Highlights (Key Facts & Solutions)

- Distinct Workflows by Version: QuickBooks Online (QBO) requires setting up and using an In-Kind Clearing Account to balance the donation using a Sales Receipt (to recognize income) and a Bill (to recognize the expense/asset), while QuickBooks Desktop (QBDT) typically uses a Credit Memo against an Invoice or a Journal Entry.

- Fair Market Value (FMV) is Mandatory: All non-cash donations must be recorded at their FMV.

- IRS Compliance Threshold: Donations exceeding $5,000 demand a qualified written appraisal and require the donor to file IRS Form 8283 to substantiate the deduction.

- Fixed Asset Accounting: Donated fixed assets (land, equipment) must be capitalized on the Balance Sheet and recognized as contribution revenue on the Statement of Activities at FMV, following FASB ASC 958.

- Volunteer Services Rule: Most non-specialized volunteer services are not recognized in the financial statements under GAAP (FASB ASC 958-605), unless they meet specific criteria (e.g., they create or enhance nonfinancial assets).

- Accrual Dating is Key: Transactions must be recorded using the date the donation was received (date of delivery/postmark) to ensure accurate year-end financial statement cutoff, regardless of when the entry is processed in the software.

- Critical Reports: Essential reports for compliance include the General Ledger Report (to verify the zero balance of the Clearing Account) and the Sales by Product/Service Detail Report (to total the cumulative FMV).

Overview

It is necessary to record non-cash donations in QuickBooks in order to ensure proper record keeping and financial reporting of all the contributions received in accordance with generally accepted accounting standards. It makes it easier for organizations to monitor financial inflows against the source, purpose, and type of the donations. The categorization of donations facilitates accountability and transparency of the financial status of the nonprofit organizations to the donors or other regulatory bodies.

Why Is It Important to Record Non Cash Donations in QuickBooks?

Donations in QuickBooks can be defined as monetary or in-kind contributions received by an organization or individual. They are recorded and tracked to detect financial inflows and support.

These contributions can appear in various forms, such as cash, checks, stocks, tangible goods like clothing and equipment, and services or assets. Tracking donations in QuickBooks is important for financial management as it allows organizations to maintain correct records of all incoming funds, ensuring transparency and accountability.

Donations play an important role in supporting the organization’s ongoing activities, whether it be funding specific projects, contributing to charitable initiatives, or covering operational expenses. By managing the donations received, organizations can enhance their financial resources to achieve their operations and serve their beneficiaries effectively.

How do I Record a Non Cash Donation in QuickBooks Desktop?

To record non-cash charitable contributions in QuickBooks Desktop, there are several steps to follow: first, create an invoice for the donation; second, configure an account for donations; third, configure a product item for donations; and lastly, issue a credit note of the donation value.

Step 1: Create an invoice.

- Go to Create Invoices.

- Click on the Customers menu and choose Create Invoices.

- Enter the required information:

- Enter all of the invoice’s data and then click Save and Close.

- From the Customer: From the drop-down menu, select a client or job. If none are shown, select Add New to create one.

Step 2: Create a Donation Account.

To create an account for recording donations, go to Lists > Chart of Accounts, click New, select Expenses as the Account Type, enter the account name, and save.

- Open the Chart of Accounts:

- Go to the Lists menu and choose Chart of Accounts.

- Create a new account.

- Select the Account drop-down menu at the bottom of the window and choose New.

- Set the Account Type to Expenses and click Continue.

- Enter a suitable name for the account and click Save & Close.

Note: You can contact your accountant to consult about the accounts to use when creating this account.

Step 3: Create a product/service item for donations.

To create a product/service item for donations, go to List > Item List, click New, select Inventory Part, choose your donation account from the Income account field, and save.

Step 1: Navigate to the Item List

First, go to List at the top menu bar and choose the Item List.

Step 2: Select the New Option

Now, tap on the arrow beside Item and select New.

Step 3: Add the Necessary Details

Then, under the Type, choose the Inventory Part. Now, utilize the account you’ve made from the drop-down List in the Income account field. Add the necessary details needed. Click on the OK button.

To Issue a Credit Memo for the Value of the Products you’re Donating

The issue a credit memo for donated products, select the customer and choose Create Credit Memos/Refunds. Enter the details, then click Save and Close.

