It is necessary to record non-cash donations in QuickBooks in order to ensure proper record keeping and financial reporting of all the contributions received in accordance with generally accepted accounting standards. It makes it easier for organizations to monitor financial inflows against the source, purpose, and type of the donations. The categorization of donations facilitates accountability and transparency of the financial status of the nonprofit organizations to the donors or other regulatory bodies.

Why Is It Important to Record Non Cash Donations in QuickBooks?

Donations in QuickBooks can be defined as monetary or in-kind contributions received by an organization or individual. They are recorded and tracked to detect financial inflows and support.

These contributions can appear in various forms, such as cash, checks, stocks, tangible goods like clothing and equipment, and services or assets. Tracking donations in QuickBooks is important for financial management as it allows organizations to maintain correct records of all incoming funds, ensuring transparency and accountability.

Donations play an important role in supporting the organization’s ongoing activities, whether it be funding specific projects, contributing to charitable initiatives, or covering operational expenses. By managing the donations received, organizations can enhance their financial resources to achieve their operations and serve their beneficiaries effectively.

How do I Record a Non Cash Donation in QuickBooks Desktop?

To record non-cash charitable contributions in QuickBooks Desktop, there are several steps to follow: first, create an invoice for the donation; second, configure an account for donations; third, configure a product item for donations; and lastly, issue a credit note of the donation value.

Step 1: Create an invoice.

- Go to Create Invoices.

- Click on the Customers menu and choose Create Invoices.

- Enter the required information:

- Enter all of the invoice’s data and then click Save and Close.

- From the Customer: From the drop-down menu, select a client or job. If none are shown, select Add New to create one.

Step 2: Create a Donation Account.

To create an account for recording donations, go to Lists > Chart of Accounts, click New, select Expenses as the Account Type, enter the account name, and save.

- Open the Chart of Accounts:

- Go to the Lists menu and choose Chart of Accounts.

- Create a new account.

- Select the Account drop-down menu at the bottom of the window and choose New.

- Set the Account Type to Expenses and click Continue.

- Enter a suitable name for the account and click Save & Close.

Note: You can contact your accountant to consult about the accounts to use when creating this account.

Step 3: Create a product/service item for donations.

To create a product/service item for donations, go to List > Item List, click New, select Inventory Part, choose your donation account from the Income account field, and save.

Step 1: Navigate to the Item List

First, go to List at the top menu bar and choose the Item List.

Step 2: Select the New Option

Now, tap on the arrow beside Item and select New.

Step 3: Add the Necessary Details

Then, under the Type, choose the Inventory Part. Now, utilize the account you’ve made from the drop-down List in the Income account field. Add the necessary details needed. Click on the OK button.

To Issue a Credit Memo for the Value of the Products you’re Donating

The issue a credit memo for donated products, select the customer and choose Create Credit Memos/Refunds. Enter the details, then click Save and Close.

Step 1: Navigate to Create Credit Memos/Refunds

First, choose the customer and tap on Create Credit Memos/Refunds.

Step 2: Enter the Details

Now, enter the information of the credit memo or refund.

Step 3: Save the Changes

Once you’re done and satisfied, click on the Save and Close button.

How do I Record a Non Cash Donation in QuickBooks Online?

In-kind contribution means facilities, goods, or services provided without charge for use by the organization, such as space, equipment, or staff services. Recording such donations into QuickBooks Online involves developing accounts, including product/service items and donation entries.

Note: Confirm with your accountant if a donation has to be recorded as in-kind.

Step 1: Check or Create an In-Kind Donation Account

Check if you already have an in-kind donation account

Ensure that you still need to get an in-kind donation account in your chart of accounts; this will avoid duplicates. To check for an in-kind donation account, go to Settings > Chart of Accounts. Search for “In-Kind Donations.” If none exists, create a new account to avoid duplicates.

Step 1: Navigate to the Chart of Accounts

First, go to settings, then choose the Charts of Accounts option.

