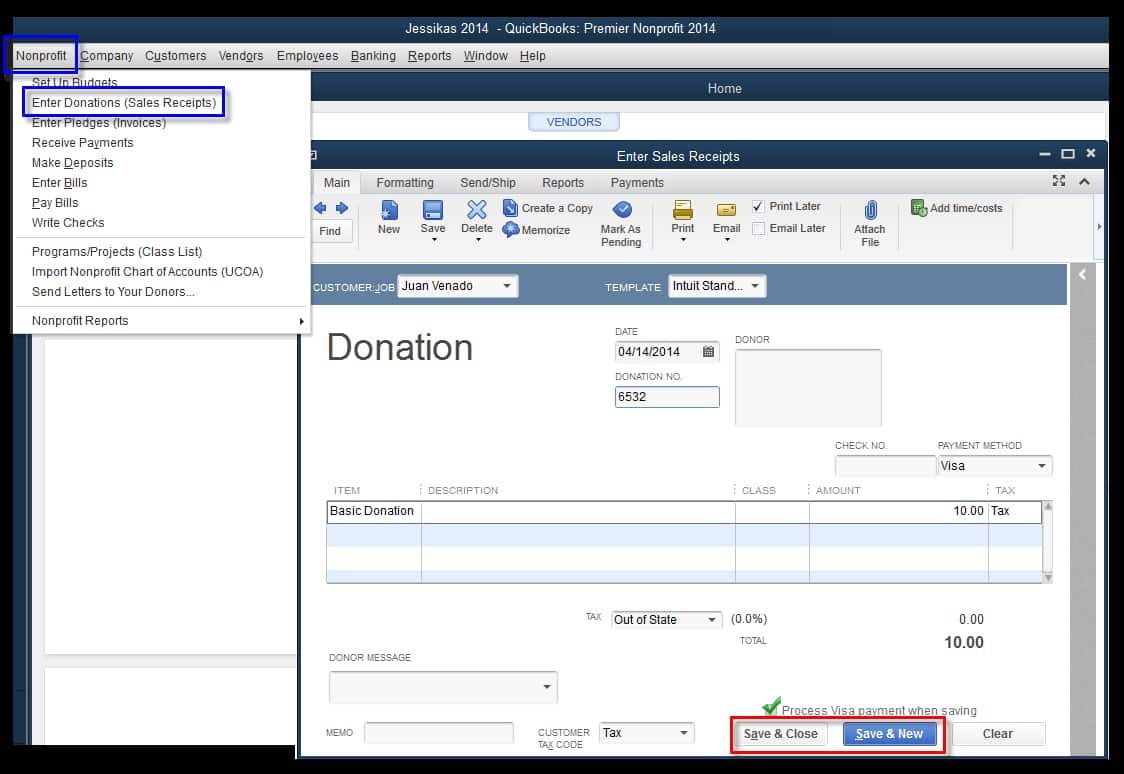

To record a donation in QuickBooks, you can either create a sales receipt or a bank deposit, depending on how the donation is received. For cash or check donations, create a sales receipt, select the donor, donation item, payment method, and save or send the receipt. For non-cash donations (in-kind donations), create a bill to record the fair market value of the donated item or service.

Donations are recorded and tracked to monitor financial inflows and support. Accurate donation tracking in QuickBooks ensures:

- Compliance with tax reporting requirements.

- Maintaining organized financial records.

- Tracking donor contributions for analysis.

These tools simplify the process of managing both cash and non-cash donations, making financial management transparent and efficient.

What is the Difference Between a Donation and a Contribution?

Donation

A donation is a voluntary gift made to a charity or nonprofit organization without expecting anything in return. It can take various forms, including money, goods, or services, and is typically aimed at supporting a specific cause or organization.

Contribution

A contribution refers to giving something as part of a collective effort to achieve a common goal. While contributions can also be charitable, they may not always be voluntary or altruistic. Contributions can include financial support, time, or resources, and are often part of a larger initiative.

How Do you Record a Donation or Charitable Contributions in QuickBooks Desktop?

To maintain accurate and compliant records, it’s important to properly track charitable donations in QuickBooks Desktop.

For non-cash charitable contributions, you must first create an invoice in QuickBooks Desktop.

Step 1. Create an Invoice

- Navigate to the Customers menu > Create Invoices.

