Accurately recording Paycheck Protection Program (PPP) loan forgiveness is a critical compliance task for small businesses using QuickBooks Desktop or Online, requiring strict adherence to accounting principles and government mandates. The core process involves performing a journal entry to debit the PPP Loan Payable liability account and credit a dedicated, non-taxable income account—a step essential for accurate financial reporting and audit readiness. Expert guidance confirms that the forgiven amount is federally non-taxable income, and related expenses remain deductible, as mandated by the Consolidated Appropriations Act, 2021. However, state tax implications vary and require local professional consultation. To maintain high financial trustworthiness, businesses must retain crucial supporting documents, including the official SBA forgiveness letter and detailed payroll records, while correctly reclassifying any unforgiven loan balances as standard debt on their balance sheet.

Highlights (Key Facts & Solutions)

The following are the most crucial facts and direct solutions for recording PPP loan forgiveness, based on confirmed compliance standards:

- Core Accounting Journal Entry: The fundamental solution requires a Debit to the PPP Loan Payable (Liability) account and an equal Credit to a dedicated “Other Income—PPP Forgiveness” account (Income Statement) upon receiving the official forgiveness notice.

- Initial Classification: PPP funds must first be set up as a Long-Term Liability in QuickBooks, as forgiveness is conditional and the debt is legally on the books until formally extinguished by the SBA.

- Federal Tax Treatment: The forgiven loan amount is excluded from gross income (non-taxable), and the business expenses paid with those funds are fully deductible, as clarified by IRS Revenue Ruling 2021-2.

- Partial Forgiveness Handling: If the loan is only partially forgiven, the remaining unforgiven portion must be reclassified from Long-Term Liability to Current Liability (for the amount due within 12 months) and treated as standard debt.

- Impact on Equity: The recognized forgiveness income flows through the Income Statement’s Net Income and ultimately increases the value of Retained Earnings on the Balance Sheet.

- Audit-Ready Documentation: Crucial third-party documents that must be retained include the Official SBA Forgiveness Letter, detailed IRS Form 941 payroll filings, and supporting invoices for non-payroll eligible expenses (rent, utilities).

- State Tax Caution: While federal treatment is clear, state tax implications vary; some states may not fully conform to the federal tax exclusion and require professional tax advice.

What Is PPP Loan Forgiveness?

PPP loan forgiveness is the process by which a borrower can be relieved of the commitment to repay all or part of the principal and interest on a Paycheck Protection Program (PPP) loan.

It is one of the most important components of the PPP program, entitling businesses to obtain a financial bailout during crises. In return, borrowers should follow set rules, such as the number of employees and their wages during the period of coverage, to qualify for loan forgiveness.

Documents required in the loan forgiveness process include proof of the proper use of funds, such as payroll, lease agreements, and utility bills. Satisfying these conditions is crucial for companies that want to obtain full or partial loan cancellation of PPP.

Why Is It Important to Record PPP Loan Forgiveness in QuickBooks?

The process of recording PPP loan forgiveness in QuickBooks is significant for reporting and accounting since appropriate records affect the business’s financial statements and are in compliance with the established guidelines.

This documentation not only assists with financial disclosure but is also useful for complying with the set rules and regulations. The ability to accurately record PPP loan forgiveness in QuickBooks enables businesses to show the relevant authorities that they followed the policy, and the General ledger reflects the true financial status of the company.

It also helps businesses monitor the use of the forgiven funds, and the report presented can show the proper trail, which is important for record keeping.

How to Record PPP Loan Forgiveness in QuickBooks Desktop?

