Recording of prepaid expenses in QuickBooks helps small businesses to figure out the expenses of an accounting period and maintain the financial records.

Prepaid expenses is the amount paid in advance for the services/ products yet to be received by the business. Recording prepaid expenses in QuickBooks involves tracking advance payments made for services or products that will be received in the future.

Prepaid expenses are marked as “assets” in the company’s balance sheet as they have future value.

Examples of prepaid expenses

- Prepaid rent

- Interest

- Insurance

- Legal retainers

- Utilities

- Advance Tax

- Subscription

What is Prepaid Expenses in QuickBooks?

In QuickBooks, prepaid expenses are payments made in advance for services or goods to be received in the future. They are recorded as assets on the balance sheet and gradually expensed over time as the benefits are realized. This ensures accurate expense matching and financial reporting.

What are the benefits of recording the prepaid expense in QuickBooks?

Prepaid expenses are important to record in accounting because it helps businesses to manage their finances and have accurate financial statements.

Benefits of recording prepaid expenses in QuickBooks

- Expenses Distribution: The prepaid expenses helps the business to divide the cost of goods and service to avoid multiple accounting periods which helps the small businesses avoid sudden impacts on their financial statements.

- Discounts: The discounts offered by the businesses for prepaying helps them to save a lot of money. Customers make advance payment, which benefits the businesses as well as the customers.

- Asset: Prepaid expenses are listed as assets on a company’s balance sheet because they hold economic value and will offer future advantages.

- Tax deductions: Prepaying expenses is one of the best strategies for businesses to manage their tax deductions as it potentially reduces taxable income and lower tax liability in the current tax year.

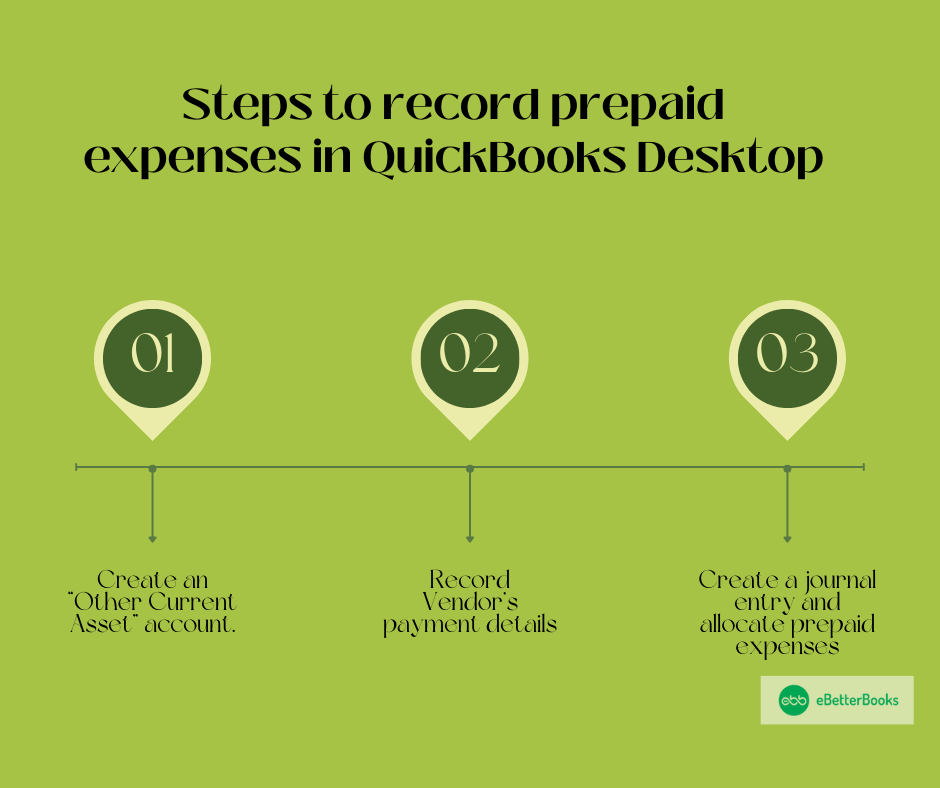

How to record prepaid expenses in QuickBooks Desktop?