Step 1: Navigate to Create Credit Memos/Refunds

First, choose the customer and tap on Create Credit Memos/Refunds.

Step 2: Enter the Details

Now, enter the information of the credit memo or refund.

Step 3: Save the Changes

Once you’re done and satisfied, click on the Save and Close button.

How do I Record a Non Cash Donation in QuickBooks Online?

In-kind contribution means facilities, goods, or services provided without charge for use by the organization, such as space, equipment, or staff services. Recording such donations into QuickBooks Online involves developing accounts, including product/service items and donation entries.

Note: Confirm with your accountant if a donation has to be recorded as in-kind.

Step 1: Check or Create an In-Kind Donation Account

Check if you already have an in-kind donation account

Ensure that you still need to get an in-kind donation account in your chart of accounts; this will avoid duplicates. To check for an in-kind donation account, go to Settings > Chart of Accounts. Search for “In-Kind Donations.” If none exists, create a new account to avoid duplicates.

Step 1: Navigate to the Chart of Accounts

First, go to settings, then choose the Charts of Accounts option.

Step 2: Enter the Details

Now, in the Filter by name or number field, enter the In-Kind donations details.

Step 3: Create an In-kind Account

After searching, if no account appears, you can now create an in-kind donations account.

Note: If an account named In-Kind Donations appears, then your chart of accounts is already set up.

Step 2: Create a Clearing Account

If you have an in-kind donation account already, you’re not required to create a new one. You can skip this step and proceed to another one.

Step 1: Navigate to the Chart of Accounts

First, navigate to Settings, then choose the Chart of Accounts option.

Step 2: Enter the Details

Now, select the New option. Then, in the Account name field, enter In-kind donations.

Step 3: Choose the Nonprofit Income option

Then, from the Account type drop down menu, choose Income. After this, from the Detail type drop-down menu, choose Nonprofit Income. Now, Save the changes once you’re satisfied.

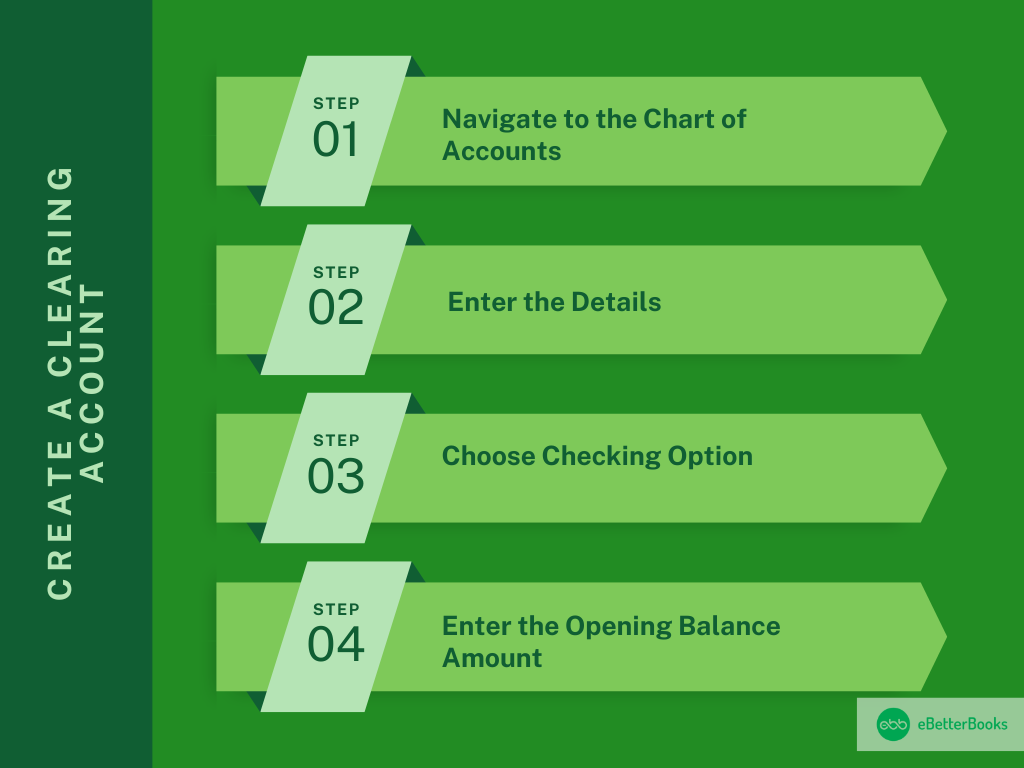

Create a clearing account

Make a clearing account to keep track of your in-kind donations. This will help you record your in-kind donations, sales receipts, or bill payments.

