Recording the personal money that is put into the business in QuickBooks is a crucial step, and every business must accurately record the transactions to handle its financial operations smoothly.

Personal money put into the business can be either considered as the owner’s contribution or the owner’s investment.

The owner’s contribution refers to the involvement of the purchase of equity or assets into the business. On the other hand, an owner’s investment refers to the direct intake of personal funds into the business.

The owner’s contribution is considered as a loan to a business. It is marked under the liability side of the company’s balance sheet, whereas the owner’s investment is recorded under the equity section of the balance sheet.

Understanding personal money or personal funds provided by the owner

Personal money refers to the funds that business owners put into their company’s finances. It is one way to add additional capital to the business.

There are two ways to put personal money into the business:

- You can list it as an “Equity”.

- You can list it as a “Loan” (i.s. loan yourself money)

Importance of recording personal money

- It helps maintain clear records of the owner’s contribution.

- It helps ensure that the financial statement shows accurate business performance.

- It ensures that the business is compliant with the latest accounting standards and tax laws.

- It helps in organizing the funds into the balance sheet.

- It helps businesses track the company’s financial records without any hassle.

How to Record Personal Money put into Business QuickBooks Desktop?

To record personal money put into a business in QuickBooks Desktop, create an equity account in the Chart of Accounts, enter the owner’s contribution, and save the transaction.

Steps to Record Owner Contributions in QuickBooks Desktop:

Part 1: Create a new bank account

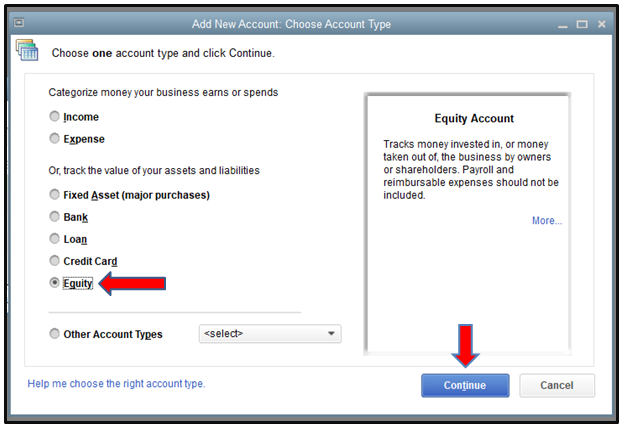

Create a new bank account in QuickBooks Desktop, go to the Chart of Accounts under Accounting, click “New,” and select Equity as the account type.

Step 1: Navigate to the Chart of Accounts

- Click on the Accounting.

- Choose the Chart of Account.

Step 2: Select the account details

- Click on the New button on the screen.

- Choose Equity under the Account Type.

Part 2: Record the Owner’s Contribution

How to record the owner’s contribution, enter the transaction in QuickBooks Desktop by selecting Owner’s Equity, inputting the contribution name and amount, then save and close the transaction.

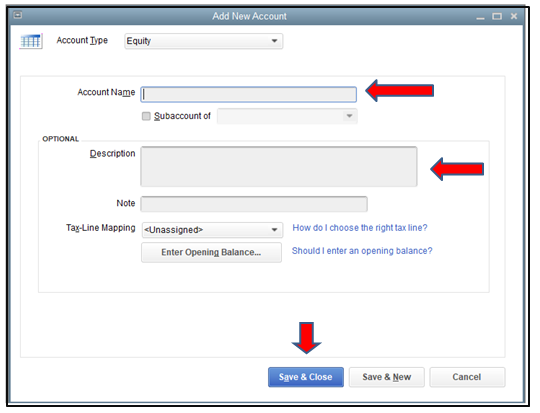

Step 1: Enter the transaction

- Choose the Owner’s Equity from the Detail Type field on the screen.

- Put the Owner’s Contribution in the Name field.

- Enter the contribution amount in the Balance field.

Step 2: Save the transaction

- Once you have entered all the required details, Click on Save and close.

How to Record Personal Money put into Business QuickBooks Online?

Record personal money in QuickBooks Online, set up an equity account under Chart of Accounts. Record the investment via a bank deposit, then pay from the investment using Check or Expense options.

Steps to Record Owner Investment in QuickBooks Online:

Part 1: Set Up an equity account

How to set up an equity account in QuickBooks Online, go to the Chart of Accounts under Settings, select Equity from the Account Type, choose Owner’s or Partner’s Equity from the Detail Type, and save.

Step 1: Navigate to the Chart of Accounts

- Click on the Setting option on the screen.

- Choose a Chart of Accounts.

Step 2: Mention the account details

- Click on Equity from the Account Type drop-down.

- Choose the Owner’s Equity or Partner’s Equity from the Detail Type drop-down.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Part 2: Record the investment

Record an investment, go to + New and select Bank Deposit. Choose the bank account, enter the date, investor details, equity account, payment method, and amount, then save the transaction.

Step 1: Navigate to the Bank deposit

- Click on the + New option on the screen.

- Choose a Bank deposit.

Step 2: Enter the transaction details

- Choose the bank account you’re depositing the money from the Account drop-down.

- Mention the date on which you have deposited the money.

- In the Add funds to this deposit section, mention the name of the investor in the Received from the field.

- Choose the appropriate equity account from the drop-down list in the Account field.

- Set a Payment method.

- Mention the investment amount in the Amount field.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Part 3: Pay the fund from the investment

How to pay from an investment, create a Check for actual payments, entering check details and categories. For card payments, record as an Expense, include vendor, payment method, and details, then save.

Case 1: Making a payment with an actual check

Make a payment with a check in QuickBooks, click + New, select Check, specify the payee, enter the check number, allocate amounts to equity and expense accounts, then save and close.

Following the step-by-step information below:

Step 1: Find the person or business

- Click on the + New button on the screen.

- Click on Check.

- Mention the person or business you’re paying back.

Step 2: Enter the check details

- For the Check no., put a check number.

- Mention the following information in the Category Details section.

- In the First line, enter the equity account you use to track the investment and the amount you’re paying back today.

- In the Second Line, enter the expense account you use to track the interest you pay and the amount of interest included in your payment today.

- In the Other lines, enter any additional fees and their appropriate accounts.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Case 2: Making a payment with a debit or credit card

To record a payment with a debit or credit card, click + New, select Expense, enter vendor details, payment method, amount, and tax. Add a description and save the transaction. Record the repayment as an expense in your QuickBooks Online account.

Following the step-by-step information below:

Step 1: Navigate to Expense

- Click on the + New button on the screen.

- Now, choose Expense.

Step 2: Enter the transaction details

- Choose the vendor in the Payee field,

- Choose the account you used to pay the expenses in the Payment Account field.

- Mention the date for the Expense in the Payment date field.

- Choose how you paid for the Expense in the Payment method field

- If you want detailed tracking, mention a Ref no or Permit no.

- In the Tags field, mention the preferred label to categorize your money.

- In the Category Details section, mention the expense information. In the Category drop-down, select the expense account you use to track expense transactions. Then, enter a description.

- Mention the Amount and Tax.

- If you plan to bill a customer for the Expense, choose the Billable checkbox and mention their name in the Customer field.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Conclusion

Categorizing personal and business funds is important for accurate financial reporting. Updating the information in your accounting software, QuickBooks helps you in generating accurate reports and update your capital accounts, equity and other related ledgers.

Disclaimer: The information outlined above for “How to Record Personal Money put into Business QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.