Cash-basis accounting uses a single-entry system that records revenues and expenses only when cash is paid or received.

What is Cash Basis Accounting?

In cash-based accounting, transactions are recorded when the cash is paid or received. In other words, revenues get recorded when the cash payment is received for the sale of products or services, and expenses are recorded when cash is paid to the vendors for purchases of products or services. Most small companies and individuals work on a cash basis and make their income taxes using this method.

Key Takeaways

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid.

- Ideal for small businesses due to its simplicity and straightforward tracking of cash flow. It helps defer tax payments by recognizing revenue only when cash is received.

- Ideal for businesses that prioritize cash flow tracking over complex financial reporting.

- Cash basis accounting doesn’t comply with Generally Accepted Accounting Principles (GAAP).

How Does Cash Basis Accounting Work?

In cash-based accounting, only activities involving cash are recorded on the firm’s books, and only expenses incurred in that period are recorded. For example, suppose a particular store dealing in sneakers employs a cash basis of accounting. In that case, the store owner will only consider the specific sneakers when he or she has received cash for any slipper sold. The owner does not count sales made on credit card or billing sales, only when the money is received into the account.

Expenses also are at the time when the store pays them. At the end of an accounting period, the store owner determines the cash flow from that in the account and from the expenses paid during the time.

Who Uses the Cash Basis of Accounting?

Let’s have a closer look to understand who can use the cash accounting methods:

- The cash method is an easy way of accounting for small business owners or individuals as it requires minimal accounting knowledge. It empowers small business owners with the capability to manage the company’s revenue or expenses effectively.

- If the company’s annual gross is less than $25 million, the IRS will allow individuals or small businesses to follow the cash accounting method for smooth cash management.

- Companies using a single-entry system rather than a double-entry system can use a cash accounting system.

- The cash method is more useful for businesses that operate without inventories and are more service-based.

Cash Method for Income Tax

Cash accounting methods can be beneficial for small businesses or individuals while paying tax for two reasons. First, cash accounting allows businesses to easily answer questions regarding financial losses, expenses, or annual revenue while paying tax. Second, cash accounting helps businesses that have a major focus on inward cash flow that makes it easier for them to record the dates of the cash received, which makes paying taxes easier.

For instance, the IRS allows S corp or small businesses in the U.S. to use the cash method while paying taxes, but the Tax Reform Act of 1986 restricts C corporations and certain partnerships from using the cash method. Cash accounting can lead to misleading financial statements during periods of fluctuating cash flows, potentially affecting business decisions and financing options.

Significance of Cash Basis of Accounting

The cash accounting method helps in the operation of businesses by showing the cash provided or used in a company’s operating activities. It helps to record revenue or expenses based on the inflow or outflow of cash. For instance, cash receipts for goods or services sold and cash payments for taxes, supplies, and other expenses are recorded when there is an exchange of cash. Cash receipts from customers are only recorded in cash-basis accounting when the cash is actually received. Similarly, cash paid to a supplier for purchasing equipment or paying cash to employees can be accounted for in cash-basis accounting.

However, businesses with inventories are required to account for their inventories at the start and closing of the tax year. This is why accounting for inventories or goods can be difficult for small businesses, as they use cash methods, which focus more on the flow of money than tracking the inventories or goods. Consequently, small businesses with annual gross less than $25 million are allowed to have inventories as services rather than as goods to continue using the cash method for accounting.