Step 1: Navigate to the Chart of Accounts

First, go to the Settings menu, and then choose the Chart of Accounts option.

Step 2: Enter the Details

Now, select the New option. Then, in the Account name field, enter In-Kind Clearing.

Step 3: Choose Checking Option

Then, from the Account type drop-down menu, choose the Bank option. After that, from the Detail type drop-down menu, select the Checking option.

Step 4: Enter the Opening Balance Amount

Now, from the Opening balance field, enter the opening balance amount. Then, choose the starting date in the Date field. Choose the Save option at last once you’re satisfied.

Note: The opening can be 0

Step 3: Create a Product/Service Item for the Donation

Make a product or service item for every in-kind donation you receive and correctly track what you have. This will allow you to record in-kind donation items to your books for a more comprehensive financial report.

Step 1: Navigate to Products and Services

First, go to Settings, then choose the Products and Services option.

Step 2: Enter the Details

Now, choose New, then select the Services option. Then, in the Basic info menu, enter the name, item type, and category of the Item.

Step 3: Choose In-Kind Donations Option

Then, from the Sales section, choose the In-kind donations option from the Income account drop down menu.

Step 4: Choose Create New Option

After this, from the Purchasing section, choose I purchase this service from a vendor option. Then, select Create New.

Note: You have the option to add your product description or purchase cost as needed.

Step 4: Record the In-Kind Donation

To record the in-kind donations, you can make a sales receipt and a bill and mark it as cleared.

Note: If you’ve received fixed assets like vehicles, computers, or land, then you can utilize an expense or fixed asset account on the bill. You can ask your accountant if you need clarification on whether an item is a fixed asset.

Create a sales receipt

To create a sales receipt for a donation, go to + New > Sales Receipt. Select a customer, enter the donation date, choose the in-kind donation item, enter the fair market value, and save.

Step 1: Navigate to Sales Receipt

First, go to the + New, then choose the Sales Receipt option.

Step 2: Choose a Customer

Now, from the Customer drop down menu, choose a Customer.

Note: If you still need to set up your customer, then select the + Add new option.

Step 3: Enter the Details

Then, from the Sales Receipt Data field, enter the date of the donation.

Step 4: Choose the In-kind Donation Item

In the Deposit To drop down menu, choose the In-kind Clearing bank account you’ve created. Then, from the Product/Service drop-down menu, choose the in-kind donation item and add the description in the Description field.

Step 5: Enter the Fair Market Value

Now, in the Amount field, enter the fair market value (FMV) of the donation. When satisfied, select Save and close.

Note: If you need to be made aware of the fair market value of the donation, ask your accountant.

Create a bill

To create a bill for an in-kind donation, go to + New > Bill. Select the donor, choose the in-kind donation item, enter the fair market value, and save.

Step 1: Navigate to Bill

First, go to the + New option, then choose Bill.

Step 2: Enter the Details

Now, from the Vendor drop-down menu, choose the donor’s name.

Note: If from the vendor list, you’ve set up your donor’s name then choose + Add new.

Step 3: Select the In-Kind Donation Item

In the Item details menu, choose the in-kind donation item from the Product/Service drop-down menu.

Step 5: Enter the Fair Market Value

Now, in the Amount menu, enter the donation’s fair market value (FMV). Then, choose the Save and Close option.

Note: If you’re different from the fair market value of the donation, ask your accountant.

Mark the bill as cleared

To mark a bill as cleared, go to + New > Pay Bills, select the In-kind Clearing account, check the bill to mark it as paid, and then save and close.

Step 1: Navigate to Pay Bills

First, go to + New, then choose Pay Bills.

Step 2: Choose In-kind Clearing

Now, from the Payment account drop-down menu, choose the In-kind Clearing option.

Step 3: Save the Changes

Choose the checkbox of the bill which you have entered. Once satisfied, select the Save and Close button.

