Financial management plays a significant role in the success of any business and a line of credit is by far one of the most useful tools a business could consider. Recording the line of credit in QuickBooks helps businesses keep track of the borrowed amounts and replacement activities.

It helps organizations to meet their immediate working expenses, emergencies, and uneven cash flow. In this article, we are going to discuss why you need to establish a line of credit, how to account for a line of credit in QuickBooks and how to make the process more effective and reliable to keep track of your books.

What is a Line of Credit?

A line of credit is a type of loan that allows a company to borrow money as needed up to a predetermined amount and pay it back gradually.

Examples of Lines of Credit:

- Business Line of Credit

- Demand Line of Credit

- Home Equity Line of Credit

- Personal Line of Credit

- Securities-Backed Line of Credit

What is the Need to Set Up a Line of Credit in QuickBooks?

Line of Credit is valuable for the company since it may be used for various needs: to pay for short-term costs, to solve the fluctuations in cash flow, and to take opportunities for development. Below are a few pointers to understand it better:

- Manage Cash Flow: Avails working capital when there is a pinch in the cash flow of the business.

- Cover Unexpected Costs: Used in reserve planning and as an emergency fund.

- Support Business Growth: As a source of funds to finance prospects such as an increase in inventory or marketing communications.

- Flexible Borrowing: This allows you to withdraw only the amount required; it does not make you incur unnecessary interest charges.

- Improve Credit Score: If you make payments on the line of credit, the company will post information on your credit reports, which will improve your business credit scores.

- Seasonal Stability: This can assist in filling the gaps in revenue occurrence in low seasons.

How to record a Line of Credit in QuickBooks Desktop?

Record a Line of Credit in QuickBooks Desktop, create a Line of Credit account under the Chart of Accounts, record borrowed amounts as deposits, track payments using checks, document interest and fees, and reconcile the account to ensure accuracy.

Process 1: Create a Line of Credit account

Create a Line of Credit account in QuickBooks Desktop, navigate to the Chart of Accounts, select “+ New,” choose “Loan” and “Other Current Liability,” enter the account details, and save the transaction.

Following the step-by-step information below:

Step 1: Navigate to the Chart of Accounts

- Click on the Lists menu on the screen.

- Select the Chart of Accounts option.

Step 2: Create a new account

- Right-click on the screen and hit the + New option.

- Select the Loan option and press Continue.

- Select the Other Account Type and then choose Other Current Liability.

- Hit Continue on the screen to proceed.

- Mention the details of your Line of Credit.

Step 3: Save the transaction

- Once you have entered all the required details, Click on Save and close.

Process 2: Recorded Borrowed Amounts

How to record borrowed amounts in QuickBooks Desktop, go to Banking, select “Make Deposits,” choose the account, enter deposit details like vendor and amount, and then save the deposit.

Following the step-by-step information below:

Step 1: Locate for Banking

- Click on the main menu.

- Click on the Banking option.

- Choose the Make Deposits.

Step 2: Create a Deposit

- In the Payments to Deposit window, Hit OK.

- In the Make Deposits window, choose the account to which you want to deposit the borrowed amount.

Enter the details of the deposit:

- Received From: Select the vendor or financial institution from whom you received the line of credit.

- From Account: Select the line of credit account you created.

- Amount: Enter the borrowed amount.

- Memo: Enter a memo for reference (optional).

Step 3: Save the Deposit

- Hit on Save & Close.

Process 3: Record Payments on the Line of Credit

Record a payment on your Line of Credit in QuickBooks Desktop, go to Banking, choose “Write Checks,” enter payment details, select the Line of Credit account, and save the transaction.

Following the step-by-step information below:

Step 1: Go to Banking

- Press Banking from the main menu.

- Choose Write Checks.

Step 2: Write a Check

- Choose the account from which you are making the payment in the Write Checks window.

- Mention the check details.

- Pay to the Order of: Choose the financial institution to which you are making the payment.

- Amount: Mention the payment amount.

- Expenses tab:

- Account: Choose the line of credit account you created.

- Amount: Put the payment amount.

- Memo: Put a memo for reference (optional).