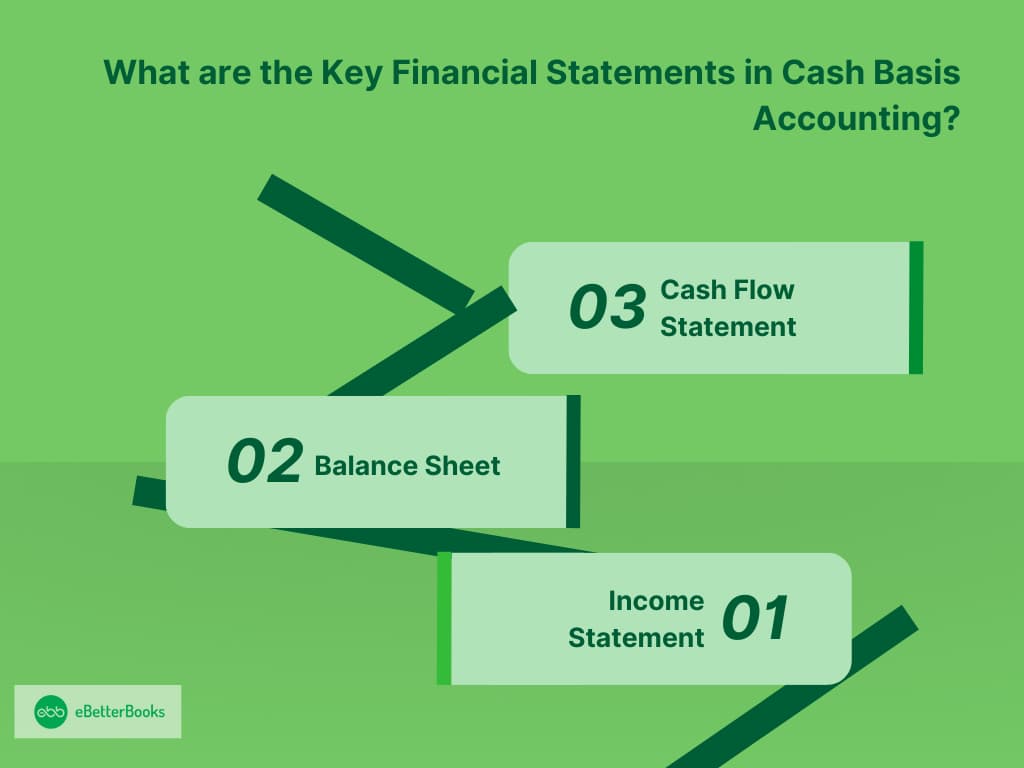

What are the Key Financial Statements in Cash Basis Accounting?

When applying a cash-based method to your business, every paid and income expense must be recorded.

There are 3 key financial statements to employ when using this accounting method:

1. Income Statement

Your income statement is also called a profit and loss statement because it reflects the revenues and expenses your company is reporting for a certain period and will give a picture of the financial condition of the business up to a certain date in a fiscal year.

2. Balance Sheet

A balance sheet is a statement that captures all assets and liabilities that a company has at any given point in time. In the case of cash accounting, revenues are written only when cash comes in, and expenses are documented only after cash is paid out.

3. Cash Flow Statement

Your company’s cash flow statement displays all the cash received and paid for your business over a one-time period. It can also serve as a summary of the following: Any cash that comes into the business Cash that goes out of the business.

These 3 statements give a snapshot of all financial operations at a certain period, a certain date.

Pros and Cons of Cash Basis Accounting

All accounting methods have their pros and cons, and there isn’t only one method that will work well for each business. It’s important to be aware of the advantages and disadvantages of cash-based accounting to decide if it’s right for your business.

Here are the pros and cons of Cash Basis of Accounting:

| Pros of Cash Basis of Accounting | Cons of Cash Basis of Accounting |

| Easy to Understand: This accounting method is easy to use. | Short-Term Indicator: Doesn’t reflect the overall financial health. |

| Shows Cash Flow: Provides a clear picture of cash on hand. | Misleads Investors: Doesn’t report accounts payable, leading to inaccurate profits. |

| Single-Entry System: Simplifies recordkeeping and reconciliation. | Not GAAP-Approved: Not suitable for public companies. |

| Requires Few Staff: No need for complex systems or full-time accountants | IRS Restrictions: Not allowed for large businesses due to tracking challenges |

| Tax on Received Income Only: Pay taxes on actual cash received | – |

Pros of Cash Basis Accounting

Below mentioned are some major advantages of using the cash basis accounting:

1. Easy to Understand

Cash basis accounting is simpler to understand than any other accounting method. Recordkeeping is simple, as the income and expenses are recorded upon receipt without any requirement to break out amounts over longer periods. If you want to implement the cash method in your small business, then it might not be important to get the help of a professional accountant.

2. Shows Cash Flow

The cash accounting method is similar to a cash flow statement. When it comes to accepting payments and paying bills, recording the transactions by using the cash-based accounting method will provide an accurate picture of how much cash your business actually has on hand. If your small business encounters cash fluctuations due to seasonal sales throughout the year, then the cash method of accounting might be beneficial to help you allocate your resources.

3. Single-Entry System

A simple single-entry system can also use the cash method, so there is no need for a complex accounting program. Month-end bank reconciliation becomes much easier when you’re not booking accruals.

4. Requires Fewer Staff

If you choose a cash-based accounting method, then you’re not required to hire a full-time accountant. It’s an easy practice that doesn’t need a complex accounting system. All you’ll require is bookkeeping software to keep track of cash flow.

5. Pay Income Taxes on Money You’ve Received

Unlike any other method, when you utilize cash accounting, then you’re required to pay tax only on the income that you’ve received within the tax year.