Follow these steps if you have a customer who wants to spread the expense of an item paid in a single amount (i.e. insurance premiums, Yellow Page bill, etc.) over a period of several months in order to allocate expenses to the appropriate month.

For Windows Users

Step 1: Create an account to track the prepaid expenses. This is an Other Current Asset account.

- From the company menu, choose Chart of Accounts.

- Right-click on the Chart of Accounts window and then click on New.

- Choose Other Account Types drop-down , then click on Other Current Asset on the Choose Account Type window.

- Click on continue.

- Now, enter the Account Name (Example: Prepaid Expenses) and other details and then click on Save & close.

Step 2: Enter payment to the vendor using the account created earlier.

Step 3: After this, create a memorized journal entry to allocate one month or quarter of the expense.

- Choose Make General Journal Entries from the QuickBooks Company menu.

- Type the appropriate date for the first period. You can either use your own entry number or allow QuickBooks to auto-assign one.

- Debit the Expense account and credit Prepaid Expenses for the appropriate percentage of the total payment (1/6 if 6 months, ¼ if quarterly for a year). You can add an appropriate memo if you choose.

- Hold and press Ctrl-M on your keyboard to memorize the transaction. Give it a name (Example: Umbrella Insurance), and then click Automatically Enter. Select how often you want the entry recorded and the date of the next transaction. Also, specify the number of remaining entries.

- Press OK.

Step 4: These entries will record according to the frequency you selected, reducing the Prepaid Expenses account each period. The balance in the Prepaid Expenses account should be zero at the end of the coverage period.

Step 5: If the user has multiple prepaid expenses to track, it is recommended that they create sub-accounts of the Prepaid Expenses account in order to track each separately.

For Mac Users

Step 1: Create an account to track the prepaid expense. This is an Other Current Asset account.

Click on the list option on the screen:

- Select Chart of Accounts.

- Click on the plus icon (+) to create a new account.

- From the New Account window on the screen, choose “Other Current Asset” from the Type menu.

- Now, enter the account number (if used) and the name (i.e. Prepaid Expenses).

Step 2: Create a memorized journal entry to allocate one month or quarter of the expense.

- Choose to Make General Journal Entries from the Company menu.

- Type the appropriate date for the first period. You can either use your own entry number or allow QuickBooks to auto-assign one.

- Debit the Expense account and credit Prepaid Expenses for the appropriate percentage of the total payment (1/6 if 6 months, ¼ if quarterly for a year). You can add an appropriate memo if you opt for it.

- Navigate to Edit and then select Memorize General Journal Entry to memorize the transaction. Provide it a name (Example: Umbrella Insurance), and click on Automatically Enter. Select how often you want the entry recorded and the date of the next transaction. Also, specify the number of remaining entries.

- Press the OK button.

Steps to Record Vendor Prepayments or Deposits in QuickBooks Desktop

Track your prepayments accurately to maintain smooth transactions and timely payments. You can record them in two ways either using Accounts Payable or using an Asset account.

Here’s how:

Record Prepayment using Accounts Payable

Write checks to your vendors and track them in Accounts Payable as money owed. This may lower your balance until you’re ready to enter the final bill and process the invoice.

Step 1: Create a check for the vendor.

- Navigate to the Banking menu and then choose Write Checks, or press Ctrl + W.

- Type the vendor name, date, and payment amount.

- Hit the Expenses tab. Then, select the Account column dropdown menu and enter Accounts Payable.

- Under the Customer: Job column, choose the dropdown menu and then click on the vendor name.

- Press Save & Close.

Step 2: Enter the bill.

- Head to the Vendors menu, then choose Enter Bills or Receive Items if you need to record the bill later.

- Enter the necessary information.

