Recording and managing grants accurately in QuickBooks is essential for nonprofit organizations to ensure financial compliance, accountability to donors, and long term sustainability. This resource provides expert, step by step instructions for setting up and tracking grant income and expenditures in both QuickBooks Desktop and QuickBooks Online. The core methodology involves using dedicated income accounts alongside specialized tracking features, primarily Class Tracking, to segregate restricted funds and link specific expenses back to the correct grant source. Proper setup supports the generation of necessary financial reports, such as the Profit & Loss by Class, which demonstrates effective fund utilization and compliance with donor terms. Furthermore, the guide addresses crucial accounting nuances, including the proper recording of quarterly grant installments versus the full amount (following the cash basis principle), the correct allocation of indirect overhead costs using journal entries, and essential monthly reconciliation practices to prevent errors and ensure audit readiness.

Key facts and solutions for effective grant management in QuickBooks:

- Class Tracking is the validated, preferred method for nonprofits to allocate income and expenses line by line, allowing a single transaction to be split across multiple grants or unrestricted funds for precise reporting.

- Grant income should be recorded only upon receipt of funds (following the cash basis principle) usually as a Bank Deposit against a dedicated Grant Income account, not as the full promised amount upfront.

- Monthly Reconciliation of grant related bank and balance sheet accounts is the minimum requirement for maintaining strong internal controls, catching misclassified expenses, and ensuring audit compliance.

- Indirect Costs (Overhead) must be allocated to grants using a Journal Entry to debit the Grant Class and credit the general overhead expense account, ensuring the full cost of the program is reflected in grant reports.

- Grant Refunds in QuickBooks Online must be processed using a Refund Receipt or a Journal Entry to correctly reduce both the bank balance and the Grant Income account, as a negative deposit is not supported.

- Temporary deficits (expenses exceeding income) in a restricted fund are not always violations but require immediate documentation, often by recording a Grant Receivable or confirming the temporary use of unrestricted funds.

What Is a Grant?

A grant is a financial contribution provided to non profit organizations for particular projects or programs. Accounting for grants is important in managing the funds and ensuring compliance with financial standards.

Proper grant management not only ensures that the funds received are put to the right use, but it also strengthens the organization’s accountability and credibility with donors, grant providers, and the public. This level of transparency fosters trust and demonstrates that the nonprofit is utilizing its resources effectively and in alignment with the terms of the grant.

Nonprofit accounting, which involves detailed tracking and allocation of grant funds, is crucial in maximizing the positive impact of the grants. By accurately managing these funds, nonprofits can sustain their operations, advance their mission, and deliver long-term benefits to the communities they serve.

Furthermore, successful grant management supports the organization’s financial sustainability, enabling it to secure future funding and continue delivering on its objectives.

Why Is It Important to Record Grants in QuickBooks?

Recording grants in QuickBooks is essential for keeping accurate financial records and ensuring that grant funds are used correctly for specific programs. By properly tracking your grants, you can maintain compliance with fund regulations, provide clear reports to stakeholders, and ensure full accountability for how funds are spent.

QuickBooks offers integrated grant management tools that make it easy to track disbursements, allocate budgets, and monitor expenses. For example, you can use class tracking to categorize grant-related income and expenses, or set up specific fund tracking categories to keep an eye on how each grant is being used.

Effective grant tracking isn’t just about compliance—it also helps you manage your organization more efficiently. With QuickBooks, you can generate reports that show where funds are going, identify potential cost-saving opportunities, and make sure resources are allocated where they’re needed most.

How to Set Up a Grant in QuickBooks?

The grant management system helps you organize your grant income and expenditures in the correct way and ensure compliance with all the required standards.

The following steps should be followed to setup a grant in QuickBooks:

- Establish an income account under the name “Grant Income” under the Charts of Accounts.

- In Sales —> Customers, include the grant provider as a customer.

- Allow class tracking under Tools —> Options —> General (Optional).

- Keep record of grant transactions employing the account referred to as “Grant Income.”

How To Record a Grant in QuickBooks Desktop?

You can record the grant as a deposit to your business account. Simultaneously, you can create a profile of the agency where the funds have appeared and the account to categorize the grant.

Follow the steps mentioned below:

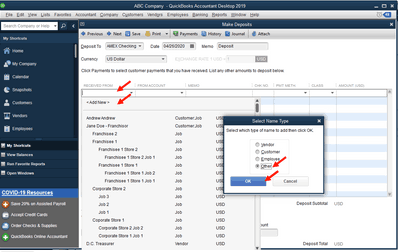

Step 1: Navigate to Make Deposit

- First, go to Banking, then select the Make Deposit option.

Step 2: Select the Account

- Now, from the Deposit To field, select the account where the money goes in.

