Why in the News?

Natural disasters would have devastating effects on the business in terms of property and inventory being damaged physically. For owners, the aftermath can be very overwhelming for them in terms of cost, which makes it even harder to recover and then get back to normal functioning. Realizing this seriousness, various financial relief schemes are offered to the businesses affected by such events.

In the wake of Hurricane Helene, a Category 5 Storm, and Hurricane Milton, which destroyed many lives, businesses, and properties in North and South Carolina, Tennessee, and Florida, several communities are struggling to recover from the disaster. Such disasters make it difficult for businesses to operate and, in some cases, retrieve their losses.

For businesses to reconstruct, the Small Business Administration provides access to crucial capital concerning low-interest disaster loans and grants such as Business Physical Disaster Loan, Economic Injury Disaster Loan, and Disaster Mitigation Assistance Loan.

These programs are intended to help businesses recover from physical damage, covering lost revenue and sustaining operations so that businesses can work properly again.

Disaster Loans by Small Business Administration

SBA Disaster Loans are the only essential source of financing through which businesses can obtain the needed cash to overcome losses caused by federally notified natural disasters, which include hurricanes, floods, tornadoes, earthquakes, wildfires, and winter storms.

The SBA offers disaster loans, which are low-interest loans that reduce the financial loss resulting from physical damage, lost revenue, and business operation disruption, allowing the business to recover and continue its operations.

SBA loans promote business stability and job needs, make it easier to implement affordable and long-term recovery measures, and help businesses recover from certain shocks.

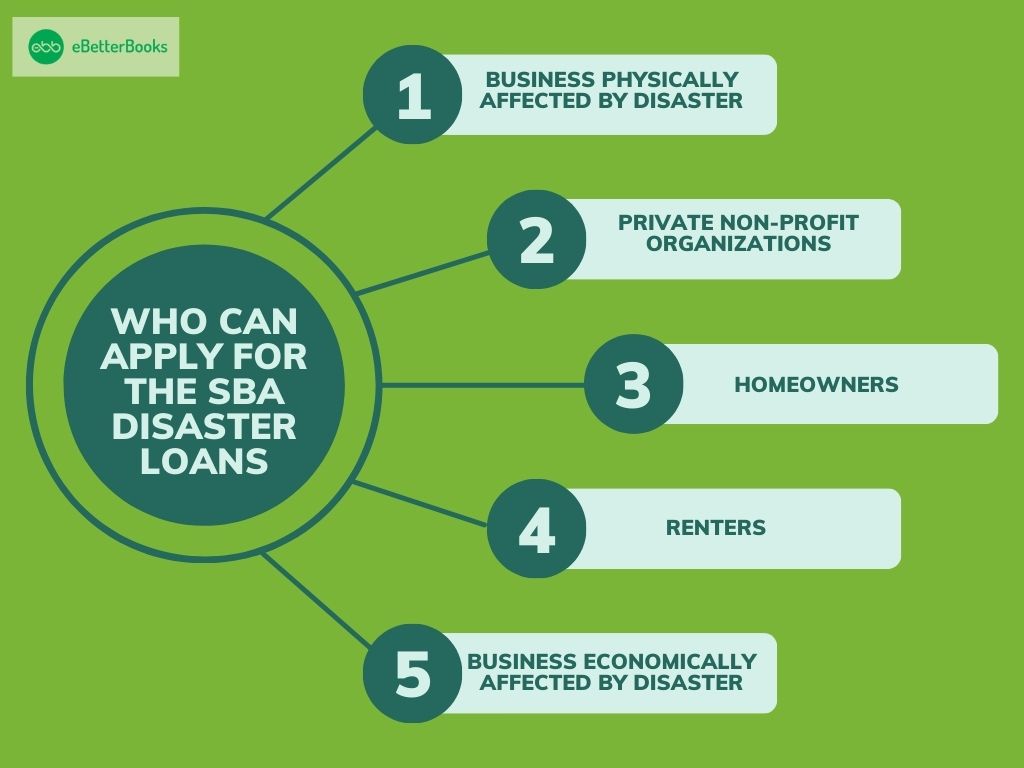

Who Can Apply for the Financial Relief / Disaster Assistance?