Step 3: Save the transaction

- Hit on Save & Close.

Process 4: Record the Interest and Fees

To record interest and fees on a Line of Credit in QuickBooks Desktop, go to Banking, select “Write Checks,” enter payment details, choose the expense account, and save the transaction.

Following the step-by-step information below:

Step 1: Locate to Banking

- From the main menu, click on Banking.

- Choose the Write Checks option.

Step 2: Write a Check for Interest/Fees

- In the Write Checks window, choose the account from which you are making the payment.

- Document the details of the check:

- Pay to the Order of Choose the financial institution to which you are paying the interest or fees.

- Amount: Put the interest or fee amount.

- Expenses tab:

- Account: Choose an appropriate expense account.

- Amount: Put the interest or fee amount.

- Memo: Put a memo for reference (optional).

Step 3: Save the transaction

- Hit on Save & Close.

Process 5: Reconcile the Line of Credit Account in QuickBooks

To reconcile your Line of Credit account in QuickBooks Desktop, go to Banking, select “Reconcile,” choose the account, enter the statement date and balance, match transactions, and press “Reconcile Now.”

Following the step-by-step information below:

Step 1: Navigate to Banking

- From the main menu, press on Banking.

- Choose Reconcile.

Step 2: Reconcile the Account:

- In the Reconcile window, choose the line of credit account from the Account dropdown.

- Mention the statement date and ending balance from your line of credit statement.

- Press Continue.

- Match the transactions in QuickBooks with your statement.

- Press the Reconcile Now button once everything matches.

How to record a Line of Credit in QuickBooks Online?

To record a Line of Credit in QuickBooks Online, create a liability account under Chart of Accounts, then record deposits and payments accurately to manage the balance.

Process 1: Create a liability account

Create a liability account in QuickBooks, navigate to the Chart of Accounts, select “New,” choose “Other Current Liabilities,” enter the details and account name, and click “Save and Close.”

Following the step-by-step information below:

Step 1: Navigate to the Chart of Accounts

- Click on the Setting option on the screen.

- Choose the Chart of Accounts.

Step 2: Create a new account

- Click on the New from the Account type dropdown.

- Now, select the Other Current Liabilities option.

Step 3: Mention the details type and account name

- Click on the Detail type dropdown menu.

- Choose the detail type that best fits the transaction you want to track.

- Put the account name.

- Enter the description.

Note: Individuals/companies who use Line of Credit choose Loan Payable as the detailed type.

Step 4: Save the transaction

- Once you have entered all the required details, Click on Save and close

Process 2: Record the deposit

To record a deposit in QuickBooks, navigate to Banking, select “Make Deposits,” choose the account, enter the deposit details, and save the transaction.

Case 1: When your bank account is connected with QuickBooks Online

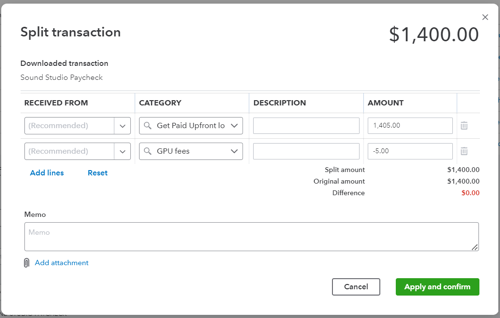

How to record a bank deposit in QuickBooks Online, navigate to Banking, find your bank account, enter the invoice amount and fees, ensure the net amount matches, then review and confirm.

Following the step-by-step information below:

Step 1: Navigate to the Bank account

- Click on the Banking option to locate the deposit.

- Find the bank account you use for a Line of Credit transaction.

- If you don’t find the bank account is not connected, enter the bank deposit information manually.

Step 2: Mention the invoice amount

- Choose the Split transaction option on the screen.

- Choose the liability account you have created for the Line of Credit transaction from the Category option.

- Put the original invoice amount.

Step 3: Mention the expense amount

- Choose the expense account used for Line of Credit fees.

- Put the fee amount as a negative number.

- Make sure that the deposit should be the same as the net amount deposited in the bank.