Step 3: Click the Add New option

Tap on the RECEIVED FROM menu and select the Add New option.

- Choose the Other name type and click OK.

- Then, enter the name of the organization that gave you the grant and hit OK. For Example: US Government / SBA.

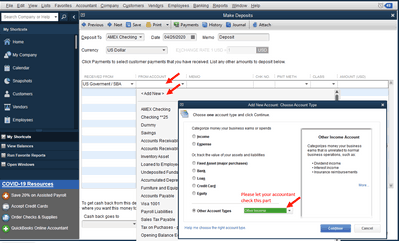

Step 4: Select the FROM ACCOUNT

Click on the FROM ACCOUNT menu, then click on the Add New option.

- Now, choose Other Income from the Other Account Types drop-down menu.

- Then, choose the Continue option and name it something like COVID-19 Grant Income.

- Tap on the Save & Close option.

Step 5: Save the Changes

After this, enter a memo and the amount and click the Save & Close option.

Although this deposit will appear under Other Income, it will be located in the Income section on your Profit and Loss report, thus lessening the total of your expenses. You may stop there.

If you want to decrease/reduce the total amount of the specific expense account in relation to the use of this grant, you can do so through journal entry. However, I advise you to consult your accountant on the specific accounts to use when preparing the report.

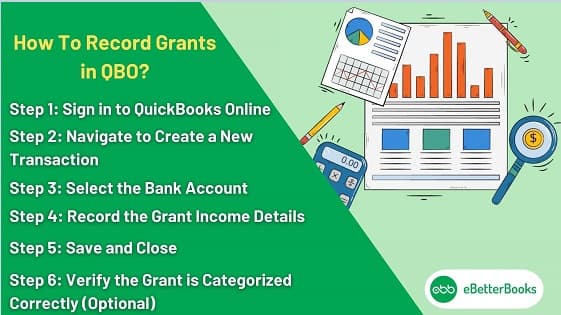

How To Record Grants in QuickBooks Online (QBO)?

Recording the grants in QuickBooks Online is very crucial to make sure that the funds are accurately tracked and accounted for. This process will help keep the correct records of your finances and make sure that you are able to report the grant on your taxes correctly.

Follow the steps mentioned below to record a grant in QBO:

Step 1: Sign in to QuickBooks Online

- Open your web browser and go to https://quickbooks.intuit.com.

- Click on the “Sign In” button in the top-right corner of the homepage.

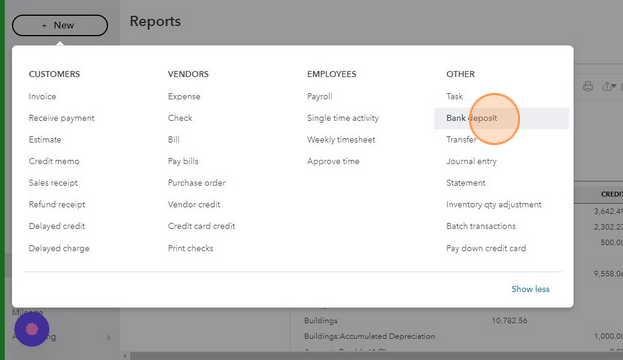

Step 2: Navigate to Create a New Transaction

- In your QuickBooks dashboard, locate the “+New” button on the left-hand menu or top menu bar.

- Click the “+New” button to open the drop-down menu.

- From the drop-down options, select “Bank Deposit” under the “Other” category. This will take you to the bank deposit form.

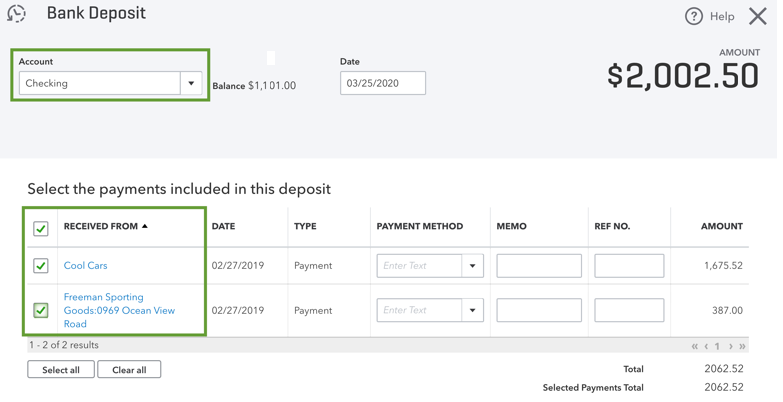

Step 3: Select the Bank Account

- At the top of the bank deposit form, find the “Account” drop-down field.

- Click on the drop-down menu and select the bank account where the grant funds were deposited.