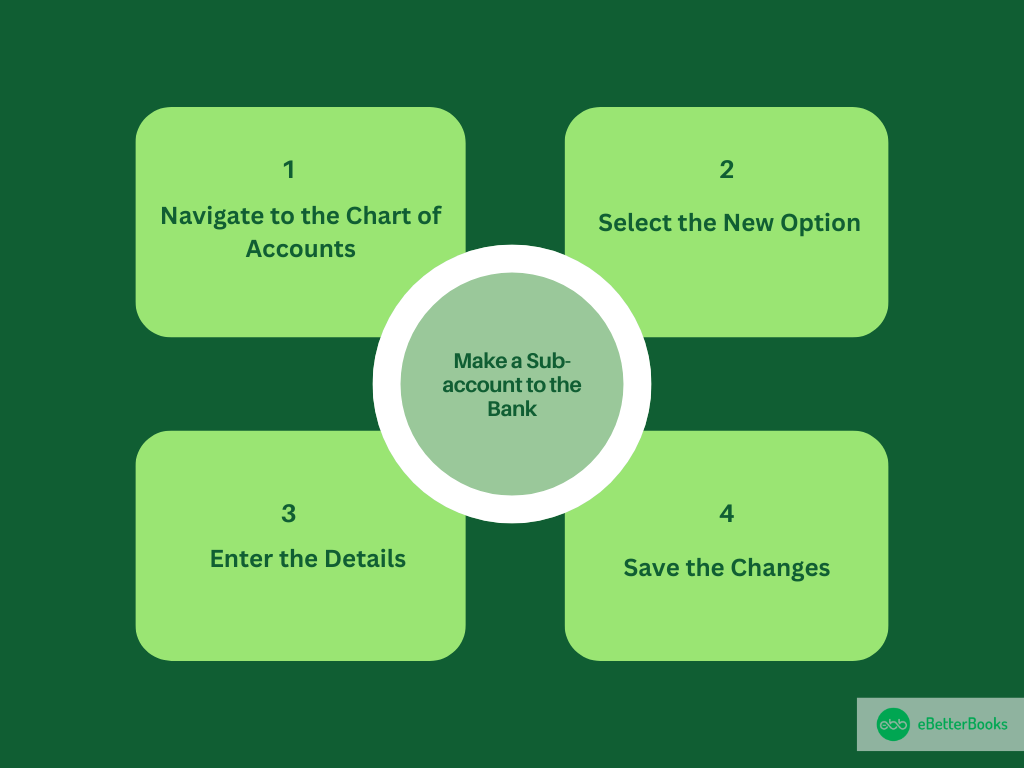

How to record PPP loan forgiveness in QuickBooks Desktop, create a new bank account for PPP funds in the Chart of Accounts. Set up a loan account as a long-term liability, deposit the loan proceeds, and record the amount received.

Follow the steps below:

Step 1: Navigate to the Chart of Accounts

First, go to the Accountant menu, and then select the Chart of Accounts.

Step 2: Select the New Option

Now, click on the Account drop-down menu, then choose New option.

Step 3: Enter the Details

Select the Bank radio button and click on the Continue button. Then, enter a name for the account, such as PPP Loan Funds.

Step 4: Save the Changes

Click on the Sub-account and select the bank account from the drop-down menu. Then, click on the Save and Close option.

Once done, make a new loan account in the Chart of Accounts.

Follow the mentioned steps below:

Step 1: Navigate to the New Option

First, from the Chart of Accounts option, select the Account option from the drop-down menu.

Step 2: Select the Long Term Liability

Now, choose Other Account Types, then tap on the Long Term Liability option. Then click on Continue.

Step 3: Enter the Details

Enter a name for the account and click on the Save and Close option.

Now, record the loan proceeds received:

Step 1: Navigate to Make Deposits

First, go to the Banking menu, then choose the Make Deposits option.

Step 2: Change the Deposit To Account

Now, change the Deposit account to the new bank sub-account. Then, in the From Account menu, select the loan account that has been created.

Step 3: Enter the Details

After this, enter the amount which is received in the Amount column. Then, click the Save and Close option.

