Inventory valuation is a major component of the production process for goods that are bought and used in the production cycle or that are sold from stock.

What is Inventory Valuation?

Inventory valuation is a process of determining the financial value of the goods and materials that a company holds for sale or production of an item. The valuation is important because inventory often represents the largest current asset on a company’s balance sheet, and accurate measurement is essential for reliable financial reporting.

The value of inventory impacts key business financial metrics, such as cost of goods sold (COGS) and gross profit, which in turn affect the company’s profitability and financial position. Proper inventory valuation guarantees that expenses and revenues are matched correctly by enabling informed business decisions and compliance with accounting standards such as AS-2 or IND AS 2, which guide how inventories should be valued and reported in income statements.

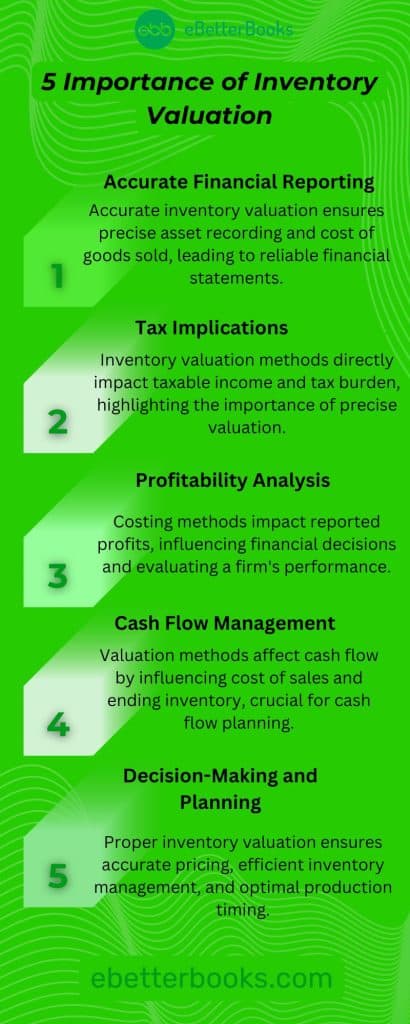

Importance of Inventory Valuation

Inventory valuation is an important aspect of the business because:

- Accurate Financial Reporting: Correct inventory value management makes it possible to accurately record the assets and the cost of the merchandise sold, hence a good financial statement.

- Tax Implications: The selection of the inventory valuation method clearly influences taxable income and, in turn, taxation. Valuation and its precision made noteworthy contributions to determining an improved tax burden.

- Profitability Analysis: Costing methods for inventories influence the reported level of profits. It’s worth noting that different techniques for arriving at profits and identifying them can have different profit margins, which affects the firm’s decisions and the ways and means used to evaluate the success of the financial performance.

- Cash Flow Management: Valuation methods impact the cash flow since expenses such as cost of sales and Forex impact the ending inventory, which is essential for cash flow planning.

- Decision-Making and Planning: Proper Inventory valuation keeps them informed about the proper management of inventories, the correct determination of the right price to charge, and even the right timing and scheduling of production.