- From the Customer: Job drop-down, choose a customer or customer job. If the customer or job is not on the list yet, you can hit the Add New icon.

- Now, add all the necessary information.

- Press Save & Close.

Step 2. Create an Account to Record Donations

- Hover over the Lists menu > Chart of Accounts.

- Select the Account drop-down arrow at the bottom of the window and then press New.

- Set Expenses as the Account Type and click on Continue.

- Enter a Name for the account.

- Hit the Save & Close tabs.

Step 3. To Create a Product/Service Item for the Donation

- Hover over List at the top menu bar > Item List.

- Click the arrow next to Item and then press New.

- Now, select the Inventory Part under the Type section.

- Use the account you’ve created from the drop-down list under the Income account field.

- After this, add the needed details.

- Hit the OK tab.

Step 4. Issue a Credit Memo for the Value of the Products you’re Donating

- Click on Customers > Create Credit Memos/Refunds.

- Type the info for the credit memo or refund.

- Once you’re done, press Save & Close.

How Do you Record Donations or Charitable Contributions in QuickBooks Online?

When the business makes donations or charitable contributions, it is important to record them correctly for accurate bookkeeping.

Users can record two types of entries:

- Cash Donation.

- Donation of goods or services.

For Cash Donations

When donating cash, treat the charitable organization as a vendor and record the payment like any other expenses.

To record cash donations in QuickBooks Online, follow the below-mentioned steps:

- Step 1: Set Up the Charitable Organization as a Vendor

- Go to Expenses > Vendors.

- Click New Vendor and enter the organization’s details.

- Step: Create a Dedicated Expense Account:

- Navigate to Settings > Chart of Accounts > New.

- Choose Expense as the Account Type.

- Select Charitable Contributions.

- Click Save and Close.

- Step: Record the Donation:

- Go to + New > Check (or Expense).

- Select the charitable vendor.

- Under Category Details, choose your Charitable Contributions account.

- Enter the amount and relevant details.

- Click Save and Close.

Note: However, make sure that the expense account you select from the Category drop-down list under the Category details section is a dedicated expense account for tax-deductible contributions.

If you don’t have an expense account, then click + Add new from the drop-down list under the Category column to add one when you record the donation.

For Donations of Products or Services Usually Sold by an Organization

To record a donation of products or services in QuickBooks, create an invoice, set up a Charitable Contributions account, add a product/service item, issue a credit memo, and verify its application to the Invoice.

Note: If the Amount you’re writing off as a contribution will significantly affect your gross sales, consult your accountant before making this entry.

To record a product and services donation, adhere to the steps listed below:

- Step: Create an Invoice for the Products or Services you Donated

To record a donation of products or services, you need to create an invoice. This helps track the income and ensures your balance is accurate.

Follow these steps:

If you’re using the New Layout

- Click + New and then select Invoice.

- Select Add Customer and then click on a customer in the drop-down menu. Make sure all of their info is accurate, especially their email address.

- Review the Invoice date, Due date, and Terms, and enter new dates or terms if you need to.

Tip: In the Terms field, Net refers to the number of days until the Payment is due.

- Choose anyone from the Product/Service drop-down to add a product or service.

Note: To add another product or service, click on Image Alt Text Add product or service.

- Write down a quantity and rate if required.

- Select Manage to customize the info or design of your invoices.

- Choose the options from the side panel. QuickBooks remembers your choices and applies them to all existing and future invoices.

There are several options for saving or sharing the Invoice:

- Press Review and send an email with the invoice to your customer.

- Adjust the email if required, then click on Send Invoice.

- Send invoices via text messages by selecting Text and following the steps.

- Choose Save or Save and close to send the invoices later.

- Hit the Save and New icons to close the current Invoice and open a new one.

- Select Print and Download to print a paper invoice.

- Click on Receive Payment if you’ve received a payment from the Customer.

- Press the Share link to send your Customer a link to their Invoice through text message.

Remember: The text invoice feature is currently only available for payments-enabled customers.

If you’re using the old layout

- Click + New and then select Invoice.

- In the Customer drop-down menu.

- Choose a customer and make sure all of their information is correct, especially their email address.

- Review the Invoice date, and if you need to modify the Due date, change the value in the Terms drop-down.

