Capital Expenditure (CAPEX in full form) is a firm’s expenditure on improving its long-term assets or purchasing new equipment. Capital expenditure is a potent financial metric that helps analysts understand a company’s investment patterns.

Key Takeaways

- Capital expenditure, or CapEx, is the acquisition of long-term fixed or physical assets used in a business’s operations.

- Capital expenditures are payments for products or services that are capitalized or recorded on a business’s balance sheet rather than expensed on the income statement.

- If an item has a useful life of less than a year, it is not considered CapEx and must be expensed on the income statement instead of being capitalized.

- Capital expenditures include the acquisition of real estate, automobiles, buildings, or large machinery.

What is Capital Expenditure

Capital Expenditure (CapEx) is the expenditure made by a firm to improve its long-term assets, purchase new equipment, or facilitate growth in the foreseeable future.

CapEx is the money a company invests in acquiring, maintaining, or improving fixed assets such as property, buildings, factories, equipment, and technology.

If the company’s capital base is reduced and assets become obsolete, no longer needed, or are sold for strategic reasons, this is considered negative capex. An example of negative capex is when a factory owner realizes that they don’t need 200+ workers anymore and only 20 workers can do the work at a time, and the workers they currently have are not being used for any productive purposes.

On the other hand, if the company invests in acquiring new assets or upgrading existing ones, then it is considered a positive capex. An example of positive CapEx is when the business decides to expand an already existing factory that needs to increase its production capacity.

Formula and Calculation of Capex

Capital Expenditure (Capex) = Ending PP&E – Beginning PP&E + Depreciation

where:

- Ending PP&E → Current Period PP&E Balance, i.e. End of Period (EoP)

- Beginning PP&E → Prior Period PP&E Balance, i.e. Beginning of Period (BoP)

- Depreciation → (Total PP&E Cost – Salvage Value) ÷ Useful Life Assumption

- Depreciation: Non-cash charge representing the allocation of the cost of a tangible asset over its useful life

- PPE (Property, Plant & Equipment): Represents the value of a company’s physical assets.

Capex is calculated across different industries such as:

- Manufacturing Industry : It includes assembly lines, vehicles, factories and heavy machinery.

- Retail Industry: It includes display equipment, logistics vehicles, warehouses and store locations.

- Energy Industry: It includes drilling equipment, pipelines, refineries and oil rigs.

- Healthcare Industry: It includes medical equipment such as MRI machines, X-ray machines ) , hospitals and specialized labs.

- Telecommunications Industry: It includes network infrastructure, fiber optic cables and cellular towers.

- Technology Industry: It includes software development , hardwares, servers, office building and data centers.

Steps to calculate capital expenditures

- Step: Locate depreciation and amortization on the income statement.

- Step: Locate the current period property, plant & equipment (PP&E) on the balance sheet.

- Step: Also, locate the prior period PP&E on the same balance sheet.

- Step: Use the formula given below to calculate the accurate CapEx:

