Recording the sale or disposal of a fixed asset within QuickBooks Desktop and Online is a vital financial procedure that ensures the integrity of the balance sheet. The process is systematically completed through five core stages: accurately calculating and posting any remaining depreciation up to the day of sale; recording the sale proceeds via an invoice or sales receipt; formally removing the asset from active records by marking it as inactive; and preparing a final, balancing journal entry to eliminate the asset’s original cost and accumulated depreciation, thereby recognizing the resulting gain or loss. This content provides detailed, expert-level instructions for both QuickBooks platforms, emphasizing that the final journal entry must balance the accounting equation. Furthermore, the material extends beyond basic sales to cover complex transactions, including the proper method for recording trade-in allowances and navigating sales tax obligations, providing comprehensive guidance necessary for accurate financial reporting and compliance.

Highlights (Key Facts & Solutions)

Why is it important to record depreciation while recording asset sales?

Recording of asset sales begins with the calculation of depreciation. So, first, calculate both depreciation and accumulated depreciation and then start with the journal entry.

Depreciation is important to record as it helps businesses determine the current value of an asset after all the wear and tear incurred during the accounting period.

In accounting, it’s crucial to mark the asset as “inactive” when selling it. All these transactions are recorded in a journal entry that includes the record of gain or loss.

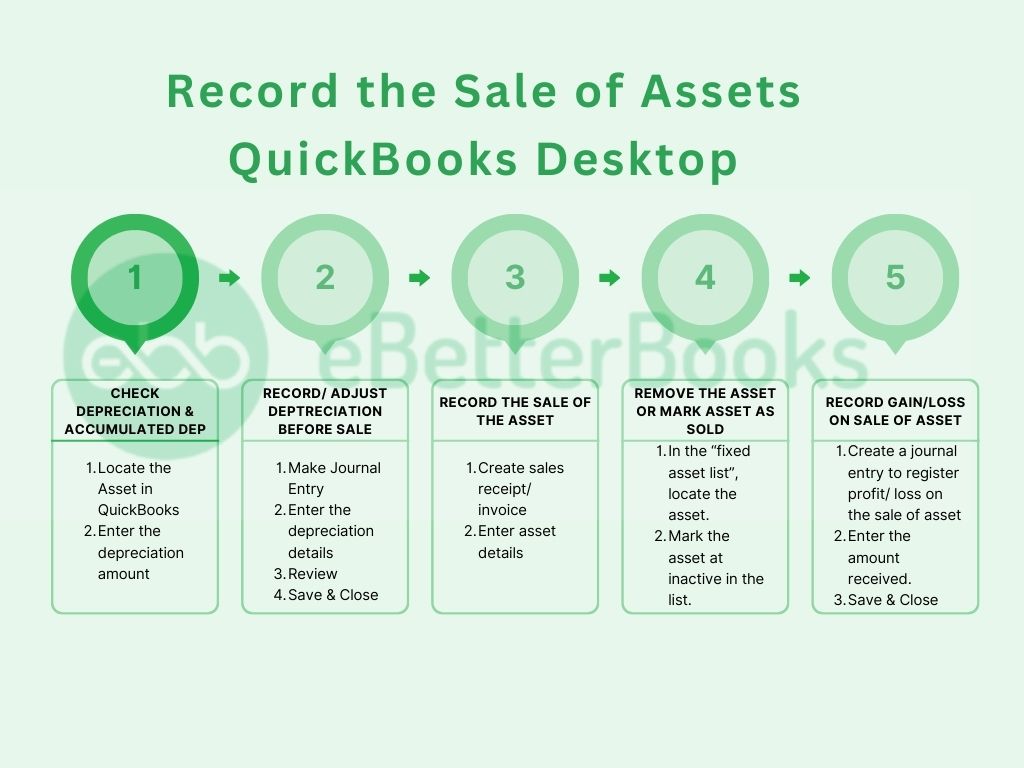

How to record the sale of assets in QuickBooks Desktop?

