The guide’s primary purpose is to move beyond simple data entry, providing a complete financial control strategy centered on stop payments. It emphasizes that a stop payment is a strategic tool for security and control over business finances, enabling immediate action against errors, fraud, or disputes. Crucially, the content dedicates significant focus to the different financial impacts and proper procedures for QBD versus QBO, specifically contrasting the risk levels of Voiding a transaction (which maintains an audit trail) versus Deleting it (which erases history).

Highlights (Key Facts and Procedures)

The following points represent the most critical, fact-checked takeaways and procedures directly supported by the article’s detailed instructions:

- Stop Payment Reasons: “Stop payment option is executed when you have made a payment that needs to be cancelled because of the following reasons such as: Errors… Cancelled Contract… Fraud… Lost or Stolen.”

- Best Practice for Bank Fees: When reconciling, the preferred method is to “Wait until you reconcile the bank account and address the stop payment charge under bank charges at the bottom of the screen.”

- Core Distinction for Auditing: “Voiding keeps the record with a $0 amount, useful for audits, historical tracking, and reconciliation. Deleting removes the transaction entirely, which is risky if the payment was processed, reported, or linked to payroll.”

- Handling Direct Deposits (CRITICAL WARNING): “Voiding a Paycheck… doesn’t stop a direct deposit from processing and doesn’t return funds to you.” (This necessitates immediate contact with the payroll provider for a reversal).

- QBD Procedure: The method for QBD involves two parts: “To record a stop payment in QuickBooks Desktop, void the contractor’s payment by navigating to Vendor Center, selecting the check, and voiding it. Then, send payroll data and review the transaction.”

- QBO Procedure: For processed payments in QBO, the key is the reversal: “To record a stop payment in QuickBooks Online, create a journal entry with debits and credits, add a memo, and save.”

- Post-Action Reconciliation: “Always reconcile your bank and accounting records right after the void to avoid future mismatches,” and “Never delete a processed transaction, as it erases audit trails, affects reports, and confuses reconciliations.”

Importance of “Stop Payment” feature in QuickBooks

- Security and Control: It adds an additional layer of security to the account and provides control over payments. In case of incorrect payment, businesses can take immediate action if the payment needs to be halted.

- Prevent Unauthorized Payment: You get access to stop the payment on a check or any electrical payment mode in case you don’t want the payment to be processed.

- Avoid penalties: It helps businesses avoid the fees or penalties that might arise from incorrect or erroneous payments.

- Maintain Accuracy: This ensures that every small business’s financial records are recorded correctly and reflect the correct information.

- Managing cash flow: Businesses can manage cash flow by avoiding funds being debited or withdrawn from their bank accounts.

What do you do to stop payment in QuickBooks?

To learn the best way to stop payment in QuickBooks, you can either delete the paycheck, edit the paycheck, or void it.

- Editing a Paycheck: This allows you to update your paycheck information directly for the payroll. You can easily edit the paycheck if you haven’t sent your payroll to us yet.

- Deleting a Paycheck: This action removes the paycheck from your payroll. You can easily delete the paycheck if you haven’t sent your payroll to us yet.

- Voiding a Paycheck: This action changes your paycheck dollar amount to zero. You may need to make adjustments to balance your books. Voiding a direct deposit ONLY zeros out your records; it DOES NOT stop the bank processing or return the funds. You must contact your payroll provider/bank immediately. You can easily void the paycheck if you haven’t sent your payroll to us yet.

How to Record a Stop Payment in QuickBooks Desktop?

In QuickBooks Desktop there’s a field for bank fees when you reconcile the account. At that point you can enter the fee for the ‘stop payment’ here and then choose the appropriate expense account.

