventory often produce a gap in the income subject to taxation.

Differences between FIFO and LIFO

Below is the difference between both methods:

| Basis | FIFO | LIFE |

| Inventory Flow Assumptions | Oldest inventory items are sold first | Recent inventory items are sold first |

| Impact on Cash Flow | It is less advantageous as it increases the tax liability | It is more advantageous as it decreases tax liability |

| International Reporting | Permitted by both GAAP and IFRS | Permitted only under GAAP |

| Impact on COGS | Lowers the amount of COGS | Higher the amount of COGS |

How to Calculate FIFO and LIFO?

FIFO (First In, First Out)

Steps to Calculate FIFO:

- List Inventory Purchases: Arrange all purchases in chronological order, including the number purchased and the cost for each.

- Identify the Oldest Inventory: In order to compute the COGS, use the price of the earliest inventory (the first one bought) when a sale takes place.

- Calculate COGS: Take the quantity of sold units and multiply it by the cost of the oldest inventory until the sold quantity is entirely covered.

- Calculate Ending Inventory: After the sale ends, we value the leftover inventory based on the most recent purchases.

Example:

- Purchase 1: 100 units at $10 each

- Purchase 2: 200 units at $12 each

- Sold: 150 units

For FIFO, you sell 100 units at $10 each from Purchase 1 and 50 units at $12 each from Purchase 2.

$1600 = COGS = (100 units x $10) + (50 units x $12) = $1000 + $600

The 150 units from Purchase 2, at a rate of $12 apiece, will remain in stock after this.

$1800 is the outcome of determining Ending Inventory = 150 units x $12.

LIFO (Last In, First Out)

Steps to Calculate LIFO:

- List Inventory Purchases: As with FIFO, include in your list all purchases arranged chronologically, together with units and costs.

- Identify the Newest Inventory: When a sale goes through, use the latest purchase’s inventory cost to determine COGS.

- Calculate COGS: Calculate the total sales units multiplied by the expense of the current inventory until the money for those sales is available.

- Calculate Ending Inventory: The leftover inventory after the sale receives valuation based on the oldest prices ever set.

Example:

- Purchase 1: 100 units at $10 each

- Purchase 2: 200 units at $12 each

- Sold: 150 units

LIFO requires you to sell 150 units from Purchase 2 at the price of $12 each.

COGS = 150 units x $12 = $1800

The remnant inventory consists of the 100 units acquired in Purchase 1 at a price of $10 each and 50 units from Purchase 2, valued at $12 each.

Ending Inventory = $1000 + $600 = $1600 = (100 units x $10) + (50 units x $12)

Real-time Solved Examples of FIFO and LIFO

FIFO (First In, First Out)

Scenario: A computer seller executed the below inventory purchases in June:

- June 1: 50 computers @ $500 each

- June 10: 40 computers @ $550 each

- June 15: 30 computers @ $600 each

- Total Sold in June: 90 computers

Step 1: Since FIFO asserts that the oldest inventory will be sold first, we will start our sales from the June 1 purchase.

- The first 50 computers purchased from June 1 at a price of $500 each add up to $25,000 or (50 x $500).

- On June 10, the subsequent 40 computers will cost $550 each, which equals 40 x $550 = $22,000.

Total COGS for FIFO:

COGS = $25,000 $22,000 $47,000

Step 2: Since 90 computers were sold, 30 remain from the original purchase on June 15.

- 15 June left 30 computers at $600 each = 30 x $600 = $18,000.

FIFO Summary:

- COGS: $47,000

- Ending Inventory: $18,000

LIFO (Last In, First Out)

Scenario: That very same company engaged in these inventory purchases in June:

- June 1: 50 computers @ $500 each

- June 10: 40 computers @ $550 each

- June 15: 30 computers @ $600 each

- Total Sold in June: 90 computers

Step 1: LIFO, which assumes the newest inventory, goes first and guides our calculation of the Cost of Goods Sold (COGS), starting with the inventory acquired on June 15.

- The first 30 computers ordered on June 15 cost $600 each, which is $18,000 x 30 x $600.

- On June 10, the next 40 computers will cost $22,000 altogether =40 x $550.

- In total, the remaining 20 computers from June 1 equal $10,000 at $500 per unit = 20 x $500.

Total COGS for LIFO:

$50,000 = $18,000 + $22,000 + $10,000

Step 2: After selling 90 computers, the inventory leftover results from the purchase made in June (30 units remain unsold).

- Staying 30 computers from June 1@, $500 each equals 30 x $500 = $15,000.

