Recording handwritten checks in QuickBooks helps businesses, provide information for financial statements and tax returns, identify opportunities and trends, and support decision-making, such as pricing products and services.

The handwritten checks could be the checks issued to vendors or those that you may have forgotten to record. After recording the checks, you may need to manually clear them or reconcile the accounts to ensure clear and accurate accounting records.

What are Handwritten Checks in QuickBooks?

In QuickBooks, handwritten checks are physical checks issued manually, not printed through the system. You record these checks in QuickBooks to track payments and expenses accurately.

Unlike expenses that are compiled automatically by QuickBooks, these checks have to be input into QuickBooks to track financial transactions. The records will always be up to date and will make sure that Bank reconciliations will be easy and accurate, and expenses will always be grouped into the right category. This feature is more beneficial for businesses that handle digital as well as manual transactions in their business operations.

How to record handwritten checks in QuickBooks Desktop?

To record a handwritten check in QuickBooks Desktop, access the “Check” option, enter the check details, navigate to the ‘Pay to Order’ section, and then review and save.

Process 1: Access the “Check” option

How to access the “Check” option, go to ‘+New,’ click on the vendor’s section, and select ‘Check.’ Enter the check details, including the date, and ensure the ‘Print later’ box is unchecked.

Step: 1 Go to check

- Go to ‘+New.’

- Click on the vendor’s section and select ‘Check.’

Step 2: Enter check details

- Put the date when the check was issued.

- Ensure that the ‘Print later’ box is unchecked.

- Mention the check number.

Process 2:

Step 1: Navigate to the Pay to order section.

- Select the name of the company or person towards whom the check was made under the ‘Pay to Order’ section.

- Enter the amount of the check.

- Select the appropriate account from the account column.

Step 2: Review and save

- Mention any other necessary details on the page.

- Click on ‘Save’ to record the check in QuickBooks.

Note: You do not have to print the check because it has already been issued.

How to record handwritten checks in QuickBooks Online?

Record a handwritten check in QuickBooks Online, access the “Add Check” option, enter check details, and save. Then, mark the check as cleared in the register.

Process 1: Access the “Add check” option

Record a check in QuickBooks Online, go to ‘Accounting,’ select your bank account, and click ‘View Register.’ Enter the check details, including date, payee, and payment, then click ‘Save.’

Step 1: Go to check

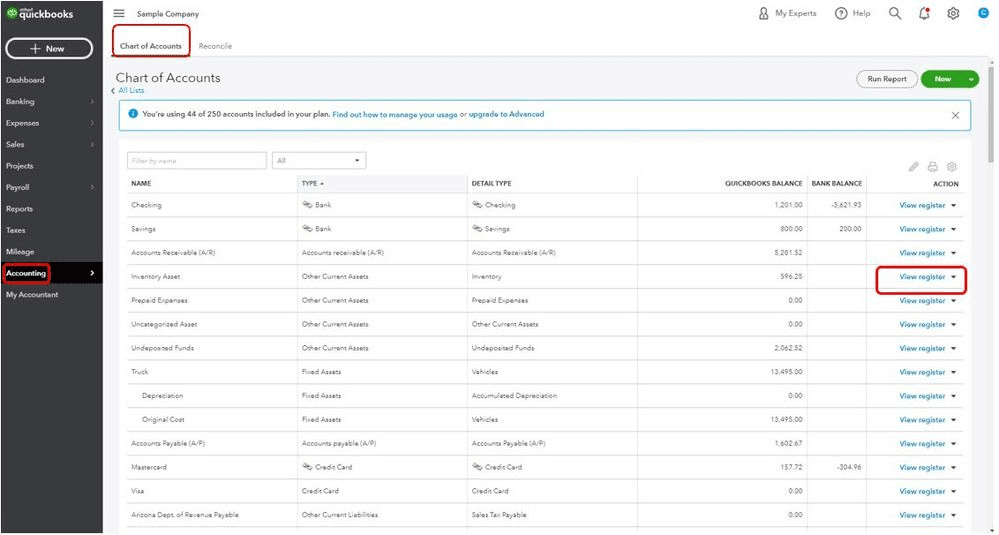

- Navigate to ‘Accounting’ from the left navigation menu.