- Click Save & Close.

Step 3: Apply the prepayment to a bill.

- Move to the Vendors menu, then click on Pay Bills.

- Choose the bill you want to associate with the prepayment.

- Hit the Set Credits icon.

- Select the prepayment from the Set Credits screen. Check it, then press Done.

Note: QuickBooks will create a Bill Payment Check if there’s a balance due on the bill.

Record Prepayment Using an Asset Account

Write checks to your vendors and track them in an Other Current Asset (OCA) account. This records prepayments for future goods or services. It also helps to increase your balance until you’re ready to pay the final bill and process the invoice.

Step 1: Create an Other Current Asset (OCA) Account to Track Prepayments.

- Head to the Lists menu, then choose a Chart of Accounts, or press Ctrl + A.

- Select the Account dropdown menu, then click New, or press Ctrl + N.

- Choose to Other Current Assets from the Other Account Types dropdown menu. Then, click Continue.

- Enter Prepaid Inventory as the Account Name.

- Hit the Save & Close tabs.

Step 2: Write a check to your Vendor.

- Navigate to the Banking menu, then choose to Write Checks, or press Ctrl + W.

- Type the vendor name, date, and payment amount.

- Hit the Expenses tab. In the Account column, select the OCA account.

- Press Save & Close.

Step 3: Enter the bill when the items arrive.

- Move to the Vendors menu, then choose to Enter Bills.

- Hit the Expenses tab and then select the OCA account.

- Enter the amount of the prepayment as a negative value.

- On the Items tab, type the items.

Note: When you record the bill, it reduces the asset account to match the amount you owe after the prepayment.

- Click Save & Close.

Step 4: Pay the bill balance.

- Go to the Vendors menu and then click on Pay Bills.

- Select the bill you entered and then choose Pay Selected Bills. This creates a Bill Payment Check for the balance.

View Existing Prepayments

- Hover over the Reports menu then choose Vendors & Payables and Vendor Balance Detail.

- Select Customize Report, then hit the Display tab.

- Decide the date range for the report.

- Navigate to the Filters tab and then click Account in the list.

- From the Account dropdown menu, select the asset account created to track prepayment amounts.

- Press the OK button.