LIFO Summary:

- COGS: $50,000

- Ending Inventory: $15,000

Advantages and Disadvantages of FIFO and LIFO

| Methods | Advantages | Disadvantages |

| FIFO (First In, First Out) | Reflects the present market value of inventory since the first sale prioritizes outdated stock. Produces better profits during periods of inflation (higher earnings reported). Easy to roll out and generally endorsed by both GAAP and IFRS. | An escalation in profits because of inflation might cause a growth in tax revenue. We need to illustrate the correct movement of goods within selected sectors. |

| LIFO (Last In, First Out) | When inflation leads to a reduction in taxable income, taxpayers can expect a decrease in their tax liability. Improves correspondence between current costs and revenues, showing the actual expense of sales. | The restrictions on international adoption are due to the fact that IFRS does not recognize it. As a result, a drop in profits may influence the ability to gain investor attention. At year-end inventories, the potential exists for older items to become underestimated and still need to be sold. |

Impact of Rising Costs on Ending Inventory During Stable Inventory Quantities

During periods when costs are rising and inventory quantities are stable, ending inventory will be:

- Higher under FIFO: FIFO assumes the oldest (and generally less expensive) inventory is the first sold. Thus, the inventory left at the end consists of more recent purchases at elevated costs, resulting in a higher ending inventory value.

- Lower under LIFO: LIFO believes that the most recent (and costly) inventory is sold off first, with remaining older, cheaper inventory continuing to be on hand. In turn, the lower historical costs of the ending inventory lead to a lower value for that inventory.

Differences Between FIFO and LIFO

Definition

- FIFO (First In, First Out): This methodology bases its assumptions on the idea that the oldest inventory items should sell first. Consequently, the oldest inventory costs are employed to determine the cost of goods sold (COGS).

- LIFO (Last In, First Out): This strategy assumes that the products we recently obtained are the first to sell. As a result, the costs connected with the most recent inventory help determine COGS calculations.

Impact on Financial Statements

- FIFO: This practice increases net income in conditions of rising prices, as current revenues are opposed to older, cheaper costs. As a result, the balance sheet shows a significantly rising inventory value at the end.

- LIFO: In most cases, it results in lower net income in periods of inflation because the most recent increased costs are used for COGS. Consequently, this leads to an inferior ending inventory value on the balance sheet.

Tax Implications

- FIFO: A rise in profits may lead to an increased tax liability since the reported earnings are higher.

- LIFO: Having lower profits can limit tax obligations, becoming beneficial in the face of climbing costs.

Inventory Valuation

- FIFO: The most current purchase prices are shown in the ending inventory, which more precisely represents the current market value.

- LIFO: The final inventory represents archaic buy prices that can undervalue inventory in situations of rising expenses.

Compliance

- FIFO: Approved under the terms of both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- LIFO: Legitimate under GAAP in the U.S. but prohibited by IFRS.

Use Cases

- FIFO: Traditionally used in industries involving short-lived goods or items that quickly lose value, FIFO ensures that older inventory is sold before newer stock.

- LIFO: Typically utilized in sectors where inventory expenses are climbing, the use allows firms to reduce their tax liability.