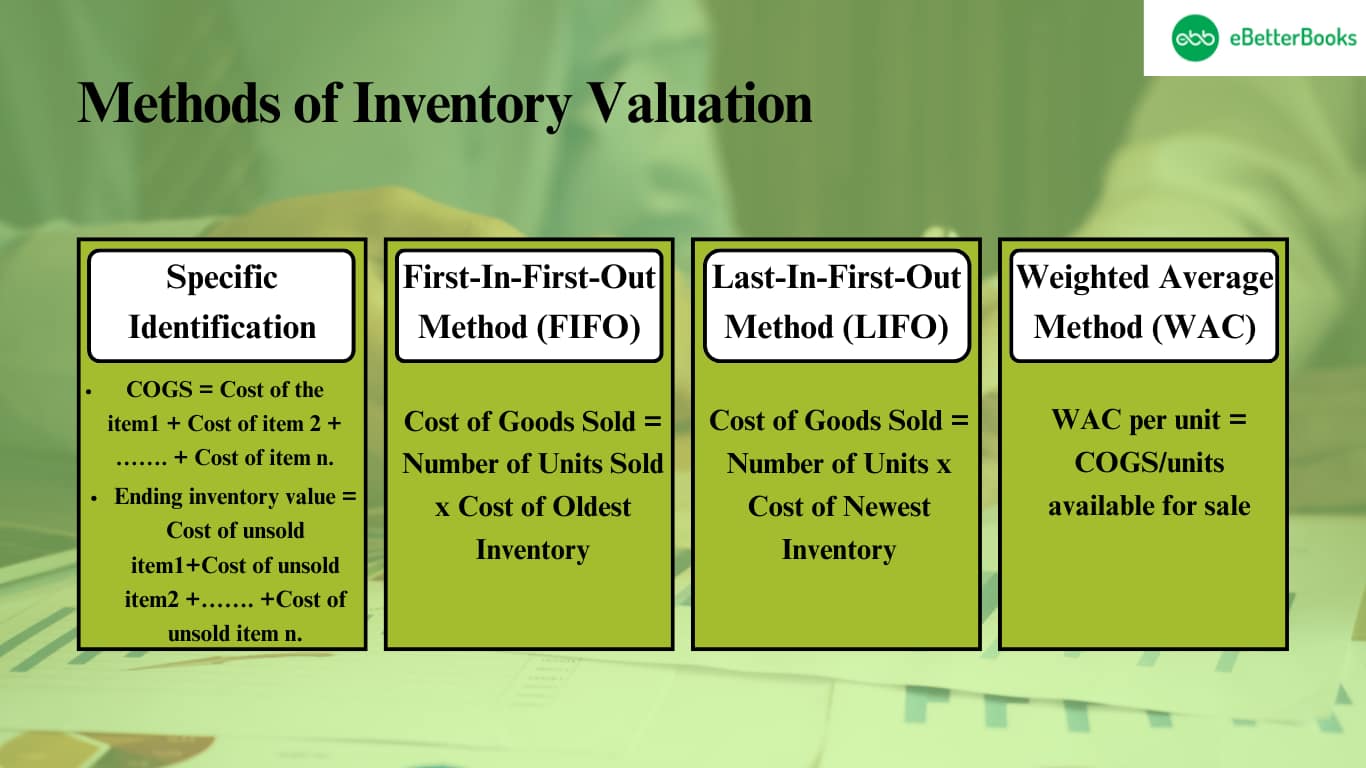

Methods of Inventory Valuation

Specific Identification

Specific Identification is the actual cost of the particular stock or things in it. Every item is reported with its particular cost, and COGS is calculated with reference to the costs of the product that has been sold. It is quite accurate when valuing the stock. It is most suitable for small businesses, companies that deal with items that are difficult to catalog, and those that require the tracking of the cost of units separately. However, it is less useful for businesses with a high stock turnover of simple and similar items of stock as it demands a record of their cost.

First-In-First-Out Method (FIFO)

First In First Out, as the name suggests, is a system where the first items that are received first are the first to be sold. Thus, the cost of the goods sold (COGS) is determined with reference to the first first out (FIFO) method. This method is useful, especially during inflation, because it brings forward lower sales costs. Thus, the reported net income is high. The ending inventory, in contrast, will only state a stock at a certain cost that relates to the price purchased at a later date when prices might have increased. This method is also strategic in business since it works with the flow of inventory, in which, in many cases, old items are sold before new ones.

Last-In-First-Out Method (LIFO)

LIFO has the principle that inventories that were bought in the last are sold first. As such, the stock is valued from the last cost, which may be relatively high since the business buys new stock at high prices during episodes of inflation. This leads to higher COGS and lower net income since the initially used, costly, and recent purchases are taken into consideration. On the contrary, the ending inventory comprises mostly old inventory, which often has lower costs. LIFO, while it can bring about the reduction of taxable income during inflation, is sometimes prohibited by some accounting standards such as IFRS.

Weighted Average Method (WAC)

The Weighted Average Cost method is used to estimate the quantity of inventory cost remaining for sale during a specific period. This method includes adding the total cost of the goods sold and then dividing the amount arrived at by the quantity of the goods. It offers an even and stable expense figure on the COGS and inventory because it equalizes price differences noted over time. It is much better than using both FIFO and LIFO since they are in the middle, preventing the formation of both of them.