- Ensure that this account matches where the grant income was physically deposited in your real bank.

Step 4: Record the Grant Income Details

- Scroll down to the “Add funds to this deposit” section, where you will enter the details of the grant income.

- Under the “Received From” column, enter the name of the organization or entity that awarded the grant.

- In the “Account” column, select the appropriate account for categorizing the grant income.

- You might want to use an account such as “Other Income” or create a specific “Grant Income” account depending on how you prefer to track it.

- In the “Payment Method” column, you can select the method by which the grant was received (e.g., ACH, check, etc.).

- Enter the amount of the grant received in the appropriate column.

- Optionally, add a memo to describe the grant for future reference.

- Review the total deposit at the bottom of the form to ensure accuracy.

Step 5: Save and Close

- Once all the details are entered and you’ve confirmed everything is correct, click the “Save and Close” button at the bottom-right of the form.

- Alternatively, if you plan to add more transactions, click “Save and New” to enter another deposit.

Step 6: Verify the Grant is Categorized Correctly (Optional)

- After saving, you may want to verify that the deposit has been categorized as Other Income or under your preferred income category.

How to Categorize a Grant in QuickBooks?

To categorize a grant in QuickBooks, follow these steps:

- Create an Income Account (if needed):

- Go to Chart of Accounts (

Settings>Chart of Accounts). - Click New and select Income as the account type.

- Name it (e.g., “Grant Income”) and save.

- Go to Chart of Accounts (

- Record the Grant:

- Go to + New > Bank Deposit (or Invoice/Sales Receipt if applicable).

- Select the Bank Account where the grant was deposited.

- Enter the Received From field with the grant provider’s name.

- Choose Grant Income (or the relevant income account).

- Input the amount, date, and details.

- Click Save and Close.

If the grant has restrictions or is for specific expenses, consider using classes or projects to track its use properly.

How to use classes or projects and link the grant to the appropriate account for better tracking and reporting.

Steps to Categorize a Grant

- Go to Products and Services.

- Click New and select Service or Expense.

- Link the item to the appropriate account.

- Create a class or project for tracking.

- Save the item.

Using Classes for Grant Tracking

- Classes are hierarchical, allowing parent and sub-classes.

- Create a class for each grant and sub-classes for budget line items.

- Financial reports can be organized like pivot tables for better insights.

- Assign income and expenses to specific classes for clear tracking.

Additional Grant Tracking Tips

- Use a designator (e.g., “R” for restricted, “U” for unrestricted) in the grant name.

- Create sub-donors under the grantor’s name for different grants.

- Enable “Track expenses by donor” in Account and Settings for better organization.

Understanding the Different Types of Grants and Their Accounting Practices

In QuickBooks, there are different types of grants you can track and manage:

- Government Grants: Financial aid provided by local, state, or federal government agencies for various purposes, like business development, training, or public welfare.

- Private Grants: Funding from private organizations, foundations, or individuals, often for specific causes or projects that align with their mission.

- Research Grants: Grants specifically for conducting research in areas like science, technology, or healthcare, usually offered by institutions, government agencies, or nonprofits.

- Project Grants: Funding for specific projects or initiatives. This can come from various sources, including government, private, or nonprofit organizations.

QuickBooks helps you track and manage these grants, ensuring you stay organized for accounting, reporting, and compliance purposes.

How to Generate Reports for Grant Tracking in QuickBooks?

To generate reports for grant tracking in QuickBooks, follow these steps:

Step 1: Set Up Grant Tracking in QuickBooks

Before generating reports, ensure that grants are properly tracked using Classes or Customers/Jobs.

Option 1: Track Grants Using Classes

- Enable Class Tracking:

- Go to Edit > Preferences.

- Select Accounting > Company Preferences tab.

- Check Use class tracking > Click OK.

- Create a Class for Each Grant:

- Go to Lists > Class List.

- Click Class > New.

- Enter the grant name (e.g., “Grant A”).

- Click OK.

- Assign Classes to Transactions:

- When entering income or expenses, select the corresponding Class for the grant.

Option 2: Track Grants Using Customers/Jobs

- Go to Customers & Jobs:

- Click Customers > Customer Center.

- Create a New Customer for Each Grant:

- Click New Customer & Job > New Customer.

- Name it after the grant (e.g., “Grant A”).

- Assign Transactions to the Customer/Job:

- When recording income or expenses, select the grant (Customer/Job) in the transaction.

Step 2: Generate Grant Tracking Reports

Now that grants are set up, run reports to track income and expenses.

Option 1: Profit & Loss by Class (For Class Tracking Users)

- Go to Reports:

- Click Reports > Company & Financial.

- Select Profit & Loss by Class:

- Click Profit & Loss by Class.