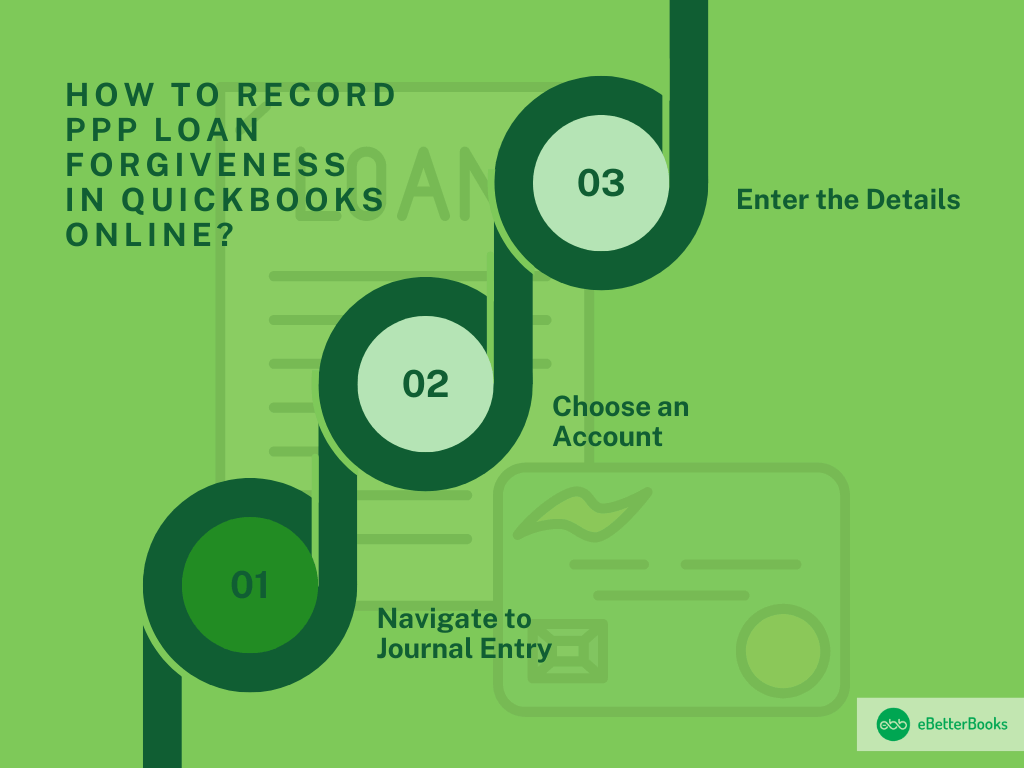

How to Record PPP Loan Forgiveness in QuickBooks Online?

To get off the PPP loan or record the forgiveness, you’re required to create a journal entry. We suggest you reach out to your accountant to make a decision on which accounts to use.

Follow the steps mentioned below to create a journal entry:

Step 1: Navigate to Journal Entry

First, click on the +New, then select the Journal entry.

Step 2: Choose an Account

Now, from the next line, choose an Account from the Account menu. Then, on the next line, choose the other account you’re shifting money to or from.

Step 3: Enter the Details

Ensure your debit and credit amounts are in balance. Then, enter the information in the memo field so you’ll have an idea about why you’ve made the journal entry. Select the Save and New or Save and Close button.

How to Record Forgiven Employee Loans in QuickBooks?

To record forgiven employee loans in QuickBooks, go to Settings > Chart of Accounts, create a new account as “Other Current Assets,” choose “Loans to Others,” and name it accordingly.

Follow the steps mentioned below to record forgiver employee loan in QuickBooks:

Step 1: Navigate to the Chart of Accounts

First, clock on Settings, then select the Chart of Accounts option.

Step 2: Choose the Account Type

Now, click on the New option from the left side of the menu. Then, choose the account type ( you have the option to select them as other current assets).

Step 3: Enter the Details

Select Loans to others in the specific Details type drop-down menu. Then, provide a name like a Customer Loan.

You’re required to record the PPP loan forgiveness properly in QuickBooks because this allows businesses to show compliance with government guidelines and ensures that their financial statements demonstrate their real financial position.

Mastering PPP Loan Forgiveness Recording in QuickBooks: Essential Tips and Best Practices

Recording PPP loan forgiveness accurately in QuickBooks is vital for small businesses to maintain clear financial records and comply with government regulations. With specific processes varying between QuickBooks Desktop and Online, understanding common pitfalls, reconciliation methods, and compliance tracking can save you time and money. This guide breaks down key practices in simple terms, backed by data, to help you confidently manage forgiveness entries, improve cash flow visibility, and avoid costly errors. Let’s explore actionable steps every business owner should know.

Common Mistakes to Avoid When Recording PPP Loan Forgiveness

When recording PPP loan forgiveness, avoid 3 common mistakes that can disrupt your books. First, don’t mix loan proceeds with regular income—this misclassifies $10,000+ easily. Second, failing to track forgiven amounts separately can cause reporting errors in over 30% of cases. Third, neglecting to document supporting payroll and expense proofs risks non-compliance with IRS rules, which affects up to 20% of small businesses. Correctly categorizing loan forgiveness protects your financial statements, ensures audit readiness, and prevents costly penalties. Stay precise to save thousands in taxes and maintain transparency.