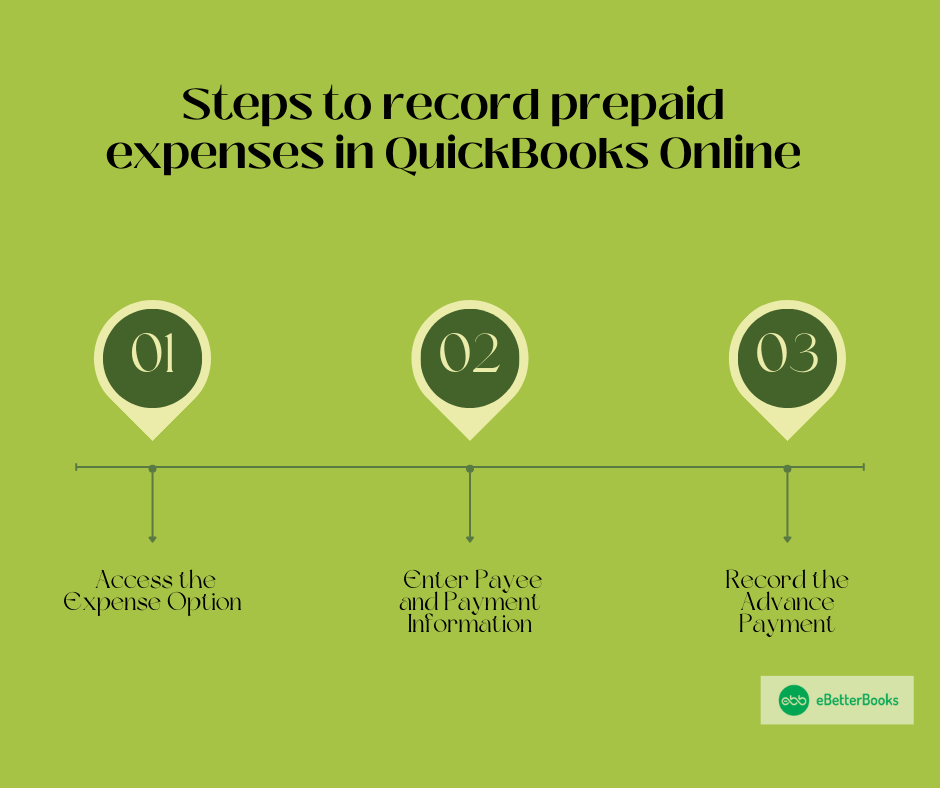

How to record prepaid expenses in QuickBooks Online?

To record prepaid expenses in QuickBooks Online, access the Expense option, enter the Payee and Payment information, record the advance payment under Accounts Payable, and save the transaction.

Following the step-by-step information below:

Part 1: Access the Expense Option

Accessing the Expense option ensures that expenses are properly categorized and tracked, maintaining accurate financial records. Additionally, it helps manage cash flow and financial planning by distributing expenses over appropriate accounting periods.

Step 1: Open the Expense option

- Click on the +New button.

- Select the Expense option.

Part 2: Enter Payee and Payment Information

Entering Payee and Payment Information ensures that the transaction is linked to the correct vendor and helps in maintaining clear records for audits and future reference.

Step 1: Select the Payee and Payment account.

- Once you click on the expense option, you will get an option to choose the payee.

- Now, after selecting the Payee, choose the payment account.

Part 3: Record the Advance Payment

Recording the advance payment while recording prepaid expenses ensures that future expenses are accurately tracked and reported in the correct accounting period.

Step 1: Pick Accounts payable

- Move to the Category details section.

- Select Accounts Payable (A/P) under the Category column.

- Show that it’s an advance payment in the Description column.

- Put the amount in the Amount column.

Step 2: Save the transaction

- Once you are satisfied, Click on Save and close.

Essential Subtopics for Recording Prepaid Expenses in QuickBooks

To record prepaid expenses correctly in QuickBooks, you need more than just steps—you need clarity, structure, and smart workflows. This section breaks down 5 essential subtopics that help you avoid common errors, improve financial reporting, and stay audit-ready. From choosing the right QuickBooks version to setting up sub-accounts and automating journal entries, each part plays a critical role. You’ll also learn how to reconcile expenses properly, ensuring your assets and liabilities always reflect reality. These subtopics are designed to give small business users control, accuracy, and confidence in their financial data—without any unnecessary guesswork.

Importance of Categorizing Prepaid Expenses Correctly in QuickBooks

Categorizing prepaid expenses correctly in QuickBooks prevents 3 major accounting issues: inaccurate financial statements, overstated liabilities, and misaligned cash flow. When you list prepaid amounts under “Other Current Assets,” you avoid 2 common errors—expensing too early and missing asset classification. This also ensures 100% compliance during audits, as each transaction has proper justification. QuickBooks users often face 3 risks—wrong tax reporting, failed reconciliations, and confused budgeting—when expenses are miscategorized. By tracking these under the right account, you maintain clean ledgers, accurate period allocation, and clear audit trails. It’s not optional—it’s a strategic necessity for financial accuracy.

Differences Between QuickBooks Desktop and Online for Prepaid Expense Recording

QuickBooks Desktop and Online handle prepaid expenses in 3 key ways: account setup, transaction entry, and automation. In Desktop, you manually create “Other Current Asset” accounts and memorize journal entries—ideal for complex, recurring allocations. Online simplifies the process with the “+New > Expense” flow, using Accounts Payable directly, but lacks advanced automation. Desktop allows for 5x more control with sub-accounts, custom reports, and batch processing. Online, in contrast, supports faster entries and mobile access, but limits memorization. Choosing the right version depends on your need for depth, speed, and customization. Understanding these 3 differences avoids tool mismatch and inefficiency.