This assistance is designed for people like:

- Owners of any business that declares that it has been affected by a disaster.

- Private non-profit organizations that have faced some measurable loss or damage.

- Homeowners who need help in replacing or rebuilding damaged homes.

- Renters whose property has been destroyed or damaged by the disaster,

- Businesses that suffered the economic loss or the loss of potential sales because of the operation interruption, if not the physical damage.

Whether for-profit or non-profit, both organizations can solicit SBA financial reliefs depending on the needs of the particular group. According to the provisions, applicants must fulfil disaster-related damage or financial need. To check whether your area is eligible for SBA Disaster Loan, please visit the official website.

Types of Disaster Loans

The SBA provides several types of disaster loans meant for people and companies to rebuild from the effects of natural disasters. Some of these loans are available to fix the physical damage to property, to obtain working capital in order to offset an economic loss, and to help homeowners and renters with repair or replacement needs.

This means that each type of loan meets specific requirements, such as financing business facilities, compensating losses, or ensuring that equipment is used.

Additional detailed descriptions of each loan category and its significance can be found below:

| Loan Types | Economic Injury Disaster Loan | Military Reservists Economic Injury Loans | Physical Damage Loans | |

| Basis | Home and Personal Property Loans | Business Physical Disaster Loan | ||

| About This Loan | It offers financial assistance to small businesses, agricultural cooperatives, and private non-profits to cover operating expenses during a temporary revenue loss. | It helps small businesses meet operational expenses when essential employees are called to active duty in the military. | Provide loans to homeowners and renters to repair or replace disaster-damaged real estate and personal property. | Provide loans to businesses to repair or replace damaged property, equipment, or inventory after a disaster. |

| Who is it for? | Small businesses, private non-profits, and agricultural cooperatives. | Small businesses with essential employees called to military service. | Homeowners and renters in disaster-affected areas. | Businesses of all sizes, private, non-profits, and landlords. |

| Any Collateral Required? | Yes, for the loans over $25,000. | Yes, for loans over $50,000. | Yes, for the loans over $25,000. | Yes, for the loans over $25,000. |

| Interest Rates for This Loan | As low as 3.305% for businesses without credit available elsewhere and 8% if credit is available. | 4% fixed rate. | This is as low as 1.438% for homeowners without credit available elsewhere and 8% if credit is available. | It is as low as 4% for businesses without credit available elsewhere and 8% if credit is available. |

| What can it be used for? | Provide working capital to cover day-to-day operational expenses. | Maintain cash flow and operational stability during an employee’s active-duty period. | Repair or replace real estate, personal property, or belongings. | Repair or replacement of physical assets, including inventory and equipment. |

| Maturity | Upto 30 years | Upto 30 years | Upto 30 years | Upto 30 years |

| Documents Needed for Application | Business financial statements.Tax returns Details of the economic impact. | Proof of active duty orders Business financial statements Operational documents | Proof of home ownership. Insurance Details. Income statements. | Business financial statements Tax returns Ownership documents |

For more information and the application process, head over to the official website of SBA Disaster Assistance.

Insurance Alternatives for Companies Following Natural Disasters

An Overview Insurance coverage is another crucial tool for businesses to protect their assets both before and after a disaster, even while disaster loans can offer much-needed financial relief. This section can discuss the many insurance plans that companies should think about in order to lessen the financial impact of natural disasters, including floods, business interruption, and property insurance.

Many companies might not be aware that some disaster-related damage (such as floods) is not covered by normal business insurance policies, which can cause gaps in recovery efforts. A business’s resilience can be greatly increased by being aware of these insurance options, the claims procedure, and ways to get ready for future calamities.

Services for Employees and Business Owners in Need of Mental Health and Support Following a Disaster

It’s easy to overlook the psychological toll that a natural disaster takes on employees and business owners. Stress, worry, and even depression can result from operational and financial difficulties. This subject can cover mental health resources, including counselings, stress management courses, and crisis intervention tools, that are accessible to managers, employees, and business owners.

It can also draw attention to the significance of mental health in the healing process, making sure that companies are not only making financial progress but are also putting their employees’ welfare first, which is essential for long-term success and morale.