Solved Example of Inventory Valuation

A company has the following inventory transactions during a month:

Beginning Inventory: 50 units at $1 each

Purchases:

- 50 units at $2 each

- 50 units at $3 each

Sales: 40 units sold at $5 each

Inventory Valuation Methods

1. First-In, First-Out (FIFO)

Under FIFO, the oldest inventory costs are used first when calculating the Cost of Goods Sold (COGS).

- COGS Calculation:

Sell 40 units from the beginning inventory: 40 units x $1 = $40

- Ending Inventory Calculation:

Remaining:

10 units from beginning inventory ($1 each) = $10

50 units from the second purchase ($2 each) = $100

50 units from the third purchase ($3 each) = $150

Total Ending Inventory = $10 + $100 + $150 = $260

2. Last-In, First-Out (LIFO)

Under LIFO, the most recently purchased inventory costs are used first for COGS.

- COGS Calculation:

Sell 40 units from the last purchase: 40 units x $3 = $120 (since only 10 from the second purchase will be sold)

- Ending Inventory Calculation:

Remaining:

50 units from the second purchase ($2 each) = $100

10 units from the beginning inventory ($1 each) = $10

Total Ending Inventory = $100 + $10 = $110

3. Weighted Average Cost (WAC)

The WAC method averages out all costs of inventory.

- Average Cost Calculation:

Total cost of inventory = (50 x $1) + (50 x $2) + (50 x $3) = $50 + $100 + $150 = $300

Total units available for sale = 50 + 50 + 50 = 150 units

Average cost per unit = Total cost / Total units = $300 / 150 = $2 per unit

- COGS Calculation:

COGS for sold units: 40 units x $2 average cost = $80

- Ending Inventory Calculation:

Remaining inventory:

Total remaining units = 150 – 40 = 110 units

Ending Inventory value: 110 x $2 average cost = $220

| Method | COGS | Ending Inventory |

| FIFO | $40 | $260 |

| LIFO | $120 | $110 |

| WAC | $80 | $220 |

This example shows how different inventory valuation methods can significantly impact both the Cost of Goods Sold and the ending inventory value. Each method has its implications for financial reporting and tax liabilities, making it essential for businesses to choose the method that aligns with their financial strategy and operational realities.

Objectives of Inventory Valuation

Here are some of the objectives of inventory valuation:

Determining Gross Profit

One of the primary objectives of inventory valuation is to accurately determine a company’s gross profit. This is achieved by calculating the cost of goods sold (COGS), which is essential for assessing profitability. The formula for COGS is:

COGS = Beginning Inventory + Purchases − Ending Inventory

Businesses can ensure that gross profit reflects the true financial performance over an accounting period by valuing inventory correctly.

Assessing Financial Position

Inventory valuation provides a clear picture of a company’s financial position. The value of closing inventory is recorded as a current asset on the balance sheet that impacts overall working capital and financial health.

Misvaluation can lead to misleading representations of a company’s financial stability, affecting decisions made by investors and creditors.

Supporting Financial Statements

Accurate inventory valuation ensures that financial statements, including the income statement and balance sheet, present a true and fair view of the company’s operations.

This is vital for compliance with accounting standards and for maintaining transparency with stakeholders.

Facilitating Inventory Management

Effective inventory valuation aids in managing stock levels efficiently. Companies can make informed decisions regarding purchasing, production, and sales strategies by understanding the value of unsold goods. This helps to avoid stock shortages or excesses that could disrupt operations and profitability.

Enhancing Tax Planning

The method chosen for inventory valuation can significantly affect taxable income. Different methods, such as FIFO vs. LIFO, yield different COGS figures which influence gross profit and tax liabilities. Businesses need to select their inventory valuation method carefully to optimize their tax position while complying with regulations.

The Rule of the Lower of Cost or Market

The Lower of Cost or Market (LCM) Rule is one of the most important rules used for merchant accounting. It ensures that stock is stated at the cost or net realizable value, whichever is lower.

It is used to reduce the grossing up in the inventory accounts and recognize losses arising from a decrease in the value of inventory.