Part 1: Verify Depreciation and the Accumulated Depreciation

Calculate an asset’s depreciation and accumulated depreciation before selling it. This step is crucial for accurate financial reporting.

- Access the Fixed Asset Item List:

- Click on the Lists menu.

- Select Fixed Asset Item List.

- Locate the asset to be sold from the list.

- Enter Depreciation Amount:

- Double-click on the asset. An “Edit Fixed Asset” window will appear.

- Enter the depreciation and accumulated depreciation amounts.

Part 2: File for a new depreciation for the car before it is sold.

Record depreciation to reflect the asset’s decreasing value over time. Use a journal entry for this purpose.

- Create a Journal Entry:

- Click on the Company menu.

- Select Make General Journal Entries.

- Enter Depreciation Details:

- Set the date of the entry as the day of sale.

- Debit the Depreciation Expense account.

- Credit the Accumulated Depreciation account.

- Enter the unrecorded depreciation amount.

- Review the details and click Save & Close.

Part 3: Record the Sale of the Asset

Properly recording the sale ensures accurate financial records.

- Create a Sales Receipt or Invoice:

- Go to the Customers menu.

- Select Create Sales Receipts or Create Invoices, depending on the sale type.

- Choose the customer purchasing the asset.

- Enter Asset Details:

- In the Item column, select the fixed asset item.

- Enter the sale price in the Amount column.

- Save the sales receipt or invoice.

Part 4: Take the Asset out of the Fixed Asset Ledger

Removing the sold asset from the list ensures accurate asset tracking.

- Locate the Asset:

- Go to the Lists menu.

- Select Fixed Asset Item List.

- Mark the Asset as Inactive:

- Right-click on the sold asset.

- Click on Make Item Inactive.

Part 5: Record the Gain or Loss on the Sale

Recording the gain or loss on the sale of an asset is crucial for facilitating better strategic planning and resource allocation. It is not necessary for the sold asset to be sold at a profit. Sometimes, businesses also sell assets at a loss.

Step 1: Create a Journal Entry for the Gain/Loss

- Click on the Company menu.

- Click on Make General Journal Entries.

Step 2: Enter Gain/Loss Details

Put the Gain/ Loss information. [ It will include the following:

- Date the entry as the day of sale.

- Debit the Accumulated Depreciation account for the total accumulated depreciation of the asset.

- Debit the Cash or Bank account for the sale price received.

- Credit the Fixed Asset account for the original cost of the asset.

Note: If there is a gain on the sale, credit the Gain on Sale of Asset account for the difference. If there is a loss, debit the Loss on Sale of Asset account for the difference.

Step 3: Save and Close

- Review the entry for accuracy.

- Click on Save & Close.