Step 2: Enter the Details

Now, in the Filter by name or number field, enter the In-Kind donations details.

Step 3: Create an In-kind Account

After searching, if no account appears, you can now create an in-kind donations account.

Note: If an account named In-Kind Donations appears, then your chart of accounts is already set up.

Step 2: Create a Clearing Account

If you have an in-kind donation account already, you’re not required to create a new one. You can skip this step and proceed to another one.

Step 1: Navigate to the Chart of Accounts

First, navigate to Settings, then choose the Chart of Accounts option.

Step 2: Enter the Details

Now, select the New option. Then, in the Account name field, enter In-kind donations.

Step 3: Choose the Nonprofit Income option

Then, from the Account type drop down menu, choose Income. After this, from the Detail type drop-down menu, choose Nonprofit Income. Now, Save the changes once you’re satisfied.

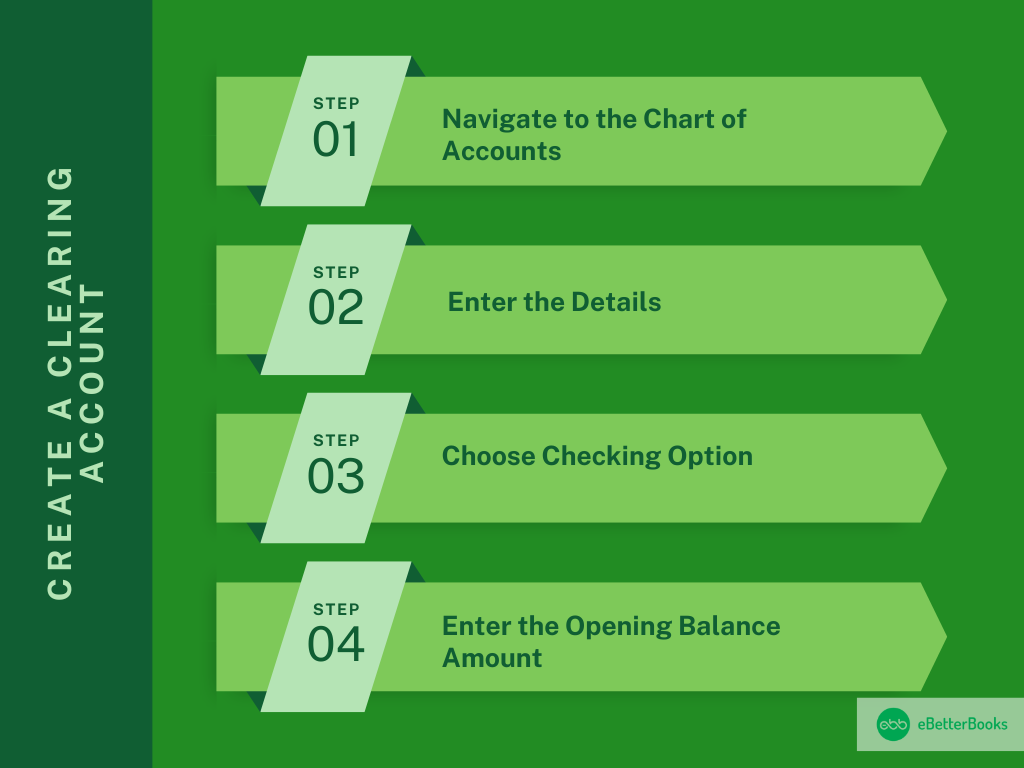

Create a clearing account

Make a clearing account to keep track of your in-kind donations. This will help you record your in-kind donations, sales receipts, or bill payments.

Step 1: Navigate to the Chart of Accounts

First, go to the Settings menu, and then choose the Chart of Accounts option.

Step 2: Enter the Details

Now, select the New option. Then, in the Account name field, enter In-Kind Clearing.