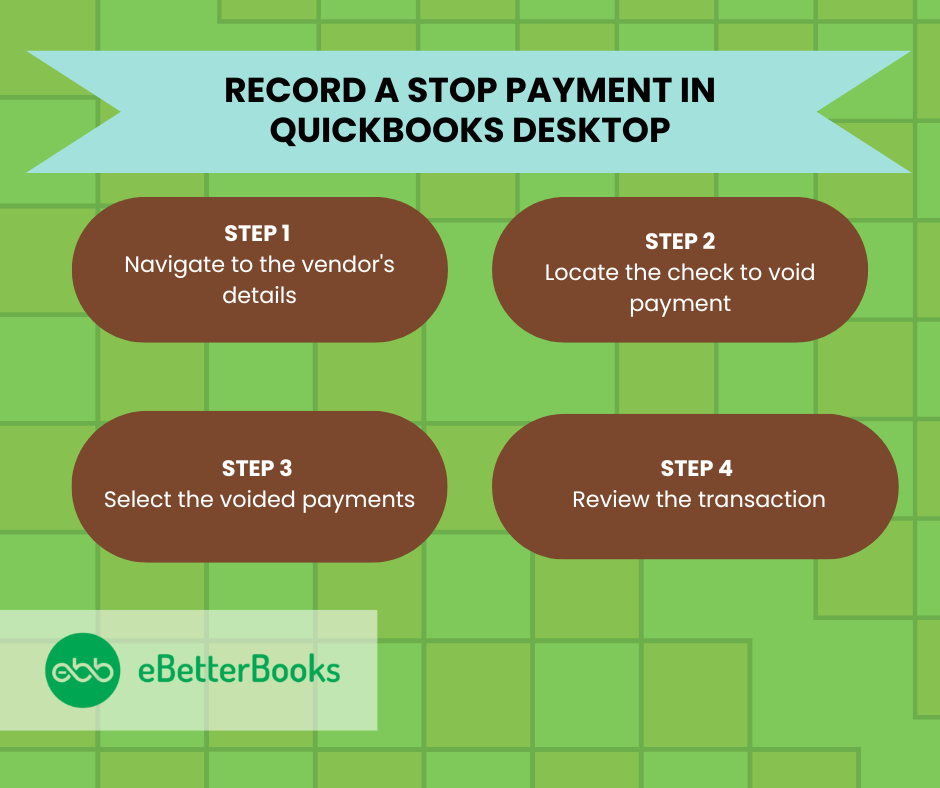

To record a stop payment in QuickBooks Desktop, void the contractor’s payment by navigating to Vendor Center, selecting the check, and voiding it. Then, send payroll data and review the transaction.

Following the step-by-step information below:

Part 1: Nullified Contractor Payments

To void a contractor payment in QuickBooks Desktop, go to the Vendor Center, select the vendor, locate the check, and choose “Void.” The check amount will update to $0.00.

Step 1: Navigate to the Vendor’s Details

- Click on the Vendor menu, then click on Vendor Center.

- From the Vendors tab, choose the vendor name.

Step 2: Locate the Check to Void Payment

- From the Transactions tab, double-click the check you want to void.

- Right-click the check image and choose Void.

- After you have voided the paycheck, a notation is included in the memo field, and the net amount of the check is 0.00.

Part 2: Do the Transaction to Stop Payment

To process a stop payment in QuickBooks Desktop, select the voided payments under the Employees menu, click “Send All,” review the transaction details, enter your PIN, and click OK.

Step 1: Select the Voided Payments

- Choose the Employees menu, then select Send Payroll Data.

- Click on Send All.

Step 2: Review the Transaction

- Check the details thoroughly.

- Enter your PIN, then select OK.

How to Record a Stop Payment in QuickBooks Online?

Journal entries are complex for non-accountants. Typically, the Debit line will be the Cash/Bank Account (to reverse the assumed withdrawal), and the Credit line will be the Accounts Payable or Expense account (to reverse the initial payment record).

To record a stop payment in QuickBooks Online, create a journal entry with debits and credits, add a memo, and save. For unprocessed payments, navigate to Vendors, select the payment, and choose to delete or void it.

Steps to recording a stop payment or processed direct deposit payments:

Step 1: Select the Journal Entry Menu

- Select + New.

- Select Journal entry.

Step 2: Enter the Journal entry Details

- First, select an account from the “Account” field on the first line. Depending on whether you need to debit or credit the account, enter the amount in the correct column.

- On the next line, select the other account you are moving money to or from. Depending on whether you entered a debit or credit on the first line, enter the same amount in the opposite column.

- Check the amounts. You should have the same amount in the “Credit” column on one line and the “Debit” column on the other. This ensures that the accounts are in balance.

Step 3: Mention the Details in the Memo Section

- Enter information in the memo section so you know why you made the journal entry.

Step 4: Save the Journal Entry

- Select Save and new or Save and close.

Steps to stop recording stop payment or unprocessed direct deposit payments or non-direct deposit payments

Step 1: Navigate to the Vendor

- Go to Expenses.

- Then click on Vendors.

Step 2: Confirm the Void/ Delete Action

- Select your contractor.

- Look for the payment you want to delete or void, then select View/Edit.

Step 3: Verify the Transaction

- Select Delete or Void.

- Select Yes to confirm changes.

Essential Sub Topics for Managing Stop Payments in QuickBooks

Understanding how to record a stop payment is only part of the process—real control comes from knowing what surrounds it. The following sub topics break down the most critical areas often overlooked when handling voided transactions, maintaining payroll accuracy, and preventing reporting errors. Each point gives you a clear, actionable view to protect your records, avoid financial missteps, and ensure compliance inside QuickBooks.