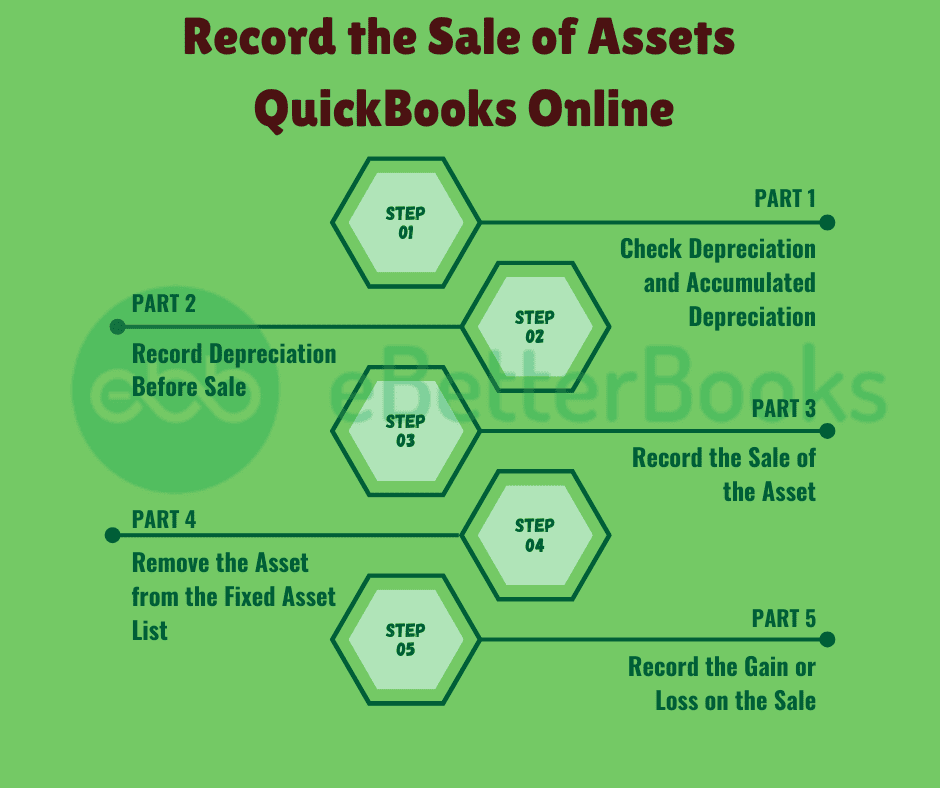

How to record the sale of assets in QuickBooks Online?

Part 1: Verify Depreciation and Accumulated Depreciation

It’s important to calculate depreciation and the accumulated depreciation before being able to sell an asset.

- Access the Chart of Accounts:

- Log in to QuickBooks Online.

- Click on the Accounting tab in the left navigation pane.

- Select Chart of Accounts.

- Review Depreciation Accounts:

- Locate accounts for Depreciation Expenses and Accumulated Depreciation.

Part 2: Record Depreciation Before Sale

Another journal entry was used to note down the asset’s depreciation.

- Create a Journal Entry:

- Click on the + New button.

- Select Journal Entry.

- Enter Depreciation Details:

- Set the date as the day of sale.

- Debit the Depreciation Expense account.

- Credit the Accumulated Depreciation account.

- Enter the unrecorded depreciation amount.

- Review the details and click Save.

Part 3: Record the Sale of the Asset

Ensure the sale is recorded properly in a way that reports on changes in asset value.

- Create a Sales Receipt or Invoice:

- Click on the + New button.

- Select Sales Receipt or Invoice, depending on the sale type.

- Choose the customer purchasing the asset.

- Enter Asset Details:

- In the Product/Service column, select the fixed asset item.

- Enter the sale price.

- Save the sales receipt or invoice.

Part 4: Delete the Asset from the Fixed Asset Register

The disposal of the sold asset helps in avoiding overstatement of assets.

- Find the Asset:

- Navigate to the Gear icon.

- Select Products and Services.

- Mark the Asset as Inactive:

- Locate the sold asset.

- Click on Edit and mark it as inactive.

Part 5: Accumulate the Gain or Loss on the Sale

- Record the financial result of the sale.

- Create a Journal Entry:

- Click on the + New button.

- Select Journal Entry.

- Enter Gain or Loss Details:

- Set the date as the day of sale.

- Debit the Accumulated Depreciation account for the total depreciation.

- Debit the Cash or Bank account for the sale proceeds.

- Credit the Fixed Asset account for the asset’s original cost.

- For a gain, credit the Gain on Sale of Asset account. For a loss, debit the Loss on Sale of Asset account.

- Review the entry and click Save.

Important Tips to Record Sale of Assets in QuickBooks

By properly entering the asset sales in QuickBooks, you will be confident that your financial statements are updated and accurate. Here are some useful tips for recording asset sales:

1. Open a New Account for Sale of Assets

The first step is to create an account in the Chart of Accounts to record revenue from asset sales. Credit transactions in the Fixed Asset account make it easier to categorize particular transactions and thus simplify reporting.

2. Class Tracking is designed to generate detailed reports.

Through QuickBooks’ Class Tracking feature, you can sort your asset sales by various classes, such as departments. This enables you to view sales historically per category or from different perspectives regarding the sale of assets from different subdivisions within the business.