Tip: Net refers to the number of days until the Payment is due. The default is 30 days, but you can change the due date if required.

- Choose a Product or Service under the Product/Service column.

- You can also click + Add new to create a new product or service right from the Invoice.

- Enter a Quantity, Rate, and Amount if needed.

- Select a VAT rate, and if you’re unable to see VAT, make sure you have set up VAT.

There are several options for saving or sharing the Invoice:

- Press Save and Send to email the Invoice to your Customer.

- Adjust the email if needed, then click Save and close to send the Invoice later.

- Select Save and new to close the current Invoice and open a new one.

- Hit Save and share a link to send your Customer a link to their Invoice through text message.

- Choose Save & Share (WhatsApp) and follow the steps to save and send your Invoice to your Customer using WhatsApp.

- Click Save to print a paper invoice. Then select Print or Preview and follow the steps to print the Invoice.

Note: If you’re using QuickBooks Simple Start, click on Send.

- Step: Create and Set up an Account for Charitable Contributions (Donations)

If you want to make an account to use to record charitable contributions, follow these steps:

- Go to Settings ⚙ in QuickBooks.

- Select Chart of Accounts.

- Click on New to create a new account.

- In the Account Type drop-down, select Expenses.

- From the Detail Type drop-down, choose Charitable Contributions or an appropriate type that matches your needs.

- Enter a name for the account (e.g., “Donations” or “Charitable Contributions“).

- Click on Save and Close to finalize the creation of your donation account.

Once done with creating this account, the next step is to create a product/service item for donations.

- Step: Create a Charitable Contributions Product/Service item

To create a product/service item for charitable contributions, go through the following steps:

- Hover over Settings and then click on Products & services.

- Click New.

- Select the type of product or service under the Product/Service information panel.

- After this, enter a Name for the item (like Charitable Contributions).

- Tick-mark: I sell this product/service to my customer’s checkbox.

- Choose the Charitable Contributions account you created from the dropdown list in the Income account field.

- Hit the Save and Close tabs.

Now, if you have created an account and a product/service item, it’s time to issue a credit memo for the value of your donation.

- Step: Issue a Credit Memo

To issue a credit memo for the value of the products or services you’re donating, do the following:

- Select + New.

- Choose Credit memo under Customers.

- Enter or select the Customer to whom you donated the product or service.

- After this, click on the Charitable Contributions item in the Product/Service column and then type the amount of your donation as a positive number.

- Write down Donation or Charitable Contribution under the Description field.

- Hit the Save and Close icons.

The credit memo reflects the Amount of your donation. After this, you are advised to verify that it has been applied to the invoice you created.

- Step: Check and Verify the Credit Memo Was Applied to the Invoice

The final step is to authenticate that the credit memo you created has been applied to the Invoice that you’ve created for the donated items.

To confirm that the credit memo has been properly applied, adhere to the steps listed below:

- Go to Sales > Customers.

- Choose the Customer to whom you donated the product or service from the list.

- After this, verify that the Invoice transaction you created at the beginning of the process has a Status of Paid on the Transaction List tab.

- Now, check that the Credit memo transaction you created is noted as Closed in the Status column.

- Also, ensure that a new Payment transaction is listed, with US $0.00 listed in the Total column and Closed noted in the Status column.

- Once done, the donation has now been correctly recorded.

How to Categorize a Donation in QuickBooks?

To categorize a donation in QuickBooks, follow the below mentioned steps:

Set Up a Donation Account

- Go to Settings > Chart of Accounts > New

- Choose Expenses as the Account Type.

- Select Charitable Contributions (or a similar category) as the Detail Type.

- Name the account (e.g., “Donations”).

- Click Save and Close.

Categorize Donations Properly

- Use the Category Dropdown List when recording transactions.

- Customize categories based on your organization’s needs.

- Keep category names consistent for accurate financial tracking.

Record In-Kind Donations

- Go to + New > Bill

- Select the donor’s name under Supplier

- Choose the in-kind donation item under Product/Service

- Enter the fair market value.

- Click Save and Close.

How to Categorize Charitable Contributions in QuickBooks

Categorizing charitable contributions in QuickBooks is simple and ensures proper expense tracking.

Follow these steps based on your version of QuickBooks:

QuickBooks Online

- Go to Settings.

- Select Chart of Accounts.

- Click New.