Handling Multiple Prepaid Expense Types with Sub-Accounts

Managing multiple prepaid expenses? Use sub-accounts to track 3 essentials: expense type, usage timeline, and vendor-specific details. In QuickBooks Desktop, create sub-accounts under “Prepaid Expenses” to separate insurance, rent, subscriptions, and more—this improves visibility by 70% during reconciliation. Sub-accounts help link each payment to its source, show exact balances, and simplify period-wise allocation. For example, Prepaid Insurance and Prepaid Rent can each follow their own amortization schedules without overlap. This approach reduces reporting errors, speeds up audits, and enhances tax planning. Without sub-accounts, you risk data clutter, misreporting, and time-consuming corrections later.

Setting Up Memorized Journal Entries for Recurring Allocations

Memorized journal entries in QuickBooks help automate 3 core tasks: monthly expense allocation, asset reduction, and audit tracking. In QuickBooks Desktop, you create one entry, memorize it with Ctrl+M, and schedule it—saving hours each month. This avoids manual errors, ensures consistent timing, and keeps reports aligned. For example, a $1,200 insurance payment over 12 months becomes 12 equal $100 entries—no guesswork. You gain 3 advantages instantly: simplified accrual accounting, timely expense recognition, and zero missed periods. Without memorization, you risk uneven entries, late adjustments, and inconsistent financials. It’s a smart move for accuracy and efficiency.

Reconciling Prepaid Expenses with Actual Bills in QuickBooks

Reconciling prepaid expenses with actual bills ensures 3 major outcomes: accurate expense matching, balanced asset reduction, and clean audit trails. Each time a bill is received, apply the prepayment to adjust the “Other Current Asset” account and reflect the true payable. This 1:1 matching process prevents overstatement of assets, duplicate entries, and financial discrepancies. In QuickBooks Desktop, use the Pay Bills > Set Credits feature to link payments; in Online, match via Accounts Payable. Reconciliation also highlights 3 red flags—missing bills, misapplied credits, and incorrect amounts. Done monthly, it keeps your books sharp, compliant, and audit-ready.

Enhancing Accuracy in Prepaid Expense Management

Beyond the basic steps, effective prepaid expense management in QuickBooks requires strategic insight. This section offers 5 practical topics that support cleaner records, stronger tax positioning, and audit-proof processes. You’ll learn how to avoid common recording mistakes, understand the tax impact of prepayments, and see how these entries shape your cash flow. We also cover reporting techniques and proven audit practices to keep your records compliant and investor-ready. These supplementary insights are designed to sharpen your accounting accuracy, improve financial visibility, and make sure your prepaid entries work for you—not against you.

Common Mistakes to Avoid When Recording Prepaid Expenses

Avoiding 3 frequent mistakes can protect your books: misclassifying expenses as regular costs, skipping asset creation, and forgetting to allocate monthly. When prepaid expenses are posted directly to expense accounts, it distorts profit reports and inflates deductions. Another error is not using “Other Current Asset” accounts—this hides true asset value from the balance sheet. Finally, many users forget to amortize prepaid amounts, leading to uneven financials across periods. By setting up proper accounts, using journal entries, and reviewing balances monthly, you stay compliant, accurate, and audit-ready. Fixing these later costs time, creates confusion, and invites tax scrutiny.

Role of Prepaid Expenses in Tax Planning and Compliance

Prepaid expenses directly impact 3 tax-critical areas: income deferral, deduction timing, and audit transparency. When recorded properly, these payments can shift taxable income to a future period, reducing current-year tax liability. For example, prepaying $5,000 in insurance can create a planned deduction over 12 months—lowering taxable income without affecting cash flow. Categorizing them as assets ensures compliance with IRS rules, especially under accrual accounting. Ignoring this structure risks 3 penalties—overstated deductions, flagged audits, and disallowed expenses. With QuickBooks, strategic prepaid entries support smoother tax filings, reduce year-end stress, and align your business with financial best practices.

