Small and growing companies need the best cash management software to support their path to success. Using good cash management software can streamline cash flow, help manage bank accounts, and centralize payments for small businesses.

What is a Cash Management Software?

Cash management software is designed to help businesses monitor, plan, and manage the movement of money in and out of the business. Businesses use it to manage cash, ensure that its availability is always optimum, and monitor financial activities. Workday, Float, and Casual are some of the cash management software.

Cash management software also works with other computer applications, such as accounting and banking, and accomplishes a variety of responsibilities involving payment, deposit, and reporting.

Through the implementation of cash management software, a business can gain better insights into its finances, lower the possibility of mistakes, boost effectiveness, and make sound decisions.

Key Takeaways

- Cash management software helps small and growing businesses streamline cash flow, manage bank accounts, and centralize payments, fostering financial stability.

- It provides real-time monitoring of cash inflows and outflows, improving transparency and decision-making.

- Cash management software automates financial processes, saving time and reducing errors compared to manual methods.

- By consolidating financial data, the advanced software provides insights that guide strategic decisions.

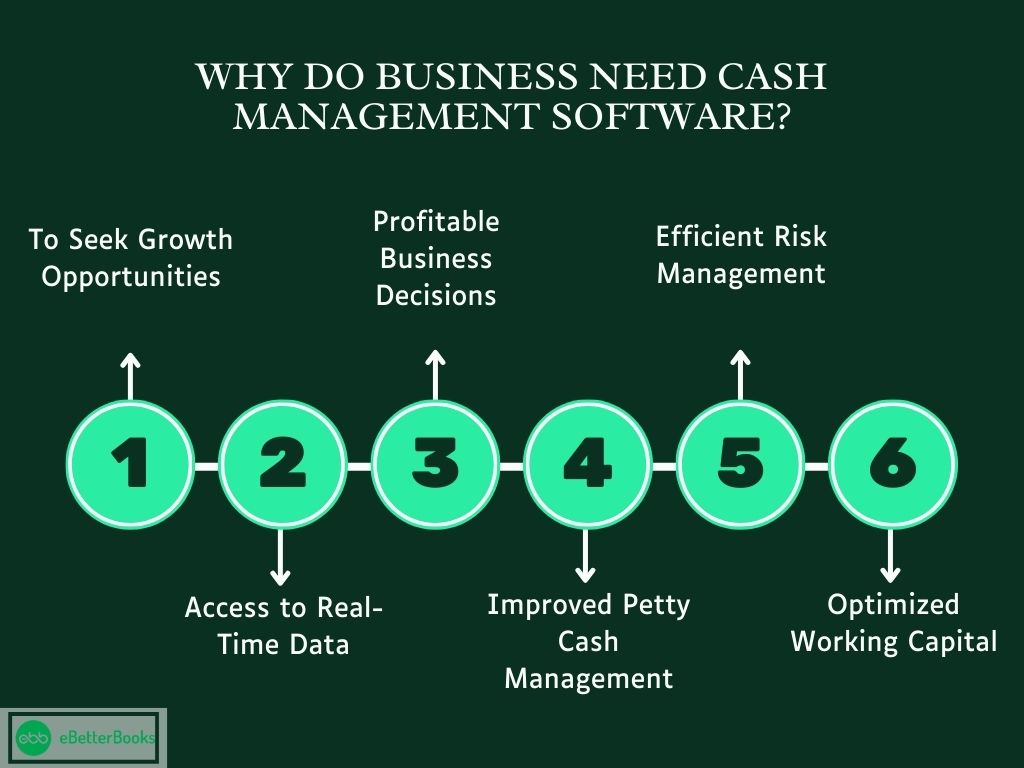

Why Do Businesses Need Cash Management Software?

Some of the benefits of cash management software for small businesses are mentioned below:

1. To Seek Growth Opportunities

Once a company’s management knows where and when surplus cash is available, they can decide to expand into new markets and plan investment in new projects or innovative ventures, ensuring long-term growth.