3. Record Depreciation Before Selling an Asset

Make sure you adjust for any amount accumulated from depreciation before selling an asset. Recording depreciation will clarify the financial records and allow you to properly estimate the sale’s effect on the company’s balance sheet.

4. Use “Fixed Asset Item” to sell fixed assets.

QuickBooks has a check called Fixed Asset Item that is suitable for creating and selling fixed assets. This tool assists in controlling the number of ledger entries and adjusting depreciation on the sale to record the correct amount and in compliance with accounting standards.

5. Use the “Other Charge Item” for Recording Property and Vehicle Sales

When dealing with property or even vehicles, you can use the Other Charge Item. This feature enables you to follow through on costs that cannot be grouped under ordinary groups to enhance your financial reports.

6. Open a “Sale of Assets” Account

The company should open a Sale of Assets account to record the money received from sales of its assets separately from other receipts.

It keeps records of expenses and incomes without complications and is useful when preparing specific financial statements on request.

Advanced Scenarios While Recording Asset Sales in QuickBooks

Recording asset sales isn’t always straightforward—especially in real-world cases like partial disposals, trade-ins, or grouped transactions. This section covers advanced subtopics that go beyond the basics, helping you navigate complex sale entries, prevent reporting errors, and maintain clean financials. Mastering these scenarios ensures your QuickBooks data stays accurate, compliant, and audit-ready.

How to Handle Partial Asset Sales in QuickBooks

Selling only a part of an asset? QuickBooks doesn’t allow splitting assets directly, so you need to create 3 key entries. First, allocate the original cost and accumulated depreciation between the sold and retained portions using journal entries. Second, record the sale as usual, but only for the sold portion’s value. Third, adjust the remaining asset value in the Fixed Asset Item List to reflect updated cost and depreciation. This ensures accurate financials, audit clarity, and future depreciation tracking. By separating values precisely, you avoid overstated assets and maintain real-time reporting integrity. Always review your gain/loss entries carefully.

Recording Trade-In Transactions Involving Fixed Assets

When trading in an old asset for a new one, you must record 3 separate values in QuickBooks. First, determine the book value of the traded asset (original cost minus accumulated depreciation). Second, create a journal entry to remove the traded asset and record any gain or loss. Third, record the purchase of the new asset, subtracting the trade-in allowance from the total cost. This method keeps balance sheets accurate, depreciation aligned, and tax reporting clean. Never skip tracking trade-in discounts—they impact your asset base, financial statements, and depreciation calculations going forward.

Accounting for Sales Tax on Asset Disposals

When selling an asset with sales tax, you must track 3 separate components: the sale price, sales tax collected, and gain or loss. Start by enabling sales tax in QuickBooks, then use Sales Receipt or Invoice to record the sale, applying the correct tax rate. Second, post the tax portion to your Sales Tax Payable account. Third, ensure your journal entry reflects only the asset’s net book value versus sale proceeds to capture the true gain/loss. This process ensures tax compliance, clean financial reporting, and accurate liability tracking—especially crucial during audits or tax season.

Managing Sale of Grouped Assets or Bulk Asset Transfers

Selling multiple assets as a group? You need to perform 3 organized steps in QuickBooks. First, break down each asset’s original cost and accumulated depreciation individually, even if sold together. Second, record a separate line for each asset in your journal entry or sales form to ensure transparency. Third, allocate the total sale amount proportionally across the assets to compute accurate gains or losses. This method supports clean reporting, easier audits, and precise depreciation history. Never lump grouped sales into one entry—doing so hides critical data and leads to misstatements in your financials.

How to Reverse an Incorrectly Recorded Asset Sale in QuickBooks

Made a mistake while recording an asset sale? QuickBooks allows you to reverse it with 3 corrective actions. First, locate and delete the incorrect journal entry or sales form linked to the sale. Second, restore the fixed asset’s value by manually re-entering original cost and accumulated depreciation in the Fixed Asset Item List. Third, re-record the correct sale details using accurate depreciation, sale amount, and gain/loss entries. This ensures error-free books, clean audit trails, and compliance with accounting standards. Avoid partial edits—always perform a full reversal to maintain transaction integrity.