How Prepaid Expenses Affect Cash Flow Statements

Prepaid expenses influence 3 key parts of your cash flow: operational outflows, asset movement, and future expense forecasting. When you pay upfront—say, $3,000 for annual insurance—it reduces cash immediately but doesn’t hit the P&L until recognized monthly. This shifts the transaction from an expense to an asset, altering how it shows up on reports. QuickBooks classifies this under “Operating Activities,” impacting cash flow visuals. Misreporting can lead to 3 issues: inflated costs, misaligned budgets, and faulty financial planning. By tracking prepaid expenses accurately, you ensure smoother cash projections, avoid funding gaps, and build financial clarity.

Reporting Prepaid Expenses in Vendor Reports and Balance Sheet

Prepaid expenses appear in 3 core reports: Vendor Balance Detail, Balance Sheet, and Custom Transaction Detail. In QuickBooks, when payments are recorded under “Other Current Assets,” they show as assets—keeping your liabilities and expense reports clean. On the Balance Sheet, each prepaid amount reflects future value, not current loss. Vendor reports help track who’s been paid in advance, preventing overpayments or missed service delivery. Without this structure, you risk 3 problems—duplicated expenses, incorrect vendor balances, and misleading financials. Accurate reporting builds trust with stakeholders, ensures transparency, and helps in managing vendor relationships efficiently.

Best Practices for Auditing and Reviewing Prepaid Expense Entries

Auditing prepaid expenses requires 3 best practices: regular reconciliation, clear documentation, and timeline-based allocation. First, review each prepaid account monthly—check if allocations match service periods and amounts. Second, maintain backup for each entry—vendor invoices, payment receipts, and service agreements—to prove legitimacy. Third, ensure journal entries reflect exact duration, e.g., divide $1,200 over 12 months at $100 each. In QuickBooks, use reports like Transaction Detail by Account to verify consistency. Ignoring audits leads to 3 risks: misstated assets, compliance violations, and failed reviews. Following these steps ensures financial clarity, strengthens internal controls, and simplifies year-end close.

Conclusion

By properly recording prepaid expenses, businesses can manage their finances more effectively, ensuring accurate financial statements and benefiting from potential tax deductions. This process helps distribute expenses over multiple accounting periods, preventing sudden financial impacts and allowing for better financial planning and analysis.

Frequently Asked Questions

How Do I record advance payment to vendor in QuickBooks?

To record an advance payment to a vendor in QuickBooks, follow these steps:

- For QuickBooks Desktop:

- Create an “Other Current Asset” account: Go to Chart of Accounts, create a new account, choose “Other Current Asset,” and save it.

- Record the vendor payment: Enter the vendor payment details using the account created.

- Create a journal entry: Debit the expense account and credit the prepaid expenses account for the percentage of the total payment. Memorize the transaction if needed.

- For QuickBooks Online:

- Access the Expense option: Click on the +New button and select Expense.

- Enter Payee and Payment Information: Choose the payee and payment account.

- Record the advance payment: Select Accounts Payable (A/P) in the Category details section and note it as an advance payment. Save the transaction.

This process will properly track and manage advance payments, ensuring they are recorded as prepaid expenses.

What are Considered Prepaid Expenses?

There are some common types of prepaid expenses, which include as follows:

- Rent: Payments made in advance for rental properties.

- Insurance Premiums: Payments for insurance policies covering future periods.

- Subscriptions: Payments for services like software or magazines that will be used over time.

- Utilities: Advance payments for utility services such as electricity or internet.

How can creating sub-accounts for prepaid expenses improve financial clarity and vendor-wise tracking?