2. Access to real-time data

Current, reliable cash flow data provides essential information to support the financial management process.

Cash flow software takes data from the accounting system, and the bank feeds it in real-time, meaning every transaction is stored in one place. These immediate updates allow you to see your current financial situation at any time of the day or night, excluding working hours.

3. More profitable business decisions

A wider definition of facts and figures drives better investment decisions ranging from stock procurement to risk management.

It is about more than awareness of the amount of cash that is available at a particular time. Automated cash flow management systems look for opportunities in income and expenditure to boost profitability.

4. Efficient Risk Management

There is cash management software that assists various companies in tackling and avoiding different risks currently existing in that sphere, such as cash deficits. Real-time visibility of cash position and other detectable financial activities, such as payments and reconciliations, means low error risks and the avoidance of fraud.

Organizations can also avoid other risks through the use of cash flow forecasting because this gives companies an opportunity to aid on existing imperfections in business plans and guarantee that they are well funded.

5. Improvement Of Petty Cash Management

Synchronizing many bank accounts is a tedious and often erratic exercise when done manually. The other way that cash management software is effective at handling reconciliation is by compiling data from various sources such as banks, payments, and invoices.

It thereby ensures that such differences are detected and corrected as soon as possible to increase efficiency. In this way, the efficiency of the cash reconciliation process provides managers with assurance that financial records are reliable and saves firms’ time for largely valuable activities.

6. Optimized Working Capital

As with any business, management of working capital is very important and determines success in whatever business. Working capital management software assists businesses in maximizing working capital by analyzing cash flow patterns, extraneous costs, payment schedules, and collections.

This, in turn, helps to manage working capital requirements effectively and optimize corporate resources towards long-term investments. However, the features of using this software, which means presenting the forecast of future cash requirements, means that businesses will always be in a position to deploy capital optimally while they meet their operational necessities.

How to Choose the Best Cash Management Software for Your Business?

- Step 1: Assess Your Business Needs: Begin by assessing the need for cash management in your case. This involves the number of accounts, the frequency of transactions, the type and size of your business, and the level of cash flow complexity. Start-ups and small businesses may only need simple tools for forecasting and reconciliation. In contrast, more significant companies operating with multiple accounts might need more sophisticated options such as multi-currency, automated cash flow management, or integration with other financial systems.

- Step 2: Consider Ease of Use: The software you opt for ought to be easy to use and should not require huge changes. Specifically, facilities should include easy-to-use dashboards as well as clear navigation to help finance teams access certain software programs without having to undergo extensive training. A graphical user interface optimizes work and reduces the rate of errors, hence making it easier to handle your money matters.

- Step 3: Security and Compliance: Because the subject of cash management is to work with important financial data, security plays an important role. Make certain the software’s security is well encrypted, it can accessed only by the right people or authorities, and if your software relates to finance in any way, it has to be GDPR, SOX, or PCI-Dss compliant. This helps protect your data from fraud and makes your business adhere to current laws of any country and international law.

- Step 4: Look for Scalability: As your business grows and develops, you may need to change your cash management approaches. Since you expect growth in your company, choose software that grows from one account, transaction, and currency to another. Customizable and expandable, you won’t grow out of the software as the financial processes evolve within the organization.

- Step 5: Evaluating Integration Capabilities: The tool you use to manage your cash should be easy to link with other tools in your company, such as accounting, ERP, or payroll tools. As the two systems work in harmony, data entry is not duplicated, and financial processes increase in effectiveness due to speed, reliability, and integration.

- Step 6: Customer Support and Training: Credible customer support is very relevant when handling money and other financial applications. Search if the provider provides responsive support and fast, useful assistance if there is training and guidance, such as tutorials or webinars. This way, if your team encounters a problem, they can address it rapidly and get the most out of the software.

Best Cash Management Software

Top 5 Free Cash Management Software for Small Businesses

1. Rho

Description:

Rho is defined as the financial operating system by which businesses can enhance their profitability. It plays a crucial role in automating accounts payable and treasury management and assisting lean businesses in earning yield on secured and readily available cash balances.