- Find the bank account related to the check and click on ‘View Register.’

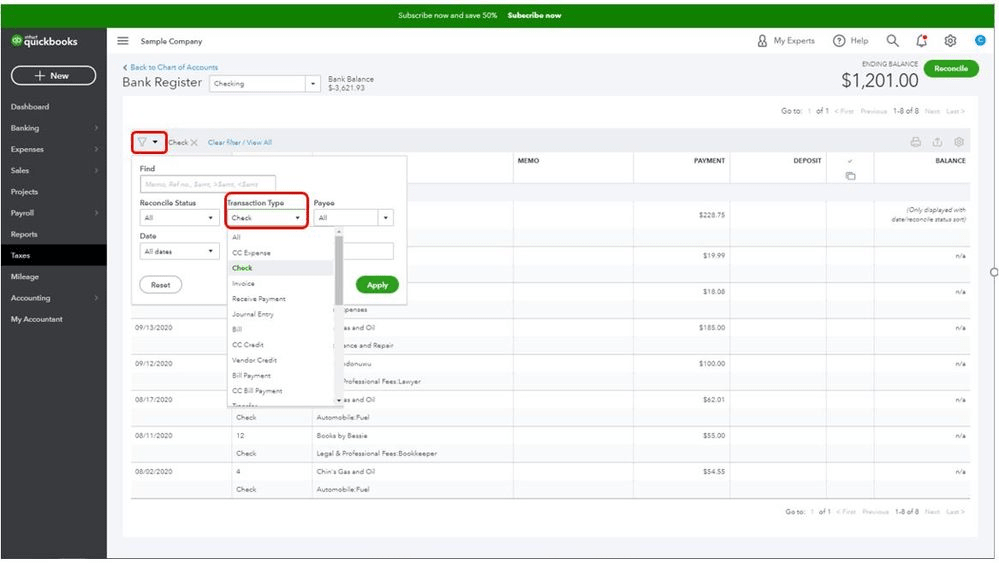

- In the date column, go to ‘Add check.’

Step 2: Mention check details

- Enter precise check details.

- Fill in all the required fields with accurate information, including date, account, reference number, payee, memo, and payment.

Step 3: Save the transaction

- Click on ‘Save’ to successfully finish recording the check in QuickBooks Online.

Process 2: Mark checks as cleared

Every time the check is cleared, you must first go to the register and mark the check as cleared. To mark checks as cleared, go to ‘Accounting,’ select ‘View Register,’ and click on the check to open details. Change the status to ‘C,’ then click ‘Save.’

Step 1: Open check details

- Go to ‘Accounting’ and select ‘View Register’ from under your bank account.

- Click on the check. [ This will automatically open the check details. ]

Step 2: Change the check status

- In the status column, click on the blank field and it will automatically be marked by a ‘C.’

- Click on ‘Save’ to clear the transaction.

Conclusion

Properly recording handwritten checks helps small businesses manage their finances more effectively, ensuring accuracy and transparency in financial statements. This method allows effective management and informed decisions based on accurate financial data.

Frequently Asked Questions

Does QuickBooks have check writing?

Yes, with QuickBooks, you can write checks from a particular account. Click on Banking in your QuickBooks menu > Write Checks, choose your account, enter the necessary information, and, if necessary, go to Print Check.

How Do I Record a Check in QuickBooks That Is Already Written?

Go to Banking > Use Register, choose the bank account and fill in the handwritten check information such as the check number, payee, amount, and expense account.

Can I manually enter a handwritten check?

This is an important advantage; as such, handwritten checks can be manually entered into QuickBooks. Another option is to open the bank register, click on the Add Check link, and complete several fields to track everything properly.

Does QuickBooks do paper checks?

Indeed, QuickBooks enables users to print paper checks. These compatible checks can be ordered for online purchase by entering the details in QuickBooks and printing them through an Inkjet Printer.

Disclaimer: The information outlined above for “How to Record Handwritten Checks in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.