Capital Expenditure (Capex) = Ending PP&E – Beginning PP&E + Depreciation

Types of Capital Expenditure

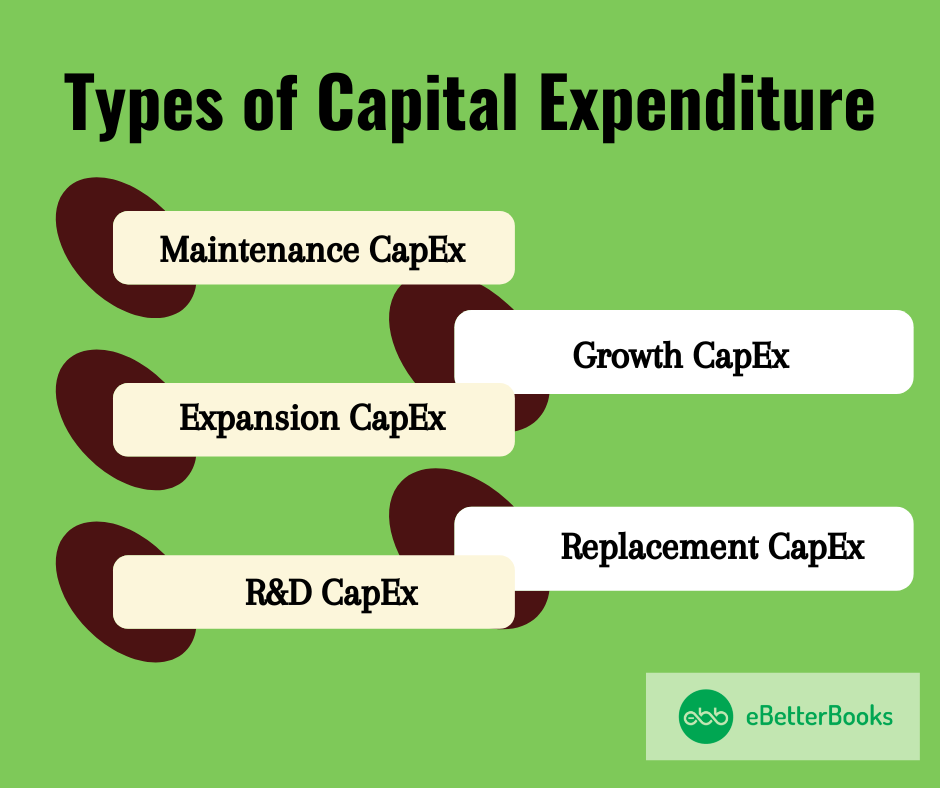

The types of capital expenditure are maintenance capex, growth capex, R&D capex, expansion capex and replacement capex.

- Maintenance CapEx: Expense incurred to maintain a company’s current operations, which includes routine repairs, refurbishments, and ongoing maintenance activities that ensure the longevity and optimal performance of the assets.

- Growth CapEx: Expenses incurred to increase earnings and capacity for future growth.

- Expansion CapEx: Capital expenditure incurred to acquire a new business or launch a new product and expand into new markets or geographic locations.

- Replacement CapEx: Capital expenditure incurred to replace old or enhance old, obsolete assets, including upgrading old machines, equipment, or technology systems to newer, more effective models.

- R&D CapEx: These expenditures focus on innovation, product development, and technological advancements, which may include developing new systems or technologies, creating new tech stacks, or even revamping existing ones.

Capex on financial statement

Capital expenditure can be found on a company’s cash flow statement under investing activities.

CapEx is included in the cash flow statement section of a company’s three financial statements, but it can also be derived from the income statement and balance sheet in most cases.

The resources for the capital expenditure are normally determined using crucial factors such as ROI, potential cash flow variance, risk assessment, and the overall financial integrity of the investment.

Capital Expenditure on Balance Sheet

Capital expenditures are recorded in property and equipment (PE) line items, which represent long-term assets such as buildings, vehicles, or machinery.

CapEx flows from the cash flow statement to the balance sheet. Once it’s capitalized, the value of the asset is slowly reduced over time via depreciation expense.

The value of such assets slowly depreciates over time. In the assets section of the balance sheet, the capex amount will be captured as an increase to the PP&E balance and reduced by the non-cash depreciation expense.

How to calculate capex from a cash flow statement?

To calculate CapEx (capital expenditure) from a cash flow statement, you should look for the “Investing Activities” section.

Under this section, you will find the direct amount spent on purchasing property, plant, and equipment (PP&E) listed as a negative figure. The negative figure represents the company’s total capital expenditure for the period.

Calculating Net Capital Expenditures

Net CapEx refers to the remaining funds used to obtain or enhance fixed assets after deducting the revenue generated from selling fixed assets. It is a difference between overall capital expenditure and the earnings from selling fixed assets.

Such expenditure helps in evaluating the efficiency of capital allocation, assessing the impact on the company’s asset base, and understanding the overall investment trends over time. It can be calculated either directly or indirectly.

In the direct approach, an analyst must add up all of the individual items that make up the total expenditures using a schedule or accounting software.

In the indirect approach, the value can be inferred by looking at the value of assets on the balance sheet in conjunction with depreciation expense.

Direct Method

| xx Amount spent on asset (#1)+ xx Amount spent on asset (#2) + xx Amount spent on asset (#3) – Value received for assets that were sold = Net CapEx |

Indirect Method

| PP&E Balance in the current period – PP&E Balance in the previous period + PP&E Balance in the previous period = Net CapEx |

Significance of Capital Expenditures

CapEx plays a key role in enabling stakeholders to determine the profitability of their assets. It helps businesses to grow and ensures sustainability.

Below are some pointers to describe the importance of capital expenditure in a firm:

Long-term Effects

CapEx allows companies to invest in growth opportunities that contribute to their long-term sustainability. The range of current production or manufacturing activities is mainly a result of past capital expenditures. Similarly, the current decisions on capital expenditures will have a major influence on the future activities of the company.

Irreversibility

Capital expenditures are often difficult to reverse without the company incurring losses. Most forms of capital equipment are customized to meet specific company requirements and needs. Also, such customized materials and machinery do not bode well in the general capital market.

High Initial Costs

Capital expenditures are characteristically very expensive, especially for companies in industries such as manufacturing, telecom, utilities, and oil exploration. Capital investments in physical assets like buildings, equipment, or property offer the potential to provide benefits in the long run but will need a large monetary outlay initially.