Mitigation Assistance

About This Loan

A Mitigation Assistance Loan is another form of loan offered by the SBA to enable businesses and homeowners to reduce future damage due to disasters. This particular loan enables applicants who qualify for the grant to consider mitigation measures whenever reconstructing their property after a disaster, with the aim of making it proof against other forms of disasters that might occur in the future.

Mitigation assistance is to be used at the immediate level to finance the projects with the goal of preventing further losses to property in cases of another disaster. Borrowers can also increase their SBA disaster loan limit by upto 20% to help pay for mitigation expenses. The reason behind this loan is to prevent the destruction from recurring and save on costs when it finally happens, as properties need to be safe.

Considerable Projects

Mitigation projects supported by the SBA typically include:

- Constructing platforms or raising buildings from an altitude where they can be easily flooded.

- It includes strengthening roofs and walls to be able to stand strong against wind storms or earthquakes.

- Storm windows or storm shutters can be used as a shield from hurricanes.

- Construction of walls or barges is needed to obtain a sharply defined edge for a flood plain.

- Replacing/ raising utility shelves (e.g., raising electrical panels above the flood heights).

- To enhance the drainage system to avoid water damage.

How to Apply?

- Apply for a Disaster Loan: To qualify for SBA’s disaster loan (e.g., Business Disaster Loan or Home and Personal Property Damage Loan), you must apply first.

- Request Mitigation Funding: After getting approval on the loan, seek approval to borrow up to 20% for qualified mitigation measures.

- Submit a Mitigation Plan: This means that the mitigation project proponents must supply very specific details and cost estimations for each project.

- Approval of Funding: After assessing the mitigation plan, the SBA will decide which candidates qualify for the funds.

Mitigation Assistance enables the state to foster the development of more disaster-resistant structures and encourages further action to minimize future hazards.

If you want to apply for mitigation assistance, you can check the official website of SBA Mitigation Assistance.

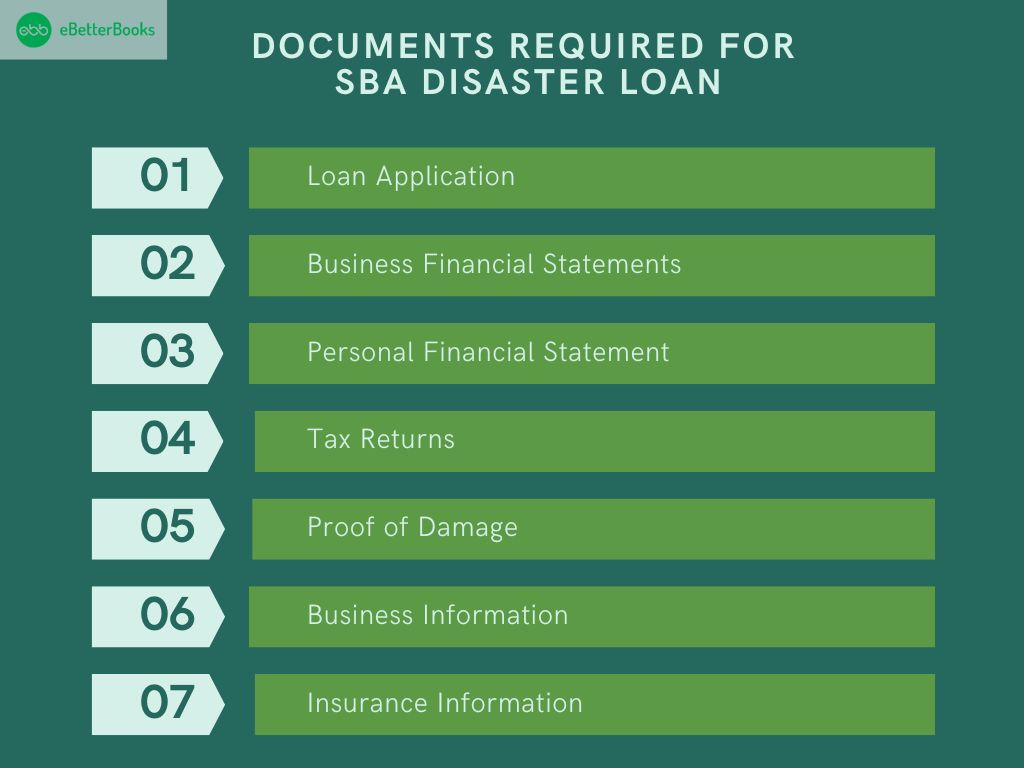

Documents Required for SBA Disaster Loan

To apply for SBA Disaster Loan, applicants typically need to provide the following documents:

- Loan Application: Fill out the SBA loan form (SBA Form 5 or 5C).