Step 4: Review the transaction

- Once you have entered all the required details, Click on Apply and confirm.

Case 2: When there is an intercepted payment

When a customer pays the invoice within the first 30 days, QuickBooks capital appies the payment to pay off your Line of Credit loan, which is known as intercepted payment.

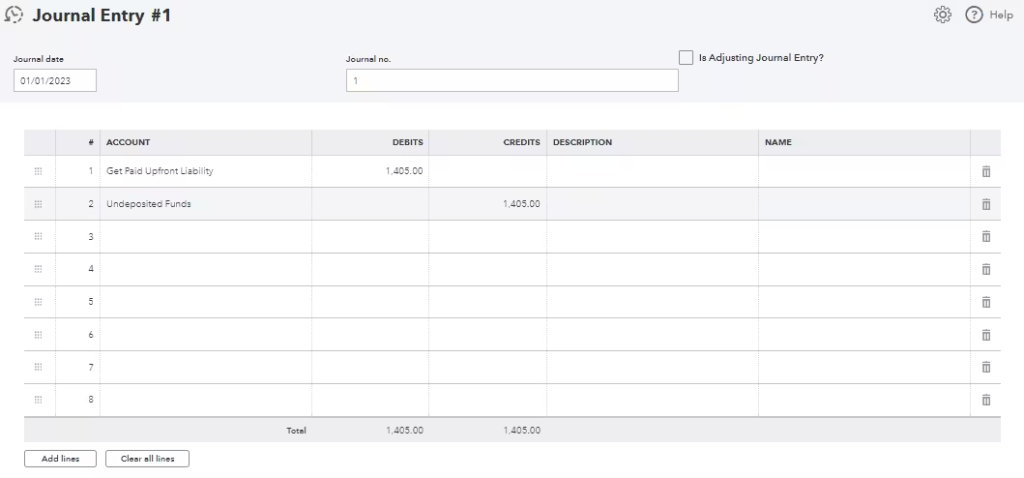

Step 1: Create a journal entry

- Click on the + New option on the screen.

- Choose the Journal entry.

Step 2: Select the liability account

- Choose the liability account ( which you have created to track the Line of Credit loans) under the Account drop down menu.

- Mention the full invoice amount received from the customer in the Debit column.

- Choose the Undeposited Funds option under the Account drop down menu.

- Mention the full invoice amount in the Credit column.

- Click on Save and Close button.

Note: Make sure that the journal entry should balance on both the debt and credit side.

Step 3: Locate the Bank deposit

- Click on the + New option on the screen.

- Choose the Bank deposit.

Step 4: Pick the bank account

- Click the Account dropdown menu on the screen.

- Choose the bank account.

Step 5: Enter the transaction details

- Put the date when the payment is received under the Date option.

- Locate the payment and check the box.

- Locate the journal entry for the same amount and check the box. The deposit should show $0.00.

Step 6: Save the transaction

- Once you have entered all the required details, Click on Save and Close.

Case 3: When a customer pays the invoice outside QuickBooks Online

To record an invoice payment made outside QuickBooks Online, log the payment as an expense, select your liability account, enter the amount, review details, and save the transaction.

Following the step-by-step information below:

Step 1: Record the invoice payment

In order to record the invoice payment, follow the steps mentioned under the heading “How to Record an Invoice in QuickBooks Online,” then proceed further.

Step 2: Locate to Expense

- Click on the + New option on the screen.

- Select the Expense option.

Step 3: Pick the liability account

- Click on the Category drop-down menu on the screen.

- Choose the liability account you have created for the Line of Credit transaction.

Step 4: Enter the transaction details

- Put the total payment under the Amount section.

- Make sure the payment matches the invoice amount to pay off the loan.

Step 5: Review the transaction

- Check the date and the bank account.

- Click on Save and Close.

Tips for Better Recording of Line of Credit in QuickBooks

Follow the tips below to better record your line of credit in QuickBooks:

- Categorize Properly: Make sure the line of credit is established as a liability account so that it is not confused with other accounts.

- Track Interest and Fees: Any interest paid on such securities or any fees paid on the securities should be recorded in specific expense accounts for better record-taking purposes.