Features of this software include:

- Rho Treasury Accounts is based on a network of more than 400 FDIC-insured banks. It enables organizations that have deposited more than $250,000 to obtain up to $75 million in FDIC deposit insurance per entity.

- Rho Prime Treasury is our treasury investment management service where your excess cash is invested in short-term government securities in the company’s account.

Why choose this software:

- No matter if you are a CFO with a small number of employees in your finance department or you are a one-woman/one-person finance department, Rho can automatically and efficiently complete most of the processes situated in the treasury for you.

- Rho ensures that your policy reflects your firm’s cash flow and security formula perfectly.

2. Causal

Description:

Causal gives you the tools to develop and construct all your business plans, forecasts, and financial models. The financial planning and analysis tool helps managers develop models linked to revenue and expense planning.

Features of this software include:

To take the use of accounting data one step further, users can extract data directly that feeds into more operationally focused systems like the CRM and data warehouse to build perfectly synchronized models. This allows users to compare various business units on one site, and budget and actuals can be viewed.

Why choose this software:

- The user interface is friendly.

- The platform also uses real-time data updates.

- Causal includes multiple ERP and other kinds of software connections.

3. Workday

Description:

Adaptive Planning by Workday is an online enterprise-level budgeting and planning software used for financial planning.

This software supports and enables an entire organization to work seamlessly without relying on spreadsheets and other manual processes.

You can effortlessly generate budgets and forecasts, perform scenario analysis, and monitor your expenses and sales. You can also build your cash flow schedule and sheet.

Features of this software include:

- Effective and efficient tools for preparation and tracking of budgets and forecasts.

- Employment planning to help manage risk arising from uncertainty about human capital costs.

- She coordinated personal selling planning for sales targets consistent with financial strategies and expectations.

Why choose this software:

- Strong cash flow features without spreadsheets.

- Exceptional reporting features.

- Comprehensive audit trails enable you to record changes and satisfy audit requirements.

4. Vena Solutions

Description:

Vena Solutions is cloud-based financial planning and cash management software that helps financial teams manage their finances efficiently.

This software offers numerous aids and procedures to facilitate improved budgeting, enhanced cash flow, account preparation, and other tasks.

Features of this software include:

- Driver-based modeling is employed to improve the financial results.

- AI application to improve forecasting with more detailed information.

- Centralized security database with encryption feature that allows for the implementation of access control rules.

Why choose this software:

- Standard choices in reporting allow for easy data analysis.

- It also features a cloud-based system that affords mobility, especially via a mobile app.

5. Centage

Description:

Centage is known as the cloud-based intelligent planning, budgeting, and forecasting platform. This software provides a decent financial intelligence tool to their users, which helps organizations of any size better understand their financial data. Centage provides clear visibility of financial health to organizations so that they can make faster decisions.

This software offers users an intuitive UI, a strong suite of financial tools, and a long list of integrations with other tools, and much more.

Features of this software include:

- Budgeting and forecasting are used to decide future planning performance, depending on historical data.

- Scenario planning to assess the influence of various options.

- Consolidated reporting is used for a robust analysis of your overall performance.

Why choose this software:

- Real-time data helps you to react to the changes that happen in the market.

- Very customizable.

- It can handle multiple departments and entities.

Top 5 Paid Cash Management Software

1. Float

Description:

Float software is specially designed for cash flow forecasting and scenario planning. This software integrates with other software like QuickBooks Online, Xero, and FreeAgent accounting software, with real-time data syncing. Through this data, Float software displays the company’s financial future on complete forecasts and models so they can make well-informed decisions for their cash flow.

This software is great for teams that work with complex project-based financial planning. It provides tools to evaluate outcomes based on varying scenarios.

Features of this software include:

- Quick forecasts with real-time data syncing.

- Monitor cash flow at particular stages by sales pipeline.

- Recruiting management to control the onboarding and payroll costs.

Why choose this software:

- Visual forecasting with intuitive tools for scenario planning.