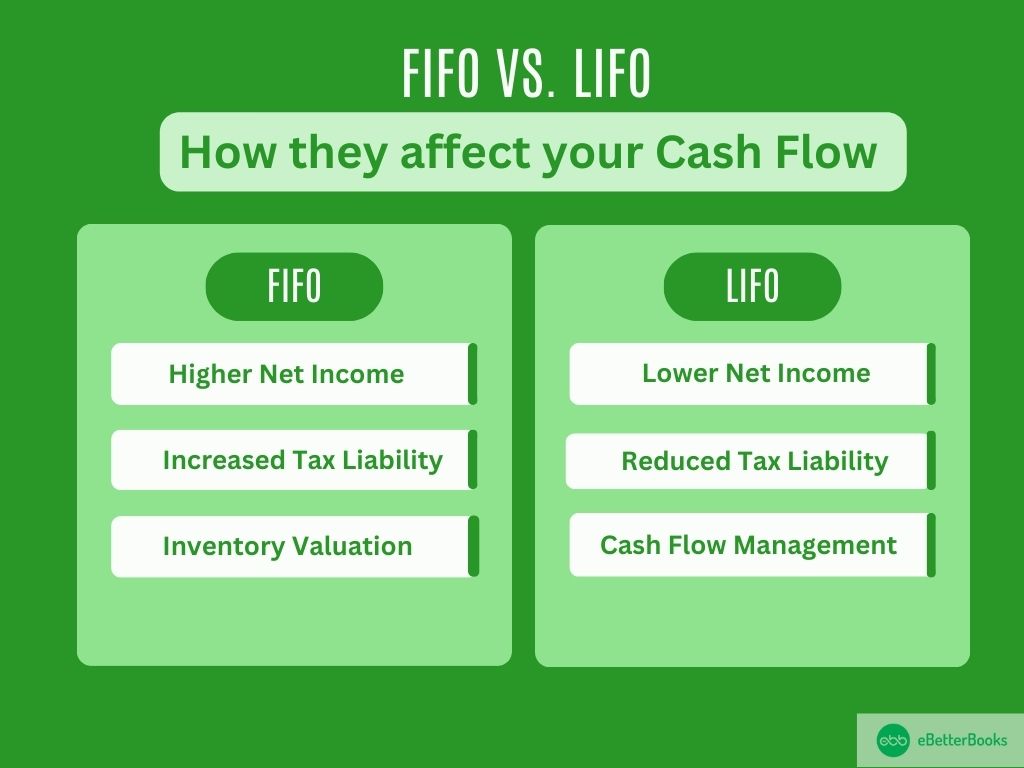

FIFO vs. LIFO: How they affect your Cash Flow

The selection of FIFO (First In, First Out) versus LIFO (Last In, First Out) can strongly affect a company’s cash flow, largely through its consequences for net income, tax liability, and managing working capital.

FIFO (First In, First Out)

- Higher Net Income:

- Impact on Cash Flow: With FIFO, in times of elevated costs, the cost of goods sold (COGS) is below par because older, less expensive inventory dictates costs. The result is an additional net income, which may help increase the cash flow gained from operations.

- Increased Tax Liability:

- Impact on Cash Flow: Elevated profits equal elevated taxes. This might lower the cash available for reinvestment or distribution to shareholders, which could negatively impact cash flow.

- Inventory Valuation:

- Impact on Cash Flow: Valuing ending inventory at its latest, highest costs can positively change current ratios and overall asset valuation, which likely enhances borrowing capacity.

LIFO (Last In, First Out)

- Lower Net Income:

- Impact on Cash Flow: During high expense periods, LIFO causes greater COGS, which concludes in a drop in net income. There could be a negative impact on cash flow from operations experienced in the short run.

- Reduced Tax Liability:

- Impact on Cash Flow: Reduced earnings, led by this, caused lowered tax liabilities, granting the firm the capacity to save more cash for operational purposes, investments, or dividends.

- Impact on Cash Flow: Employing LIFO to frame reported earnings can help companies maintain improved cash flow in high inflationary times, thereby leaving more cash for strategic initiatives.

Summary

Typically leading to both higher net income and elevated tax liabilities, FIFO tends to tie up cash flow, mainly during periods of inflation. However, it raises asset valuation and might improve liquidity.

Which Method is Better?

Depending largely on key elements like a company’s financing strategy, the business sector, and the dominant economic climate, choosing between FIFO (First In, First Out) and LIFO (Last In, First Out) inventory valuation methods is important. Here are some considerations for each method:

When FIFO Might Be Better

- Rising Prices:

FIFO usually results in improved net income during inflationary times as it sells older, lower-priced inventory initially. This situation has the potential to help attract investors and ensure loan guarantees.

- Inventory Turnover:

For markets that deal with perishable goods or items that could lose relevance, FIFO, which is widely used, preserves the tradition of focusing on older inventory to essentially reduce the chances of having leftover supplies.

- Higher Asset Valuation:

By considering ending inventory at more recent costs, FIFO can inflate asset values on the balance sheet, which may, in turn, boost financial ratios, including current and quick ratios.

- Global Compliance:

When companies work internationally, they prefer FIFO because it is acceptable under GAAP and IFRS.

When LIFO Might Be Better

- Tax Advantages:

By using LIFO (last in, first out), firms can reduce their taxable income in the event of escalating costs. This income can be used for operations, investments, or distribution to shareholders.

- Cost Matching:

In circumstances marked by high inflation, applying LIFO could produce a more beneficial profitability calculation by relating modern costs to income.

- Cash Flow Management:

As reported profits decline, firms find it easier to regulate cash flow, which could benefit short-term financial planning.

- Industry Practice:

In special industries, especially those that deal with durable or voluminous items, LIFO tends to be the standard method, which facilitates competitive benchmarking.

Conclusion

Methods known as FIFO and LIFO have different benefits and disadvantages. FIFO, for example, allows for the definition of current inventory values, especially for products with a short shelf life. This ensures that outdated stock is sold off first.

Should taxable income rise in an inflationary environment, it will, in turn, increase tax obligations. In contrast, LIFO manages tax advantages in inflationary witnessed settings by linking ongoing expenditures to revenue, thereby helping lower taxable income. In any case, this method may produce incorrect inventory valuations, especially given IFRS regulations, since it might not indicate the current market value of leftover inventory.

The choice between either valuation method truly relies on a company’s business financial ambitions, industry stipulations, and legal requirements, so companies should consider their situation when selecting an inventory valuation approach.