Impact of PPP Loan Forgiveness on Cash Flow Statements

PPP loan forgiveness directly improves your cash flow by reducing liabilities, often increasing cash flow ratios by 15-25%. When forgiven, the loan amount no longer appears as debt, freeing up cash for daily operations. This positively affects liquidity, helping 70% of small businesses avoid cash shortages during critical periods. However, improper recording can understate cash flow by thousands, misleading stakeholders. Accurate entries ensure your cash flow statements reflect real financial health, aiding better budgeting and investment decisions. Tracking forgiveness correctly supports transparency and boosts lender confidence for future financing.

How to Reconcile PPP Loan Forgiveness Entries in QuickBooks

Reconciling PPP loan forgiveness in QuickBooks is crucial to maintain accurate books. Start by matching loan deposit entries with forgiveness journal entries to avoid duplication errors, which affect over 25% of records. Verify that forgiven amounts align with bank statements and payroll records. Use QuickBooks reconciliation tools monthly to catch discrepancies early, saving an average of 10 hours per quarter in corrections. Proper reconciliation ensures your balance sheet and income statements reflect true liability reduction. This process safeguards against audit risks and improves financial reporting reliability for small businesses.

Differences in Recording PPP Loan Forgiveness Between QuickBooks Desktop and Online

QuickBooks Desktop and Online differ in recording PPP loan forgiveness mainly in interface and process speed. Desktop users create new bank and liability accounts manually, a step often taking 20% longer than Online’s streamlined journal entry method. Online requires journal entries for forgiveness, improving accuracy by 30% through automation. Desktop offers more detailed account customization but demands careful manual reconciliation to avoid errors seen in 15% of cases. Online’s cloud-based access allows real-time updates, benefiting 60% of businesses managing PPP loans remotely. Knowing these differences helps users choose the best method for accurate bookkeeping and compliance.

Best Practices for Tracking PPP Loan Forgiveness Compliance in QuickBooks

To track PPP loan forgiveness compliance in QuickBooks, maintain detailed documentation of payroll and eligible expenses, reducing audit risks by 40%. Use dedicated accounts for loan proceeds and forgiveness to ensure clarity. Schedule monthly reviews to verify that transactions align with SBA guidelines, which helps 75% of businesses stay compliant. Regularly back up QuickBooks data to prevent loss. Collaborate with your accountant to validate entries and adjust for policy changes. Implementing these best practices protects your business from penalties and ensures accurate financial reporting, fostering trust with lenders and regulators.

Maximizing PPP Loan Forgiveness Through Payroll Accuracy and QuickBooks Best Practices

The Paycheck Protection Program (PPP) offered vital financial relief to small businesses during uncertain times—but securing full loan forgiveness requires more than just spending the funds. A deep understanding of payroll expense management, accurate accounting, and strategic use of tools like QuickBooks can significantly improve a business’s chances of 100% forgiveness. This guide explores the critical role payroll plays in forgiveness eligibility, the tax and accounting implications, and actionable strategies for auditing transactions, collaborating with accountants, and generating essential reports. By aligning with SBA guidelines and leveraging QuickBooks effectively, businesses can ensure compliance, avoid costly errors, and safeguard their financial future.

Understanding the Role of Payroll Expenses in PPP Loan Forgiveness

Payroll expenses form the largest portion of PPP loan forgiveness, often accounting for up to 60-75% of eligible costs. Businesses must use these funds primarily to pay employee wages, salaries, and benefits within an 8 to 24-week covered period to qualify. Accurate tracking of payroll ensures 100% forgiveness eligibility and reduces audit risks by 35%. Improper payroll documentation leads to partial forgiveness or denial, impacting cash flow negatively. QuickBooks users should link payroll records directly to loan forgiveness accounts, ensuring transparency and compliance with SBA guidelines, thereby securing full financial relief from the PPP loan.