- Reconcile Regularly: Compare the QuickBooks record with the bank statements in order to delete the difference.

- Use Clear Descriptions: To enhance tracking and auditing procedures, it is recommended that memos related to withdrawals, repayments, and other connected transactions be entered in a greater degree of detail.

- Consult a Professional: In case of doubt, consult an accountant to keep books of account business-like and avoid legal repercussions.

How to set up a line of credit in QuickBooks?

To set up a line of credit in QuickBooks:

- Go to Chart of Accounts

- Click Lists > Chart of Accounts

- Create a New Liability Account

- Click Account > New

- Select Other Current Liability (short-term) or Long Term Liability (long-term)

- Click Continue

- Enter Account Details

- Name the account (e.g., “Line of Credit – [Bank Name]”)

- Set the Opening Balance if needed

- Click Save & Close

how to categorize line of credit in QuickBooks?

In QuickBooks, categorize a line of credit as follows:

- Set Up the Line of Credit Account:

- Go to Lists > Chart of Accounts > New.

- Select Other Account Types > Credit Card (or Loan if you prefer).

- Name the account (e.g., “Bank Line of Credit”).

- Record Draws from the Line of Credit:

- Go to Banking > Write Checks (or Transfer Funds if moving money).

- Select the Line of Credit account as the source.

- Deposit the funds into the appropriate bank account.

- Record Payments to the Line of Credit:

- Go to Banking > Write Checks.

- Select your Bank Account as the source.

- Choose the Line of Credit account in the “Expenses” tab.

This ensures accurate tracking of your credit balance and payments.

How to Split a Transaction in QuickBooks Desktop for Line of Credit Usage

Splitting a transaction in QuickBooks Desktop allows you to allocate portions of a single transaction to different accounts, ensuring accurate financial tracking. If you’re using a line of credit, you can split a transaction to record both the borrowed amount and any related expenses.

Steps to Split a Transaction for Line of Credit Usage

- Locate the Transaction

- Go to Banking and open your bank register.

- Find the transaction you need to split.

- Select “Split Transaction”

- Click on the transaction to open it.

- Choose the “Split” option.

- Assign the Line of Credit Account

- In the Category field, select the liability account created for your line of credit.

- Enter the Split Amounts

- Input the portion of the transaction that represents the borrowed funds.

- If applicable, add another split line for fees or interest and categorize it as an expense.

- Review and Save

- Ensure the total split matches the original transaction amount.

- Click Apply to save the changes.

Key Tips for Accuracy

✔ Set Up a Dedicated Line of Credit Account – Ensure a liability account is created in the Chart of Accounts.

✔ Track Fees Separately – Record any interest or fees in a separate expense account.

✔ Verify Bank Feed Transactions – Check imported transactions to prevent duplicates or mismatches.

How to Reconcile a Line of Credit in QuickBooks Online & Desktop?

Reconciling your line of credit in QuickBooks ensures your financial records match your bank statements, helping you track payments, withdrawals, and interest accurately. Here’s how to do it for QuickBooks Online and QuickBooks Desktop:

Step 1: Gather Your Statements

Before reconciling, obtain your latest line of credit statement from your bank. Make sure it includes all transactions, balances, and interest charges for the period you are reconciling.

Step 2: Start the Reconciliation Process

For QuickBooks Online:

- Go to the Reconciliation Page

- Click Settings > Reconcile.

- Select your line of credit account from the dropdown.

- Enter Statement Details

- Input the ending balance and statement date from your bank statement.

- Match Transactions

- Compare each transaction in QuickBooks with your bank statement.

- Ensure payments, withdrawals, and interest charges are recorded correctly.

- Fix Discrepancies (If Any)

- If transactions are missing, manually enter them.

- Adjust any incorrect amounts if needed.

- Complete the Reconciliation

- If the difference is $0, click Finish Now to complete.

For QuickBooks Desktop:

- Go to Banking > Reconcile

- Choose your line of credit account.

- Enter the statement’s ending balance and date.

- Check off each transaction that matches your bank statement.

- If everything is correct, click Reconcile Now.