- Customize Report for Specific Grant:

- Click Customize Report.

- Go to the Filters tab.

- Under Class, select the grant name.

- Click OK.

- Review & Export:

- The report will display income and expenses by grant.

- Click Excel or Print if needed.

Option 2: Profit & Loss by Customer/Job (For Customer/Job Tracking Users)

- Go to Reports:

- Click Reports > Company & Financial.

- Select Profit & Loss by Job:

- Click Profit & Loss by Job.

- Filter for a Specific Grant:

- Click Customize Report.

- Go to Filters > Select Name.

- Choose the specific Grant (Customer/Job).

- Click OK.

- Export or Print:

- Click Excel or Print for sharing.

What Are the Common Mistakes to Avoid When Recording Grants in QuickBooks?

When you’re recording grants in QuickBooks, it is important to avoid some very common mistakes for accurate financial tracking and reporting. Whether you’re using QuickBooks Desktop or QuickBooks Online, there are common mistakes to avoid to maintain compliance and ensure proper grant management:

Below are a few points that you should consider while recording Grants:

Common Mistakes to Avoid in QuickBooks Desktop:

- Not Setting Up a Dedicated Grant Fund Account: In QuickBooks Desktop, not setting up a dedicated grant fund account is considered a mistake. This will affect fund management, financial controls, and efficient fund reconciliation processes for grants-related transactions.

Best Practice:

Set up a separate fund account to track all grant-related income and expenses. This allows you to create clear financial reports and ensures compliance with grant requirements.

- Improper Expense Tracking : Failing to track grant-related expenses accurately in QuickBooks Desktop can cause discrepancies, leading to problems in financial reporting. You need to allocate each expense properly to avoid overspending or misallocation, which can jeopardize the grant. Other than control through tracking, detailed financial reporting is needed to ensure the members are aware of the association’s financial position. Some of these processes employ grant management software or grant tracking systems to enable the provision of appropriate and proper financial control of the grant and tracking of the grant expenses.

Best Practice:

Create detailed classes or customer jobs in QuickBooks Desktop to monitor expenses by grant. This ensures that all expenditures are aligned with the grant’s budget and requirements.

- Not Reconciling Grant Accounts Regularly : If you don’t reconcile the grant accounts regularly with QuickBooks, it will lead to discrepancies in fund reconciliation. Without reconciliation, there can be discrepancies between actual and reported figures, leading to potential audit issues and noncompliance with grant terms.

Best Practice:

Set a monthly schedule to reconcile grant accounts. Regular reconciliations help you catch errors early and ensure accurate fund tracking and reporting.

- Failing to Allocate Indirect Costs : If you forget to allocate overhead or indirect costs in QuickBooks Desktop, your financial statements may reflect incomplete project costs, leading to budget shortfalls and compliance issues.

Best Practice:

Use the allocation feature to apply indirect costs to the appropriate grant fund, ensuring that all project-related expenses are accounted for.

Common Mistakes to Avoid When Recoding Grants in QuickBooks Online:

- Not Setting Up a Separate Income and Expense Account for Each Grant: Unlike QuickBooks Desktop, QuickBooks Online may not have built-in features for fund accounting, so it’s crucial to create separate income and expense accounts for each grant. Failing to do this will lead to a lack of clarity in tracking how the grant funds are spent.

Best Practice:

Create a specific income account and an expense account for each grant you manage. This will allow for better tracking and reporting in QuickBooks Online.

- Improper Categorization of Transactions : In QuickBooks Online, miscategorising transactions related to grants can result in inaccurate financial reports. It’s easy to overlook the proper assignment of transactions when dealing with multiple funding sources.

Best Practice:

Set up clear categories for grant income and expenses in QuickBooks Online. Use tags or classes to distinguish between different grants and ensure accurate reporting for each.

- Neglecting to Reconcile Accounts Regularly : Just as in QuickBooks Desktop, not reconciling grant-related accounts regularly can create reporting errors in QuickBooks Online. Inconsistent reconciliation can result in compliance issues and difficulties when reporting to funders.

Best Practice:

Schedule monthly reconciliations in QuickBooks Online. This ensures that your financial records reflect the actual status of your grant funding and that no discrepancies go unnoticed.

- Not Utilizing Grant Tracking Features: While QuickBooks Online has fewer fund accounting features compared to Desktop, it does offer tools like “Tags” and “Projects” to help track grants. Failing to use these features can make it difficult to allocate and track expenses accurately.

Best Practice:

Utilize the “Projects” feature in QuickBooks Online to manage grants. This tool allows you to track income, expenses, and profitability by project (or grant) and provides a clear overview of how funds are being utilized.