- Choose Expenses as the Account Type.

- Select Charitable Contributions as the Detail Type.

QuickBooks Desktop

- Create an invoice for the donation.

- Set Up a Charitable Contributions account.

- Create a product item for the donation.

- Issue a credit memo for the donated value.

This process helps keep your financial records accurate and organized.

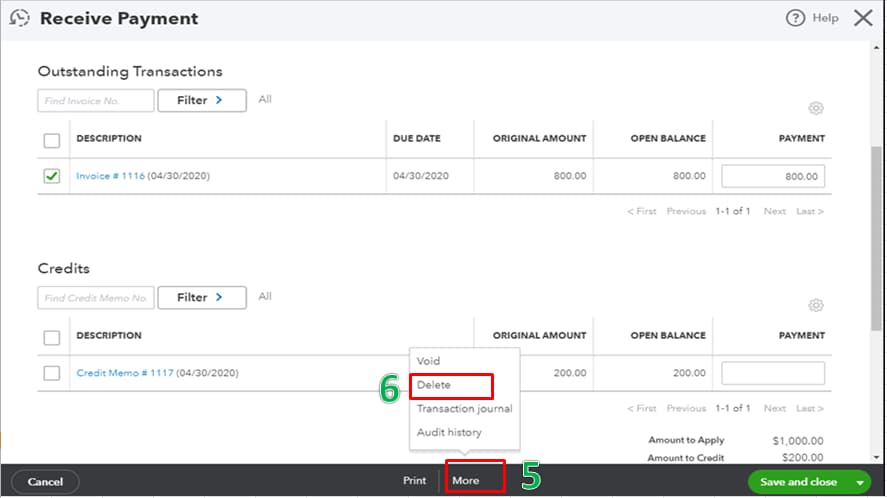

How to Refund a Donation in QuickBooks Online and Desktop?

In cases of donor-requested returns, duplicate entries, or misapplied payments, QuickBooks Online and Desktop allow you to record donation refunds using their built-in refund and credit transaction features.

Follow the below mentioned steps to record donation refunds:

Refunding a Donation in QuickBooks Online

- Locate the Donation Transaction

- Go to Sales > Customers and find the donor’s profile.

- Locate the original donation (invoice or sales receipt).

- Issue a Refund

- Click More > Refund Receipt or Credit Memo (based on your setup).

- Select the donor, enter the refund amount, and choose the correct payment method.

- Ensure the donation category/account matches the original entry.

- Process the Refund

- If issuing a refund via bank transfer or credit card, ensure funds are available.

- Save the transaction and verify it under Banking or Transactions.

Refunding a Donation in QuickBooks Desktop

- Find the Original Donation

- Navigate to Customers > Customer Center > Locate the donor.

- Open the original donation record (invoice or sales receipt).

- Create a Credit Memo or Refund

- Click Create Credit Memos/Refunds and select the donor.

- Enter the refund details, ensuring it is categorized under the same donation account.

- Process the Payment

- If refunding via check, create and print it under Banking > Write Checks.

- For credit card refunds, ensure the payment method is correctly selected.

- Confirm the Refund

- Check the Chart of Accounts or Transaction History to confirm the refund was processed correctly.