- A very easy interface which makes it effortless even for non-experts.

2. PlanGuru

Description:

PlanGuru is defined as a planning tool that handles the activities of small and midsize companies, including budgeting, forecasting, and performance reviews. It integrates with software like QuickBooks and Excel, which makes it simpler to use for cash management.

Features of this software include:

- Make detailed models with budgeting and forecasting features.

- Reduce time-consuming admin by automatically solving cash flow statements.

- Optimize your financial reporting with an in-built financial statement structure.

Why choose this software:

- Customer feedback is given priority.

- Scenario planning is fast and easy.

3. Jirav

Description:

Jirav is known as the driver-based planning tool that will replace your Excel model. This tool offers cash flow analysis and forecasting capabilities and is an option for teams that need a different approach to cash management.

Jirav is recommended for small- to medium-sized companies that are independent of their Excel models.

Features of this software include:

- Get the most related metric of your company by industry-specific KPIs.

- For faster and clearer cash flow presentations, get board-ready reporting templates.

- Departmental reporting to highlight the financial health of particular teams.

Why choose this software:

- Collaborative dashboards.

- Real-time tracking of budget.

- Granular visibility.

4. Kolleno

Description:

Kolleno is known as the smart credit control platform and automated accounts receivable solution for companies seeking to streamline their financial operations.

This software helps the finance teams with payment processing, upgraded credit control, and accuracy in their accounts.

Features of this software include:

- It offers accounts receivable management.

- Automated tasks and workflow creation, which time and streamlines workflows.

- Manage the tasks and projects by in-built to-do lists.

Why choose this software:

- Automates your manual tasks like A/R collection and cash forecasting.

- Premade reporting makes it simple to be at the top of your financial status.

5. Anaplan

Description:

Anaplan is known as the cloud-native cash management app, which helps to arrange better business performance.

It is made for businesses of all sizes to solve financial-related challenges. The Anaplan platforms allow users to streamline the financial process and better understand everything from day-to-day cash flow to complex financial solutions.

Features of this software include:

- Scenario modeling analyzes many pathways to understand possible impacts.

- Align your resources accordingly by sales and purchase forecasting.

- Plan your future employee-related expenses with the employee cost predictions feature.

Why choose this software:

- Get a link with any number of planning streams with one dashboard.

- Provides an intuitive UX with a good deal of customizability.

- Allow analysis down to a granular level.

Top 5 Cash Management Software for Large Businesses

1. SAP Cash Management

Description:

SAP Cash Management is part of the larger SAP ecosystem. It is known as a powerful cash management platform, but teams that are already using SAP might find that the cost outweighs the benefits.

Features of this software include:

- It provides bank relationship management through which you can maintain transparency with financial entities.

- For planning and presentations, use the cash flow forecasting feature.

- AI simulations and projections for fast and more correct predictions.

Why choose this software:

- Real-time access to correct the cash information in a central platform.

- Good for SAP ERP users, with all the ease of integrations you’d want from the tools owned by the same brand.

2. Tesorio

Description:

Tesorio is known as an A/R Cash Flow Performance Platform, which is made to return cash flow forecasting and collection processes.

The key value of this software is that it allows teams to collect cash faster. Terorio integrates with ERP systems so that nothing slips through the cracks.

Tesorio software is a partial FP & A platform and takes your cash flow management out of spreadsheets, so that’s a consideration for scaling teams.

Features of this software include:

- Consolidate cash flow data from many sources through cash aggregation.

- Quickly navigate and analyze financial data with search analysis.

- Unified account reporting, which combines accounting data into one handy dashboard.

Why choose this software:

- Good at helping the teams reduce DSO.

- Integrates with various ERP systems.

3. Prophix

Description:

Prophix is well-known as a cloud-based financial performance platform that helps companies budget, plan, consolidate, and report. Just like many other tools from this list, Prophix is designed to tear and replace the spreadsheet with new software.

Features of this software include:

- Financial consolidation, which combines the data from multiple sources into one place.

- Close management to be at the top of payments.