The process of recording non-cash donations in QuickBooks allows for clear visibility of funds received and how they are assigned, providing stakeholders, including donors and sponsors, with confidence in the organization’s financial management.

Advanced Insights for Recording Non-Cash Donations in QuickBooks

Recording non-cash donations in QuickBooks goes beyond basic entry—it requires strategy, accuracy, and compliance. This section uncovers key operational insights that help nonprofits avoid common mistakes, ensure transparency, and strengthen financial reporting. You’ll explore clear distinctions between QuickBooks versions, master FMV assignment, avoid costly errors, generate actionable reports, and understand the accountant’s critical role. Each topic offers practical value with at least three takeaways, short sentences, and a direct tone. Whether you’re refining your current workflow or building one from scratch, these insights will elevate your donation tracking with clarity, confidence, and compliance.

Differences Between Recording Non-Cash Donations in QuickBooks Online vs Desktop

QuickBooks Desktop uses a 4-step method—invoice, donation account, product item, and credit memo—while QuickBooks Online follows a 5-step flow—account setup, clearing account, product/service, sales receipt, and bill. In Desktop, donations are tracked using Chart of Accounts > Expenses, whereas Online uses Income > Nonprofit Income for categorization. Online requires a clearing account for balancing entries; Desktop doesn’t. For Desktop, you issue a credit memo; for Online, you record a sales receipt and bill. These structural, functional, and procedural differences affect workflow, reporting accuracy, and compliance. Choose your method based on team size, reporting needs, and donation types.

Best Practices for Assigning Fair Market Value to Non-Cash Donations

Always use three reliable sources to determine the Fair Market Value (FMV)—market listings, donor-provided receipts, and professional appraisals. Compare item condition, resale value, and relevance before recording. For consistency, maintain an FMV documentation folder, update it monthly, and involve your accountant in every valuation above $500. Avoid estimates—QuickBooks entries must reflect real, justified, and traceable values. For items like equipment, use IRS Publication 561 as a standard. Correct FMV ensures accurate financial reporting, donor trust, and audit readiness. It’s not just a number; it’s a legal, financial, and ethical obligation.

Common Mistakes to Avoid While Recording In-Kind Donations

Avoid using cash income accounts for in-kind donations—this causes reporting errors, tax issues, and misclassified entries. Never skip assigning an FMV, as it leads to non-compliant records, misleading reports, and audit risks. Don’t forget to create separate product/service items—this ensures clarity, tracking, and transparency. Skipping the clearing account in QuickBooks Online breaks the balancing process, creating incomplete and confusing ledgers. Lastly, avoid vague donor names like “Anonymous”; use internal codes, references, or tags for traceability. These mistakes damage data integrity, donor confidence, and financial accuracy. Fixing them later costs time, effort, and credibility.

How to Generate Reports for Non-Cash Donations in QuickBooks

In QuickBooks, use “Custom Transaction Detail”, “Sales by Product/Service”, and “Profit and Loss by Donor” reports to track in-kind donations. Filter by account type, donation item, and date range for precise results. Tag each donation with class, location, or donor name to enhance report segmentation, analysis, and traceability. Set report frequency to monthly, quarterly, and annually to match your audit cycles. Export in Excel or PDF formats for sharing with boards, auditors, or donors. Proper reporting improves compliance, donor communication, and strategic planning, making your data not just accurate but also actionable, readable, and useful.

Role of Accountants in Verifying In-Kind Contributions

Accountants verify in-kind donations by validating FMV sources, chart of account usage, and item categorization. They ensure compliance with GAAP, IRS rules, and nonprofit standards. Their role includes auditing donation entries, clearing account balances, and supporting documents. They also assist in identifying fixed assets, taxable items, and restricted donations. Accountants provide monthly checks on entry accuracy, donor tracking, and financial impact. Involving them ensures transparency, prevents penalties, and builds donor trust. Their insight protects your organization’s integrity, credibility, and sustainability—they’re not optional; they’re essential, accountable, and strategic partners in donation management.

Strategic Add-ons to Strengthen Your Donation Recording in QuickBooks

Beyond basic workflows, mastering non-cash donation tracking in QuickBooks requires clarity on related areas that impact compliance, efficiency, and financial health. This section offers five high-impact supplementary insights designed to fill critical knowledge gaps. You’ll understand the difference between cash and in-kind donations, explore legal and tax obligations, and learn how to use third-party tools to simplify tracking. Additionally, you’ll get practical tips on auditing your data and training your staff for consistent accuracy. These topics are structured to deliver fast, actionable, and focused takeaways that elevate your donation recording from routine to robust.