Step 3: Review and Save Reports

After reconciling, save or print a Reconciliation Report for your records. This helps track any errors and keeps your financials organized.

Best Practices for Reconciling a Line of Credit in QuickBooks

Reconciling your line of credit in QuickBooks is crucial to maintaining accurate financial records and ensuring your books are in balance. Here are some best practices to help make the process smoother:

- Create a Line of Credit Account: Before reconciling, make sure you’ve set up a liability account for your line of credit. This will help you accurately track your balance.

- Match Bank Transactions: Ensure that all transactions (deposits, withdrawals, and interest) from your line of credit are imported from your bank feed or entered manually. Make sure they match your bank statements.

- Record Interest and Fees Separately: Interest charges and fees on your line of credit should be recorded as expenses. This helps maintain clear financial statements and avoids confusion during reconciliation.

- Check for Errors: Double-check for missing or duplicate transactions that may disrupt the balance. Correct these before finalizing the reconciliation.

- Reconcile Regularly: It’s important to reconcile your line of credit on a regular basis to ensure that all payments and charges are properly recorded.

Generate Reports: Use QuickBooks reports to keep track of your line of credit balance, interest, and fees, helping you make informed decisions and stay on top of your finances.

Conclusion

Keep track of the line of credit using QuickBooks, make timely payments and stay updated on the fund utilization from the borrowed accounts. It is important to record the borrowed amount and any payments made toward a line of credit in QuickBooks to ensure that your financial statements are accurate. Businesses can easily clarify the Line of Credit as a liability and monitor interest costs accordingly.

Frequently Asked Questions:

Q1. What is the difference between a line of credit and a loan?

A line of credit is a type of credit in which the borrower has an open line of credit. He can use any amount of credit he wants at any given time, and the credit amount can be borrowed, repaid, and borrowed again, while a loan is a lump sum credit advanced at a particular period/or time to a borrower, with the agreement that the borrower will repay the loan with an agreed interest over a specific period of time.

Q2. How do I record a line of credit repayment in QuickBooks?

Repayments should be recorded as transfers from the bank account created for the line of credit to the liability account that was established for it. However, interest and fees should be recorded in separate expense accounts.

Q3. What personal expenses can I have using line credit?

A line of credit ought to be used for business-only expenses, as it is confusing to have personal and business funding in one account.

Q4. How often should I reconcile my line of credit in QuickBooks?

You should balance your line of credit at least every month to ensure QuickBooks matches your bank.

Q5. How to Reconcile a Line of Credit in QuickBooks Online?

Follow these steps to reconcile it with your bank statement:

Step 1: Open the Reconciliation Tool

- In QuickBooks Online, go to Settings (⚙️) > Reconcile.

- Choose the line of credit account you want to reconcile.

Step 2: Enter Statement Details

- Enter the statement ending balance and statement date from your financial statement.

- Click Start Reconciling.

Step 3: Match Transactions

- Compare transactions in QuickBooks with your statement.

- Check off transactions that match.

- If there are missing or incorrect entries, add, edit, or delete them as needed.

Step 4: Confirm the Difference

- The difference at the bottom should be $0.00.

- If there’s a discrepancy, double-check for missing transactions or incorrect amounts.

Step 5: Finish and Save

- Once everything matches, click Finish Now.

- QuickBooks will save the reconciliation, keeping your records accurate.

Q6. What Type of Account is a Line of Credit in QuickBooks?

In QuickBooks, a line of credit (LOC) is recorded as a liability account because it represents borrowed funds that need to be repaid. When setting up a line of credit in QuickBooks, it is typically categorized as a “Loan” or “Other Current Liability” if it is a short-term loan, or as a “Long-Term Liability” if the repayment extends beyond a year.

This categorization helps in accurately tracking borrowed amounts, repayments, interest charges, and available credit, ensuring proper financial reporting. Keeping the line of credit separate from income and expenses allows for better financial management and reconciliation.