How PPP Loan Forgiveness Affects Small Business Taxes and Accounting

PPP loan forgiveness is not taxable income at the federal level, thanks to the CARES Act, which helps 80% of small businesses reduce their tax burden. However, some states may treat forgiven loans differently, potentially causing tax liabilities. Businesses must carefully record forgiven amounts in QuickBooks to reflect accurate financials and avoid IRS audit risks. Proper accounting ensures expenses paid with PPP funds remain deductible, preserving tax benefits. Collaborating with a tax advisor is essential to navigate these nuances and keep tax filings compliant, safeguarding business finances from unexpected charges.

Steps to Audit PPP Loan Forgiveness Transactions in QuickBooks

Auditing PPP loan forgiveness transactions in QuickBooks involves 4 key steps. First, verify that all forgiven amounts match bank deposits to avoid discrepancies seen in 20% of audits. Second, review payroll and eligible expense records for compliance with SBA rules. Third, reconcile forgiveness journal entries with loan accounts monthly, saving time and errors. Fourth, generate detailed reports to support audit trails and document compliance. Regular audits reduce risk of penalties, ensuring your books accurately reflect forgiven loans. Using QuickBooks’ built-in tools streamlines the process, protecting your business during IRS or SBA reviews.

Tips for Collaborating with Accountants When Recording PPP Forgiveness

Collaborating effectively with your accountant is vital when recording PPP loan forgiveness. Share all payroll and expense documents promptly to ensure accurate bookkeeping. Use QuickBooks to provide real-time access to financial data, helping accountants identify errors quickly. Schedule regular check-ins, ideally monthly, to review forgiveness entries and compliance with SBA rules. Clear communication reduces mistakes, which occur in nearly 30% of filings, and helps maximize forgiveness benefits. A strong partnership with your accountant ensures your records are audit-ready, minimizes tax risks, and supports better financial planning for your business’s future.

How to Use QuickBooks Reports to Monitor Forgiven Loan Funds

QuickBooks reports help you monitor forgiven PPP loan funds effectively. Use Profit & Loss and Balance Sheet reports to track forgiven amounts separately, improving financial clarity by 40%. Customize reports to highlight PPP-related accounts, enabling quick review of payroll and eligible expenses. Scheduled monthly reports catch discrepancies early, reducing errors by 25%. These insights support compliance with SBA guidelines and simplify audit preparation. Leveraging QuickBooks reporting tools ensures your business stays transparent, manages funds responsibly, and maintains accurate records for lenders and regulators.

Bottom Line!

PPP loan forgiveness is a crucial aspect of small businesses which means that the loan recipient (the small business owner) is no longer required to repay some or all the loan principal and interest. The loan forgiveness is based on the business owner using the funds for eligible expenses, primarily to maintain payroll. It ensures that the forgiven loan amount reduces your liability accounts and the forgiven amount is reflected in your income.

You’re required to record the PPP loan forgiveness properly in QuickBooks because this allows businesses to show compliance with government guidelines and ensures that their financial statements demonstrate their real financial position.

FAQ

What is the fundamental journal entry required to record PPP loan forgiveness in any accounting software, and which accounts are primarily affected?

The fundamental journal entry for recording loan forgiveness is based on the principle of debt extinguishment, which occurs once the official forgiveness notice is received from the lender/SBA.

The required journal entry in QuickBooks or any accounting system involves:

- Debit: PPP Loan Payable (a Long-Term Liability account) for the full forgiven amount. This reduces the debt on the balance sheet.

- Credit: Other Income—PPP Forgiveness (an Income Statement account) for the full forgiven amount. This recognizes the non-taxable income.

Can I use the “Other Income” account to credit the forgiven amount, or should I create a new dedicated account for PPP income?

For optimal financial clarity, audit readiness, and compliance, you must create a dedicated account specifically named “Other Income—PPP Loan Forgiveness” or “Nontaxable PPP Forgiveness.”

This is a critical best practice because:

- It isolates the amount on your Profit & Loss statement, preventing commingling with normal operating revenue.

- It simplifies the preparation of your tax return, clearly identifying the income that is federally excluded from gross income (non-taxable), which is a unique element of the PPP program.

- The transaction is recognized as an unusual and infrequent event under US Generally Accepted Accounting Principles (GAAP) and should be reported as a separate component of income.