Depreciation

Capital expenditures have an initial increase in the asset accounts of an organization. However, once capital assets start being put in service, depreciation begins, and as a result their value continues to decrease throughout their useful lives.

Cash Flow Management

Cash expenditure plays a crucial role in budgeting and financial planning. By monitoring and analyzing cash outflows, businesses can develop realistic budgets and forecast future cash requirements. Also, can ensure they have sufficient funds to meet their day-to-day expenses, such as payroll, rent, utilities, and supplier payments.

Investment Analysis

Cash expenditure is a critical factor when evaluating investment decisions. Businesses can assess the feasibility and profitability of a project. Analyzing the cash expenditure associated with various investment options helps to determine the potential return on investment (ROI). This enables you to make better decisions regarding resource allocation, investment opportunities, and cost management strategies.

Challenges with Capital Expenditures

Here are some common challenges that business entities encounter with capital expenditure –

Measurement Problems

Business entities and financial experts often face problems when it comes to identifying, measuring and estimating the costs involved and benefits of a capital expenditure proposal.

Unpredictability

Most large investments are made in capital assets with the hope of generating predictable outcomes. However, such outcomes are not guaranteed, and losses may be incurred. The costs and benefits of capital expenditure decisions are usually characterized by a lot of uncertainty. Even the best forecasters sometimes make mistakes.

Organizations need to account for risks to reduce potential losses during financial planning, even though it is not possible to eliminate them.

Temporal Spread

The cost and benefit of CAPEX are spread over an extended period. As a result, the temporal spreads often rise when estimating the discount rate and establishing equivalence.

Calculate CapEx in Excel

Let’s have a look at CapEx in 2018 as well as the following information:

- 2018 Depreciation & amortization is $15,005 on the income statement.

- In the current period (2018), PP&E is $37,508 on the balance sheet.

- In the prior period (2017), PP&E was $37,513 on the balance sheet.

Now, calculate the capital expenditure using the formula:

CapEx = PP&E (current period) – PP&E (prior period) + Depreciation (current period)

CapEx = $37,508 – $37,513 + $15,005

CapEx = $15,000

| Financial Statement | 2017 | 2018 | 2019 | 2020 | 2021 |

| Balance Sheet Check | OK | OK | OK | OK | OK |

| Income Statement | |||||

| Revenue | 158,311 | 165,435 | 172,052 | 178,074 | 183,416 |

| COGS | 58,575 | 61,211 | 61,939 | 64,107 | 64,196 |

| Gross Profit | 99,736 | 104,224 | 110,113 | 113,967 | 119,220 |

| Expenses | |||||

| Salaries and Benefits | 26,913 | 28,124 | 29,249 | 30,273 | 31,181 |

| Rent and Overhead | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| Depreciation & Amortization | 15,008 | 15,005 | 15,003 | 15,002 | 15,001 |

| Interest | 1,500 | 1,500 | 500 | 500 | 500 |

| Total Expenses | 53,421 | 54,629 | 55,752 | 55,774 | 56,682 |

| Balance Sheet | |||||

| Assets | |||||

| Cash | 272,530 | 307,632 | 368,097 | 368,487 | 413,243 |

| Accounts Receivable | 7,807 | 8,158 | 8,485 | 8.782 | 9,045 |

| Inventory | 11,715 | 12,242 | 12,388 | 12,821 | 12,839 |

| Property & Equipment | 37,513 | 37,508 | 37,505 | 37,503 | 37,502 |

| Total Assets | 329,564 | 365,540 | 385,474 | 427,592 | 472,629 |

CapEx vs. OpEx (Operating Expenses)

| CapEx ( Capital Expenditure) | OpEx (Revenue expenditure) | |

| Definition | Capital expenditures are long-term in nature that adds value for the future growth including. | Revenue expenditures are short-term in nature used for day-to-day business operations. |

| Accounting treatment | CapEx usually can be seen on the Cash flow statement of a company and on the balance sheet, it appears under the header of fixed assets. | OpEx displays on the Income statement of a firm and not is reported on the balance sheet. |

| Purpose | Such expenses aim to improve a firm’s earning capacity. | These expenses only focus on sustainable earnings. |

| Examples | Real estate, Machinery, Equipment, Furniture, Vehicles | Rent, Wages, License fees and Utilities. |

| Financial Reporting | CapEx is reported as an asset. | OpEx is reported as an expense. |

| Reversibility | Capital expenditures are non-recurring and not easily reversible, which means companies are not likely to recover the initial value of an asset even if they decide they no longer need it. | Such expenses are incurred frequently and are easily reversible, which means companies can recover the initial value of a purchase more easily through the cancellation process. |

| Capitalization | Capital expenditures are capitalized. | Revenue expenditures are not capitalized. |

| Depreciation | Depreciation is charged on capital expenditure every year. | Depreciation is not usually charged on revenue expenses. |

| Tax treatment | These expenses are not tax-deductible. | Operating expenses are fully deductible from the company’s tax in the same year in which the expenses occur. |