Best Practices for Handling Voided Transactions in QuickBooks

Voiding a transaction in QuickBooks needs clarity, timing, and record alignment. Always record the void with a clear memo to ensure traceability, update the impacted accounts immediately to reflect accurate balances, and notify affected parties like vendors or employees if the void relates to a payment or paycheck. Use the void option only when the transaction has been recorded but not processed by the bank. For audit purposes, retain the original transaction with the void status rather than deleting it. Also, make sure to reconcile your bank and accounting records right after the void to avoid future mismatches.

Common Mistakes to Avoid When Recording Stop Payments

Avoiding errors starts with precision. Never delete a processed transaction, as it erases audit trails, affects reports, and confuses reconciliations. Don’t forget to add memos or notes—missing context leads to miscommunication, compliance issues, and extra work during audits. Avoid skipping reconciliation after stop payments, as it causes discrepancies in reports, impacts cash flow visibility, and delays financial closing. Make sure you record the bank’s stop payment fee immediately to reflect actual expenses. Lastly, don’t void direct deposit payments after payroll is sent, as funds won’t return automatically and can mislead your balance sheet.

How Stop Payments Affect Reconciliation and Reporting

Stop payments directly impact your bank reconciliation process, especially when voided or deleted checks remain uncleared. These actions cause unmatched transactions, create timing issues, and lead to incorrect cash balances. In reports, improperly recorded stop payments distort expense totals, affect vendor payment history, and skew monthly summaries. Always reconcile voided transactions against bank statements to avoid misreporting. Use filters in reconciliation tools to track voided or stopped payments separately, enabling faster audits, clearer adjustments, and accurate month-end closings. Ignoring these details leads to reporting gaps, financial confusion, and compliance issues.

Differences Between Voiding, Deleting, and Editing Transactions

Each action serves a distinct purpose. Voiding keeps the record with a $0 amount, useful for audits, historical tracking, and reconciliation. Deleting removes the transaction entirely, which is risky if the payment was processed, reported, or linked to payroll. Editing is ideal before processing, allowing changes to date, amount, or payee without affecting reports or history. Use void for transparency, delete only for errors caught early, and edit only before submission. Misusing these options can break transaction trails, cause tax reporting issues, and confuse bank reconciliation efforts.

Impact of Stop Payments on Payroll and Tax Reporting

Stop payments can delay employee payouts, create mismatches in payroll summaries, and confuse direct deposit timelines. If not recorded properly, they can affect tax liability reports, misstate year-to-date totals, and lead to IRS discrepancies. Always void or edit paychecks before payroll is submitted to ensure W-2 and 941 forms remain accurate. Failing to do so may result in duplicate entries, incorrect net pay reporting, and end-of-year tax errors. Consistent communication with your payroll provider ensures faster corrections, reduced penalties, and accurate financial compliance.

Strengthening Your Stop Payment Strategy in QuickBooks

Recording a stop payment accurately is essential, but understanding the surrounding processes and potential risks gives your financial management an extra layer of strength. This section offers practical insights into fees, compliance, communication, and expert guidance that enhance how you handle stop payments in QuickBooks. These topics are designed to help you avoid common pitfalls, stay legally protected, and maintain operational clarity—ensuring your accounting system works smarter, not harder.

Understanding Bank Fees Associated with Stop Payments

Banks typically charge a stop payment fee ranging from $15 to $35, depending on the account type, transaction method, and timing. These fees can impact expense tracking, especially if not recorded under the correct account in QuickBooks. Always log the fee under ‘Bank Charges’ during reconciliation to maintain expense accuracy, audit readiness, and cash flow transparency. If the stop payment is renewed after expiry (usually 6 months), additional fees apply, which must be tracked. Ignoring these fees can distort your net expenses, misalign budgets, and lead to overlooked financial obligations.

Note that if a stop payment order expires (usually after 6 months) and you need to renew it, you will likely incur a new, separate fee for the renewal.

Legal and Compliance Implications of Stop Payments

Stop payments carry legal weight in business contracts, especially when tied to vendor agreements, payroll, or disputed invoices. Incorrect handling can lead to breach of contract claims, loss of trust, or even litigation risks. In regulated industries, failing to document stop payments properly may violate audit standards, trigger penalties, and flag compliance issues. Always maintain a written reason, approval record, and transaction trail to protect your company legally. QuickBooks helps you stay compliant by enabling audit logs, memos, and controlled void actions, which preserve transparency and protect against future disputes.

How to Communicate Stop Payments to Vendors or Employees

Clear communication is key when issuing a stop payment. Always notify the vendor or employee immediately, explaining the reason, expected resolution, and next steps. Use email for written proof, phone calls for clarity, and update notes within QuickBooks for internal tracking. If a replacement payment is planned, confirm revised amounts, dates, and method to prevent duplicate payouts or confusion. Miscommunication can lead to damaged relationships, delayed services, and trust issues. Document every interaction to ensure accountability, transparency, and financial consistency in both your records and business operations.