Cons of Cash Basis Accounting

There are also some drawbacks to using the cash method of accounting:

1. It’s Only a Short-Term Indicator

Cash accounting might give a different picture of your company’s overall financial position. It’s very black-or-white and doesn’t take nuances into account, like the time it takes for transactions to go through inventory on hand and expenses incurred. This discrepancy can paint an inaccurate picture of how well the company is doing and can make comparative analysis difficult, especially if you owe multiple debts.

2. It Could Mislead Investors

Cash accounting does not report accounts payables, which will make the company look much more profitable in a particular period than it is. Investors might then conclude the company’s profits when it is, in fact, in financial trouble if there are many unpaid bills.

3. It’s Not GAAP Approved

If you run a public company, then you must utilize the generally accepted accounting principles (GAAP) and cannot use a cash method.

4. Restrictions

The IRS restricts large business owners from using cash methods because it can be complicated to track financial records. This can mislead them regarding the company’s financial condition while paying taxes.

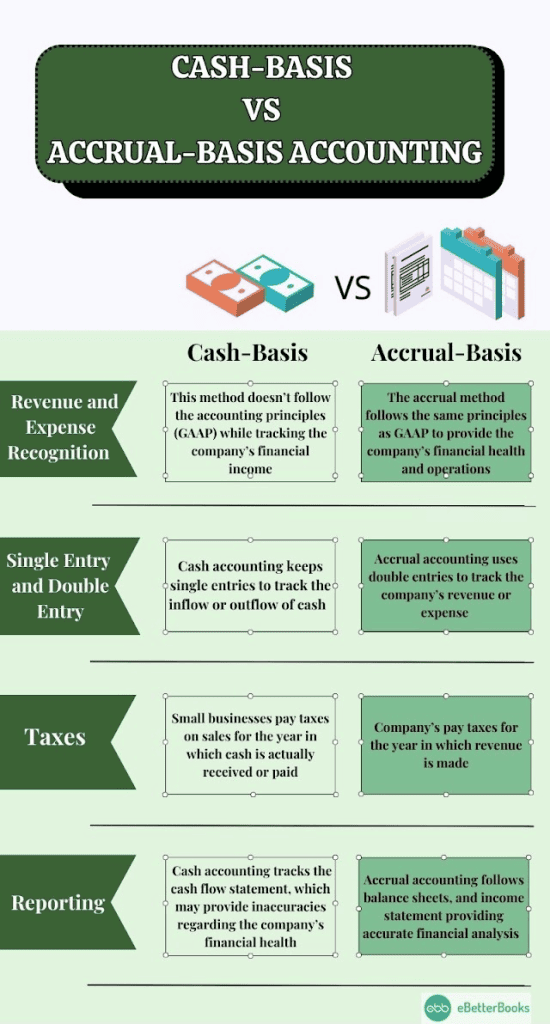

Cash Basis VS. Accrual Accounting

Cash accounting and accrual accounting can differ on the various factors:

- Revenue and Expense Recognition

In cash basis accounting the revenue and expenses of a company is recorded when the cash is actually received or paid. Whereas, in accrual method follows the Generally Accepted Accounting Principles (GAAP) for the recognition of revenue and expenses are not depended upon the flow of cash.

Revenue is recognised when it is earned, similarly expense is recognised when an asset is purchased for the company.

For instance, if a clothing company sold a fabric to a consumer then in that case cash accounting method will record the revenue of the company when the cash is actually paid, whereas according to accrual method the revenue was generated when the company sold the fabric.

- Single Entry and Double Entry

The cash method uses a single-entry system to record the inflow and outflow of cash as income or expense. The accrual method uses a double-entry system in which every transaction is recorded under two accounts. The transactions resulting from the credited account should be similar to those of the debited account.

- Taxes

The cash and accrual methods both significantly affect tax because the recognition of revenue and expense differs according to the cash or accrual method.

| For instance, if a company prepared an invoice of $10,000 to their customer on August 20, 2024, and the customer paid the amount on March 1, 2025. The businesses using the cash method don’t have to add these earnings to the tax for the year 2024, whereas according to the accrual method, as revenue is already generated, the company will include this revenue in the year 2024. |

- Reporting

Companies keep a financial statement record to keep track of the performance and growth of the company, which is important for every business. These financial statement records have three useful statements that are; cash flow statement, balance sheets, and income statement or profit or loss statement.

The cash flow statement provided by the cash method gives a view of how much money is there in the company at that given point of time by keeping a record on actual paid or received cash. In accrual method, the revenue is made without keeping a track on actual cash flow.

Balance sheets generally provide information on the company’s assets, liabilities, and investments (equity). In the cash method, the company doesn’t record the account receivables or payables. This is why the balance sheet doesn’t show the liabilities or assets, whereas accrual accounting provides a clear picture of the company’s assets, liabilities, and equity.