- Automation and workflows over the board to streamline repetitive processes.

Why choose this software:

- Powerful software designed for easy consolidations and flexibility over the structure set up in the tool makes organizational changes (like M&A) as simple as possible.

- Robust ad hoc reporting capabilities.

4. HighRadius

Description:

HighRadius is a well-known fintech enterprise SaaS company that sells AI-based technologies to assist companies in automating their cash management processes.

This software provides solutions for autonomous treasury and autonomous receivables, optimizing the process across order-to-cash, treasury, and record-to-report cycles.

Features of this software include:

- Treasury payments and automated collections.

- Add efficiency to your workflows with cash application management.

- Assess and manage customer credit risk, a credit management feature.

Why choose this software:

- Constant global cash visibility.

- Short-term cash position keeping.

- Automated bank reconciliation.

5. Abacum

Description:

Abacum is an FP&A tool that helps the finance teams at mid-market organizations make faster revenue forecasts and OPEX breakdowns.

It is a cloud-based tool that gets you out of Excel and into their planning platform.

Features of this software include:

- Revenue planning to predict and manage the incoming cash flow and support business growth.

- Headcount planning to assess future workforce requirements and costs.

- OPEX planning to manage and predict operational expenses.

Why choose this software:

- It offers a modern-looking UI.

- It is very simple to share across departments and teams.

- Robust and expensive customer success team.

If you have cash management software, you can centralize and automate your payments and cash management through various company branches and manage many processes more accurately. If cash management is done manually, it can create unnecessary risks of human errors or payment fraud, which can be avoided by automation.

How to Choose the Best Cash Management Software for Your Business?

- Assess Your Business Needs

Begin by assessing the need for cash management in your case. This involves the number of accounts, the frequency of transactions, the type and size of your business, and the level of cash flow complexity. Start-ups and small businesses may only need simple tools for forecasting and reconciliation. In contrast, more significant companies operating with multiple accounts might need more sophisticated options such as multi-currency, automated cash flow management, or integration with other financial systems.

- Consider Ease of Use

The software you opt for ought to be easy to use and should not require huge changes. Specifically, facilities should include easy-to-use dashboards as well as clear navigation to help finance teams access certain software programs without having to undergo extensive training. A graphical user interface optimizes work and reduces the rate of errors, hence making it easier to handle your money matters.

- Security and Compliance

Because the subject of cash management is to work with important financial data, security plays an important role. Make certain the software’s security is well encrypted, it can accessed only by the right people or authorities, and if your software relates to finance in any way, it has to be GDPR, SOX, or PCI-Dss compliant. This helps protect your data from fraud and makes your business adhere to current laws of any country and international law.

- Look for Scalability

As your business grows and develops, you may need to change your cash management approaches. Since you expect growth in your company, choose software that grows from one account, transaction, and currency to another. Customizable and expandable, you won’t grow out of the software as the financial processes evolve within the organization.

- Evaluating Integration Capabilities

The tool you use to manage your cash should be easy to link with other tools in your company, such as accounting, ERP, or payroll tools. As the two systems work in harmony, data entry is not duplicated, and financial processes increase in effectiveness due to speed, reliability, and integration.

- Customer Support and Training:

Credible customer support is very relevant when handling money and other financial applications. Search if the provider provides responsive support and fast, useful assistance if there is training and guidance, such as tutorials or webinars. This way, if your team encounters a problem, they can address it rapidly and get the most out of the software.

Benefits of Cash Management Software

Cash management software has several benefits that businesses require for accurate financial management.

Here are the main benefits:

- Improved cash Flow Visibility: Features like cash management help businesses see their total cash balance at any time, while features like projection help a business see what cash it is likely to need in the future. These all affect minimizing cash deficiencies or excesses and provide the basis for sound financial decisions.

- Automation of Financial Tasks: By minimizing or neglecting payment, account processing, financial reporting, and other cash management operations, the software eliminates, to a large extent, manual inputs to the financial process. Its automation prevents the possibility of having a human ear and hence improves the accuracy of financial transactions and, hence, financial operations.