Here is how the LCM rule works:

- Cost: This is the cost of goods purchased or manufactured and brought into the business for resale adjusted for the cost of acquisition of the asset; it is the cost of purchasing or manufacturing the inventory that appears on the balance sheet.

- Market Value: This refers to the price that was paid to acquire the inventory, which can be referred to as the cost of replacing the inventory at present-day prices. Yet, it cannot extend to such a degree as to exceed the net realization value wherein the estimated selling price is less than the costs that may be incurred in the course of completing the goods as well as selling them.

- Comparison: Based on the LCM rue, the value reported on the balance sheet for inventories is the cost or its market value, whichever is lower. This approach helps to minimize cases of overstocking, and thus, inventory is balanced. In addition, potential losses are also recorded in the correct period.

- Application: According to ACC, if the inventory value is reduced to its market value, which is below the cost, the inventory is written down. This write-down appears on the income statement line, the loss line.

- Impact: The application of the LCM rule can cause changes in the financial statements, including a decline in the value and an increment in the COGS in case a write-down is needed. It aids in painting a conservative picture of the company and a more realistic picture of its financial position.

Costs Included in Inventory Valuation

The costs included in the inventory valuation generally encompass the following:

- Purchase Costs: The amount of money spent procuring the materials that make up the stock and any price incurred in acquiring the inventories, including purchase cost and freight-in, among other things.

- Production Costs: In manufacturing goods, this entails the direct cost, which is the cost of material used, labor, and other expenses. Manufacturing overhead includes expenses incurred in the production process, such as the cost of electricity, equipment, and factory space.

- Storage Costs: Storage Costs are the costs of holding inventory until it is sold in the market. They also include the costs of insuring the inventory in case of loss or damage.

- Handling Costs: The expenses related to the physical transfer, examination, and handling of stocks in the warehouse or production center. This entails expenses related to labor in handling and storing inventory and equipment used in the same process.

- Quality Control Costs: Costs arising from examining or checking goods for quality before they are sold or further processed. This means the costs of testing materials, the quality of the material, and other related expenses.

- Packaging Costs: Packaging Costs are expenses incurred in packaging related to making the inventory ready for sale or distribution. This comprises the prices of the boxes, labels, and other accessories associated with packaging.

Altogether, these costs go towards the figure of inventory in financial statements and influence COGS and net income.

Challenges of Valuing the Inventory

- Price Fluctuations: This fact suggests that market conditions are rather volatile, and actual prices for inventory fluctuate quite often, which makes it necessary to reevaluate them for quite a short time.

- Method Selection: The selection of the most suitable method of inventory valuation (LIFO, FIFO, Weighted Average, Specific Identification) Affects the filer’s financial statements and tax liabilities and does not always correspond to best practices or set standards.

- Complexity in Tracking: Controlling the costs of inventory and establishing a tracking system can be problematic for the company, particularly if its activity implies an extensive assortment of products or a great number of similar products.

- Obsolescence and Spoilage: Materials may Degrade or become damaged, and thus, changes to lower the inventory value may be necessary to avoid overstating the inventory.

- Regulatory Compliance: Consequently, accounting standards and government regulations affect inventory valuation and reporting, notably for multinationals or industries with strict standard requirements.

- Inventory Shrinkage: Shrinkage through theft, damage, or inaccuracies in records impacts the value, and it must be audited and managed effectively.

How Does Inventory Accounting Differ between IFRS and GAAP?

The differences between IFRS and GAAP mainly lie in the section on inventory costs and the allowed methods for inventory valuation.

Here are the key differences:

Cost Flow Assumptions

- IFRS: The IFRS standards do not allow the use of the LIFO inventory management method. It also restricts the organization from using only FIFO and the weighted average cost method for inventory calculation.

- GAAP: GAAP recognizes current and last-in, first-out techniques, cost flow inventory methods, and average cost methods.

Revaluation

- IFRS: It is important to note that IFRS does permit revaluation of inventory to the present market price if the price depicted is less than the cost, which is especially true in a scenario where the particular kind of asset is the agricultural products in the present case. Where it applies, it is generally used for most inventory, the carrying amount of which approximates the cost.