Income statements offer a comprehensive overview of a company’s revenue, expenses, and profit or loss over a specific period. In cash accounting, however, the picture of income needs to be more accurate, as it only reflects cash flow when transactions are actually paid or received. This approach may result in an inaccurate income statement, failing to account for revenue when it is earned. In contrast, accrual accounting presents a clearer representation of the income statement by recording all revenues and expenses as they occur, regardless of cash flow.

Other leading approaches to accounting include cash-basis accounting, which, although easier compared to other methods, may need to be more accurate.

It is the GAAP due to the following reasons:

- Compared to other accounting methods, it reflects the most honest picture of accounts payable and receivable and the real status of any bill or invoice, including the deal that still needs to be completed but is pending.

- Next, the choice of the accounting system has a major impact on the operations. The following are some of the important features that distinguish cash and accrual basis of accounting.

Cash Basis Accounting Example

Here’s an example to help you understand how cash basis accounting operates:

Let’s say you have a $1000 assignment that you have to do between May 1st and June 30th.

On May 1st, you and your customer signed the contract, and on that same day, your crew started working to finish the job. However, you still need to be paid.

- Suppose you intend to record $10,000 of revenue only when it is generated, not when the contract was signed on May 1st, if you were going to adopt the accrual method of accounting. One of the key characteristics that sets accrual accounting apart from other forms of accounting is this approach to revenue recognition.

- Accounts receivable, or money that you will get in the coming months or when you complete the job on May 30th, would be the format for the record.

- You don’t keep track of transactions or accounts receivable while using the cash approach. When the client transfers $10,000 into your company account, that’s when you record the $10,000 as revenue.

How Cash Basis Accounting Violates GAAP

The Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) provide restrictions on who is able to and cannot utilize cash-based accounting. Both the matching and period of the cash accounting approach break GAAP principles.

The following requirements must be met in order for you to adopt cash basis accounting under these globally accepted accounting standards:

- Regarding partnerships, limited liability firms, S corporations, C corporations, and sole proprietors:

- You have not received more than $1 million in gross earnings in any one year, and throughout the previous three years, you have received $5 million.

- Except in some cases, you don’t keep inventories.

Rather than being a specified service trade or business (SSTB), you are a personal service business (legal firms, accountancy, consulting, engineering, and architectural companies).

A small firm that maintains inventory may occasionally be allowed to use cash-basis accounting by the IRS if its annual revenue is greater than $1 million but less than $10 million. This is known as the inventory test, and it will require yearly gross revenues for the previous three years to ascertain and substantiate this claim.

For farms held by families: Your average yearly gross earnings are less than $25 million.

It could be necessary for you to convert to the accrual accounting system if your firm does not fall under any of these categories (for instance, if it is a publicly listed corporation).

Many professionals and small-business owners utilize cash basis accounting. It is considered as the simplest accounting method. Cash basis accounting also offers a quick look at the amount of money the business actually has on hand. That’s an important metric for any company.

Frequently Asked Questions (FAQs)

What is the Cash Basis of Accounting?

The cash basis of accounting is a method where revenues and expenses are recorded only when cash is received or paid. Income is recognized when it’s physically received, and expenses are recorded when they’re actually paid rather than when they’re incurred.

What is the Difference Between Cash and Accrual Basis Accounting?

The key differences between cash basis and accrual basis accounting are:

- Cash Basis:

- Revenues are recorded when cash is received.

- Expenses are recorded when cash is paid.

- Simple to use and ideal for small businesses.

- Accrual Basis:

- Revenues are recorded when they are earned (regardless of when cash is received).

- Expenses are recorded when they are incurred (regardless of payment timing).

- It provides a clearer picture of a business’s financial position but is more complex.

These are the major differences between the cash and accrual basis of accounting.

What is the Cash Basis Accounting Rule?

The cash basis accounting rule states:

- Record income only when cash is received from customers or clients.

- Record expenses only when cash is paid to vendors or suppliers.

This method does not recognize accounts receivable or accounts payable, as it focuses purely on cash transactions.

How Do you Record Cash Basis Accounting?

To record cash basis accounting:

- Record Revenue: When you receive cash for goods or services, create a cash receipt or sales entry.

| Example: You receive $500 in cash; you record it as income immediately. |

- Record Expenses: When you pay for an expense, immediately log it in your accounting records.

| Example: You pay $200 for supplies; record the expense as it happens. |

- Avoid recording unpaid invoices or unpaid bills, as cash basis accounting only tracks actual cash flows.

| Tools Tip: Most accounting software, like QuickBooks, allows businesses to switch between cash basis and accrual basis reporting for flexibility. |