- Better Forecasting: It helps the business forecast cash required in the future from analysis of past data on expenses and revenues. Budgeting of cash flows is used to plan cash flow surpluses, control working capital, and plan long-term capital outlay.

- Security and Compliance: Cash management software may also incorporate security solutions such as encrypting services, authorization, and examination services. These features safeguard the integrity of financial data and avoid violating existing legislation on fraud and data privacy.

- Optimal Management and Multi-Currency: Cash management software solves significant problems for companies with multiple accounts and operations in different currencies, making activities less problematic in such conditions. It compiles all the information in one place, so users have an easier time supervising financial matters.

- Time and Cost Saving: The software contributes to both time savings and operating expense reductions by decreasing manually performed operations and ensuring more exact cash management. It also helps finance teams spend less time on cash management activities that might otherwise result in major work on a specific day.

In general, CM software improves productivity, reliability, and tactical planning, which gives operating organizations significant value for money.

What Features Should You Look for in a Cash Management Platform

1. Real-Time Cash Flows Tracking

The cash management software must have facilities that enable the tracking of cash in real time. It allows for checking the working capital status, observing the inflows and outflows of cash, and making daily financial decisions. In turn, monitoring real-time data makes it possible for firms to adjust to new financial statuses that may necessitate having sufficient amounts of cash for business operational requirements and other expenditures.

2. Automated Reconciliation

Another important operation is automated bank account reconciliation because it has fewer mistakes and is less time-consuming. In this case, the software matches the information in more than one bank account, compares it with the bank statement, corrects it, and also ensures a neat record of the accounts.

3. Cash Flow Forecasting

The business use of cash flow forecasting helps them plan, and the preferred methods assist in the same, thus improving the ability to plan for cash expected in coming periods. Info about forecasts should be extracted from historical data, and the software should permit future invoices and expenses. This feature helps businesses understand future expansion goals, accommodate unpredictable expenses, and have adequate working capital in their business.

4. Forex Trading; Multiple Currency Trading; Multiple Account Trading

For companies that need to work with different currencies and have accounts in different banks, multi-currency and multi-account calculations are critical. This feature helps organizations to address different currencies and accounts of counterparties in one place, so it is convenient to monitor and control transactions.

5. Security and Compliance

Data privacy should be strengthened through features such as encryption, user and access controls, and audit trails to prevent the leakage of financial data. Also, compliance tools facilitate the implementation of rules and regulations in business practices, especially concerning finance, at local and international standards.

6. Integration with other Tools

Cash management software should be easily compatible with other accounting, ERP, and banking systems. This allows for the ease of sharing such information, enhanced workflow, and better tracking of the financial aspect with less data input.

Conclusion

In conclusion, the factors that provide the basis for choosing the best cash management software include understanding your business needs, ease of use, security, and scalability. Maintenance of compatibility with other current financial systems and good customer service are as vital as each other for efficiency. When all these factors are well analyzed, businesses are able to manage their cash flow well, improve their efficiency, and make the right financial choices that will enable them to grow and be financially stable in the future.

FAQs

Which is the most effective software for handling cash for the small business?

There are a couple of well-known solutions, like QuickBooks and Xero. Many of these software solutions have intuitive user interfaces, cash flow management, automatic entry matching, and linkage to accounting systems. They are ideal for companies with little turnover and, therefore, simple cash management requirements,

Can cash management software integrate with my existing accounting system?

Yes, most cash management software connects directly with an accounting system such as QuickBooks, NetSuite, or Sage. This connectivity avoids the need to manually transfer data from your accounting applications, simplifying activities such as reconciling, reporting, and predictions.

In what way does cash management software assist with cash flow predictions?

The best complement to cash management software is that a cash management program itself contains the anticipated cash inflows and the expected cash outflows based on the prior records and the expected invoices and expenses. These forecasts enable businesses to know if there are likely to be shortfalls or surpluses in cash in the future, hence enabling businesses to make necessary preparations when planning.