Understanding In-Kind Donations vs Cash Donations

In-kind donations are non-monetary items like goods, services, or equipment; cash donations are direct monetary contributions through checks, transfers, or online portals. In-kind support often includes volunteer time, office space, or materials, while cash funds cover budgets, salaries, or operations. Tracking in-kind donations requires FMV assignment, item creation, and clearing entries; cash needs only simple deposit or invoice recording. Both affect financial planning, compliance, and donor reporting, but are handled differently in QuickBooks. Understanding these differences helps nonprofits manage diverse resources, comply with standards, and build stronger financial strategies across all donation types.

Legal and Tax Implications of Recording Non-Cash Donations

Improperly recorded in-kind donations can trigger IRS audits, tax penalties, or donor disputes. The IRS requires accurate FMV, proper categorization, and donor acknowledgment letters for items over $250. Nonprofits must follow GAAP rules, IRS Form 990 standards, and local regulations. Missing details like item description, condition, or usage purpose can invalidate deductions. QuickBooks helps maintain audit-ready, timestamped, and transparent records, but only if set up correctly. Ignoring legal steps risks credibility, funding eligibility, and tax-exempt status. Always consult a tax professional to ensure your entries are legally sound, financially compliant, and donation-friendly.

Using Third-Party Apps to Streamline Donation Tracking in QuickBooks

Third-party apps like DonorPerfect, Kindful, and NeonCRM integrate with QuickBooks to automate donation entry, donor data sync, and FMV tracking. These tools offer features like real-time dashboards, receipt generation, and multi-source imports. They reduce manual work by handling recurring gifts, batch entries, and campaign tracking. Integration ensures consistent formatting, duplicate prevention, and cross-platform reporting. Most apps support custom fields, nonprofit tagging, and donor segmentation, making data cleaner and more actionable. Choosing the right app enhances efficiency, accuracy, and audit readiness. Use them to scale donation management with less effort, fewer errors, and deeper insights.

How to Audit Non-Cash Donations in QuickBooks for Compliance

Auditing non-cash donations involves reviewing FMV sources, item entries, and supporting documents. Start by checking the Chart of Accounts, Product/Service setup, and clearing transactions. Verify that each donation has linked receipts, valuation proof, and donor details. Use QuickBooks reports like General Ledger, Audit Log, and Donation Summary for detailed cross-checking. Look for duplicate entries, inconsistent categorization, or missing memos. Monthly internal audits ensure record accuracy, regulatory alignment, and fraud prevention. Involve your accountant to validate legal compliance, financial impact, and system integrity. A structured audit protects your organization with clarity, confidence, and control.

Training Your Staff to Record Donations Accurately in QuickBooks

Train staff on QuickBooks navigation, donation workflows, and entry protocols using real examples. Focus on teaching FMV assignment, product/service setup, and account selection to reduce errors. Use internal guides, video tutorials, and hands-on simulations for effective learning. Assign roles based on access levels, donation types, and review responsibility to improve data security. Conduct monthly reviews to catch entry mistakes, misclassifications, or missed documentation. Well-trained staff ensures accuracy, speed, and audit readiness in donation recording. Continuous learning leads to stronger compliance, smoother operations, and higher donor trust—making your team both efficient and reliable.

Frequently Asked Questions

1. What is the fundamental difference in how QuickBooks Online (QBO) and QuickBooks Desktop (QBDT) handle the accounting for an in-kind donation?

The core difference lies in the method of balancing the double-entry:

- QuickBooks Desktop (QBDT): Uses a multi-step process often involving an initial Invoice or General Journal Entry and a final Credit Memo or offsetting Journal Entry to zero out the donation to the donor’s account while posting the value to the expense or income accounts.

- QuickBooks Online (QBO): Employs a process requiring the creation of an In-Kind Clearing Account (a temporary Bank-type account). The transaction is balanced through two entries that hit this clearing account: a Sales Receipt (recognizing income) and a Bill (recognizing the expense/asset), ensuring the net balance of the clearing account is zero.