Recording grants in QuickBooks is very important for maintaining accurate financial records, successfully managing grant funds, and tracking the utilization of grants for particular programs or initiatives.

Best Practices for Effectively Recording Grants in QuickBooks

Here are some best practices for recording grants in QuickBooks:

- Create Dedicated Accounts: Within the income account, it should be possible to establish sub-accounts, particularly for grants, with the aim of differentiating them from other sources of income.

- Track Restrictions: Use classes or sub-accounts to separate the restricted and unrestricted funds.

- Record Transactions Accurately: Check the form to see if grant receipts have been recorded under the correct income account for proper book recording.

- Link Expenses to Grant: Expenses should be capitalized and linked to the grant so as to know how the funds is being used.

- Use Memorized Transactions: For recurring grants, create memorized transactions to ensure their effectiveness in the future.

- Maintain Detailed Records: Enter memos and include supporting documents as additional records to a certain transaction for quick retrieval during an audit.

- Regularly Reconcile Accounts: Ensure that records of grants-related accounts tally with the bank statements to avoid mistakes.

How to handle restricted vs. unrestricted grants in QuickBooks?

- Restricted Grants: These grants come with specific conditions or purposes outlined by the donor. To handle them:

- Ensure the funds are used only for the specified purpose.

- Keep detailed records and receipts of expenses.

- Regularly report back to the donor on how the funds are being used.

- Unrestricted Grants: These grants provide flexibility in how the funds are spent. To handle them:

- Use the funds for general operational costs or any area of need.

- Track spending to ensure it aligns with your organization’s goals.

- Report back to the donor on overall usage and outcomes.

In both cases, maintain clear documentation and transparency to ensure compliance with donor expectations.

How to Record a grant refund in QuickBooks Online and Desktop?

To record a grant refund in QuickBooks, follow these steps:

For QuickBooks Online (QBO):

Step 1: Navigate to the Bank Deposit Screen

- Log in to QuickBooks Online.

- Click the + New button in the left menu.

- Select Bank Deposit under the “Vendors” section.

Step 2: Enter Deposit Details

- Bank Account: Select the bank account where you received the refund.

- Received From: Choose the grant provider (or create a new vendor if it doesn’t exist).

- Account: Choose the original income account used when the grant was recorded.

- Payment Method: Select the method (Check, ACH, Wire, etc.).

- Amount: Enter the exact refund amount.

- Memo: Optionally, add a note about the refund for reference.

Step 3: Save the Deposit

- Click Save and Close or Save and New to record the refund.

For QuickBooks Desktop (QBD):

Step 1: Open the Make Deposits Window

- Open QuickBooks Desktop and go to the Banking menu.

- Click Make Deposits from the dropdown.

Step 2: Enter Deposit Information

- In the Received From column, choose the grant provider.

- Under From Account, select the same income account used when the grant was first recorded.

- Amount: Enter the refund amount.

- Payment Method: Select how the refund was received (Check, ACH, etc.).

- Date: Ensure the deposit date matches when you received the refund.

- Memo: Optionally, add details for future reference.

Step 3: Save and Close

- Click Save & Close to finalize the transaction.

How to Track Grant Expenses with QuickBooks Classes?

Tracking grant expenses in QuickBooks is essential for accurate financial reporting, especially for nonprofits managing multiple grants. Utilizing the Class Tracking feature allows you to categorize and monitor each grant’s income and expenses effectively. Here’s a step-by-step guide for both QuickBooks Online (QBO) and QuickBooks Desktop (QBD) users:

For QuickBooks Online (QBO)

Step 1: Enable Class Tracking

- Click the Gear icon (⚙) in the upper-right corner.

- Select Account and Settings > Advanced.

- Find the Categories section and click Edit (✏️).

- Turn on Track Classes and choose:

- One to each row in a transaction (if expenses have multiple grant categories).

- One per transaction (if each transaction belongs to only one grant).

- Click Save, then Done.

Step 2: Create Grant-Specific Classes

- Click the Gear icon > Lists > All Lists.

- Select Classes > New.

- Name the class based on the grant (e.g., “Grant – ABC Foundation”).

- Click Save.

- Repeat for each grant you want to track.

Step 3: Categorize Grant Expenses by Class

- When entering expenses, bills, or checks:

- Go to + New > Expense (or Bill/Check).

- Enter payee, account, and amount.

- In the Class column, select the appropriate grant.

- Click Save and Close.

Step 4: Generate Grant Reports

- Go to Reports in the left menu.

- Search for Profit and Loss by Class or Transaction List by Class.

- Customize the date range and filter by class (grant).

- Click Run Report to analyze expenses per grant.

For QuickBooks Desktop (QBD)

Step 1: Enable Class Tracking

- Go to Edit > Preferences in QuickBooks Desktop.