Using Audit Trail in QuickBooks to Track Changes and Voids

QuickBooks’ audit trail feature lets you track every edit, void, or deletion, including the user who made it, time stamp, and changes applied. This is essential for fraud prevention, error detection, and accountability in financial workflows. To enable transparency, regularly review the audit trail report, especially after processing stop payments or voids. It helps identify unauthorized changes, overlooked adjustments, and inconsistent entries. By maintaining a clean audit history, your business gains stronger internal controls, easier audits, and reliable transaction history, which are crucial for long-term compliance and trust.

When to Consult a Financial Advisor or Accountant for Stop Payments

If a stop payment involves large sums, tax-sensitive transactions, or recurring errors, consult a financial advisor or accountant. These professionals can assess risks, ensure proper classification, and maintain audit-proof documentation. They help verify if voiding, editing, or journal entries are the right approach, especially when dealing with payroll, vendors, or legal disputes. Seeking expert guidance also protects against regulatory missteps, tax reporting mistakes, and balance sheet inaccuracies. In complex cases, their support ensures compliance, clarity, and confident decision-making within QuickBooks and your broader financial strategy.

Conclusion!

A stop payment that is properly documented can help protect against future problems with creditors and vendors by demonstrating the purpose and approval of the stopped transaction. Ensuring the accuracy of your financial records and their reflection of your company’s real-time transactions is ensured by recording a stop payment in QuickBooks.

You maintain an accurate and transparent accounting system, which is necessary for efficient financial oversight and decision-making, by carefully handling stop payments in QuickBooks.

Frequently Asked Questions

If I voided a direct deposit paycheck too late, how long does it take for the funds to be returned to my bank account, and what is the exact process?

Voiding a direct deposit in QuickBooks does not automatically pull the money back; it only zeros out your internal records. You must immediately contact your payroll provider to initiate a direct deposit reversal. Reversals are not guaranteed and must be requested within 1-5 banking days (varies by bank). If the reversal fails, you will need to recover the funds directly from the employee, often leading to a challenging Accounts Receivable situation.

My bank statement shows a cleared check, but I realized it was an error. Why can’t I just delete the transaction in QuickBooks to fix it?

You should never delete a transaction that has already cleared the bank. Deleting it erases the audit trail and breaks the link between your accounting records and your bank statement, making future bank reconciliations impossible and potentially leading to fraud risks. Always Void a cleared transaction instead. Voiding sets the dollar amount to $0.00 but preserves the transaction history, date, and check number for audit purposes.

When I reconcile, should I classify the bank’s stop payment fee as a general ‘Bank Service Charge’ or create a specific ‘Stop Payment Fee Expense’ account?

While you can use ‘Bank Service Charge,’ creating a specific expense account like ‘Stop Payment Fees & Penalties’ is the best practice for accurate reporting. This allows you to track, analyze, and budget for non-standard, avoidable bank expenses separately from routine fees. Detailed tracking is essential for informed financial oversight and during an audit.

How can I quickly use the QuickBooks Audit Trail to verify that a stop payment was correctly voided and not accidentally deleted?

In QuickBooks Desktop, go to Reports > Accountant & Taxes > Audit Trail. In QuickBooks Online, go to Settings (gear icon) > Audit Log. Search the report using the date or the name of the user who performed the action. A successful Void will show the transaction listed with the status change. Delete will simply show the original entry followed by a Deletion status, which should be flagged for review.

I voided a check and plan to issue a new one. What is the most critical internal control step to ensure I don’t accidentally pay the vendor twice?

The most critical step is to update the original bill/invoice immediately after voiding the first payment. Go back to the original bill and ensure the status is changed back from “Paid” to “Open” or “Unpaid.” If the bill remains marked as paid, your accounting team may overlook it and create a duplicate payment when processing the next batch of invoices.

Can issuing a stop payment on a vendor check lead to a breach of contract or other legal issues for my business?

Yes, it can. If the stop payment is issued without justification (i.e., you stop payment solely due to insufficient funds without immediate remediation, or without a valid dispute), the vendor may view it as a breach of contract or refusal to pay for services rendered. Always document a clear, legally defensible reason (like fraud or major dispute) and notify the vendor in writing immediately to mitigate legal risk.

For a QuickBooks Online user, is it more efficient to use a Journal Entry or simply delete the non-direct deposit payment record?

If the payment has not been sent/cleared by the bank, simply deleting the transaction is the most efficient method, as it removes the record entirely. However, if the payment was sent and the bank stop-payment process has been initiated, use the Journal Entry method to reverse the bank’s assumed withdrawal and keep a clear audit trail of the reversal, even though the original check is now void.

Disclaimer: The information outlined above for “How to Record a Stop Payment in QuickBooks Desktop & Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.