- GAAP: GAAP is largely mechanical and does not permit the revaluation of inventory. Year-end stock is stated at the lower of cost or replacement cost, net of any impairment, which is referred to as market value.

Costs of Goods Sold

- IFRS: Under IFRS, costs of goods sold are calculated by using the cost flow assumption; IFRS inventory is stated at the lower of cost or net realizable value.

- GAAP: Likewise, according to GAAP, the cost of goods sold depends on the specific method selected by the company in terms of the cost flow assumption. This is, however, subject to the lower cost or market rule where the market refers to the replacement cost, which is, however, limited to the net realizable value.

Therefore, it can be noted that the primary discrepancy between IFRS and US GAAP is the IFRS’s lack of allowance for LIFO, as well as the option for revaluation allowed within the IFRS in some climates.

Convergence

Convergence is the process by which GAAP and IFRS are fine-tuned so that accounting practices can be universally comparable. The concept of convergence aims to bring the two frameworks as close as possible so that firms’ operations worldwide become easier and investors can easily compare various financial statements worldwide.

Attempts to optimize the process are intended to standardize and clarify accounting standards worldwide to facilitate the financial reporting process.

Tips for Choosing the Best Inventory Valuation Method

The most effective method for the valuation of inventory depends on the company’s requirements and financial targets.

Here are the key factors to consider:

- Financial Impact: Determine each method’s impact on COGS, income, and taxes. For instance, FIFO is useful during inflation as it results in high net income, while LIFO reduces taxable income.

- Industry Practices: Consider the trends that are currently used in your sphere. Some business sectors have predetermined practices for selecting the method of inventory valuation that conforms to the rest of the company’s standards.

- Inventory Type: Determine the characteristics of your inventory. Business entities that deal with specialized or costly goods should prefer specific identification. FIFO or Weighted Average is preferable for businesses that work with a significant amount of similar goods.

- Regulatory Requirements: One is to ensure that the accounting practices and measurements in use adhere to the set accounting standards and policies recognized in your country. Certain methods, such as LIFO, could be prohibited based on certain standards, such as the IFRS.

- Cash Flow Considerations: Discern how the methods affect cash flow. FIFO generates higher reported profits and taxes, while LIFO generates cash flow by showing lower taxable income.

- Management and Reporting Needs: Another factor to think about is how the selected method impacts internal management reports and analysis. It is essential to indicate that some methods provide better clarity to the manager regarding the costs of inventory and the economics of operations.

Therefore, by developing an understanding of these factors, a business can choose the correct inventory valuation method that meets its financial objectives, the guidelines within the specific sector in which it resides, and the practicalities within the particular organization in question.

Conclusion

The method used to value inventories must be selected based on business influence, standard practices, type of inventory, necessity and availability of rules, and managerial and cash flow demands. The assessment of these factors makes it possible to uphold the necessity and goals of the business as well as the laws that govern the organization.

The process of bringing together GAAP and IFRS means smoothing out differences in order to facilitate the analysis of financial statements provided by companies around the world. Lastly, choosing the right method improves the quality of financial reporting and provides better solutions for decision-making tasks concerning taxes and the distribution of monetary funds.

Frequently Asked Questions

What is Inventory Valuation and its Importance?

The cost of unsold inventory when preparing financial reports is known as inventory valuation. Accurate inventory valuation is crucial since it affects a company’s profitability, taxation, and loan eligibility.

What are the four Types of iInventory Valuation?

There are four inventory valuation methods, which are as follows:

- LIFO – Last in, first out

- FIFO – First i,n first out

- WAC – Weighted average cost

- Specific identification

What is the Importance of the Valuation of the System?

Valuation is the process of figuring out how much an asset or business is worth. It’s crucial because it gives potential purchasers a sense of the price they should pay for a business or asset and the price at which they should sell it.

How is Inventory Valuation Calculated?

The following are the main formulas used to determine inventory valuation:

- The cost of the oldest inventory times the quantity of inventory sold is known as FIFO.

- LIFO is equal to the cost of the most recent inventory times the quantity sold.

- Weighted average cost is calculated by dividing the total number of inventory units by the cost of the products for sale.

- Specific identification = New purchases + beginning inventor – associated costs = COGS.