Supplementary Insights for Smarter Asset Sale Management in QuickBooks

Beyond basic entries, effective asset sale recording in QuickBooks requires strategic awareness. This section offers practical guidance, advanced tools, and common pitfalls to help you manage fixed assets with confidence. By applying these insights, you ensure accuracy, compliance, and financial clarity—even in complex or high-volume scenarios.

Difference Between Fixed Asset Disposal and Write-Off in QuickBooks

Disposal and write-off may seem similar but involve 3 key differences in QuickBooks. Disposal means selling, trading, or retiring an asset, where value exchange occurs, and a gain or loss is recorded. Write-off, on the other hand, applies when an asset is damaged, obsolete, or stolen, with no sale involved—only a loss is recorded. In disposal, you adjust both the Fixed Asset and Accumulated Depreciation accounts. In a write-off, you bypass income accounts and directly debit Loss on Asset Write-Off. Understanding this ensures accurate entries, prevents tax issues, and maintains balance sheet integrity.

Integrating Asset Sale Entries with QuickBooks Reports and Dashboards

To reflect asset sales in reports, follow 3 integration steps in QuickBooks. First, tag every journal entry or invoice with relevant classes, locations, or custom fields for traceability. Second, use pre-built reports like “Profit and Loss” and “Fixed Asset Listing” to track gains, losses, and book value changes. Third, customize your dashboard using filters to show asset disposal trends, depreciation impact, and cash inflows. This integration boosts financial visibility, executive insights, and faster decision-making. Always refresh your reports after entries—real-time syncing ensures you’re not relying on outdated numbers.

Best Practices for Auditing Asset Sales at Year-End

Auditing asset sales? Stick to 3 core practices for a smooth year-end close. First, reconcile all asset sale entries with supporting documents—sales receipts, depreciation schedules, and journal entries. Second, ensure each sale has a matching gain/loss entry and updated Fixed Asset List. Third, compare balance sheet changes against prior periods to flag discrepancies. These steps offer clean audit trails, reduce compliance risks, and ensure accurate tax filings. Don’t forget to lock your books post-review—this prevents future edits and preserves data integrity during audits.

How to Use QuickBooks with Third-Party Fixed Asset Management Tools

Need advanced control over fixed assets? Combine QuickBooks with third-party tools using these 3 integration steps. First, sync asset data using export/import features or direct app integrations like Asset Panda, Sage Fixed Assets, or NetSuite. Second, manage depreciation schedules, asset locations, and warranty info outside QuickBooks for deeper visibility. Third, post summarized entries back into QuickBooks to maintain concise ledgers while preserving detailed tracking elsewhere. This method ensures scalable asset tracking, enhanced reporting accuracy, and audit compliance. Always validate sync settings—one mismatch can distort both depreciation and disposal entries.

Common Mistakes to Avoid When Recording Asset Sales in QuickBooks

Avoiding errors in asset sale entries? Watch out for these 3 common mistakes. First, never skip recording accumulated depreciation—it distorts gain/loss calculations. Second, don’t record the full asset value as income; always offset it with depreciation and book value adjustments. Third, avoid forgetting to mark the asset as inactive after sale—this causes asset overstatements. These oversights lead to misleading financials, tax issues, and failed audits. Always double-check journal entries, run post-sale reports, and consult depreciation schedules before finalizing transactions.

Conclusion

One of the most important steps in keeping correct financial records is entering the sale of an asset into QuickBooks. Ensure that QuickBooks has all information accurately entered, including the sale price, any accrued depreciation, and the asset’s disposal. A journal entry must be made to remove the asset from the balance sheet and record any profit or loss from the sale.

By taking these actions, you can make sure your records are current and adhere to accounting rules while appropriately reflecting the effect of the asset sale on your financial statements.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “How to Record Sale of Assets in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.