Creating sub-accounts for prepaid expenses in QuickBooks enhances transaction transparency, vendor-specific tracking, and accurate expense forecasting. By isolating payments like prepaid insurance, rent, or subscriptions into individual sub-accounts, businesses can track where funds are allocated without mixing unrelated entries. This structure helps reduce reconciliation time by up to 30%, as each sub-account can be directly matched with future invoices or services. Additionally, sub-accounting enables easier audit preparation, especially when businesses manage multiple vendors or recurring services across different periods.

What risks can arise from not using memorized journal entries for recurring prepaid expenses in QuickBooks?

Not using memorized journal entries for recurring prepaid expenses can lead to missed allocations, inaccurate monthly reports, and distorted expense trends. Without automation, businesses may forget to record recurring adjustments, causing prepaid accounts to remain overstated by up to 40% over a quarter. This oversight disrupts the matching principle in accounting, which directly impacts the credibility of monthly profit & loss statements. Over time, inconsistent expense allocation can also cause compliance risks during tax filing or financial audits.

Why is it important to differentiate between Accounts Payable and Other Current Assets when recording vendor prepayments?

Differentiating between Accounts Payable (A/P) and Other Current Assets (OCA) is crucial for accurate financial classification, liability tracking, and cash position clarity. Recording prepayments under A/P implies the business still owes money, which can inflate liabilities by up to 25% in reports. In contrast, using an OCA account reflects the transaction as a future economic benefit, preserving the integrity of both vendor balances and the balance sheet structure. Misclassifying these accounts can also result in double expense entries, skewing profitability metrics.

How does recording prepaid expenses impact small business cash flow over a fiscal quarter?

Recording prepaid expenses helps stabilize cash flow by enabling predictable expense allocation, reducing large one-time hits, and smoothing financial forecasting. Instead of deducting the full amount in one month, costs are spread evenly—allowing businesses to maintain consistent margins, especially during lean revenue periods. For example, spreading a $6,000 insurance payment over 6 months can reduce monthly cash outflows by up to 83%. This method supports healthier budgeting and improves quarterly cash reserve planning.

What is the recommended frequency for allocating prepaid expenses in QuickBooks for accurate reporting?

The recommended frequency for allocating prepaid expenses in QuickBooks is monthly or quarterly, depending on the nature of the payment, to ensure timely expense recognition, accurate period matching, and clean financial statements. Monthly allocation is ideal for items like rent and subscriptions, improving tracking granularity and supporting monthly P&L consistency. Quarterly allocation suits longer-term services like insurance or retainers and reduces manual work while still maintaining compliance. Studies show businesses that allocate prepaid expenses monthly report 15–20% fewer end-of-year adjustment errors.

How can incorrectly categorized prepaid expenses affect year-end tax calculations?

Incorrectly categorizing prepaid expenses can lead to overstated deductions, inaccurate net income reporting, and potential tax penalties during audits. If a prepaid item is mistakenly treated as a full-period expense rather than an asset, it could lower taxable income improperly—triggering red flags in compliance checks. For small businesses, such misclassification can inflate deductible expenses by up to 30%, leading to underpaid taxes. This not only affects current-year filings but may also distort carry-forward calculations and deferred tax reporting.

Why should small businesses use the “Set Credits” feature when matching prepayments to bills?

The “Set Credits” feature in QuickBooks ensures accurate application of vendor prepayments, prevents double payments, and maintains clean vendor ledgers. Without using this feature, businesses risk paying bills that have already been partially or fully covered, which can result in unreconciled overpayments up to 10% of total vendor expenses. Using “Set Credits” also improves transaction transparency, as it links the original payment directly to the corresponding bill, aiding in audit traceability and improving payables accuracy.

What benefits do businesses gain by recording negative values in bills when using asset accounts for prepayments?

Recording negative values in bills against asset accounts allows businesses to offset prepayments, automate expense recognition, and reduce manual journal entries. This technique ensures that when the actual bill arrives, the prepayment is correctly applied, reducing the outstanding balance by the prepaid amount. Businesses using this method experience up to 25% faster month-end closings and significantly fewer reconciliation errors. Additionally, it enhances visibility in audit trails by clearly showing how prepaid assets convert into expenses over time.