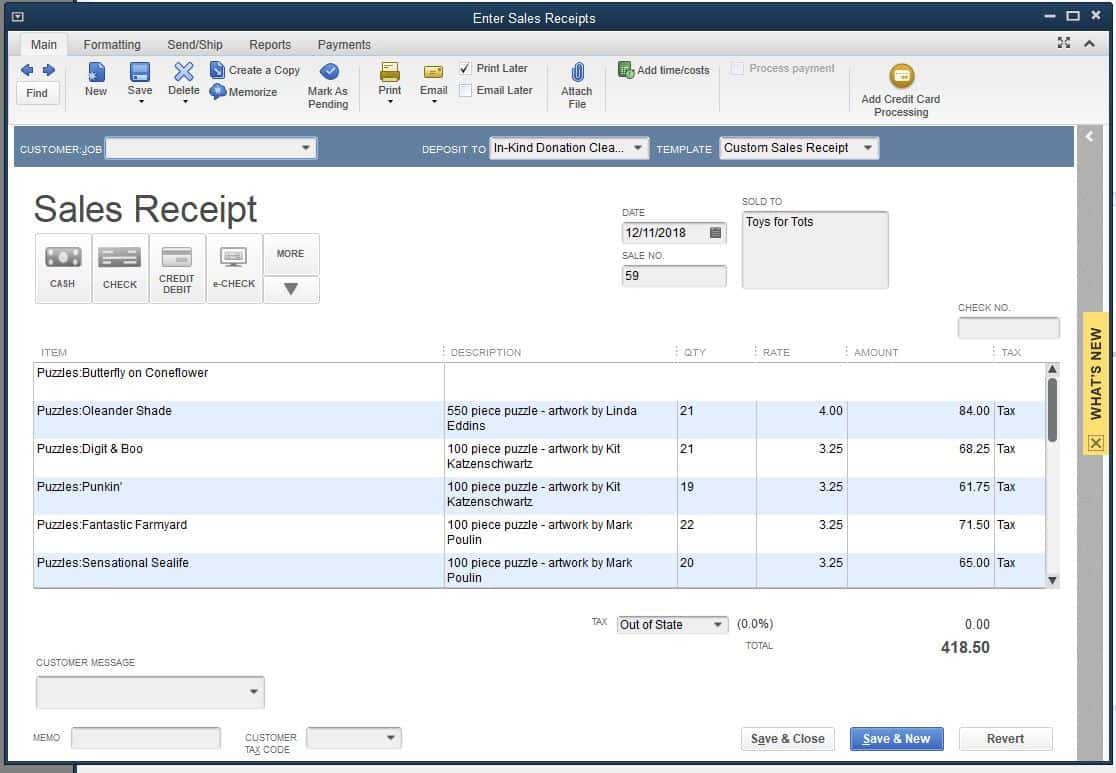

How to Record In-Kind Donation in QuickBooks Desktop and Online?

In-kind donations refer to non-cash contributions such as goods, services, or assets provided to an organization. Donated office supplies, professional services, or use of facilities are some examples of In-Kind donation.

Set Up In-kind Donations in QuickBooks Online

To set up in-kind donations, first check for an existing in-kind donations account in your chart of accounts. If needed, create an in-kind donations account and a clearing account. Then, add a product or service item for each donation.

Follow the step-by-step information below:

Step 1: Check if you Already Have an in-Kind Donation Account

Make sure you don’t already have an in-kind donation account in your chart of accounts to avoid duplicates.

- Navigate to Settings, then select Chart of Accounts.

- Now, enter In-kind donations in the Filter by name or number field.

- If no account is displayed, you can now create an in-kind donations account.

Note: If you see an account named “In-kind donations”, your chart of accounts is already set up, which means you don’t have to do anything.

Step 2: Create an in-Kind Donation Account

If you already have an in-kind donations account, you no longer need to create one, and you can easily skip this step.

- Hover over Settings, then choose a Chart of Accounts.

- Click New.

- Enter In-kind donations under the Account name field.

- After this, select Income from the Account type drop-down menu.

- Under the Detail type drop-down, choose the Non-Profit Income option.

- Press Save at the end.

Step 3: Make a Clearing Account

To keep track of your in-kind donations, create a clearing account. This helps you to record your in-kind donations’ sales receipts or bill payments.

Follow the steps listed below:

- Go to Settings and then choose a Chart of accounts.

- Hit the New tab.

- Type In-kind Clearing under the Account name field.

- Once done, select Bank from the Account type drop-down menu.

- In the Detail type drop-down, click on Checking.

- Enter the opening balance amount under the Opening Balance field. Then, choose the starting date in the Date field. Note: The opening balance can be $0.

- Press the Save button.

Step 4: Create a Product or Service Item

Create a product or service item for each in-kind donation you receive and accurately track what you have. This allows you to record in-kind donation items to your books for a more detailed financial report.

Let’s see how:

- Head to Settings and then choose Products and Services.

- Press New and then click Service.

- Enter the name, item type, and category of the item under the Basic Info section.

- In the Sales section, select In-kind donations from the Income account drop-down.

- After this, opt for I purchase this service from a vendor under the Purchasing section.

- Note: You can add your product description or purchase cost if required.

- Click on the Create new option.

Record In-kind Donations in QuickBooks Online

To record in-kind donations in QuickBooks, create a sales receipt for the donation’s fair market value, then create a bill for the same amount, and finally mark the bill as cleared.

