Understanding how different types of costs affect pricing is crucial for setting effective prices that ensure profitability. Costs such as fixed, variable, direct, indirect, overhead, and opportunity costs all play a role in determining the right price for products or services. Accurately incorporating these costs into pricing strategies helps businesses cover expenses, maintain profit margins, and stay competitive in the market. This balance is essential for achieving financial stability and operating success.

The Basics of Cost and Pricing

What is Cost?

Costs represent the expenses a business incurs in producing goods or services. They are divided into fixed and variable costs. Fixed costs, such as rent and salaries, remain constant regardless of production volume. These costs do not change with the number of units produced. On the other hand, variable costs, like raw materials and direct labor, fluctuate with production levels. As production increases, variable costs rise, and as production decreases, these costs fall. Understanding these cost components is crucial for determining accurate pricing strategies and ensuring profitability.

What is Pricing?

Pricing refers to the process of setting the amount of money customers must pay for a product or service. The primary objective is to cover costs and achieve a desired profit margin. One common approach is cost-plus pricing, where a fixed percentage is added to the total cost of production to set the selling price. This method ensures that all costs are covered and a profit is included. Additionally, break-even analysis helps set prices by identifying sales volume and market conditions to optimize revenue and maintain competitiveness.

How Cost Affects Pricing

- Cost-Plus Pricing: This method involves adding a certain percentage or an additional amount to the total cost of production to fix the sales price directly.

- Break-Even Point: Elementary knowledge of the break-even point is that it is the rate of sales at which total income is equal to total cost. It assists in defining the minimal price required to cover all the costs and protect against losses.

- Cost Behavior: Variable costs influence pricing strategies and vary with levels of production. As production scales, variable costs change, affecting the price that must be paid to make a profit.

- Margin Requirements: The desired profit margin affects pricing decisions. Adding a safety margin over the cost of production makes prices accommodate costs and achieve business profits. For example, a company may propose charging a price that gives them a profit of thirty percent above the cost.

- Cost Allocation: Indirect costs include overhead, and when allocated correctly, they determine the right pricing for products or services. When indirect costs are not considered, prices may be set too low, which may cause the company to make losses.

- Competitive Pricing: Some competitor factors relate to pricing cost factors, such as price schedules. Businesses need to compare the competitors’ prices and cost structures in order to set a price that is both dependent and independent.

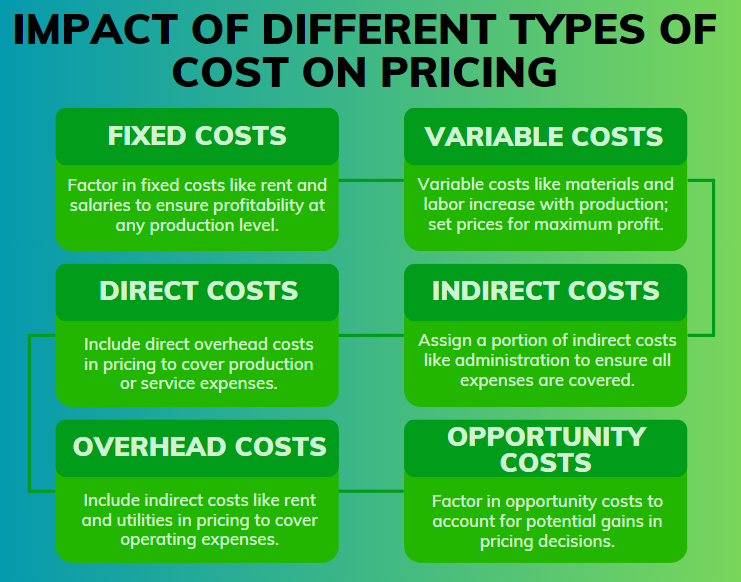

Impact of Different Types of Cost on Pricing

Fixed costs are constant, variable costs change with production, direct and indirect costs cover specific expenses, overhead supports operations, and opportunity costs reflect potential missed gains in pricing.

- Fixed Costs: These costs include rent, salaries, etc.; that is, they do not change with the level of production or output. The prices should factor in such costs to realize profits even at low production capacities.

- Variable Costs: Some costs, such as raw materials and direct labor, are variable with changes in production volume. These costs rise with higher production, and so does the need to set higher prices to meet maximum profit levels.

- Direct Costs: Overhead costs attributable directly to a product or service must also be added to the pricing of that product to cover the cost of direct expenses in making the product or offering the service.

- Indirect Costs: This consists of costs like administration costs and others that are not directly part of the production line. Pricing can only then assign a portion of these costs to guarantee that all costs are adjusted for.

- Overhead Costs: These are costs like rent and utility costs that are needed to operate the business but may not be directly linked to the product. They are factored into the price to ensure they share the costs in the final price of products.

- Opportunity Costs: Pricing should include an expected increment that can be received based on choice; this means that potential gains that are missed when choosing one option or another should be considered.

Step-by-Step Description of How Costs Affect the Pricing Strategies

Identify Costs: This can be done in the form of fixed costs, which are always incurred regardless of the level of production, such as rent, salaries, and insurance, among others, and variable costs, which are costs as per the quantity of production, like raw materials, direct labor, and packaging.