- Select Accounting > Company Preferences.

- Check Use class tracking for transactions.

- Click OK.

Step 2: Set Up Grant-Specific Classes

- Click Lists > Class List.

- Click Class > New.

- Enter the grant name as the class.

- Click OK and repeat for other grants.

Step 3: Assign Expenses to Classes

- When entering transactions (checks, bills, expenses):

- Select the Account and enter details.

- In the Class column, select the grant.

- Click Save & Close.

Step 4: Generate Class-Based Reports

- Click Reports > Company & Financial.

- Choose Profit & Loss by Class or Transaction Detail by Class.

- Set the date range and filter by class.

- Click Refresh to see categorized expenses.

How to Record Grant Revenue in QuickBooks for Nonprofits?

Recording grant revenue accurately in QuickBooks is essential for nonprofits to ensure proper financial tracking and compliance. Below is a detailed, step-by-step guide for both QuickBooks Online (QBO) and QuickBooks Desktop (QBD) users.

For QuickBooks Online (QBO):

Step 1: Enable Donor Tracking

- Access Account and Settings:

- Log in to QuickBooks Online.

- Click on the Gear icon (⚙️) in the upper right corner.

- Under “Your Company,” select “Account and Settings.”

- Activate Donor Tracking:

- In the left-hand menu, click on “Expenses.”

- Locate the “Track expenses and items by donor” option.

- Toggle it to “On.”

- Click “Save,” then “Done.”

Step 2: Set Up the Grantor as a Donor

- Navigate to Donors:

- From the left navigation pane, go to “Sales” > “Donors.”

- Create a New Donor:

- Click the “New Donor” button in the upper right corner.

- Fill in the grantor’s details, such as name and contact information.

- Click “Save.”

Step 3: Record the Grant Income

- Create a Sales Receipt:

- Click the + New button on the left.

- Under the “Customers” section, select “Sales Receipt.”

- Enter Grant Details:

- Donor: Select the grantor from the drop-down menu.

- Date: Enter the date the grant funds were received.

- Payment Method: Choose the appropriate method (e.g., Check, Bank Transfer).

- Deposit To: Select the bank account where the funds were deposited.

- Product/Service: If you have a predefined item for grants, select it. If not:

- Click “Add New.”

- Name it “Grant Income.”

- Under “Income Account,” select “Grants” or create a new income account specifically for grants.

- Amount: Input the grant amount received.

- Class/Location: If your organization uses classes or locations for tracking, assign the appropriate category.

- Save the Transaction:

- After verifying all details, click “Save and Close” or “Save and New” to record the transaction.

Step 4: Track Expenses Related to the Grant

- Assign Expenses to the Grantor:

- When entering expenses (e.g., Bills, Checks, Expenses), ensure the Donor field is populated with the grantor’s name. This links the expense to the specific grant, facilitating accurate tracking.

Step 5: Generate Grant Reports

- Run Statement of Activity by Donor:

- Navigate to “Reports.”

- In the search bar, type “Statement of Activity by Donor” (or “Profit and Loss by Customer” if not configured for nonprofits).

- Select the report and set the desired date range.

- Click “Run Report.”

- Review the Report:

- This report will display all income and expenses associated with each donor, aiding in monitoring grant fund utilization.

For QuickBooks Desktop (QBD):

Step 1: Set Up the Grantor as a Customer

- Navigate to Customer Center:

- Open QuickBooks Desktop.

- Go to “Customers” > “Customer Center.”

- Create a New Customer:

- Click “New Customer & Job” > “New Customer.”

- Enter the grantor’s information, including name and contact details.

- Click “OK.”

Step 2: Create an Income Account for Grants

- Access Chart of Accounts:

- Go to “Lists” > “Chart of Accounts.”

- Add a New Account:

- Right-click anywhere in the list and select “New.”

- Choose “Income” as the account type.

- Name the account “Grant Income” or a similar descriptor.

- Click “Save & Close.”

Step 3: Record the Grant Funds Received

- Make a Deposit:

- Navigate to “Banking” > “Make Deposits.”

- If prompted by the “Payments to Deposit” window, click “OK.”

- Enter Deposit Details:

- Deposit To: Select the bank account where the grant funds were deposited.

- Date: Enter the deposit date.

- Received From: Choose the grantor’s name.

- From Account: Select “Grant Income” (the income account created earlier).

How to Record Government Sector Grants in QuickBooks?

Recording government grants accurately in QuickBooks is essential for maintaining precise financial records and ensuring compliance with accounting standards. Below is a detailed, step-by-step guide tailored for both QuickBooks Online and QuickBooks Desktop users.