Step 3: Choose Checking Option

Then, from the Account type drop-down menu, choose the Bank option. After that, from the Detail type drop-down menu, select the Checking option.

Step 4: Enter the Opening Balance Amount

Now, from the Opening balance field, enter the opening balance amount. Then, choose the starting date in the Date field. Choose the Save option at last once you’re satisfied.

Note: The opening can be 0

Step 3: Create a Product/Service Item for the Donation

Make a product or service item for every in-kind donation you receive and correctly track what you have. This will allow you to record in-kind donation items to your books for a more comprehensive financial report.

Step 1: Navigate to Products and Services

First, go to Settings, then choose the Products and Services option.

Step 2: Enter the Details

Now, choose New, then select the Services option. Then, in the Basic info menu, enter the name, item type, and category of the Item.

Step 3: Choose In-Kind Donations Option

Then, from the Sales section, choose the In-kind donations option from the Income account drop down menu.

Step 4: Choose Create New Option

After this, from the Purchasing section, choose I purchase this service from a vendor option. Then, select Create New.

Note: You have the option to add your product description or purchase cost as needed.

Step 4: Record the In-Kind Donation

To record the in-kind donations, you can make a sales receipt and a bill and mark it as cleared.

Note: If you’ve received fixed assets like vehicles, computers, or land, then you can utilize an expense or fixed asset account on the bill. You can ask your accountant if you need clarification on whether an item is a fixed asset.

Create a sales receipt

To create a sales receipt for a donation, go to + New > Sales Receipt. Select a customer, enter the donation date, choose the in-kind donation item, enter the fair market value, and save.

Step 1: Navigate to Sales Receipt

First, go to the + New, then choose the Sales Receipt option.

Step 2: Choose a Customer

Now, from the Customer drop down menu, choose a Customer.

Note: If you still need to set up your customer, then select the + Add new option.

Step 3: Enter the Details

Then, from the Sales Receipt Data field, enter the date of the donation.

Step 4: Choose the In-kind Donation Item

In the Deposit To drop down menu, choose the In-kind Clearing bank account you’ve created. Then, from the Product/Service drop-down menu, choose the in-kind donation item and add the description in the Description field.

Step 5: Enter the Fair Market Value

Now, in the Amount field, enter the fair market value (FMV) of the donation. When satisfied, select Save and close.

Note: If you need to be made aware of the fair market value of the donation, ask your accountant.

Create a bill

To create a bill for an in-kind donation, go to + New > Bill. Select the donor, choose the in-kind donation item, enter the fair market value, and save.

Step 1: Navigate to Bill

First, go to the + New option, then choose Bill.

Step 2: Enter the Details

Now, from the Vendor drop-down menu, choose the donor’s name.

Note: If from the vendor list, you’ve set up your donor’s name then choose + Add new.

Step 3: Select the In-Kind Donation Item

In the Item details menu, choose the in-kind donation item from the Product/Service drop-down menu.

Step 5: Enter the Fair Market Value

Now, in the Amount menu, enter the donation’s fair market value (FMV). Then, choose the Save and Close option.

Note: If you’re different from the fair market value of the donation, ask your accountant.

Mark the bill as cleared

To mark a bill as cleared, go to + New > Pay Bills, select the In-kind Clearing account, check the bill to mark it as paid, and then save and close.

Step 1: Navigate to Pay Bills

First, go to + New, then choose Pay Bills.

Step 2: Choose In-kind Clearing

Now, from the Payment account drop-down menu, choose the In-kind Clearing option.

Step 3: Save the Changes

Choose the checkbox of the bill which you have entered. Once satisfied, select the Save and Close button.

The process of recording non-cash donations in QuickBooks allows for clear visibility of funds received and how they are assigned, providing stakeholders, including donors and sponsors, with confidence in the organization’s financial management.

Disclaimer: The information outlined above for “How do I Record a Non Cash Donation in QuickBooks Online and Desktop?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.