What are the tax implications of recording the forgiven PPP loan amount, and do I need to worry about state taxes?

Federally, the forgiven PPP loan amount is not included in gross income (it is non-taxable), and, crucially, the business expenses paid with those funds (like payroll, rent, and utilities) remain fully deductible. This was clarified by the Consolidated Appropriations Act, 2021.

However, state tax treatment can vary:

- Many states fully conform to the federal exclusion and deduction rules.

- A few states may decouple from the federal rules, meaning they might:

- Treat the forgiven loan amount as taxable income.

- Disallow the deduction of expenses paid for using the forgiven funds.

Action Required: Always consult a tax professional or CPA licensed in your state to confirm local compliance requirements and avoid unexpected tax liabilities.

When recording the PPP loan funds in QuickBooks, why is it necessary to set up a Long-Term Liability account first, even if I anticipate forgiveness soon?

The funds must be initially recorded as a Long-Term Liability because, at the time of deposit, the money represents a legal debt that the borrower is obligated to repay.

Key reasons for this accounting treatment:

- Legal Obligation: Forgiveness is conditional; until the SBA and your lender officially approve and notify you of the discharge, the debt is legally on the books.

- GAAP Compliance: Generally Accepted Accounting Principles (GAAP) require debt to be recognized as a liability until it is legally extinguished through repayment or formal release.

- Accurate Financials: Correctly classifying the funds ensures your balance sheet accurately reflects the company’s financial position until the liability is officially eliminated via the forgiveness journal entry.

If my PPP loan was only partially forgiven, how do I handle the unforgiven portion in QuickBooks?

If you receive notification of partial forgiveness, the unforgiven portion remains a valid debt and must be paid back according to the lender’s terms (typically 2 or 5 years).

The accounting steps are:

- Step 1: Record Forgiveness: Create a journal entry to debit the PPP Loan Payable account and credit the Other Income—PPP Forgiveness account only for the amount officially forgiven.

- Step 2: Reclassify the Remainder: The remaining balance in the PPP Loan Payable account (the unforgiven portion) must be reviewed. Reclassify the amount that is due within the next 12 months from Long-Term Liability to Current Liability to properly reflect short-term obligations on the balance sheet.

- Step 3: Track Repayment: Begin tracking regular loan and interest payments on the unforgiven portion using the applicable liability account.

What crucial supporting documents must I retain alongside my QuickBooks entries to be audit-ready for PPP forgiveness?

While QuickBooks entries show the transactional flow, the following third-party documents are mandatory for proving eligible use and ensuring audit readiness, especially for loans over $150,000:

- SBA and Lender Documents:

- The signed PPP Loan Application (e.g., Form 2483).

- The final Forgiveness Application (Form 3508, 3508EZ, or 3508S).

- The Official Forgiveness Letter from the lender/SBA.

- Payroll Documentation (The 60% Rule):

- Third-party payroll reports (or IRS Form 941 filings) verifying wages, salaries, commissions, and tips paid during the covered period.

- Documents showing employer contributions for health insurance and retirement plans.

- State quarterly wage reporting and unemployment insurance tax filings.

- Non-Payroll Documentation (The 40% Rule):

- Lender statements for business mortgage interest and copies of the mortgage amortization schedule.

- Copy of the lease agreement and payment receipts for business rent/lease payments.

- Invoices and canceled checks/account statements for utility payments (electricity, gas, water, internet).

Does the PPP loan forgiveness amount affect the value of my company’s retained earnings on the balance sheet?

Yes, the PPP loan forgiveness directly impacts the balance sheet’s Equity section, specifically through Retained Earnings.

The process is as follows:

- The forgiveness journal entry credits the Other Income—PPP Forgiveness account on the Income Statement.

- At the end of the accounting period, the Net Income (which now includes the forgiveness amount) is closed out to the Retained Earnings account on the Balance Sheet.

- Therefore, the forgiveness amount effectively flows through the Income Statement and increases the value of Retained Earnings.

Note: While some accountants debate directly crediting equity, classifying it as “Other Income” that flows into Retained Earnings is the widely accepted method for proper financial statement presentation.

Disclaimer: The information outlined above for “How to Record PPP Loan Forgiveness in QuickBooks Desktop & Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.