Examples of Capital Expenditure

Many types of assets can attribute long-term value to a company. Capital expenditure falls into two categories: tangible and intangible assets. Below are a few examples of both:

Tangible CapEx Assets:

- Real estate, such as land or a new building for an organization

- Machinery and equipment;

- Computers or servers

- Vehicles like cars and trucks

- Furniture, including office chairs, desks, and couches

Intangible CapEx Assets:

- Patents used for product development and

- Licenses for products & services with a value that extends beyond a single year.

Examples of Operating Expenses

The asset that contributes short-term value to a company is known as operating (revenue) expenditure.

Below are some examples of revenue expenditure:

- Payroll Equipment leases

- Rent

- Utilities

- Property taxes

- Business travel

- Benefits

- Debt interest

- Software licenses

How does CapEx and OpEx work?

Capital expenditure describes the funds spent by a company to acquire, upgrade, and maintain physical fixed assets, such as property, buildings, and equipment.

For example, the act of repairing a roof, building a new factory, or purchasing a piece of equipment would each be categorized as a capital expenditure.

Capital Expenditure (Capex) → Capex is distinct from an operating expense (Opex) as the underlying asset – i.e. the fixed asset associated with the capital spending – is expected to generate long-term benefits in excess of 12 months.

Operating Expenses (Opex) → In contrast, operating expenses refer to the indirect costs incurred in the ordinary course of business, such as selling, general, and administrative (SG&A) expenses.

For example, wages and salaries, rent and utilities, equipment repair and lease, etc. All of these expenses benefit the company in the short term.

Capital Expenditure and Depreciation

CapEx and depreciation are closely related financial metrics. When managing and assessing a company’s assets and expenses, you are always recommended to monitor Capex and depreciation. When capital expenditures are used over some time, they are automatically depreciated.

Depreciation refers to the reduction in the value of long-term assets over time. Capital expenditure and depreciation are interconnected because CapEx investments in long-term assets are subjected to depreciation.

When a company invests in CapEx, the cost is recorded as a long-term asset on the balance sheet. Over time, the value of this asset is gradually decreased through depreciation expense, reflecting the asset’s consumption or value.

The total depreciation will be equal to the net capital expenditure. If a company regularly has more CapEx than depreciation, its asset base is growing.

Here’s how to see if a company is growing or shrinking (over time):

- CapEx > Depreciation = Growing Assets

- CapEx < Depreciation = Shrinking Assets

Conclusion

Companies often incur capital expenditures to invest in their long-term capabilities. They must carefully plan and execute their capital expenditure strategies to make a balance between expanding their operational capabilities and maintaining financial health. CapEx can tell you how much a company invests in existing and new fixed assets to maintain or grow its business.

From buying land, buildings, and equipment to enhancing manufacturing or warehouse opportunities or technology, CapEx includes everything that brings revenue to the company.

FAQ’s

What is Capex in Simple Terms?

Capex in simple words is the amount spent to increase future earnings of the company by adding more capabilities. The impact of Capex lasts for more than one accounting year.

What is the Formula for Calculating Capex in Manufacturing?

XYZ Inc is a manufacturer of Earpods.The Opening PPE (Year1) is $5,000,000, Closing PPE (Year 2) is $5,500,000 and Depreciation Expense is $400,000.

CapEx Calculation = Ending PP&E – Beginning PP&E + Dep

= (5,500,000 − 5,000,000) + 400,000

= 9,00,000

The manufacturing company spent $900,000 in capital expenditures during the period.

What Type of Investment Is CapEx?

CapEx is the investments that a company makes to grow or maintain its day-to-day business operations. Capital expenditures are less predictable than operating expenses, which recur consistently from year to year.

A company that buys expensive new equipment would account for that investment as a capital expenditure. It would, therefore, depreciate the cost of the equipment throughout its useful life.

Is CapEx Tax Deductible?

Capital expenditures aren’t directly tax-deductible but they can indirectly reduce a company’s taxes through the depreciation they generate.

For example: A company may include $100,000 of depreciation expense each year for 10 years if it purchases a $1 million piece of equipment with a useful life of 10 years. This depreciation would decrease the company’s pre-tax income by $100,000 annually, reducing its income taxes.

When Should Expenditure be Capital or Expense?

The expenditure should be a capital or expense that totally depends on how long the benefit of that spending will be expected to last. If the benefit is less than 1 year, it must be expensed directly on the income statement. However, if the benefit is more than 1 year, it must be capitalized as an asset on the balance sheet.