- Business Financial Statements: Provide copies of the last three years profit and loss statements and statements of financial position.

- Personal Financial Statement: Complete SBA Form 413, which is required for a personal balance sheet of assets and liabilities.

- Tax Returns: Submit the tax returns of the federal income of the business for the last 3 years, as well as personal tax returns, if any, to the business.

- Proof of Damage: Pictures or receipts of the devastated area that give an estimate of the incurred loss.

- Business Information: Information about the business background, such as its form, ownership, and development.

- Insurance Information: Additional information about the insurance coverage may cushion the occurrence of losses.

These documents enable the SBA to review the applications and determine the applicant’s need for funds. The SBA’s official website provides more details about disaster loan applications.

Mortgage Help and Home Repair Loans After a Disaster

Unfortunately, disaster brings immense turmoil for homeowners who are trying to get through the process and restore their residences and lives. To help with the recovery, some mortgage assistance programs and other home repair grants are available to help match the appropriate requirements that individuals will need.

The most common and used one is the FHA 203(h) Loan, designed to help owners who have lost their homes in a disaster. This program enables people to build a new home or reconstruct the destroyed ones without making any upfront payment.

The FHA 203(h) Loan is easy to pay back since it comes with low interest rates and long-term repayment schedules, keeping in mind that those affected may not have a large cash pile to make huge down payments.

Apart from the FHA 203(h) loan, there are Home Repair loans in SBA and other programs. These loans are targeted to pay for repairs that make the dwelling units safe and reasonably fit to live in. They offer low payments and flexible repayment and are favorable for homeowners who need to make urgent repair work without incurring deeper financial losses. This financial help can be used to do a broad range of repair works, such as repairing roofs and pipes and restoring electricity and other utilities.

Homeowners can apply for disaster relief grants offered by the local and federal departments. These grants are generally for short-term needs, like assistance for food, shelter, and other minor repair jobs. Unlike loans, these grants do not have to be paid back, which gives families a source of hope in bad times caused by the disaster.

In conclusion, mortgage help and home repair loans are very useful after a natural disaster. These programs can effectively help affected individuals start the restoration process and carry on their lives.

FEMA Shelter

According to the Federal Emergency Management Agency (FEMA), it offers emergency temporary accommodation to people and families who have been forced out of their homes through natural disasters such as hurricanes like Helene.

These shelters provide accommodation with the comfort of safety and essential needs such as food, water, medical attention, etc. FEMA works with the local shelter to open up schools, community centers, and other facilities where people can go for refuge and stay until they can rebuild their homes. It also provides information on finding more permanent homes as individuals start the process of getting their lives back together.

To access FEMA shelter during a disaster, individuals should follow these steps:

- Stay Informed: Look for the details from local news and weather concerning the evolutions and shelters.

- Contact Local Authorities: Get guidance from the local emergency management offices of local shelters or local organizations that deal with disasters.

- Register for Assistance: To Get FEMA help, complete a registration form online or call a FEMA emergency helpline if you cannot get online (it is 211 for most parts of the US).

- Follow Instructions: When identifying a shelter, children should observe the strict local standards and measures for entry.

D-SNAP Disaster Food Relief

The Disaster Supplemental Nutrition Assistance Program (D-SNAP) offers food assistance to households after getting affected by a natural disaster. The D-SNAP program is affiliated with USDAs and promotes it for families that experience income change or lose their homes in such disasters as hurricanes, floods, earthquakes, etc. Different from normal SNAP, D-SNAP has a shorter paperwork process to fill in than the normal one in order to provide food soon after the disaster. The program assists in recovery by guaranteeing that families are nourished during the recovery period so expenses associated with disaster recovery are not oppressive.