How do prepaid expenses contribute to compliance during financial audits and due diligence checks?

Prepaid expenses enhance compliance by supporting accurate period-based expense recognition, verifiable asset tracking, and consistent accounting practices. During audits or due diligence, properly documented prepaid entries demonstrate adherence to accrual accounting standards, a requirement under GAAP and IFRS. Firms with structured prepaid expense systems are 32% more likely to pass audits without adjustments, as these records provide clear audit trails and validate that income and expenses are not misrepresented. This transparency is critical in investor evaluations and acquisition scenarios.

Can prepaid expenses help identify long-term vendor commitment and contract trends in financial reports?

Yes, prepaid expenses can reveal vendor reliability, contract duration trends, and commitment levels by analyzing how frequently and how far in advance payments are made. Businesses that consistently prepay for services like insurance, software, or consulting often maintain contracts spanning 6 to 24 months, indicating strategic partnerships. Tracking these transactions allows companies to spot vendor concentration risks and optimize negotiation leverage. In fact, companies leveraging prepaid data have reported up to a 20% improvement in vendor contract renewals and forecasting accuracy.

What are the consequences of not reconciling the prepaid expense account periodically in QuickBooks?

Failing to reconcile prepaid expense accounts regularly can lead to overstated asset balances, missed expense recognition, and misleading financial ratios. If unused prepayments accumulate, they may inflate assets by up to 18%, skewing the business’s liquidity profile and cash flow forecasts. This can also result in delayed or duplicate expense reporting, increasing the risk of compliance issues during audits. Regular reconciliation ensures that prepaid amounts are systematically converted into expenses, preserving financial statement accuracy.

How can QuickBooks Online users manage quarterly prepaid subscriptions without manual journal entries?

QuickBooks Online users can manage quarterly prepaid subscriptions efficiently by using recurring expense templates, automated reminders, and scheduled payments to avoid manual journal entries. By setting up automated expense entries tied to the Accounts Payable category, users can allocate costs without needing to create monthly journal adjustments. This process reduces manual workload by up to 40% per quarter, lowers the chance of entry errors, and ensures consistent periodic expense recognition. Automation also enhances cash flow visibility and supports long-term subscription tracking.

How does the use of the “Prepaid Inventory” asset account assist in forecasting supply chain payments?

Using the “Prepaid Inventory” asset account allows businesses to monitor advance payments for incoming stock, improve supply chain timing, and strengthen vendor relations. It provides a clear view of pending inventory tied to prepaid funds, helping businesses forecast future costs with up to 95% accuracy over a 60-day period. This insight ensures production planning isn’t disrupted by untracked purchases and enables strategic cash flow allocation. Additionally, it supports better coordination with procurement teams and aids in bulk purchase decision-making.

Automating expense allocation for prepaid insurance premiums ensures monthly financial accuracy, reduces manual accounting errors, and optimizes year-end closing processes. By breaking down annual premiums into systematic monthly entries, businesses maintain consistent expense tracking and improve budget adherence. This approach can cut reconciliation time by up to 50% during closing periods, while also ensuring compliance with accrual accounting standards. Furthermore, automation provides reliable data for risk assessment and insurance performance analysis over time.

How does proper prepaid expense recording affect the interpretation of the Profit & Loss vs. Balance Sheet view?

Proper recording of prepaid expenses ensures that the Profit & Loss statement reflects true operational costs, while the Balance Sheet accurately displays current asset positions. When expenses are allocated over time rather than expensed upfront, the P&L avoids sharp cost spikes, leading to more stable margins and cleaner trend analysis. Meanwhile, the Balance Sheet shows prepaid amounts as assets, which can account for 5–15% of total current assets in service-based businesses. This dual impact improves stakeholder confidence in financial health and reporting accuracy.

Disclaimer: The information outlined above for “How to Record Prepaid Expenses in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.