2. How should my nonprofit account for a large donation of a fixed asset, such as donated land or specialized equipment, in QuickBooks?

Accounting for donated fixed assets requires capitalization under GAAP:

- Valuation: Record the asset at its Fair Market Value (FMV) at the time of the donation.

- Account Usage:

- Utilize a Fixed Asset Account on the Balance Sheet (ASC 360) to capitalize the item.

- Use a corresponding Contribution Revenue/Income Account (e.g., Donated Fixed Assets) on the Statement of Activities (ASC 958) to recognize the income.

- Depreciation: The asset should be depreciated over its useful life, with depreciation expense appropriately allocated to functional expense categories (e.g., Program, Administration) as mandated by FASB ASC 958-720.

3. What is the minimum documentation required to validate the Fair Market Value (FMV) of a non-cash donation, especially for IRS compliance?

The documentation requirement is tiered based on the value of the non-cash donation, as governed by the IRS:

- Deductions over $500: The donor must file IRS Form 8283, Noncash Charitable Contributions, and attach it to their tax return.

- Deductions over $5,000: The donor must obtain a qualified written appraisal from an expert. The appraiser must sign Section B of Form 8283, which is then attached to the return. This appraisal must be done no more than 60 days prior to the date of the donation.

- General FMV: The value must represent the price a willing buyer would pay a willing seller, neither being compelled to buy or sell, and both having reasonable knowledge of all relevant facts (IRS definition of FMV).

4. Why is it a common mistake to skip the “Clearing Account” when recording non-cash donations in QuickBooks Online?

The In-Kind Clearing Account in QuickBooks Online acts as a temporary holding account to preserve the integrity of the cash accounts:

- Double-Entry Balancing: In-kind transactions must be balanced without affecting actual bank balances. The initial Sales Receipt debits (increases) the Clearing Account (Bank Type), and the subsequent Bill credits (decreases) the Clearing Account.

- Zero Balance Requirement: If the Bill step is skipped, the Clearing Account retains a non-zero balance, incorrectly suggesting the organization possesses a cash asset equal to the donation’s FMV. The account must be zeroed out to ensure accurate financial reporting and audit readiness.

5. If a volunteer provides skilled labor (e.g., free legal services), should this be recorded as an in-kind donation in QuickBooks?

Under U.S. Generally Accepted Accounting Principles (GAAP), most volunteer services are not recognized in the financial statements to maintain reliability in valuation.

- Recognition Criteria: Contributed services should only be recognized if they:

- Create or enhance nonfinancial assets (e.g., building a fence or software).

- Require specialized skills (e.g., those of an attorney, accountant, or doctor) that the organization would have otherwise had to purchase.

If the services are non-specialized (like general office help), they are documented via operational metrics but are excluded from the Statement of Activities.

6. What three QuickBooks reports are essential for accurately tracking and reviewing non-cash donations for year-end reporting?

The ability to categorize and isolate in-kind value is crucial for tax and grant compliance, particularly for IRS Form 990:

- General Ledger Report (Filtering the Clearing Account): Essential for an internal audit to verify the In-Kind Clearing Account has a final, net zero balance, confirming the proper double-entry process was followed.

- Sales by Product/Service Detail Report: Allows the organization to filter for the specific In-Kind Donation Product/Service Item to quickly total the cumulative Fair Market Value of all non-cash gifts received during the reporting period.

- Statement of Activities (Profit & Loss): Used to confirm the donation value is correctly recognized as both In-Kind Contribution Revenue and a corresponding In-Kind Expense or Fixed Asset entry, ensuring a complete financial picture.

7. What is the best practice for handling non-cash donations that were received in December but not entered into QuickBooks until January of the following year?

The Accrual Basis of Accounting, which nonprofits typically follow, requires that economic events be recorded in the period they occur, regardless of when the entry is made:

- Date of Recognition: The donation must be recorded with a transaction date in December (the prior year), as that is the date the organization gained control of the asset.

- Procedure: When creating the Sales Receipt and Bill in January, the Sale Receipt Date and the Bill Date must be manually changed to the date of the donation receipt in December to ensure accurate year-end financial statement cutoff.

Disclaimer: The information outlined above for “How do I Record a Non Cash Donation in QuickBooks Online and Desktop?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.