Disaster Unemployment Benefits

Disaster Unemployment Benefits are critical relief aids realized through nominal relief programs developed to help jobless due to natural disasters. FEMA and the state’s unemployment offices offer such benefits after a disaster to help workers make ends meet for a short period before the employee can find a new job.

Applicants seeking disaster unemployment benefits must prove that their unemployment is due to the declared disaster. This may include job loss due to business closure, inability to get to work, or halting business operations due to a disaster. To claim, an application is made to the state’s unemployment office, and other supporting documents show how the disaster has affected employment.

They are generally time-bound and extend to normal waged workers and sporadically working freelancers affected by the disaster. The amount paid can be influenced by previous wages or percentages and decisions made by the state concerned. There are extra types of benefits in situations where all the standard unemployment benefits have been used.

To understand more, one must visit his/her state’s unemployment insurance website or the FEMA website to read more details.

Help With Utility Bills After a Disaster

Several things can happen after the disaster that would assist with utility bills so that families can get back on track.

- Federal Emergency Management Agency (FEMA): Provides money grants for temporary housing and some utilities under the Individual Assistance.

- Local Utility Companies: Some utility providers have disaster relief programs through which they help their affected customers manage their bills.

- State and Local Programs: Different states provide financial assistance in the form of emergency assistance for utility bills.

Contact the agencies and utility providers in your area for further information and details regarding the availability of specific programs.

Student Loan Payments After a Disaster

When a natural disaster hits, the U.S. Department of Education offers relief measures for federal student loan borrowers. Student loan borrowers can get relief by applying for forbearance, which partially or fully suspends their obligation to pay, giving the affected person some time to get back on his/her feet.

Forbearance means the borrower does not need to make any payments during the forbearance period, and this is different for various loan types. Interest does not accumulate. Borrowers can also arrive late or have other excessive charges dropped for them or rental payments’ due dates adjusted to allow the borrowers to avoid further charges while they stabilize their lives.

It looks at providing important support to the disaster survivors to relieve them of the financial burden while they can easily focus on the recovery process.

What to Do Before and After a Natural Disaster or an Emergency?

Before a natural disaster or emergency:

- Create an Emergency Plan: All family members should be aware of the escape plans and the main ways to communicate.

- Prepare an Emergency Kit: This kit should include essential items such as water, canned foods, a first aid box, documents such as identification, medical records, and prescriptions, as well as tools.

- Stay Informed: Carry out a Weather update and follow or obey government alerts.

After a disaster or emergency:

- Ensure safety: Look for signs of collision, wrecked structures, and portable power lines outages.

- Contact authorities: The customer should report any type of damage and also report to seek help if needed.

- Begin recovery: Use it for insurance claims or apply for relief aid, such as an SBA loan or D-SNAP.

To avail of disaster assistance, please visit the.

Conclusion

Finally, it reveals that financial relief programs serve as an indispensable instrument in supporting business victims of natural disasters. SBA’s Disaster Loans, such as Business Physical Disaster Loans, Economic Injury Disaster Loans, and Disaster Mitigation Assistance Loans, are essential sources of funding for recovery and reconstruction.

Such resources enable companies to fix damaged properties, meet organizational expenses, and finance protection against future calamities. The applicants of the financial relief options could restore the financial health of their companies, sustain the local economy, and recover after the disasters. Early intervention is critical to promote a timely and healthy recovery that is also sustainable.

FAQs

What is an SBA Disaster Loan?

SBA Disaster Loans are low-interest loans provided by the Small Business Administration to help businesses recover from natural disasters.

Who is Eligible to Apply for SBA Disaster Assistance?

Small businesses, private non-profits, agricultural cooperatives, homeowners, and renters affected by a federally declared disaster are eligible.

What Types of SBA Disaster Loans are Available for Businesses?

SBA offers Economic Injury Disaster Loans, Business Physical Disaster Loans, and Mitigation Assistance Loans to support recovery.

Is Collateral Required for SBA Disaster Loans?

Yes, collateral is required for loans over $25,000, depending on the type of loan and the loan amount.

How Can Businesses Apply for SBA Disaster Assistance?

Businesses can apply through the SBA’s official website by submitting required documentation such as financial statements and proof of damage.