Q7. How to Record Interest Charges on a Line of Credit in QuickBooks

Recording interest charges for your line of credit in QuickBooks is essential for accurate financial tracking. Here’s a simple way to do it:

- Create an Interest Expense Account

If you haven’t already, create an “Interest Expense” account under the Chart of Accounts. This will help you categorize and track interest charges separately from other expenses. - Record the Interest Charge

When your lender charges interest, create a journal entry to record it:- Debit the “Interest Expense” account for the amount of interest.

- Credit the liability account associated with your line of credit for the same amount.

- Paying the Interest

If you make a payment towards the interest:- Go to Banking > Write Checks or Pay Bills.

- Choose your line of credit liability account and enter the amount you’re paying for interest.

- Ensure that the payment is applied to the interest expense account.

- Reconcile Interest Payments

Ensure your interest payments are reconciled by comparing them with your bank statements. This keeps your financial records up-to-date.

By recording interest charges, you’ll have a clearer picture of your line of credit usage and ensure your books are accurate.

Q8. Common Mistakes to Avoid When Recording a Line of Credit in QuickBooks

Recording a line of credit in QuickBooks is essential for managing your business’s finances accurately, but common mistakes can lead to issues down the line. Here are some mistakes to watch out for:

- Incorrect Account Categorization

Always ensure the line of credit is set up as a liability account in QuickBooks. Incorrect categorization could mislead your financial reports and affect your balance sheet. - Mixing Personal and Business Expenses

Never use your business’s line of credit for personal expenses. This can create confusion in your records and lead to potential tax issues. Keep business and personal finances separate. - Failing to Record Interest and Fees Separately

It’s important to track interest and fees separately from the principal balance. Not doing so can skew your profit and loss reports and make it harder to track the true cost of using the line of credit. - Not Reconciling Regularly

Not reconciling your line of credit account regularly can result in mismatched balances, which might lead to inaccurate reports and missed payments. Reconcile frequently to ensure everything is up-to-date.

Neglecting Repayment Entries

If you forget to record repayments or payments, your balance will remain inflated, and your reports won’t reflect the actual amount owed. Ensure each repayment is recorded correctly.

Q9. How to Categorize Withdrawals from a Line of Credit in QuickBooks?

When using a line of credit (LOC) in QuickBooks, correctly categorizing withdrawals ensures accurate financial tracking. Since an LOC is a liability account, funds withdrawn should be recorded as borrowed money, not income.

Steps to Categorize Withdrawals in QuickBooks Desktop & Online:

- Go to Banking – Navigate to the Banking or Transactions menu.

- Find the Withdrawal – Locate the transaction in your bank feed or manually enter it.

- Select the Right Account – Choose the Line of Credit (Liability) Account to track the borrowed amount.

- Categorize the Transaction – Mark the withdrawal as a transfer or expense, depending on its use:

- If transferring to a bank account: Use “Transfer” and select the receiving account.

- If paying for an expense directly: Categorize it under the appropriate expense category (e.g., office supplies, rent).

- Save and Reconcile – Ensure transactions match your LOC statement during reconciliation.

Best Practices:

- Always review transactions to prevent misclassification.

- Avoid categorizing LOC withdrawals as income, as this can distort financial reports.

Set up automation rules in QuickBooks Online for recurring LOC withdrawals.

Q10. How to Categorize Repayments on a Line of Credit in QuickBooks?

Properly categorizing line of credit (LOC) repayments in QuickBooks helps maintain accurate financial records. Follow these simple steps:

1. Identify the Repayment Transaction

Locate the payment made toward your line of credit under your bank or credit card account in QuickBooks.

2. Categorize as a Liability Payment

Since a line of credit is a liability, categorize the repayment as a “Transfer to Line of Credit” or select the appropriate liability account you created for the LOC.

3. Record Interest Separately (If Applicable)

If your payment includes interest, split the transaction:

- Assign the principal amount to the LOC liability account.

- Assign the interest portion to an interest expense category.

4. Save and Reconcile

Once categorized, save the transaction and reconcile your LOC account regularly to ensure accuracy.

By following these steps, you can track your line of credit repayments efficiently, keeping your QuickBooks records accurate and up to date.

Disclaimer: The information outlined above for “How to Record a Line of Credit in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.