Follow the step-by-step information below:

Note: If you receive fixed assets like vehicles, computers, or land, use an expense or fixed asset account on the bill. You can consult with your accountant if you’re unsure about whether an item is a fixed asset or not.

Step 1: Create a Sales Receipt

- Navigate to + New, and then choose Sales Receipt.

- Select a customer from the Customer drop-down menu. Note: If you haven’t set up your customer yet, select + Add new.

- Enter the date of the donation in the Sales Receipt Date field.

- After this, select the In-kind Clearing bank account that you created from the Deposit To drop-down.

- Under the Product/Service drop-down, select the in-kind donation item. Then, add a description in the Description field.

- Type the fair market value (FMV) of the donation in the Amount field. Note: If you’re not sure about the fair market value of the donation, connect with your accountant.

- At last, press the Save and close tabs.

Step 2: Create a Bill

- Head to + New, then click on Bill.

- From the Vendor dropdown menu, choose the donor’s name. Note: If you haven’t set up your donor’s name in the vendor list, select + Add new.

- Select the in-kind donation item from the Product/Service dropdown under the Item details section.

- After this, enter the fair market value (FMV) of the donation in the Amount field. Note: Contact your accountant if you’re not sure about the fair market value of the donation.

- Hit the Save and Close tabs.

Step 3: Mark the Bill as Cleared

- Go to + New and then choose Pay Bills.

- Now, select In-kind Clearing from the Payment account drop-down menu.

- Tick-mark the checkbox of the bill you entered.

- Click Save and close.

Note: Always consult with your accountant to confirm whether a contribution qualifies as an in-kind donation and should be recorded accordingly.

How to Record In-Kind Donations in QuickBooks Desktop?

Recording in-kind donations (non-cash contributions) in QuickBooks Desktop is essential for tracking the value of donated goods or services.

Follow these simple steps to ensure proper recording:

Step 1: Create an In-Kind Donation Account

- Go to Lists > Chart of Accounts > New.

- Select Income as the account type.

- Name it In-Kind Donations and click Save & Close.

Step 2: Set Up a Donated Item or Service

- Open Lists > Item List > New.

- Choose Non-inventory or Service, depending on the donation type.

- Enter the item name (e.g., “Donated Supplies”).

- Assign the In-Kind Donations account.

- Set the value based on the fair market price.

Step 3: Record the Donation Transaction

- Go to Customers > Create Invoices.

- Select the donor (or create a new customer named “In-Kind Donations”).

- Add the donated item and its value.

- Click Save & Close.

Step 4: Offset the Donation with a Journal Entry

- Open Company > Make General Journal Entries.

- Debit the In-Kind Donations expense account.

- Credit the Revenue – In-Kind Donations account.

- Click Save & Close.

This method ensures accurate tracking of non-cash contributions for financial reporting and tax purposes.

Conclusion

Properly recording and categorizing donations in QuickBooks is crucial for maintaining accurate financial records, ensuring transparency, and staying compliant with accounting standards. By using features such as sales receipts and properly categorizing donations, organizations can streamline their financial processes.

Frequently Asked Questions

How do I record a cash donation in QuickBooks?

To record a cash donation in QuickBooks, set up the charitable organization as a vendor and enter the donation as a check or bill payment. Ensure the expense account selected is dedicated to tax-deductible contributions for easier tracking during tax preparation.

Why is it important to create a Charitable Contributions account in QuickBooks?

Creating a Charitable Contributions account allows you to accurately record and categorize donations, ensuring proper financial reporting and tax compliance. This helps maintain transparency and accountability in your financial management.

How do I record non-cash charitable contributions in QuickBooks Desktop?

In QuickBooks Desktop, record non-cash charitable contributions by creating an invoice for the donation, setting up a Charitable Contributions account, creating a product item for the donation, and issuing a credit memo for the value of the donated items.

What type of account is charitable contributions in QuickBooks?

In QuickBooks, charitable contributions are recorded as an expense account.

Setting this up is simple:

- Go to Settings > Chart of Accounts.

- Click New > Choose Expenses under Account Type.

- Select Charitable Contributions from the Detail Type dropdown.

- Enter the name of the account.

- Click Save and Close.

Disclaimer: The information outlined above for “How to Record a Donation in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.