For QuickBooks Online Users:

- Create an Income Account for the Grant:

- Navigate to the Accounting menu and select Chart of Accounts.

- Click on New to create a new account.

- In the Account Type dropdown, select Other Income.

- For Detail Type, choose Other Miscellaneous Income.

- Name the account appropriately, such as “Government Grant Income”.

- Save the new account.

- Record the Grant Deposit:

- Click on the + New button and select Bank Deposit.

- In the Account dropdown, choose the bank account where the grant funds were deposited.

- In the Add funds to this deposit section:

- Enter the grant provider’s name in the Received From field.

- Select the “Government Grant Income” account created earlier in the Account field.

- Enter the amount received.

- Save the transaction.

- Track Grant Expenses:

- When recording expenses paid using the grant funds, ensure each expense transaction is categorized appropriately.

- Utilize the Class or Location feature to tag expenses related to the grant for detailed tracking and reporting.

For QuickBooks Desktop Users:

- Set Up an Income Account for the Grant:

- Go to the Lists menu and select Chart of Accounts.

- Right-click anywhere in the list and choose New.

- Select Income as the account type.

- Name the account, for example, “Government Grant Income”.

- Click Save & Close.

- Record the Grant Funds Received:

- Navigate to the Banking menu and select Make Deposits.

- If prompted, choose the bank account where the funds were deposited.

- In the Received From column, enter the grant provider’s name.

- In the From Account column, select the “Government Grant Income” account.

- Enter the amount of the grant.

- Save the deposit.

- Monitor Grant Expenditures:

- When entering expenses paid with grant funds, assign them to the appropriate expense accounts.

- Consider using the Customer:Job feature to create a job for the grant, allowing for detailed tracking of all related income and expenses.

Important Considerations:

- Tax Implications: Consult with a tax professional to determine whether the grant received is taxable income and to ensure compliance with all relevant tax laws.

- Documentation: Maintain thorough records of all grant-related transactions, including award letters, grant agreements, and receipts for expenses paid with grant funds.

- Reporting: Utilize QuickBooks’ reporting features to generate reports that detail grant income and expenses, aiding in transparency and compliance with grantor requirements.

By following these steps, you can effectively record and manage government grants in QuickBooks, ensuring accurate financial tracking and compliance with accounting standards.

How do grants impact taxes and QuickBooks tax reporting?

Here’s a detailed, step-by-step guide to understanding and managing grants within QuickBooks:

1. Understand How Grants Impact Taxes

Grants are usually considered taxable income unless otherwise specified. Make sure to consult a tax professional to confirm the taxability of each grant received.

2. Set Up Accounts in QuickBooks

- Income Account: Create an “Other Income” account to track grant income.

- Liability Account: If the grant is repayable, create a liability account to track the obligation.

3. Record Grant Funds in QuickBooks

- For Non-Repayable Grants:

- Go to Banking > Make Deposits.

- Select the grantor and the “Other Income” account.

- Enter the amount and save the transaction.

- For Repayable Grants:

- Go to Banking > Make Deposits.

- Select the grantor and the liability account.

- Enter the amount and save.

4. Track Expenses

- Use Classes or Projects in QuickBooks to categorize expenses related to each grant. This makes tracking easier and ensures proper allocation of funds.

5. Monitor Grant Activity

Regularly review the following reports in QuickBooks to stay on top of grant management:

- Profit and Loss by Class or Project to see income and expenses linked to each grant.

- Balance Sheet to monitor any liabilities for repayable grants.

6. Tax Reporting

- Confirm taxable grant income is included in your gross income.

- Keep track of any expenses funded by grants for possible deductions.

7. Stay Compliant

Adhere to grant-specific conditions, such as reporting requirements or spending restrictions, to avoid penalties.

By following these steps, you’ll be able to efficiently manage grants and ensure accurate tax reporting in QuickBooks. Always consult a tax professional for specific advice.

FAQs!

Q1. How do I properly account for an expenditure split between a Restricted Grant and Unrestricted Funds in QuickBooks?

Accounting for split expenses is crucial for maintaining compliance with donor restrictions. The validated method involves utilizing Class Tracking to separate the expense at the transaction level.

- Enable Classes: Turn on Class Tracking in your QuickBooks settings (Gear Icon > Account and Settings > Advanced > Categories).

- Use Classes for Funds: Create a dedicated Class for each major restricted grant (e.g., Restricted – Youth Program Fund) and one for Unrestricted activities.

- Split the Expense: When entering a bill, check, or expense, enter the total cost, but use the detail lines (or split lines) to allocate the amount:

- Allocate the grant portion to the corresponding Grant Class.

- Allocate the remaining portion covered by general operating budget to the Unrestricted Class.