Determine Total Costs: Dead cost = fixed cost + variable cost at a given level of production. They allow you to have a snapshot of your general expenditures.

Calculate the Break-Even Point (BEP): Formula:

BEP (units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Determine the number of units that make up all the cost. This will help establish a sales volume that will enable you to break even.

Set Pricing Strategy: Use a formula to arrive at your selling price by calculating the cost-plus pricing formula by putting markup on variable cost per unit, where it should cover fixed and variation cost price and profit margin. Using the current market trends and price offers set by competitors, it is possible to fine-tune the pricing strategy.

Achieve Profitability: Multiply its selling price with the cost of sales to arrive at Profit.

Profit = (Selling Price per Unit−Variable Cost per Unit) × Quantity Sold−Fixed Costs

The general business concept of earning profits is defined as a situation where total sales are higher than total cost. To achieve constant profit making, price changes, production rates, and costs must be closely and frequently controlled.

Strategies to Align Costs with Pricing

Implement cost control measures, value-based and cost-plus pricing, dynamic pricing strategies, accurate cost allocation, and regular cost reviews to align costs with pricing and maintain profitability.

- Cost Control Measures: It is important to keep checking and controlling expenses to ensure that the firm is profitable. For example, try to negotiate better supplier rates, take measures to cut employee wastage, and enhance organizational efficiency.

- Value-Based Pricing: Because customers perceive the value of the product or service, fixed standard prices should instead be set to reflect the value of costs. Know your customers so that they can price products at a value that they are willing to pay, hence increasing the possibility of a higher percentage price margin.

- Cost-Plus Pricing: Customers tend to overemphasize the price more when it is developed using cost-plus pricing. However, the markup percentage has to be reconsidered periodically to suit the current cost structure and market trends. This feature allows users to alter the markup according to the usual fluctuating costs of production or in line with any set organizational goals.

- Dynamic Pricing: Sustain the use of dynamic pricing and develop new options that depend on real-time factors, including demand, competition, and other market pressures. This also assists in choosing the right pricing policies to correspond to present-day costs and market opportunities for increasing revenues.

- Cost Allocation Accuracy: This will make it easier to correctly assign both direct and indirect costs to an organization’s offerings. This encompasses the issue of overhead and administrative costs so that every product or service produced by the company bears the appropriate cost for production.

- Regular Cost Reviews: Carry out cost-balance checks and cost reconciliations at long intervals to identify any irregularities or inefficiencies in costs. This allows for periodic changes in price strategies to cover current costs and market forces, ensuring a company remains viable and competitive at all times.

Adapting to Market Conditions

Conduct quarterly competitive pricing audits, adjust for market demand, consider economic factors, and implement seasonal pricing strategies to optimize sales and maintain profitability while meeting consumer needs.

- Competitive Pricing Analysis: It is important to conduct a pricing audit on competitors at least every quarter to close the gap if your prices have drifted off the market. This is a process of learning competitors’ pricing strategies, the products they offer to their clients, and their position in the market. Price yourself as low as possible without reducing your business’s profitability.

- Market Demand Fluctuations: Another is to weigh the shifts in demand preference from the general consumer and adjust the prices of the product. Prices are usually higher when demand is high to exploit customers and lower when demand is low to attract customers.

- Economic Factors: Be aware of other economic factors like inflation or an economic recession, which will affect prices and the buying capacity of its customers. Synchronize the changes in pricing strategies in line with these aspects of economics with the ability to make sounds economical and reasonable for consumers as well as workable for business organizations.

- Seasonal Pricing Adjustments: Adopt a seasonal pricing policy mainly to activate demand during certain months and control it during others. For instance, sales, discounts, or advertisements should be held during low-demand periods to create demand, while in high-demand periods, the prices of goods should be raised since people will be willing to pay a high price.

Common Pricing Mistakes to Avoid

Ignoring costs can lead to inadequate pricing, while overpricing discourages sales and underpricing harms profitability. Neglecting market research results in ineffective pricing strategies that don’t meet consumer needs.

- Ignoring Costs: If all costs related to service delivery, both fixed and variable, are not considered, then what the company charges in terms of pricing may not even cover the cost. To reduce costs, it is important to incorporate every cost of production, operation, and overhead into the unit price.

- Overpricing: However, when prices are set too high, it can put off the consumption volume by the consumers. Price decisions have to be made with reference to market trends and consumer price sensitivity to arrive at the right price that is sustainable and viable in the market.

- Under-pricing: When products are underpriced too much, then there needs to be more money to cover the cost and make a profit. Competition-savvy pricing is crucial, but when prices are brought down, they affect company stability and reputation.

- Neglecting Market Research: Lack of research may also result in wrong pricing strategies since the firm might need to position its prices to suit the consumers or the market. Research that should be carried out periodically includes studying the general trends in the market, constantly studying the freighting and preferences of the customers, etc.

Conclusion

Incorporating a comprehensive understanding of various costs into pricing strategies enables businesses to set prices that cover expenses and generate profit. By considering fixed, variable, direct, overhead, and opportunity costs, companies can make informed pricing decisions that support financial health and market competitiveness. Regularly reviewing and adjusting prices based on cost changes and market conditions ensures ongoing profitability and aligns with strategic business goals.