This approach allows you to run a Profit & Loss by Class report, which accurately shows the inflows and outflows specific to each fund, ensuring correct reporting for donors.

Q2. If a grant is provided in quarterly installments, should I record the entire grant amount or just the installment received in QuickBooks?

You should only record the installment amount you have actually received as income or a deposit.

- Cash Basis Principle: If your organization operates on a cash basis (the standard for many small nonprofits), revenue is recognized only when cash changes hands. Recording the full grant upfront violates this principle.

- Best Practice: Record each quarterly payment as a separate Bank Deposit (or Sales Receipt) when the cash is deposited into your bank account. Use a designated Grant Income account for categorization.

- Total Tracking: The total promised grant amount should be tracked via a grant agreement file or a separate Accounts Receivable entry (if using the accrual method), but should not be immediately recognized as income until the conditions for release are met and the cash is received.

Q3. When setting up a grant, what is the key difference between using a Class versus a Customer:Job for tracking in QuickBooks Desktop?

The choice impacts how you view and report financial information. For grant tracking, both methods are viable in QuickBooks Desktop, depending on the required focus:

- Classes (Preferred for Fund Accounting):

- Function: Used primarily for tracking Funding Sources or Functional Expenses (Program vs. Admin).

- Flexibility: Allows splitting a single expense transaction line-by-line across multiple grants/classes.

- Report: Generates the Profit & Loss by Class report.

- Customer:Job (or Projects in QBO):

- Function: Used primarily for tracking profitability for a specific, distinct Project or Grant Period.

- Structure: Grants are set up as Jobs under the Grantor (Customer).

- Report: Generates the Profit & Loss by Job report.

Recommendation: Many experts prefer Classes for tracking restricted funds because they align with functional expense reporting (IRS Form 990) and allow for easier allocation of shared expenses across funds.

Indirect costs (overhead) must be systematically allocated to the grants they support, ensuring compliance with grant requirements, such as the OMB Uniform Guidance for federal funds.

- Accumulate Indirect Costs: Post all general overhead (e.g., rent, administrative salaries) to a single Shared or Overhead Class.

- Determine Allocation Base: Calculate the distribution percentage using a consistent method (e.g., percentage of direct program staff time or percentage of direct costs).

- Allocate via Journal Entry: At the end of the month or quarter, use a Journal Entry to move the calculated costs:

- Debit the Program/Grant Classes for their respective allocated amounts.

- Credit the original Shared/Overhead Class to zero out the allocation.

This method, often called “Allocating Below the Line,” keeps the individual expense accounts clean but uses the Class dimension to show the full, true cost of the grant on the P&L by Class report.

Q5. What is the correct way to record a Grant Refund in QuickBooks Online?

Since QuickBooks cannot deposit a negative value by itself, the refund process requires one of the following methods to correctly reduce your bank balance and Grant Income account.

- Preferred Method (Refund Receipt):

- Go to + New and select Refund Receipt.

- Select the Grantor (Customer/Donor) and the bank account from which the money was returned.

- In the details, select the original Grant Income account and enter the amount.

- Save and Close.

- Alternative Method (Journal Entry):

- Go to + New and select Journal Entry.

- Credit the Bank Account for the refund amount (to reduce the cash balance).

- Debit the original Grant Income account for the same amount (to reduce the income recognized).

Q6. My QuickBooks reports show grant expenses exceeding income. Is this always a compliance violation?

No, but it is a major internal control flag that requires immediate review and documentation.

Reasons for a temporary deficit in a restricted grant report:

- Timing Difference: Expenses were paid using general operating funds while awaiting a scheduled reimbursement or the next grant installment.

- Grant Receivable: The expense has been incurred and paid, but the corresponding revenue is recorded as a Grant Receivable (asset) because the invoice has been submitted to the grantor but not yet paid.

Compliance Risk: The risk occurs if the deficit is permanent or if unrestricted funds were used without the board’s official designation. Significant deficits or failure to properly document the temporary use of unrestricted funds can lead to audit findings and loss of donor confidence.

You should reconcile all grant-related bank and balance sheet accounts monthly without exception.

- Bank Accounts: Monthly reconciliation is a cornerstone of financial management and ensures that all grant deposits and expenditures recorded in QuickBooks match the bank’s records, providing audit readiness.

- Compliance Control: Consistent monthly reconciliation helps to:

- Identify misclassified expenses before they become audit issues.

- Catch missing deposits or fraudulent transactions early.

- Ensure that internal financial statements for the board and external reports for the grantor are accurate and timely.

While some large organizations may opt for weekly or daily reconciliation, monthly is the minimum frequency recommended by accounting experts for maintaining financial accuracy and compliance.

Disclaimer: The information outlined above for “How To Record A Grant In QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.